Key Insights

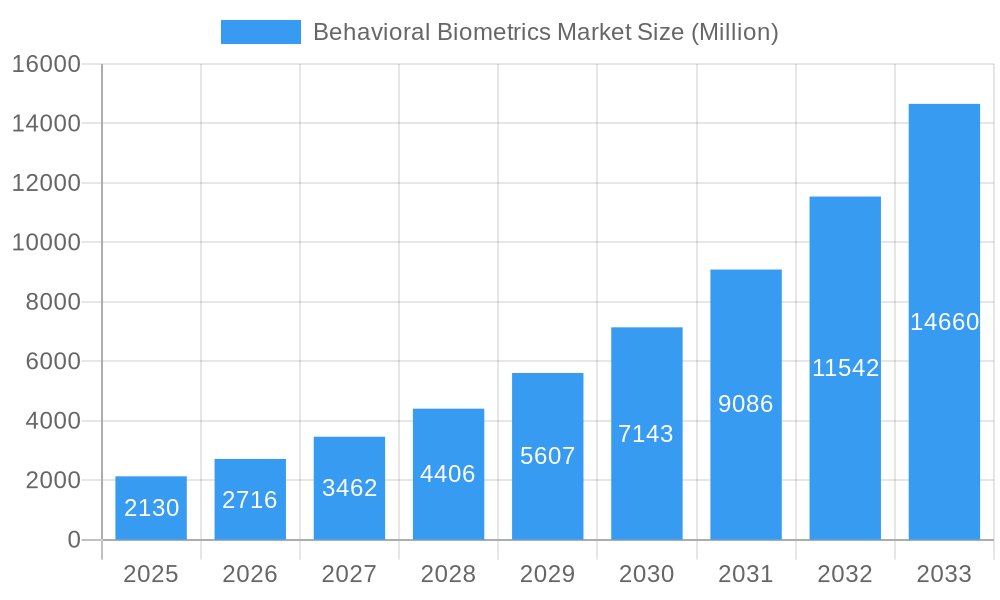

The Behavioral Biometrics market is experiencing robust growth, projected to reach $2.13 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 27.64% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of cybercrime and the need for enhanced security measures across various sectors, including BFSI (Banking, Financial Services, and Insurance), retail and e-commerce, healthcare, and government, are fueling demand for sophisticated authentication solutions. Behavioral biometrics, which analyzes user behavior patterns to verify identity, offers a superior alternative to traditional methods like passwords, significantly reducing fraud and improving security posture. Secondly, advancements in technologies like AI and machine learning are enhancing the accuracy and efficiency of behavioral biometric systems, making them more widely applicable and cost-effective. The market is witnessing a shift towards cloud-based deployments, offering scalability and accessibility benefits. The growing adoption of continuous authentication, which verifies user identity throughout a session rather than just at login, further contributes to market growth.

Behavioral Biometrics Market Market Size (In Billion)

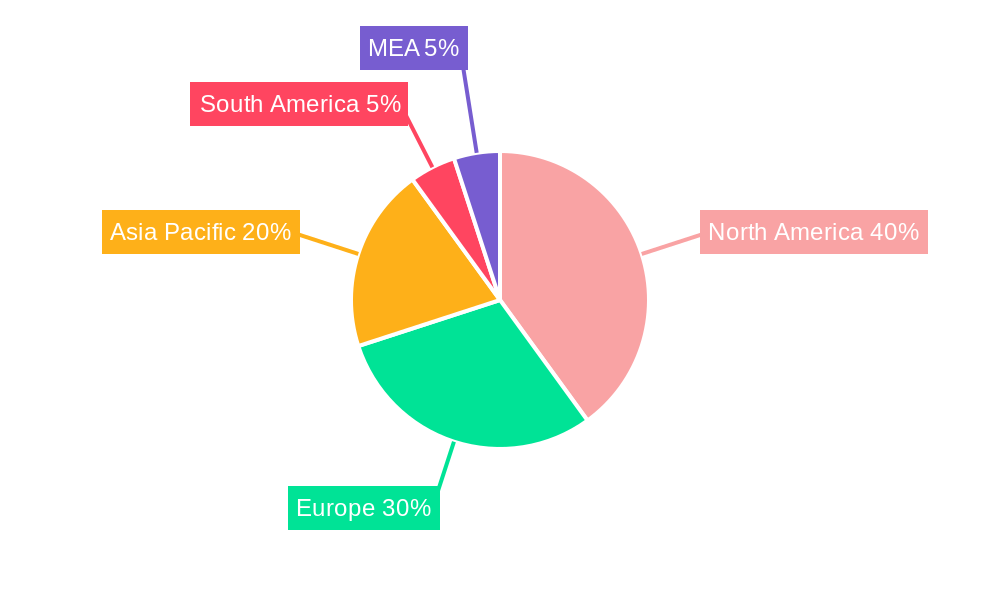

Different behavioral biometric technologies, such as signature analysis, keystroke dynamics, voice recognition, and gait analysis, cater to diverse applications, including identity proofing, continuous authentication, risk and compliance management, and fraud detection and prevention. While the North American market currently holds a significant share, driven by early adoption and technological advancements, Asia-Pacific is projected to witness substantial growth in the coming years due to increasing digitalization and a growing awareness of cybersecurity threats. However, factors such as data privacy concerns and the need for robust regulatory frameworks could potentially hinder market growth. Nevertheless, the overall outlook remains positive, with the market expected to maintain a high growth trajectory throughout the forecast period, driven by the continuous need for secure and seamless user authentication.

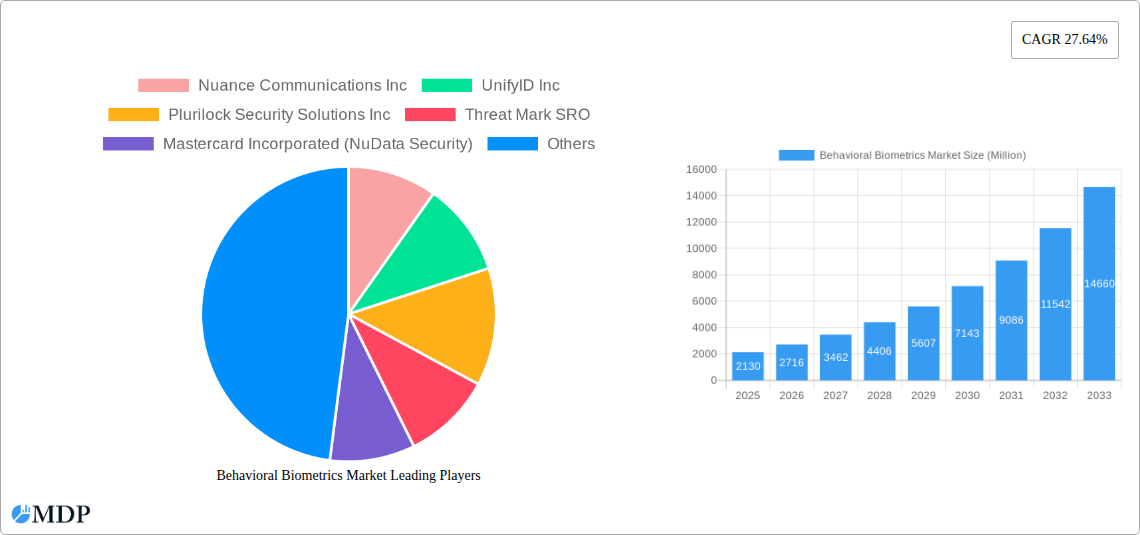

Behavioral Biometrics Market Company Market Share

Behavioral Biometrics Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Behavioral Biometrics Market, offering valuable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, industry trends, leading segments, and key players, forecasting robust growth and highlighting significant opportunities.

Behavioral Biometrics Market Dynamics & Concentration

The Behavioral Biometrics Market is experiencing significant growth driven by increasing concerns over digital security and fraud prevention. Market concentration is moderately high, with several key players holding substantial market share. However, the market also features a number of smaller, innovative companies, leading to a dynamic competitive landscape.

Market Concentration: While precise market share data for individual companies remains proprietary, estimates suggest that the top five players account for approximately xx% of the market in 2025. This concentration is expected to remain relatively stable during the forecast period, although smaller players are likely to gain share through innovation and strategic partnerships.

Innovation Drivers: Advancements in machine learning, artificial intelligence, and data analytics are key drivers of innovation, enabling more accurate and sophisticated behavioral biometrics solutions. The rising adoption of cloud-based solutions also fuels innovation by enabling scalability and accessibility.

Regulatory Frameworks: Government regulations concerning data privacy and security, such as GDPR and CCPA, are creating both challenges and opportunities. Compliance requirements necessitate robust biometric security solutions, while also influencing data handling practices and vendor selection.

Product Substitutes: Traditional authentication methods like passwords and one-time pins remain prevalent, posing a competitive threat to behavioral biometrics. However, the inherent weaknesses of these methods are leading to increased adoption of more secure alternatives.

End-User Trends: The BFSI sector remains a dominant adopter of behavioral biometrics, driven by the need to secure online banking and financial transactions. However, expanding adoption in retail, healthcare, and the public sector reflects the market's broadening applicability.

M&A Activities: The number of M&A deals in the behavioral biometrics sector has seen a steady increase over the historical period, with xx deals recorded from 2019 to 2024, reflecting industry consolidation and expansion strategies.

Behavioral Biometrics Market Industry Trends & Analysis

The Behavioral Biometrics Market is experiencing significant growth, projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing adoption of digital channels across various sectors is driving the demand for robust security solutions, while the limitations of traditional authentication methods are pushing organizations toward advanced alternatives. Technological advancements in machine learning and AI are improving the accuracy and efficiency of behavioral biometrics, further expanding market adoption. Consumer preferences are shifting towards more convenient and secure authentication methods, bolstering the demand for user-friendly and seamless behavioral biometric systems. The heightened focus on risk mitigation and compliance, particularly in regulated industries, creates a significant impetus for the market's growth. Furthermore, the rise in cybercrime and financial fraud accelerates the adoption of advanced security solutions. The competitive landscape is also characterized by ongoing innovation, partnerships, and strategic investments, all contributing to market expansion. Market penetration is estimated at xx% in 2025, expected to grow significantly by 2033.

Leading Markets & Segments in Behavioral Biometrics Market

The BFSI sector is currently the leading end-user segment, followed by retail and e-commerce. Geographically, North America and Europe currently hold the largest market share, driven by high technology adoption and stringent security regulations. However, rapidly developing markets in Asia-Pacific are projected to witness significant growth during the forecast period.

- Dominant End-User Segment: BFSI (Banking, Financial Services, and Insurance)

- Dominant Deployment Type: On-cloud

- Dominant Application: Fraud Detection and Prevention

- Dominant Region: North America

- Key Drivers for BFSI Segment Growth: Stringent regulatory compliance requirements, increasing online and mobile banking transactions, high fraud risk.

- Key Drivers for Retail and E-commerce Segment Growth: Rising online shopping, growing need for secure payment gateways, increasing customer data protection concerns.

- Key Drivers for Healthcare Segment Growth: HIPAA compliance, protection of sensitive patient data, growing use of telehealth services.

- Key Drivers for Government and Public Sector Growth: Need for secure access control, protection of citizen data, increasing cybersecurity threats.

- Key Drivers for On-Cloud Deployment Growth: Scalability, cost-effectiveness, ease of integration.

Behavioral Biometrics Market Product Developments

Recent product developments focus on improving accuracy, reducing friction, and enhancing adaptability across diverse platforms. This includes advancements in machine learning algorithms, which enhance user experience and reduce false positives. New applications are emerging in areas like IoT security and supply chain management, reflecting the technology's broadening scope. Competitive advantages are driven by proprietary algorithms, advanced analytics capabilities, and strong partnerships with system integrators.

Key Drivers of Behavioral Biometrics Market Growth

Technological advancements in AI and machine learning, coupled with rising cybersecurity concerns and government regulations promoting data protection, are significantly fueling market expansion. Increasing adoption of digital platforms and the growth of e-commerce further propel the demand for robust security measures. Economic factors, such as increasing fraud losses, also incentivize adoption.

Challenges in the Behavioral Biometrics Market

Data privacy concerns, and the complexities of balancing security with user experience, pose significant challenges. The need for robust data protection measures and compliance with regulations like GDPR and CCPA add to the complexities. Competitive pressures from established security vendors and emerging technologies also impact market growth. Furthermore, the relatively high implementation costs can hinder adoption among smaller businesses.

Emerging Opportunities in Behavioral Biometrics Market

The integration of behavioral biometrics with other security technologies, such as multi-factor authentication, presents a significant opportunity for growth. The expansion of the technology into new vertical markets, like IoT security and supply chain management, also presents exciting potential. Strategic partnerships and alliances between technology providers and industry players will accelerate market penetration and drive long-term growth.

Leading Players in the Behavioral Biometrics Market Sector

- Nuance Communications Inc

- UnifyID Inc

- Plurilock Security Solutions Inc

- Threat Mark SRO

- Mastercard Incorporated (NuData Security)

- SecureAuth Corporation

- SecuredTouch Inc

- BehavioSec Inc

- Zighra Inc

- BioCatch Ltd

Key Milestones in Behavioral Biometrics Market Industry

- October 2020: BioCatch secured USD 168 Million in Series C funding, led by major banks including Barclays, Citi, HSBC, and NAB. This significant investment highlights the growing confidence in the behavioral biometrics market and BioCatch's position within it.

- June 2020: SecureAuth Corporation signed a distribution agreement with Arrow Electronics for Australia and New Zealand, marking its entry into the A/NZ market and expanding its reach. This strategic partnership broadened SecureAuth's market presence and potential customer base.

Strategic Outlook for Behavioral Biometrics Market

The Behavioral Biometrics Market is poised for significant expansion, driven by ongoing technological advancements, growing adoption across various sectors, and the increasing need for robust security solutions. Strategic partnerships, focused product development, and expansion into emerging markets will be crucial for success. The market's future potential rests on continuous innovation, addressing privacy concerns, and demonstrating the technology's value proposition to a wider range of businesses and consumers.

Behavioral Biometrics Market Segmentation

-

1. Type

- 1.1. Signature Analysis

- 1.2. Keystroke Dynamics

- 1.3. Voice Recognition

- 1.4. Gait Analysis

-

2. Deployment

- 2.1. On-premise

- 2.2. On-cloud

-

3. Application

- 3.1. Identity Proofing

- 3.2. Continuous Authentication

- 3.3. Risk and Compliance

- 3.4. Fraud Detection and Prevention

-

4. End-User

- 4.1. BFSI

- 4.2. Retail and E-commerce

- 4.3. Healthcare

- 4.4. Government and Public Sector

- 4.5. Other End-user Verticals

Behavioral Biometrics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Behavioral Biometrics Market Regional Market Share

Geographic Coverage of Behavioral Biometrics Market

Behavioral Biometrics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Applications of Biometric Technology in the Commercial and Government Sectors; Increase in Online Transactions and Fraudulent Activities

- 3.3. Market Restrains

- 3.3.1. Privacy Intrusion Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Data Breaches in BFSI will Drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Signature Analysis

- 5.1.2. Keystroke Dynamics

- 5.1.3. Voice Recognition

- 5.1.4. Gait Analysis

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. On-cloud

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Identity Proofing

- 5.3.2. Continuous Authentication

- 5.3.3. Risk and Compliance

- 5.3.4. Fraud Detection and Prevention

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI

- 5.4.2. Retail and E-commerce

- 5.4.3. Healthcare

- 5.4.4. Government and Public Sector

- 5.4.5. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Signature Analysis

- 6.1.2. Keystroke Dynamics

- 6.1.3. Voice Recognition

- 6.1.4. Gait Analysis

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. On-cloud

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Identity Proofing

- 6.3.2. Continuous Authentication

- 6.3.3. Risk and Compliance

- 6.3.4. Fraud Detection and Prevention

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI

- 6.4.2. Retail and E-commerce

- 6.4.3. Healthcare

- 6.4.4. Government and Public Sector

- 6.4.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Signature Analysis

- 7.1.2. Keystroke Dynamics

- 7.1.3. Voice Recognition

- 7.1.4. Gait Analysis

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. On-cloud

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Identity Proofing

- 7.3.2. Continuous Authentication

- 7.3.3. Risk and Compliance

- 7.3.4. Fraud Detection and Prevention

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI

- 7.4.2. Retail and E-commerce

- 7.4.3. Healthcare

- 7.4.4. Government and Public Sector

- 7.4.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Signature Analysis

- 8.1.2. Keystroke Dynamics

- 8.1.3. Voice Recognition

- 8.1.4. Gait Analysis

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. On-cloud

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Identity Proofing

- 8.3.2. Continuous Authentication

- 8.3.3. Risk and Compliance

- 8.3.4. Fraud Detection and Prevention

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI

- 8.4.2. Retail and E-commerce

- 8.4.3. Healthcare

- 8.4.4. Government and Public Sector

- 8.4.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Signature Analysis

- 9.1.2. Keystroke Dynamics

- 9.1.3. Voice Recognition

- 9.1.4. Gait Analysis

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. On-cloud

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Identity Proofing

- 9.3.2. Continuous Authentication

- 9.3.3. Risk and Compliance

- 9.3.4. Fraud Detection and Prevention

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI

- 9.4.2. Retail and E-commerce

- 9.4.3. Healthcare

- 9.4.4. Government and Public Sector

- 9.4.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nuance Communications Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 UnifyID Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Plurilock Security Solutions Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Threat Mark SRO

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mastercard Incorporated (NuData Security)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SecureAuth Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SecuredTouch Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BehavioSec Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zighra Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BioCatch Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nuance Communications Inc

List of Figures

- Figure 1: Global Behavioral Biometrics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 9: North America Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Europe Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Europe Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Rest of the World Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of the World Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Rest of the World Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Rest of the World Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Behavioral Biometrics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Behavioral Biometrics Market?

The projected CAGR is approximately 27.64%.

2. Which companies are prominent players in the Behavioral Biometrics Market?

Key companies in the market include Nuance Communications Inc, UnifyID Inc, Plurilock Security Solutions Inc, Threat Mark SRO, Mastercard Incorporated (NuData Security), SecureAuth Corporation, SecuredTouch Inc, BehavioSec Inc, Zighra Inc, BioCatch Ltd.

3. What are the main segments of the Behavioral Biometrics Market?

The market segments include Type, Deployment, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Applications of Biometric Technology in the Commercial and Government Sectors; Increase in Online Transactions and Fraudulent Activities.

6. What are the notable trends driving market growth?

Increasing Data Breaches in BFSI will Drive the Growth of this Market.

7. Are there any restraints impacting market growth?

Privacy Intrusion Concerns.

8. Can you provide examples of recent developments in the market?

October 2020 - BioCatch managed to raise a total of USD 91 million in new funding. It added USD 20 million to its Series C bringing in a total of USD 168 million for the round of investment until October 2020. The investment was led by major banks Barclays, Citi, HSBC, and National Australia Bank (NAB).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Behavioral Biometrics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Behavioral Biometrics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Behavioral Biometrics Market?

To stay informed about further developments, trends, and reports in the Behavioral Biometrics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence