Key Insights

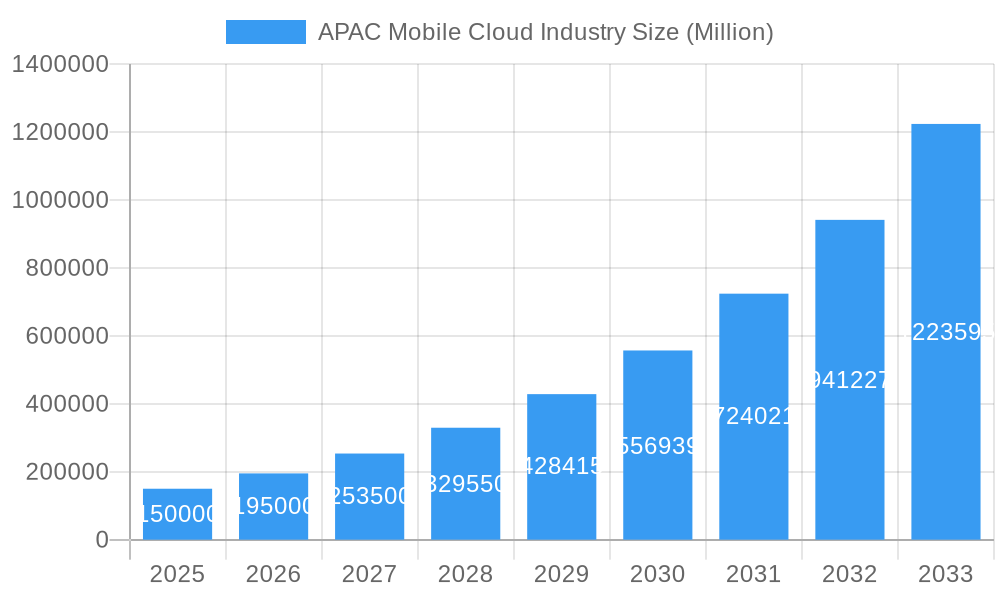

The APAC Mobile Cloud Industry is projected for significant expansion, with an estimated market size of $22.89 billion by 2025, experiencing a compound annual growth rate (CAGR) of 11.89%. This growth is propelled by increasing mobile-first strategies among businesses and consumers, alongside a rising demand for immediate access to applications and data. Key growth drivers include widespread smartphone adoption, enhanced internet penetration, and the increasing complexity of mobile applications requiring scalable cloud infrastructure. The integration of 5G technology further accelerates this trend by offering faster speeds and lower latency, unlocking new mobile cloud applications and improving user experiences across various sectors.

APAC Mobile Cloud Industry Market Size (In Billion)

The APAC mobile cloud market is characterized by emerging trends like edge computing for localized data processing, the integration of AI and machine learning into mobile applications, and a growing emphasis on data security and privacy. Challenges such as evolving regulatory landscapes and data sovereignty concerns may influence adoption rates. However, diverse application segments, including gaming, finance, entertainment, education, and healthcare, are all poised for substantial growth. China and India are anticipated to lead market expansion due to strong digital infrastructures and large user bases, with Japan and Australia also making significant contributions. Leading technology companies are heavily investing in advanced mobile cloud solutions, further bolstering the industry's growth trajectory.

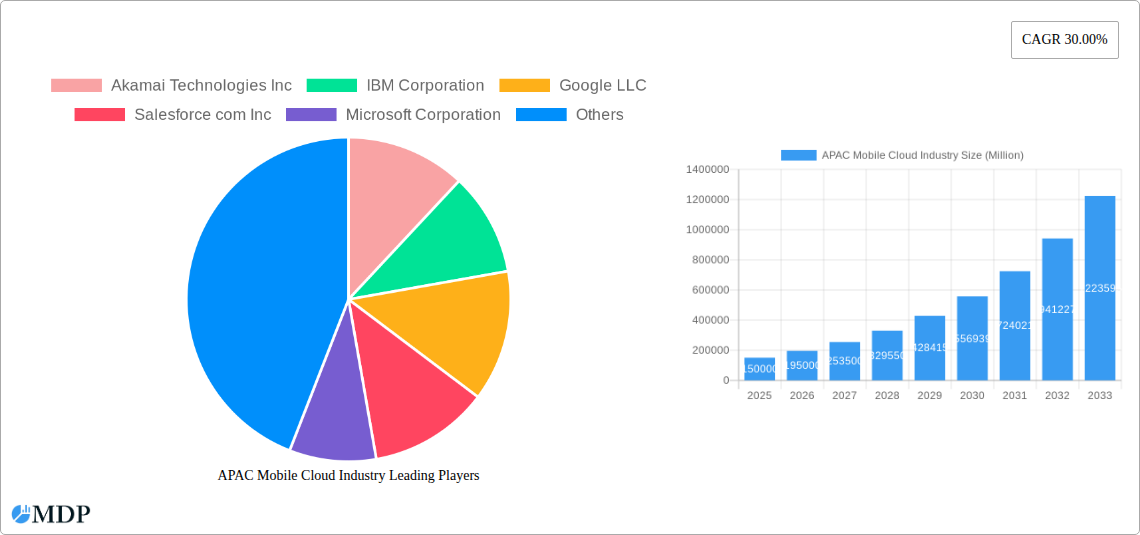

APAC Mobile Cloud Industry Company Market Share

Explore the dynamic APAC mobile cloud industry with this comprehensive report. It serves as an essential guide to understanding market dynamics, technological advancements, and growth opportunities throughout the Asia-Pacific region. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, this analysis provides actionable insights for stakeholders, including enterprises, consumers, and businesses in sectors such as gaming, finance, entertainment, education, healthcare, and travel. Leverage critical data on cloud adoption, mobile cloud services, and digital transformation to effectively navigate this rapidly expanding market.

APAC Mobile Cloud Industry Market Dynamics & Concentration

The APAC mobile cloud industry exhibits a dynamic and evolving market concentration. While major players like Amazon Web Services Inc, Google LLC, and Microsoft Corporation hold significant market share, the presence of innovative companies such as Cloudways Ltd and niche providers catering to specific segments injects competitive energy. Innovation drivers include the increasing demand for scalable infrastructure, real-time data processing, and enhanced mobile user experiences. Regulatory frameworks, while varying across countries, are gradually aligning to foster cloud adoption and data security. Product substitutes, such as on-premises solutions, are diminishing in relevance as the cost-effectiveness and agility of mobile cloud services become more apparent. End-user trends highlight a growing preference for accessible, secure, and integrated mobile cloud solutions across all demographics. Mergers and acquisition (M&A) activities, with an estimated 150+ M&A deals projected within the forecast period, are shaping market consolidation and fostering strategic alliances, with key players like IBM Corporation, Oracle Corporation, and SAP SE actively participating in the ecosystem. The market share of leading cloud providers is estimated to reach 75% by 2027, underscoring a concentrated yet competitive landscape.

APAC Mobile Cloud Industry Industry Trends & Analysis

The APAC mobile cloud industry is experiencing unprecedented growth, driven by several key trends. The increasing proliferation of smartphones and the burgeoning internet penetration across developing economies are significant market growth drivers. These factors fuel the demand for mobile-first cloud solutions, enabling seamless access to applications and data on the go. Technological disruptions, such as the widespread adoption of 5G networks, are revolutionizing mobile cloud capabilities, offering higher speeds and lower latency, thereby unlocking new use cases and enhancing user experiences. Artificial intelligence (AI) and machine learning (ML) integrated into mobile cloud platforms are further personalizing user experiences and automating complex processes, particularly in finance and business applications and healthcare. Consumer preferences are shifting towards on-demand services, personalized content, and secure data management, all of which are readily facilitated by advanced mobile cloud offerings. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on expanding service portfolios to cater to diverse industry needs. The Compound Annual Growth Rate (CAGR) for the APAC mobile cloud market is projected to be a robust 28% over the forecast period, indicating substantial expansion. Market penetration is expected to reach 85% of businesses by 2030, showcasing a rapid embrace of cloud technologies. The rise of edge computing, coupled with the demand for real-time analytics in sectors like gaming and entertainment, further propels the industry forward. Furthermore, the growing emphasis on data sovereignty and compliance is driving the development of localized cloud infrastructure and services, catering to specific regional requirements. The evolving landscape of remote work and digital collaboration also significantly contributes to the sustained demand for agile and scalable mobile cloud solutions.

Leading Markets & Segments in APAC Mobile Cloud Industry

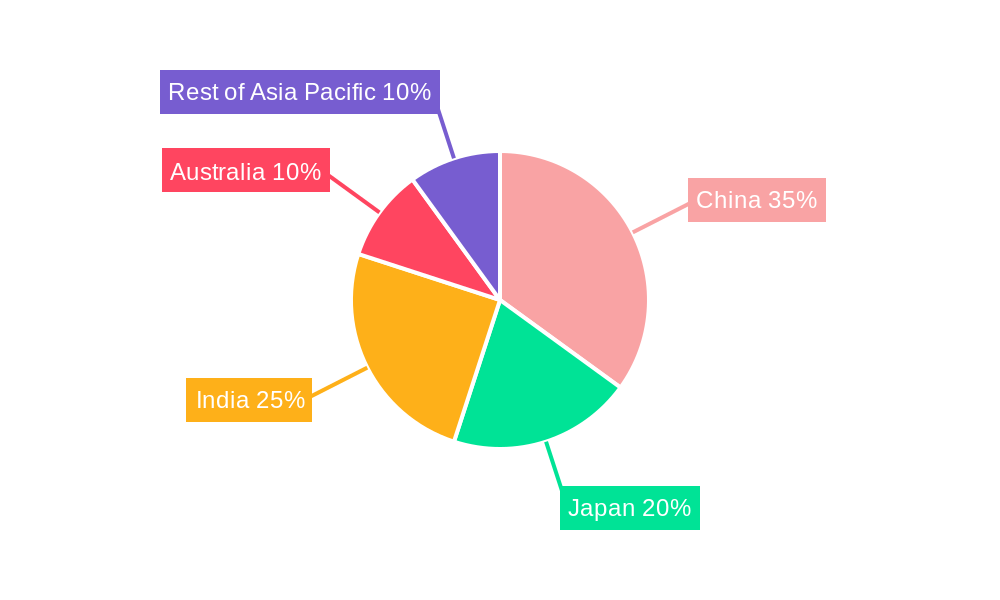

China and India stand out as dominant regions within the APAC mobile cloud industry, driven by their massive populations, rapidly expanding digital economies, and significant government investments in technological infrastructure. China, with its advanced technological ecosystem and a high adoption rate of mobile applications, leads in various segments, particularly in gaming and entertainment, where the demand for low-latency, high-performance cloud solutions is paramount. Key drivers for China's dominance include supportive government policies promoting cloud innovation and substantial private sector investment in research and development. India, on the other hand, is rapidly emerging as a powerhouse, fueled by its vast consumer base, a growing tech-savvy population, and a concerted push towards digital transformation across all sectors. The enterprise segment in India is witnessing substantial growth, with businesses of all sizes adopting mobile cloud solutions for operational efficiency, data management, and customer engagement. Economic policies favoring digital adoption, coupled with improving internet connectivity and a burgeoning startup ecosystem, are critical factors underpinning India's ascent.

- User Segments: The Enterprise segment is the primary revenue driver, accounting for an estimated 60% of the market share, as businesses leverage mobile cloud for enhanced productivity, scalability, and data analytics. The Consumer segment, while smaller in direct revenue contribution, acts as a significant influencer, driving demand for cloud-backed mobile applications and services across various entertainment and utility platforms.

- Application Segments: Gaming and Finance and Business are leading application segments, demanding high-performance, secure, and scalable mobile cloud infrastructure. The proliferation of mobile banking, fintech solutions, and online gaming platforms directly correlates with the growth of these segments. The Healthcare sector is also a rapidly growing area, with mobile cloud enabling remote patient monitoring, telehealth services, and efficient data management, showing an estimated CAGR of 30% within this segment.

- Geographical Dominance:

- China: Dominates due to its massive user base, advanced technological ecosystem, and strong government support for cloud innovation. Its contribution to the market is estimated to be 35%.

- India: Rapidly growing market driven by digital transformation initiatives and a large, young population. Expected to capture 25% of the market by 2030.

- Japan: A mature market with a strong focus on enterprise cloud solutions and technological advancements.

- Australia: Demonstrates strong adoption of cloud services, particularly in the enterprise sector, driven by innovation and demand for secure solutions.

- Rest of Asia-Pacific: A diverse region with significant growth potential, driven by increasing mobile penetration and digital initiatives in emerging economies.

APAC Mobile Cloud Industry Product Developments

Product developments in the APAC mobile cloud industry are characterized by a relentless pursuit of enhanced performance, security, and user-centricity. Companies are focusing on integrating advanced AI and ML capabilities into their mobile cloud platforms to offer personalized user experiences and predictive analytics. Innovations in serverless computing and containerization are enabling greater agility and scalability for mobile applications. The development of specialized cloud solutions tailored for specific industry verticals, such as healthcare and finance, is also a key trend, offering enhanced compliance and specialized functionalities. These advancements provide competitive advantages by enabling faster deployment, reduced operational costs, and improved data security for businesses leveraging mobile cloud services.

Key Drivers of APAC Mobile Cloud Industry Growth

The growth of the APAC mobile cloud industry is propelled by a confluence of technological, economic, and regulatory factors. The rapid proliferation of high-speed mobile internet, including the widespread adoption of 5G technology, is a fundamental enabler, facilitating seamless access to cloud-based applications and services. Economic growth across the region, coupled with increasing disposable incomes, is driving higher consumer spending on mobile devices and digital services, indirectly boosting demand for mobile cloud infrastructure. Furthermore, government initiatives promoting digital transformation and smart city development in countries like China and India are creating a conducive environment for cloud adoption. The increasing need for remote work capabilities and collaboration tools, amplified by recent global events, has also accelerated the adoption of mobile cloud solutions.

Challenges in the APAC Mobile Cloud Industry Market

Despite its robust growth, the APAC mobile cloud industry faces several challenges. Regulatory hurdles, including varying data localization laws and privacy regulations across different countries, can complicate cross-border operations and data management. Cybersecurity threats and concerns over data breaches remain a significant barrier to adoption for some organizations. The shortage of skilled cloud professionals across the region poses a challenge for businesses looking to implement and manage complex cloud solutions. Additionally, legacy infrastructure in some markets can hinder the seamless integration of modern cloud services, and intense competitive pressures from established global players and emerging local providers can impact pricing and profitability.

Emerging Opportunities in APAC Mobile Cloud Industry

Emerging opportunities in the APAC mobile cloud industry are vast, driven by technological breakthroughs and evolving market demands. The continued expansion of 5G networks presents a significant catalyst, enabling new use cases like enhanced mobile gaming, augmented reality (AR) experiences, and sophisticated IoT applications powered by mobile cloud. Strategic partnerships between cloud providers and telecommunication companies are crucial for leveraging this potential. The increasing adoption of hybrid and multi-cloud strategies by enterprises seeking flexibility and resilience offers substantial growth avenues. Furthermore, the growing demand for industry-specific cloud solutions, particularly in rapidly digitizing sectors like healthcare, education, and agriculture, presents a fertile ground for innovation and market expansion. The development of sustainable cloud infrastructure and the integration of AI-powered analytics into mobile cloud offerings will further shape the future landscape.

Leading Players in the APAC Mobile Cloud Industry Sector

- Akamai Technologies Inc

- IBM Corporation

- Google LLC

- Salesforce com Inc

- Microsoft Corporation

- Cloudways Ltd

- Amazon Web Services Inc

- Oracle Corporation

- Kony Inc

- SAP SE

Key Milestones in APAC Mobile Cloud Industry Industry

- December 2022: Breeze Connect introduced a cloud-based phone system for channel partners in Australia, offering an innovative solution for organizations to host phone systems in the cloud while retaining on-premises benefits, and providing a unified system for multiple branches that can be scaled.

- August 2022: Radware launched a new cloud security center in Taiwan, enhancing data center, network, online, and mobile app security for customers with low latency and mitigating compliance requirements associated with offshore routing.

Strategic Outlook for APAC Mobile Cloud Industry Market

The strategic outlook for the APAC mobile cloud industry is exceptionally bright, fueled by sustained digital transformation and increasing technological adoption. The future growth will be accelerated by the continued expansion of 5G infrastructure, enabling a new wave of mobile-first applications and services. Strategic focus will increasingly shift towards providing more specialized, industry-tailored cloud solutions, catering to the unique demands of sectors like healthcare, finance, and education. The ongoing development and integration of AI and machine learning capabilities within mobile cloud platforms will unlock further opportunities for data analytics, personalization, and automation. Furthermore, cross-border collaborations and strategic alliances will be crucial for navigating regulatory complexities and expanding market reach across the diverse APAC landscape, ensuring continued innovation and value creation.

APAC Mobile Cloud Industry Segmentation

-

1. User

- 1.1. Enterprise

- 1.2. Consumer

-

2. Application

- 2.1. Gaming

- 2.2. Finance and Business

- 2.3. Entertainment

- 2.4. Education

- 2.5. Healthcare

- 2.6. Travel

- 2.7. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

APAC Mobile Cloud Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Mobile Cloud Industry Regional Market Share

Geographic Coverage of APAC Mobile Cloud Industry

APAC Mobile Cloud Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development in IT Infrastructure in the Emerging Countries; Advancing Internet Connectivity

- 3.3. Market Restrains

- 3.3.1. Concerns Associated With Data Security

- 3.4. Market Trends

- 3.4.1. The Travel Segment is Expected to Significantly Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by User

- 5.1.1. Enterprise

- 5.1.2. Consumer

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gaming

- 5.2.2. Finance and Business

- 5.2.3. Entertainment

- 5.2.4. Education

- 5.2.5. Healthcare

- 5.2.6. Travel

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by User

- 6. China APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by User

- 6.1.1. Enterprise

- 6.1.2. Consumer

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gaming

- 6.2.2. Finance and Business

- 6.2.3. Entertainment

- 6.2.4. Education

- 6.2.5. Healthcare

- 6.2.6. Travel

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by User

- 7. Japan APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by User

- 7.1.1. Enterprise

- 7.1.2. Consumer

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gaming

- 7.2.2. Finance and Business

- 7.2.3. Entertainment

- 7.2.4. Education

- 7.2.5. Healthcare

- 7.2.6. Travel

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by User

- 8. India APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by User

- 8.1.1. Enterprise

- 8.1.2. Consumer

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gaming

- 8.2.2. Finance and Business

- 8.2.3. Entertainment

- 8.2.4. Education

- 8.2.5. Healthcare

- 8.2.6. Travel

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by User

- 9. Australia APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by User

- 9.1.1. Enterprise

- 9.1.2. Consumer

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gaming

- 9.2.2. Finance and Business

- 9.2.3. Entertainment

- 9.2.4. Education

- 9.2.5. Healthcare

- 9.2.6. Travel

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by User

- 10. Rest of Asia Pacific APAC Mobile Cloud Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by User

- 10.1.1. Enterprise

- 10.1.2. Consumer

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gaming

- 10.2.2. Finance and Business

- 10.2.3. Entertainment

- 10.2.4. Education

- 10.2.5. Healthcare

- 10.2.6. Travel

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akamai Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Salesforce com Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microsoft Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cloudways Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amazon Web Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kony Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Akamai Technologies Inc

List of Figures

- Figure 1: Global APAC Mobile Cloud Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Mobile Cloud Industry Revenue (billion), by User 2025 & 2033

- Figure 3: China APAC Mobile Cloud Industry Revenue Share (%), by User 2025 & 2033

- Figure 4: China APAC Mobile Cloud Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: China APAC Mobile Cloud Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: China APAC Mobile Cloud Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: China APAC Mobile Cloud Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Mobile Cloud Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: China APAC Mobile Cloud Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan APAC Mobile Cloud Industry Revenue (billion), by User 2025 & 2033

- Figure 11: Japan APAC Mobile Cloud Industry Revenue Share (%), by User 2025 & 2033

- Figure 12: Japan APAC Mobile Cloud Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Japan APAC Mobile Cloud Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Japan APAC Mobile Cloud Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Japan APAC Mobile Cloud Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Japan APAC Mobile Cloud Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Japan APAC Mobile Cloud Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: India APAC Mobile Cloud Industry Revenue (billion), by User 2025 & 2033

- Figure 19: India APAC Mobile Cloud Industry Revenue Share (%), by User 2025 & 2033

- Figure 20: India APAC Mobile Cloud Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: India APAC Mobile Cloud Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: India APAC Mobile Cloud Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: India APAC Mobile Cloud Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Mobile Cloud Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: India APAC Mobile Cloud Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia APAC Mobile Cloud Industry Revenue (billion), by User 2025 & 2033

- Figure 27: Australia APAC Mobile Cloud Industry Revenue Share (%), by User 2025 & 2033

- Figure 28: Australia APAC Mobile Cloud Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Australia APAC Mobile Cloud Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Australia APAC Mobile Cloud Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Australia APAC Mobile Cloud Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Australia APAC Mobile Cloud Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Australia APAC Mobile Cloud Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue (billion), by User 2025 & 2033

- Figure 35: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue Share (%), by User 2025 & 2033

- Figure 36: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Mobile Cloud Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 2: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 6: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 10: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 14: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 18: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global APAC Mobile Cloud Industry Revenue billion Forecast, by User 2020 & 2033

- Table 22: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Mobile Cloud Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mobile Cloud Industry?

The projected CAGR is approximately 11.89%.

2. Which companies are prominent players in the APAC Mobile Cloud Industry?

Key companies in the market include Akamai Technologies Inc, IBM Corporation, Google LLC, Salesforce com Inc, Microsoft Corporation, Cloudways Ltd, Amazon Web Services Inc, Oracle Corporation, Kony Inc *List Not Exhaustive, SAP SE.

3. What are the main segments of the APAC Mobile Cloud Industry?

The market segments include User, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.89 billion as of 2022.

5. What are some drivers contributing to market growth?

Development in IT Infrastructure in the Emerging Countries; Advancing Internet Connectivity.

6. What are the notable trends driving market growth?

The Travel Segment is Expected to Significantly Drive the Market.

7. Are there any restraints impacting market growth?

Concerns Associated With Data Security.

8. Can you provide examples of recent developments in the market?

December 2022: Breeze Connect introduced a cloud-based phone system for channel partners in Australia. This innovative solution allows organizations to host their phone systems in the cloud while still getting the benefits of on-premises solutions. Furthermore, it offers the advantages of a unified phone system for multiple branches that can be scaled up or down as the company's demands change.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mobile Cloud Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mobile Cloud Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mobile Cloud Industry?

To stay informed about further developments, trends, and reports in the APAC Mobile Cloud Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence