Key Insights

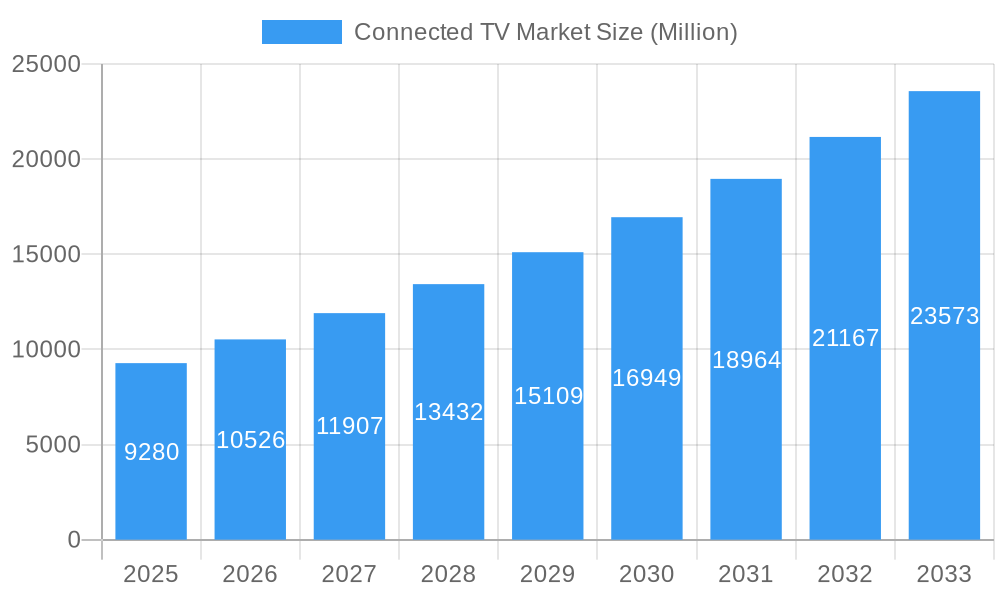

The global Connected TV (CTV) market is experiencing robust expansion, projected to reach a significant size by 2025. Driven by an impressive Compound Annual Growth Rate (CAGR) of 13.20%, the market is expected to demonstrate sustained momentum throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of smart televisions and the escalating demand for seamless streaming experiences. Consumers are increasingly gravitating towards integrated entertainment solutions, leading to a surge in smart TV sales and a corresponding decline in traditional television viewership. The proliferation of content streaming platforms, coupled with the development of advanced streaming technologies, further underpins this upward trajectory. Key segments within the CTV market include Smart TVs, which are central to the ecosystem, and dedicated streaming devices like Amazon Fire TV, Apple TV, and Roku, which offer enhanced functionality and content accessibility. The shift towards smart functionality within televisions has become a pivotal trend, making smart TVs the primary gateway to digital content for a vast majority of households.

Connected TV Market Market Size (In Billion)

Several factors contribute to the healthy expansion of the CTV market. The ongoing innovation in display technologies, such as 4K and 8K resolution, along with the integration of artificial intelligence for personalized content recommendations, are enhancing the user experience and driving device upgrades. Furthermore, the growing penetration of high-speed internet across developing regions is creating a fertile ground for CTV adoption. While the market is predominantly shaped by the Smart TV segment, the influence of streaming media players cannot be understated, as they cater to a wide range of consumer needs, from budget-friendly options like Google Chromecast to premium offerings. Major players like Samsung, LG Electronics, Sony, and TCL are at the forefront of this evolution, continually introducing advanced features and expanding their smart TV portfolios. Emerging markets, particularly in Asia, are poised to become significant growth contributors due to their rapidly expanding middle class and increasing disposable incomes, creating substantial opportunities for market participants.

Connected TV Market Company Market Share

Unlock the future of home entertainment with our comprehensive Connected TV market report. This in-depth analysis provides critical insights into market dynamics, industry trends, and emerging opportunities within the rapidly evolving CTV landscape. With a forecast period spanning 2025-2033, our report offers actionable intelligence for stakeholders aiming to capitalize on the burgeoning Connected TV market, projected to reach significant valuations from its base in 2025.

This report is meticulously researched to provide actionable insights for a range of industry stakeholders, including:

Our study period encompasses 2019–2033, with the Base Year and Estimated Year set at 2025. The Forecast Period runs from 2025–2033, building upon the Historical Period of 2019–2024.

- TV Manufacturers: Understand evolving consumer demands and technological advancements.

- Content Providers & Streaming Services: Identify new avenues for distribution and audience engagement.

- Advertisers & Marketers: Leverage the growing reach and sophisticated targeting capabilities of CTV.

- Technology Developers: Discover opportunities in smart TV operating systems, apps, and hardware.

- Investors: Gain a clear understanding of market potential and growth trajectories.

Connected TV Market Market Dynamics & Concentration

The Connected TV (CTV) market is characterized by dynamic growth and increasing concentration among key players, driven by rapid technological innovation and evolving consumer preferences for integrated entertainment experiences. Market concentration is evident as a few dominant players, including Samsung Corporation, LG Electronics, and Sony Corporation, command significant market share, alongside tech giants like Amazon (Fire TV) and Google (Chromecast) influencing the streaming device segment. Innovation drivers are primarily fueled by advancements in display technologies (e.g., 8K resolution, QLED, OLED), smart operating systems, and the seamless integration of streaming services. Regulatory frameworks, while still developing, are increasingly focusing on data privacy, content accessibility, and digital advertising standards, influencing market strategies. Product substitutes, such as traditional cable TV and mobile-based streaming, continue to face pressure from the superior user experience and content aggregation offered by CTVs. End-user trends highlight a growing demand for personalized content, interactive features, and the consolidation of entertainment into a single, smart device. Merger and acquisition (M&A) activities are moderate but strategic, focusing on acquiring innovative technologies, expanding content libraries, or gaining access to new market segments. For instance, recent M&A activities have aimed at strengthening advertising capabilities and enhancing smart TV platform ecosystems. The market share of leading players is continuously analyzed to identify shifts in competitive positioning.

Connected TV Market Industry Trends & Analysis

The Connected TV (CTV) market is experiencing robust expansion, propelled by several converging trends. The increasing adoption of high-speed internet infrastructure globally is a fundamental growth driver, enabling smoother streaming of high-definition content and facilitating the proliferation of interactive features. Technological disruptions, such as the widespread availability of 4K and 8K resolution displays, HDR (High Dynamic Range) technology, and advanced audio formats, are significantly enhancing the viewing experience, making CTVs the preferred choice for immersive entertainment. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) is personalizing content recommendations and enhancing user interface navigability, contributing to increased user engagement. Consumer preferences are rapidly shifting towards on-demand content consumption, driving the growth of subscription video-on-demand (SVOD) and advertising-supported video-on-demand (AVOD) services, which are intrinsically linked to the CTV ecosystem. The competitive dynamics within the market are intensifying, with traditional TV manufacturers competing not only amongst themselves but also with technology companies that offer integrated streaming solutions and operating systems. The market penetration of CTVs is steadily increasing across developed and emerging economies, signaling a transformative shift in how consumers access and consume media. The compound annual growth rate (CAGR) for the CTV market is projected to remain strong, reflecting sustained consumer interest and ongoing technological advancements.

Leading Markets & Segments in Connected TV Market

The Smart TV segment, encompassing both integrated Smart TVs and streaming devices that enhance traditional televisions, is the dominant force within the Connected TV market. Within this, Smart TV as a primary device category is experiencing unparalleled growth, driven by inherent convenience and advanced functionalities. The sub-segment of Smart TV devices further consolidates this dominance, offering a unified platform for content consumption and app integration. Key shif in consumer behavior towards integrated entertainment hubs further propels the Smart TV segment's leadership.

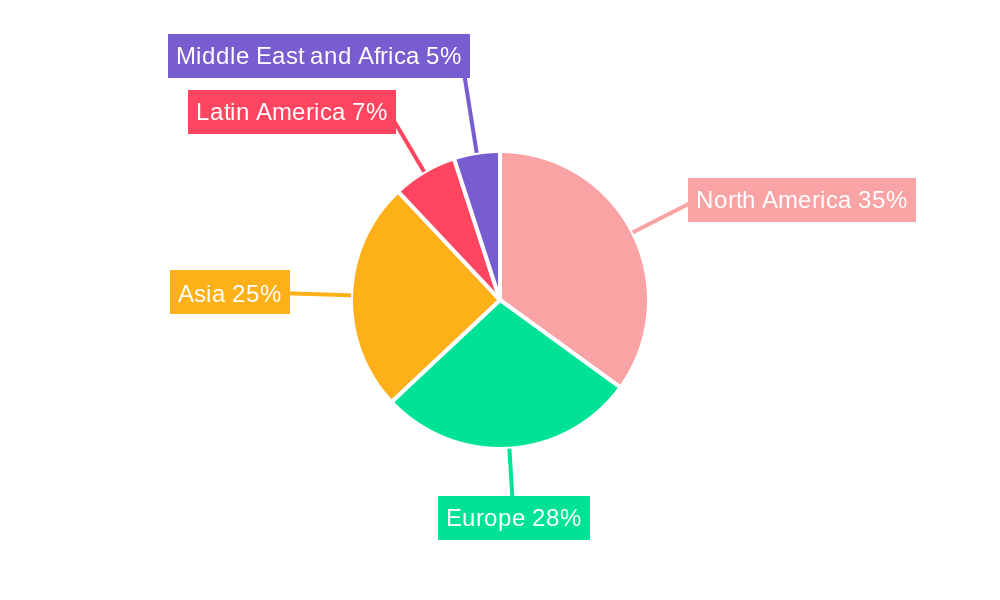

- North America currently leads the global Connected TV market, fueled by high disposable incomes, widespread high-speed internet penetration, and a mature streaming content ecosystem. The economic policies supporting technological adoption and robust infrastructure development create an optimal environment for CTV growth.

- Asia Pacific is emerging as the fastest-growing market, driven by a burgeoning middle class, increasing smartphone penetration leading to a demand for larger screen experiences, and government initiatives promoting digital infrastructure and smart home adoption. Countries like China and India represent significant untapped potential.

- Europe exhibits steady growth, with a strong emphasis on premium viewing experiences and growing adoption of AVOD services. Regulatory frameworks in Europe also play a role in shaping content delivery and data utilization.

The dominance of the Smart TV segment is attributed to its ability to offer a seamless, all-in-one entertainment solution, catering to the increasing consumer demand for convenience and integrated digital experiences. The ongoing advancements in display technology and smart operating systems continue to reinforce the appeal of Smart TVs over standalone streaming devices for many consumers.

Connected TV Market Product Developments

Product developments in the Connected TV market are focused on enhancing user experience through higher resolution displays, advanced picture and sound quality, and intuitive smart interfaces. Innovations like mini-LED and micro-LED technologies offer superior contrast and brightness, while AI-powered upscaling and object recognition optimize content playback. Seamless integration with voice assistants and smart home ecosystems is a key trend, allowing for effortless control and personalized content discovery. The competitive advantage lies in creating a more immersive and personalized viewing experience, with manufacturers like Samsung, LG Electronics, and TCL leading the charge in pushing the boundaries of visual and auditory fidelity in their Smart TV offerings.

Key Drivers of Connected TV Market Growth

The Connected TV (CTV) market is propelled by several key drivers. Technological advancements in display resolutions (4K, 8K), HDR, and immersive audio are making CTVs the preferred platform for premium content consumption. The increasing penetration of high-speed broadband internet globally is essential for seamless streaming, a fundamental requirement for CTV functionality. Shifting consumer preferences towards on-demand content, driven by the popularity of streaming services like Netflix and Disney+, directly fuels CTV adoption. Furthermore, growing advertising expenditure on CTV platforms, due to their ability to offer targeted advertising and measurable ROI, acts as a significant economic catalyst. Government initiatives promoting digital transformation and smart home technologies also contribute to market expansion.

Challenges in the Connected TV Market Market

Despite robust growth, the Connected TV market faces several challenges. Regulatory hurdles, particularly concerning data privacy and content licensing, can complicate operations for content providers and advertisers. Supply chain disruptions for critical components can impact manufacturing timelines and pricing. Intense competitive pressures among established players and emerging entrants can lead to price wars and squeezed profit margins. Furthermore, fragmentation in CTV operating systems and ad tech platforms creates complexity for advertisers seeking unified campaign execution and measurement. Ensuring interoperability across different devices and platforms remains a persistent challenge.

Emerging Opportunities in Connected TV Market

Emerging opportunities in the Connected TV market are primarily driven by advancements in programmatic advertising and data analytics. The ability to leverage first-party data for highly targeted advertising campaigns on CTV platforms presents a significant revenue stream. The expansion of FAST (Free Ad-Supported Streaming TV) channels provides new avenues for content monetization and user acquisition, broadening the audience base for advertisers. Strategic partnerships between TV manufacturers, content providers, and technology enablers are fostering innovation in areas like interactive advertising, shoppable content, and personalized user experiences. The ongoing development of immersive technologies like augmented reality (AR) and virtual reality (VR) integration with CTVs also presents a long-term growth catalyst.

Leading Players in the Connected TV Market Sector

- Panasonic

- Amazon (streaming media player - Fire TV)

- Hisense

- Apple (streaming media player - Apple TV)

- Skyworth

- Google (Chromecast)

- Sharp Electronics

- Xiaomi Corporation

- TCL

- Haier Group

- Vizio Inc

- Roku (streaming media player - Roku)

- Samsung Corporation

- LG Electronics

- Sony Corporation

Key Milestones in Connected TV Market Industry

- May 2023: Blaupunkt and Flipkart announced a partnership to launch the 40-inch Android TV Sigma series. The new Blaupunkt Sigma Series Android TV features a bezel-less design, 512 MB RAM, 4 GB ROM, two bottom-firing built-in speakers with surround sound technology, and 3 HDMI and 2 USB ports, enhancing budget-friendly smart TV options.

- May 2023: Hisense announced the launch of its new ULED X and hero U8 TV products in the United Arab Emirates. The company reported a significant increase in brand awareness in the UAE market from 48% to 73%, a 25 percentage point jump, highlighting successful market penetration strategies.

- November 2022: Samsung launched the Samsung Crystal 55AU7700 55-inch Ultra HD 4K Smart LED TV in India. This Smart TV features a 4K Resolution (3840 x 2160-pixel average), a 60 Hz Refresh Rate, and a 178° Viewing Angle, reinforcing Samsung's commitment to delivering high-quality 4K entertainment at competitive price points.

Strategic Outlook for Connected TV Market Market

The strategic outlook for the Connected TV market remains exceptionally strong, with continued innovation and market expansion as key themes. Growth accelerators will focus on enhancing the ad-supported content ecosystem, including the proliferation of FAST channels and the development of sophisticated programmatic advertising solutions that offer precise targeting and measurable outcomes. The integration of advanced AI capabilities for hyper-personalized user experiences and content recommendations will be crucial for retaining user engagement. Strategic partnerships between hardware manufacturers, software developers, and content creators will foster a more cohesive and user-friendly CTV environment. Furthermore, the increasing adoption of CTVs in emerging markets, coupled with the development of more affordable yet feature-rich devices, will unlock significant new revenue streams and broaden the global reach of connected entertainment.

Connected TV Market Segmentation

-

1. Device

-

1.1. Smart TV

- 1.1.1. Smart TV

- 1.1.2. Smart TV

- 1.1.3. Key shif

- 1.2. Streamin

-

1.1. Smart TV

Connected TV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Connected TV Market Regional Market Share

Geographic Coverage of Connected TV Market

Connected TV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing internet penetration and anticipated shift from conventional TVs; Industry collaborations and favorable market conditions (shift from internet TV to smart TV)

- 3.3. Market Restrains

- 3.3.1. The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution

- 3.4. Market Trends

- 3.4.1. Smart TV Accounts for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Smart TV

- 5.1.1.1. Smart TV

- 5.1.1.2. Smart TV

- 5.1.1.3. Key shif

- 5.1.2. Streamin

- 5.1.1. Smart TV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Smart TV

- 6.1.1.1. Smart TV

- 6.1.1.2. Smart TV

- 6.1.1.3. Key shif

- 6.1.2. Streamin

- 6.1.1. Smart TV

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Smart TV

- 7.1.1.1. Smart TV

- 7.1.1.2. Smart TV

- 7.1.1.3. Key shif

- 7.1.2. Streamin

- 7.1.1. Smart TV

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Smart TV

- 8.1.1.1. Smart TV

- 8.1.1.2. Smart TV

- 8.1.1.3. Key shif

- 8.1.2. Streamin

- 8.1.1. Smart TV

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Latin America Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Smart TV

- 9.1.1.1. Smart TV

- 9.1.1.2. Smart TV

- 9.1.1.3. Key shif

- 9.1.2. Streamin

- 9.1.1. Smart TV

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Middle East and Africa Connected TV Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Smart TV

- 10.1.1.1. Smart TV

- 10.1.1.2. Smart TV

- 10.1.1.3. Key shif

- 10.1.2. Streamin

- 10.1.1. Smart TV

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon (streaming media player - Fire TV)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hisense

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Apple (streaming media player - Apple TV)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skyworth

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google (Chromecast)*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sharp Electronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xiaomi Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TCL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haier Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vizio Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Roku (streaming media player - Roku)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Samsung Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LG Electronics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sony Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Connected TV Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Connected TV Market Revenue (Million), by Device 2025 & 2033

- Figure 3: North America Connected TV Market Revenue Share (%), by Device 2025 & 2033

- Figure 4: North America Connected TV Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Connected TV Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Connected TV Market Revenue (Million), by Device 2025 & 2033

- Figure 7: Europe Connected TV Market Revenue Share (%), by Device 2025 & 2033

- Figure 8: Europe Connected TV Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Connected TV Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Connected TV Market Revenue (Million), by Device 2025 & 2033

- Figure 11: Asia Connected TV Market Revenue Share (%), by Device 2025 & 2033

- Figure 12: Asia Connected TV Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Connected TV Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Connected TV Market Revenue (Million), by Device 2025 & 2033

- Figure 15: Latin America Connected TV Market Revenue Share (%), by Device 2025 & 2033

- Figure 16: Latin America Connected TV Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Connected TV Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Connected TV Market Revenue (Million), by Device 2025 & 2033

- Figure 19: Middle East and Africa Connected TV Market Revenue Share (%), by Device 2025 & 2033

- Figure 20: Middle East and Africa Connected TV Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Connected TV Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 2: Global Connected TV Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 4: Global Connected TV Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 8: Global Connected TV Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 13: Global Connected TV Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: China Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: India Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia and New Zealand Connected TV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 19: Global Connected TV Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Connected TV Market Revenue Million Forecast, by Device 2020 & 2033

- Table 21: Global Connected TV Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected TV Market?

The projected CAGR is approximately 13.20%.

2. Which companies are prominent players in the Connected TV Market?

Key companies in the market include Panasonic, Amazon (streaming media player - Fire TV), Hisense, Apple (streaming media player - Apple TV), Skyworth, Google (Chromecast)*List Not Exhaustive, Sharp Electronics, Xiaomi Corporation, TCL, Haier Group, Vizio Inc, Roku (streaming media player - Roku), Samsung Corporation, LG Electronics, Sony Corporation.

3. What are the main segments of the Connected TV Market?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing internet penetration and anticipated shift from conventional TVs; Industry collaborations and favorable market conditions (shift from internet TV to smart TV).

6. What are the notable trends driving market growth?

Smart TV Accounts for the Largest Market Share.

7. Are there any restraints impacting market growth?

The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution.

8. Can you provide examples of recent developments in the market?

May 2023: Blaupunkt and Flipkart announced a partnership to launch the 40-inch Android TV Sigma series. The new Blaupunkt Sigma Series Android TV has a bezel-less design, 512 MB RAM, 4 GB ROM, two bottom-firing built-in speakers with surround sound technology, and 3 HDMI and 2 USB ports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected TV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected TV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected TV Market?

To stay informed about further developments, trends, and reports in the Connected TV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence