Key Insights

The Asia-Pacific primary battery market, valued at approximately $X billion in 2025, is projected to experience robust growth, exceeding a 5.5% CAGR from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning electronics industry, particularly in countries like China, India, and South Korea, creates significant demand for primary batteries powering portable devices, toys, and various industrial applications. Rising disposable incomes and increasing urbanization further contribute to this growth, as consumer electronics penetration deepens across the region. Growth in sectors like healthcare, where primary batteries power medical devices, also plays a crucial role. While the market is dominated by alkaline batteries, the demand for longer-lasting and environmentally friendly alternatives like NiMH batteries is steadily increasing, driving segment diversification and innovation. However, challenges remain, including fluctuating raw material prices and growing environmental concerns surrounding battery disposal and recycling, potentially impacting the market's trajectory. The competitive landscape is intense, featuring both established global players like Panasonic and Energizer, as well as numerous regional manufacturers. Strategic partnerships, technological advancements, and a focus on sustainable practices will be crucial for companies to thrive in this dynamic market.

The forecast period (2025-2033) anticipates continued market expansion, driven by sustained economic growth across the Asia-Pacific region and the increasing adoption of portable electronic devices. Despite potential regulatory hurdles related to environmental concerns, the market is expected to remain resilient due to the pervasive need for reliable and cost-effective power sources in diverse applications. The dominance of alkaline batteries is likely to continue, but a gradual shift towards higher-performance and environmentally conscious battery types, such as NiMH, is anticipated. This shift will be driven by both consumer preference and government regulations aimed at promoting sustainability. Competition among established and emerging players is expected to remain fierce, resulting in continued innovation and price competitiveness.

Asia-Pacific Primary Battery Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia-Pacific primary battery market, providing valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. High-growth keywords like "Asia-Pacific Primary Battery Market," "Primary Alkaline Battery," "NiMH Battery," "Lithium-ion Battery," and "Battery Market Growth" are strategically integrated throughout to ensure optimal search visibility.

Asia-Pacific Primary Battery Market Market Dynamics & Concentration

The Asia-Pacific primary battery market is characterized by a moderately consolidated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological advancements, economies of scale, and regulatory pressures. Innovation is driven by the increasing demand for higher energy density batteries, improved safety features, and environmentally friendly materials. Stringent environmental regulations across several Asia-Pacific nations are also shaping the market. The rise of alternative power sources, such as fuel cells and solar energy, present a challenge in the form of product substitutes. However, the cost-effectiveness and convenience of primary batteries ensure ongoing demand. End-user trends are heavily influenced by consumer electronics, portable devices, and industrial applications. Furthermore, significant M&A activities are reshaping the competitive landscape. For example, the market witnessed xx M&A deals in 2024, resulting in a xx% increase in market concentration. Key players such as Saft Groupe SA, Panasonic Corporation, and Energizer Holdings Inc. maintain a significant portion of the market share (estimated at xx% combined in 2024), while smaller regional players contribute to the remaining share.

Asia-Pacific Primary Battery Market Industry Trends & Analysis

The Asia-Pacific primary battery market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by rising disposable incomes, increasing urbanization, and expanding electronics consumption across the region. Technological advancements such as the development of higher energy density batteries and improved battery management systems are further stimulating market expansion. Consumer preferences are shifting towards longer-lasting, more reliable, and environmentally sustainable batteries. Competitive dynamics are intense, with leading players focusing on product innovation, strategic partnerships, and aggressive marketing strategies to gain a competitive edge. Market penetration of primary alkaline batteries remains high, but the adoption of other types, such as NiMH and other specialized batteries, is gradually increasing, driven by demand for higher energy density and performance.

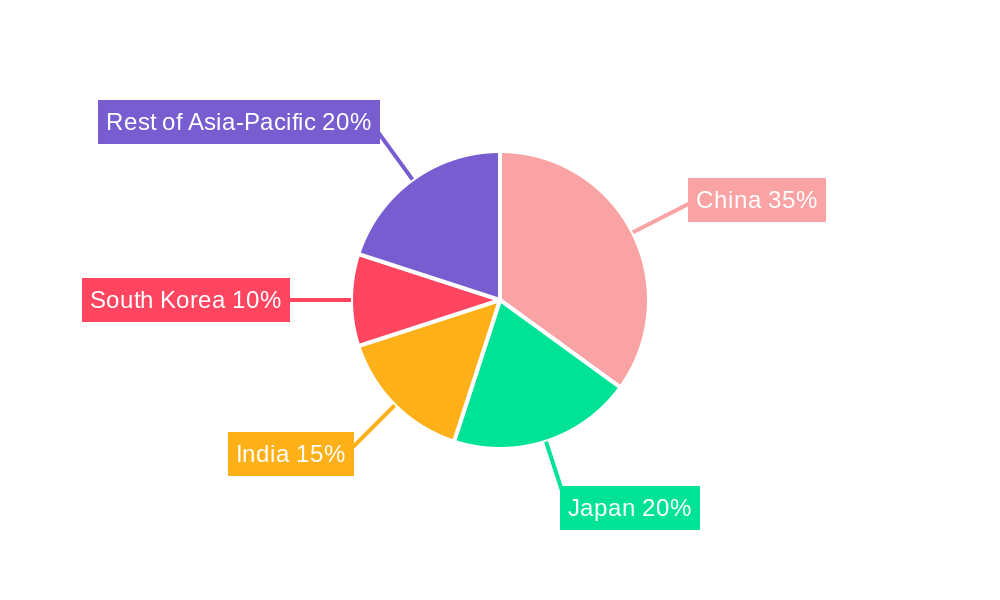

Leading Markets & Segments in Asia-Pacific Primary Battery Market

China and India stand as the undisputed leaders within the Asia-Pacific primary battery market, collectively holding a significant share in 2024. China's dominance stems from its vast manufacturing base and massive consumer electronics sector, while India's burgeoning economy and large, young population drive substantial demand. This leadership is further cemented by:

- Massive Consumer Base: High population density across the region translates to an immense and ever-growing demand for battery-powered devices, ranging from portable electronics and toys to essential household appliances.

- Robust Economic Expansion: The accelerated economic growth witnessed throughout Asia-Pacific significantly boosts consumer spending power, fostering a greater adoption of advanced technologies and, consequently, a higher demand for reliable battery solutions.

- Accelerated Industrialization and Urbanization: The ongoing expansion of industrial sectors and the rapid growth of urban centers are creating new and expanding existing demands for primary batteries in diverse applications, from smart meters and remote sensors to medical devices and security systems.

Among the diverse battery chemistries, Primary Alkaline Batteries continue to command the largest market share due to their compelling combination of affordability, accessibility, and versatility, making them the go-to choice for a wide array of everyday consumer products. However, the landscape is dynamic. Nickel-Metal Hydride (NiMH) batteries are steadily gaining traction, driven by their superior energy density and rechargeability, offering a more sustainable alternative to single-use batteries. Conversely, the market share of Nickel-Cadmium (NiCd) batteries is witnessing a downward trend, primarily attributed to growing environmental concerns and stricter regulations regarding their disposal. The market is also observing niche growth for other specialized primary battery types, meticulously designed to meet the unique performance requirements of specific advanced applications.

Asia-Pacific Primary Battery Market Product Developments

The primary battery market in the Asia-Pacific region is experiencing a wave of innovation, with a strong emphasis on enhancing battery performance, extending operational lifespan, and bolstering safety standards. Key advancements include the development of novel electrode materials that offer improved energy storage capabilities, the formulation of advanced electrolytes that optimize ion conductivity and reduce degradation, and the implementation of more robust and efficient packaging technologies. These breakthroughs are directly addressing the escalating demand for batteries that deliver higher energy density for longer usage, increased durability, and improved environmental sustainability across a spectrum of applications. The strategic focus is on developing products that offer a superior market fit by precisely targeting specific user needs and the unique operational demands of diverse application environments, from the most intricate consumer gadgets to critical industrial equipment.

Key Drivers of Asia-Pacific Primary Battery Market Growth

The robust expansion of the Asia-Pacific primary battery market is propelled by a confluence of powerful factors. Technological advancements stand as a cornerstone, with continuous innovation leading to the development of batteries boasting significantly higher energy densities and enhanced performance characteristics. This technological leap is complemented by favorable economic dynamics, including rising disposable incomes and increased consumer spending across the region, which directly translate into a greater demand for battery-powered devices. Furthermore, supportive government policies and regulatory frameworks play a crucial role, actively encouraging the adoption of more environmentally friendly battery solutions. Many governments are implementing proactive initiatives focused on promoting battery recycling programs and ensuring responsible end-of-life management, further bolstering the market's sustainable growth trajectory.

Challenges in the Asia-Pacific Primary Battery Market Market

The Asia-Pacific primary battery market faces several challenges. Stricter environmental regulations increase manufacturing costs and necessitate investments in eco-friendly technologies. Fluctuations in raw material prices and supply chain disruptions can significantly impact profitability. Intense competition from established players and the emergence of new entrants put pressure on profit margins and market share. These challenges collectively lead to an estimated xx% reduction in overall market profitability in 2024.

Emerging Opportunities in Asia-Pacific Primary Battery Market

The Asia-Pacific primary battery market is ripe with emerging opportunities, primarily fueled by groundbreaking technological breakthroughs in battery chemistry and design. These innovations are paving the way for the development of batteries that offer unprecedented levels of performance, significantly extended lifespans, and enhanced safety features. Furthermore, the formation of strategic partnerships between leading battery manufacturers and cutting-edge technology companies is creating powerful synergies, accelerating the pace of innovation and facilitating broader market penetration. The ongoing expansion into new and rapidly developing markets within the vast Asia-Pacific region presents significant untapped growth potential for battery manufacturers willing to adapt to local demands and opportunities.

Leading Players in the Asia-Pacific Primary Battery Market Sector

- Saft Groupe SA

- GP Batteries International Ltd

- Camelion Battery Co Ltd

- FDK Corporation

- Toshiba Corporation

- Spectrum Brands Holdings Inc (Energizer Holdings Inc)

- Duracell Inc

- Energizer Holdings Inc

- Panasonic Corporation

Key Milestones in Asia-Pacific Primary Battery Market Industry

- March 2022: Reliance Industries Ltd (RIL), through its subsidiary Reliance New Energy Ltd (RNEL), acquired all assets of Lithium Werks BV for USD 61 Million, significantly impacting the market landscape and signifying a move towards greater vertical integration within the industry.

Strategic Outlook for Asia-Pacific Primary Battery Market Market

The Asia-Pacific primary battery market presents significant growth potential in the coming years. The continued expansion of consumer electronics, the increasing adoption of electric vehicles, and the growing demand for portable power solutions will propel market expansion. Strategic opportunities for players include focusing on product innovation, strategic partnerships, and expansion into new and emerging markets within the region. Companies that can effectively navigate the challenges and capitalize on the emerging opportunities are poised for significant growth and success.

Asia-Pacific Primary Battery Market Segmentation

-

1. Type

- 1.1. Primary Alkaline Battery

- 1.2. Nickel-cadmium (NiCD) Battery

- 1.3. Nickel-Metal Hydride (NiMH) Battery

- 1.4. Other Types

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Primary Battery Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Primary Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure

- 3.3. Market Restrains

- 3.3.1. Limited Investments to Support Medium-voltage Transmission Network

- 3.4. Market Trends

- 3.4.1. Primary Alkaline Battery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Alkaline Battery

- 5.1.2. Nickel-cadmium (NiCD) Battery

- 5.1.3. Nickel-Metal Hydride (NiMH) Battery

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Alkaline Battery

- 6.1.2. Nickel-cadmium (NiCD) Battery

- 6.1.3. Nickel-Metal Hydride (NiMH) Battery

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Alkaline Battery

- 7.1.2. Nickel-cadmium (NiCD) Battery

- 7.1.3. Nickel-Metal Hydride (NiMH) Battery

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Alkaline Battery

- 8.1.2. Nickel-cadmium (NiCD) Battery

- 8.1.3. Nickel-Metal Hydride (NiMH) Battery

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Alkaline Battery

- 9.1.2. Nickel-cadmium (NiCD) Battery

- 9.1.3. Nickel-Metal Hydride (NiMH) Battery

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Primary Alkaline Battery

- 10.1.2. Nickel-cadmium (NiCD) Battery

- 10.1.3. Nickel-Metal Hydride (NiMH) Battery

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. China Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Primary Battery Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Saft Groupe SA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 GP Batteries International Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Camelion Battery Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 FDK Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Toshiba Corporation*List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Spectrum Brands Holdings Inc (Energizer Holdings Inc )

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Duracell Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Energizer Holdings Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Panasonic Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.1 Saft Groupe SA

List of Figures

- Figure 1: Asia-Pacific Primary Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Primary Battery Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Primary Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Primary Battery Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 27: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 33: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 45: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 47: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 51: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 52: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 53: Asia-Pacific Primary Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Asia-Pacific Primary Battery Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Primary Battery Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Asia-Pacific Primary Battery Market?

Key companies in the market include Saft Groupe SA, GP Batteries International Ltd, Camelion Battery Co Ltd, FDK Corporation, Toshiba Corporation*List Not Exhaustive, Spectrum Brands Holdings Inc (Energizer Holdings Inc ), Duracell Inc, Energizer Holdings Inc, Panasonic Corporation.

3. What are the main segments of the Asia-Pacific Primary Battery Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure.

6. What are the notable trends driving market growth?

Primary Alkaline Battery to Dominate the Market.

7. Are there any restraints impacting market growth?

Limited Investments to Support Medium-voltage Transmission Network.

8. Can you provide examples of recent developments in the market?

March 2022: Reliance Industries Ltd (RIL) through its wholly owned subsidiary Reliance New Energy Ltd (RNEL) has signed a definitive agreement to acquire all the assets of and Lithium WerksBV, a primary battery manufacturer for a total transaction value of USD 61 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Primary Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Primary Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Primary Battery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Primary Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence