Key Insights

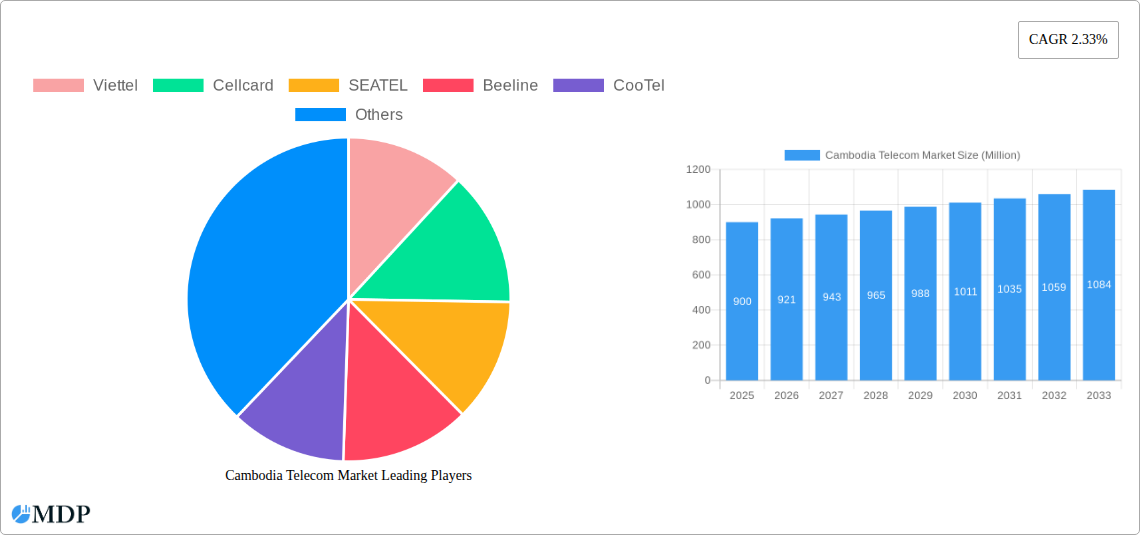

The Cambodian telecom market, valued at $900 million in 2025, exhibits a steady growth trajectory, projected at a Compound Annual Growth Rate (CAGR) of 2.33% from 2025 to 2033. This growth is driven by increasing smartphone penetration, rising data consumption fueled by the popularity of social media and OTT platforms, and expanding 4G/5G network coverage across the country. Key players like Viettel, Cellcard, and Smart Axiata are aggressively competing to capture market share through strategic pricing, innovative service bundles (including data packages, messaging, and bundled OTT/PayTV services), and network infrastructure investments. The market is segmented into voice services, data and messaging services (encompassing internet and handset data packages, and promotional discounts), and OTT/PayTV services. While the market enjoys consistent growth, challenges include maintaining affordability in a price-sensitive market and ensuring equitable access to broadband services in rural areas. Furthermore, regulatory frameworks and infrastructure limitations could potentially impede the sector's full growth potential. The continued expansion of digital services and the increasing demand for higher bandwidth services will likely present substantial opportunities for growth. Over the forecast period, the market is anticipated to witness a continuous evolution with increasing competition and diversification of services.

Cambodia Telecom Market Market Size (In Million)

The projected market size for 2026 is approximately $920 million (based on a 2.33% CAGR applied to the 2025 value). This growth is anticipated to continue at a similar rate, driven by factors such as expanding mobile broadband adoption, increasing mobile data usage amongst the growing young population, and the continued investment in network infrastructure by telecom operators. Competition amongst established and emerging players is expected to remain fierce, necessitating constant innovation in service offerings and pricing strategies. The focus on value-added services, such as bundled packages and OTT integrations, will likely continue to be a key differentiator in the market. The market’s future development will depend on factors such as government policies promoting digital inclusion, further development of infrastructure, and the ability of telecom companies to adapt to the evolving needs of consumers.

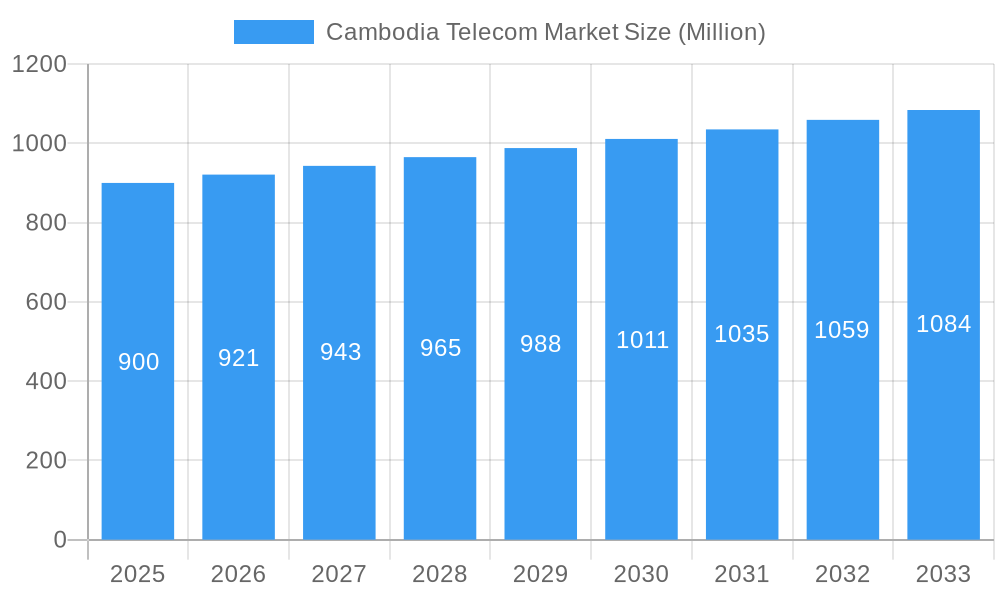

Cambodia Telecom Market Company Market Share

Cambodia Telecom Market Report: 2019-2033 Forecast

Dive deep into the dynamic Cambodian telecom landscape with this comprehensive market report, covering the period 2019-2033. This in-depth analysis provides invaluable insights for industry stakeholders, investors, and strategic planners seeking to navigate this rapidly evolving market. Unlock actionable intelligence on market size, growth drivers, competitive dynamics, and future opportunities. The report incorporates data from a wide range of sources to provide a holistic view of the market and its future trajectory.

Cambodia Telecom Market Market Dynamics & Concentration

The Cambodian telecom market, valued at xx Million in 2024, exhibits a moderately concentrated landscape dominated by several key players. Market share analysis reveals that Cellcard, Smart Axiata, and Viettel hold significant positions, while other operators like SEATEL, Beeline, and CooTel compete for market share. Innovation is driven by the demand for increased data speeds, improved network coverage, and the proliferation of mobile devices. The regulatory framework, while generally supportive of market growth, is undergoing constant evolution to address emerging challenges. Product substitutes, such as alternative communication methods, pose limited threats. End-user trends showcase a growing appetite for data-intensive services and mobile financial services. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with Cellcard, Smart Axiata, and Viettel leading.

- Innovation Drivers: Data demand, network coverage, mobile device proliferation.

- Regulatory Framework: Supportive but constantly evolving.

- Product Substitutes: Limited threat from alternative communication methods.

- End-User Trends: Increasing data consumption and mobile financial services adoption.

- M&A Activity: xx deals between 2019 and 2024.

Cambodia Telecom Market Industry Trends & Analysis

The Cambodian telecom market is experiencing robust growth, driven by increasing mobile penetration, rising disposable incomes, and government initiatives to expand digital infrastructure. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of 5G technology and the expansion of fiber optic networks, are transforming the market landscape. Consumer preferences are shifting towards higher data packages, mobile financial services, and over-the-top (OTT) platforms. Competitive dynamics are characterized by intense competition on pricing, data offerings, and service quality. Market penetration of mobile services is currently at xx%, with significant potential for further growth in underserved areas.

Leading Markets & Segments in Cambodia Telecom Market

The Cambodian telecom market is characterized by a strong nationwide presence, with no single region exhibiting dominant market share. However, urban areas generally show higher penetration rates due to improved infrastructure and greater consumer spending power.

Cellcard's Dominance:

- Data and Messaging Services: Cellcard holds a leading position in this segment, driven by competitive pricing, extensive coverage, and attractive data packages. They offer a wide range of internet and handset data packages, leveraging package discounts to attract and retain customers.

- OTT and PayTV Services: Cellcard’s expansion into OTT and PayTV services reflects growing consumer demand for diverse entertainment options.

- Voice Services: Cellcard maintains a substantial share in the voice services market, capitalizing on established infrastructure and brand recognition.

Key Drivers:

- Favorable Economic Policies supporting infrastructure development.

- Government Investments in digital infrastructure expansion.

- Growing demand for data and mobile financial services.

Cambodia Telecom Market Product Developments

The Cambodian telecom market is witnessing significant product innovation, with a focus on enhancing data speeds, expanding network coverage, and introducing value-added services. Operators are investing heavily in 4G and 5G infrastructure to meet the growing demand for high-speed connectivity. The market is also seeing increased adoption of innovative solutions like Fixed Wireless Access (FWA) to address broadband access in underserved areas. These developments are driven by competitive pressures and the need to cater to evolving consumer preferences.

Key Drivers of Cambodia Telecom Market Growth

Several factors are fueling the growth of the Cambodian telecom market. Firstly, rising disposable incomes are driving increased demand for mobile and internet services. Secondly, government initiatives to expand digital infrastructure are improving network coverage and accessibility. Thirdly, the increasing adoption of smartphones and other mobile devices is boosting data consumption. Furthermore, the development and expansion of mobile financial services are creating new opportunities for telecom operators.

Challenges in the Cambodia Telecom Market Market

The Cambodian telecom market faces several challenges. Regulatory complexities and licensing procedures can hinder market entry and expansion. Supply chain disruptions and the availability of advanced technologies pose ongoing challenges for network infrastructure improvements. Finally, intense competition among operators puts downward pressure on pricing, affecting profitability. These issues collectively impact market growth and operational efficiency.

Emerging Opportunities in Cambodia Telecom Market

The Cambodian telecom market presents significant opportunities for long-term growth. The rollout of 5G technology will offer increased speeds and capacity, opening new possibilities for data-intensive applications. Strategic partnerships between operators and technology providers can enhance network capabilities and bring innovative services to market. Moreover, the expanding digital economy and increasing adoption of mobile financial services create promising avenues for revenue generation and market expansion.

Leading Players in the Cambodia Telecom Market Sector

- Viettel

- Cellcard

- SEATEL

- Beeline

- CooTel

- VEON

- Singmeng

- EZECOM

- Smart Axiata

- Digi

Key Milestones in Cambodia Telecom Market Industry

- March 2022: Smart Axiata and Huawei collaborate on premium broadband services, leveraging FWA technology developed during the COVID-19 pandemic.

- July 2022: Nokia deploys XGS-PON solution for SINET, upgrading fiber access nodes for high-speed connectivity.

- September 2022: MekongNet and Huawei sign an MoU to improve internet connectivity nationwide.

Strategic Outlook for Cambodia Telecom Market Market

The Cambodian telecom market holds significant potential for future growth, driven by continuous infrastructure upgrades, increased mobile penetration, and rising data consumption. Strategic partnerships, technological innovations (particularly 5G), and expansion into value-added services present key opportunities for operators to capture market share and enhance profitability. The focus on digital inclusion and financial services integration will play a crucial role in driving sustainable long-term expansion.

Cambodia Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.1.3. Cellcard

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Cambodia Telecom Market Segmentation By Geography

- 1. Cambodia

Cambodia Telecom Market Regional Market Share

Geographic Coverage of Cambodia Telecom Market

Cambodia Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth

- 3.4. Market Trends

- 3.4.1. Growing demand for Wireless Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodia Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.1.3. Cellcard

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Viettel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cellcard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEATEL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beeline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CooTel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VEON

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singmeng

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EZECOM*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smart Axiata

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Digi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Viettel

List of Figures

- Figure 1: Cambodia Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cambodia Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Cambodia Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Cambodia Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Cambodia Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Cambodia Telecom Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodia Telecom Market?

The projected CAGR is approximately 2.33%.

2. Which companies are prominent players in the Cambodia Telecom Market?

Key companies in the market include Viettel, Cellcard, SEATEL, Beeline, CooTel, VEON, Singmeng, EZECOM*List Not Exhaustive, Smart Axiata, Digi.

3. What are the main segments of the Cambodia Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Growing demand for Wireless Services.

7. Are there any restraints impacting market growth?

Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth.

8. Can you provide examples of recent developments in the market?

March 2022 - Smart Axiata and Huawei collaborated to bring premium broadband services to Cambodia. During the COVID-19 pandemic, they jointly worked on Fixed Wireless Access (FWA) Suite to facilitate home broadband service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodia Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodia Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodia Telecom Market?

To stay informed about further developments, trends, and reports in the Cambodia Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence