Key Insights

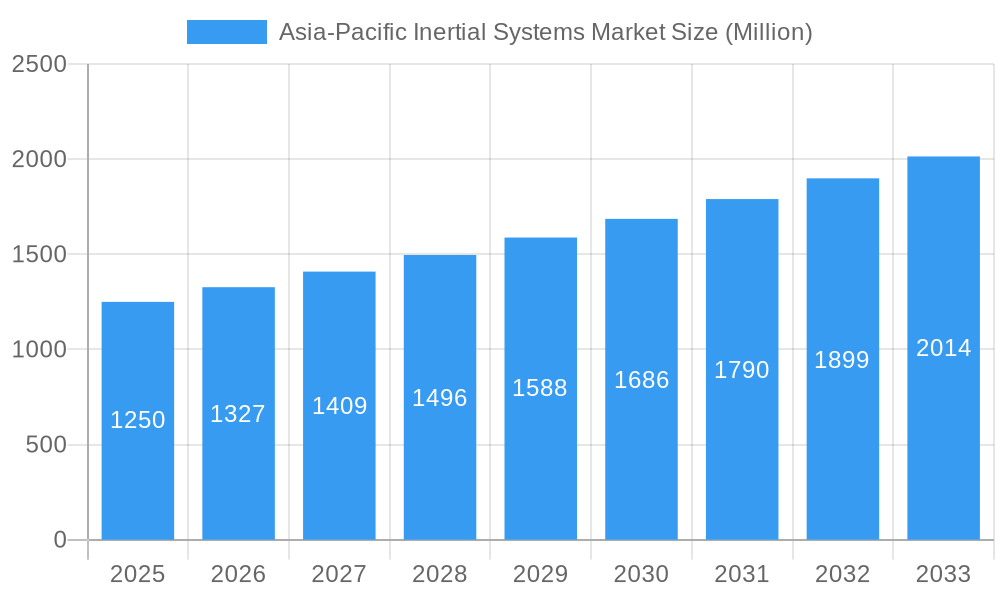

The Asia-Pacific Inertial Systems Market is poised for robust expansion, projected to reach approximately USD 1,250 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 6.10% through 2033. This growth is significantly fueled by the escalating demand across diverse applications, particularly in Civil Aviation and Defense sectors within key economies like China, Japan, and India. The burgeoning aerospace industry, coupled with increasing defense modernization efforts and the proliferation of advanced unmanned aerial vehicles (UAVs), are primary catalysts. Furthermore, the burgeoning consumer electronics market, with its integration of advanced sensing technologies in wearables and smart devices, and the automotive sector's push towards autonomous driving solutions, are also contributing substantially to market expansion. The increasing adoption of IMUs (Inertial Measurement Units) and Gyroscopes as core components, owing to their precision and versatility, underscores the technological advancements driving this market forward.

Asia-Pacific Inertial Systems Market Market Size (In Billion)

The market's trajectory is further shaped by several key trends, including the miniaturization of inertial sensors, enhanced performance characteristics like higher accuracy and lower power consumption, and the integration of inertial systems with other navigation technologies like GPS for improved robustness. However, the market faces certain restraints, such as the high cost associated with advanced inertial system development and manufacturing, and the stringent regulatory requirements prevalent in some end-use industries, particularly aviation and defense. Despite these challenges, the collaborative efforts among key players like Honeywell Aerospace, Analog Devices, and STMicroelectronics, alongside significant investments in research and development, are expected to overcome these hurdles. The strategic focus on emerging applications in medical devices and energy infrastructure also presents considerable untapped potential, promising to diversify revenue streams and sustain the market's upward momentum in the Asia-Pacific region.

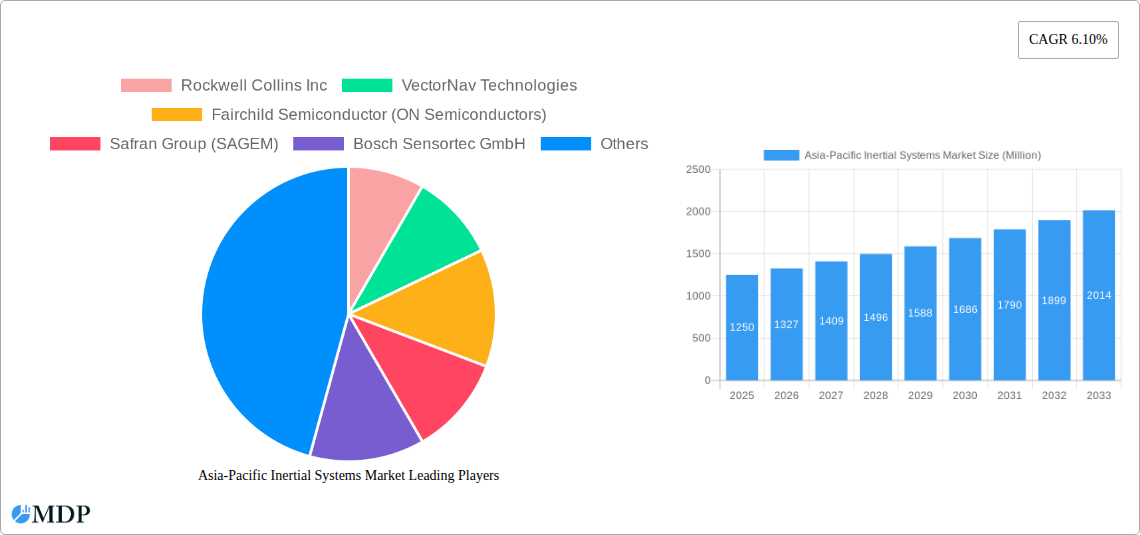

Asia-Pacific Inertial Systems Market Company Market Share

Here is an SEO-optimized, engaging report description for the Asia-Pacific Inertial Systems Market, incorporating high-traffic keywords and adhering to your specified structure and constraints:

Report Description: Asia-Pacific Inertial Systems Market: Growth, Trends, and Competitive Landscape (2019–2033)

Unlock critical insights into the rapidly expanding Asia-Pacific Inertial Systems Market. This comprehensive report offers an in-depth analysis of market dynamics, industry trends, leading segments, and key players, providing actionable intelligence for stakeholders. Spanning the historical period of 2019–2024, the base year of 2025, and a robust forecast period from 2025–2033, this study is your definitive guide to navigating the complexities and opportunities within this vital sector. Discover the latest advancements in accelerometers, gyroscopes, IMUs, magnetometers, and AHRS, and understand their impact across civil aviation, defense, consumer electronics, automotive, and other crucial applications.

Asia-Pacific Inertial Systems Market Market Dynamics & Concentration

The Asia-Pacific Inertial Systems Market is characterized by a moderate to high level of concentration, with major global players holding significant market shares, alongside a growing number of regional innovators. Innovation drivers are primarily fueled by advancements in micro-electro-mechanical systems (MEMS) technology, leading to smaller, more accurate, and cost-effective inertial sensors. The increasing demand for autonomous navigation in defense, automotive, and industrial applications is a key catalyst. Regulatory frameworks, particularly concerning aviation safety and automotive standards, are becoming more stringent, influencing product development and market entry. Product substitutes, such as GPS/GNSS, are often complementary rather than direct replacements, with inertial systems providing crucial redundancy and precision in GNSS-denied environments. End-user trends indicate a strong preference for miniaturization, power efficiency, and enhanced performance, driven by the proliferation of smart devices and connected systems. Mergers and acquisitions (M&A) activity is anticipated to increase as companies seek to consolidate market position, acquire new technologies, and expand their geographic reach. For instance, the pursuit of advanced navigation solutions for unmanned aerial systems (UAS) is a significant focus.

Asia-Pacific Inertial Systems Market Industry Trends & Analysis

The Asia-Pacific Inertial Systems Market is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is driven by several interconnected trends. The burgeoning defense sector across countries like China, India, and South Korea is a primary growth engine, with increased investment in advanced weaponry, autonomous systems, and surveillance technologies that heavily rely on precise inertial navigation. The rapid adoption of electric vehicles (EVs) and autonomous driving technologies in the automotive sector is another significant contributor, demanding sophisticated inertial measurement units (IMUs) for enhanced stability control, lane keeping, and precise positioning. Consumer electronics, including smartphones, wearables, and drones, continue to demand smaller, more affordable, and power-efficient inertial sensors, fueling innovation and market penetration in this segment.

Technological disruptions, such as the development of fiber-optic gyroscopes (FOGs) and advanced MEMS accelerometers offering superior accuracy and durability, are reshaping the competitive landscape. The integration of artificial intelligence (AI) and machine learning (ML) algorithms with inertial data is creating new possibilities for predictive maintenance, enhanced navigation accuracy, and improved situational awareness in various applications. Consumer preferences are increasingly leaning towards integrated solutions that offer seamless navigation and tracking capabilities across multiple platforms, from personal devices to industrial machinery. Competitive dynamics are evolving with both established aerospace and defense giants and specialized technology firms vying for market share. The growing emphasis on domestic manufacturing and technological self-reliance in key Asia-Pacific nations is also fostering the growth of local players, albeit often in collaboration with or as suppliers to international corporations. The market penetration of inertial systems is expected to deepen across all application segments as the benefits of enhanced navigation, motion sensing, and stabilization become more widely recognized and integrated into product designs.

Leading Markets & Segments in Asia-Pacific Inertial Systems Market

The Defense segment is currently the dominant market within the Asia-Pacific Inertial Systems Market, driven by significant government expenditures on national security, modernization of military fleets, and the increasing adoption of unmanned aerial vehicles (UAVs) and autonomous combat systems. Countries like China, India, Japan, and South Korea are at the forefront of this demand, investing heavily in advanced inertial navigation systems (INS) for missiles, aircraft, naval vessels, and ground vehicles.

- Defense Dominance Drivers:

- Geopolitical Tensions: Regional security concerns necessitate continuous upgrades and procurement of sophisticated defense equipment.

- Autonomous Warfare: The shift towards autonomous and semi-autonomous military platforms requires highly accurate and resilient navigation solutions.

- Precision Guidance: The need for precision-guided munitions (PGMs) and advanced targeting systems relies heavily on inertial guidance.

- Surveillance and Reconnaissance: Unmanned systems for intelligence, surveillance, and reconnaissance (ISR) missions are increasingly deployed, demanding robust inertial capabilities.

Within components, the IMU (Inertial Measurement Unit) segment holds a commanding position. IMUs, which combine accelerometers and gyroscopes (and often magnetometers), are the foundational building blocks for most inertial navigation systems. Their versatility allows them to be integrated into a wide array of applications, from high-end defense platforms to consumer-grade sensors. The demand for compact, high-performance IMUs is steadily rising across all end-user segments.

- IMU Segment Dominance Drivers:

- Integration Hub: IMUs serve as the core sensing element for INS, enabling precise measurement of linear acceleration and angular velocity.

- Miniaturization and Cost Reduction: Advances in MEMS technology have made IMUs smaller, lighter, and more affordable, facilitating their adoption in a broader range of devices.

- Enhanced Accuracy: The development of multi-axis IMUs with improved bias stability and noise performance caters to demanding applications.

- Versatility: Their application spans across defense, automotive, aerospace, consumer electronics, and industrial automation.

Geographically, China represents the largest and fastest-growing market within Asia-Pacific for inertial systems. Its massive manufacturing base, coupled with substantial investments in defense modernization, aerospace programs, and the burgeoning automotive and consumer electronics sectors, drives significant demand. The country's focus on indigenous technological development further bolsters its domestic inertial systems industry.

- China Market Dominance Drivers:

- Large-Scale Manufacturing: China is a global hub for electronics manufacturing, creating substantial demand for inertial components in consumer products.

- Defense Modernization: Significant government investment in military upgrades fuels demand for high-performance inertial systems.

- Automotive Growth: The rapid expansion of its automotive industry, particularly in EVs and autonomous driving research, requires advanced navigation solutions.

- Space Exploration: China's ambitious space program necessitates precise inertial guidance systems.

Asia-Pacific Inertial Systems Market Product Developments

Product development in the Asia-Pacific Inertial Systems Market is characterized by a relentless pursuit of higher accuracy, smaller form factors, lower power consumption, and enhanced resilience. Companies are focusing on leveraging advanced MEMS fabrication techniques to create next-generation accelerometers and gyroscopes with improved bias stability and reduced noise. Innovations in sensor fusion algorithms are enabling more robust navigation solutions, particularly in environments where GNSS signals are unreliable. The integration of inertial sensors with other sensing modalities, such as lidar and radar, is leading to sophisticated perception systems for autonomous vehicles and drones. This continuous innovation ensures that inertial systems remain indispensable across a wide spectrum of demanding applications, from precision defense systems to advanced consumer electronics.

Key Drivers of Asia-Pacific Inertial Systems Market Growth

The Asia-Pacific Inertial Systems Market growth is propelled by several key factors. Firstly, the escalating defense spending by major Asia-Pacific nations, driven by geopolitical considerations, fuels demand for advanced inertial navigation systems for military applications. Secondly, the rapid evolution and widespread adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) in the automotive sector necessitate highly accurate and reliable inertial sensors for positioning and stability. Thirdly, the burgeoning consumer electronics industry, with its demand for wearables, drones, and smart devices, constantly requires miniaturized and cost-effective inertial components. Finally, government initiatives promoting domestic manufacturing and technological self-sufficiency in countries like China and India are creating a favorable environment for the growth of local inertial system providers.

Challenges in the Asia-Pacific Inertial Systems Market Market

Despite robust growth, the Asia-Pacific Inertial Systems Market faces several challenges. Supply chain disruptions, exacerbated by global events and trade tensions, can impact the availability and cost of critical raw materials and components. Stringent regulatory compliance, particularly in the aerospace and automotive sectors, requires significant investment in testing and certification, posing a hurdle for smaller players. Intense competition from both established global manufacturers and emerging local companies can lead to price pressures and squeezed profit margins. Furthermore, the rapid pace of technological advancement necessitates continuous R&D investment to keep pace with evolving industry demands, which can be a significant financial burden.

Emerging Opportunities in Asia-Pacific Inertial Systems Market

Emerging opportunities in the Asia-Pacific Inertial Systems Market are manifold. The increasing deployment of unmanned systems across various sectors, including logistics, agriculture, and infrastructure inspection, presents a significant growth avenue for specialized inertial solutions. The development of smart cities and the expansion of intelligent transportation systems will further drive demand for precise positioning and navigation technologies. Strategic partnerships between established inertial system providers and emerging technology companies, particularly in areas like AI-powered navigation and sensor fusion, offer potential for accelerated innovation and market penetration. Moreover, the growing focus on space exploration and satellite technology within the region creates a demand for high-reliability, radiation-hardened inertial components.

Leading Players in the Asia-Pacific Inertial Systems Market Sector

- Rockwell Collins Inc

- VectorNav Technologies

- Fairchild Semiconductor (ON Semiconductors)

- Safran Group (SAGEM)

- Bosch Sensortec GmbH

- Moog Inc

- Thales Group

- STMicroelectronics NV

- Meggitt PLC

- Analog Devices Inc

- Honeywell Aerospace Inc

- InvenSense Inc

- Northrop Grumman Corporation

Key Milestones in Asia-Pacific Inertial Systems Market Industry

- November 2022: Honeywell signed an MoU with NewSpace Research and Technologies to collaborate on navigation systems for unmanned aerial systems, enhancing operational capabilities for military use with Honeywell's advanced navigation and Resilient Navigation System for GNSS-denied environments.

- November 2022: Collins Aerospace and Hainan Airlines signed a FlightSense contract, providing customizable support solutions for Hainan Airlines' fleet of Boeing 787s, aiming to reduce repair time and costs for 185 aircraft through 2025 and ensuring MRO supply chain management.

Strategic Outlook for Asia-Pacific Inertial Systems Market Market

The strategic outlook for the Asia-Pacific Inertial Systems Market is exceptionally positive, driven by ongoing technological advancements and expanding application horizons. Future growth will be accelerated by the continued integration of inertial systems with AI and machine learning for enhanced autonomous capabilities, particularly in the automotive and defense sectors. The increasing demand for miniaturized and power-efficient sensors will fuel innovation in consumer electronics and IoT applications. Strategic opportunities lie in forming robust partnerships to address complex navigation challenges, such as those in GNSS-denied environments, and in capitalizing on the growing trend of localized manufacturing and technological self-sufficiency across key Asia-Pacific economies.

Asia-Pacific Inertial Systems Market Segmentation

-

1. Application

- 1.1. Civil Aviation

- 1.2. Defense

- 1.3. Consumer Electronics

- 1.4. Automotive

- 1.5. Energy and Infrastructure

- 1.6. Medical

- 1.7. Other Applications

-

2. Component

- 2.1. Accelerometer

- 2.2. Gyroscope

- 2.3. IMU

- 2.4. Magnetometer

- 2.5. Attitude Heading and Navigation System

- 2.6. Other Components

Asia-Pacific Inertial Systems Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

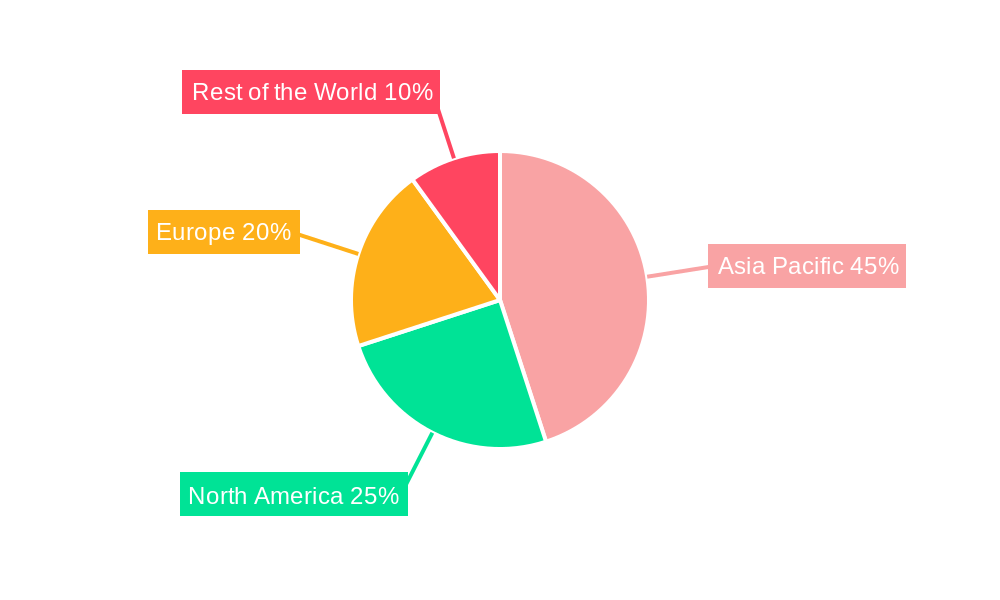

Asia-Pacific Inertial Systems Market Regional Market Share

Geographic Coverage of Asia-Pacific Inertial Systems Market

Asia-Pacific Inertial Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of MEMS Technology; Inclination Toward Defense and Aerospace; Technological Advancements in Navigation Systems

- 3.3. Market Restrains

- 3.3.1. Operational Complexity and High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Accuracy to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Inertial Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil Aviation

- 5.1.2. Defense

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive

- 5.1.5. Energy and Infrastructure

- 5.1.6. Medical

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Accelerometer

- 5.2.2. Gyroscope

- 5.2.3. IMU

- 5.2.4. Magnetometer

- 5.2.5. Attitude Heading and Navigation System

- 5.2.6. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Collins Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VectorNav Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fairchild Semiconductor (ON Semiconductors)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran Group (SAGEM)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sensortec GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moog Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 STMicroelectronics NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meggitt PL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Analog Devices Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honeywell Aerospace Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 InvenSense Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Northrop Grumman Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Rockwell Collins Inc

List of Figures

- Figure 1: Asia-Pacific Inertial Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Inertial Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Asia-Pacific Inertial Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Inertial Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Inertial Systems Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Asia-Pacific Inertial Systems Market?

Key companies in the market include Rockwell Collins Inc, VectorNav Technologies, Fairchild Semiconductor (ON Semiconductors), Safran Group (SAGEM), Bosch Sensortec GmbH, Moog Inc, Thales Group, STMicroelectronics NV, Meggitt PL, Analog Devices Inc, Honeywell Aerospace Inc, InvenSense Inc, Northrop Grumman Corporation.

3. What are the main segments of the Asia-Pacific Inertial Systems Market?

The market segments include Application, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of MEMS Technology; Inclination Toward Defense and Aerospace; Technological Advancements in Navigation Systems.

6. What are the notable trends driving market growth?

Increasing Demand for Accuracy to Drive the Market.

7. Are there any restraints impacting market growth?

Operational Complexity and High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

November 2022 - Honeywell signed an MoU with NewSpace Research and Technologies, an emerging India-based developer of unmanned platforms, to collaborate on navigation systems for unmanned aerial systems. Both companies will bring improved operational capabilities to unmanned platforms for military use, leveraging Honeywell's advanced navigation technologies. Honeywell will also provide its Resilient Navigation System, which enables UAVs to navigate autonomously denied environments in Global Navigation Satellite System (GNSS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Inertial Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Inertial Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Inertial Systems Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Inertial Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence