Key Insights

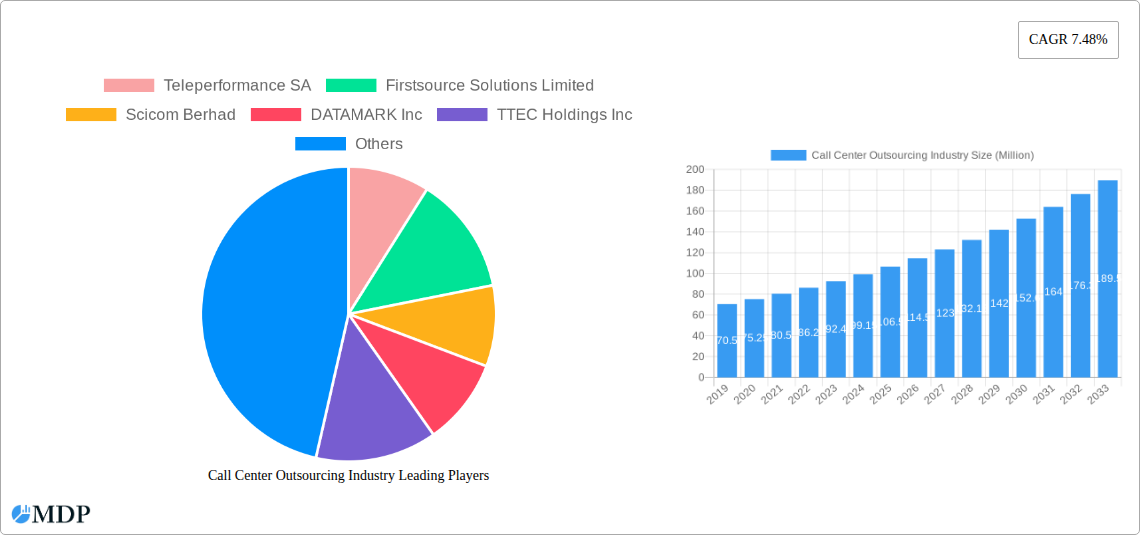

The global Call Center Outsourcing market is poised for significant expansion, projected to reach a substantial size of USD 109.34 million with a robust Compound Annual Growth Rate (CAGR) of 7.48% throughout the forecast period of 2025-2033. This impressive growth is fueled by several key drivers, primarily the relentless pursuit of operational efficiency and cost optimization by businesses across diverse sectors. Companies are increasingly recognizing the strategic advantage of outsourcing non-core customer service functions to specialized providers, allowing them to focus on core competencies and innovation. The escalating demand for enhanced customer experience, coupled with the need for scalable and flexible support solutions, further propels the market forward. Technological advancements, including the integration of AI-powered chatbots and advanced analytics, are also playing a pivotal role in shaping the future of call center outsourcing, enabling more personalized and effective customer interactions. The market's dynamism is further evidenced by the diverse range of service types, from traditional email and chat support to more sophisticated voice-based offshore and onshore solutions, catering to a broad spectrum of business needs.

Call Center Outsourcing Industry Market Size (In Million)

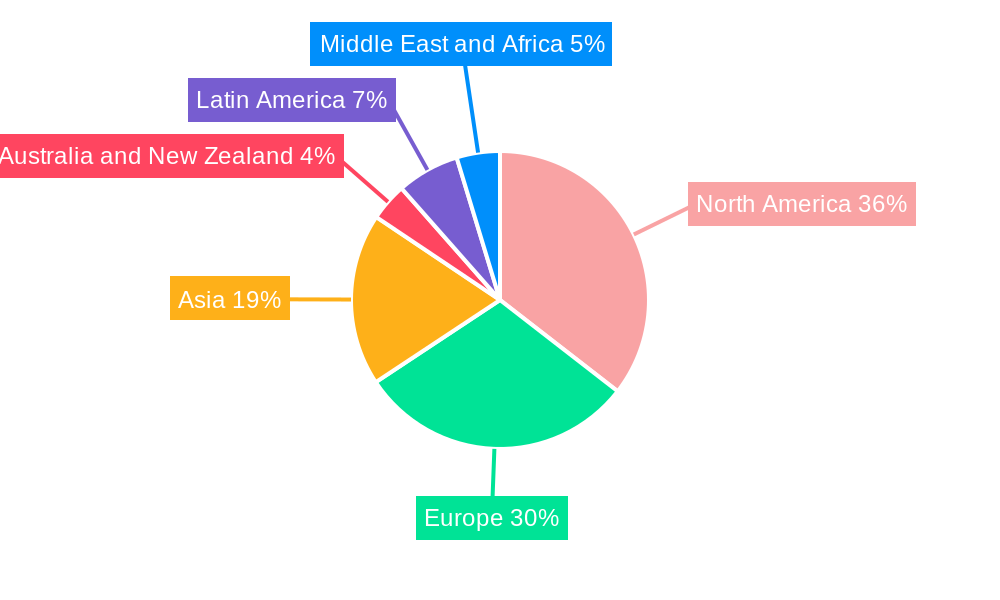

The market is segmented across critical end-user industries, with BFSI, Healthcare, and IT & Telecom emerging as significant contributors due to their high volume of customer interactions and stringent service level requirements. Retail and Manufacturing also represent substantial growth avenues as they adapt to evolving consumer expectations. Regionally, North America and Europe are expected to maintain their dominant positions, driven by established outsourcing ecosystems and a strong emphasis on customer satisfaction. However, the Asia Pacific region is anticipated to witness the fastest growth, fueled by a large, skilled, and cost-effective talent pool, alongside increasing digital adoption. While the market benefits from strong growth drivers, potential restraints such as data security concerns and the complexities of managing offshore teams can pose challenges. Nevertheless, the overarching trend towards digital transformation and the imperative to deliver superior customer experiences suggest a highly optimistic outlook for the call center outsourcing industry.

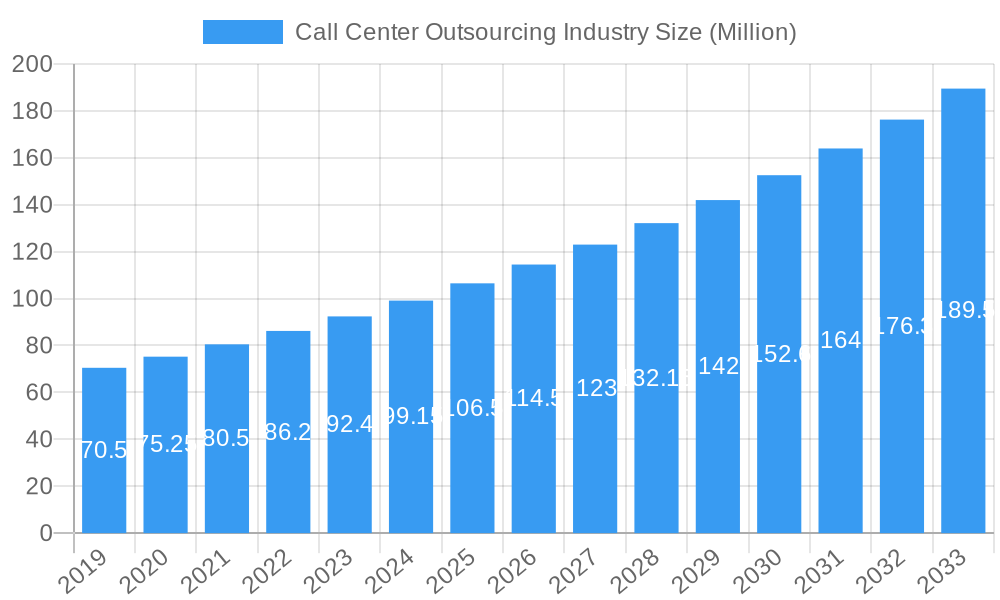

Call Center Outsourcing Industry Company Market Share

Gain deep insights into the dynamic Call Center Outsourcing (CCO) industry with our in-depth report. This comprehensive analysis covers the global outsourced call center market from 2019 to 2033, with a base year of 2025, offering detailed forecasts and historical data. Our report delves into customer service outsourcing, BPO services, and contact center solutions, exploring offshore and onshore capabilities across various service types including Email Support, Chat Support, and Voice Services. We meticulously examine the impact of CCO on key end-user industries such as BFSI, Healthcare, IT and Telecom, and Retail. Discover market drivers, emerging trends, leading players, and strategic opportunities shaping the future of global call center outsourcing.

Call Center Outsourcing Industry Market Dynamics & Concentration

The call center outsourcing industry exhibits a moderate to high concentration, with a few dominant players commanding a significant portion of the global outsourced call center market share. Innovation drivers are primarily fueled by the relentless demand for enhanced customer experience, digital transformation initiatives, and the adoption of advanced technologies like Artificial Intelligence (AI) and automation. Regulatory frameworks, while evolving, aim to balance data privacy with service delivery efficiency, influencing operational strategies. Product substitutes, though nascent, include in-house customer service departments leveraging advanced self-service portals and AI-powered chatbots, but the cost-effectiveness and specialized expertise of outsourcing continue to make it a preferred choice for many businesses. End-user trends point towards a greater emphasis on personalized customer interactions, omnichannel support, and proactive customer engagement. Mergers and acquisitions (M&A) activity remains robust as larger players seek to expand their service offerings, geographical reach, and technological capabilities. The CCO market has witnessed several strategic acquisitions aimed at consolidating market leadership and integrating innovative solutions. For instance, numerous M&A deals have been observed in the past few years, indicating a strong trend towards consolidation and strategic expansion within the outsourced contact center sector. The overall market share of leading entities is estimated to be around 60% of the total addressable market.

Call Center Outsourcing Industry Industry Trends & Analysis

The call center outsourcing industry is experiencing robust growth, driven by businesses seeking to optimize costs, enhance customer service, and leverage specialized expertise. A significant market growth driver is the increasing complexity of customer interactions, necessitating advanced technological solutions and skilled agents that outsourced providers often excel at delivering. Technological disruptions are rapidly transforming the landscape, with AI-powered chatbots, virtual assistants, and omnichannel platforms becoming standard offerings. These innovations not only improve efficiency but also provide a more seamless and personalized customer journey. Consumer preferences are evolving towards instant gratification and self-service options, pushing call centers to adopt proactive support strategies and offer multiple communication channels. The competitive dynamics within the CCO market are intense, characterized by a race for technological superiority, service diversification, and global reach. Companies are increasingly investing in cloud-based solutions and advanced analytics to gain a competitive edge. The projected Compound Annual Growth Rate (CAGR) for the outsourced call center market is estimated to be around 8-10% over the forecast period. Market penetration of advanced solutions like AI-driven customer engagement platforms is rapidly increasing, demonstrating a strong adoption rate across various industry verticals. The ability to scale operations rapidly, coupled with the cost advantages of offshore outsourcing, continues to make BPO services an attractive proposition for businesses of all sizes, from startups to large enterprises seeking to manage fluctuating customer demand.

Leading Markets & Segments in Call Center Outsourcing Industry

The global call center outsourcing industry is characterized by dominant regions and segments that are pivotal to its growth. Geographically, North America and Europe currently lead the market, owing to the presence of established businesses with high demand for customer support and advanced technological infrastructure. However, the Asia Pacific region is emerging as a significant growth hub, driven by cost advantages and a growing talent pool.

Service Type Dominance:

- Voice Support (Offshore and Onshore): Remains the largest segment due to the enduring need for human interaction in complex customer service scenarios. Offshore voice support continues to be a major cost-saving driver for businesses, while onshore voice support is favored for its ability to provide localized expertise and cultural understanding.

- Email Support: Experiencing steady growth as a primary channel for formal communication and customer inquiries.

- Chat Support: Witnessing rapid expansion due to the preference for real-time, text-based communication and its efficiency in handling multiple queries simultaneously.

- Other Service Types: This increasingly encompasses social media monitoring, technical support, IT help desk services, and customer success management, reflecting the evolving scope of customer engagement outsourcing.

End-user Industry Dominance:

- IT and Telecom: This sector consistently drives demand for call center outsourcing due to its high volume of customer interactions, technical queries, and the need for 24/7 support.

- BFSI (Banking, Financial Services, and Insurance): A major adopter of outsourced call centers for customer onboarding, transaction support, dispute resolution, and compliance-related inquiries. The sensitivity of data in this sector has led to a strong emphasis on security and compliance from CCO providers.

- Healthcare: Growing significantly, with outsourced call centers handling appointment scheduling, patient inquiries, insurance claims processing, and remote patient monitoring. The increasing adoption of digital health solutions is further fueling this trend.

- Retail: Leverages CCO for order processing, product inquiries, returns management, and personalized customer experiences, especially during peak seasons.

- Government and Defense: Utilizes outsourced call centers for public service information dissemination, citizen support, and case management.

- Manufacturing: Employs call centers for after-sales support, warranty claims, and technical assistance.

The dominance of these segments is influenced by factors such as economic policies promoting outsourcing, robust technological infrastructure, the availability of skilled labor, and the increasing need for specialized customer service capabilities that call center outsourcing companies are adept at providing.

Call Center Outsourcing Industry Product Developments

Recent product developments in the call center outsourcing industry focus on leveraging advanced technologies to enhance customer experience and operational efficiency. Innovations include AI-powered chatbots capable of handling complex queries, advanced analytics platforms for customer behavior prediction, and unified omnichannel communication solutions. These developments aim to provide seamless customer journeys across various touchpoints. For example, cloud-based contact center software platforms are gaining traction, offering scalability and flexibility while reducing IT infrastructure burdens. The competitive advantage lies in providers’ ability to integrate these cutting-edge technologies, offering bespoke solutions that address specific client needs and improve key performance indicators like customer satisfaction and first-call resolution rates.

Key Drivers of Call Center Outsourcing Industry Growth

Several key factors are propelling the growth of the call center outsourcing industry. Technological advancements, including AI, automation, and cloud computing, are enabling more efficient and sophisticated customer service operations. Economic benefits, such as cost reduction through labor arbitrage and optimized operational expenses, remain a primary driver for businesses. The increasing demand for specialized customer support across diverse industries, from IT and Telecom to Healthcare and BFSI, is also fueling market expansion. Furthermore, the need for businesses to focus on core competencies while outsourcing non-core functions like customer service drives the adoption of outsourced call center solutions. The globalization of businesses and the expansion of e-commerce also necessitate round-the-clock customer support, which call center outsourcing companies are well-equipped to provide.

Challenges in the Call Center Outsourcing Industry Market

Despite its growth, the call center outsourcing industry faces several challenges. Regulatory hurdles, particularly concerning data privacy and security (e.g., GDPR, CCPA), require significant compliance efforts and can increase operational costs. Supply chain disruptions, though less direct, can impact technology availability and partner reliability. Intense competitive pressures can lead to price wars and margin erosion. Furthermore, maintaining consistent quality and brand voice across geographically dispersed teams can be challenging, impacting customer perception. The ongoing need to upskill and reskill agents to handle increasingly complex customer interactions and new technologies also presents a human capital challenge.

Emerging Opportunities in Call Center Outsourcing Industry

Emerging opportunities in the call center outsourcing industry are driven by continuous technological breakthroughs and evolving business needs. The rapid adoption of AI and machine learning presents a significant catalyst for enhancing predictive analytics, hyper-personalization of customer interactions, and automated issue resolution, leading to improved customer satisfaction and loyalty. Strategic partnerships between technology providers and outsourcing firms are creating integrated, cutting-edge solutions. Market expansion into emerging economies, driven by growing middle classes and increasing digital literacy, offers substantial growth potential. Furthermore, the demand for specialized BPO services in niche sectors like telehealth, cybersecurity support, and sustainability consulting is creating new avenues for revenue generation and differentiation.

Leading Players in the Call Center Outsourcing Industry Sector

- Teleperformance SA

- Firstsource Solutions Limited

- Scicom Berhad

- DATAMARK Inc

- TTEC Holdings Inc

- Sykes Enterprises Incorporated

- Hgs

- Atento SA

- Startek

Key Milestones in Call Center Outsourcing Industry Industry

- April 2023: Decipher Health Records Inc., an Indian company, announced plans to open a new healthcare call center in Guyana, aiming to create at least 300 employment opportunities upon full operation. A Memorandum of Understanding (MoU) was signed with the Guyana Office for Investment, signaling the government's support for this expansion. Decipher Health Records is actively scouting potential sites, with a target of 300 seats.

- April 2023: Teckinfo Solutions Pvt. Ltd. unveiled its latest offering, the ID Cloud - Premium Contact Centre Software platform. This cloud-based solution caters to ITES/BPO, Enterprise, and MSMEs, offering a unified platform for seamless client engagement across all organizational sizes, freeing up IT resources.

Strategic Outlook for Call Center Outsourcing Industry Market

The strategic outlook for the call center outsourcing industry is one of continued innovation and expansion. Growth accelerators include the deeper integration of AI and automation for enhanced customer service, proactive engagement strategies, and advanced data analytics for personalized experiences. Businesses will increasingly seek outsourcing partners that can offer specialized expertise in emerging areas such as cybersecurity support and digital transformation consulting. Strategic opportunities lie in expanding service portfolios to include value-added services beyond traditional support, such as customer success management and digital marketing support. Furthermore, focusing on niche markets and catering to the specific needs of growing industries will be crucial for sustained success and market leadership in the evolving global contact center landscape.

Call Center Outsourcing Industry Segmentation

-

1. Service Type

- 1.1. Email Support

- 1.2. Chat Support

- 1.3. Voice (Offshore and Onshore)

- 1.4. Other Service Types

-

2. End-user Industry

- 2.1. BFSI

- 2.2. Government and Defense

- 2.3. Healthcare

- 2.4. IT and Telecom

- 2.5. Retail

- 2.6. Manufacturing

- 2.7. Other End-user Industries

Call Center Outsourcing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Call Center Outsourcing Industry Regional Market Share

Geographic Coverage of Call Center Outsourcing Industry

Call Center Outsourcing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Office Space from the BPO Sector; Increasing Investment in Public and Private Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Lower Awareness of Facility Management Services

- 3.4. Market Trends

- 3.4.1. Multi Channel Customer Engagement Trends are Expected to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Email Support

- 5.1.2. Chat Support

- 5.1.3. Voice (Offshore and Onshore)

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. Government and Defense

- 5.2.3. Healthcare

- 5.2.4. IT and Telecom

- 5.2.5. Retail

- 5.2.6. Manufacturing

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Email Support

- 6.1.2. Chat Support

- 6.1.3. Voice (Offshore and Onshore)

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. BFSI

- 6.2.2. Government and Defense

- 6.2.3. Healthcare

- 6.2.4. IT and Telecom

- 6.2.5. Retail

- 6.2.6. Manufacturing

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Email Support

- 7.1.2. Chat Support

- 7.1.3. Voice (Offshore and Onshore)

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. BFSI

- 7.2.2. Government and Defense

- 7.2.3. Healthcare

- 7.2.4. IT and Telecom

- 7.2.5. Retail

- 7.2.6. Manufacturing

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Email Support

- 8.1.2. Chat Support

- 8.1.3. Voice (Offshore and Onshore)

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. BFSI

- 8.2.2. Government and Defense

- 8.2.3. Healthcare

- 8.2.4. IT and Telecom

- 8.2.5. Retail

- 8.2.6. Manufacturing

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Email Support

- 9.1.2. Chat Support

- 9.1.3. Voice (Offshore and Onshore)

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. BFSI

- 9.2.2. Government and Defense

- 9.2.3. Healthcare

- 9.2.4. IT and Telecom

- 9.2.5. Retail

- 9.2.6. Manufacturing

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Email Support

- 10.1.2. Chat Support

- 10.1.3. Voice (Offshore and Onshore)

- 10.1.4. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. BFSI

- 10.2.2. Government and Defense

- 10.2.3. Healthcare

- 10.2.4. IT and Telecom

- 10.2.5. Retail

- 10.2.6. Manufacturing

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Call Center Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Email Support

- 11.1.2. Chat Support

- 11.1.3. Voice (Offshore and Onshore)

- 11.1.4. Other Service Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. BFSI

- 11.2.2. Government and Defense

- 11.2.3. Healthcare

- 11.2.4. IT and Telecom

- 11.2.5. Retail

- 11.2.6. Manufacturing

- 11.2.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Teleperformance SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Firstsource Solutions Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Scicom Berhad

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DATAMARK Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TTEC Holdings Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sykes Enterprises Incorporated

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hgs

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Atento SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Startek

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Teleperformance SA

List of Figures

- Figure 1: Global Call Center Outsourcing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Call Center Outsourcing Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 5: North America Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: North America Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 16: Europe Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 17: Europe Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 18: Europe Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 19: Europe Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Europe Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 28: Asia Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 29: Asia Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Asia Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 31: Asia Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Asia Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 40: Australia and New Zealand Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 41: Australia and New Zealand Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 42: Australia and New Zealand Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 43: Australia and New Zealand Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Australia and New Zealand Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Australia and New Zealand Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Australia and New Zealand Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Australia and New Zealand Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Latin America Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 53: Latin America Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Latin America Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Latin America Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Latin America Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Latin America Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Latin America Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Latin America Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Call Center Outsourcing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 64: Middle East and Africa Call Center Outsourcing Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 65: Middle East and Africa Call Center Outsourcing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 66: Middle East and Africa Call Center Outsourcing Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 67: Middle East and Africa Call Center Outsourcing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Middle East and Africa Call Center Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Middle East and Africa Call Center Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Middle East and Africa Call Center Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Middle East and Africa Call Center Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Call Center Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Call Center Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Call Center Outsourcing Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 3: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Call Center Outsourcing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 9: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 15: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 20: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 21: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 27: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 33: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Call Center Outsourcing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 39: Global Call Center Outsourcing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Call Center Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Call Center Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Call Center Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Call Center Outsourcing Industry?

The projected CAGR is approximately 7.48%.

2. Which companies are prominent players in the Call Center Outsourcing Industry?

Key companies in the market include Teleperformance SA, Firstsource Solutions Limited, Scicom Berhad, DATAMARK Inc, TTEC Holdings Inc, Sykes Enterprises Incorporated, Hgs, Atento SA, Startek.

3. What are the main segments of the Call Center Outsourcing Industry?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Office Space from the BPO Sector; Increasing Investment in Public and Private Infrastructure Development.

6. What are the notable trends driving market growth?

Multi Channel Customer Engagement Trends are Expected to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Lower Awareness of Facility Management Services.

8. Can you provide examples of recent developments in the market?

April 2023: Decipher Health Records Inc., an Indian company, will open a new healthcare call center in Guyana with the intention of creating at least 300 employment opportunities there once it is fully operational. A memorandum of understanding (MoU) was signed by the Guyana Office for Investment, the government's investment arm, and will result in the call center opening in Guyana this year. In accordance with a news release from the Guyana Office for Investment (GO Invest), Decipher Health Records is scouting potential sites and moving forward with the call center's implementation. 300 seats are the goal once it is fully operating.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Call Center Outsourcing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Call Center Outsourcing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Call Center Outsourcing Industry?

To stay informed about further developments, trends, and reports in the Call Center Outsourcing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence