Key Insights

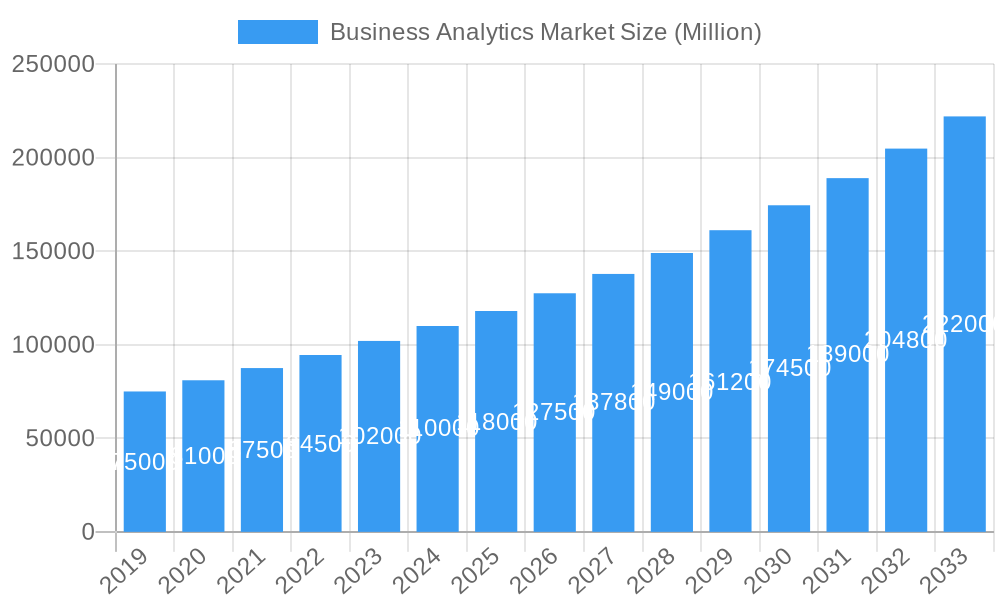

The global Business Analytics Market is projected to experience substantial growth, reaching an estimated market size of $660.06 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 13% anticipated through 2033. This expansion is fueled by the increasing demand for data-driven decision-making and the exponential growth in data generation. Businesses are increasingly leveraging analytics for competitive advantage, operational optimization, and revenue enhancement. Cloud-based solutions are a dominant trend, offering scalability and cost-effectiveness, particularly beneficial for SMEs. The integration of AI and ML is driving more sophisticated insights, predictive capabilities, and automated reporting, accelerating market adoption.

Business Analytics Market Market Size (In Billion)

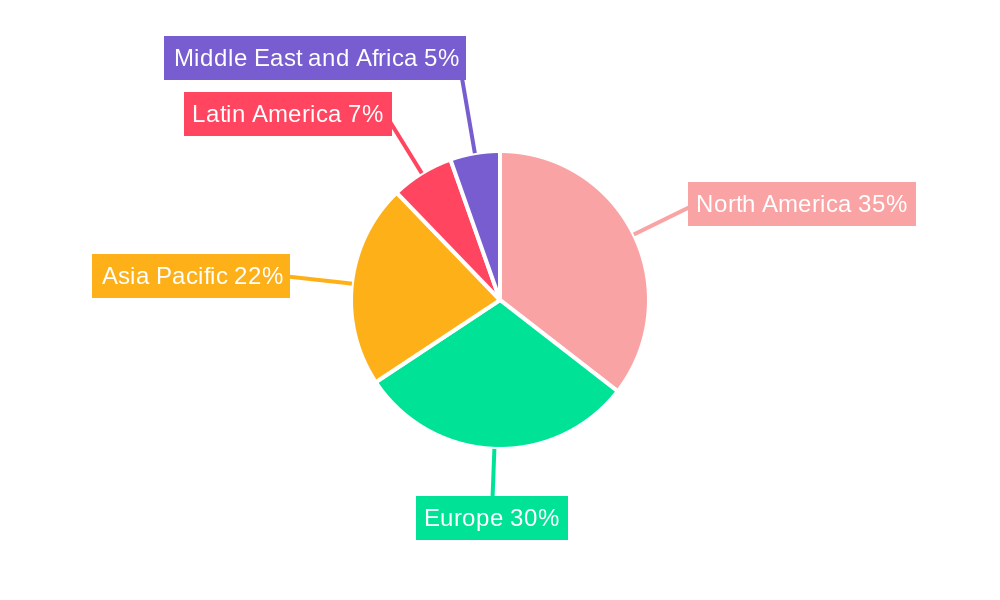

Key growth drivers include the imperative for enhanced customer understanding, improved risk management, and personalized customer experiences, especially within the BFSI sector. Manufacturing also shows significant investment in analytics for supply chain and production efficiency. Potential restraints include data privacy concerns, a shortage of skilled data scientists, and high initial investment costs for advanced solutions. However, evolving tools and accessible cloud platforms are mitigating these challenges. North America and Europe lead in adoption, while the Asia Pacific region exhibits rapid growth due to increasing digitalization. Leading players like SAS Institute, Salesforce (Tableau), and Microsoft are driving innovation.

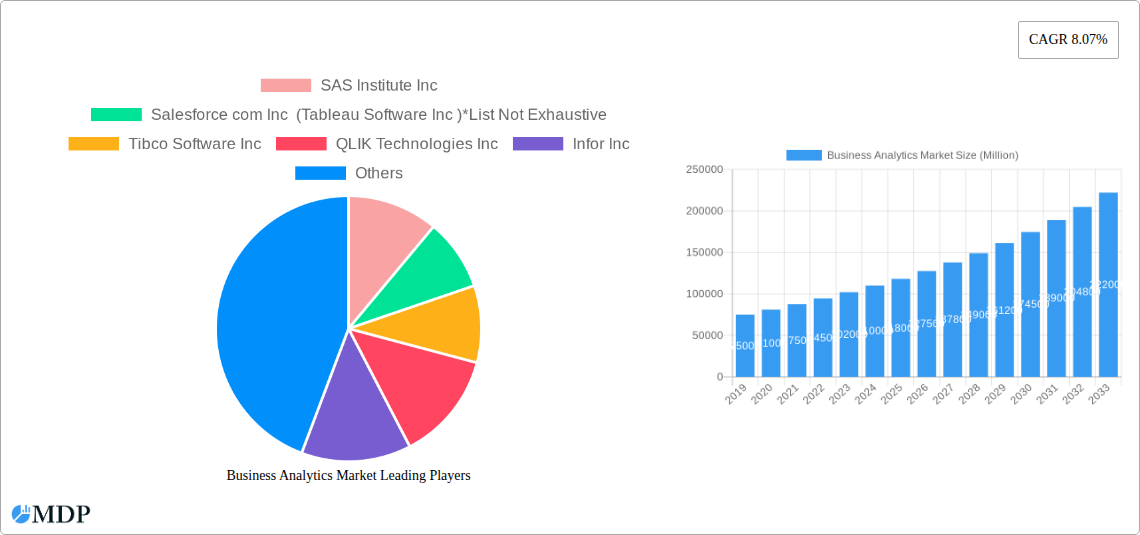

Business Analytics Market Company Market Share

Gain comprehensive insights into the global Business Analytics market, a rapidly expanding sector driven by the imperative for data-driven decision-making. This in-depth report, with a base year of 2025, delivers a meticulous analysis of market dynamics, leading players, and emerging trends. Understand how businesses are leveraging advanced analytics, business intelligence (BI), big data, AI, and machine learning to optimize operations, enhance customer experiences, and achieve sustainable competitive advantages. Explore the intricate interplay of deployment models (On-premise, Cloud-based, Hybrid) and the impact of end-user industries such as BFSI, Healthcare, Manufacturing, Retail, and Telecom & IT. This report is an essential resource for stakeholders seeking to navigate and capitalize on the significant opportunities within this transformative market.

Business Analytics Market Market Dynamics & Concentration

The Business Analytics market is characterized by a dynamic and evolving landscape, with market concentration influenced by significant technological advancements and increasing data volumes. Innovation drivers are primarily fueled by the escalating demand for predictive and prescriptive analytics, alongside the integration of Artificial Intelligence (AI) and Machine Learning (ML). Regulatory frameworks, while sometimes presenting hurdles, are also pushing for greater data governance and privacy, indirectly fostering the development of more robust and compliant analytics solutions. Product substitutes are minimal given the specialized nature of business analytics, but advancements in adjacent technologies can influence adoption rates. End-user trends strongly indicate a shift towards cloud-based solutions, driven by scalability and cost-efficiency. Mergers and Acquisitions (M&A) activities are consistently shaping the market, with a notable increase in deal counts as larger players acquire innovative startups to expand their product portfolios and market reach. For instance, the BFSI sector often leads in adopting advanced analytics due to stringent compliance needs and the potential for significant ROI in fraud detection and customer segmentation. The market share of leading players continues to evolve, with strategic partnerships and acquisitions being key to maintaining competitive positions.

Business Analytics Market Industry Trends & Analysis

The Business Analytics market is witnessing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR). This expansion is propelled by the fundamental shift in how organizations approach decision-making, moving from intuition-based strategies to data-driven insights. Technological disruptions, particularly in the realms of AI, ML, and Big Data, are continuously redefining the capabilities of analytics solutions. These innovations enable real-time analysis, predictive modeling, and automated insights, empowering businesses to anticipate trends and respond proactively. Consumer preferences are increasingly aligning with hyper-personalized experiences, driving the demand for analytics that can segment customer bases with granular precision and deliver tailored offerings. The competitive dynamics within the market are intense, with established giants continuously innovating and newer, agile players emerging with specialized solutions. Market penetration is deep across industries, yet there remains significant untapped potential, particularly in emerging economies and niche sectors. The ability to derive actionable intelligence from vast datasets is becoming a critical differentiator for businesses across all sectors. The ongoing evolution of data visualization tools further enhances accessibility and comprehension of complex data, democratizing analytics and fostering wider adoption.

Leading Markets & Segments in Business Analytics Market

The Business Analytics market showcases distinct regional dominance and segment preferences.

- Dominant Region: North America currently leads the market, driven by early adoption of advanced technologies, a strong presence of tech giants, and significant investment in R&D.

- Key Drivers: Robust economic policies supporting innovation, extensive digital infrastructure, and a highly skilled workforce contribute to this leadership.

- Leading End-User Industry: The Banking, Financial Services, and Insurance (BFSI) sector is a significant driver of business analytics adoption.

- Detailed Dominance Analysis: BFSI organizations leverage analytics for critical functions such as fraud detection, risk management, customer segmentation, personalized financial product development, and regulatory compliance. The sheer volume of sensitive data generated within this sector necessitates sophisticated analytics to ensure security and optimize operations.

- Dominant Deployment Model: Cloud-based deployment is rapidly gaining traction and is projected to become the dominant model.

- Key Drivers: Scalability, flexibility, cost-effectiveness, and ease of access to advanced analytics tools without significant upfront hardware investment are key factors.

- Detailed Dominance Analysis: Cloud platforms offer pay-as-you-go models, reducing the financial burden for businesses of all sizes, and enable rapid deployment and updates of analytics solutions. This is particularly attractive for smaller and medium-sized enterprises seeking to leverage powerful analytics capabilities.

Business Analytics Market Product Developments

Product developments in the Business Analytics market are primarily focused on enhancing AI and ML capabilities, enabling deeper insights and more automated decision-making. Innovations include advanced natural language processing (NLP) for intuitive data querying, augmented analytics for automated data preparation and insight discovery, and embedded analytics for seamless integration into existing business workflows. Companies are also prioritizing the development of real-time analytics platforms that can process and analyze streaming data, providing immediate actionable intelligence. These advancements offer a significant competitive advantage by enabling businesses to react swiftly to market changes, optimize operations in real-time, and deliver personalized customer experiences. The emphasis is on making analytics more accessible, intuitive, and impactful across all levels of an organization.

Key Drivers of Business Analytics Market Growth

The growth of the Business Analytics market is propelled by several key drivers:

- Increasing Data Volumes: The exponential growth in data generated from various sources (IoT devices, social media, transactions) necessitates sophisticated analytics for extraction of value.

- Technological Advancements: Continuous innovation in AI, ML, cloud computing, and Big Data technologies empowers businesses with more powerful and accessible analytics tools.

- Demand for Data-Driven Decision Making: Organizations across industries are increasingly recognizing the competitive advantage derived from making informed, data-backed decisions.

- Enhanced Customer Experience: Analytics enables businesses to understand customer behavior, personalize offerings, and improve service delivery, leading to higher satisfaction and loyalty.

- Regulatory Compliance and Risk Management: Industries like BFSI and Healthcare rely heavily on analytics for meeting stringent regulatory requirements and mitigating risks.

Challenges in the Business Analytics Market Market

Despite its rapid growth, the Business Analytics market faces several challenges:

- Data Security and Privacy Concerns: The sensitive nature of data handled by analytics solutions raises significant security and privacy concerns, requiring robust governance frameworks.

- Talent Gap: A shortage of skilled data scientists, analysts, and engineers capable of leveraging complex analytics tools remains a significant barrier.

- Integration Complexity: Integrating new analytics solutions with legacy IT infrastructure can be complex and time-consuming for many organizations.

- Cost of Implementation: While cloud solutions are reducing costs, the initial investment and ongoing operational expenses for comprehensive analytics platforms can still be substantial.

- Data Quality and Silos: Inconsistent or poor-quality data, often residing in disparate silos, can hinder the accuracy and effectiveness of analytics initiatives.

Emerging Opportunities in Business Analytics Market

The Business Analytics market is brimming with emerging opportunities driven by several catalysts:

- AI-Powered Automation: The integration of AI and ML into analytics platforms is creating opportunities for hyper-automation of insights and decision-making processes.

- Edge Analytics: The rise of IoT devices is creating a demand for analytics capabilities at the edge of networks, enabling real-time processing of data closer to the source.

- Industry-Specific Solutions: Development of tailored analytics solutions for niche industries with unique data challenges and regulatory requirements presents significant growth potential.

- Ethical AI and Explainable AI (XAI): Growing emphasis on transparency and fairness in AI algorithms is creating opportunities for solutions that offer explainability and ethical compliance.

- Data Monetization Strategies: Businesses are increasingly exploring opportunities to monetize their data assets through advanced analytics, creating new revenue streams.

Leading Players in the Business Analytics Market Sector

- SAS Institute Inc

- Salesforce com Inc (Tableau Software Inc )

- Tibco Software Inc

- QLIK Technologies Inc

- Infor Inc

- Microstrategy Incorporated

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

Key Milestones in Business Analytics Market Industry

- June 2023: MicroStrategy Incorporated initiated a multi-year partnership with Microsoft, enhancing the availability of MicroStrategy's products powered by Microsoft Azure. This collaboration integrates MicroStrategy's advanced analytics with Azure OpenAI Service, enabling businesses to fully leverage their data.

- May 2023: Rackspace US Inc. introduced Object Storage, a secure solution for storing and utilizing large volumes of unstructured data. This offering significantly reduces costs by eliminating data egress, retrieval, and transaction charges, potentially saving over 80% compared to hyper-scale cloud storage. It represents a new paradigm for multi-cloud customers with S3-enabled applications, promising better performance and lower costs for data-intensive applications.

Strategic Outlook for Business Analytics Market Market

The strategic outlook for the Business Analytics market is exceptionally positive, driven by the continued digital transformation across all sectors. Future growth will be accelerated by the increasing adoption of cloud-native analytics, the pervasive integration of AI and ML for predictive and prescriptive insights, and the development of specialized solutions catering to the unique needs of emerging industries. Emphasis on data governance, security, and ethical AI will shape product development and market strategies. Partnerships and collaborations, such as the one between MicroStrategy and Microsoft, will be crucial for expanding reach and innovation. The market is poised for sustained expansion as organizations globally recognize business analytics as an indispensable tool for competitive advantage and operational excellence.

Business Analytics Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud-based

- 1.3. Hybrid

-

2. End-user Industry

- 2.1. Banking, Financial Services, and Insurance

- 2.2. Healthcare

- 2.3. Manufacturing

- 2.4. Retail

- 2.5. Telecom and IT

- 2.6. Other End-user Industries

Business Analytics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Analytics Market Regional Market Share

Geographic Coverage of Business Analytics Market

Business Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volumes of Data and Cloud Deployment; Business Analytics/Intelligence Providers' Partnerships with Companies from Diversified Businesses to Leverage Analytics Capabilities

- 3.3. Market Restrains

- 3.3.1. ROI Remains a Core Concern for Potential Adopters

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Banking, Financial Services, and Insurance

- 5.2.2. Healthcare

- 5.2.3. Manufacturing

- 5.2.4. Retail

- 5.2.5. Telecom and IT

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud-based

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Banking, Financial Services, and Insurance

- 6.2.2. Healthcare

- 6.2.3. Manufacturing

- 6.2.4. Retail

- 6.2.5. Telecom and IT

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud-based

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Banking, Financial Services, and Insurance

- 7.2.2. Healthcare

- 7.2.3. Manufacturing

- 7.2.4. Retail

- 7.2.5. Telecom and IT

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud-based

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Banking, Financial Services, and Insurance

- 8.2.2. Healthcare

- 8.2.3. Manufacturing

- 8.2.4. Retail

- 8.2.5. Telecom and IT

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud-based

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Banking, Financial Services, and Insurance

- 9.2.2. Healthcare

- 9.2.3. Manufacturing

- 9.2.4. Retail

- 9.2.5. Telecom and IT

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Business Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud-based

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Banking, Financial Services, and Insurance

- 10.2.2. Healthcare

- 10.2.3. Manufacturing

- 10.2.4. Retail

- 10.2.5. Telecom and IT

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Salesforce com Inc (Tableau Software Inc )*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tibco Software Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 QLIK Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infor Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microstrategy Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBM Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microsoft Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Business Analytics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Analytics Market Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America Business Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Business Analytics Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Business Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Business Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Business Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Business Analytics Market Revenue (billion), by Deployment 2025 & 2033

- Figure 9: Europe Business Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Business Analytics Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Business Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Business Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Business Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Business Analytics Market Revenue (billion), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Business Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Business Analytics Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Business Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Business Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Business Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Business Analytics Market Revenue (billion), by Deployment 2025 & 2033

- Figure 21: Latin America Business Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Latin America Business Analytics Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Business Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Business Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Business Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Business Analytics Market Revenue (billion), by Deployment 2025 & 2033

- Figure 27: Middle East and Africa Business Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East and Africa Business Analytics Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Business Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Business Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Business Analytics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Business Analytics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 5: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Business Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Business Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 11: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Business Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Business Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Business Analytics Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 17: Global Business Analytics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Business Analytics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Analytics Market?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the Business Analytics Market?

Key companies in the market include SAS Institute Inc, Salesforce com Inc (Tableau Software Inc )*List Not Exhaustive, Tibco Software Inc, QLIK Technologies Inc, Infor Inc, Microstrategy Incorporated, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE.

3. What are the main segments of the Business Analytics Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 660.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volumes of Data and Cloud Deployment; Business Analytics/Intelligence Providers' Partnerships with Companies from Diversified Businesses to Leverage Analytics Capabilities.

6. What are the notable trends driving market growth?

BFSI is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

ROI Remains a Core Concern for Potential Adopters.

8. Can you provide examples of recent developments in the market?

June 2023: MicroStrategy Incorporated, the independent publicly traded analytics and business intelligence firm, has started a new multi-year partnership with Microsoft that will extend the availability of MicroStrategy’s products powered by Microsoft Azure. The collaboration will incorporate MicroStrategy’s advanced analytics abilities with Azure OpenAI Service to help businesses harness the full potential of their data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Analytics Market?

To stay informed about further developments, trends, and reports in the Business Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence