Key Insights

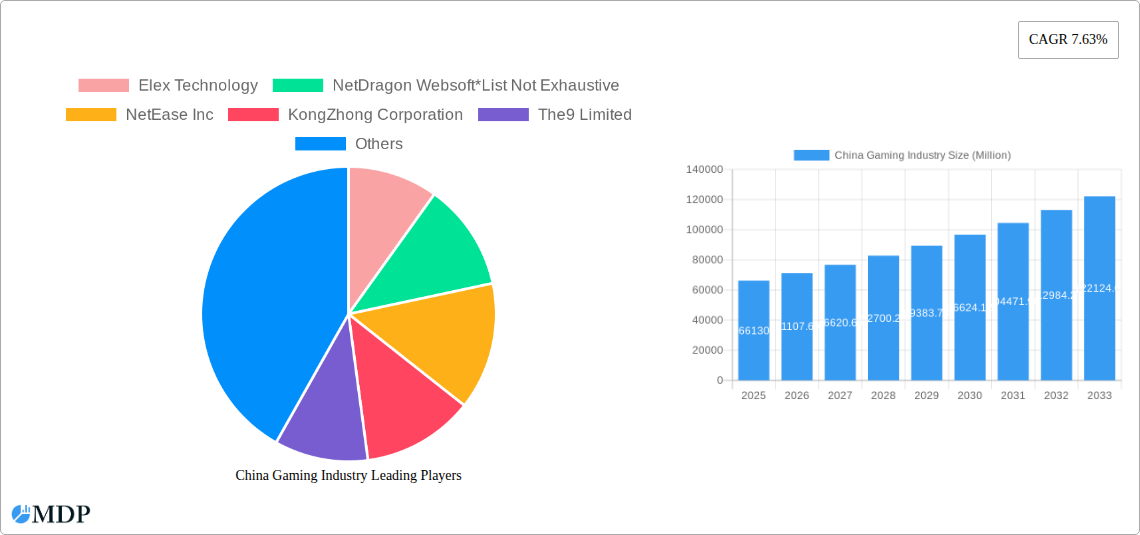

The China gaming market, valued at $66.13 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.63% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing penetration of smartphones and high-speed internet access across China has significantly broadened the accessibility of online gaming, particularly mobile games. Secondly, the rising disposable income among younger demographics fuels higher spending on gaming-related products and services, including in-app purchases and premium game titles. Furthermore, the continuous evolution of game genres, particularly the emergence of esports and immersive experiences like virtual reality (VR) and augmented reality (AR) games, is attracting a diverse and expanding player base. Competitive dynamics among major players such as Tencent Holdings, NetEase Inc., and others, further contributes to innovation and market expansion.

China Gaming Industry Market Size (In Billion)

However, the market's growth is not without its challenges. Government regulations on game content and playtime, especially concerning minors, represent a significant constraint. Fluctuations in the global economy could also impact consumer spending on non-essential entertainment such as gaming. Despite these restraints, the market's inherent dynamism and strong underlying growth drivers suggest a positive outlook for the long term. The segmentation of the market, with PC, console, and mobile gaming platforms all contributing to overall revenue, presents opportunities for diversified growth strategies among market participants. Strategic partnerships, targeted marketing campaigns, and innovative game development will be crucial for companies looking to capitalize on this thriving market.

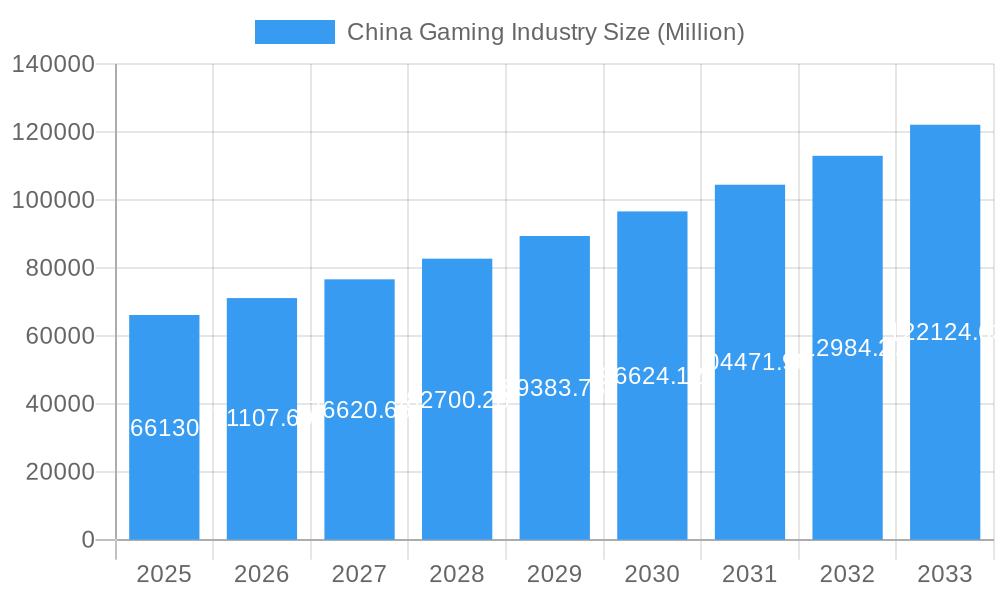

China Gaming Industry Company Market Share

China Gaming Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China gaming industry, encompassing market size, segmentation, key players, growth drivers, challenges, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The report projects a market value exceeding XX Million by 2033.

China Gaming Industry Market Dynamics & Concentration

The China gaming market, valued at XX Million in 2024, exhibits high concentration, with a few dominant players controlling significant market share. Tencent Holdings and NetEase Inc. consistently rank among the top players, commanding a combined market share exceeding XX%. This concentration is driven by substantial investments in game development, aggressive marketing strategies, and strong intellectual property portfolios. However, a growing number of smaller, independent studios are emerging, particularly in the mobile gaming segment.

Market dynamics are shaped by several factors:

- Innovation: Continuous innovation in game design, technology (e.g., VR/AR, cloud gaming), and monetization models fuels market growth.

- Regulatory Framework: The Chinese government's evolving regulatory landscape significantly impacts the industry, with licensing requirements and content restrictions influencing market access and investment decisions. Recent easing of restrictions (Sept 2022) suggests a potential shift.

- Product Substitutes: Competition from other entertainment forms, such as streaming services and e-sports, poses a challenge.

- End-User Trends: Changing consumer preferences, particularly among younger demographics, drive demand for specific game genres and platforms (e.g., mobile gaming's continued dominance).

- M&A Activities: Mergers and acquisitions (M&A) are frequent, with major players consolidating market share and acquiring promising studios (e.g., NetEase's acquisition of Quantic Dream in August 2022). The number of M&A deals in the sector averaged XX per year during the historical period.

China Gaming Industry Industry Trends & Analysis

The China gaming market is characterized by robust growth, driven by several key factors. The compound annual growth rate (CAGR) during the historical period (2019-2024) was XX%, indicating a rapidly expanding market. This growth is fueled by increasing internet penetration, rising smartphone adoption, and expanding access to high-speed internet. Technological advancements, especially in mobile gaming technology and the rise of esports, further contribute to market expansion. Consumer preferences are shifting towards mobile and casual gaming experiences, impacting platform-specific growth rates. The market is also witnessing increased competition, with both established players and new entrants vying for market share, resulting in a dynamic competitive landscape. The market penetration of online gaming, particularly mobile games, is reaching saturation in urban areas, but continues to grow in rural regions.

Leading Markets & Segments in China Gaming Industry

The mobile gaming segment dominates the China gaming market, accounting for XX% of total revenue in 2024. This dominance is driven by factors such as:

- High Smartphone Penetration: The widespread adoption of smartphones provides easy access to mobile games for a vast user base.

- Affordability and Accessibility: Mobile games are generally more affordable and accessible than PC or console games.

- Ease of Play: The casual nature of many mobile games makes them appealing to a broad audience.

While mobile games lead, PC gaming maintains a significant presence, fueled by robust esports scenes and the release of high-quality titles. The console gaming segment lags, primarily due to limited market access and high console prices. Geographic distribution shows strong growth in less developed regions as infrastructure improves and affordability increases.

China Gaming Industry Product Developments

The China gaming industry showcases continuous product innovation, characterized by enhanced graphics, immersive gameplay, and diverse game genres. Technological advancements, particularly in artificial intelligence (AI) and virtual reality (VR), are shaping game development, creating more realistic and engaging experiences. Many developers are focusing on creating games with global appeal, while simultaneously catering to specific cultural preferences within the Chinese market, ensuring a good market fit.

Key Drivers of China Gaming Industry Growth

Several factors propel the growth of the China gaming industry:

- Technological Advancements: The development of advanced gaming technologies, such as 5G networks and cloud gaming, enhances gaming experiences and expands accessibility.

- Economic Growth: Rising disposable incomes, particularly among younger generations, fuel increased spending on gaming entertainment.

- Favorable Regulatory Environment (with caveats): While historically stringent, recent government policies have shown signs of relaxation, creating a more favorable environment for industry expansion.

Challenges in the China Gaming Industry Market

The China gaming industry faces several challenges:

- Stringent Regulations: Government regulations on game content and licensing pose significant hurdles for market entry and expansion.

- Intense Competition: The highly competitive landscape requires substantial investment in game development and marketing to gain market share.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of hardware and software components for game development and distribution. This caused a XX Million loss in revenue in 2023, according to industry estimates.

Emerging Opportunities in China Gaming Industry

Significant opportunities exist for long-term growth in the China gaming industry. These include leveraging technological breakthroughs in areas like virtual and augmented reality, fostering strategic partnerships to expand into new markets, and developing innovative monetization models to capitalize on the burgeoning esports market. Exploring untapped markets within China itself, particularly in rural regions, also presents vast potential.

Leading Players in the China Gaming Industry Sector

- Elex Technology

- NetDragon Websoft

- NetEase Inc

- KongZhong Corporation

- The9 Limited

- 37 Interactive Entertainment

- Perfect World Games

- Tencent Holdings

- Beijing Kunlun Technology Co Ltd

- Shanda Games

Key Milestones in China Gaming Industry Industry

- September 2022: Tencent Holdings and NetEase received approval to launch new paid games, signaling a relaxation of government restrictions on the gaming sector. Seventy-three online games received publishing licenses, indicating increased regulatory leniency.

- August 2022: NetEase Inc. acquired Quantic Dream SA, expanding its game development capabilities and portfolio.

Strategic Outlook for China Gaming Industry Market

The China gaming market is poised for continued growth, driven by technological advancements, expanding access to high-speed internet, and a potentially more favorable regulatory environment. Strategic partnerships, innovative game development, and expansion into new markets will be crucial for companies seeking to capitalize on the long-term growth potential of this dynamic sector. The market is projected to reach XX Million by 2033, creating substantial opportunities for investors and industry players.

China Gaming Industry Segmentation

- 1. China Gaming Market Sizing & Forecast

- 2. Gamers Population in China

- 3. Gamers Population Age and Gender

-

4. Market Segmentation Platform

- 4.1. PC Games

- 4.2. Console Games

- 4.3. Mobile Games

- 5. PC Games

- 6. Console Games

- 7. Mobile Games

- 8. Top 20 Android Games & Apps in China

- 9. Top 20 iOS Games & Apps in China

- 10. Suspension of Gaming Licenses in China

- 11. Foreign Companies Share in Chinese Gaming Industry

China Gaming Industry Segmentation By Geography

- 1. China

China Gaming Industry Regional Market Share

Geographic Coverage of China Gaming Industry

China Gaming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Advancement in Technological Developments

- 3.3. Market Restrains

- 3.3.1. Fluctuating Government Regulations Regarding Gaming Industry

- 3.4. Market Trends

- 3.4.1. Mobile Games Occupies the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gaming Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 5.2. Market Analysis, Insights and Forecast - by Gamers Population in China

- 5.3. Market Analysis, Insights and Forecast - by Gamers Population Age and Gender

- 5.4. Market Analysis, Insights and Forecast - by Market Segmentation Platform

- 5.4.1. PC Games

- 5.4.2. Console Games

- 5.4.3. Mobile Games

- 5.5. Market Analysis, Insights and Forecast - by PC Games

- 5.6. Market Analysis, Insights and Forecast - by Console Games

- 5.7. Market Analysis, Insights and Forecast - by Mobile Games

- 5.8. Market Analysis, Insights and Forecast - by Top 20 Android Games & Apps in China

- 5.9. Market Analysis, Insights and Forecast - by Top 20 iOS Games & Apps in China

- 5.10. Market Analysis, Insights and Forecast - by Suspension of Gaming Licenses in China

- 5.11. Market Analysis, Insights and Forecast - by Foreign Companies Share in Chinese Gaming Industry

- 5.12. Market Analysis, Insights and Forecast - by Region

- 5.12.1. China

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Elex Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NetDragon Websoft*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NetEase Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KongZhong Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The9 Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 37 Interactive Entertainment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perfect World Games

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tencent Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Kunlun Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shanda Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Elex Technology

List of Figures

- Figure 1: China Gaming Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Gaming Industry Share (%) by Company 2025

List of Tables

- Table 1: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2020 & 2033

- Table 2: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2020 & 2033

- Table 3: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2020 & 2033

- Table 4: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2020 & 2033

- Table 5: China Gaming Industry Revenue Million Forecast, by PC Games 2020 & 2033

- Table 6: China Gaming Industry Revenue Million Forecast, by Console Games 2020 & 2033

- Table 7: China Gaming Industry Revenue Million Forecast, by Mobile Games 2020 & 2033

- Table 8: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2020 & 2033

- Table 9: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2020 & 2033

- Table 10: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2020 & 2033

- Table 11: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2020 & 2033

- Table 12: China Gaming Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 13: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2020 & 2033

- Table 14: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2020 & 2033

- Table 15: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2020 & 2033

- Table 16: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2020 & 2033

- Table 17: China Gaming Industry Revenue Million Forecast, by PC Games 2020 & 2033

- Table 18: China Gaming Industry Revenue Million Forecast, by Console Games 2020 & 2033

- Table 19: China Gaming Industry Revenue Million Forecast, by Mobile Games 2020 & 2033

- Table 20: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2020 & 2033

- Table 21: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2020 & 2033

- Table 22: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2020 & 2033

- Table 23: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2020 & 2033

- Table 24: China Gaming Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gaming Industry?

The projected CAGR is approximately 7.63%.

2. Which companies are prominent players in the China Gaming Industry?

Key companies in the market include Elex Technology, NetDragon Websoft*List Not Exhaustive, NetEase Inc, KongZhong Corporation, The9 Limited, 37 Interactive Entertainment, Perfect World Games, Tencent Holdings, Beijing Kunlun Technology Co Ltd, Shanda Games.

3. What are the main segments of the China Gaming Industry?

The market segments include China Gaming Market Sizing & Forecast, Gamers Population in China, Gamers Population Age and Gender, Market Segmentation Platform, PC Games, Console Games, Mobile Games, Top 20 Android Games & Apps in China, Top 20 iOS Games & Apps in China, Suspension of Gaming Licenses in China, Foreign Companies Share in Chinese Gaming Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Advancement in Technological Developments.

6. What are the notable trends driving market growth?

Mobile Games Occupies the Largest Market Share.

7. Are there any restraints impacting market growth?

Fluctuating Government Regulations Regarding Gaming Industry.

8. Can you provide examples of recent developments in the market?

September 2022: Tencent Holdings and NetEase, two of China's largest video game companies, got approval to launch new paid games for the first time since July last year, indicating Beijing's relaxation of a two-year crackdown on the tech sector. Seventy-three online games, including 69 mobile games, were given publishing licenses by the National Press and Publication Administration. Licenses were also granted to CMGE Technology Group., Leiting, XD Inc, and Zhong Qing Bao.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gaming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gaming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gaming Industry?

To stay informed about further developments, trends, and reports in the China Gaming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence