Key Insights

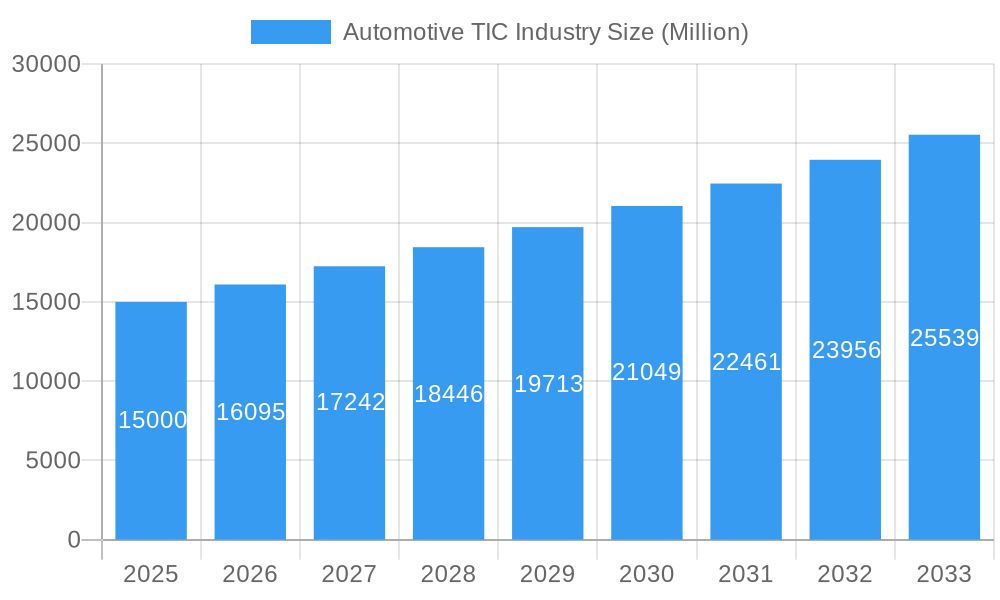

The global Automotive Testing, Inspection, and Certification (TIC) market is poised for significant expansion, driven by increasingly stringent vehicle safety and emission regulations. The market is forecast to reach $20.31 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033. Key growth catalysts include the widespread adoption of Advanced Driver-Assistance Systems (ADAS) and Electric Vehicles (EVs), which necessitate advanced testing and certification protocols. Furthermore, burgeoning global automotive production, particularly within rapidly developing Asia-Pacific economies, is a major market contributor. The escalating focus on environmental sustainability also fuels growth as manufacturers prioritize compliance with rigorous emission standards. Service-wise, testing and inspection segments dominate, with passenger vehicles representing a substantial portion, although commercial vehicle testing also shows notable upward momentum. Leading players such as Intertek Group, Eurofins Group, TÜV Rheinland Group, SGS Group, TÜV SÜD Group, Dekra SE, Applus Group, TÜV Nord, and Bureau Veritas are strategically investing in technology and expanding their global footprint to capitalize on market opportunities.

Automotive TIC Industry Market Size (In Billion)

The competitive landscape is characterized by strategic consolidation and continuous innovation. Established companies are enhancing their service offerings and geographical reach, while emerging firms are developing specialized solutions for niche market segments. Despite substantial growth prospects, the industry encounters challenges, including the considerable cost of testing and certification, which may present hurdles for smaller automotive manufacturers. Maintaining uniform standards and consistency across diverse regional regulatory frameworks remains a critical consideration. Nonetheless, the long-term outlook for the Automotive TIC market remains highly positive, underpinned by ongoing technological advancements in the automotive sector and the persistent imperative for regulatory adherence.

Automotive TIC Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Automotive Testing, Inspection, and Certification (TIC) industry, projecting a robust market expansion. It provides actionable insights into market dynamics, key industry players, technological innovations, and future growth prospects, catering to stakeholders across the automotive value chain. The analysis encompasses historical data from 2019-2024 and forecasts from 2025 (base year) to 2033 (forecast period).

Automotive TIC Industry Market Dynamics & Concentration

The Automotive TIC (Testing, Inspection, and Certification) market, projected to reach **$XX Billion in 2024**, is experiencing robust and sustained growth. This expansion is fundamentally propelled by a dynamic interplay of factors, including increasingly stringent global safety and environmental regulations, the ever-growing complexity of modern vehicle architectures, and the transformative rise of electric, connected, and autonomous vehicle (CAV) technologies. The market landscape is characterized by significant concentration, with a select group of global leaders holding a substantial portion of the market share. As of 2024, the top 10 key players, including prominent names such as Intertek Group, Eurofins Group, TÜV Rheinland Group, SGS Group, TÜV SÜD Group, Dekra SE, Applus Group, TÜV Nord, and Bureau Veritas, collectively command an estimated **XX% of the total market share**. This high level of concentration is further intensified by a consistent trend of strategic mergers and acquisitions (M&A), which serve to consolidate expertise, expand service portfolios, and enhance geographical reach.

- Market Concentration: The Automotive TIC market exhibits high concentration, with the top 10 industry leaders collectively securing approximately **XX%** of the global market share in 2024.

- Key Growth Drivers: Primary catalysts for market expansion include the relentless pursuit of enhanced vehicle safety and environmental compliance, the accelerating adoption of electric powertrains and advanced driver-assistance systems (ADAS), and continuous innovation in testing methodologies and technologies.

- Evolving Regulatory Landscape: The continuous evolution and enforcement of global regulatory frameworks, such as those from UNECE and ISO, are critical determinants of market demand, necessitating comprehensive testing and certification services throughout the vehicle lifecycle.

- Competitive Pressures: While direct product substitutes are limited, the internal testing and validation capabilities of Original Equipment Manufacturers (OEMs) represent a significant competitive factor influencing the demand for external TIC services.

- End-User Behavior: A discernible trend among OEMs is the increasing outsourcing of complex and specialized TIC functions to dedicated, third-party providers, thereby driving market growth and specialization.

- Mergers & Acquisitions (M&A): The industry has witnessed a significant volume of M&A activity, with an estimated **XX deals** recorded in the past five years. This consolidation trend highlights a strategic imperative for market expansion, acquisition of specialized capabilities, and penetration into new service domains and geographical regions. A notable instance of this strategic pursuit is Applus's acquisition of IMA Dresden in 2021, reinforcing the drive to integrate specialized testing expertise.

Automotive TIC Industry Industry Trends & Analysis

The Automotive TIC market exhibits a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Several factors fuel this growth, including:

- Technological Disruptions: The rise of autonomous vehicles, connected car technologies, and electric vehicles necessitates specialized testing and certification services, driving market expansion. Advanced driver-assistance systems (ADAS) and cybersecurity testing represent particularly high-growth segments.

- Market Growth Drivers: Increasing vehicle production, stricter emission regulations, and growing awareness of vehicle safety are major growth catalysts.

- Consumer Preferences: Growing consumer demand for safer, more reliable, and technologically advanced vehicles drives the need for robust TIC services.

- Competitive Dynamics: The market is characterized by intense competition among established players and emerging specialized service providers. Continuous innovation and strategic partnerships are crucial for sustained growth. Market penetration of new technologies is accelerating, especially in the areas of battery testing and cybersecurity.

Leading Markets & Segments in Automotive TIC Industry

The global automotive TIC market is geographically diverse, with North America and Europe representing the largest regional segments. However, the Asia-Pacific region is experiencing the fastest growth, fueled by rapid automotive production expansion in countries like China and India.

By Service Type:

- Testing & Inspection: This segment dominates the market, accounting for approximately XX% of total revenue in 2024, driven by the continuous need for rigorous vehicle testing throughout the production lifecycle.

- Certification: This segment is experiencing substantial growth due to stringent regulatory requirements and growing consumer demand for certified vehicles.

- Others (Auditing, Consulting, and Training Services): This is a smaller but rapidly growing segment, offering substantial added value and enhancing the overall TIC service packages offered by market leaders.

By Vehicle Type:

- Passenger Vehicles: This segment remains the largest, owing to the high volume of passenger vehicle production globally. Demand for stringent testing and certification is especially high in advanced safety and emission testing segments.

- Commercial Vehicles: This segment exhibits strong growth potential, driven by the increasing demand for safer and more efficient commercial vehicles. Stricter regulations in commercial vehicle emissions and safety are driving high demand for TIC services.

Key Drivers: Strong economic growth, substantial investments in automotive infrastructure, and the implementation of favorable government policies are major contributing factors to regional growth variations.

Automotive TIC Industry Product Developments

Innovation within the Automotive TIC sector is largely focused on pioneering advanced testing methodologies designed to meet the demands of next-generation vehicles. This includes the integration of sophisticated artificial intelligence (AI) for enhanced data analysis, the development of highly realistic autonomous driving simulation environments, and the implementation of cutting-edge emission measurement systems. These technological advancements are instrumental in elevating the accuracy, efficiency, and speed of testing processes, thereby delivering greater value to clients. Companies are actively developing bespoke solutions that specifically address the unique engineering and safety challenges posed by electric vehicles (EVs) and autonomous driving systems. This proactive approach facilitates faster product development cycles, optimizes cost-effectiveness, and strengthens competitive positioning within a rapidly evolving automotive landscape.

Key Drivers of Automotive TIC Industry Growth

The substantial growth trajectory of the Automotive TIC market is underpinned by a synergistic combination of influential factors:

- Technological Advancements: The continuous development and adoption of sophisticated testing equipment and methodologies, particularly those leveraging AI and advanced analytics, are pivotal in enhancing the precision and scope of validation processes.

- Global Economic Expansion: Rising disposable incomes and increasing vehicle sales, especially in emerging economies, represent a significant stimulant for overall market growth.

- Stringent Regulatory Mandates: Governments worldwide are progressively enforcing more rigorous safety and environmental regulations, thereby necessitating thorough testing and certification across all vehicle types. The ongoing evolution of emission standards, such as the **Euro 7 regulations** in Europe, exemplifies this trend and drives demand for specialized testing services.

Challenges in the Automotive TIC Industry Market

Challenges include:

- Regulatory Hurdles: Navigating complex and evolving regulations across different jurisdictions poses a significant operational challenge.

- Supply Chain Issues: The global supply chain disruptions of recent years impact the availability of testing equipment and expertise, increasing operating costs.

- Intense Competition: The presence of numerous established and emerging players results in fierce competition, necessitating continuous innovation and cost optimization. Competitive pressures also impact profitability, requiring constant adjustment of pricing and service strategies.

Emerging Opportunities in Automotive TIC Industry

The Automotive TIC industry is poised for significant long-term growth, presenting a wealth of emerging opportunities:

- Technological Frontier: Breakthroughs in AI, big data analytics, IoT integration, and autonomous testing technologies are expected to dramatically improve testing efficiency, accuracy, and predictive capabilities.

- Strategic Alliances: The formation of collaborative partnerships with innovative technology providers and leading automotive OEMs will unlock new avenues for market penetration, the development of integrated solutions, and enhanced service offerings.

- Geographical Expansion: Tapping into the burgeoning automotive markets in Asia and Africa offers substantial potential for growth and diversification, driven by increasing vehicle adoption and evolving regulatory requirements in these regions.

Leading Players in the Automotive TIC Industry Sector

Key Milestones in Automotive TIC Industry Industry

- May 2021: Applus acquired IMA Dresden, expanding its materials testing capabilities and strengthening its position in the European market.

- April 2021: DEKRA became an MFi Authorized Test Laboratory, gaining access to the Apple ecosystem and expanding its certification services.

Strategic Outlook for Automotive TIC Industry Market

The Automotive TIC market presents a compelling landscape with substantial long-term growth prospects. This is primarily fueled by the relentless pace of technological innovation, the evolving and often tightening regulatory environment, and the escalating consumer and regulatory demand for safer, more sustainable, and increasingly sophisticated vehicles. Strategic players who proactively embrace and leverage technological advancements, cultivate robust strategic partnerships, and execute efficient global expansion strategies are best positioned to capitalize on this dynamic market. This approach will not only foster long-term, sustainable growth but also enable significant enhancement of market share and industry leadership.

Automotive TIC Industry Segmentation

-

1. Service Type

- 1.1. Testing & Inspection

- 1.2. Certification

- 1.3. Others

-

2. Vehicle Type

- 2.1. Passenger

- 2.2. Commercial

Automotive TIC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automotive TIC Industry Regional Market Share

Geographic Coverage of Automotive TIC Industry

Automotive TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization

- 3.3. Market Restrains

- 3.3.1. Lack of International Accepted Standards

- 3.4. Market Trends

- 3.4.1. Testing is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing & Inspection

- 5.1.2. Certification

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing & Inspection

- 6.1.2. Certification

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing & Inspection

- 7.1.2. Certification

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing & Inspection

- 8.1.2. Certification

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing & Inspection

- 9.1.2. Certification

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing & Inspection

- 10.1.2. Certification

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TUV Rhienland Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV SUD Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dekra SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Applus Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TUV Nord

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Intertek Group

List of Figures

- Figure 1: Global Automotive TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Latin America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Latin America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive TIC Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Automotive TIC Industry?

Key companies in the market include Intertek Group, Eurofins Group, TUV Rhienland Group, SGS Group, TUV SUD Group, Dekra SE, Applus Group, TUV Nord, Bureau Veritas.

3. What are the main segments of the Automotive TIC Industry?

The market segments include Service Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization.

6. What are the notable trends driving market growth?

Testing is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of International Accepted Standards.

8. Can you provide examples of recent developments in the market?

May 2021 - Applus acquired IMA Dresden, a leading testing laboratory in Europe which is a well-diversified structural and materials testing laboratory, with a good reputation for excellence and a European leader in most of its key markets of railway, aerospace & defense, wind power, building products, medical devices and automotive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive TIC Industry?

To stay informed about further developments, trends, and reports in the Automotive TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence