Key Insights

The Angola Telecom Market is projected to expand significantly, reaching an estimated $600 million by 2024, driven by a robust Compound Annual Growth Rate (CAGR) of 10.7%. Key growth catalysts include increasing mobile penetration, escalating demand for high-speed internet, and ongoing digital transformation initiatives across Angolan industries. Government investments in telecommunications infrastructure, coupled with growing affordability of mobile devices and data plans, are pivotal. The rising adoption of Over-The-Top (OTT) and Pay-TV services further stimulates market dynamism and revenue generation. While 5G rollout may be nascent, advancements in network technologies are expected to contribute to future expansion.

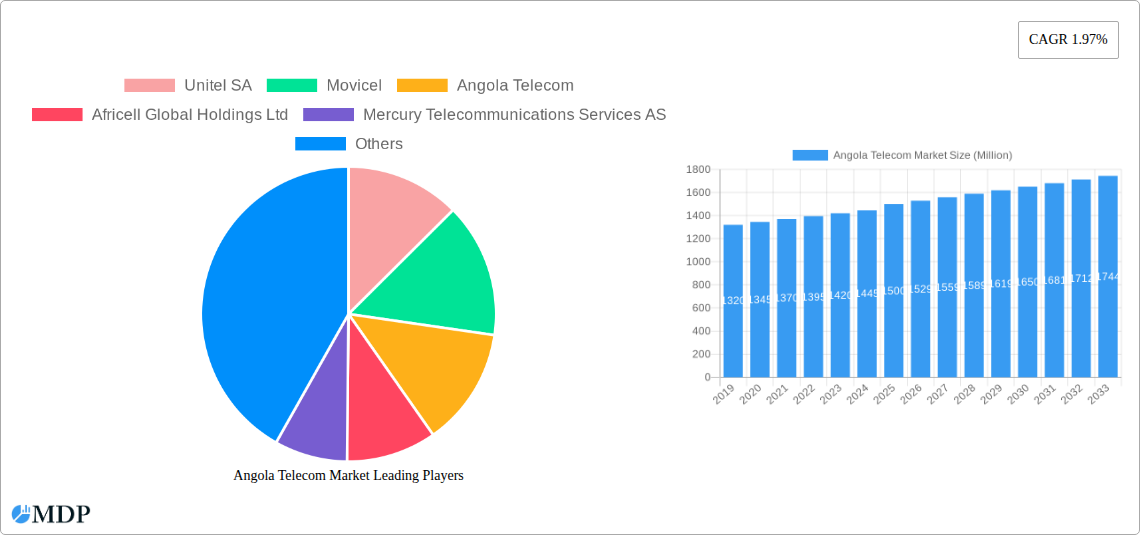

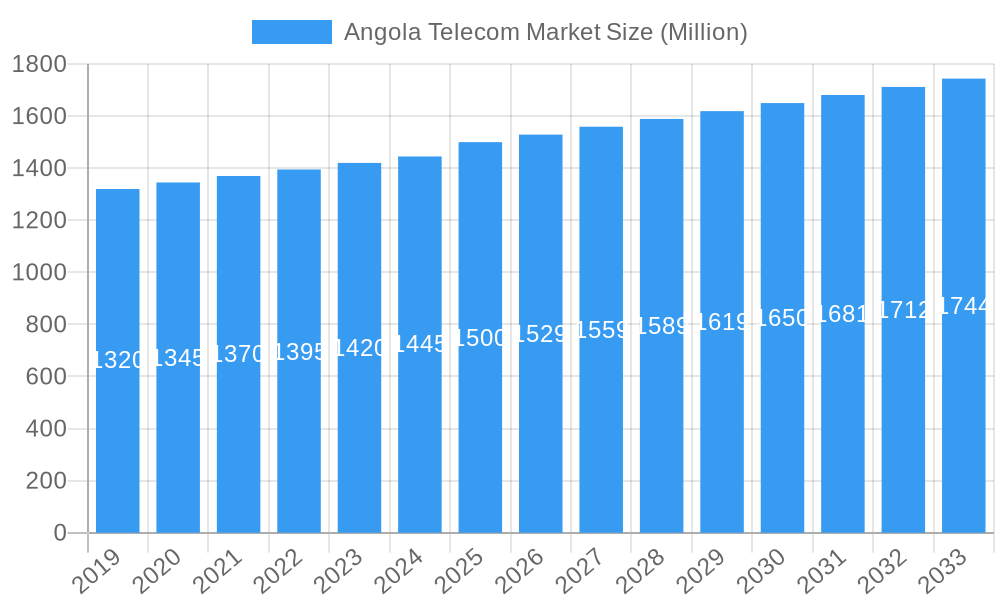

Angola Telecom Market Market Size (In Million)

Potential growth impediments include substantial infrastructure investment needs, particularly for rural coverage, and navigating regulatory complexities. High operational costs and intense market competition among key players also present challenges. The market is segmented into Voice Services (Wired and Wireless), Data and Messaging Services, and OTT and Pay-TV Services. Data and Messaging Services are anticipated to experience strong growth due to increased smartphone usage and data consumption. Wireless voice services remain a significant revenue contributor. The strategic initiatives of major operators, including Unitel SA, Movicel, and Angola Telecom, will be critical for market navigation and capitalizing on emerging opportunities within the Angolan telecommunications sector.

Angola Telecom Market Company Market Share

Unlock the Future of Connectivity: Angola Telecom Market Report - Forecast 2025-2033

Dive deep into the dynamic Angola telecom market with our comprehensive report, covering the historical period of 2019-2024 and extending through an in-depth forecast from 2025-2033, with 2025 serving as the base and estimated year. This report is your definitive guide to understanding the intricate market dynamics, identifying key growth drivers, and navigating the competitive landscape of Angola's burgeoning telecommunications sector. Discover critical insights into evolving consumer preferences, disruptive technologies, and regulatory shifts that are shaping the future of connectivity in this rapidly developing African nation. Packed with actionable intelligence, this analysis empowers industry stakeholders, investors, and strategists to make informed decisions and capitalize on emerging opportunities within the Angola telecom industry.

Angola Telecom Market Market Dynamics & Concentration

The Angola telecom market is characterized by a moderate to high level of concentration, with key players like Unitel SA and Movicel holding significant market share. While specific market share figures fluctuate, Unitel SA is estimated to command over 50 Million of the subscriber base, with Movicel following closely. Angola Telecom, as the state-owned entity, also maintains a substantial presence. The market is driven by a constant pursuit of innovation, particularly in data services and the expansion of mobile broadband. Regulatory frameworks, while evolving, are crucial in shaping competition and investment, with the government actively promoting digital transformation. Product substitutes are increasingly relevant, especially with the rise of Over-The-Top (OTT) services impacting traditional voice and messaging revenues. End-user trends indicate a strong demand for affordable, high-speed internet and a growing adoption of digital services across various sectors. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate market presence and expand service portfolios. The historical period (2019-2024) saw an increase in M&A deal counts, particularly in the consolidation of smaller service providers.

Angola Telecom Market Industry Trends & Analysis

The Angola telecom market is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8% over the forecast period of 2025-2033. This expansion is fueled by several key industry trends and analytical insights. A primary growth driver is the increasing demand for mobile data services, spurred by rising smartphone penetration and a growing young population that is digitally native. Market penetration for mobile broadband is expected to reach over 70 Million by 2033. Technological disruptions, such as the ongoing rollout of 5G technology, are set to revolutionize service delivery, enabling faster speeds and new application development. The government's commitment to improving digital infrastructure, including the expansion of fiber optic networks, is a significant catalyst. Consumer preferences are shifting towards integrated digital solutions, including streaming services and mobile money, which are creating new revenue streams for telecom operators. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. The exploration of new business models, such as IoT and enterprise solutions, is becoming increasingly important for sustained growth. The historical period has witnessed a steady increase in data consumption, with average data usage per subscriber projected to grow by 15 Million per annum. The impact of global trends, such as the increasing reliance on digital platforms for education, commerce, and entertainment, is amplified in Angola, driving the need for reliable and accessible telecommunication services.

Leading Markets & Segments in Angola Telecom Market

The Data and Messaging Services segment is the dominant force within the Angola telecom market, driven by the increasing adoption of smartphones and the growing demand for internet connectivity. This segment is projected to account for over 60 Million of the total market revenue by 2033. The expansion of mobile broadband, coupled with affordable data plans, has made it the primary mode of communication and information access for a vast majority of the Angolan population.

Key Drivers of Data and Messaging Dominance:

- Economic Policies: Government initiatives aimed at promoting digital inclusion and economic diversification are fostering investment in data infrastructure.

- Infrastructure Development: Significant investments in fiber optic networks and mobile base stations are enhancing network coverage and capacity, supporting higher data speeds.

- Consumer Demand: A young and increasingly urbanized population has a high appetite for social media, video streaming, and online services, driving data consumption.

- Affordability: Telecom operators are increasingly offering competitive data packages, making internet access more accessible to a wider segment of the population.

Detailed Dominance Analysis: The rapid growth in smartphone usage, estimated to surpass 40 Million users by 2030, directly translates into increased demand for data services. Furthermore, the proliferation of Over-The-Top (OTT) communication apps has shifted the messaging landscape, further solidifying the dominance of data-centric services. While Voice Services (Wired and Wireless) remain essential, their revenue contribution is gradually being overshadowed by the exponential growth in data consumption. PayTV services, though a growing segment, are still nascent compared to the widespread adoption of data-driven entertainment and communication.

Angola Telecom Market Product Developments

Product development in the Angola telecom market is increasingly focused on delivering enhanced data experiences and integrated digital solutions. Innovations are centered around expanding 4G and rolling out 5G capabilities to provide faster, more reliable internet access. Telecom operators are investing in smart home solutions, IoT applications for businesses, and cloud-based services to cater to evolving consumer and enterprise needs. The competitive advantage lies in offering bundled packages that combine data, voice, and digital content, as well as providing superior network performance and customer service. Technological trends such as AI-driven customer support and network optimization are also being explored to improve operational efficiency and user satisfaction. The market fit for these innovations is strong, given the growing demand for digital services across various sectors of the Angolan economy.

Key Drivers of Angola Telecom Market Growth

Several key factors are driving the growth of the Angola telecom market. Technological advancements, particularly the ongoing expansion of 4G networks and the anticipation of 5G deployment, are fundamental. This enhanced infrastructure supports higher data speeds and new service possibilities. Economic growth and diversification efforts within Angola are also significant catalysts, as businesses increasingly rely on robust telecommunications for operations, e-commerce, and global connectivity. Government initiatives promoting digital transformation and investment in ICT infrastructure, such as the Angosat 2 satellite program, are creating a favorable environment for market expansion. Furthermore, a growing young population with increasing digital literacy and a demand for mobile-centric services acts as a consistent demand driver. The increasing affordability of smartphones and data plans is making telecommunications services accessible to a broader segment of the population, further fueling market growth.

Challenges in the Angola Telecom Market Market

Despite the promising growth trajectory, the Angola telecom market faces several challenges. Regulatory hurdles and bureaucratic processes can sometimes slow down infrastructure deployment and new service introductions, impacting the speed of innovation. Infrastructure development costs remain substantial, particularly in expanding coverage to remote and rural areas. Supply chain issues, including the availability of specialized equipment and skilled labor, can also pose constraints. Intense competitive pressures among established players and the threat of new entrants can lead to price wars, impacting profitability. Furthermore, the affordability of services for lower-income segments of the population remains a concern, limiting market penetration in certain demographics. The ongoing need to invest in network upgrades to meet evolving technological standards presents a continuous financial challenge for operators.

Emerging Opportunities in Angola Telecom Market

Emerging opportunities in the Angola telecom market are diverse and poised to drive long-term growth. The expansion of the digital economy, fueled by e-commerce, fintech, and online education, presents a significant opportunity for telcos to provide the underlying connectivity and develop value-added services. The Angosat 2 satellite program opens doors for enhanced broadband access in underserved areas and the development of specialized services in sectors like agriculture, mining, and climate monitoring. Strategic partnerships between telecom operators, technology providers, and government entities can accelerate infrastructure development and the adoption of new technologies like IoT and AI. Furthermore, the untapped potential in enterprise solutions and digital transformation services for businesses across various industries represents a substantial growth avenue. The preparation for Unitel's IPO signals a broader trend of attracting foreign investment, which can further fuel market expansion and technological advancement.

Leading Players in the Angola Telecom Market Sector

- Unitel SA

- Movicel

- Angola Telecom

- Africell Global Holdings Ltd

- Mercury Telecommunications Services AS

- Internet Technologies Angola SA

- Telecom Namibia Ltd

- NEXUS

- Angola Cables SA

- Startel

Key Milestones in Angola Telecom Market Industry

- April 2024: Kenya and Angola entered a partnership to enhance telecommunications infrastructure and satellite capabilities across Africa. Under the leadership of Minister Mário Oliveira, Angola leveraged its communication satellite, Angosat 2, to unlock opportunities in various industries, including information and communication technology (ICT), agriculture, mining, and climate monitoring. This initiative significantly boosts the country's digital infrastructure and connectivity potential across the continent.

- February 2024: Unitel, a prominent telecommunications company in Angola, announced its preparation for an Initial Public Offering (IPO). This strategic move aims to stimulate economic growth, attract foreign investment, and enhance the company's capital-raising capabilities, signaling a significant development in the market's financial landscape.

Strategic Outlook for Angola Telecom Market Market

The strategic outlook for the Angola telecom market is highly positive, driven by a confluence of factors that are accelerating its growth and innovation. Continued investment in 5G network deployment will be a key differentiator, unlocking new revenue streams through enhanced mobile broadband, fixed wireless access, and enterprise IoT solutions. The government's focus on digital transformation and the utilization of satellite capabilities like Angosat 2 will further bridge connectivity gaps and foster growth in non-traditional sectors. The anticipated increased foreign investment, signaled by upcoming IPOs, will provide the necessary capital for network expansion and technological upgrades. Operators are expected to focus on diversifying their service portfolios beyond traditional voice and data to include cloud services, cybersecurity, and digital content. Building robust ecosystems through strategic partnerships will be crucial for delivering integrated digital solutions and capturing market share. The market is poised for sustained expansion, driven by increasing demand for high-speed connectivity and digital services.

Angola Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Angola Telecom Market Segmentation By Geography

- 1. Angola

Angola Telecom Market Regional Market Share

Geographic Coverage of Angola Telecom Market

Angola Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Significant Investments in 4G and 5G Technologies

- 3.2.2 Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1 Significant Investments in 4G and 5G Technologies

- 3.3.2 Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Growth of IoT Usage in the Telecom Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unitel SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Movicel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Angola Telecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Africell Global Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mercury Telecommunications Services AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Internet Technologies Angola SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telecom Namibia Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEXUS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angola Cables SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Startel*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unitel SA

List of Figures

- Figure 1: Angola Telecom Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Angola Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Angola Telecom Market Revenue million Forecast, by Services 2020 & 2033

- Table 2: Angola Telecom Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Angola Telecom Market Revenue million Forecast, by Services 2020 & 2033

- Table 4: Angola Telecom Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Telecom Market?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Angola Telecom Market?

Key companies in the market include Unitel SA, Movicel, Angola Telecom, Africell Global Holdings Ltd, Mercury Telecommunications Services AS, Internet Technologies Angola SA, Telecom Namibia Ltd, NEXUS, Angola Cables SA, Startel*List Not Exhaustive.

3. What are the main segments of the Angola Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 600 million as of 2022.

5. What are some drivers contributing to market growth?

Significant Investments in 4G and 5G Technologies. Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Growth of IoT Usage in the Telecom Industry.

7. Are there any restraints impacting market growth?

Significant Investments in 4G and 5G Technologies. Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

April 2024: Kenya and Angola entered a partnership to enhance telecommunications infrastructure and satellite capabilities across Africa. Under the leadership of Minister Mário Oliveira, Angola leveraged its communication satellite, Angosat 2, to unlock opportunities in various industries, including information and communication technology (ICT), agriculture, mining, and climate monitoring.February 2024: Unitel, a telecommunications company in Angola, announced that it had been preparing for an IPO. This strategic initiative by the central African nation's company aims to stimulate economic growth and attract foreign investment. An IPO, or initial public offering, is a process where shares of a private company are made available to the public for the first time. This process allows a company to raise equity capital from public investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Telecom Market?

To stay informed about further developments, trends, and reports in the Angola Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence