Key Insights

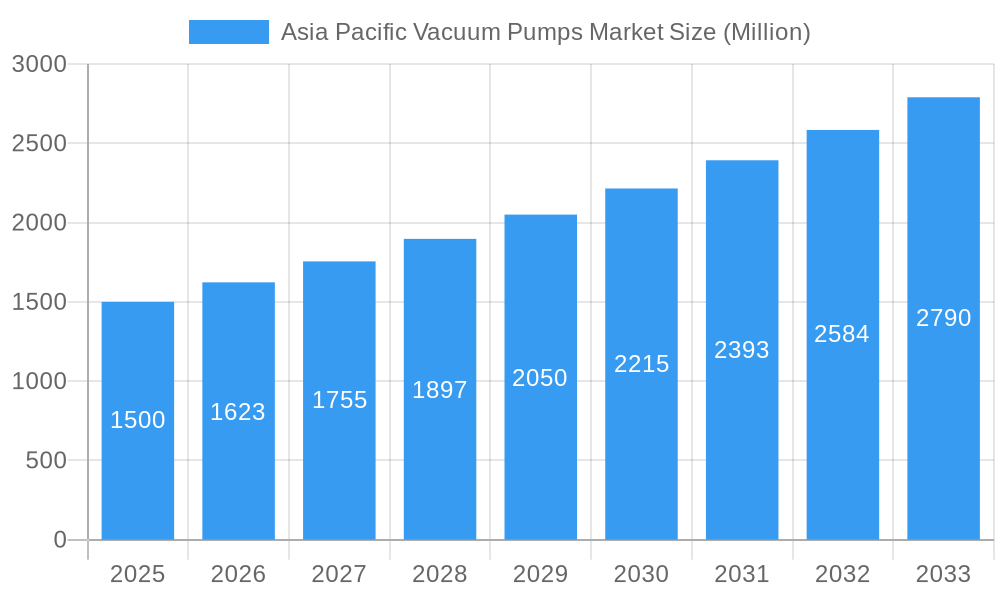

The Asia Pacific vacuum pumps market is projected for significant expansion, expected to reach $6.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This growth is primarily driven by escalating industrialization and manufacturing output across the region, notably in China, India, and Southeast Asian economies. The robust expansion of the electronics sector, fueled by consumer goods and advanced technology demand, is a key contributor, requiring sophisticated vacuum solutions for semiconductor fabrication and assembly. Additionally, the expanding oil and gas industry, alongside continuous advancements in chemical processing and pharmaceuticals, mandates dependable vacuum systems for critical operations like distillation, drying, and filtration. The increasing integration of advanced vacuum pump technologies, including rotary vane, screw, and turbomolecular pumps, is enhancing efficiency, reducing energy consumption, and improving process control.

Asia Pacific Vacuum Pumps Market Market Size (In Billion)

Key market accelerators include supportive government policies championing manufacturing and technological progress, alongside the escalating adoption of industrial automation. The growing demand for energy-efficient and eco-friendly vacuum solutions is also a significant trend, spurring innovation among manufacturers. Nevertheless, market challenges such as the substantial upfront investment for advanced vacuum pump systems and the availability of less expensive alternatives in specific applications may pose constraints. Despite these hurdles, the strong economic prospects of the Asia Pacific region and persistent demand for quality and efficiency across varied end-user industries are anticipated to drive market growth. Leading companies, including Ingersoll Rand Inc., Atlas Copco, and Ebara Corporation, are strategically investing in research and development to meet the evolving demands of this dynamic market.

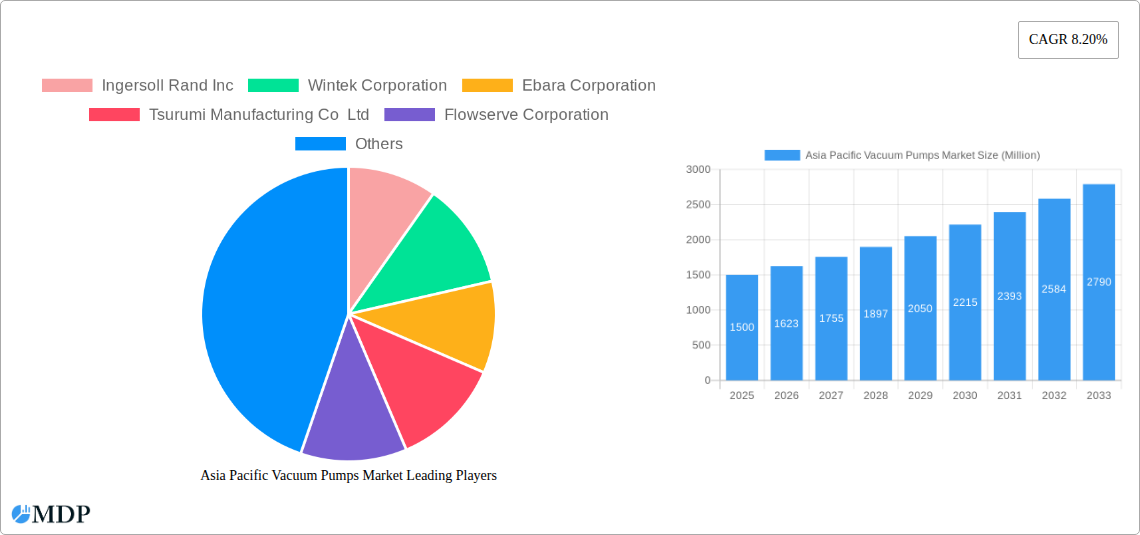

Asia Pacific Vacuum Pumps Market Company Market Share

Asia Pacific Vacuum Pumps Market: Comprehensive Growth Analysis and Forecast (2019-2033)

This in-depth report provides a critical analysis of the Asia Pacific Vacuum Pumps Market, offering comprehensive insights into its current landscape and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study delves into market dynamics, key trends, leading segments, and the strategic initiatives of major players. We meticulously examine the influence of technological advancements, evolving end-user demands, and regulatory shifts on the market's growth, projected to reach USD XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. The report is structured to equip industry stakeholders with actionable intelligence, from identifying lucrative sub-segments within Rotary, Reciprocating, Kinetic, Dynamic, and Specialized Vacuum Pumps to understanding the critical role of these pumps in diverse applications such as Oil and Gas, Electronics, Medicine, Chemical Processing, Food and Beverages, and Power Generation.

Asia Pacific Vacuum Pumps Market Market Dynamics & Concentration

The Asia Pacific vacuum pumps market is characterized by a moderate to high level of concentration, with a few key global players dominating significant market share, alongside a growing number of regional manufacturers. Innovation remains a pivotal driver, fueled by the relentless pursuit of energy efficiency, reduced footprint, and enhanced process control, especially in the context of Industry 4.0 adoption. Regulatory frameworks concerning environmental emissions and industrial safety are increasingly shaping product development and market entry strategies across the region. Product substitutes, while existing in certain niche applications, are largely outpaced by the specialized performance and reliability offered by advanced vacuum pump technologies. End-user trends indicate a strong demand for customizable and intelligent solutions, particularly within the rapidly expanding electronics and medical sectors. Mergers and Acquisitions (M&A) activities are a notable feature, with companies strategically acquiring smaller players to expand their product portfolios, geographic reach, and technological capabilities. For instance, the acquisition of HHV Pumps Pvt. Ltd. by Atlas Copco in January 2022 underscores this trend, aiming to bolster its presence in critical industrial sectors. The market has witnessed approximately XX M&A deals between 2019 and 2024, indicating a dynamic consolidation landscape. Leading companies like Atlas Copco, Ingersoll Rand Inc., and Ebara Corporation hold substantial market shares, estimated to be in the range of XX% to XX% collectively for the top five players.

Asia Pacific Vacuum Pumps Market Industry Trends & Analysis

The Asia Pacific vacuum pumps market is experiencing robust growth, propelled by several interconnected industry trends and analytical drivers. A primary growth driver is the escalating industrialization and manufacturing expansion across key economies like China, India, and Southeast Asian nations. This surge in manufacturing necessitates a greater demand for sophisticated vacuum technologies across diverse applications. Technological disruptions are also playing a crucial role, with advancements in pump design, material science, and control systems leading to more efficient, reliable, and environmentally friendly vacuum solutions. The increasing adoption of Industry 4.0 principles, characterized by smart manufacturing and automation, is driving the demand for intelligent vacuum pumps with enhanced connectivity and diagnostic capabilities. Consumer preferences are shifting towards solutions that offer lower operating costs, reduced maintenance, and a smaller environmental footprint. This is evident in the growing demand for variable speed drive (VSD) pumps, which optimize energy consumption based on real-time process requirements. Competitive dynamics are intensifying, with established global players facing increasing pressure from agile regional manufacturers who are leveraging cost-effectiveness and localized support. Market penetration of advanced vacuum technologies is steadily increasing, with specialized pumps like turbomolecular and cryogenic pumps finding wider applications in research and development, as well as advanced manufacturing processes. The overall market is projected to grow at a significant CAGR of XX% during the forecast period, indicating a healthy expansion trajectory.

Leading Markets & Segments in Asia Pacific Vacuum Pumps Market

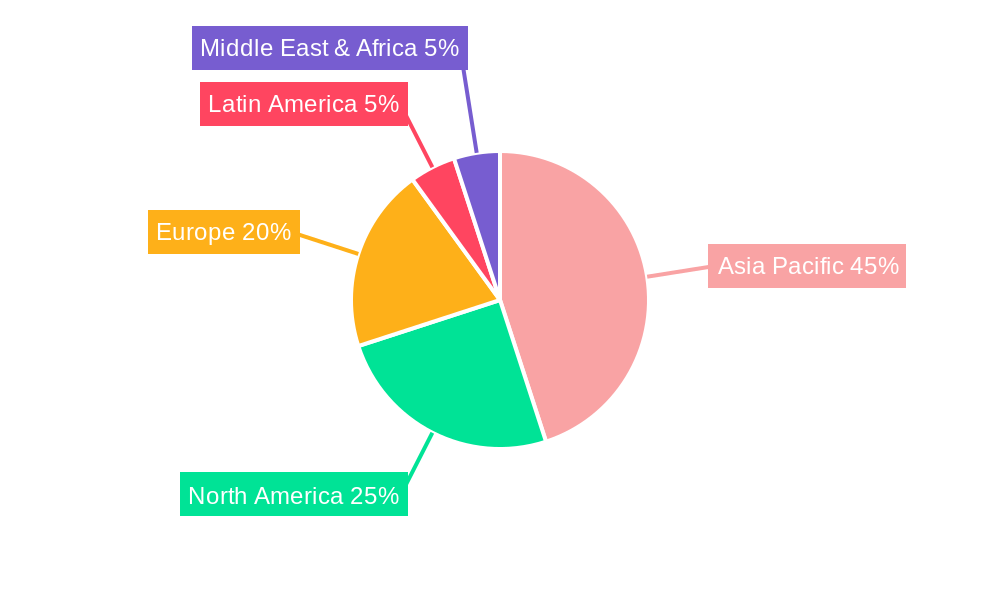

The Asia Pacific vacuum pumps market is a complex ecosystem with distinct regional leadership and segment dominance. Geographically, China stands as the largest and most influential market, driven by its massive manufacturing base, particularly in electronics, automotive, and general industrial sectors. India follows as a rapidly growing market, fueled by its burgeoning manufacturing and pharmaceutical industries. Southeast Asian nations like Japan, South Korea, and Singapore are significant contributors, excelling in advanced manufacturing and research-intensive applications.

Dominant Segments by Type:

- Rotary Vacuum Pumps: This segment commands a substantial market share, with Screw and Claw Pumps and Rotary Vane Pumps being particularly dominant. Their versatility and suitability for a wide range of industrial processes, from material handling to packaging, drive this leadership. Economic policies promoting industrial development and infrastructure investments directly correlate with the demand for these pumps.

- Dynamic Pumps: Liquid Ring Pumps are a crucial segment, especially in industries like chemical processing and oil and gas, where they handle aggressive media and require robust performance. Their reliability and ability to operate with seal fluids contribute to their widespread adoption.

- Kinetic Vacuum Pumps: While historically more specialized, Turbomolecular Pumps are gaining traction in the electronics sector for semiconductor manufacturing and R&D, where ultra-high vacuum conditions are essential. The increasing sophistication of electronic component production is a key driver.

Dominant Segments by End-User Application:

- Electronics: This is arguably the most significant end-user application, demanding high-precision vacuum for semiconductor fabrication, flat-panel display manufacturing, and advanced packaging. The growth of the electronics industry in the Asia Pacific region, particularly in China and Southeast Asia, directly fuels demand for sophisticated vacuum pumps.

- Chemical Processing: The extensive chemical industry in countries like China and India necessitates reliable vacuum systems for distillation, drying, and reaction processes. The demand for efficient and safe chemical processing technologies is a major growth catalyst.

- Oil and Gas: While undergoing transformation, the oil and gas sector continues to require vacuum pumps for various applications, including gas processing and refining. Infrastructure development and energy demands in the region support this segment.

- Medicine: The growing healthcare sector and advancements in medical device manufacturing, including diagnostics and pharmaceutical production, are driving demand for specialized and hygienic vacuum solutions.

Asia Pacific Vacuum Pumps Market Product Developments

Product developments in the Asia Pacific vacuum pumps market are increasingly focused on enhancing efficiency, reducing environmental impact, and integrating smart technologies. Atlas Copco's recent launches, such as the GHS VSD+ vacuum pump series in May 2022, exemplify this trend. These pumps offer improved performance, a smaller footprint, and advanced controllers supporting Industry 4.0 applications, indicating a move towards more intelligent and energy-efficient solutions. Companies are investing in R&D to develop pumps with lower energy consumption, quieter operation, and extended service intervals. The incorporation of predictive maintenance capabilities and enhanced digital connectivity is a key competitive advantage, catering to the evolving needs of automated and data-driven industrial processes.

Key Drivers of Asia Pacific Vacuum Pumps Market Growth

Several key drivers are propelling the growth of the Asia Pacific vacuum pumps market. The rapid industrialization and expansion of manufacturing sectors across the region, particularly in electronics, automotive, and pharmaceuticals, is a primary catalyst. Increasing investments in infrastructure development and the ongoing pursuit of advanced technological capabilities in sectors like semiconductor manufacturing and biotechnology are creating sustained demand. Furthermore, a growing emphasis on energy efficiency and environmental regulations is pushing manufacturers towards adopting more advanced and sustainable vacuum pump technologies, such as variable speed drive (VSD) pumps. The burgeoning healthcare sector and the demand for precision in medical applications also contribute significantly to market expansion.

Challenges in the Asia Pacific Vacuum Pumps Market Market

Despite the promising growth, the Asia Pacific vacuum pumps market faces several challenges. Intense price competition, particularly from local manufacturers, can put pressure on profit margins for global players. Fluctuations in raw material costs, such as metals and specialized components, can impact manufacturing expenses and pricing strategies. Stringent and evolving environmental regulations in some countries can necessitate significant R&D investment and product redesign, increasing compliance costs. Supply chain disruptions, as evidenced by recent global events, can also affect the timely delivery of components and finished products, leading to production delays and customer dissatisfaction. The rapid pace of technological advancement requires continuous innovation, which can be resource-intensive.

Emerging Opportunities in Asia Pacific Vacuum Pumps Market

Emerging opportunities in the Asia Pacific vacuum pumps market are driven by significant technological breakthroughs and strategic market expansion. The widespread adoption of Industry 4.0 and the increasing demand for smart manufacturing solutions present a substantial opportunity for companies offering intelligent and connected vacuum pumps with advanced diagnostic and predictive maintenance capabilities. The growing demand for specialized vacuum pumps in emerging high-tech industries like advanced materials, aerospace, and renewable energy (e.g., solar panel manufacturing) offers lucrative avenues for growth. Strategic partnerships and collaborations with local players can help foreign companies navigate complex regional markets and distribution networks. Furthermore, the increasing focus on sustainability and circular economy principles is creating opportunities for the development and adoption of energy-efficient and environmentally friendly vacuum pump technologies.

Leading Players in the Asia Pacific Vacuum Pumps Market Sector

- Ingersoll Rand Inc.

- Wintek Corporation

- Ebara Corporation

- Tsurumi Manufacturing Co Ltd

- Flowserve Corporation

- Continental AG

- Atlas Copco

- Robert Bosch

- Agilent Technologies Inc

- Becker Pumps Corporation

Key Milestones in Asia Pacific Vacuum Pumps Market Industry

- May 2022: Atlas Copco launched a diverse range of GHS VSD+ vacuum pumps. The new GHS 1402-2002 VSD+ series pumps feature a new design for better performance, a smaller footprint, optimal oil separation, and an innovative new controller to support the use cases of Industry 4.0. The company offers these speed-driven screw pumps in three pumping speed classes.

- January 2022: Atlas Copco acquired HHV Pumps Pvt. Ltd., a provider of vacuum pumps for the chemical and pharmaceutical industries, electrical power equipment, and general industry, and rotary vane pumps for manufacturing refrigeration and air-conditioning.

Strategic Outlook for Asia Pacific Vacuum Pumps Market Market

The strategic outlook for the Asia Pacific vacuum pumps market is overwhelmingly positive, driven by a confluence of accelerating industrialization, technological innovation, and evolving end-user demands. Future growth will be significantly shaped by the increasing adoption of smart manufacturing technologies, emphasizing IoT integration, data analytics, and predictive maintenance in vacuum pump systems. Companies that can offer robust, energy-efficient, and highly customizable solutions tailored to the specific needs of high-growth sectors like electronics, medical devices, and advanced materials will be well-positioned for success. Strategic collaborations with local distributors and end-users will be crucial for expanding market reach and fostering deeper customer relationships. The ongoing drive for sustainability will further propel the demand for eco-friendly vacuum pump technologies, creating opportunities for companies investing in green engineering and circular economy principles.

Asia Pacific Vacuum Pumps Market Segmentation

-

1. Type

-

1.1. Rotary Vacuum Pumps

- 1.1.1. Rotary Vane Pumps

- 1.1.2. Screw and Claw Pumps

- 1.1.3. Roots Pumps

-

1.2. Reciprocating Vacuum Pumps

- 1.2.1. Diaphragm Pumps

- 1.2.2. Piston Pumps

-

1.3. Kinetic Vacuum Pumps

- 1.3.1. Ejector Pumps

- 1.3.2. Turbomolecular Pumps

- 1.3.3. Diffusion Pumps

-

1.4. Dynamic Pumps

- 1.4.1. Liquid Ring Pumps

- 1.4.2. Side Channel Pumps

-

1.5. Specialized Vacuum Pumps

- 1.5.1. Getter Pumps

- 1.5.2. Cryogenic Pumps

-

1.1. Rotary Vacuum Pumps

-

2. End-user Application

- 2.1. Oil and Gas

- 2.2. Electronics

- 2.3. Medicine

- 2.4. Chemical Processing

- 2.5. Food and Beverages

- 2.6. Power Generation

- 2.7. Other

Asia Pacific Vacuum Pumps Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Vacuum Pumps Market Regional Market Share

Geographic Coverage of Asia Pacific Vacuum Pumps Market

Asia Pacific Vacuum Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of MEMS Technology; Increasing Demand for Dry Vacuum Pump

- 3.3. Market Restrains

- 3.3.1. ; Unstable Raw Material Prices; Complications in Installation

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rotary Vacuum Pumps

- 5.1.1.1. Rotary Vane Pumps

- 5.1.1.2. Screw and Claw Pumps

- 5.1.1.3. Roots Pumps

- 5.1.2. Reciprocating Vacuum Pumps

- 5.1.2.1. Diaphragm Pumps

- 5.1.2.2. Piston Pumps

- 5.1.3. Kinetic Vacuum Pumps

- 5.1.3.1. Ejector Pumps

- 5.1.3.2. Turbomolecular Pumps

- 5.1.3.3. Diffusion Pumps

- 5.1.4. Dynamic Pumps

- 5.1.4.1. Liquid Ring Pumps

- 5.1.4.2. Side Channel Pumps

- 5.1.5. Specialized Vacuum Pumps

- 5.1.5.1. Getter Pumps

- 5.1.5.2. Cryogenic Pumps

- 5.1.1. Rotary Vacuum Pumps

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Oil and Gas

- 5.2.2. Electronics

- 5.2.3. Medicine

- 5.2.4. Chemical Processing

- 5.2.5. Food and Beverages

- 5.2.6. Power Generation

- 5.2.7. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingersoll Rand Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wintek Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ebara Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tsurumi Manufacturing Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Flowserve Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atlas copco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agilent Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Becker Pumps Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ingersoll Rand Inc

List of Figures

- Figure 1: Asia Pacific Vacuum Pumps Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Vacuum Pumps Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 4: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 5: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 10: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 11: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Vacuum Pumps Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Asia Pacific Vacuum Pumps Market?

Key companies in the market include Ingersoll Rand Inc, Wintek Corporation, Ebara Corporation, Tsurumi Manufacturing Co Ltd, Flowserve Corporation, Continental AG, Atlas copco, Robert Bosch, Agilent Technologies Inc, Becker Pumps Corporation.

3. What are the main segments of the Asia Pacific Vacuum Pumps Market?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of MEMS Technology; Increasing Demand for Dry Vacuum Pump.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; Unstable Raw Material Prices; Complications in Installation.

8. Can you provide examples of recent developments in the market?

May 2022 - Atlas Copco launched a diverse range of GHS VSD+ vacuum pumps. The new GHS 1402-2002 VSD+ series pumps feature a new design for better performance, a smaller footprint, optimal oil separation, and an innovative new controller to support the use cases of Industry 4.0. The company offers these speed-driven screw pumps in three pumping speed classes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Vacuum Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Vacuum Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Vacuum Pumps Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Vacuum Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence