Key Insights

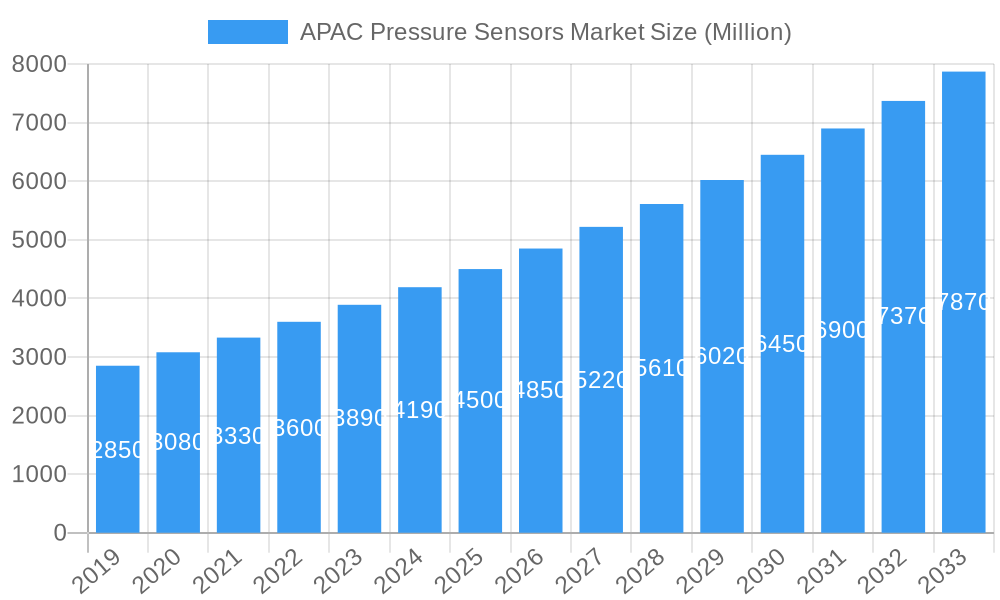

The Asia Pacific (APAC) pressure sensors market is projected for significant expansion. With a Base Year of 2025, the market size was valued at 13.07 billion. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 6.2%, reaching an estimated value by 2033. This growth is primarily driven by rapid industrialization and technological advancements across key APAC economies. The automotive sector is a major contributor, with increasing demand for advanced sensors in ADAS, powertrain management, and electric vehicles (EVs) to boost safety and efficiency. Medical applications are also experiencing a surge, fueled by the need for accurate pressure monitoring in diagnostic and patient care equipment, alongside an aging population and rising healthcare expenditure. Furthermore, the booming consumer electronics sector, with its demand for smart devices and wearables, significantly contributes to this upward market trend.

APAC Pressure Sensors Market Market Size (In Billion)

Key market trends include the miniaturization of pressure sensors, integration of AI for predictive maintenance and enhanced functionality, and the growing adoption of IoT devices across industries. Advancements in materials science and manufacturing processes are leading to more durable, accurate, and cost-effective sensing solutions. Potential challenges to market expansion include high initial investment costs for advanced sensor technologies and supply chain complexities in some developing APAC economies. Nevertheless, the continuous demand for precise pressure measurement across critical sectors, coupled with ongoing innovation and supportive government initiatives for smart manufacturing and digital transformation, will drive sustained and robust growth in the APAC pressure sensors market throughout the forecast period.

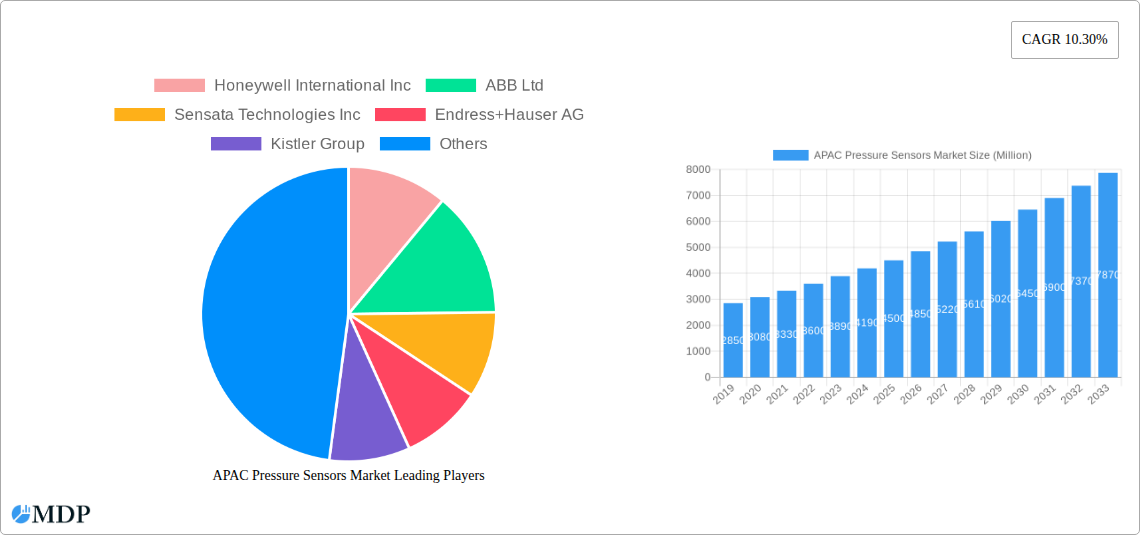

APAC Pressure Sensors Market Company Market Share

APAC Pressure Sensors Market Analysis: 2025-2033 Forecast

This comprehensive report provides critical insights into the dynamic APAC Pressure Sensors Market. Focusing on the Base Year 2025 and extending through 2033, this analysis details market intricacies, growth trends, and competitive dynamics. The report examines pressure sensor applications across key sectors including automotive, medical, consumer electronics, industrial, aerospace and defence, food and beverage, and HVAC. It also covers pressure sensor types such as piezoresistive, capacitive, optical, resonant, and thermal. Leveraging high-impact keywords, this report targets industry stakeholders, procurement managers, R&D professionals, and market strategists. Discover actionable intelligence on market drivers, innovation, regulations, emerging trends, leading markets, product advancements, growth opportunities, challenges, key players, and strategic outlooks.

APAC Pressure Sensors Market Market Dynamics & Concentration

The APAC Pressure Sensors Market exhibits a moderate to high concentration, characterized by the presence of several global giants and an increasing number of specialized regional players. Innovation is a key driver, fueled by the relentless demand for miniaturization, enhanced accuracy, and integration with IoT technologies across various end-use industries. Regulatory frameworks, while varying by country, are increasingly focusing on safety, environmental standards, and data security, impacting product development and market entry strategies. Product substitutes, such as flow sensors and level sensors, pose a competitive challenge in certain applications, but pressure sensors offer unique advantages in monitoring critical parameters. End-user trends are heavily influenced by the rapid adoption of smart technologies, automation, and the growing emphasis on predictive maintenance. Mergers and acquisitions (M&A) activities are strategically employed by leading companies to expand their product portfolios, gain access to new markets, and consolidate market share.

- Market Concentration: Dominated by a mix of large multinational corporations and agile regional manufacturers.

- Innovation Drivers: Miniaturization, IoT integration, increased accuracy, energy efficiency, and novel sensing technologies.

- Regulatory Frameworks: Evolving standards for safety, environmental compliance, and data integrity across key APAC nations.

- Product Substitutes: Flow sensors, level sensors, and other monitoring devices, with pressure sensors maintaining dominance in specific applications.

- End-User Trends: Surge in demand from automotive electrification, smart manufacturing, advanced medical devices, and connected consumer electronics.

- M&A Activities: Strategic acquisitions to enhance technological capabilities, expand market reach, and strengthen competitive positioning.

APAC Pressure Sensors Market Industry Trends & Analysis

The APAC Pressure Sensors Market is poised for significant expansion, driven by a confluence of robust economic growth, rapid industrialization, and a burgeoning technology sector across the region. The increasing adoption of Industry 4.0 principles is a primary growth catalyst, propelling the demand for sophisticated pressure sensing solutions in smart manufacturing, automation, and industrial control systems. Automotive applications, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), are witnessing substantial growth, necessitating precise and reliable pressure monitoring for critical components like tires, fuel systems, and battery management. The healthcare sector's continuous evolution, marked by the development of advanced medical devices, diagnostic equipment, and wearable health monitors, further fuels the demand for high-precision medical-grade pressure sensors. Consumer electronics, a consistently high-growth segment, is increasingly integrating smart features that rely on pressure sensing for functions ranging from barometric altimeters in smartphones to advanced appliance controls.

Technological disruptions are reshaping the market landscape. The development of novel materials and sensing technologies, such as MEMS (Micro-Electro-Mechanical Systems) and advanced optical sensing, is enabling the creation of smaller, more energy-efficient, and highly accurate pressure sensors. The growing prevalence of the Internet of Things (IoT) is a significant trend, as pressure sensors become integral components of connected devices, facilitating real-time data collection and analysis for predictive maintenance, performance optimization, and enhanced safety. Consumer preferences are increasingly leaning towards smart, connected, and intuitive products, which in turn drives demand for integrated pressure sensing capabilities. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a keen focus on cost-effectiveness without compromising quality. Companies are investing heavily in research and development to stay ahead of the curve and cater to the evolving needs of diverse end-use industries. The market penetration of advanced pressure sensing technologies is expected to deepen, especially in emerging economies within APAC, as infrastructure develops and technological adoption accelerates.

Leading Markets & Segments in APAC Pressure Sensors Market

The Industrial segment is currently the dominant force within the APAC Pressure Sensors Market, driven by the region's status as a global manufacturing hub. Countries like China, Japan, South Korea, and India are heavily investing in automation, smart factories, and advanced industrial processes, leading to an insatiable demand for reliable and high-performance industrial pressure sensors. Key drivers for this dominance include significant investments in infrastructure development, the widespread adoption of Industry 4.0 technologies, and stringent quality control requirements across manufacturing sectors.

Within the By Type segmentation, Piezoresistive Pressure Sensors command the largest market share due to their versatility, cost-effectiveness, and wide range of applications across industrial, automotive, and consumer electronics sectors. Their proven reliability and established manufacturing processes make them a go-to choice for many OEMs. However, Capacitive Pressure Sensors are rapidly gaining traction, particularly in applications requiring high sensitivity and stability, such as in medical devices and advanced HVAC systems. Optical Pressure Sensors are emerging as a significant growth area, especially in niche applications like medical implants and hazardous environments, owing to their immunity to electromagnetic interference and high accuracy.

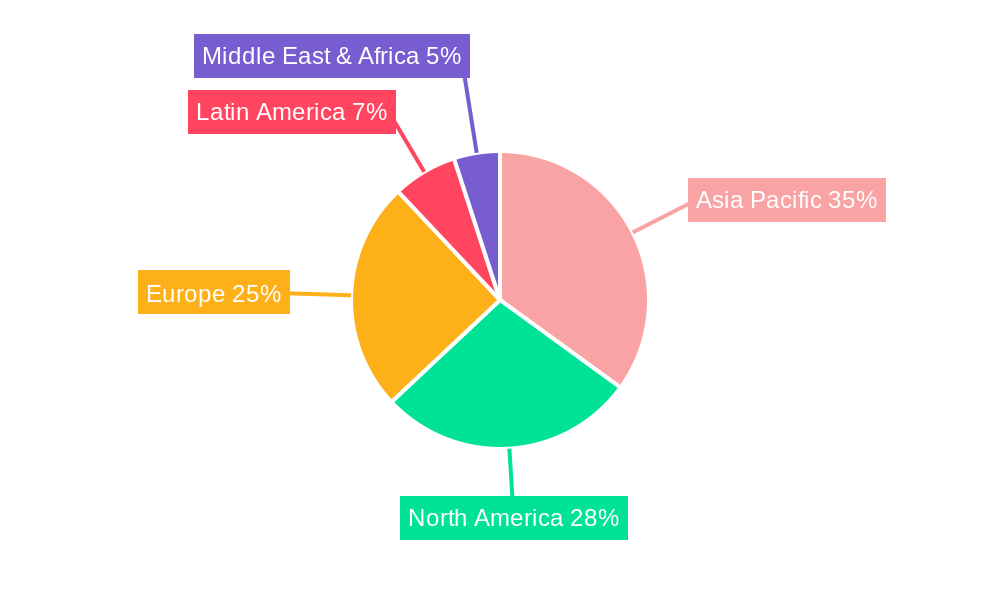

In terms of geographical markets, China is the undisputed leader in the APAC Pressure Sensors Market. Its vast manufacturing base, significant investments in technological advancements, and a rapidly growing domestic market for consumer electronics and automotive products make it a powerhouse. Following closely are Japan and South Korea, known for their advanced technological innovation and strong presence in the automotive and consumer electronics industries, respectively. India represents a rapidly growing market, fueled by its expanding industrial sector, burgeoning automotive industry, and increasing focus on smart city initiatives and healthcare infrastructure. The economic policies in these leading nations, which encourage domestic manufacturing and technological adoption, coupled with substantial infrastructure investments, further solidify their positions as key demand centers for pressure sensors.

- Dominant Segment (Application): Industrial – Driven by manufacturing automation, smart factories, and process control.

- Key Drivers: Industry 4.0 adoption, extensive manufacturing output, stringent quality mandates.

- Dominant Segment (Type): Piezoresistive Pressure Sensors – Preferred for their cost-effectiveness, reliability, and broad applicability.

- Key Drivers: Established technology, high production volumes, diverse end-user adoption.

- Emerging Segment (Type): Optical Pressure Sensors – Gaining prominence in specialized high-accuracy and hazardous applications.

- Key Drivers: Electromagnetic immunity, non-intrusive sensing, advancements in material science.

- Leading Geographical Market: China – Supported by its massive manufacturing base and strong domestic demand.

- Key Drivers: Government support for advanced manufacturing, massive consumer market, rapid urbanization.

- Key Growing Markets: India, Southeast Asian nations – Driven by industrialization, infrastructure development, and increasing technological adoption.

- Key Drivers: Favorable economic policies, growing middle class, increasing foreign direct investment.

APAC Pressure Sensors Market Product Developments

Recent product developments in the APAC Pressure Sensors Market highlight a strong trend towards miniaturization, enhanced intelligence, and specialized applications. Companies are focusing on creating sensors with integrated digital interfaces, improving their energy efficiency for IoT deployments, and enhancing their resilience in harsh environmental conditions. Innovations are also centered around developing highly sensitive and biocompatible pressure sensors for advanced medical diagnostics and therapeutic devices, as well as ruggedized sensors for demanding industrial and aerospace applications. These advancements aim to offer superior performance, reduced form factors, and seamless integration into complex systems, thereby providing manufacturers with a competitive edge in their respective markets.

Key Drivers of APAC Pressure Sensors Market Growth

The APAC Pressure Sensors Market is propelled by several interconnected growth drivers. The relentless advancement and adoption of IoT and Industry 4.0 technologies are paramount, enabling smart manufacturing, predictive maintenance, and connected devices that require ubiquitous sensing. The automotive sector's evolution, particularly the surge in electric vehicles (EVs) and autonomous driving technologies, necessitates sophisticated pressure sensing for critical safety and performance functions. Growing healthcare expenditure and the demand for advanced medical devices are creating a robust market for high-precision medical pressure sensors. Furthermore, increasing disposable incomes and a growing middle class are fueling demand for consumer electronics and smart home devices, which often incorporate pressure sensing capabilities. Government initiatives promoting domestic manufacturing and technological innovation also play a crucial role in fostering market expansion.

Challenges in the APAC Pressure Sensors Market Market

Despite its strong growth potential, the APAC Pressure Sensors Market faces several challenges. Intense price competition among manufacturers, particularly in high-volume segments, can squeeze profit margins. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact production and delivery timelines. Navigating the complex and evolving regulatory landscapes across different APAC countries requires significant compliance efforts and can pose barriers to market entry for smaller players. Furthermore, the shortage of skilled workforce capable of developing and maintaining advanced sensor technologies can hinder innovation and production scalability. Rapid technological obsolescence also presents a challenge, requiring continuous investment in R&D to remain competitive.

Emerging Opportunities in APAC Pressure Sensors Market

Emerging opportunities within the APAC Pressure Sensors Market are abundant, driven by technological innovation and expanding application areas. The burgeoning smart city initiatives across the region present significant demand for pressure sensors in infrastructure monitoring, environmental sensing, and traffic management systems. The continuous innovation in wearable technology and the Internet of Medical Things (IoMT) opens vast avenues for miniaturized, high-accuracy medical pressure sensors. Furthermore, the increasing focus on sustainability and energy efficiency in industrial processes and buildings is driving demand for sensors that can optimize resource utilization. Strategic partnerships between sensor manufacturers and technology integrators, as well as expansion into rapidly developing economies within Southeast Asia and India, represent significant growth catalysts.

Leading Players in the APAC Pressure Sensors Market Sector

- Honeywell International Inc

- ABB Ltd

- Sensata Technologies Inc

- Endress+Hauser AG

- Kistler Group

- Bosch Sensortec GmbH

- Siemens AG

- Yokogawa Corporation

- Invensys Ltd

- Rockwell Automation Inc

- All Sensors Corporation

- GMS Instruments BV

- Rosemount Inc (Emerson Electric Company)

Key Milestones in APAC Pressure Sensors Market Industry

- January 2020: JK Tyre, an Indian tire manufacturer, introduced a Tire Pressure Monitoring System (TPMS) via previously acquired TREEL mobility Solutions, TREEL Sensors, which monitor the tyre's vital statistics, including pressure and temperature.

- June 2021: Hong Kong Polytechnic University creates optical fiber sensors with health monitoring capabilities. The biocompatible microsensors are extremely sensitive to small pressure changes inside the human body.

Strategic Outlook for APAC Pressure Sensors Market Market

The strategic outlook for the APAC Pressure Sensors Market is highly optimistic, characterized by sustained growth fueled by technological advancements and expanding end-use applications. Key growth accelerators include the continued integration of AI and machine learning with sensor data for advanced analytics and predictive capabilities, further solidifying the market's reliance on intelligent sensing solutions. The increasing demand for miniaturized and highly integrated sensors for mobile devices, medical implants, and wearable technology will drive innovation in micro-fabrication and materials science. Strategic partnerships and collaborations aimed at developing innovative solutions for nascent markets like advanced robotics and sustainable energy technologies will be crucial. Market players are expected to focus on geographical expansion into high-potential emerging economies and diversification of product portfolios to cater to evolving industry needs, ensuring a robust trajectory for the APAC Pressure Sensors Market.

APAC Pressure Sensors Market Segmentation

-

1. By Application

- 1.1. Automotive

- 1.2. Medical

- 1.3. Consumer Electronics

- 1.4. Industrial

- 1.5. Aerospace and Defence

- 1.6. Food and Beverage

- 1.7. HVAC

-

2. By Type

- 2.1. Piezoresistive Pressure Sensors

- 2.2. Capacitive Pressure Sensors

- 2.3. Optical Pressure Sensors

- 2.4. Resonant Pressure Sensors

- 2.5. Thermal Pressure Sensors

APAC Pressure Sensors Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN

- 1.6. Oceania

- 1.7. Rest of Asia Pacific

APAC Pressure Sensors Market Regional Market Share

Geographic Coverage of APAC Pressure Sensors Market

APAC Pressure Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth Of End-user Verticals

- 3.2.2 such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Sensing Products

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by By Application

- 5.1.1. Automotive

- 5.1.2. Medical

- 5.1.3. Consumer Electronics

- 5.1.4. Industrial

- 5.1.5. Aerospace and Defence

- 5.1.6. Food and Beverage

- 5.1.7. HVAC

- 5.2. Market Analysis, Insights and Forecast - by By Type

- 5.2.1. Piezoresistive Pressure Sensors

- 5.2.2. Capacitive Pressure Sensors

- 5.2.3. Optical Pressure Sensors

- 5.2.4. Resonant Pressure Sensors

- 5.2.5. Thermal Pressure Sensors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by By Application

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sensata Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Endress+Hauser AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kistler Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bosch Sensortec GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yokogawa Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invensys Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rockwell Automation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 All Sensors Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GMS Instruments BV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Rosemount Inc (Emerson Electric Company)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global APAC Pressure Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Pressure Sensors Market Revenue (billion), by By Application 2025 & 2033

- Figure 3: Asia Pacific APAC Pressure Sensors Market Revenue Share (%), by By Application 2025 & 2033

- Figure 4: Asia Pacific APAC Pressure Sensors Market Revenue (billion), by By Type 2025 & 2033

- Figure 5: Asia Pacific APAC Pressure Sensors Market Revenue Share (%), by By Type 2025 & 2033

- Figure 6: Asia Pacific APAC Pressure Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific APAC Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Pressure Sensors Market Revenue billion Forecast, by By Application 2020 & 2033

- Table 2: Global APAC Pressure Sensors Market Revenue billion Forecast, by By Type 2020 & 2033

- Table 3: Global APAC Pressure Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global APAC Pressure Sensors Market Revenue billion Forecast, by By Application 2020 & 2033

- Table 5: Global APAC Pressure Sensors Market Revenue billion Forecast, by By Type 2020 & 2033

- Table 6: Global APAC Pressure Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Oceania APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Pressure Sensors Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the APAC Pressure Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Sensata Technologies Inc, Endress+Hauser AG, Kistler Group, Bosch Sensortec GmbH, Siemens AG, Yokogawa Corporation, Invensys Ltd, Rockwell Automation Inc, All Sensors Corporation, GMS Instruments BV, Rosemount Inc (Emerson Electric Company).

3. What are the main segments of the APAC Pressure Sensors Market?

The market segments include By Application, By Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth Of End-user Verticals. such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry.

6. What are the notable trends driving market growth?

Automotive Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with Sensing Products.

8. Can you provide examples of recent developments in the market?

January 2020 - JK Tyre, an Indian tire manufacturer, introduced a Tire Pressure Monitoring System (TPMS) via previously acquired TREEL mobility Solutions, TREEL Sensors, which monitor the tyre's vital statistics, including pressure and temperature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Pressure Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Pressure Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Pressure Sensors Market?

To stay informed about further developments, trends, and reports in the APAC Pressure Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence