Key Insights

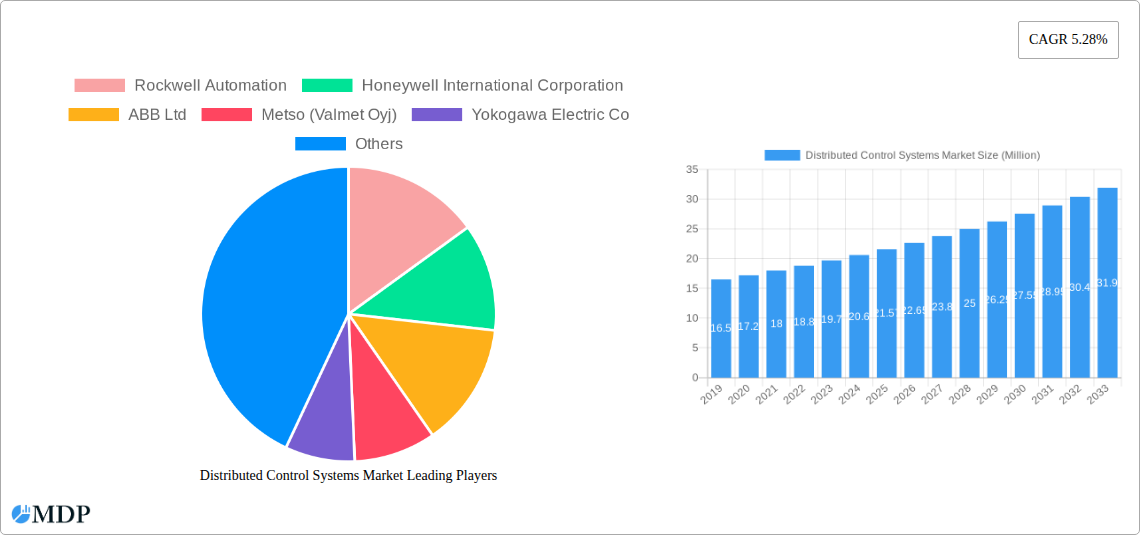

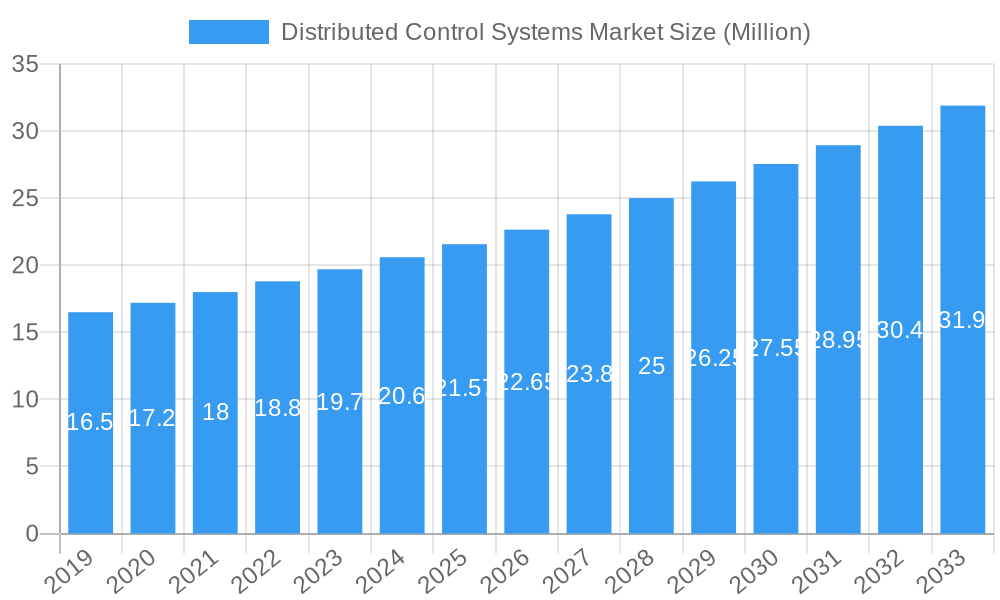

The global Distributed Control Systems (DCS) market is poised for robust expansion, projected to reach a substantial USD 21.57 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.28% anticipated from 2025 through 2033. This growth is fundamentally driven by the increasing demand for automation and sophisticated process control across a wide spectrum of industrial sectors. Key sectors such as Power Generation, Oil & Gas, Chemicals, and Refining are at the forefront of adopting DCS solutions to enhance operational efficiency, improve safety, and ensure regulatory compliance. The inherent benefits of DCS, including centralized monitoring, improved system reliability, and reduced downtime, make them indispensable for managing complex industrial operations. Furthermore, advancements in IoT integration, edge computing, and AI within DCS platforms are creating new avenues for intelligent automation and predictive maintenance, further fueling market adoption. The ongoing digital transformation initiatives across industries worldwide are a significant tailwind, encouraging investments in modern DCS infrastructure.

Distributed Control Systems Market Market Size (In Million)

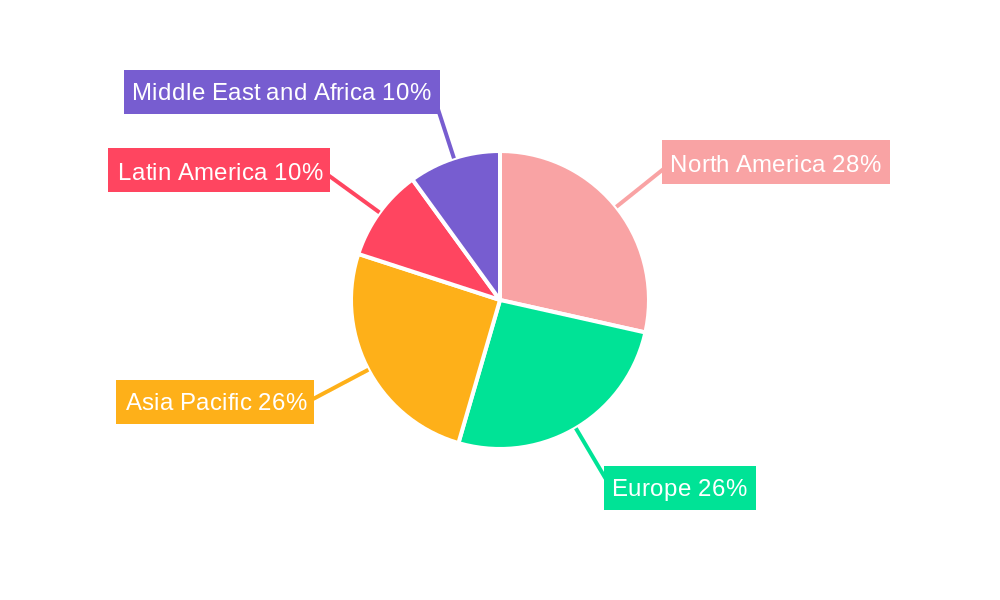

The market's trajectory is further supported by ongoing trends such as the increasing adoption of integrated solutions that combine hardware, software, and services for a comprehensive approach to industrial control. The growing emphasis on cybersecurity within industrial environments also necessitates robust and secure DCS solutions, presenting an opportunity for vendors to innovate and differentiate. While the market is largely optimistic, potential restraints could include the high initial investment costs associated with DCS implementation and the need for specialized skilled labor for operation and maintenance. However, the long-term benefits in terms of cost savings, increased productivity, and enhanced safety often outweigh these initial challenges. Geographically, North America and Europe are expected to maintain significant market shares due to established industrial bases and early adoption of advanced technologies, while the Asia Pacific region is anticipated to witness the fastest growth driven by rapid industrialization and increasing investments in manufacturing and energy sectors. Key players are actively investing in research and development to offer more intelligent, scalable, and cyber-resilient DCS solutions.

Distributed Control Systems Market Company Market Share

Distributed Control Systems (DCS) Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a strategic analysis of the global Distributed Control Systems (DCS) market, encompassing a comprehensive market size estimation of USD 20,000 Million in 2025, with a projected growth trajectory up to 2033. Delve into critical market dynamics, industry trends, leading segments, and key players shaping the future of industrial automation. This report is essential for stakeholders seeking actionable insights into the DCS market, including hardware, software, and services, across vital end-user verticals such as Power Generation, Oil & Gas, Chemicals, Refining, Mining & Metals, and Paper and Pulp. Leverage our expert analysis to understand market concentration, innovation drivers, regulatory landscapes, and emerging opportunities.

Distributed Control Systems Market Market Dynamics & Concentration

The Distributed Control Systems (DCS) market is characterized by a moderate to high concentration, with key players like Siemens AG, ABB Ltd, Honeywell International Corporation, and Emerson Electric Company holding significant market share. Innovation in areas such as cybersecurity, AI-driven analytics, and cloud integration are key drivers of market growth. Robust regulatory frameworks, particularly concerning industrial safety and data privacy, influence system design and deployment. Product substitutes, while present in simpler automation solutions, are less impactful for complex process control applications addressed by DCS. End-user trends indicate a strong demand for enhanced operational efficiency, predictive maintenance, and remote monitoring capabilities, particularly driven by digital transformation initiatives. Mergers and acquisitions (M&A) activity is moderate, with strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, the past few years have seen several targeted acquisitions of smaller automation solution providers by larger DCS vendors to bolster their software and service offerings.

Distributed Control Systems Market Industry Trends & Analysis

The Distributed Control Systems (DCS) market is experiencing robust growth, fueled by increasing industrial automation adoption across diverse sectors and the escalating need for operational efficiency and safety. The Compound Annual Growth Rate (CAGR) is projected to be a healthy 5.8% between 2025 and 2033, driven by significant investments in smart manufacturing and the Industrial Internet of Things (IIoT). Technological disruptions, such as the integration of AI and machine learning for predictive analytics and advanced process optimization, are transforming DCS capabilities. Consumer preferences are shifting towards more scalable, flexible, and cyber-secure DCS solutions that can seamlessly integrate with existing IT infrastructure. Competitive dynamics are intensifying, with vendors focusing on offering comprehensive lifecycle services and intelligent solutions beyond basic control functionalities. Market penetration is steadily increasing, particularly in developing economies adopting advanced manufacturing practices. The drive towards sustainability and reduced energy consumption in industrial operations further propels the demand for sophisticated DCS for precise process control and resource management.

Leading Markets & Segments in Distributed Control Systems Market

The Asia-Pacific region is a dominant market for Distributed Control Systems (DCS), driven by rapid industrialization, substantial investments in infrastructure, and government initiatives promoting manufacturing excellence. Within this region, China stands out as a leading country due to its massive manufacturing base and increasing adoption of advanced automation technologies across its key end-user verticals.

- Component: Hardware

- Key Drivers: The increasing demand for more powerful and compact control hardware, including advanced processors, I/O modules, and network infrastructure, to support sophisticated automation tasks. The need for ruggedized hardware capable of operating in harsh industrial environments across Oil & Gas, Mining & Metals, and Power Generation sectors is also a significant driver.

- Component: Software

- Key Drivers: The exponential growth in demand for advanced DCS software solutions, including SCADA, HMI, and asset management software, is fueled by the need for better data visualization, real-time monitoring, and historical data analysis. Cybersecurity features and AI/ML integration for predictive maintenance and process optimization are crucial software differentiators.

- Component: Services

- Key Drivers: The increasing reliance on expert services for system integration, consulting, maintenance, and upgrades is a significant growth catalyst. As industries focus on core competencies, outsourcing DCS management and optimization to specialized service providers is becoming prevalent, particularly in complex sectors like Chemicals and Refining.

- End-User Vertical: Power Generation

- Key Drivers: The global push for cleaner energy sources and the modernization of existing power plants necessitate advanced control systems for efficient operation and grid stability. DCS plays a crucial role in managing complex energy generation processes and integrating renewable energy sources.

- End-User Vertical: Oil & Gas

- Key Drivers: The stringent safety regulations, the need for precise process control in exploration, production, and refining, and the growing demand for enhanced efficiency in upstream, midstream, and downstream operations make DCS indispensable. The remote operation and monitoring capabilities are particularly vital in this sector.

- End-User Vertical: Chemicals

- Key Drivers: The high-hazard nature of chemical processes and the demand for consistent product quality and safety compliance drive the adoption of sophisticated DCS. The ability to manage complex reactions, optimize yields, and ensure adherence to environmental regulations is paramount.

- End-User Vertical: Refining

- Key Drivers: The continuous drive for operational efficiency, yield optimization, and stringent environmental compliance in refining operations fuels the demand for advanced DCS. The ability to manage complex distillation and cracking processes with precision is critical.

- End-User Vertical: Mining & Metals

- Key Drivers: Increasing automation in extraction, processing, and material handling, coupled with the need for improved safety and resource management, drives DCS adoption. The ability to control and monitor large-scale operations in remote and challenging environments is a key factor.

- End-User Vertical: Paper and Pulp

- Key Drivers: The demand for consistent product quality, efficient resource utilization (water and energy), and automation in large-scale production processes makes DCS essential. Advancements in controlling complex paper machine operations are a significant driver.

Distributed Control Systems Market Product Developments

Recent product developments in the Distributed Control Systems (DCS) market focus on enhancing cybersecurity, integrating artificial intelligence, and improving scalability. Innovations like Emerson's NextGen Smart Firewall for the DeltaV DCS significantly bolster perimeter security, addressing critical industry concerns. ABB's continued support for DS Smith with its ABB Ability System 800xA highlights the trend towards integrated and highly automated operations, demonstrating the competitive advantage of robust, secure, and connected DCS solutions that drive efficiency and sustainability in complex manufacturing environments like the paper and pulp industry.

Key Drivers of Distributed Control Systems Market Growth

The growth of the Distributed Control Systems (DCS) market is primarily driven by the escalating demand for industrial automation across various sectors to improve operational efficiency and productivity. The increasing adoption of IIoT technologies and the growing need for real-time data analysis and predictive maintenance capabilities are significant catalysts. Stringent safety regulations and environmental compliance mandates also necessitate the implementation of advanced DCS for precise process control. Furthermore, the ongoing digital transformation initiatives in manufacturing and the trend towards smart factories are propelling the demand for sophisticated and integrated automation solutions.

Challenges in the Distributed Control Systems Market Market

Despite robust growth, the Distributed Control Systems (DCS) market faces several challenges. High initial implementation costs and the complexity of integrating DCS with legacy systems can be significant barriers for some organizations. Cybersecurity threats and the increasing sophistication of cyber-attacks pose a continuous risk, demanding substantial investments in robust security measures. Furthermore, the shortage of skilled personnel capable of designing, implementing, and maintaining advanced DCS can hinder adoption and operational efficiency. Fluctuations in raw material prices for hardware components can also impact pricing and supply chain stability.

Emerging Opportunities in Distributed Control Systems Market

Emerging opportunities in the Distributed Control Systems (DCS) market lie in the growing adoption of edge computing and cloud-based DCS solutions, offering enhanced data processing and accessibility. The increasing demand for AI and machine learning integration for advanced analytics, predictive maintenance, and autonomous operations presents a significant growth avenue. Strategic partnerships between DCS vendors and cybersecurity firms are crucial for developing more resilient and secure systems. Furthermore, the expansion of IIoT and the need for seamless integration across disparate industrial systems create substantial market potential for interoperable and intelligent DCS platforms.

Leading Players in the Distributed Control Systems Market Sector

- Rockwell Automation

- Honeywell International Corporation

- ABB Ltd

- Metso (Valmet Oyj)

- Yokogawa Electric Co

- Siemens AG

- Omron Corporation

- Toshiba International

- Schneider Electric

- Azbil Corporation

- Mitsubishi Motors Corporation

- Novatech Llc (Weir Group)

- Emerson Electric Company

Key Milestones in Distributed Control Systems Market Industry

- May 2023: Emerson announced the introduction of its NextGen Smart Firewall, enhancing the perimeter security of its DeltaV distributed control system (DCS) with a purpose-built solution for easy installation and maintenance across all industries.

- May 2022: ABB secured a contract from DS Smith for its Kemsley Mill in the UK. This initiative aims to achieve highly automated, connected, and secure operations, leveraging ABB Ability System 800xA DCS and paper machine drives upgrades for PM3, PM4, and PM6, supporting an annual production capacity exceeding 840,000 tons.

Strategic Outlook for Distributed Control Systems Market Market

The strategic outlook for the Distributed Control Systems (DCS) market is overwhelmingly positive, driven by the continuous pursuit of operational excellence, safety, and sustainability in industrial sectors. Future growth will be accelerated by the deeper integration of AI, machine learning, and cloud technologies, enabling more intelligent and autonomous operations. Investments in cybersecurity will remain paramount. Strategic opportunities lie in providing comprehensive lifecycle services, focusing on digital transformation consulting, and developing modular, scalable DCS solutions that cater to evolving industry needs and emerging technologies, ensuring long-term market relevance and expansion.

Distributed Control Systems Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-User Vertical

- 2.1. Power Generation

- 2.2. Oil & Gas

- 2.3. Chemicals

- 2.4. Refining

- 2.5. Mining & Metals

- 2.6. Paper and Pulp

- 2.7. Other End-User Verticals

Distributed Control Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. South Africa

- 5.3. Rest of Middle East

Distributed Control Systems Market Regional Market Share

Geographic Coverage of Distributed Control Systems Market

Distributed Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Energy Demand from Major Emerging Economies; Growing Adoption for Smart Applications and Iot Technologies; Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Alternative Technologies in the Field of Process Automation

- 3.4. Market Trends

- 3.4.1. Services Constitute a Considerable Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Power Generation

- 5.2.2. Oil & Gas

- 5.2.3. Chemicals

- 5.2.4. Refining

- 5.2.5. Mining & Metals

- 5.2.6. Paper and Pulp

- 5.2.7. Other End-User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.2.1. Power Generation

- 6.2.2. Oil & Gas

- 6.2.3. Chemicals

- 6.2.4. Refining

- 6.2.5. Mining & Metals

- 6.2.6. Paper and Pulp

- 6.2.7. Other End-User Verticals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.2.1. Power Generation

- 7.2.2. Oil & Gas

- 7.2.3. Chemicals

- 7.2.4. Refining

- 7.2.5. Mining & Metals

- 7.2.6. Paper and Pulp

- 7.2.7. Other End-User Verticals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.2.1. Power Generation

- 8.2.2. Oil & Gas

- 8.2.3. Chemicals

- 8.2.4. Refining

- 8.2.5. Mining & Metals

- 8.2.6. Paper and Pulp

- 8.2.7. Other End-User Verticals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.2.1. Power Generation

- 9.2.2. Oil & Gas

- 9.2.3. Chemicals

- 9.2.4. Refining

- 9.2.5. Mining & Metals

- 9.2.6. Paper and Pulp

- 9.2.7. Other End-User Verticals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.2.1. Power Generation

- 10.2.2. Oil & Gas

- 10.2.3. Chemicals

- 10.2.4. Refining

- 10.2.5. Mining & Metals

- 10.2.6. Paper and Pulp

- 10.2.7. Other End-User Verticals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metso (Valmet Oyj)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yokogawa Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toshiba International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Azbil Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mitsubishi Motors Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novatech Llc (Weir Group)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Emerson Electric Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: Global Distributed Control Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 5: North America Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 6: North America Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 11: Europe Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 12: Europe Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 17: Asia Pacific Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 18: Asia Pacific Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 23: Latin America Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 24: Latin America Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 29: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 30: Middle East and Africa Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 3: Global Distributed Control Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 6: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 11: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: UK Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 19: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 26: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 32: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: UAE Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Distributed Control Systems Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Distributed Control Systems Market?

Key companies in the market include Rockwell Automation, Honeywell International Corporation, ABB Ltd, Metso (Valmet Oyj), Yokogawa Electric Co, Siemens AG, Omron Corporation, Toshiba International, Schneider Electric, Azbil Corporation, Mitsubishi Motors Corporation, Novatech Llc (Weir Group), Emerson Electric Company.

3. What are the main segments of the Distributed Control Systems Market?

The market segments include Component, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Energy Demand from Major Emerging Economies; Growing Adoption for Smart Applications and Iot Technologies; Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector.

6. What are the notable trends driving market growth?

Services Constitute a Considerable Market Share.

7. Are there any restraints impacting market growth?

Growing Availability of Alternative Technologies in the Field of Process Automation.

8. Can you provide examples of recent developments in the market?

May 2023: Emerson announced that it is improving perimeter security for the DeltaV distributed control system (DCS) with its new NextGen Smart Firewall, a purpose-built control system firewall designed to provide easy-to-install and easy-to-maintain perimeter security for all industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Distributed Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Distributed Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Distributed Control Systems Market?

To stay informed about further developments, trends, and reports in the Distributed Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence