Key Insights

The cloud advertising market is projected to experience significant expansion, driven by the escalating adoption of cloud technologies and robust growth in digital ad spending. With a projected CAGR of 9.08%, the market is estimated to reach $13.53 billion by 2025. Key growth factors include the inherent scalability and cost-efficiency of cloud-based advertising platforms, advanced data analytics for precise campaign targeting, and the rising trend of omnichannel marketing. The market is segmented by deployment model (public, private, hybrid), service type (IaaS, SaaS, PaaS), and end-user industries (retail, media & entertainment, IT & telecom, BFSI, government). Major industry players like Google, Amazon, Microsoft, and Salesforce dominate the landscape, reflecting high market entry barriers and intense innovation. The integration of AI and machine learning is further enhancing campaign personalization and effectiveness. Geographic expansion, particularly in the Asia-Pacific region with its increasing internet penetration, is a notable driver of market growth. While data privacy concerns and evolving regulations pose potential challenges, the outlook for the cloud advertising market remains highly favorable.

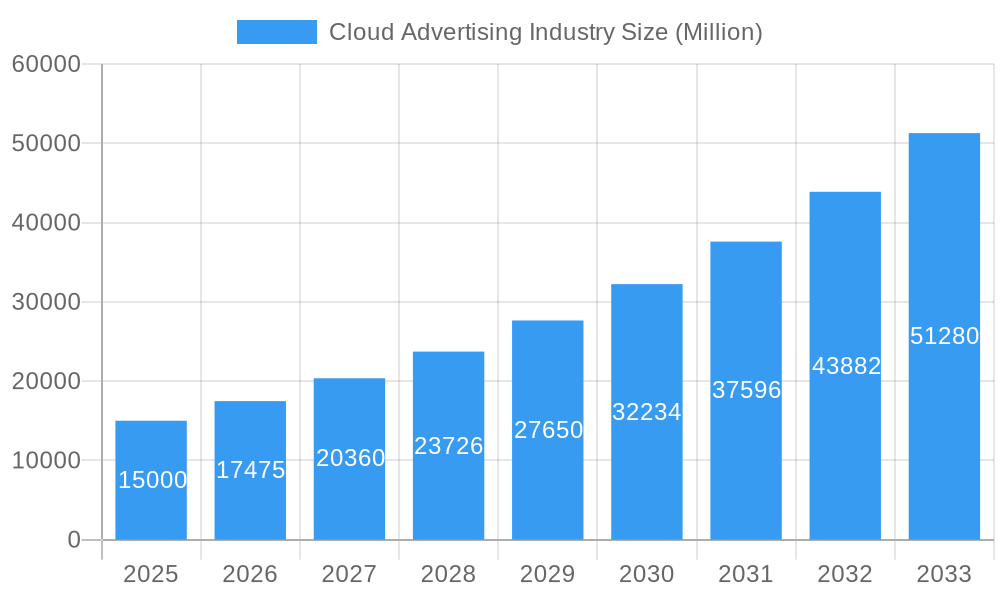

Cloud Advertising Industry Market Size (In Billion)

The competitive environment features a blend of established technology leaders and specialized advertising technology providers. Leading companies leverage their extensive infrastructure and customer networks to deliver integrated cloud advertising solutions. Simultaneously, agile, specialized firms focus on niche segments such as programmatic advertising and specific industry solutions. Future market dynamics will be influenced by emerging technologies like serverless computing, edge computing, and the Internet of Things (IoT), which will enable real-time advertising and hyper-personalization, thereby improving advertiser ROI. The increasing demand for sophisticated analytics tools for campaign optimization and performance measurement will also spur innovation and investment within the cloud advertising sector. Furthermore, the sustained shift towards mobile advertising and the growing popularity of video content are key contributors to ongoing market expansion.

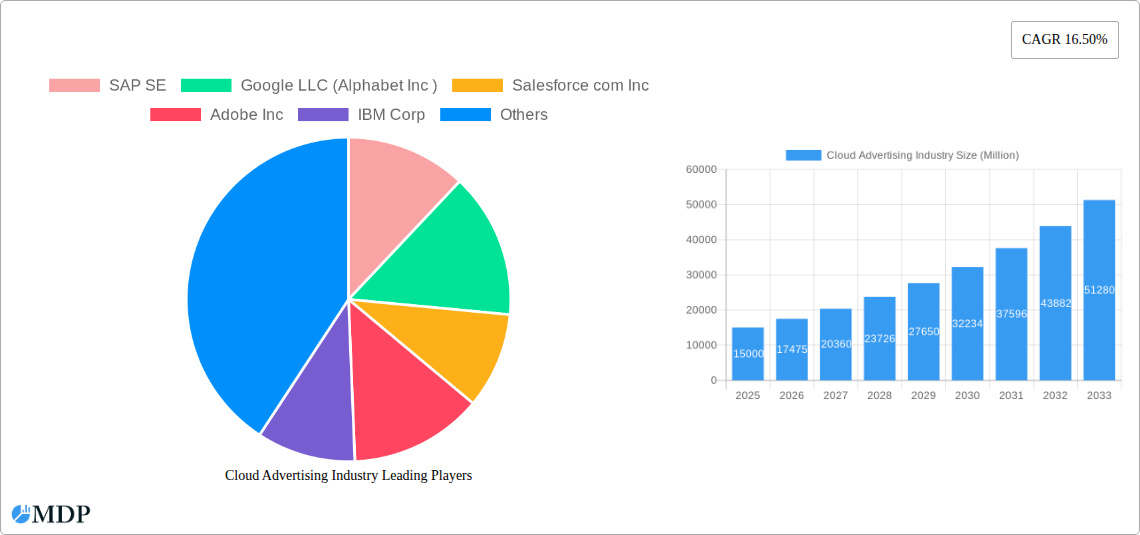

Cloud Advertising Industry Company Market Share

Cloud Advertising Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Cloud Advertising Industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report leverages extensive data analysis to project a market valued at $xx Million by 2033, exhibiting a robust CAGR of xx%.

Cloud Advertising Industry Market Dynamics & Concentration

The Cloud Advertising Industry is characterized by high dynamism and a concentrated competitive landscape. While a few major players command significant market share, smaller, specialized firms are also making inroads, fostering innovation and competition. Market concentration is evident in the dominance of leading players like Google LLC, Amazon Web Services, and Microsoft Corp, who collectively hold an estimated xx% market share in 2025. However, the continuous influx of new entrants and strategic partnerships is leading to a more diversified landscape.

Several factors contribute to the industry's dynamism:

- Innovation Drivers: Constant advancements in AI, machine learning, and big data analytics are pushing the boundaries of targeted advertising, creating new opportunities for growth and efficiency.

- Regulatory Frameworks: Evolving data privacy regulations (like GDPR and CCPA) are reshaping advertising practices and influencing market consolidation. Compliance costs represent a significant barrier for smaller firms.

- Product Substitutes: The emergence of alternative advertising platforms and channels poses a challenge to traditional cloud advertising models. Competition from decentralized advertising networks and alternative data sources is increasing.

- End-User Trends: The increasing preference for personalized and contextual advertising drives demand for sophisticated cloud-based advertising solutions. Rising adoption of mobile devices and connected devices exponentially increases the addressable market.

- M&A Activities: The industry witnesses regular mergers and acquisitions, with over xx M&A deals recorded between 2019 and 2024. These activities reflect efforts to consolidate market share, enhance technological capabilities, and broaden market reach. For example, the acquisition of Aarin Inc. by OSF Digital in July 2022 signifies the ongoing consolidation within the Salesforce Marketing Cloud ecosystem.

Cloud Advertising Industry Industry Trends & Analysis

The Cloud Advertising Industry is experiencing exponential growth fueled by several key factors. The market is projected to reach $xx Million by 2033, driven by increasing digitalization, the rise of mobile advertising, and the growing adoption of programmatic advertising technologies.

Key trends shaping the industry include:

- Market Growth Drivers: The proliferation of connected devices, increased internet penetration, and the rising adoption of cloud-based services are major drivers of market expansion. Businesses are increasingly relying on cloud-based advertising platforms for improved targeting, measurement, and campaign optimization.

- Technological Disruptions: Artificial intelligence (AI) and machine learning (ML) are revolutionizing the industry by enabling advanced targeting, audience segmentation, and real-time campaign optimization. Blockchain technology is emerging as a potential solution for enhancing transparency and security in digital advertising.

- Consumer Preferences: Consumers are becoming more discerning about their online experiences, demanding personalized and relevant advertising. This preference drives demand for cloud-based solutions that enable sophisticated targeting and personalization.

- Competitive Dynamics: The industry is marked by intense competition among established players and emerging companies. Competitive strategies involve product innovation, strategic partnerships, and acquisitions. The increasing importance of data privacy and security is further shaping competitive landscapes.

Leading Markets & Segments in Cloud Advertising Industry

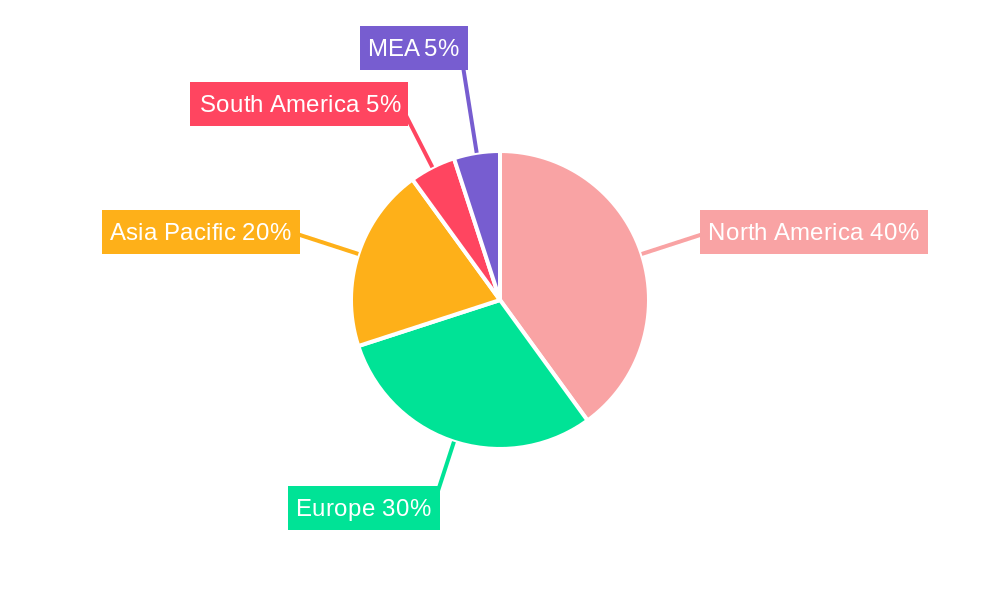

The North American region currently holds the largest market share in the Cloud Advertising Industry, driven by high internet penetration, a robust digital economy, and the presence of major technology companies. However, Asia-Pacific is poised for significant growth in the coming years, fueled by rapid digitalization and increasing smartphone adoption.

Dominant Segments:

- By Type: Public cloud dominates the market, representing approximately xx% of total revenue in 2025 due to its scalability and cost-effectiveness.

- By Service: SaaS currently holds the largest market share, followed by IaaS and PaaS. The dominance of SaaS is primarily attributed to its ease of implementation and subscription-based model.

- By End User: The retail, media and entertainment, and IT and telecom sectors are major consumers of cloud advertising services. The BFSI sector is also showing significant growth, driven by the need for enhanced customer engagement and personalized offerings.

Key Drivers for Dominant Segments:

- North America: Strong technological infrastructure, favorable government policies, and high consumer spending power contribute to the region's dominance.

- Public Cloud: Scalability, cost-effectiveness, and ease of implementation fuel its market leadership.

- SaaS: User-friendly interface, subscription-based pricing, and regular software updates contribute to its popularity.

- Retail, Media & Entertainment: High competition and the need for effective marketing strategies drive high demand for cloud advertising.

Cloud Advertising Industry Product Developments

Recent product developments focus on enhancing targeting capabilities, improving campaign measurement, and providing greater transparency and control over advertising spend. AI-powered solutions are becoming increasingly prevalent, enabling automated campaign optimization and personalized ad delivery. There's a growing focus on integrating data privacy and security measures into cloud advertising platforms, addressing consumer concerns. The industry also witnesses the introduction of new ad formats and creative tools, improving engagement and effectiveness.

Key Drivers of Cloud Advertising Industry Growth

The Cloud Advertising Industry's growth is driven by several key factors:

- Technological Advancements: AI, machine learning, and big data analytics are continuously improving targeting, measurement, and campaign optimization.

- Economic Factors: The expansion of the digital economy, increasing internet penetration, and growing e-commerce are driving demand for effective online advertising.

- Regulatory Changes: While regulations pose challenges, they also create opportunities for companies offering compliant solutions.

Challenges in the Cloud Advertising Industry Market

The industry faces challenges such as:

- Data Privacy Concerns: Increasing regulatory scrutiny and consumer concerns over data privacy require significant investment in compliance measures.

- Ad Fraud: The prevalence of ad fraud and bot traffic poses a significant threat to the industry's credibility and effectiveness.

- Competition: Intense competition from both established and emerging players leads to price pressures and margin erosion.

Emerging Opportunities in Cloud Advertising Industry

Long-term growth opportunities are fueled by technological breakthroughs in AI and machine learning, strategic partnerships among technology providers and advertisers, and the expansion of cloud advertising into emerging markets. The development of new advertising formats, such as interactive and immersive advertising experiences, also presents significant potential.

Leading Players in the Cloud Advertising Industry Sector

Key Milestones in Cloud Advertising Industry Industry

- June 2022: Zomentum launches PartnerAlign program, aligning SaaS providers and partners' revenue generation.

- August 2022: Vendr releases Vendr 2.0, a comprehensive SaaS buying platform.

- July 2022: OSF Digital acquires Aarin Inc., strengthening its Salesforce Marketing Cloud capabilities.

Strategic Outlook for Cloud Advertising Industry Market

The Cloud Advertising Industry is poised for continued growth, driven by technological innovation, evolving consumer preferences, and the expansion of digital advertising into new markets. Strategic partnerships, investment in AI and machine learning, and a focus on data privacy and security will be crucial for success in this dynamic market. Companies that can effectively adapt to changing regulations and consumer demands while leveraging the latest technological advancements will be best positioned to capture future market opportunities.

Cloud Advertising Industry Segmentation

-

1. Type

- 1.1. Public Cloud

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

2. Service

- 2.1. Infrastructure as a Service (IaaS)

- 2.2. Software as a Service (SaaS)

- 2.3. Platform as a Service (PaaS)

-

3. End User

- 3.1. Retail

- 3.2. Media and Entertainment

- 3.3. IT and Telecom

- 3.4. BFSI

- 3.5. Government

- 3.6. Other End Users

Cloud Advertising Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Advertising Industry Regional Market Share

Geographic Coverage of Cloud Advertising Industry

Cloud Advertising Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend for the Adoption of Cloud Services; Growing Emphasis on Targeted Marketing and Competitive Intelligence

- 3.3. Market Restrains

- 3.3.1. Data Privacy Laws are Limiting the Market Growth

- 3.4. Market Trends

- 3.4.1. Software-as-a -Service (SaaS) segment is Expected to Occupy Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Infrastructure as a Service (IaaS)

- 5.2.2. Software as a Service (SaaS)

- 5.2.3. Platform as a Service (PaaS)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Retail

- 5.3.2. Media and Entertainment

- 5.3.3. IT and Telecom

- 5.3.4. BFSI

- 5.3.5. Government

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Public Cloud

- 6.1.2. Private Cloud

- 6.1.3. Hybrid Cloud

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Infrastructure as a Service (IaaS)

- 6.2.2. Software as a Service (SaaS)

- 6.2.3. Platform as a Service (PaaS)

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Retail

- 6.3.2. Media and Entertainment

- 6.3.3. IT and Telecom

- 6.3.4. BFSI

- 6.3.5. Government

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Public Cloud

- 7.1.2. Private Cloud

- 7.1.3. Hybrid Cloud

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Infrastructure as a Service (IaaS)

- 7.2.2. Software as a Service (SaaS)

- 7.2.3. Platform as a Service (PaaS)

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Retail

- 7.3.2. Media and Entertainment

- 7.3.3. IT and Telecom

- 7.3.4. BFSI

- 7.3.5. Government

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Public Cloud

- 8.1.2. Private Cloud

- 8.1.3. Hybrid Cloud

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Infrastructure as a Service (IaaS)

- 8.2.2. Software as a Service (SaaS)

- 8.2.3. Platform as a Service (PaaS)

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Retail

- 8.3.2. Media and Entertainment

- 8.3.3. IT and Telecom

- 8.3.4. BFSI

- 8.3.5. Government

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Public Cloud

- 9.1.2. Private Cloud

- 9.1.3. Hybrid Cloud

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Infrastructure as a Service (IaaS)

- 9.2.2. Software as a Service (SaaS)

- 9.2.3. Platform as a Service (PaaS)

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Retail

- 9.3.2. Media and Entertainment

- 9.3.3. IT and Telecom

- 9.3.4. BFSI

- 9.3.5. Government

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Cloud Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Public Cloud

- 10.1.2. Private Cloud

- 10.1.3. Hybrid Cloud

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Infrastructure as a Service (IaaS)

- 10.2.2. Software as a Service (SaaS)

- 10.2.3. Platform as a Service (PaaS)

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Retail

- 10.3.2. Media and Entertainment

- 10.3.3. IT and Telecom

- 10.3.4. BFSI

- 10.3.5. Government

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAP SE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Google LLC (Alphabet Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Salesforce com Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Adobe Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sprinklr Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amazon Web Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InMobi Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Microsoft Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SAP SE

List of Figures

- Figure 1: Global Cloud Advertising Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Cloud Advertising Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Advertising Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Cloud Advertising Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Cloud Advertising Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cloud Advertising Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Cloud Advertising Industry Revenue (billion), by Service 2025 & 2033

- Figure 8: North America Cloud Advertising Industry Volume (K Unit), by Service 2025 & 2033

- Figure 9: North America Cloud Advertising Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: North America Cloud Advertising Industry Volume Share (%), by Service 2025 & 2033

- Figure 11: North America Cloud Advertising Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Cloud Advertising Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Cloud Advertising Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Cloud Advertising Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Cloud Advertising Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Cloud Advertising Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cloud Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cloud Advertising Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cloud Advertising Industry Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe Cloud Advertising Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Cloud Advertising Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Cloud Advertising Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Cloud Advertising Industry Revenue (billion), by Service 2025 & 2033

- Figure 24: Europe Cloud Advertising Industry Volume (K Unit), by Service 2025 & 2033

- Figure 25: Europe Cloud Advertising Industry Revenue Share (%), by Service 2025 & 2033

- Figure 26: Europe Cloud Advertising Industry Volume Share (%), by Service 2025 & 2033

- Figure 27: Europe Cloud Advertising Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe Cloud Advertising Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Cloud Advertising Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Cloud Advertising Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Cloud Advertising Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Cloud Advertising Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cloud Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cloud Advertising Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cloud Advertising Industry Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific Cloud Advertising Industry Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Cloud Advertising Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Cloud Advertising Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Cloud Advertising Industry Revenue (billion), by Service 2025 & 2033

- Figure 40: Asia Pacific Cloud Advertising Industry Volume (K Unit), by Service 2025 & 2033

- Figure 41: Asia Pacific Cloud Advertising Industry Revenue Share (%), by Service 2025 & 2033

- Figure 42: Asia Pacific Cloud Advertising Industry Volume Share (%), by Service 2025 & 2033

- Figure 43: Asia Pacific Cloud Advertising Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific Cloud Advertising Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Cloud Advertising Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Cloud Advertising Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Cloud Advertising Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Cloud Advertising Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cloud Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cloud Advertising Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Cloud Advertising Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: Latin America Cloud Advertising Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Latin America Cloud Advertising Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Cloud Advertising Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Cloud Advertising Industry Revenue (billion), by Service 2025 & 2033

- Figure 56: Latin America Cloud Advertising Industry Volume (K Unit), by Service 2025 & 2033

- Figure 57: Latin America Cloud Advertising Industry Revenue Share (%), by Service 2025 & 2033

- Figure 58: Latin America Cloud Advertising Industry Volume Share (%), by Service 2025 & 2033

- Figure 59: Latin America Cloud Advertising Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: Latin America Cloud Advertising Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Latin America Cloud Advertising Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Latin America Cloud Advertising Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Latin America Cloud Advertising Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Latin America Cloud Advertising Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Cloud Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Cloud Advertising Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Cloud Advertising Industry Revenue (billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Cloud Advertising Industry Volume (K Unit), by Type 2025 & 2033

- Figure 69: Middle East and Africa Cloud Advertising Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Cloud Advertising Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Cloud Advertising Industry Revenue (billion), by Service 2025 & 2033

- Figure 72: Middle East and Africa Cloud Advertising Industry Volume (K Unit), by Service 2025 & 2033

- Figure 73: Middle East and Africa Cloud Advertising Industry Revenue Share (%), by Service 2025 & 2033

- Figure 74: Middle East and Africa Cloud Advertising Industry Volume Share (%), by Service 2025 & 2033

- Figure 75: Middle East and Africa Cloud Advertising Industry Revenue (billion), by End User 2025 & 2033

- Figure 76: Middle East and Africa Cloud Advertising Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Cloud Advertising Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Cloud Advertising Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Cloud Advertising Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Cloud Advertising Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Cloud Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Cloud Advertising Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 4: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 5: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Cloud Advertising Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Cloud Advertising Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 13: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Cloud Advertising Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Cloud Advertising Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 20: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 21: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Cloud Advertising Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Cloud Advertising Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 29: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: Global Cloud Advertising Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Cloud Advertising Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 36: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 37: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 39: Global Cloud Advertising Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Cloud Advertising Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Cloud Advertising Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Cloud Advertising Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Cloud Advertising Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 44: Global Cloud Advertising Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 45: Global Cloud Advertising Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 46: Global Cloud Advertising Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Global Cloud Advertising Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Cloud Advertising Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Advertising Industry?

The projected CAGR is approximately 9.08%.

2. Which companies are prominent players in the Cloud Advertising Industry?

Key companies in the market include SAP SE, Google LLC (Alphabet Inc ), Salesforce com Inc, Adobe Inc, IBM Corp, Sprinklr Inc, Amazon Web Services Inc, InMobi Pte Ltd, Oracle Corp, Microsoft Corp.

3. What are the main segments of the Cloud Advertising Industry?

The market segments include Type, Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend for the Adoption of Cloud Services; Growing Emphasis on Targeted Marketing and Competitive Intelligence.

6. What are the notable trends driving market growth?

Software-as-a -Service (SaaS) segment is Expected to Occupy Significant Share.

7. Are there any restraints impacting market growth?

Data Privacy Laws are Limiting the Market Growth.

8. Can you provide examples of recent developments in the market?

July 2022 - OSF Digital, a provider of digital transformation services, has acquired Aarin Inc., a full-stack Salesforce Marketing Cloud systems integrator with headquarters in the United States. The purchase of Aarin by OSF Digital will increase OSF Digital's proficiency with Salesforce Marketing Cloud and broaden the combined firms' Salesforce Marketing Cloud delivery team and center of excellence footprint in North America. With the purchase of Aarin, OSF Digital solidifies its position as a preeminent global Salesforce multi-cloud solution supplier and consulting partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Advertising Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Advertising Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Advertising Industry?

To stay informed about further developments, trends, and reports in the Cloud Advertising Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence