Key Insights

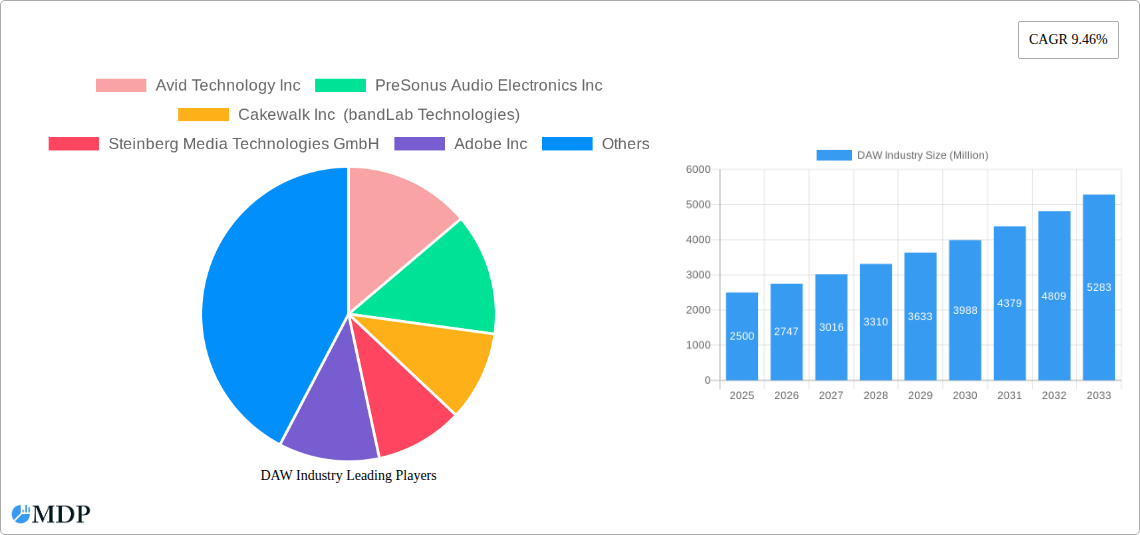

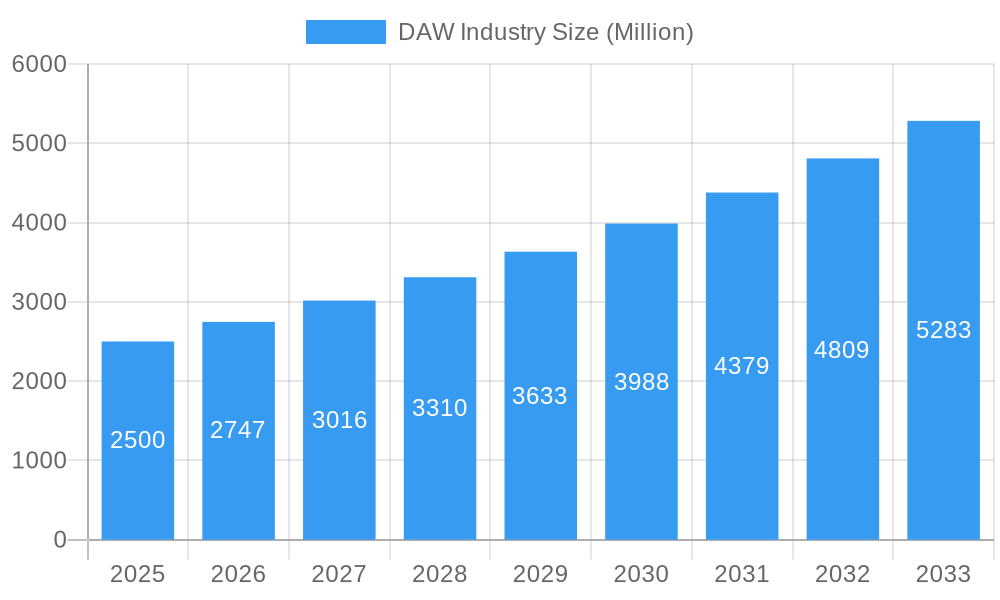

The Digital Audio Workstation (DAW) market is demonstrating substantial expansion, propelled by the increasing integration of digital music production tools across diverse user demographics. The market, valued at an estimated $4394.1 million in the base year of 2025, is forecasted to achieve significant growth by 2033, reflecting a consistent compound annual growth rate (CAGR) of 9.4%. This upward trajectory is underpinned by several critical drivers. The burgeoning popularity of music creation as both a hobby and a profession, particularly among electronic musicians and independent artists, serves as a primary catalyst. Technological advancements, yielding more potent and intuitive DAW software with advanced features like enhanced audio processing, virtual instruments, and collaborative functionalities, further accelerate demand. The accessibility of cost-effective hardware, including powerful computing devices with adequate processing power, also contributes to market expansion. The cross-platform compatibility of leading DAWs across major operating systems ensures widespread accessibility.

DAW Industry Market Size (In Billion)

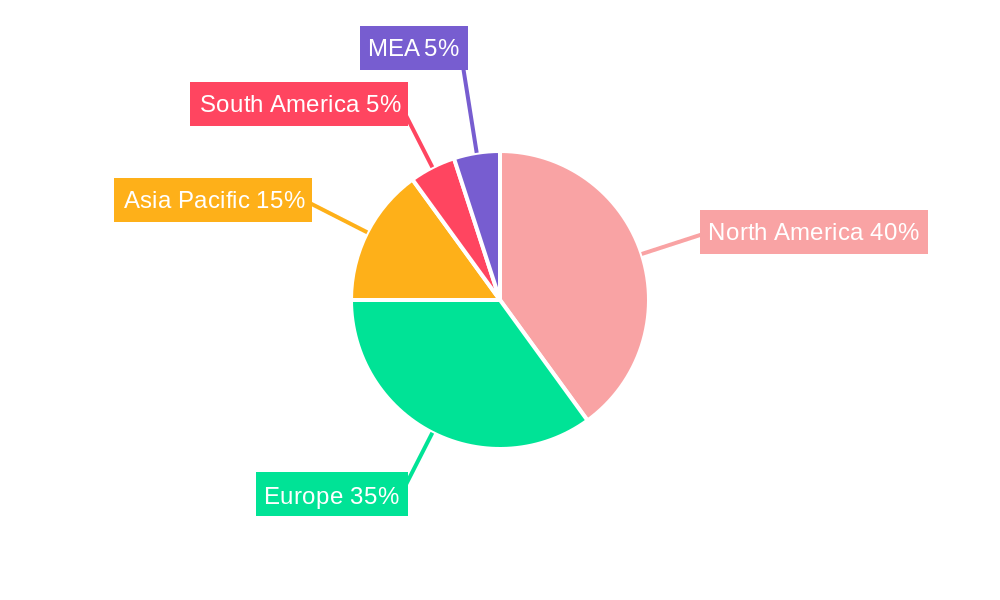

Market segmentation highlights key opportunities within specific end-user categories. Professional audio engineers and mixers remain a foundational segment, relying on high-performance DAWs for studio recording and post-production. However, the electronic musician and music producer segment is exhibiting particularly accelerated growth, signifying a broader democratization of music creation. Geographic analysis indicates a robust presence in North America and Europe, with substantial growth potential identified in the Asia-Pacific region, driven by increased internet penetration and rising disposable incomes. Market impediments include the premium pricing of professional-grade DAW software and hardware, potentially limiting adoption among cost-sensitive users. Nevertheless, the increasing availability of affordable and proficient alternatives, coupled with flexible subscription models, is effectively addressing this constraint. Competitive dynamics among established vendors such as Avid, PreSonus, Steinberg, and Adobe, alongside the emergence of new participants, foster market vitality and continuous innovation. Future expansion will be contingent upon technological advancements, particularly in AI-driven music composition and production tools, and the development of cloud-based DAW solutions.

DAW Industry Company Market Share

DAW Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Digital Audio Workstation (DAW) industry, projecting market trends and opportunities from 2019 to 2033. We delve into market dynamics, leading players, technological advancements, and future growth prospects, offering actionable insights for industry stakeholders. The report covers key segments including operating systems (Mac, Windows, and others), end-users (professional audio engineers, electronic musicians, music studios, etc.), and examines the impact of significant industry developments. With a projected market value exceeding $XX Million by 2033, this report is an essential resource for anyone involved in or interested in the future of music production technology.

DAW Industry Market Dynamics & Concentration

The DAW industry exhibits a moderately concentrated market structure, with several key players commanding significant market share. The market is characterized by intense competition, fueled by continuous innovation and the release of new features and functionalities. Regulatory frameworks vary by region, impacting data privacy, software licensing, and intellectual property rights. Cloud-based DAWs are emerging as strong substitutes for traditional desktop software, while the rise of mobile music production apps presents another competitive challenge. End-user trends reveal a growing preference for user-friendly interfaces, collaborative tools, and AI-powered features. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with a total of XX M&A deals recorded between 2019 and 2024. Key players are constantly striving to improve their offerings through innovation and strategic partnerships.

- Market Share: Avid Technology Inc., Steinberg Media Technologies GmbH, and PreSonus Audio Electronics Inc. hold the largest market share, collectively accounting for approximately XX% of the global market in 2024.

- M&A Activity: The industry has witnessed XX M&A deals between 2019 and 2024, primarily driven by smaller companies being acquired by larger players to expand their product portfolios or gain access to new technologies.

DAW Industry Trends & Analysis

The DAW industry is experiencing robust growth, driven by several key factors. The increasing popularity of music production as a hobby and profession fuels demand for sophisticated yet accessible DAW software. Technological advancements, including improved AI capabilities, cloud-based platforms, and enhanced audio processing, continuously improve the user experience. Consumers increasingly prioritize ease of use, integration with other software, and creative features. The competitive landscape is highly dynamic, with continuous innovation and the entry of new players shaping the market. The compound annual growth rate (CAGR) for the DAW industry is estimated at XX% during the forecast period (2025-2033). Market penetration is expected to increase significantly, particularly in emerging markets. The shift towards subscription-based models is also impacting the market dynamics. This trend offers users more flexibility and affordability, and generates more predictable revenue streams for providers.

Leading Markets & Segments in DAW Industry

The North American market currently dominates the DAW industry, accounting for approximately XX% of global revenue in 2024. This dominance is driven by a large and established music production community, coupled with high levels of technological adoption and disposable income. However, rapid growth is also observed in Asia-Pacific, particularly in countries like China and Japan.

- Operating Systems: Windows remains the dominant operating system for DAWs, with a market share of approximately XX% in 2024. However, the Mac operating system continues to hold a significant portion of the market, driven by its popularity among professional audio engineers and music producers.

- End-Users: Professional/Audio Engineers and Mixers represent the largest end-user segment, accounting for approximately XX% of total revenue in 2024. Their demand for high-quality audio processing capabilities and advanced features drives innovation within the industry.

Key Drivers:

- North America: Strong music industry infrastructure, high disposable income, early adoption of new technologies.

- Asia-Pacific: Growing middle class, increasing internet penetration, rising interest in music production.

DAW Industry Product Developments

Recent product innovations showcase a trend towards cloud-based solutions, seamless integration with other production tools, and AI-powered features like automated mixing and stem separation. Companies are focusing on intuitive user interfaces, enhancing collaboration capabilities, and providing access to expansive sound libraries. The market is witnessing a shift from traditional perpetual licenses towards subscription-based models, offering greater flexibility and accessibility to users. These developments aim to meet the growing demands of both professional and amateur music producers, solidifying the DAW's role as a cornerstone of modern music creation.

Key Drivers of DAW Industry Growth

Several factors fuel the growth of the DAW industry. Technological advancements, such as AI-powered features and improved audio processing capabilities, enhance the user experience and expand creative possibilities. The rising popularity of music production as a hobby and profession, along with increasing internet and mobile penetration, broaden the market. Government initiatives promoting digital content creation and supportive policies further boost industry growth. The emergence of cloud-based solutions provides greater accessibility and collaboration opportunities.

Challenges in the DAW Industry Market

The DAW industry faces challenges including intense competition from established players and new entrants. Maintaining market share requires ongoing innovation and adaptability. High development costs and the need for regular software updates present ongoing challenges. Data security and privacy concerns related to cloud-based solutions need to be addressed effectively. Intellectual property rights protection and licensing issues continue to be points of contention.

Emerging Opportunities in DAW Industry

The DAW industry presents exciting long-term growth opportunities. The integration of AI and machine learning promises to revolutionize music production, automating tasks and unlocking new creative possibilities. Strategic partnerships between DAW providers and music streaming services could create new revenue streams and expand market reach. Expansion into emerging markets with growing internet penetration presents significant untapped potential.

Leading Players in the DAW Industry Sector

- Avid Technology Inc

- PreSonus Audio Electronics Inc

- Cakewalk Inc (bandLab Technologies)

- Steinberg Media Technologies GmbH

- Adobe Inc

- Native Instruments GmbH

- MAGIX Software GmbH

- Apple Inc

- Harrison Consoles Inc

Key Milestones in DAW Industry

- August 2022: Spotify's Soundtrap introduces live collaboration, auto-save, and comments features, enhancing remote collaboration capabilities.

- April 2023: Audio Design Desk releases version 2.0, featuring a revamped UI, automated mixing, stem separation, and integration with industry-standard NLEs and Makr.ai, a collaborative marketplace.

- April 2023: Avid launches the MTRX II and MTRX Thunderbolt 3 module, improving audio capabilities for post-production users.

- June 2023: Triton Digital and Basis Technologies collaborate, enabling streamlined advertising across various audio segments.

Strategic Outlook for DAW Industry Market

The DAW industry is poised for significant growth, driven by technological innovation and evolving user needs. Cloud-based solutions, AI-powered features, and enhanced collaboration tools will continue to shape the market. Strategic partnerships and expansion into emerging markets offer further growth potential. The industry's future depends on adapting to evolving technological trends and effectively addressing user needs and challenges.

DAW Industry Segmentation

-

1. Operating System

- 1.1. Mac

- 1.2. Windows

- 1.3. Other Operating Systems

-

2. End User

- 2.1. Professional/Audio Engineers and Mixers

- 2.2. Electronic Musicians

- 2.3. Music Studios

- 2.4. Music Schools

- 2.5. Other End Users

DAW Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

DAW Industry Regional Market Share

Geographic Coverage of DAW Industry

DAW Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 3.4. Market Trends

- 3.4.1. MAC Operating System is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DAW Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Mac

- 5.1.2. Windows

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Professional/Audio Engineers and Mixers

- 5.2.2. Electronic Musicians

- 5.2.3. Music Studios

- 5.2.4. Music Schools

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. North America DAW Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 6.1.1. Mac

- 6.1.2. Windows

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Professional/Audio Engineers and Mixers

- 6.2.2. Electronic Musicians

- 6.2.3. Music Studios

- 6.2.4. Music Schools

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 7. Europe DAW Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 7.1.1. Mac

- 7.1.2. Windows

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Professional/Audio Engineers and Mixers

- 7.2.2. Electronic Musicians

- 7.2.3. Music Studios

- 7.2.4. Music Schools

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 8. Asia DAW Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 8.1.1. Mac

- 8.1.2. Windows

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Professional/Audio Engineers and Mixers

- 8.2.2. Electronic Musicians

- 8.2.3. Music Studios

- 8.2.4. Music Schools

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 9. Latin America DAW Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 9.1.1. Mac

- 9.1.2. Windows

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Professional/Audio Engineers and Mixers

- 9.2.2. Electronic Musicians

- 9.2.3. Music Studios

- 9.2.4. Music Schools

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 10. Middle East and Africa DAW Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 10.1.1. Mac

- 10.1.2. Windows

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Professional/Audio Engineers and Mixers

- 10.2.2. Electronic Musicians

- 10.2.3. Music Studios

- 10.2.4. Music Schools

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avid Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PreSonus Audio Electronics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cakewalk Inc (bandLab Technologies)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steinberg Media Technologies GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Adobe Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Native Instruments GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MAGIX Software GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apple Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harrison Consoles Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Avid Technology Inc

List of Figures

- Figure 1: Global DAW Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 3: North America DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 4: North America DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 5: North America DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 9: Europe DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 10: Europe DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 11: Europe DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 15: Asia DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 16: Asia DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 17: Asia DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 21: Latin America DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 22: Latin America DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 23: Latin America DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Latin America DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 27: Middle East and Africa DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 28: Middle East and Africa DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 29: Middle East and Africa DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa DAW Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 2: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global DAW Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 5: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 8: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 9: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 11: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 12: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 14: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 17: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DAW Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the DAW Industry?

Key companies in the market include Avid Technology Inc, PreSonus Audio Electronics Inc, Cakewalk Inc (bandLab Technologies), Steinberg Media Technologies GmbH, Adobe Inc, Native Instruments GmbH, MAGIX Software GmbH, Apple Inc, Harrison Consoles Inc.

3. What are the main segments of the DAW Industry?

The market segments include Operating System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4394.1 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making.

6. What are the notable trends driving market growth?

MAC Operating System is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices.

8. Can you provide examples of recent developments in the market?

April 2023: AVID introduced Tools MTRX II and MTRX Thunderbolt 3 module, specifically designed for post-production users to enhance audio capabilities to get the prime sound possible. MTRX II empowers users with greater IO capacity, routing, and immersive monitoring flexibility. It allows capturing tools and software-based workflows, providing flexibility and expandability than MTRX.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DAW Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DAW Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DAW Industry?

To stay informed about further developments, trends, and reports in the DAW Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence