Key Insights

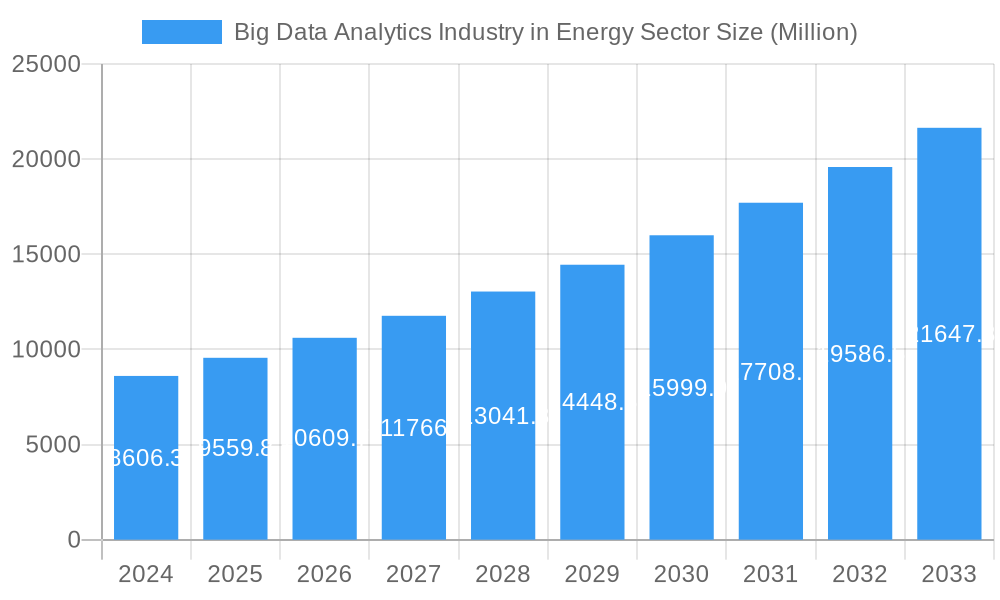

The Big Data Analytics market within the Energy Sector is poised for substantial growth, projected to reach a market size of $9.56 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.07%. This robust expansion is fueled by the increasing need for efficient grid operations, the widespread adoption of smart metering technologies, and the critical demand for advanced asset and workforce management solutions. Energy companies are increasingly leveraging big data to optimize power generation, transmission, and distribution, leading to reduced operational costs and enhanced reliability. The proliferation of IoT devices in smart grids generates vast amounts of data, which, when analyzed, provides actionable insights for predictive maintenance, demand forecasting, and personalized energy services. This transformative capability is crucial for navigating the complexities of modern energy infrastructure and meeting evolving consumer expectations.

Big Data Analytics Industry in Energy Sector Market Size (In Billion)

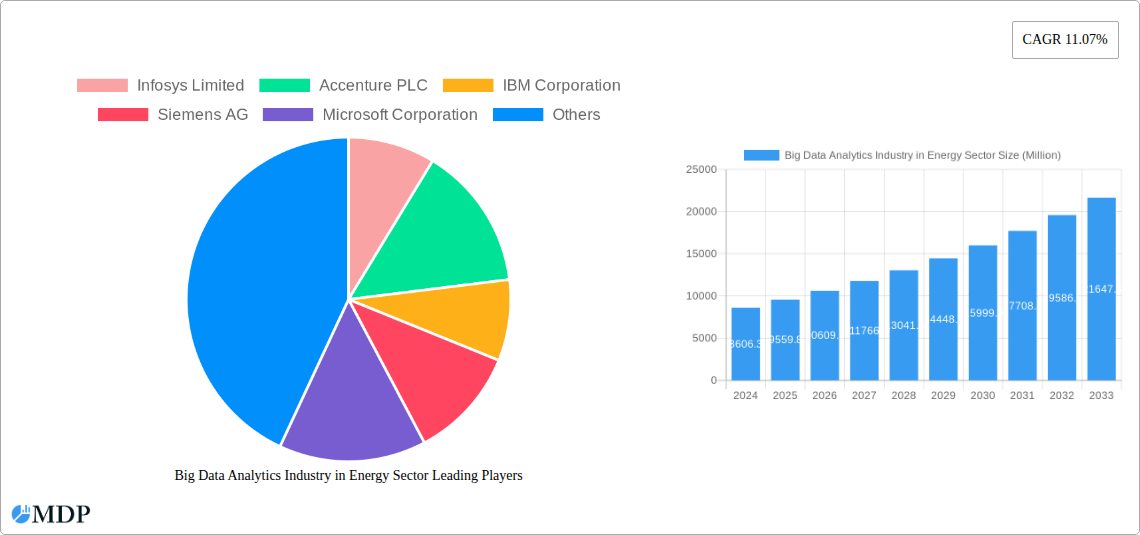

Key players such as Infosys Limited, Accenture PLC, IBM Corporation, Siemens AG, and Microsoft Corporation are at the forefront of this digital transformation, offering sophisticated analytics platforms and services. Their solutions are instrumental in enabling utilities to harness the power of data for improved decision-making, enhanced security, and better regulatory compliance. The market is further driven by initiatives focused on renewable energy integration and the development of smart cities, both of which rely heavily on data-driven analytics for seamless operation and management. While the market exhibits strong growth, challenges such as data security concerns, the need for specialized talent, and the integration of legacy systems present areas for continuous innovation and strategic development. However, the overarching trend points towards a future where big data analytics is indispensable for a sustainable, efficient, and resilient energy sector.

Big Data Analytics Industry in Energy Sector Company Market Share

Big Data Analytics in Energy Sector: Market Report Description

Unlock critical insights into the burgeoning Big Data Analytics in Energy Sector market. This comprehensive report delves into the transformative power of big data, artificial intelligence (AI), and machine learning (ML) in revolutionizing energy operations, from grid modernization and smart metering to asset management and workforce optimization. Discover the market dynamics, key trends, and strategic imperatives shaping this multi-billion dollar industry. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report provides an in-depth analysis of the historical period from 2019 to 2024. Whether you're a utility provider, technology vendor, investor, or policymaker, this report offers actionable intelligence to navigate the complexities and capitalize on the immense opportunities within the energy analytics market.

Big Data Analytics Industry in Energy Sector Market Dynamics & Concentration

The Big Data Analytics Industry in the Energy Sector is characterized by a dynamic interplay of innovation, regulation, and evolving consumer demands. Market concentration is moderately high, with a few key players like IBM Corporation, Siemens AG, and Microsoft Corporation holding significant market shares, estimated to be around 15-20% combined. However, the landscape is continuously evolving due to intense competition and a steady stream of innovative startups. The primary innovation drivers are the increasing need for operational efficiency, predictive maintenance, and the integration of renewable energy sources. Regulatory frameworks, particularly those supporting grid modernization and data privacy, play a crucial role in shaping market accessibility and adoption rates.

Product substitutes are emerging, including advanced IoT platforms and specialized energy management software, though none yet offer the comprehensive data integration and analytical depth of dedicated big data solutions. End-user trends are strongly skewed towards a demand for real-time insights, enhanced grid stability, and personalized energy consumption management. Mergers and acquisitions (M&A) activities are a significant indicator of market maturity and strategic consolidation. We anticipate approximately 5-7 significant M&A deals annually over the forecast period, driven by companies seeking to expand their technological capabilities or market reach. For instance, a hypothetical acquisition of a specialized AI firm by a large utility software provider could consolidate market power and accelerate innovation. The overall market share for big data analytics in the energy sector is projected to grow substantially, fueled by digital transformation initiatives across the industry.

Big Data Analytics Industry in Energy Sector Industry Trends & Analysis

The Big Data Analytics Industry in the Energy Sector is experiencing robust growth, driven by a confluence of technological advancements, escalating energy demands, and the imperative for sustainable energy solutions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period of 2025–2033. Market penetration is rapidly increasing, with over 60% of major energy companies actively deploying or planning to implement big data analytics solutions by 2025.

Technological disruptions are at the forefront of this expansion. The proliferation of the Internet of Things (IoT) devices, including smart meters and sensors deployed across the grid, generates vast volumes of real-time data. This data, when analyzed using advanced big data platforms and AI algorithms, enables unprecedented insights into grid performance, consumption patterns, and asset health. Furthermore, advancements in cloud computing have made sophisticated analytical tools more accessible and scalable for energy enterprises. Consumer preferences are shifting towards greater energy awareness and control. Smart metering initiatives, supported by big data analytics, empower consumers with detailed information about their energy usage, fostering conservation and enabling participation in demand-response programs. This trend is a significant market growth driver, pushing utilities to invest in analytics that can cater to these evolving needs.

Competitive dynamics are intensifying, with established technology giants like Microsoft Corporation and IBM Corporation competing with specialized analytics firms and energy-focused technology providers. The development of predictive maintenance solutions, which utilize historical data and real-time sensor readings to anticipate equipment failures, is a key competitive advantage. This not only reduces operational downtime but also significantly lowers maintenance costs, a critical factor in the cost-sensitive energy industry. The increasing integration of renewable energy sources like solar and wind power, which are inherently intermittent, further accentuates the need for sophisticated big data analytics to manage grid stability and optimize energy distribution. The ability to forecast energy generation and demand with greater accuracy is paramount, and big data analytics provides the essential tools to achieve this. The ongoing digital transformation within the energy sector, coupled with a growing emphasis on grid resilience and cybersecurity, will continue to fuel the adoption of big data analytics, making it an indispensable component of modern energy operations.

Leading Markets & Segments in Big Data Analytics Industry in Energy Sector

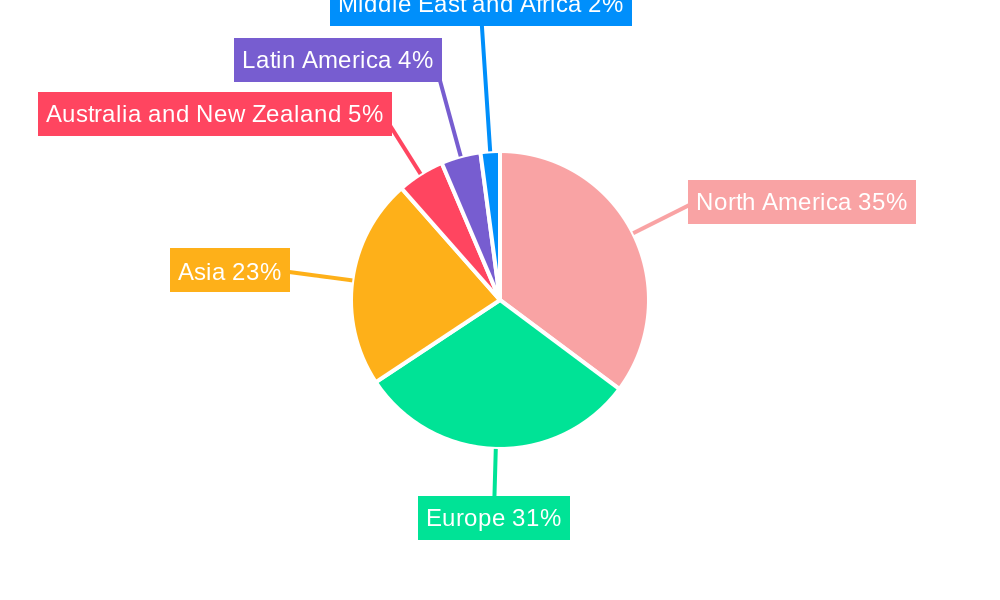

The Big Data Analytics Industry in the Energy Sector is experiencing significant traction across various geographical regions and application segments, with North America currently dominating the market share, estimated at over 35% of the global market. This leadership is attributed to substantial investments in smart grid infrastructure, favorable regulatory environments promoting data-driven utility operations, and a strong presence of major energy companies and technology providers. The United States, in particular, leads with extensive deployments of smart metering projects and advanced grid management systems, further solidifying its position.

Within application segments, Smart Metering is a pivotal driver of growth, projected to account for a substantial portion of the market revenue, estimated at around 40% by 2025. The increasing adoption of smart meters globally, driven by the need for accurate billing, demand-side management, and reduced energy theft, generates massive datasets that are ideal for big data analysis. This segment's growth is further propelled by initiatives such as the one announced by Polaris Smart Metering, which signed two smart meter projects in Uttar Pradesh, India, worth a combined USD 623.4 Million, involving the installation of over 5.1 million smart meters. This highlights the significant global momentum in smart metering deployments.

Grid Operations is another critical segment, with a projected market share of approximately 30% by 2025. Big data analytics enables utilities to optimize grid performance, enhance reliability, and improve outage management through real-time monitoring and predictive analytics. This is crucial for integrating renewable energy sources and managing the complexities of a decentralized grid. The introduction of meters like Xylem's Sensus Stratus IQ+ exemplifies the trend towards more data-rich grid edge devices, providing utilities with deeper insights into consumer electricity usage and the health of the distribution system, directly benefiting grid operations.

Asset and Workforce Management constitutes the remaining significant segment, focusing on predictive maintenance of critical infrastructure and optimizing workforce deployment. By analyzing data from sensors on turbines, transformers, and other assets, companies can predict failures, schedule maintenance proactively, and reduce costly unplanned outages. Similarly, big data analytics helps in optimizing field service operations, improving technician efficiency, and ensuring worker safety. Economic policies that encourage infrastructure upgrades and the increasing demand for energy efficiency are key drivers for the dominance of these segments.

Big Data Analytics Industry in Energy Sector Product Developments

Recent product developments in the Big Data Analytics Industry in the Energy Sector are focused on enhancing data integration, predictive capabilities, and user accessibility. Companies are innovating by developing more sophisticated AI-powered analytics platforms that can process diverse data streams from IoT devices, smart meters, and operational systems. A key trend is the integration of machine learning algorithms for advanced forecasting of energy demand and renewable generation, crucial for grid stability. Products are increasingly offering real-time anomaly detection for grid faults and asset performance monitoring, enabling proactive maintenance and minimizing downtime. The competitive advantage lies in solutions that provide granular insights into consumer behavior for tailored energy management programs and enhanced cybersecurity features to protect sensitive energy data.

Key Drivers of Big Data Analytics Industry in Energy Sector Growth

The growth of the Big Data Analytics Industry in the Energy Sector is propelled by several key factors. Firstly, the increasing digitization of the energy infrastructure, including the widespread deployment of smart meters and IoT sensors, generates massive volumes of data essential for analytics. Secondly, the growing demand for enhanced operational efficiency and cost reduction is compelling utilities to leverage big data for predictive maintenance and optimized resource allocation. Thirdly, the imperative to integrate intermittent renewable energy sources like solar and wind power necessitates advanced analytics for grid balancing and demand forecasting. Lastly, evolving regulatory landscapes that mandate data utilization for grid modernization and consumer empowerment further stimulate market expansion.

Challenges in the Big Data Analytics Industry in Energy Sector Market

Despite its immense potential, the Big Data Analytics Industry in the Energy Sector faces several challenges. A significant hurdle is the data integration complexity; energy companies often operate with disparate legacy systems, making it difficult to consolidate data for comprehensive analysis. Data security and privacy concerns are paramount, requiring robust cybersecurity measures to protect sensitive consumer and operational data from breaches. Talent shortage for skilled data scientists and analysts with domain expertise in the energy sector also poses a restraint. Furthermore, the high initial investment required for implementing advanced analytics platforms and infrastructure can be a barrier for smaller utilities. Finally, regulatory uncertainties and the slow pace of regulatory adaptation to new data-driven technologies can impede widespread adoption.

Emerging Opportunities in Big Data Analytics Industry in Energy Sector

Emerging opportunities in the Big Data Analytics Industry in the Energy Sector are vast and transformative. The increasing adoption of electric vehicles (EVs) presents a significant opportunity for analyzing charging patterns and optimizing grid load. Decentralized energy resources (DERs), such as rooftop solar and battery storage, create new avenues for managing and optimizing distributed energy generation through sophisticated analytics. Strategic partnerships between energy companies and AI/ML solution providers are fostering innovation in areas like predictive grid maintenance and smart grid resilience. Furthermore, the growing focus on energy transition and achieving net-zero emissions is driving demand for analytics that can support the integration of cleaner energy sources and the development of smart cities, opening up new market expansion strategies.

Leading Players in the Big Data Analytics Industry in Energy Sector Sector

- Infosys Limited

- Accenture PLC

- IBM Corporation

- Siemens AG

- Microsoft Corporation

- Enel X Italia Srl (Enel SpA)

- Dell Technologies Inc

- Intel Corporation

- SAP SE

- Palantir Technologies Inc

Key Milestones in Big Data Analytics Industry in Energy Sector Industry

- January 2024: Polaris Smart Metering announced the signing of two smart meter projects in Uttar Pradesh, India, valued at INR 5,200 crore (USD 623.4 Million). These contracts involve the installation of over 5.1 million smart meters in the Lucknow and Ayodhya/Devipatan regions for Madhyanchal Vidyut Vitran Nigam Limited (MVVNL), with completion expected over the next 27 months.

- December 2023: Xylem introduced its Sensus brand's grid edge Stratus IQ+ smart electricity meter. This meter provides utilities with enhanced data capabilities, including information on customer EV charging, and offers advanced system diagnostics for a better understanding of consumer electricity usage and distribution system health.

Strategic Outlook for Big Data Analytics Industry in Energy Sector Market

The strategic outlook for the Big Data Analytics Industry in the Energy Sector is exceptionally positive, driven by an accelerating push towards a smarter, more sustainable, and resilient energy future. The increasing integration of renewable energy sources and the growing complexity of grid management will continue to necessitate advanced analytical solutions for real-time monitoring, forecasting, and optimization. Emerging technologies such as edge computing, blockchain for energy trading, and advanced AI for autonomous grid operations will unlock new market potential. Strategic opportunities lie in developing comprehensive data analytics platforms that offer end-to-end solutions, from data acquisition to actionable insights, and in forging collaborations to address the evolving needs of the energy transition, ensuring continued growth and innovation in the sector.

Big Data Analytics Industry in Energy Sector Segmentation

-

1. Application

- 1.1. Grid Operations

- 1.2. Smart Metering

- 1.3. Asset and Workforce Management

Big Data Analytics Industry in Energy Sector Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Big Data Analytics Industry in Energy Sector Regional Market Share

Geographic Coverage of Big Data Analytics Industry in Energy Sector

Big Data Analytics Industry in Energy Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enormous Influx of Data; Volatility in the Oil Prices

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Grid Operations Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Grid Operations

- 5.1.2. Smart Metering

- 5.1.3. Asset and Workforce Management

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Grid Operations

- 6.1.2. Smart Metering

- 6.1.3. Asset and Workforce Management

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Grid Operations

- 7.1.2. Smart Metering

- 7.1.3. Asset and Workforce Management

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Grid Operations

- 8.1.2. Smart Metering

- 8.1.3. Asset and Workforce Management

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Grid Operations

- 9.1.2. Smart Metering

- 9.1.3. Asset and Workforce Management

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Grid Operations

- 10.1.2. Smart Metering

- 10.1.3. Asset and Workforce Management

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Big Data Analytics Industry in Energy Sector Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Grid Operations

- 11.1.2. Smart Metering

- 11.1.3. Asset and Workforce Management

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infosys Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Accenture PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Microsoft Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Enel X Italia Srl (Enel SpA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dell Technologies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Intel Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SAP SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Palantir Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Infosys Limited

List of Figures

- Figure 1: Global Big Data Analytics Industry in Energy Sector Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 15: Australia and New Zealand Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 16: Australia and New Zealand Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 19: Latin America Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 20: Latin America Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Big Data Analytics Industry in Energy Sector Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Big Data Analytics Industry in Energy Sector Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Big Data Analytics Industry in Energy Sector Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Big Data Analytics Industry in Energy Sector Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Big Data Analytics Industry in Energy Sector Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Big Data Analytics Industry in Energy Sector?

The projected CAGR is approximately 11.07%.

2. Which companies are prominent players in the Big Data Analytics Industry in Energy Sector?

Key companies in the market include Infosys Limited, Accenture PLC, IBM Corporation, Siemens AG, Microsoft Corporation, Enel X Italia Srl (Enel SpA, Dell Technologies Inc, Intel Corporation, SAP SE, Palantir Technologies Inc.

3. What are the main segments of the Big Data Analytics Industry in Energy Sector?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Enormous Influx of Data; Volatility in the Oil Prices.

6. What are the notable trends driving market growth?

Grid Operations Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

January 2024 - Polaris Smart Metering announced that it signed two smart meter projects in Uttar Pradesh, India, worth a combined INR 5,200 crore (USD 623.4 million). The contracts for the installation of more than 5.1 million smart meters in the significant Lucknow and Ayodhya/Devipatan regions have been given to Madhyanchal Vidyut Vitran Nigam Limited (MVVNL). The business intends to install the meters over the course of the next 27 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Big Data Analytics Industry in Energy Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Big Data Analytics Industry in Energy Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Big Data Analytics Industry in Energy Sector?

To stay informed about further developments, trends, and reports in the Big Data Analytics Industry in Energy Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence