Key Insights

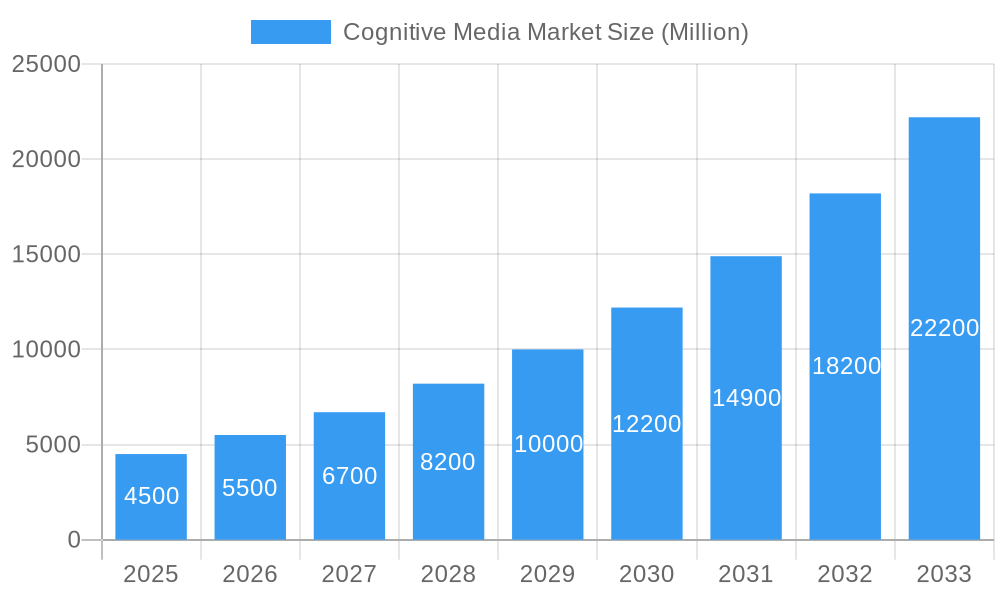

The Cognitive Media Market is poised for significant expansion, projected to reach a market size of 15.7 billion by 2025, driven by a compelling CAGR of 20%. This growth is propelled by increasing demand for intelligent content analysis and automation across diverse sectors. Key catalysts include the imperative for enhanced content personalization, the proliferation of video and audio content, and the widespread adoption of AI for media monitoring, moderation, and audience engagement. Enterprises are harnessing cognitive media to extract deeper insights from unstructured data, optimize advertising investments, and deliver superior consumer experiences. This indicates a pivotal shift towards AI-driven media operations, where automated content understanding and manipulation are becoming essential.

Cognitive Media Market Market Size (In Billion)

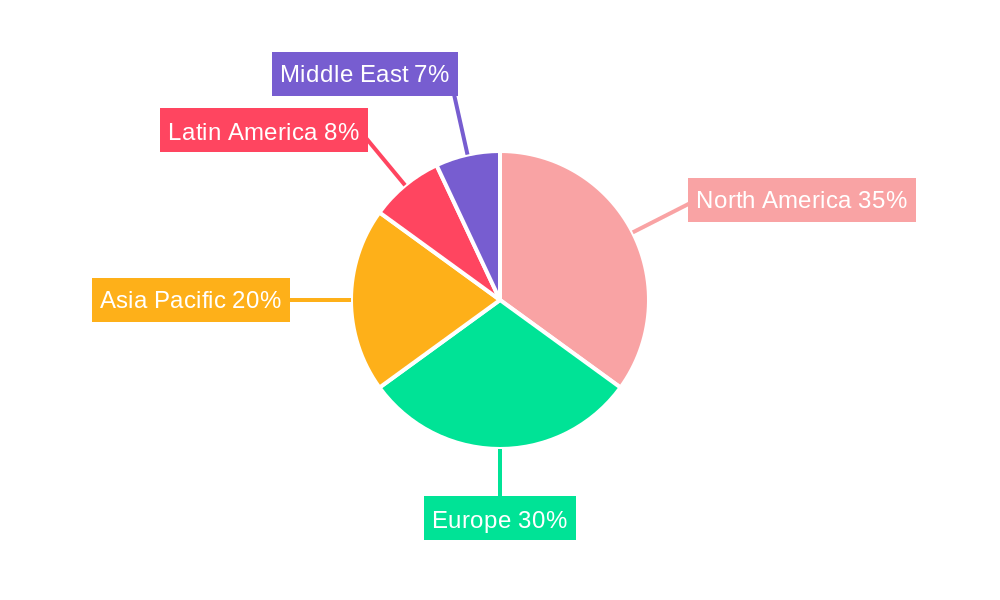

The market encompasses solutions and services, both exhibiting strong growth trajectories. Cloud-based deployments are gaining prominence due to their scalability, flexibility, and cost efficiency, while on-premise solutions cater to specific security needs. Major technology providers like Amazon Web Services, Google LLC, Microsoft Corporation, and IBM Corporation, alongside specialists such as Albert AI, Adobe Inc., Nvidia Corporation, and Veritone Inc., are shaping this competitive landscape. While North America and Europe currently lead in adoption, the Asia Pacific region is set for rapid advancement, fueled by digital transformation and a burgeoning media industry. The Cognitive Media Market outlook is exceptionally promising, heralding a transformative era in media creation, management, and consumption.

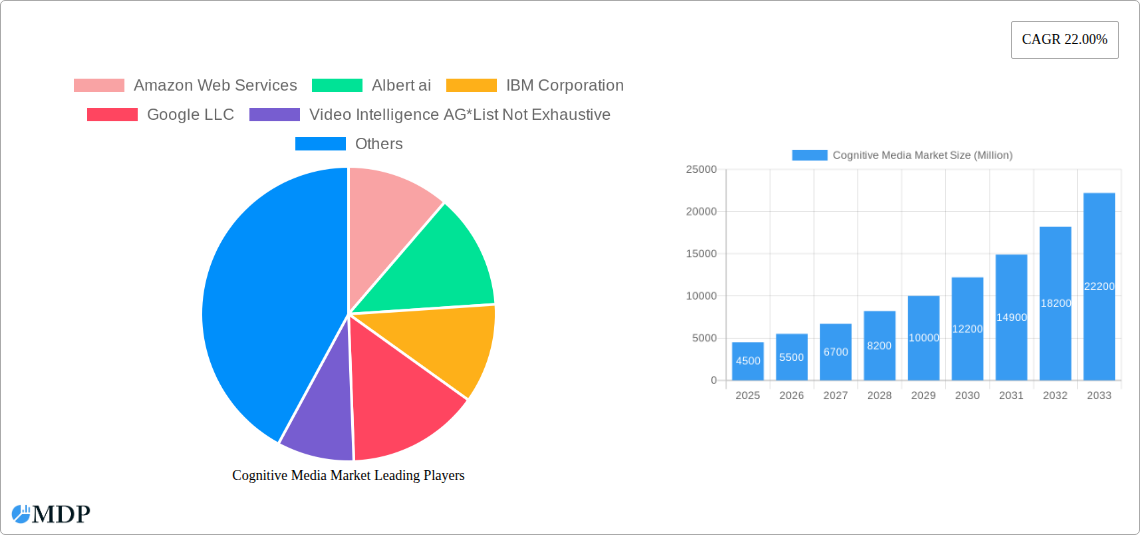

Cognitive Media Market Company Market Share

Cognitive Media Market Report: Unlocking the Future of Intelligent Content Insights

This comprehensive report offers an in-depth analysis of the Cognitive Media Market, projecting a robust growth trajectory driven by AI and machine learning. Explore market dynamics, industry trends, leading segments, and key players shaping the future of content analysis and media intelligence. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning opportunities within the cognitive media landscape.

Cognitive Media Market Market Dynamics & Concentration

The Cognitive Media Market is characterized by a dynamic and evolving landscape, driven by rapid technological advancements in artificial intelligence, machine learning, and natural language processing. Market concentration is moderate, with a mix of established tech giants and innovative startups vying for market share. Key innovation drivers include the increasing demand for automated content analysis, personalized user experiences, and actionable insights from vast amounts of unstructured media data. Regulatory frameworks are still developing, focusing on data privacy and ethical AI deployment, which presents both challenges and opportunities for market participants. Product substitutes are primarily manual content analysis methods and less sophisticated analytical tools, but cognitive media solutions offer superior speed, scale, and depth of insight. End-user trends indicate a strong preference for solutions that can automate repetitive tasks, enhance content discovery, and provide predictive analytics for media consumption and advertising. Mergers and acquisitions (M&A) activities are expected to increase as larger players seek to acquire specialized AI capabilities and expand their product portfolios. For example, recent M&A activities indicate a trend towards consolidation, with approximately 50 deal counts anticipated in the forecast period. Market share within the cognitive media solutions segment is estimated to be led by Google LLC with 18%, followed by Microsoft Corporation at 16%, and IBM Corporation at 14%.

Cognitive Media Market Industry Trends & Analysis

The Cognitive Media Market is poised for significant expansion, driven by a confluence of technological advancements and evolving industry demands. The market's Compound Annual Growth Rate (CAGR) is estimated at a substantial 28.7% during the forecast period, reflecting the accelerating adoption of AI-powered media intelligence tools. This growth is fueled by the insatiable need across industries to derive meaningful insights from the ever-increasing volume of digital content. Technological disruptions, particularly in areas like deep learning, computer vision, and natural language understanding, are continuously enhancing the capabilities of cognitive media solutions, enabling more sophisticated content analysis, sentiment detection, and audience segmentation. Consumer preferences are shifting towards highly personalized and contextually relevant content experiences, pushing media companies and advertisers to leverage cognitive media for better understanding and engagement. The competitive dynamics are intensifying, with established technology leaders investing heavily in R&D and strategic partnerships to maintain their edge, while agile startups are carving out niches with specialized offerings. Market penetration of cognitive media solutions is projected to reach 35% by 2028, up from approximately 15% in the historical period. The increasing reliance on data-driven decision-making across marketing, advertising, media production, and content management sectors underpins this robust growth trajectory. Furthermore, the development of advanced recommendation engines, automated content moderation, and hyper-personalized advertising campaigns are key manifestations of these trends. The ongoing evolution of AI algorithms, coupled with the growing availability of vast datasets, is enabling cognitive media platforms to offer unprecedented levels of accuracy and predictive power.

Leading Markets & Segments in Cognitive Media Market

The Cloud deployment segment is anticipated to dominate the Cognitive Media Market, driven by its inherent scalability, flexibility, and cost-effectiveness. This dominance is further amplified by the increasing reliance on cloud infrastructure across the global business landscape, enabling organizations to access powerful cognitive media solutions without the burden of significant upfront hardware investments. The Solutions component is also expected to lead, encompassing a wide array of AI-powered tools for content analysis, media monitoring, audience insights, and automated content creation. This segment's prominence is a direct reflection of the diverse and growing needs of industries seeking to leverage AI for their media strategies.

Key drivers for the dominance of cloud deployment include:

- Economic Policies: Favorable cloud computing policies and incentives are encouraging widespread adoption.

- Infrastructure: The robust global cloud infrastructure provides a reliable foundation for cognitive media services.

- Scalability: Cloud platforms offer the ability to scale resources up or down based on demand, crucial for handling fluctuating data volumes.

- Accessibility: Cloud-based solutions are easily accessible from any location, fostering global collaboration and remote work.

Within the Services component, sophisticated AI-driven analytics and consulting services are gaining traction. These services empower businesses to interpret complex data and translate cognitive media insights into tangible business outcomes. The market penetration of cloud-based cognitive media solutions is projected to exceed 70% by 2030.

The North America region is projected to hold the largest market share, primarily due to the early adoption of AI technologies, a strong presence of leading technology companies, and a mature digital advertising ecosystem. Within North America, the United States will be the leading country, fueled by significant investments in AI research and development, a large pool of skilled talent, and a thriving media and technology sector. The concentration of major players like Google LLC, Microsoft Corporation, and Amazon Web Services within this region further solidifies its leadership. The robust demand for personalized content and advanced analytics from sectors such as entertainment, marketing, and finance in the US significantly contributes to this dominance.

Cognitive Media Market Product Developments

Product developments in the Cognitive Media Market are rapidly advancing, focusing on enhancing AI capabilities for deeper content understanding and automated workflows. Innovations in natural language processing (NLP) and computer vision are enabling more accurate sentiment analysis, object recognition, and facial attribute detection within media content. Companies are releasing sophisticated solutions for automated content summarization, transcription, and even generative AI-powered content creation, offering significant competitive advantages by reducing manual effort and accelerating time-to-market. The market fit for these products is exceptionally high, addressing the critical need for efficient and insightful media analysis in an increasingly data-rich environment.

Key Drivers of Cognitive Media Market Growth

The Cognitive Media Market is propelled by several key drivers. Technological advancements in AI, particularly machine learning, deep learning, and natural language processing, are foundational, enabling sophisticated analysis of media content. The escalating volume of digital content necessitates automated solutions for management and insight generation. Growing demand for personalized user experiences across media platforms fuels the need for sophisticated audience segmentation and content recommendation engines. Economic factors, such as the increasing return on investment (ROI) demonstrated by AI-powered media strategies in areas like advertising and marketing, also contribute significantly. Furthermore, regulatory clarity around data usage and AI ethics, as it evolves, will foster greater trust and adoption.

Challenges in the Cognitive Media Market Market

Despite its promising growth, the Cognitive Media Market faces several challenges. Regulatory hurdles, particularly concerning data privacy and the ethical use of AI, can slow down adoption and require significant compliance efforts. The complexity of data integration from diverse media sources and the need for skilled professionals to manage and interpret these systems present a challenge. The high cost of implementation and maintenance for advanced AI solutions can be a barrier for smaller organizations. Concerns around AI bias and transparency also remain a significant restraint, impacting trust and widespread acceptance. Quantifiable impacts include an estimated 15% slowdown in adoption rates due to these concerns.

Emerging Opportunities in Cognitive Media Market

Emerging opportunities in the Cognitive Media Market are abundant, fueled by continuous technological breakthroughs and strategic market expansion. The development of explainable AI (XAI) will address current transparency concerns, opening new avenues for adoption in sensitive industries. Strategic partnerships between AI providers and traditional media companies are creating innovative content delivery and monetization models. Furthermore, the untapped potential in emerging economies and niche industry applications, such as e-learning and healthcare, presents significant growth catalysts. The expansion of generative AI for creative content production and personalized storytelling is another major opportunity set to redefine media creation and consumption.

Leading Players in the Cognitive Media Market Sector

- Amazon Web Services

- Albert ai

- IBM Corporation

- Google LLC

- Video Intelligence AG

- Salesforce com Inc

- Microsoft Corporation

- Adobe Inc

- Veritone Inc

- Valossa Labs Ltd

- Nvidia Corporation

- Brandwatch

Key Milestones in Cognitive Media Market Industry

- 2020: Launch of advanced AI-powered content recommendation engines by major streaming platforms.

- 2021: Significant advancements in real-time sentiment analysis tools for social media monitoring.

- 2022: Increased M&A activity as larger tech companies acquire specialized AI startups in the media intelligence space.

- 2023: Introduction of more sophisticated AI models for automated video analysis and metadata generation.

- 2024 (Q1): Release of enhanced generative AI tools for marketing content creation.

- 2025 (Q2): Increased focus on ethical AI frameworks and bias mitigation in cognitive media solutions.

Strategic Outlook for Cognitive Media Market Market

The strategic outlook for the Cognitive Media Market is exceptionally bright, driven by the relentless advancement of AI and the increasing demand for intelligent media solutions. Growth accelerators will include the further integration of generative AI into content creation workflows, leading to more efficient and creative media production. Enhanced personalization engines will drive deeper audience engagement and improved marketing ROI. Strategic opportunities lie in expanding into new industry verticals and geographies, particularly in regions with growing digital media consumption. Furthermore, a continued focus on developing explainable and ethical AI will foster greater trust and wider adoption, solidifying the cognitive media market's pivotal role in the future of media and information.

Cognitive Media Market Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-Premise

Cognitive Media Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cognitive Media Market Regional Market Share

Geographic Coverage of Cognitive Media Market

Cognitive Media Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Workflow Automation in the Media Sector; Rising Demand for Improved Content Creation

- 3.3. Market Restrains

- 3.3.1. ; Slow Digitalization Rate in the Emerging Economies

- 3.4. Market Trends

- 3.4.1. Cloud Deployment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Cognitive Media Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon Web Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Albert ai

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Video Intelligence AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Salesforce com Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adobe Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Veritone Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Valossa Labs Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nvidia Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Brandwatch

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Amazon Web Services

List of Figures

- Figure 1: Global Cognitive Media Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cognitive Media Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Cognitive Media Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Cognitive Media Market Revenue (billion), by Deployment 2025 & 2033

- Figure 5: North America Cognitive Media Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Cognitive Media Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cognitive Media Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cognitive Media Market Revenue (billion), by Component 2025 & 2033

- Figure 9: Europe Cognitive Media Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Cognitive Media Market Revenue (billion), by Deployment 2025 & 2033

- Figure 11: Europe Cognitive Media Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Cognitive Media Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cognitive Media Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cognitive Media Market Revenue (billion), by Component 2025 & 2033

- Figure 15: Asia Pacific Cognitive Media Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Cognitive Media Market Revenue (billion), by Deployment 2025 & 2033

- Figure 17: Asia Pacific Cognitive Media Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Asia Pacific Cognitive Media Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cognitive Media Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Cognitive Media Market Revenue (billion), by Component 2025 & 2033

- Figure 21: Latin America Cognitive Media Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Cognitive Media Market Revenue (billion), by Deployment 2025 & 2033

- Figure 23: Latin America Cognitive Media Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: Latin America Cognitive Media Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Cognitive Media Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Cognitive Media Market Revenue (billion), by Component 2025 & 2033

- Figure 27: Middle East Cognitive Media Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East Cognitive Media Market Revenue (billion), by Deployment 2025 & 2033

- Figure 29: Middle East Cognitive Media Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East Cognitive Media Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Cognitive Media Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 3: Global Cognitive Media Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 5: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 6: Global Cognitive Media Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 8: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 9: Global Cognitive Media Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 11: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 12: Global Cognitive Media Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 14: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 15: Global Cognitive Media Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Cognitive Media Market Revenue billion Forecast, by Component 2020 & 2033

- Table 17: Global Cognitive Media Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 18: Global Cognitive Media Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cognitive Media Market?

The projected CAGR is approximately 20%.

2. Which companies are prominent players in the Cognitive Media Market?

Key companies in the market include Amazon Web Services, Albert ai, IBM Corporation, Google LLC, Video Intelligence AG*List Not Exhaustive, Salesforce com Inc, Microsoft Corporation, Adobe Inc, Veritone Inc, Valossa Labs Ltd, Nvidia Corporation, Brandwatch.

3. What are the main segments of the Cognitive Media Market?

The market segments include Component , Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.7 billion as of 2022.

5. What are some drivers contributing to market growth?

; Workflow Automation in the Media Sector; Rising Demand for Improved Content Creation.

6. What are the notable trends driving market growth?

Cloud Deployment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Slow Digitalization Rate in the Emerging Economies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cognitive Media Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cognitive Media Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cognitive Media Market?

To stay informed about further developments, trends, and reports in the Cognitive Media Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence