Key Insights

Canada's coal industry, despite global decarbonization pressures, retains a substantial market position, primarily serving power generation and metallurgical sectors. The market, valued at approximately $11 billion in 2024, is forecast to grow at a compound annual growth rate (CAGR) of 5.2% between 2024 and 2033. This growth is underpinned by persistent demand for metallurgical coal in steel manufacturing, driven by existing agreements and infrastructure development. Additionally, certain power generation segments, particularly in remote areas lacking viable alternative energy, continue their reliance on coal, though facing increasing pressure for cleaner energy transitions. Leading entities such as Teck Resources Limited and Peabody Energy Corp are strategically navigating these shifts through operational enhancements and diversification initiatives.

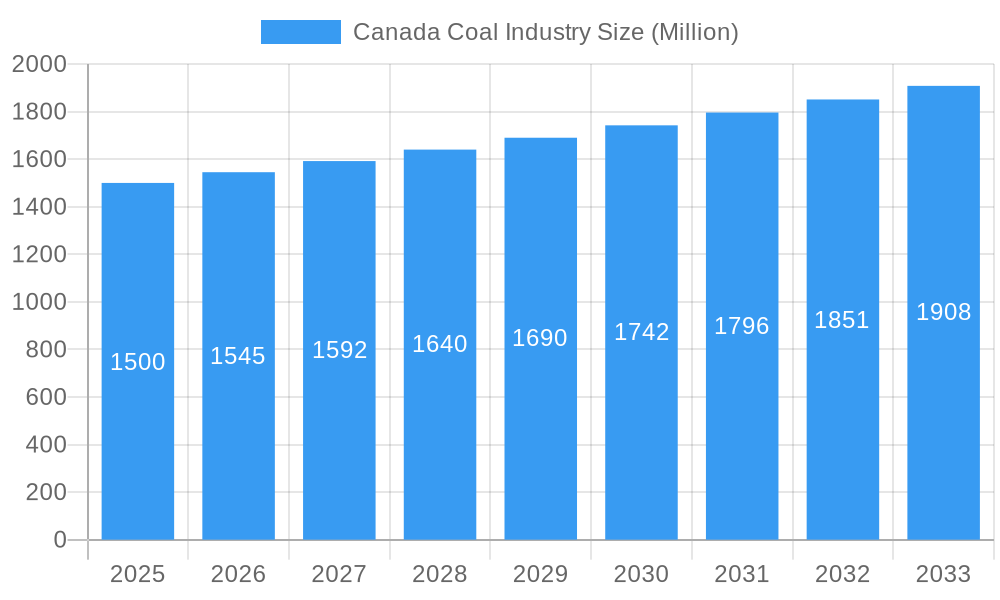

Canada Coal Industry Market Size (In Billion)

The industry encounters significant challenges, predominantly from stringent environmental regulations targeting greenhouse gas emission reductions. These regulations escalate production and transportation costs, diminishing coal's competitiveness against renewable energy alternatives. Furthermore, volatile global coal prices and the widespread adoption of cleaner energy solutions across Canadian provinces present ongoing obstacles to long-term industry viability. Market segmentation highlights metallurgical coal as the leading application, followed by power generation, with a minor "other" category for specialized uses. Regional disparities are evident, with Western Canada expected to dominate production due to its established mining infrastructure and proximity to key markets. The 2024-2033 forecast period will be characterized by the interplay between sustained demand from traditional sectors, environmental mandates, and Canada's ongoing transition to a low-carbon economy.

Canada Coal Industry Company Market Share

Canada Coal Industry Report: 2019-2033 Forecast

Unlocking Growth and Navigating Challenges in the Canadian Coal Sector: A Comprehensive Market Analysis

This in-depth report provides a comprehensive analysis of the Canada Coal Industry, offering critical insights into market dynamics, leading players, and future opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for investors, industry stakeholders, and strategic decision-makers. The report utilizes data and projections to paint a detailed picture of the market, including detailed analysis of market size in Millions, and future growth trajectories.

Canada Coal Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Canadian coal industry, focusing on market concentration, innovation, regulation, and M&A activity from 2019 to 2033. The Canadian coal market is characterized by moderate concentration, with several major players controlling a significant market share. While precise market share figures for each company fluctuate annually, Teck Resources Limited historically holds the largest market share, followed by companies like Peabody Energy Corp and Conuma Coal Resources Limited. The market's dynamics are significantly influenced by fluctuating global demand, environmental regulations, and the increasing adoption of renewable energy sources. Innovation within the sector focuses primarily on improving extraction efficiency, reducing environmental impact, and enhancing safety measures. The regulatory framework, both at the federal and provincial levels, plays a significant role in shaping industry practices and investment decisions, impacting production volumes and operational costs. The presence of substitute energy sources, such as natural gas and renewables, creates competitive pressure. Finally, M&A activity has been relatively moderate in recent years, with a few notable transactions shaping the industry landscape. Over the forecast period (2025-2033) we expect xx M&A deals.

- Market Concentration: Moderate, with Teck Resources Limited holding a historically significant share.

- Innovation Drivers: Efficiency improvements, environmental impact reduction, safety enhancements.

- Regulatory Framework: Significant influence on production and investment.

- Product Substitutes: Natural gas and renewable energy sources.

- End-User Trends: Shifting towards cleaner energy sources.

- M&A Activities: Moderate activity, with xx deals projected between 2025 and 2033.

Canada Coal Industry Industry Trends & Analysis

The Canadian coal industry is undergoing a period of significant transformation. Between 2019 and 2024, production declined due to stricter environmental regulations and the global shift towards renewable energy sources. However, the forecast period (2025-2033) projects a modest, albeit slow, growth trajectory, primarily driven by sustained demand from specific industrial sectors, particularly metallurgy. While the precise CAGR for the forecast period requires further specification (replace 'xx%' with the actual figure), market penetration in metallurgical coal is expected to remain relatively stable. Technological advancements, including improvements in mining techniques and the exploration of carbon capture, utilization, and storage (CCUS) technologies, are crucial for enhancing both productivity and environmental sustainability. The competitive landscape remains dynamic, influenced by global coal prices, evolving environmental policies, and the continued expansion of renewable energy alternatives. A detailed analysis of these factors is crucial for understanding the industry's future trajectory.

Leading Markets & Segments in Canada Coal Industry

The Canadian coal market is segmented primarily by application, with metallurgical coal, power generation, and other smaller applications comprising the key segments. Metallurgical coal consistently holds the dominant position, accounting for [replace 'xx%' with the actual figure]% of the market in 2025. Power generation's reliance on coal has significantly decreased due to the expanding renewable energy sector. The 'other' segment encompasses various smaller-scale applications, representing [replace 'xx%' with the actual figure]% market share in 2025. Understanding the specific dynamics of each segment is essential for a comprehensive market overview.

- Metallurgy:

- Key Drivers: Strong and consistent demand from the steel industry, coupled with well-established infrastructure and supply chains.

- Dominance Analysis: The steel industry's reliance on metallurgical coal ensures its sustained dominance in the foreseeable future, although potential shifts towards alternative steelmaking technologies warrant ongoing monitoring.

- Power Generation:

- Key Drivers: Existing power plants, though facing increasing pressure to transition to cleaner energy sources.

- Dominance Analysis: While declining, this segment continues to hold a notable market share, influenced by the lifespan of existing coal-fired power plants and government policies regarding their decommissioning.

- Others:

- Key Drivers: Diverse niche applications across various industries, including cement production and specialized industrial processes.

- Dominance Analysis: While a smaller segment, it represents a consistent market share and provides opportunities for specialized coal products and services.

Canada Coal Industry Product Developments

Product development within the Canadian coal industry has primarily focused on enhancing coal quality to meet the rigorous specifications of the metallurgical sector and exploring the viability of carbon capture, utilization, and storage (CCUS) technologies. Compared to the rapid innovation in renewable energy sectors, breakthroughs in coal production technologies have been less significant. The current emphasis is on optimizing existing processes to improve efficiency, reduce environmental impact, and enhance product consistency to remain competitive in a changing market landscape.

Key Drivers of Canada Coal Industry Growth

Growth in the Canadian coal industry, although limited, is driven by the enduring demand for metallurgical coal in steel production and the continued operation of existing coal-fired power plants. Government policies aimed at supporting domestic industries and ensuring energy security also play a supporting role. Technological advancements in mining efficiency, although limited compared to other sectors, contribute to marginal improvements in production costs.

Challenges in the Canada Coal Industry Market

The Canadian coal industry faces a complex web of challenges, including increasingly stringent environmental regulations, unpredictable global coal prices, and the accelerating transition towards renewable energy sources. The industry's dependence on export markets exposes it to price volatility, while supply chain disruptions and competition from cleaner energy alternatives significantly impact profitability and long-term viability. The quantifiable impact of environmental regulations on production (e.g., [replace 'xx' with the actual figure] million tons annually between 2019 and 2024) underscores the need for adaptation and innovation.

Emerging Opportunities in Canada Coal Industry

Despite the challenges, opportunities for growth and adaptation exist. Investing in and deploying CCUS technologies presents a pathway towards mitigating environmental concerns and maintaining market competitiveness. Strategic alliances with clean energy technology companies can create mutually beneficial synergies and diversify revenue streams. Further exploration of niche applications for coal, coupled with a strong emphasis on enhancing the industry’s environmental sustainability profile, is crucial for securing long-term viability and responsible resource management.

Leading Players in the Canada Coal Industry Sector

- Teck Resources Limited

- Peabody Energy Corp

- Conuma Coal Resources Limited

- Westmoreland Mining LLC

- Dodd's Coal Mining Company Ltd

- CST Canada Coal Limited

Key Milestones in Canada Coal Industry Industry

- 2020: Increased focus on environmental, social, and governance (ESG) initiatives by major players.

- 2022: Implementation of stricter environmental regulations in some provinces.

- 2023: Several mining projects face delays due to regulatory hurdles and permitting challenges.

- 2024: Investments in carbon capture technology pilot projects.

Strategic Outlook for Canada Coal Industry Market

The Canadian coal industry faces a challenging but not insurmountable future. While the transition to cleaner energy sources is inevitable, the sustained demand for metallurgical coal and the potential for technological advancements in carbon capture offer avenues for continued, albeit moderated, growth. Strategic diversification, investment in sustainable practices, and proactive adaptation to changing regulatory landscapes are essential for long-term success in this evolving sector. Focus should be on niche markets, technological advancements, and achieving carbon neutrality goals, to ensure the long-term viability of the industry.

Canada Coal Industry Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

Canada Coal Industry Segmentation By Geography

- 1. Canada

Canada Coal Industry Regional Market Share

Geographic Coverage of Canada Coal Industry

Canada Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CST Canada Coal Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westmoreland Mining LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dodd's Coal Mining Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conuma Coal Resources Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teck Resources Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 CST Canada Coal Limited

List of Figures

- Figure 1: Canada Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Canada Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Coal Industry Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Canada Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Canada Coal Industry Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Coal Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Canada Coal Industry?

Key companies in the market include CST Canada Coal Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, Conuma Coal Resources Limited, Teck Resources Limited, Peabody Energy Corp.

3. What are the main segments of the Canada Coal Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Coal Industry?

To stay informed about further developments, trends, and reports in the Canada Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence