Key Insights

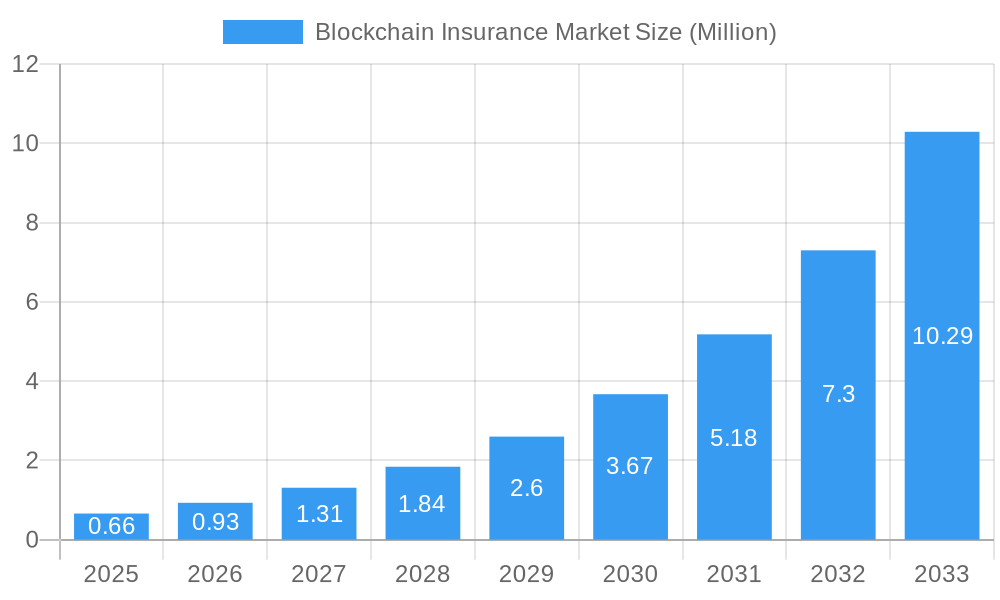

The global Blockchain Insurance market is poised for extraordinary growth, projected to reach a substantial market size of $0.66 million in the base year of 2025. This burgeoning market is expected to witness a Compound Annual Growth Rate (CAGR) of an impressive 41.32% throughout the forecast period of 2025-2033, indicating a rapid adoption and integration of blockchain technology within the insurance sector. The primary drivers fueling this expansion are the inherent benefits of blockchain, including enhanced transparency, robust security, streamlined claims processing, and the potential to significantly reduce operational costs and fraud. Smart contract adoption for automated claims payouts and policy management is a key trend, promising greater efficiency and customer satisfaction. Furthermore, the increasing demand for decentralized insurance solutions and the growing focus on granular risk assessment are also contributing to this robust growth trajectory.

Blockchain Insurance Market Market Size (In Million)

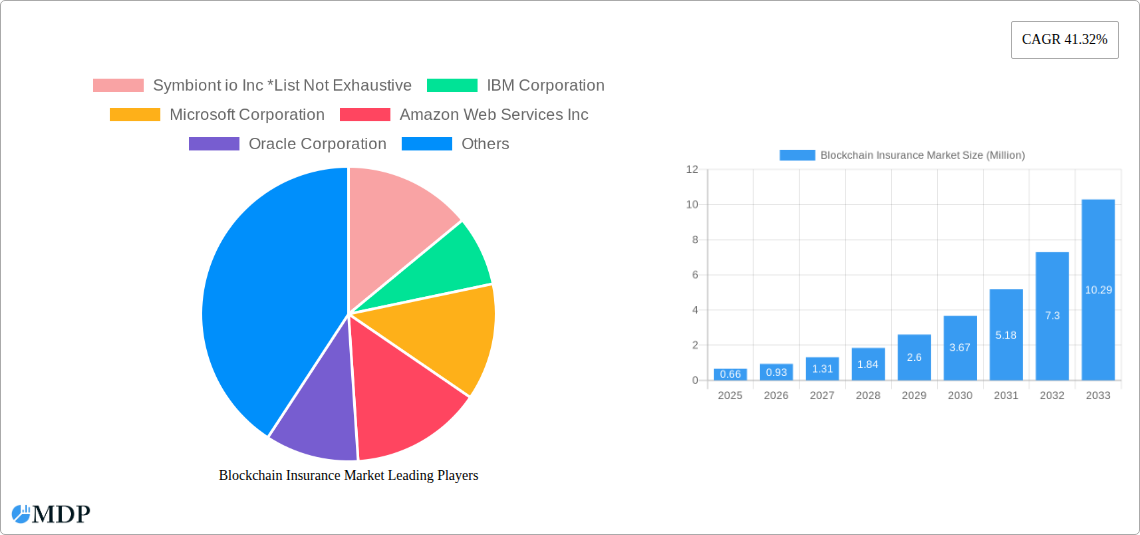

The market is segmenting rapidly across various deployment models, with Cloud-Based solutions projected to dominate due to their scalability and cost-effectiveness, while On-Premise deployments will cater to organizations with specific security and regulatory requirements. In terms of type, Public blockchains will likely see wider adoption for their openness, while Private blockchains will be favored by enterprises requiring greater control and privacy. Key applications driving this growth include GRC (Governance, Risk and Compliance) Management, Identity Management & Fraud Detection, and Financial Management (Payments), all of which directly benefit from blockchain's immutable ledger and cryptographic security features. Major technology players like IBM Corporation, Microsoft Corporation, and Amazon Web Services Inc., alongside specialized blockchain firms such as Symbiont io Inc., are actively shaping this landscape with innovative solutions, further accelerating market penetration across regions like North America and Europe.

Blockchain Insurance Market Company Market Share

This comprehensive report dives deep into the burgeoning Blockchain Insurance Market, analyzing its transformative potential for the insurance industry. Spanning from the historical period of 2019–2024 through to a robust forecast period of 2025–2033, with a pivotal base and estimated year of 2025, this report provides invaluable insights into market dynamics, key trends, leading segments, and the strategic landscape. Explore how distributed ledger technology is revolutionizing insurance claims processing, smart contract automation, fraud detection, and GRC management, paving the way for unprecedented efficiency and transparency.

Blockchain Insurance Market Market Dynamics & Concentration

The Blockchain Insurance Market is characterized by a dynamic interplay of innovation, regulatory evolution, and increasing stakeholder interest. Market concentration, while currently moderate, is projected to shift as major tech players and specialized blockchain firms solidify their positions. Key innovation drivers include the pursuit of enhanced data security, immutability for policy records, and the streamlining of complex claims adjudication processes. Regulatory frameworks are gradually adapting to accommodate blockchain's decentralized nature, focusing on data privacy, consumer protection, and interoperability standards. Product substitutes, primarily traditional centralized insurance systems, are facing increasing pressure from blockchain's inherent advantages in transparency and efficiency. End-user trends indicate a growing demand for faster claims settlements, more personalized insurance products, and a reduction in administrative overhead. Merger and acquisition (M&A) activities are expected to accelerate as established insurance giants seek to integrate blockchain capabilities and startups aim for scalability and broader market reach. The market share distribution is currently fragmented, with specialized providers carving out niches, but this is anticipated to consolidate around key technology enablers and major insurance carriers.

Blockchain Insurance Market Industry Trends & Analysis

The Blockchain Insurance Market is poised for significant expansion, driven by a confluence of technological advancements and a growing recognition of its inherent benefits. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 25% over the forecast period, indicating substantial market penetration and adoption across various insurance verticals. A primary growth driver is the increasing demand for enhanced security and immutability of insurance policies and claims data, which blockchain technology effectively addresses by providing a decentralized and tamper-proof ledger. This also directly combats the persistent challenge of insurance fraud detection, where blockchain's transparency and auditability enable quicker identification and prevention of fraudulent activities. Furthermore, the automation of insurance processes through smart contracts is a major disruptive force. These self-executing contracts, powered by blockchain, can automatically trigger payouts upon predefined conditions being met, drastically reducing claim settlement times and operational costs for insurers. This efficiency translates to improved customer satisfaction and a competitive edge. The rise of decentralized applications (dApps) tailored for insurance, such as peer-to-peer insurance platforms, is also contributing to market growth, offering alternative insurance models and greater control to policyholders. Consumer preferences are evolving towards more transparent, efficient, and personalized insurance solutions, which blockchain-based offerings are uniquely positioned to deliver. The competitive dynamics are characterized by a blend of traditional insurance giants investing in blockchain pilot programs and dedicated blockchain startups innovating at a rapid pace. The increasing integration of blockchain with existing enterprise resource planning (ERP) systems and customer relationship management (CRM) platforms further fuels its adoption, creating a more connected and intelligent insurance ecosystem.

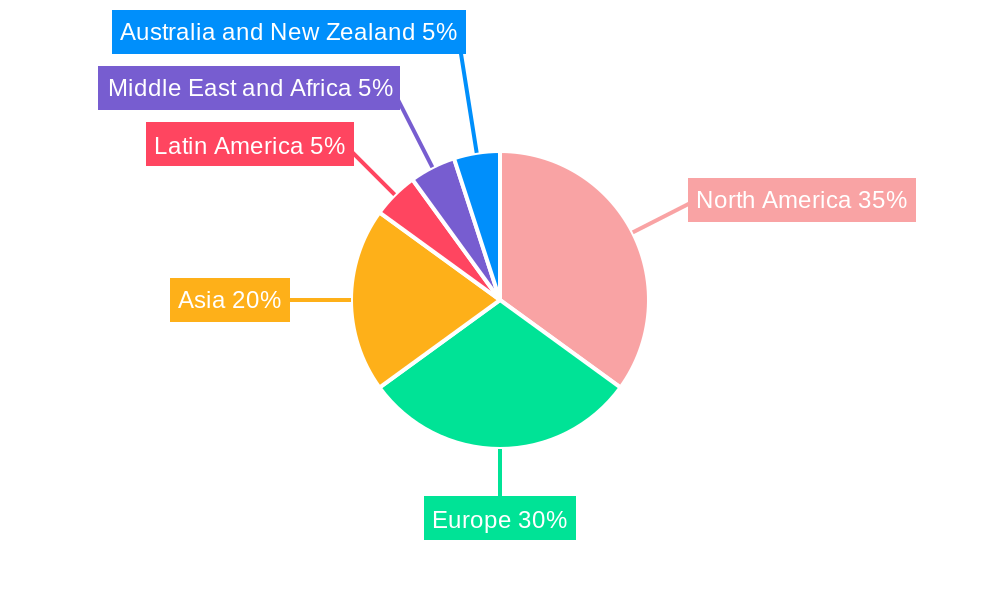

Leading Markets & Segments in Blockchain Insurance Market

The Blockchain Insurance Market exhibits distinct regional dominance and segment-specific growth. North America is anticipated to lead the market, driven by strong technological infrastructure, a mature insurance industry, and favorable regulatory environments that encourage innovation. Within North America, the United States, with its extensive network of insurance providers and a high propensity for adopting new technologies, will be a key contributor.

Deployment:

- Cloud Based: This segment is expected to dominate due to its scalability, flexibility, and lower upfront costs for insurers, enabling faster deployment and broader accessibility.

- On-premise: While having a smaller market share, this segment will remain relevant for large enterprises with stringent data sovereignty requirements and existing robust IT infrastructure.

Type:

- Private Blockchains: These are projected to hold the largest market share, offering controlled environments with enhanced privacy and performance, making them ideal for sensitive insurance data and consortia.

- Public Blockchains: These will see increasing adoption for specific applications like parametric insurance where transparency is paramount, and for broader decentralized insurance initiatives.

Application:

- GRC (Governance, Risk and Compliance) Management: This is a high-growth area, with blockchain providing immutable audit trails, enhancing regulatory compliance, and simplifying risk assessment.

- Smart Contract: The automation of policy issuance, claims processing, and premium collection through smart contracts is a significant driver of market expansion.

- Financial Management (Payments): Blockchain's ability to facilitate faster, more secure, and cost-effective cross-border payments for claims and premiums will see substantial growth.

- Identity Management & Fraud Detection: The immutable nature of blockchain makes it a powerful tool for verifying identities and preventing fraudulent claims, a critical application for insurers.

- Death and Claims Management: Streamlining the complex and often lengthy process of death and claims management through blockchain-based record-keeping and automated payouts offers significant efficiencies.

Blockchain Insurance Market Product Developments

Product developments in the Blockchain Insurance Market are focused on enhancing efficiency, transparency, and security. Innovations include decentralized applications (dApps) for parametric insurance, enabling automatic payouts based on verifiable external data like weather events. Smart contract platforms are being refined to handle complex insurance policy terms and conditions, automating premium collection and claim adjudication with unparalleled speed and accuracy. Furthermore, solutions are emerging for secure and immutable storage of policyholder data, bolstering identity management and fraud detection capabilities. These developments offer significant competitive advantages by reducing operational costs, minimizing human error, and improving the overall customer experience.

Key Drivers of Blockchain Insurance Market Growth

The Blockchain Insurance Market is propelled by several key drivers. Technologically, the inherent immutability and transparency of blockchain offer unparalleled data integrity and security for policy and claims management, significantly reducing fraud. Economically, the automation capabilities of smart contracts promise substantial cost savings through streamlined claims processing and reduced administrative overhead. Regulatory drivers are also emerging as governments and industry bodies begin to understand and, in some cases, support the adoption of blockchain for its potential to enhance financial inclusion and market efficiency. The increasing need for faster and more reliable insurance payouts and the growing demand for personalized insurance products are further accelerating adoption.

Challenges in the Blockchain Insurance Market Market

Despite its promise, the Blockchain Insurance Market faces several challenges. Regulatory uncertainty remains a significant hurdle, as evolving legal frameworks around digital assets and distributed ledger technology can create compliance complexities. The high initial investment required for implementing blockchain solutions, coupled with a shortage of skilled blockchain developers and IT professionals, presents a barrier for many smaller insurance providers. Interoperability between different blockchain networks and legacy systems also poses a technical challenge, hindering seamless data exchange. Furthermore, the perceived complexity of blockchain technology by some stakeholders and the need for robust cybersecurity measures to protect decentralized networks are areas requiring continuous attention.

Emerging Opportunities in Blockchain Insurance Market

The Blockchain Insurance Market is ripe with emerging opportunities. The development of decentralized autonomous organizations (DAOs) for insurance pools, offering community-driven risk sharing and governance, represents a significant shift. The integration of blockchain with the Internet of Things (IoT) devices opens avenues for real-time, usage-based insurance policies, automatically adjusting premiums based on behavior and risk. Furthermore, the expansion of blockchain-based solutions into emerging markets, addressing the underinsured populations with more accessible and affordable insurance products, presents a substantial growth catalyst. Strategic partnerships between established insurers and blockchain technology providers will continue to drive innovation and market penetration.

Leading Players in the Blockchain Insurance Market Sector

- Symbiont io Inc

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services Inc

- Oracle Corporation

- GuardTime AS

- Auxesis Group

- Chainthat Limited

- SAP SE

Key Milestones in Blockchain Insurance Market Industry

- January 2023: Amazon Web Services partnered with Ava Labs, a company building out layer-1 blockchain Avalanche, to assist in scaling blockchain adoption across institutions, enterprises, and governments. The partnership intends to make it more uncomplicated for individuals to launch and manage nodes on Avalanche while also seeking to give the network more strength and flexibility for developers.

- September 2022: XA Group unveiled Addenda, the first 'Made in the UAE,' a Blockchain-based, end-to-end digital solution that facilitates insurers to reconcile motor recovery receivables between each other. XA Group announced that it would grant all MENA motor insurers open access to the solution for the first six months to enhance their financial position and enable them to overcome the challenge of motor recovery receivables.

Strategic Outlook for Blockchain Insurance Market Market

The strategic outlook for the Blockchain Insurance Market is exceptionally positive, driven by ongoing technological advancements and a clear demand for more efficient and secure insurance solutions. Future growth will be accelerated by the continued development of interoperable blockchain platforms, fostering greater collaboration across the insurance ecosystem. Emphasis will be placed on developing user-friendly interfaces and educating stakeholders on the benefits of blockchain, thereby driving wider adoption. The market will see an increase in specialized blockchain solutions tailored for niche insurance products and services, further expanding its reach. Strategic partnerships and consortia formation will be crucial for addressing regulatory complexities and establishing industry-wide standards, ultimately unlocking the full potential of blockchain in reshaping the global insurance landscape.

Blockchain Insurance Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud Based

-

2. Type

- 2.1. Public

- 2.2. Private

-

3. Application

- 3.1. GRC (Governance, Risk and Compliance) Management

- 3.2. Smart Contract

- 3.3. Financial Management (Payments)

- 3.4. Identity Management & Fraud Detection

- 3.5. Death and Claims Management

- 3.6. Other Applications

Blockchain Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. Singapore

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Blockchain Insurance Market Regional Market Share

Geographic Coverage of Blockchain Insurance Market

Blockchain Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 41.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of Automation Across the BFSI Sector; Increasing Need for Reducing the Total Cost of Ownership

- 3.3. Market Restrains

- 3.3.1. Security Vulnerability of Transaction Across the Insurance Platform using Blockchain Technology; Lack of Awareness about Blockchain in the Industry Professionals

- 3.4. Market Trends

- 3.4.1. The On-Premises Segment is Anticipated to Witness Increasing Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud Based

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. GRC (Governance, Risk and Compliance) Management

- 5.3.2. Smart Contract

- 5.3.3. Financial Management (Payments)

- 5.3.4. Identity Management & Fraud Detection

- 5.3.5. Death and Claims Management

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud Based

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Public

- 6.2.2. Private

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. GRC (Governance, Risk and Compliance) Management

- 6.3.2. Smart Contract

- 6.3.3. Financial Management (Payments)

- 6.3.4. Identity Management & Fraud Detection

- 6.3.5. Death and Claims Management

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud Based

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Public

- 7.2.2. Private

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. GRC (Governance, Risk and Compliance) Management

- 7.3.2. Smart Contract

- 7.3.3. Financial Management (Payments)

- 7.3.4. Identity Management & Fraud Detection

- 7.3.5. Death and Claims Management

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud Based

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Public

- 8.2.2. Private

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. GRC (Governance, Risk and Compliance) Management

- 8.3.2. Smart Contract

- 8.3.3. Financial Management (Payments)

- 8.3.4. Identity Management & Fraud Detection

- 8.3.5. Death and Claims Management

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud Based

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Public

- 9.2.2. Private

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. GRC (Governance, Risk and Compliance) Management

- 9.3.2. Smart Contract

- 9.3.3. Financial Management (Payments)

- 9.3.4. Identity Management & Fraud Detection

- 9.3.5. Death and Claims Management

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Blockchain Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud Based

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Public

- 10.2.2. Private

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. GRC (Governance, Risk and Compliance) Management

- 10.3.2. Smart Contract

- 10.3.3. Financial Management (Payments)

- 10.3.4. Identity Management & Fraud Detection

- 10.3.5. Death and Claims Management

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Symbiont io Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amazon Web Services Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oracle Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GuardTime AS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Auxesis Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chainthat Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SAP SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Symbiont io Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Blockchain Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Blockchain Insurance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Blockchain Insurance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Blockchain Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Blockchain Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Blockchain Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Blockchain Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Blockchain Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Blockchain Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Blockchain Insurance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Blockchain Insurance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Blockchain Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Blockchain Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Blockchain Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Blockchain Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Blockchain Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Blockchain Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Blockchain Insurance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Blockchain Insurance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Blockchain Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Blockchain Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Blockchain Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Blockchain Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Blockchain Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Blockchain Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Blockchain Insurance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Blockchain Insurance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Blockchain Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Blockchain Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Blockchain Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Blockchain Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Blockchain Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Blockchain Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Blockchain Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Singapore Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia and New Zealand Blockchain Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 27: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 31: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain Insurance Market?

The projected CAGR is approximately 41.32%.

2. Which companies are prominent players in the Blockchain Insurance Market?

Key companies in the market include Symbiont io Inc *List Not Exhaustive, IBM Corporation, Microsoft Corporation, Amazon Web Services Inc, Oracle Corporation, GuardTime AS, Auxesis Group, Chainthat Limited, SAP SE.

3. What are the main segments of the Blockchain Insurance Market?

The market segments include Deployment, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of Automation Across the BFSI Sector; Increasing Need for Reducing the Total Cost of Ownership.

6. What are the notable trends driving market growth?

The On-Premises Segment is Anticipated to Witness Increasing Market Growth.

7. Are there any restraints impacting market growth?

Security Vulnerability of Transaction Across the Insurance Platform using Blockchain Technology; Lack of Awareness about Blockchain in the Industry Professionals.

8. Can you provide examples of recent developments in the market?

January 2023 - Amazon Web Services partnered with Ava Labs, a company building out layer-1 blockchain Avalanche, to assist in scaling blockchain adoption across institutions, enterprises, and governments. The partnership intends to make it more uncomplicated for individuals to launch and manage nodes on Avalanche while also seeking to give the network more strength and flexibility for developers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain Insurance Market?

To stay informed about further developments, trends, and reports in the Blockchain Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence