Key Insights

The Africa Outdoor Small Cell Market is projected to experience substantial growth, reaching an estimated market size of $3.3 billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 36.2% anticipated through 2033. This significant expansion is driven by the escalating demand for superior mobile broadband services across Africa. Key factors propelling this growth include the widespread adoption of smartphones, increasing consumption of data-intensive applications such as video streaming and online gaming, and mobile network operators' efforts to enhance network coverage and capacity in both urban and suburban areas. The ongoing deployment of 5G technology, even in its early stages in many African nations, further stimulates the adoption of small cell solutions, essential for network densification and achieving the high speeds and low latency of next-generation mobile networks. Government initiatives focused on digital inclusion and bridging the digital divide are also instrumental, encouraging investment in robust and accessible mobile infrastructure.

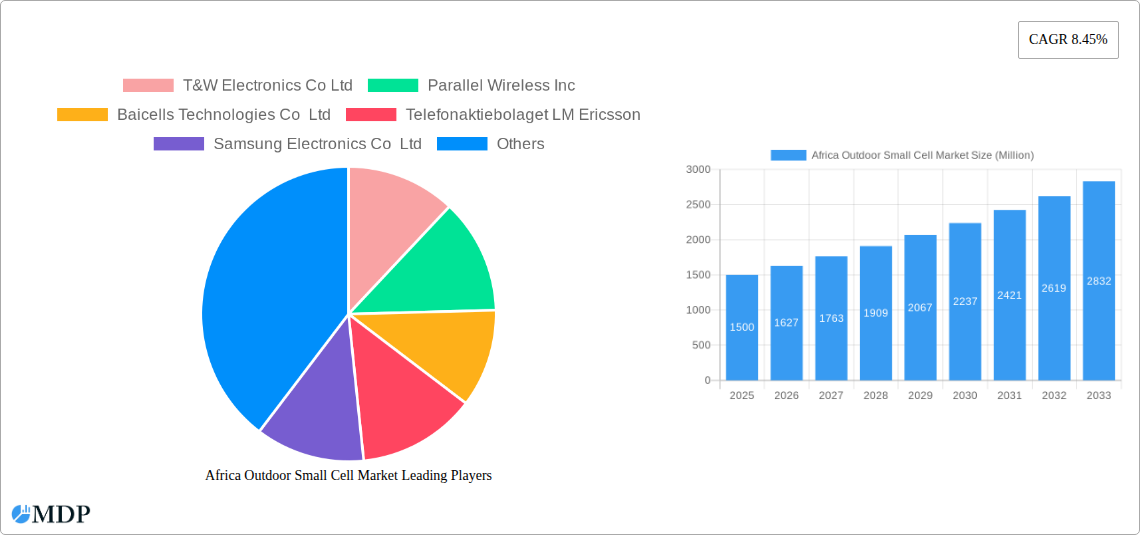

Africa Outdoor Small Cell Market Market Size (In Billion)

Several emerging trends are shaping the Africa Outdoor Small Cell Market. A notable trend is the growing adoption of Open RAN architectures, promoting vendor diversity and innovation, which can lead to reduced costs and faster deployment. Additionally, the integration of AI and machine learning for network optimization and management is gaining momentum, promising more efficient and self-healing small cell networks. However, the market faces certain challenges. Significant upfront investment costs for deployment, particularly in areas with underdeveloped infrastructure, can be a barrier. Furthermore, regulatory complexities and spectrum availability issues in some countries may slow down adoption. Despite these obstacles, the fundamental need for enhanced connectivity and the strategic importance of mobile infrastructure for Africa's economic development are expected to overcome these restraints, fostering sustained growth and innovation in the Africa Outdoor Small Cell Market. The primary applications within this market are anticipated to be outdoor deployments, serving public spaces, transportation hubs, and densely populated urban environments.

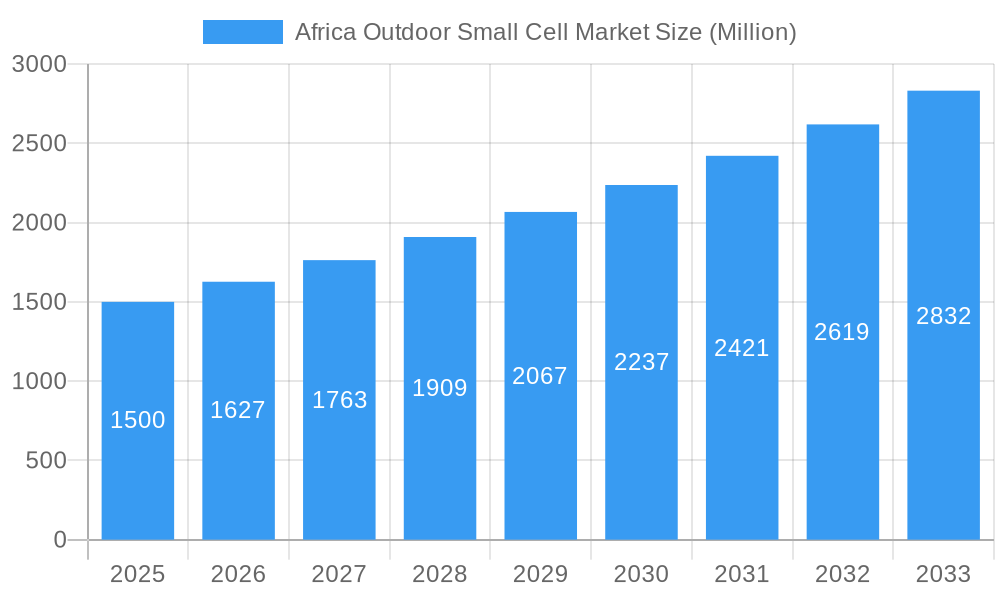

Africa Outdoor Small Cell Market Company Market Share

Africa Outdoor Small Cell Market: Unleashing Connectivity in a Developing Continent (2019–2033)

This comprehensive report offers an in-depth analysis of the Africa Outdoor Small Cell Market, projecting its trajectory from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. Delving into the crucial outdoor small cell market landscape, this study dissects the driving forces, emerging opportunities, and strategic imperatives shaping connectivity across Africa. We explore the rapid evolution of mobile network infrastructure and its impact on telecom deployment in this dynamic continent.

This report is indispensable for telecom operators, infrastructure providers, technology vendors, investors, and government bodies seeking to understand and capitalize on the burgeoning African small cell market. With a focus on rural connectivity, urban densification, and the deployment of 5G small cells, this analysis provides actionable insights into market dynamics, technological advancements, and competitive strategies.

Key Segments Covered:

- Application: Outdoor, Indoor

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Africa Outdoor Small Cell Market Market Dynamics & Concentration

The Africa Outdoor Small Cell Market is characterized by a dynamic interplay of driving forces and emerging trends. Market concentration is currently moderate, with a few key players holding significant influence, while numerous smaller entities contribute to a competitive landscape. Innovation is primarily driven by the escalating demand for ubiquitous mobile coverage, particularly in underserved rural Africa, and the need to augment capacity in densely populated urban centers. Regulatory frameworks are a significant factor, with governments actively promoting digital transformation and investing in telecom infrastructure development through initiatives like universal service funds. Product substitutes, such as macrocells and traditional network expansion, exist but are often less cost-effective or efficient for localized coverage needs. End-user trends reveal a growing reliance on mobile data services for communication, commerce, and education, fueling the demand for enhanced mobile broadband. Merger and acquisition (M&A) activities are expected to increase as larger players seek to expand their footprint and acquire specialized technologies. For instance, recent M&A activity in the broader African telecom sector indicates a trend towards consolidation, with an estimated xx M&A deals recorded historically. Market share for outdoor small cells is projected to reach XX% of the total African small cell market by 2033, driven by these dynamics.

Africa Outdoor Small Cell Market Industry Trends & Analysis

The Africa Outdoor Small Cell Market is poised for significant expansion, fueled by a confluence of robust growth drivers, transformative technological disruptions, evolving consumer preferences, and intensifying competitive dynamics. The increasing penetration of smartphones and the growing demand for mobile data services, particularly for video streaming, social media, and e-commerce, are primary catalysts for market growth. This trend is further amplified by the ongoing digitalization of African economies, which necessitates reliable and high-capacity mobile network coverage. Technological disruptions, such as advancements in small cell technology, including carrier-grade small cells and integrated access and backhaul (IAB) solutions, are enabling more efficient and cost-effective deployments. The integration of AI and machine learning in network management is also improving operational efficiency and service quality.

Consumer preferences are shifting towards seamless and high-speed mobile experiences, driving operators to deploy small cells for network densification and to offload traffic from macrocells. This is particularly evident in high-traffic urban areas where capacity constraints are a major concern. The competitive landscape is dynamic, with established telecom equipment vendors and emerging players vying for market share. The average annual growth rate (CAGR) for the Africa Outdoor Small Cell Market is projected to be approximately XX% over the forecast period. Market penetration, currently at around XX%, is expected to rise significantly as deployment costs decrease and regulatory support strengthens. The increasing adoption of private mobile networks for enterprises and industrial applications also presents a substantial growth avenue. Furthermore, the continent's young and tech-savvy population is a key demographic driving the demand for advanced mobile services, necessitating the deployment of modern cellular infrastructure. The phased rollout of 5G technology across various African nations will further accelerate the adoption of small cells to provide the necessary densification and capacity.

Leading Markets & Segments in Africa Outdoor Small Cell Market

The Outdoor segment is set to dominate the Africa Outdoor Small Cell Market, driven by the imperative to extend mobile network coverage into vast rural and suburban regions, as well as to enhance capacity in densely populated urban environments. This dominance is underpinned by several key drivers:

- Bridging the Digital Divide: Governments across Africa are actively pursuing policies aimed at bridging the digital divide, making outdoor small cell deployments a critical tool for extending connectivity to previously unserved or underserved populations. Initiatives focused on rural broadband access are directly supporting the growth of the outdoor segment.

- Urban Capacity Augmentation: As African cities continue to experience rapid population growth and increased mobile data consumption, outdoor small cells are essential for augmenting network capacity, improving user experience, and preventing network congestion. This is particularly true for areas with high foot traffic such as business districts, shopping centers, and public transportation hubs.

- Cost-Effectiveness for Wider Coverage: Compared to traditional macrocell deployments, outdoor small cells offer a more cost-effective solution for achieving widespread coverage, especially in challenging terrains and dispersed settlements.

- Support for Emerging Technologies: The deployment of 5G networks, which require denser infrastructure, inherently boosts the demand for outdoor small cells to provide the necessary coverage and capacity, especially for millimeter-wave (mmWave) deployments.

- Enterprise and Industrial Applications: The growing adoption of IoT devices and the demand for private mobile networks in sectors like mining, agriculture, and logistics in outdoor environments are further propelling the growth of this segment.

While the Indoor segment also holds significant potential, particularly for enterprise deployments and enhancing indoor mobile signal strength in large venues, the sheer scale of the challenge in providing basic mobile access across the continent positions the outdoor segment for unparalleled growth. The economic policies promoting telecom infrastructure investment and the strategic importance of connecting the unconnected are powerful accelerators for outdoor small cell deployments. For instance, countries like Nigeria, Egypt, and South Africa are expected to lead in terms of outdoor small cell deployments due to their large populations and ongoing efforts to improve digital infrastructure. The economic impact of improved connectivity, from enhanced trade to greater educational opportunities, further solidifies the strategic importance of the outdoor segment.

Africa Outdoor Small Cell Market Product Developments

Product innovations in the Africa Outdoor Small Cell Market are increasingly focused on enhanced performance, cost-efficiency, and ease of deployment. Vendors are developing multi-band small cells that support various frequency bands, simplifying network upgrades and reducing hardware requirements. Energy-efficient designs are also a key trend, aligning with sustainability goals and reducing operational expenses. Furthermore, the integration of advanced features like intelligent beamforming and software-defined networking (SDN) capabilities is improving network agility and performance. The competitive advantage lies in offering compact, ruggedized, and easy-to-install solutions that can withstand diverse African environmental conditions while delivering reliable and high-speed connectivity for both consumers and enterprises, crucial for 5G deployment.

Key Drivers of Africa Outdoor Small Cell Market Growth

Several key factors are driving the growth of the Africa Outdoor Small Cell Market. The relentless demand for enhanced mobile broadband and increased data consumption, fueled by a young and growing population, is a primary driver. Governments' commitment to digital inclusion and expanding telecommunications infrastructure through various initiatives and favorable regulatory policies are creating a fertile ground for deployments. The ongoing rollout of 5G networks necessitates denser infrastructure, making small cells a vital component. Furthermore, the increasing adoption of IoT devices and the burgeoning enterprise demand for private mobile networks in sectors like manufacturing and logistics are also significant growth catalysts, pushing for more localized and efficient wireless solutions.

Challenges in the Africa Outdoor Small Cell Market Market

Despite the promising growth, the Africa Outdoor Small Cell Market faces significant challenges. Regulatory hurdles, including complex permitting processes and spectrum allocation complexities across different nations, can impede timely deployments. High upfront investment costs for infrastructure and the need for robust power and backhaul connectivity in remote areas remain a barrier. Supply chain disruptions and the availability of skilled labor for installation and maintenance can also pose significant restraints. Moreover, competition from existing macrocell networks and the need to demonstrate a clear return on investment for operators can create market pressures, with an estimated XX% of potential projects delayed due to these challenges.

Emerging Opportunities in Africa Outdoor Small Cell Market

Emerging opportunities in the Africa Outdoor Small Cell Market are abundant, driven by technological breakthroughs and strategic market expansion. The increasing adoption of neutral host small cell solutions and shared infrastructure models presents a significant opportunity for cost optimization and faster deployment. The growing demand for private LTE/5G networks for industrial use cases, such as smart cities, mining operations, and agricultural automation, offers a substantial growth avenue. Furthermore, partnerships between mobile operators, infrastructure providers, and local governments are crucial for unlocking new deployment models and accelerating connectivity initiatives, particularly in regions with limited existing infrastructure. The potential for satellite backhaul integration also opens new possibilities for connecting remote areas.

Leading Players in the Africa Outdoor Small Cell Market Sector

- T&W Electronics Co Ltd

- Parallel Wireless Inc

- Baicells Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Nokia Corporation

- NEC Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Airspan Networks Inc

Key Milestones in Africa Outdoor Small Cell Market Industry

- November 2023: Parallel Wireless announced the deployment of 2G and 4G networks for a large national operator, focusing on rural and suburban areas in East Africa under the Universal Communications Service Access Fund (UCSAF). This initiative aims to significantly expand cellular connectivity across the region.

- September 2023: InfiniG introduced its first true neutral host service utilizing shared spectrum for enhanced in-building mobile coverage. This innovative service integrates optimized shared infrastructure within buildings, managed by InfiniG’s cloud platform, and seamlessly connects buildings to mobile operator networks with zero manual intervention, streamlining operations and spectrum access.

Strategic Outlook for Africa Outdoor Small Cell Market Market

The strategic outlook for the Africa Outdoor Small Cell Market is overwhelmingly positive, characterized by accelerating growth and expanding opportunities. The continued drive for digital transformation across the continent, coupled with significant investments in telecom infrastructure, will fuel demand for small cell solutions. Key growth accelerators include the widespread adoption of 5G technologies, the increasing need for network densification in both urban and rural areas, and the burgeoning enterprise demand for private mobile networks. Strategic partnerships between technology providers, mobile network operators, and governments will be crucial for overcoming deployment challenges and unlocking the full potential of the market. Focusing on innovative deployment models, such as neutral host solutions and shared infrastructure, will further enhance market penetration and drive the expansion of robust mobile connectivity across Africa.

Africa Outdoor Small Cell Market Segmentation

-

1. Application

- 1.1. Outdoor

- 1.2. Indoor

Africa Outdoor Small Cell Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Outdoor Small Cell Market Regional Market Share

Geographic Coverage of Africa Outdoor Small Cell Market

Africa Outdoor Small Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 36.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents

- 3.3. Market Restrains

- 3.3.1. Various Regulations and Policies Coupled with Storage Issues

- 3.4. Market Trends

- 3.4.1. Outdoor to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 T&W Electronics Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Parallel Wireless Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baicells Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telefonaktiebolaget LM Ericsson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nokia Corporation*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NEC Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZTE Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Airspan Networks Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 T&W Electronics Co Ltd

List of Figures

- Figure 1: Africa Outdoor Small Cell Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Outdoor Small Cell Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Outdoor Small Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 3: Africa Outdoor Small Cell Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 5: Africa Outdoor Small Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 7: Africa Outdoor Small Cell Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Nigeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 11: South Africa Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 13: Egypt Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Egypt Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 15: Kenya Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Ethiopia Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 19: Morocco Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Morocco Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 21: Ghana Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Ghana Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 23: Algeria Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Algeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 25: Tanzania Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 27: Ivory Coast Africa Outdoor Small Cell Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Ivory Coast Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Outdoor Small Cell Market?

The projected CAGR is approximately 36.2%.

2. Which companies are prominent players in the Africa Outdoor Small Cell Market?

Key companies in the market include T&W Electronics Co Ltd, Parallel Wireless Inc, Baicells Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Nokia Corporation*List Not Exhaustive, NEC Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Airspan Networks Inc.

3. What are the main segments of the Africa Outdoor Small Cell Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents.

6. What are the notable trends driving market growth?

Outdoor to Have Significant Share.

7. Are there any restraints impacting market growth?

Various Regulations and Policies Coupled with Storage Issues.

8. Can you provide examples of recent developments in the market?

November 2023 - Parallel Wireless has announced that it will be deploying 2G and 4G networks for a for a large national operator, Where It will focus on rural and suburban areas, deploying and delivering cellular connectivity under the Universal Communications Service Access Fund (UCSAF) in East Africa which is a government initiative aimed to deliver greater coverage to all residents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Outdoor Small Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Outdoor Small Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Outdoor Small Cell Market?

To stay informed about further developments, trends, and reports in the Africa Outdoor Small Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence