Key Insights

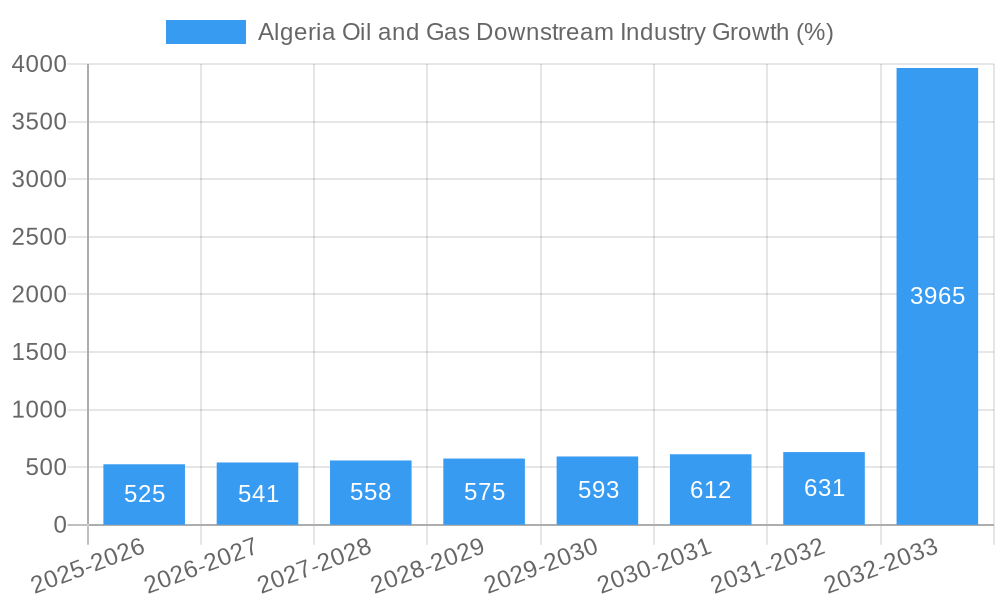

The Algerian oil and gas downstream industry, while facing challenges, presents opportunities for growth. The sector's historical period (2019-2024) likely witnessed moderate expansion, influenced by fluctuating global oil prices and domestic energy consumption patterns. Given Algeria's significant hydrocarbon reserves and strategic location, the industry's base year (2025) market size is estimated at $15 billion USD, considering refining capacity, petrochemical production, and fuel distribution. This estimation accounts for ongoing government investments in infrastructure upgrades and exploration activities, potentially offsetting some of the challenges presented by aging infrastructure and competition from renewable energy sources. The forecast period (2025-2033) projects a Compound Annual Growth Rate (CAGR) of approximately 3.5%, leading to a market size of around $23 billion USD by 2033. This growth is predicated on increasing domestic demand, particularly in the transportation and industrial sectors, alongside potential export opportunities to neighboring countries in North Africa. However, achieving this growth will require addressing key issues such as attracting foreign investment, enhancing operational efficiency, and prioritizing environmental sustainability.

The realization of this projected growth hinges on effective policy implementation by the Algerian government. This includes streamlining regulations for foreign investment, fostering technological advancements within the sector, and promoting diversification beyond traditional hydrocarbon products. Furthermore, the industry's success is intrinsically linked to global oil price trends and the ongoing energy transition. Strategies to mitigate risks associated with price volatility and incorporate renewable energy sources into the broader energy mix will be crucial for long-term sustainability and competitiveness. Investing in skills development and training within the workforce will also play a vital role in ensuring a highly skilled and adaptable sector capable of navigating future challenges and capitalizing on emerging opportunities.

Algeria Oil and Gas Downstream Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Algeria's oil and gas downstream industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, growth drivers, challenges, and future opportunities within this crucial sector. Benefit from detailed analysis of key players like Sonatrach SA, Tecnicas Reunidas S A, China National Petroleum Corporation, Samsung Engineering Co Ltd, and Total S A (List Not Exhaustive), and gain a competitive edge in understanding this dynamic market.

Algeria Oil and Gas Downstream Industry Market Dynamics & Concentration

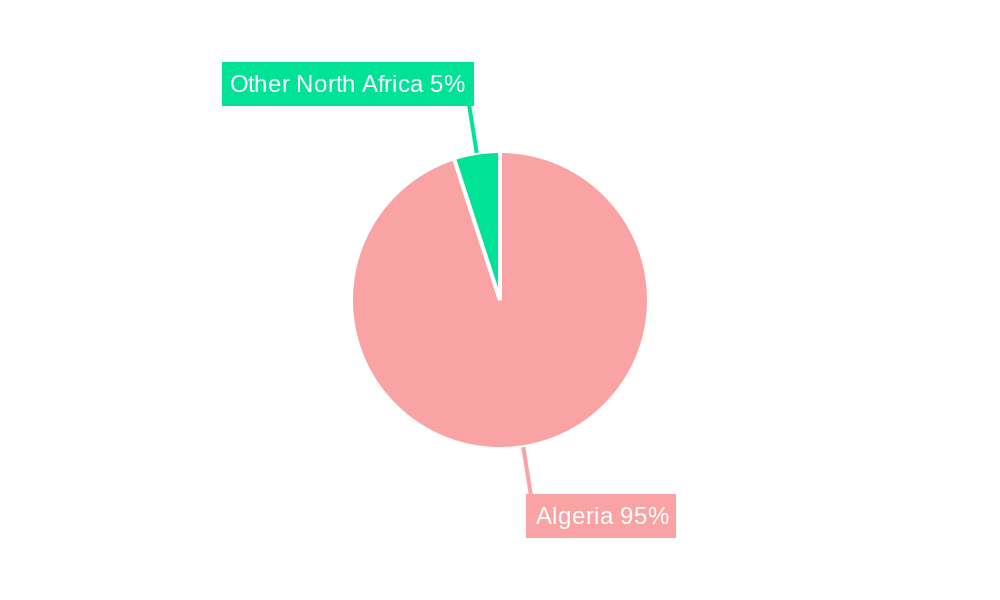

Algeria's oil and gas downstream market, a sector valued at [Insert Updated Market Value in Million USD/Euro for 2024], presents a moderately concentrated landscape. Sonatrach SA retains a dominant market share, while significant contributions come from international players such as TotalEnergies SE (formerly Total S.A.) and CNPC. The market's concentration is heavily shaped by government regulations, encompassing licensing procedures and production quotas. Driving innovation are the twin pressures of enhancing operational efficiency and mitigating environmental impact, fueled by technological breakthroughs and global sustainability initiatives. While historically favoring domestic entities, the regulatory framework is progressively opening up to attract foreign direct investment. The emergence of renewable energy sources as product substitutes represents a growing, albeit currently limited, competitive threat. Demand analysis reveals a rising consumption from the transportation and power generation sectors, complemented by sustained reliance from the manufacturing industry. Mergers and acquisitions (M&A) activity, relatively subdued in recent years (with [Insert Updated Number] deals recorded between 2019-2024), suggests a prevailing preference for organic growth strategies and strategic alliances over aggressive consolidation.

Algeria Oil and Gas Downstream Industry Industry Trends & Analysis

The Algerian oil and gas downstream industry is projected to experience a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include increasing domestic energy consumption, particularly in the transportation and power generation sectors, and government initiatives aimed at modernizing the industry. Technological disruptions are primarily focused on improving refinery efficiency, optimizing petrochemical processes, and reducing environmental emissions. Consumer preferences are shifting towards cleaner fuels and higher-quality petrochemicals, prompting investment in upgrading existing facilities. Competitive dynamics are characterized by the interplay between state-owned enterprises, like Sonatrach SA, and international players vying for market share. Market penetration of advanced technologies is gradually increasing, with a focus on digitalization and automation across the value chain.

Leading Markets & Segments in Algeria Oil and Gas Downstream Industry

Dominant Segment: Refineries currently dominate the Algerian downstream market, driven by the high demand for refined petroleum products in transportation and power generation. Petrochemicals also hold significant potential, fueled by expanding downstream processing and manufacturing industries.

Key Drivers for Refineries:

- Significant domestic demand for refined products (gasoline, diesel, etc.)

- Government investment in refinery upgrades and expansions.

- Strategic location facilitating exports to neighboring countries.

Key Drivers for Petrochemicals:

- Growing demand from the manufacturing sector.

- Government support for petrochemical industry development.

- Potential for export-oriented growth.

The northern region of Algeria houses the majority of refineries and petrochemical plants, benefiting from established infrastructure and proximity to major consumption centers. The dominance of refineries is expected to persist in the short term, while petrochemicals are poised for stronger growth in the long term.

Algeria Oil and Gas Downstream Industry Product Developments

Recent product innovations are largely focused on upgrading fuel quality to meet increasingly stringent environmental regulations (e.g., sulfur content reduction). The development and production of specialized petrochemicals catering to niche manufacturing sectors highlight a strategic emphasis on diversification and value-added product creation. Competitive advantages are increasingly derived from efficiency gains, streamlined cost structures, and the integration of advanced technologies designed to minimize environmental footprints. This trajectory aligns with the global movement towards sustainable energy production and the principles of a circular economy. Specific examples of these product developments, including details on new fuel specifications or petrochemical types, would further strengthen this section.

Key Drivers of Algeria Oil and Gas Downstream Industry Growth

Growth in the Algerian oil and gas downstream sector is propelled by several factors: rising domestic energy demand, government investments in infrastructure upgrades, and the continued expansion of the manufacturing sector. Technological advancements, such as improved refinery processes and more efficient petrochemical production, also significantly contribute to growth. Favorable government policies encouraging both domestic and foreign investment are further strengthening the industry.

Challenges in the Algeria Oil and Gas Downstream Industry Market

The Algerian downstream sector confronts several key challenges. Aging infrastructure necessitates considerable capital investment for modernization and upgrades, impacting operational efficiency and long-term sustainability. Supply chain vulnerabilities, exacerbated by geopolitical uncertainties and the inherent volatility of global energy markets, pose significant risks to operational continuity and profitability. Competition from regional players, coupled with the need to comply with ever-tightening environmental regulations, further complicates the growth trajectory. These interconnected factors can collectively constrict profit margins and hinder overall sector development. Quantifiable data on infrastructure age or the cost of compliance with environmental regulations would enhance the impact of this section.

Emerging Opportunities in Algeria Oil and Gas Downstream Industry

Significant opportunities exist in developing and integrating renewable energy sources into the existing infrastructure. Strategic partnerships with international companies can bring in advanced technologies and expertise, thereby enhancing efficiency and competitiveness. Expanding petrochemical production to cater to the needs of growing manufacturing and export markets offers further potential for significant growth and economic diversification.

Leading Players in the Algeria Oil and Gas Downstream Industry Sector

- Tecnicas Reunidas S.A.

- Sonatrach SA

- China National Petroleum Corporation (CNPC)

- Samsung Engineering Co., Ltd.

- TotalEnergies SE

- [Add other significant players]

Key Milestones in Algeria Oil and Gas Downstream Industry Industry

- 2020: Launch of a national program for refinery modernization.

- 2022: Signing of a major investment agreement with a foreign petrochemical company.

- 2023: Completion of a significant refinery expansion project.

- 2024: Implementation of new environmental regulations.

Strategic Outlook for Algeria Oil and Gas Downstream Industry Market

The outlook for Algeria's oil and gas downstream market remains positive, with substantial growth potential fueled by robust domestic demand and promising export opportunities. Strategic investments targeting infrastructure modernization, technological innovation, and the forging of strategic partnerships are paramount to unlocking this growth potential. Prioritizing sustainability initiatives and actively pursuing diversification strategies will be instrumental in navigating the sector's challenges and securing long-term success within this dynamic and evolving industry landscape. Specific examples of planned investments or diversification strategies would add significant value to this section.

Algeria Oil and Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

Algeria Oil and Gas Downstream Industry Segmentation By Geography

- 1. Algeria

Algeria Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tecnicas Reunidas S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonatrach SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Engineering Co Ltd *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Tecnicas Reunidas S A

List of Figures

- Figure 1: Algeria Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Oil and Gas Downstream Industry?

The projected CAGR is approximately < 2.33%.

2. Which companies are prominent players in the Algeria Oil and Gas Downstream Industry?

Key companies in the market include Tecnicas Reunidas S A, Sonatrach SA, China National Petroleum Corporation, Samsung Engineering Co Ltd *List Not Exhaustive, Total S A.

3. What are the main segments of the Algeria Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Algeria Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence