Key Insights

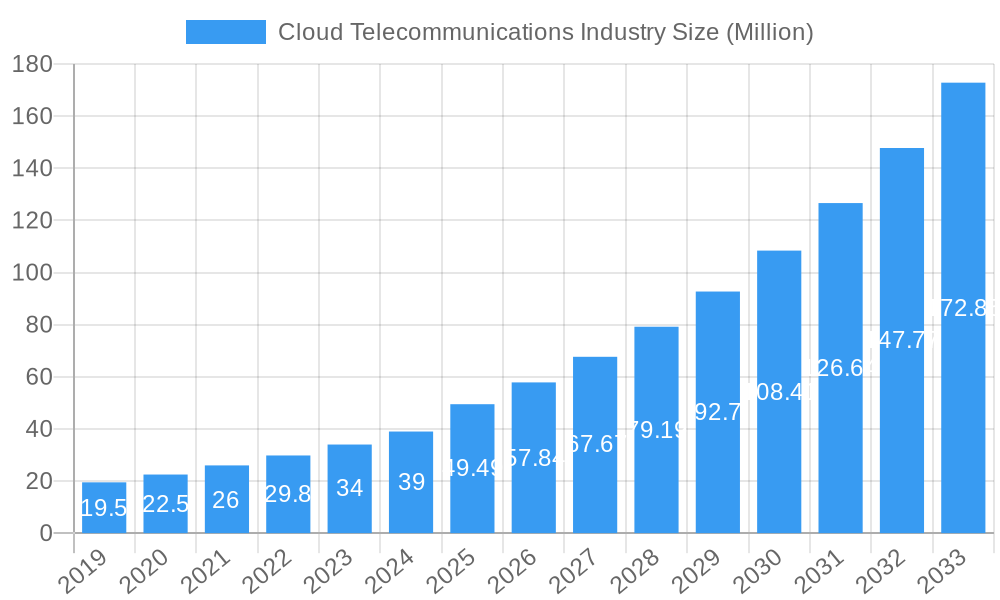

The global Cloud Telecommunications market is poised for robust expansion, projected to reach an estimated market size of $49.49 billion by 2025. This significant growth is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 16.76% during the forecast period of 2025-2033. This upward trajectory is primarily propelled by the increasing adoption of cloud-based solutions across various industries, driven by the inherent benefits of scalability, flexibility, and cost-efficiency that cloud telecommunications offer. The transition from traditional on-premise infrastructure to agile cloud services is a critical driver, enabling businesses to enhance their communication capabilities, streamline operations, and improve customer engagement. Furthermore, the burgeoning demand for advanced communication features such as unified communications, VoIP, and collaboration tools, all readily available through cloud platforms, is fueling market expansion. The increasing digitalization initiatives across sectors like BFSI, retail, and manufacturing are also playing a pivotal role in driving the adoption of cloud telecommunications, as these industries seek to leverage enhanced connectivity and data management for improved service delivery and operational efficiency.

Cloud Telecommunications Industry Market Size (In Million)

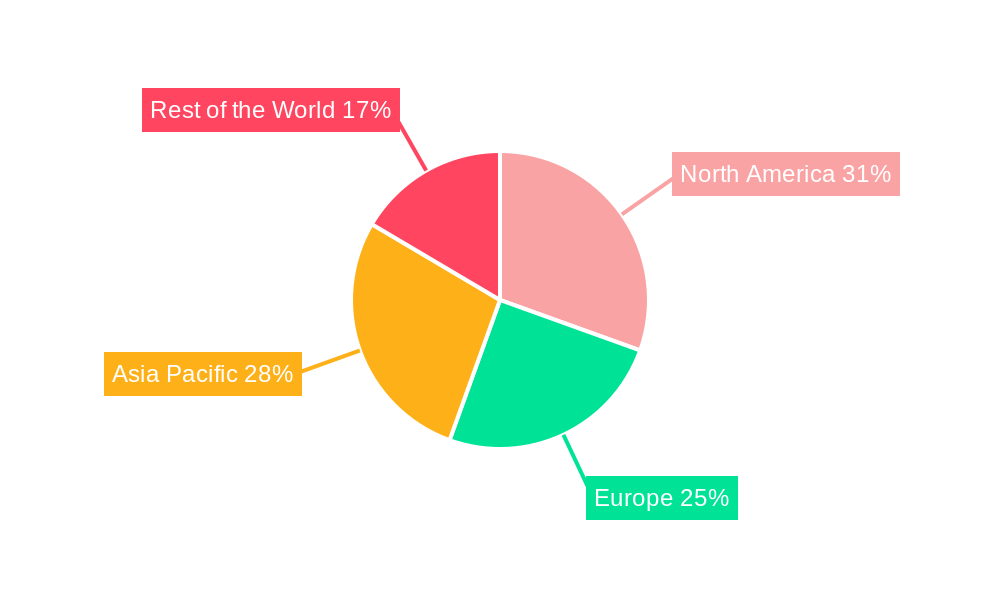

Key trends shaping the Cloud Telecommunications Industry include the rise of hybrid and multi-cloud strategies, offering organizations greater control and flexibility in their deployment. The integration of artificial intelligence (AI) and machine learning (ML) into cloud communication platforms is enhancing functionalities like intelligent routing, predictive analytics, and personalized customer interactions, thereby boosting market adoption. The growing emphasis on cybersecurity and data privacy is also driving demand for secure and compliant cloud telecommunication solutions. However, certain challenges, such as the complexity of migrating legacy systems and concerns regarding vendor lock-in, may present some restraints. Despite these hurdles, the market is expected to witness substantial growth across segments like Billing and Provisioning and Traffic Management, with significant contributions from end-users in BFSI, Retail, and Manufacturing. Regionally, North America and Asia Pacific are anticipated to lead the market, owing to their advanced technological infrastructure and high adoption rates of cloud services, while Europe and the Rest of the World also present significant growth opportunities.

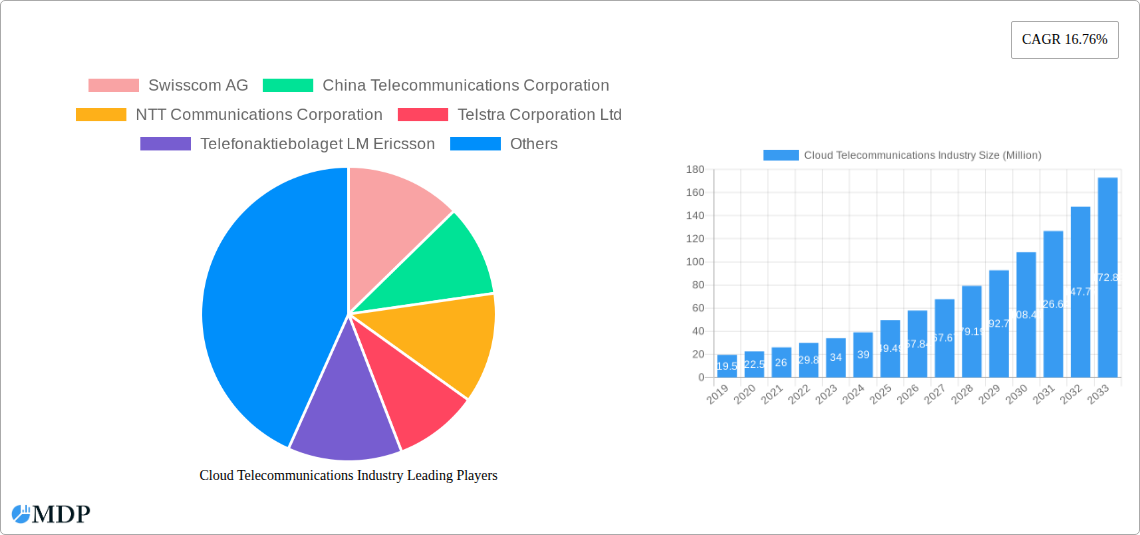

Cloud Telecommunications Industry Company Market Share

This comprehensive market research report delves deep into the dynamic Cloud Telecommunications Industry, providing invaluable insights for Communication Service Providers (CSPs), enterprises, and industry stakeholders. Spanning the historical period of 2019–2024 and a robust forecast period from 2025–2033, with a base year of 2025, this report offers a detailed analysis of market dynamics, growth drivers, emerging trends, and competitive landscapes. With a projected market size in the hundreds of billions of dollars and a significant Compound Annual Growth Rate (CAGR), the cloud telecom market is poised for exponential expansion. This report is your definitive guide to navigating the opportunities and challenges within this transformative sector, covering key segments like cloud communication solutions, telecom cloud services, and 5G cloud infrastructure.

Cloud Telecommunications Industry Market Dynamics & Concentration

The Cloud Telecommunications Industry is characterized by a dynamic interplay of innovation, regulation, and strategic partnerships. Market concentration is moderately fragmented, with a few dominant players holding significant market share, alongside a growing number of agile startups introducing disruptive technologies. Key innovation drivers include the relentless demand for enhanced network agility, scalability, and cost optimization through cloud adoption. Regulatory frameworks, while sometimes posing challenges, are also evolving to support the secure and efficient deployment of cloud-based telecom services. Product substitutes, such as on-premise solutions, are increasingly being overshadowed by the superior flexibility and cost-effectiveness of cloud offerings. End-user trends showcase a strong preference for integrated communication platforms and unified communications as a service (UCaaS) across sectors like BFSI, retail, and healthcare. Merger and acquisition (M&A) activities remain a significant aspect of market dynamics, with approximately 50-70 major M&A deals anticipated between 2025 and 2030, driven by consolidation and the pursuit of synergistic capabilities. For instance, AT&T Inc. and Verizon Communications Inc. have been actively involved in strategic partnerships and divestitures to optimize their cloud-centric portfolios. The total market share of the top 5 players is estimated to be around 35-45% in 2025, with an expected increase in concentration as the market matures.

Cloud Telecommunications Industry Industry Trends & Analysis

The Cloud Telecommunications Industry is experiencing robust growth driven by the widespread adoption of digital transformation initiatives across all sectors. The increasing demand for flexible and scalable communication solutions to support remote workforces, enhanced customer engagement, and efficient business operations is a primary growth catalyst. Technological disruptions, particularly the evolution of 5G networks, edge computing, and artificial intelligence (AI), are fundamentally reshaping the industry's landscape. These advancements enable lower latency, higher bandwidth, and more intelligent network management, paving the way for innovative applications such as IoT communications, virtualized network functions (VNFs), and software-defined networking (SDN). Consumer preferences are shifting towards seamless, integrated communication experiences, emphasizing the importance of UCaaS, contact center as a service (CCaaS), and collaboration tools. The competitive dynamics are intensifying, with established telecom giants like Deutsche Telekom, BT Group PLC, and NTT Communications Corporation investing heavily in cloud infrastructure and services, while agile players like Telefonaktiebolaget LM Ericsson focus on network modernization and cloud-native solutions. The market penetration of cloud-based telecom solutions is expected to reach over 60% by 2030. The estimated CAGR for the Cloud Telecommunications Industry from 2025 to 2033 is projected to be in the range of 15-18%, reaching a market valuation exceeding $700 Billion by the end of the forecast period. The ongoing expansion of cloud infrastructure and the development of next-generation telecom platforms are critical to sustaining this upward trajectory. Furthermore, the increasing integration of cloud services with business applications is driving significant demand from industries like manufacturing and transportation and distribution, seeking to optimize their supply chains and operational efficiencies. The proliferation of cloud-native architectures is also enabling Communication Service Providers to accelerate innovation and reduce time-to-market for new services.

Leading Markets & Segments in Cloud Telecommunications Industry

North America currently dominates the Cloud Telecommunications Industry, driven by advanced technological infrastructure, high adoption rates of cloud services, and a robust regulatory environment supporting innovation. The United States, in particular, represents a significant market share, fueled by the presence of major telecom operators and a strong enterprise demand for cloud communication solutions.

Type Segmentation Dominance:

- Solution: The cloud communication solution segment is experiencing substantial growth, encompassing UCaaS, CCaaS, and video conferencing solutions. Key drivers include the need for enhanced collaboration and customer engagement, particularly post-pandemic. Enterprises are increasingly migrating their communication infrastructure to the cloud to benefit from scalability and cost efficiencies.

- Service: The telecom cloud service segment, including network-as-a-service (NaaS) and managed cloud services, is a critical component of the industry's growth. CSPs are leveraging cloud platforms to deliver agile and on-demand network capabilities, supporting dynamic bandwidth requirements and flexible service deployment.

- Other Types: This segment, encompassing specialized cloud offerings for specific industry needs, is also showing promising growth, driven by tailored solutions in areas like IoT connectivity and private cloud deployments for enhanced security.

Application Segmentation Dominance:

- Billing and Provisioning: This segment is crucial for CSPs seeking to streamline their operations and improve customer billing accuracy. The adoption of cloud-based billing and provisioning systems is driven by the need for greater automation, real-time data processing, and enhanced subscriber management.

- Traffic Management: As network traffic continues to surge with the proliferation of digital services, cloud-based traffic management solutions are becoming indispensable. These solutions leverage AI and analytics to optimize network performance, ensure quality of service (QoS), and manage bandwidth effectively.

- Other Applications: This broad category includes applications such as network analytics, service assurance, and security management, all of which are increasingly being delivered through cloud platforms to provide enhanced visibility and control.

End User Segmentation Dominance:

- BFSI: The Banking, Financial Services, and Insurance (BFSI) sector is a major adopter of cloud telecommunications due to its stringent security requirements, need for reliable communication for customer service, and regulatory compliance mandates. Cloud-based solutions enable secure and efficient communication channels for financial transactions and customer support.

- Retail: The retail industry utilizes cloud telecommunications for enhanced customer engagement through unified communication platforms, improved supply chain coordination, and scalable solutions for seasonal demand fluctuations.

- Manufacturing: Manufacturing enterprises are increasingly adopting cloud solutions for real-time communication, machine-to-machine (M2M) communication, and collaborative operations to optimize production lines and supply chain visibility.

- Transportation and Distribution: This sector benefits from cloud telecommunications for fleet management, logistics optimization, and real-time tracking of shipments, leading to improved efficiency and customer satisfaction.

- Healthcare: The healthcare industry leverages cloud-based solutions for telemedicine, secure patient data communication, and remote patient monitoring, enhancing accessibility and efficiency of healthcare services.

- Government: Government agencies are increasingly adopting cloud telecommunications for secure communication, citizen services, and efficient disaster management, driven by the need for cost-effectiveness and agility.

- Media and Entertainment: This sector utilizes cloud platforms for content delivery, live streaming, and collaborative production workflows, requiring high bandwidth and low latency.

Cloud Telecommunications Industry Product Developments

The Cloud Telecommunications Industry is witnessing a rapid evolution of product developments, driven by advancements in AI, 5G, and edge computing. Key innovations focus on enhancing network automation, improving user experience, and enabling new service offerings. Telefonaktiebolaget LM Ericsson and Nokia are at the forefront, developing cloud-native IMS Voice Core products that boost operational agility for CSPs and reduce network management costs. Furthermore, the integration of AI in traffic management solutions is optimizing network performance and predicting potential disruptions. The development of secure and scalable cloud communication platforms for diverse end-users, including BFSI and healthcare, highlights the market's responsiveness to specific industry needs. These advancements aim to deliver seamless, reliable, and intelligent communication services.

Key Drivers of Cloud Telecommunications Industry Growth

The exponential growth of the Cloud Telecommunications Industry is propelled by several key drivers. The escalating demand for scalable and flexible network infrastructure to support burgeoning data traffic and emerging technologies like IoT and AI is paramount. Digital transformation initiatives across all industries necessitate robust and agile communication solutions, driving the adoption of cloud-based services. Furthermore, the pursuit of operational efficiency and cost reduction by enterprises and CSPs alike makes cloud solutions an attractive proposition. Favorable regulatory landscapes and government initiatives promoting digital connectivity also play a significant role in fostering market expansion. The ongoing evolution of 5G technology is a critical enabler, unlocking new revenue streams and application possibilities for cloud telecom providers.

Challenges in the Cloud Telecommunications Industry Market

Despite its promising growth, the Cloud Telecommunications Industry faces several significant challenges. Regulatory hurdles and data privacy concerns remain a constant concern, particularly with cross-border data flows and evolving compliance landscapes. Cybersecurity threats continue to pose a substantial risk, necessitating robust security protocols and ongoing vigilance. Interoperability issues between different cloud platforms and legacy systems can hinder seamless integration and deployment. Furthermore, the high initial investment costs for migrating to cloud infrastructure and the shortage of skilled IT professionals with cloud expertise can act as barriers for some organizations. Intense competitive pressures also necessitate continuous innovation and strategic differentiation to maintain market share.

Emerging Opportunities in Cloud Telecommunications Industry

The Cloud Telecommunications Industry is ripe with emerging opportunities, driven by technological breakthroughs and evolving market demands. The widespread deployment of 5G networks presents a significant catalyst, enabling the development of ultra-low latency applications, massive IoT deployments, and enhanced mobile broadband experiences. The growing adoption of edge computing offers opportunities for localized data processing and reduced latency, crucial for real-time applications in sectors like autonomous vehicles and industrial automation. Strategic partnerships between telecom operators, cloud providers, and application developers are creating new ecosystems and service bundles. Furthermore, the increasing demand for hybrid and multi-cloud solutions provides opportunities for vendors offering flexible and interoperable cloud management platforms. The expansion into underserved markets and the development of specialized solutions for emerging industries are also significant growth avenues.

Leading Players in the Cloud Telecommunications Industry Sector

- AT&T Inc.

- Verizon Communications Inc.

- Deutsche Telekom

- BT Group PLC

- Singapore Telecommunications Limited

- Swisscom AG

- China Telecommunications Corporation

- NTT Communications Corporation

- Telstra Corporation Ltd

- Telus Corporation

- CenturyLink Inc

- Telefonaktiebolaget LM Ericsson

Key Milestones in Cloud Telecommunications Industry Industry

- July 2022: Nokia and AST SpaceMobile, Inc. inked a five-year 5G agreement. Following this agreement, the businesses will collaborate to increase universal coverage and connect underserved communities worldwide.

- May 2022: Nokia unveiled the release of the cloud-native IMS Voice Core product, which would aid CSPs (Communication Service Providers) in improving operational agility, streamlining network operations, and lowering network management costs.

Strategic Outlook for Cloud Telecommunications Industry Market

The strategic outlook for the Cloud Telecommunications Industry is overwhelmingly positive, driven by ongoing technological advancements and increasing global demand for digital connectivity. Key growth accelerators include the continued rollout of 5G infrastructure, enabling a new generation of low-latency, high-bandwidth applications. The burgeoning adoption of edge computing will further enhance the capabilities of cloud telecom services, particularly for real-time processing and localized data management. Strategic partnerships between CSPs, cloud providers, and enterprises will foster innovation and create synergistic opportunities for new service development and market penetration. The focus on hybrid and multi-cloud strategies will also drive demand for interoperable and flexible solutions. The industry is poised for significant expansion as it continues to underpin digital transformation across all sectors.

Cloud Telecommunications Industry Segmentation

-

1. Type

- 1.1. Solution

- 1.2. Service

- 1.3. Other Types

-

2. Application

- 2.1. Billing and Provisioning

- 2.2. Traffic Management

- 2.3. Other Applications

-

3. End User

- 3.1. BFSI

- 3.2. Retail

- 3.3. Manufacturing

- 3.4. Transportation and Distribution

- 3.5. Healthcare

- 3.6. Government

- 3.7. Media and Entertainment

- 3.8. Other End Users

Cloud Telecommunications Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Cloud Telecommunications Industry Regional Market Share

Geographic Coverage of Cloud Telecommunications Industry

Cloud Telecommunications Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Hybrid Cloud in Telecom; Lower Operational and Administration Costs

- 3.3. Market Restrains

- 3.3.1. Privacy and Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Solution Expected To Dominate the Telecom Cloud Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solution

- 5.1.2. Service

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billing and Provisioning

- 5.2.2. Traffic Management

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Manufacturing

- 5.3.4. Transportation and Distribution

- 5.3.5. Healthcare

- 5.3.6. Government

- 5.3.7. Media and Entertainment

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cloud Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solution

- 6.1.2. Service

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Billing and Provisioning

- 6.2.2. Traffic Management

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. Retail

- 6.3.3. Manufacturing

- 6.3.4. Transportation and Distribution

- 6.3.5. Healthcare

- 6.3.6. Government

- 6.3.7. Media and Entertainment

- 6.3.8. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cloud Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solution

- 7.1.2. Service

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Billing and Provisioning

- 7.2.2. Traffic Management

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. Retail

- 7.3.3. Manufacturing

- 7.3.4. Transportation and Distribution

- 7.3.5. Healthcare

- 7.3.6. Government

- 7.3.7. Media and Entertainment

- 7.3.8. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Cloud Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solution

- 8.1.2. Service

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Billing and Provisioning

- 8.2.2. Traffic Management

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. Retail

- 8.3.3. Manufacturing

- 8.3.4. Transportation and Distribution

- 8.3.5. Healthcare

- 8.3.6. Government

- 8.3.7. Media and Entertainment

- 8.3.8. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Cloud Telecommunications Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solution

- 9.1.2. Service

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Billing and Provisioning

- 9.2.2. Traffic Management

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. BFSI

- 9.3.2. Retail

- 9.3.3. Manufacturing

- 9.3.4. Transportation and Distribution

- 9.3.5. Healthcare

- 9.3.6. Government

- 9.3.7. Media and Entertainment

- 9.3.8. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Swisscom AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 China Telecommunications Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NTT Communications Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Telstra Corporation Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Telefonaktiebolaget LM Ericsson

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CenturyLink Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Verizon Communications Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Singapore Telecommunications Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BT Group PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AT&T Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Deutsche Telekom

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Telus Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Swisscom AG

List of Figures

- Figure 1: Global Cloud Telecommunications Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud Telecommunications Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Telecommunications Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Cloud Telecommunications Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Cloud Telecommunications Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cloud Telecommunications Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Cloud Telecommunications Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Cloud Telecommunications Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Cloud Telecommunications Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Cloud Telecommunications Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Cloud Telecommunications Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Cloud Telecommunications Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Cloud Telecommunications Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Cloud Telecommunications Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Cloud Telecommunications Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Cloud Telecommunications Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cloud Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cloud Telecommunications Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cloud Telecommunications Industry Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Cloud Telecommunications Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Cloud Telecommunications Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Cloud Telecommunications Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Cloud Telecommunications Industry Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Cloud Telecommunications Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Cloud Telecommunications Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Cloud Telecommunications Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Cloud Telecommunications Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Cloud Telecommunications Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Cloud Telecommunications Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Cloud Telecommunications Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Cloud Telecommunications Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Cloud Telecommunications Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cloud Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cloud Telecommunications Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cloud Telecommunications Industry Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Cloud Telecommunications Industry Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Cloud Telecommunications Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Cloud Telecommunications Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Cloud Telecommunications Industry Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Cloud Telecommunications Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Cloud Telecommunications Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Cloud Telecommunications Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Cloud Telecommunications Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Cloud Telecommunications Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Cloud Telecommunications Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Cloud Telecommunications Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Cloud Telecommunications Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Cloud Telecommunications Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cloud Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cloud Telecommunications Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Cloud Telecommunications Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Rest of the World Cloud Telecommunications Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Rest of the World Cloud Telecommunications Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Rest of the World Cloud Telecommunications Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Rest of the World Cloud Telecommunications Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Rest of the World Cloud Telecommunications Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Rest of the World Cloud Telecommunications Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of the World Cloud Telecommunications Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Rest of the World Cloud Telecommunications Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Rest of the World Cloud Telecommunications Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Rest of the World Cloud Telecommunications Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of the World Cloud Telecommunications Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of the World Cloud Telecommunications Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Cloud Telecommunications Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Cloud Telecommunications Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Cloud Telecommunications Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Telecommunications Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Cloud Telecommunications Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Cloud Telecommunications Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Cloud Telecommunications Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Cloud Telecommunications Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cloud Telecommunications Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Cloud Telecommunications Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Cloud Telecommunications Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Cloud Telecommunications Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Cloud Telecommunications Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: US Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: US Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Cloud Telecommunications Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Cloud Telecommunications Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Global Cloud Telecommunications Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Cloud Telecommunications Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global Cloud Telecommunications Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: Germany Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Germany Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: UK Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: UK Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Global Cloud Telecommunications Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 41: Global Cloud Telecommunications Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: Global Cloud Telecommunications Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Cloud Telecommunications Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 45: Global Cloud Telecommunications Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 47: India Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: China Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Japan Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Cloud Telecommunications Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Cloud Telecommunications Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Cloud Telecommunications Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 57: Global Cloud Telecommunications Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Cloud Telecommunications Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 60: Global Cloud Telecommunications Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 61: Global Cloud Telecommunications Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Cloud Telecommunications Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Telecommunications Industry?

The projected CAGR is approximately 16.76%.

2. Which companies are prominent players in the Cloud Telecommunications Industry?

Key companies in the market include Swisscom AG, China Telecommunications Corporation, NTT Communications Corporation, Telstra Corporation Ltd, Telefonaktiebolaget LM Ericsson, CenturyLink Inc, Verizon Communications Inc, Singapore Telecommunications Limited, BT Group PLC, AT&T Inc, Deutsche Telekom, Telus Corporation.

3. What are the main segments of the Cloud Telecommunications Industry?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Hybrid Cloud in Telecom; Lower Operational and Administration Costs.

6. What are the notable trends driving market growth?

Solution Expected To Dominate the Telecom Cloud Market.

7. Are there any restraints impacting market growth?

Privacy and Data Security Concerns.

8. Can you provide examples of recent developments in the market?

July 2022 - Nokia and AST SpaceMobile, Inc, inked a five-year 5G agreement. Following this agreement, the businesses will collaborate to increase universal coverage and connect underserved communities worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Telecommunications Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Telecommunications Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Telecommunications Industry?

To stay informed about further developments, trends, and reports in the Cloud Telecommunications Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence