Key Insights

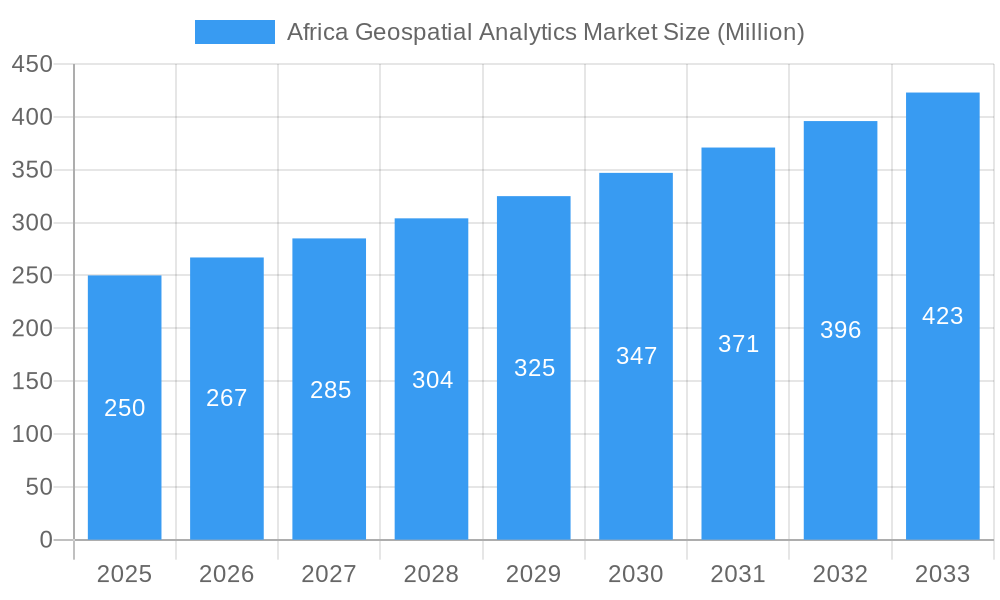

The Africa Geospatial Analytics Market is experiencing robust growth, driven by increasing government investments in infrastructure development, rising adoption of precision agriculture techniques, and the expanding telecommunications sector. The market's Compound Annual Growth Rate (CAGR) of 6.99% from 2019 to 2024 suggests a significant upward trajectory, projected to continue into the forecast period (2025-2033). Key drivers include the need for improved resource management across various sectors like mining, agriculture, and urban planning. The increasing availability of high-resolution satellite imagery, coupled with advancements in data analytics and cloud computing, further fuels market expansion. Segmentation reveals strong demand across end-user verticals, with agriculture, utilities and communication, and government sectors leading the charge. Surface analysis currently holds a significant market share due to its widespread application in mapping and land surveying, but network and geo-visualization analysis segments are poised for rapid growth, fueled by the increasing availability of data and the rising need for sophisticated spatial analysis. While data limitations hinder precise market sizing, considering the CAGR and market dynamics, a reasonable estimation places the 2025 market value at approximately $250 million, anticipating substantial growth exceeding $500 million by 2033.

Africa Geospatial Analytics Market Market Size (In Million)

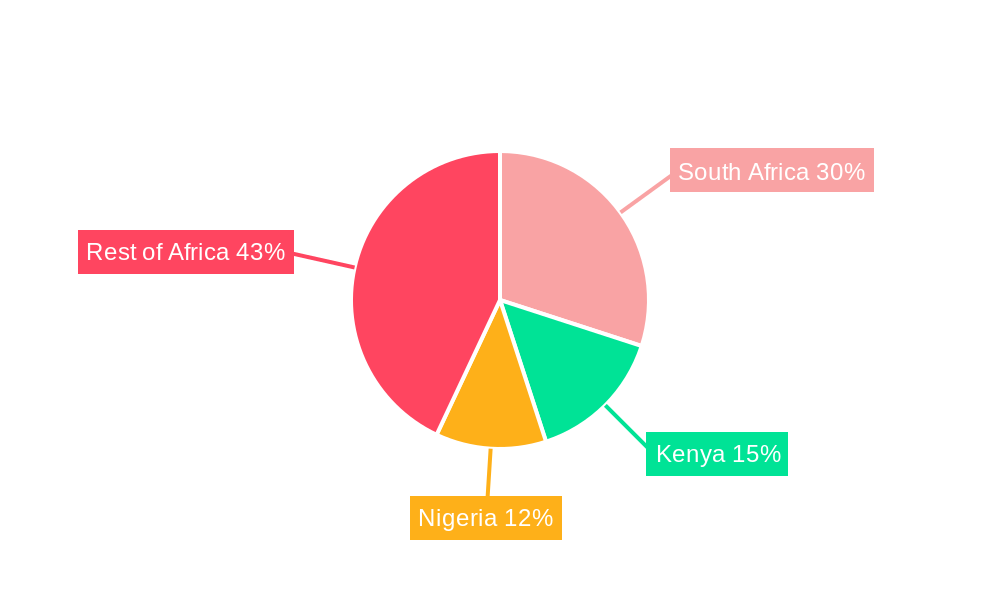

Geographic analysis indicates varied market penetration across Africa, with South Africa, Kenya, and other rapidly developing nations showing higher adoption rates. However, challenges remain, including limited technological infrastructure in certain regions, a shortage of skilled professionals in geospatial analytics, and high initial investment costs for advanced technologies. Despite these restraints, the long-term outlook remains positive, with government initiatives promoting digitalization and technological advancements expected to significantly mitigate these challenges. The competitive landscape is dynamic, with both international giants and regional players vying for market share. Strategic partnerships, technological innovation, and expansion into underserved markets are key success factors for companies operating in this sector. Overall, the African Geospatial Analytics Market presents a lucrative investment opportunity, offering significant potential for growth and innovation across multiple sectors.

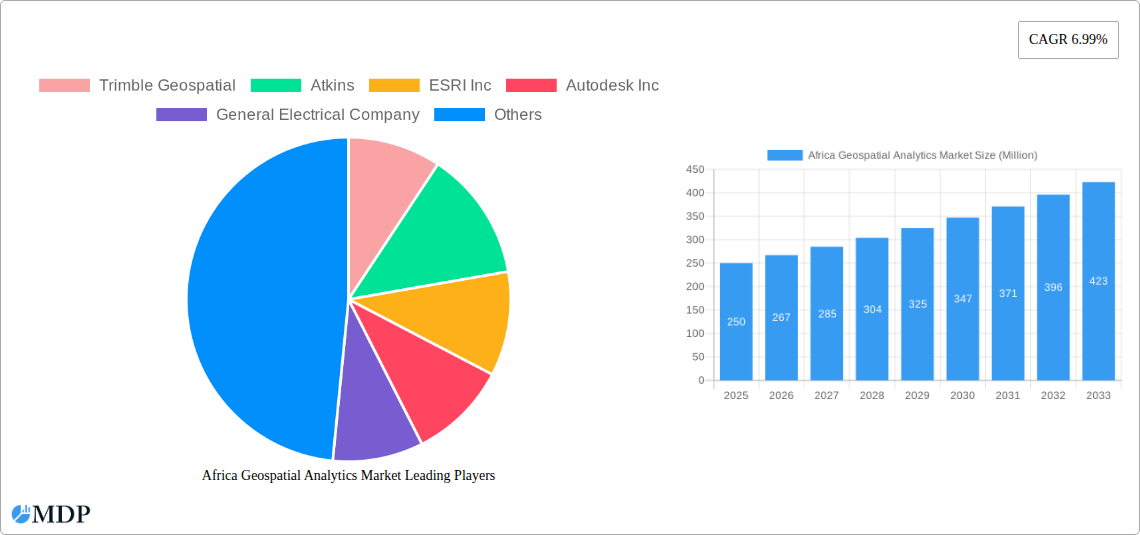

Africa Geospatial Analytics Market Company Market Share

Africa Geospatial Analytics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Geospatial Analytics Market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on the burgeoning opportunities within the African geospatial analytics landscape. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Africa Geospatial Analytics Market Dynamics & Concentration

The Africa Geospatial Analytics market is characterized by a moderately concentrated landscape with a few dominant players and numerous smaller niche players. Market share is largely influenced by technological capabilities, data accessibility, and established client relationships. Innovation drives substantial market growth, fueled by advancements in satellite imagery, AI, and machine learning algorithms. Regulatory frameworks, while varied across African nations, are gradually becoming more supportive of geospatial data utilization, stimulating market expansion. Product substitutes, such as traditional surveying methods, are gradually losing ground to the efficiency and accuracy offered by geospatial analytics. End-user trends are shifting towards cloud-based solutions and advanced analytics for improved decision-making. Mergers and acquisitions (M&A) activity within the sector remains moderate, with an estimated xx M&A deals concluded in the historical period (2019-2024). Key companies are strategically expanding their geographical reach and service offerings to capture market share.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Innovation Drivers: AI, Machine Learning, Cloud Computing, improved satellite imagery resolution.

- Regulatory Landscape: Gradually improving, with increasing emphasis on data governance and standardization.

- M&A Activity: Estimated xx deals in 2019-2024.

Africa Geospatial Analytics Market Industry Trends & Analysis

The Africa Geospatial Analytics market is experiencing robust growth, driven by the increasing adoption of geospatial technologies across various sectors. The rising need for precise mapping, infrastructure development, resource management, and improved agricultural practices is fueling demand. Technological disruptions, such as the proliferation of affordable drones and improved satellite data availability, are lowering the barrier to entry for many businesses. Consumer preferences are shifting towards solutions offering higher accuracy, accessibility, and ease of integration with existing systems. Competitive dynamics are intense, with companies focusing on developing innovative solutions, strengthening partnerships, and expanding into new geographic areas. The market penetration rate is currently estimated at xx% in 2025, expected to increase to xx% by 2033.

Leading Markets & Segments in Africa Geospatial Analytics Market

The Real Estate and Construction, and Mining and Natural Resources segments currently dominate the Africa Geospatial Analytics market, driven by significant infrastructure projects and the need for efficient resource management. South Africa, Nigeria, and Kenya are currently the leading markets due to robust economic growth, substantial investments in infrastructure, and a comparatively developed technological landscape.

Key Drivers for Dominant Segments:

- Real Estate & Construction: Rapid urbanization, infrastructure development projects, and the need for precise land surveying and mapping.

- Mining & Natural Resources: Exploration of mineral deposits, resource management, and environmental impact assessments.

- Agriculture: Precision farming, crop monitoring, and improved yield prediction.

- Government: Urban planning, disaster management, and national security initiatives.

Dominance Analysis:

South Africa leads due to its advanced infrastructure and technological capabilities. Nigeria and Kenya are experiencing rapid growth, fueled by increasing investments in digital infrastructure and the growing adoption of geospatial technologies by both private and public sector organizations.

Africa Geospatial Analytics Market Product Developments

Recent product developments focus on integrating AI and machine learning for advanced data analysis, cloud-based platforms for improved accessibility, and user-friendly interfaces for enhanced usability. These innovations cater to the diverse needs of different end-users, offering tailored solutions for specific applications. The market is witnessing a trend towards integrated platforms providing comprehensive solutions across the entire geospatial analytics workflow. This includes everything from data acquisition and processing to analysis and visualization.

Key Drivers of Africa Geospatial Analytics Market Growth

Several factors are driving the growth of the Africa Geospatial Analytics market:

- Technological Advancements: Improved satellite imagery resolution, the proliferation of drones, and advancements in AI and machine learning algorithms.

- Economic Growth: Increased investments in infrastructure development across many African nations.

- Government Initiatives: Government policies promoting the adoption of geospatial technologies for national development.

Challenges in the Africa Geospatial Analytics Market

Several challenges hinder the growth of the Africa Geospatial Analytics market:

- Data Availability & Accessibility: Inconsistent data quality, and limited access to high-resolution data in some regions.

- Infrastructure Limitations: Inadequate internet connectivity and lack of digital infrastructure in certain areas.

- Skill Gap: Shortage of skilled professionals with expertise in geospatial analytics.

Emerging Opportunities in Africa Geospatial Analytics Market

Significant opportunities exist for businesses in the Africa Geospatial Analytics market, particularly in leveraging emerging technologies to improve data accessibility and affordability. Strategic partnerships with local stakeholders, focusing on capacity building and knowledge transfer, are vital to fostering market expansion. Government initiatives promoting digital transformation and investment in infrastructure development presents a significant catalyst for long-term growth.

Leading Players in the Africa Geospatial Analytics Market Sector

- Trimble Geospatial

- Atkins

- ESRI Inc

- Autodesk Inc

- General Electrical Company

- Eos Data Analytics Inc

- Bentley Systems Inc

- Pitney Bowes Inc

- Intergraph (Hexagon AB)

- Fugro

Key Milestones in Africa Geospatial Analytics Market Industry

- November 2022: Memorandum of Understanding (MOU) signed by SaskTel and Axiom Exploration Group to explore geospatial data applications in Saskatchewan (Note: This event is outside of Africa, but relevant to broader geospatial trends).

- September 2022: Two-day conference on Data Analytics and visualization held in Kenya, highlighting growing interest and collaboration within the sector.

Strategic Outlook for Africa Geospatial Analytics Market

The Africa Geospatial Analytics market is poised for significant growth, driven by increasing technological advancements, economic development, and supportive government policies. Strategic partnerships, investments in human capital development, and the adoption of innovative solutions will be critical for companies seeking to capitalize on the immense market potential. Focusing on addressing challenges related to data accessibility and infrastructure limitations will unlock significant opportunities for sustainable market expansion.

Africa Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geo-visualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

Africa Geospatial Analytics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Geospatial Analytics Market Regional Market Share

Geographic Coverage of Africa Geospatial Analytics Market

Africa Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Commercialization of spatial data; Increased smart city & infrastructure projects

- 3.3. Market Restrains

- 3.3.1. High costs associated with geospatial technologies

- 3.4. Market Trends

- 3.4.1. Commercialization of Spatial Data

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geo-visualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trimble Geospatial

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atkins

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ESRI Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Autodesk Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electrical Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eos Data Analytics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bentley Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pitney Bowes Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Intergraph (Hexagon AB)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fugro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trimble Geospatial

List of Figures

- Figure 1: Africa Geospatial Analytics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Geospatial Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Geospatial Analytics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Africa Geospatial Analytics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Africa Geospatial Analytics Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 4: Africa Geospatial Analytics Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 5: Africa Geospatial Analytics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Africa Geospatial Analytics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Africa Geospatial Analytics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Africa Geospatial Analytics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Africa Geospatial Analytics Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 10: Africa Geospatial Analytics Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 11: Africa Geospatial Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Africa Geospatial Analytics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Geospatial Analytics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Geospatial Analytics Market?

The projected CAGR is approximately 19%.

2. Which companies are prominent players in the Africa Geospatial Analytics Market?

Key companies in the market include Trimble Geospatial, Atkins, ESRI Inc, Autodesk Inc, General Electrical Company, Eos Data Analytics Inc, Bentley Systems Inc, Pitney Bowes Inc , Intergraph (Hexagon AB), Fugro.

3. What are the main segments of the Africa Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Commercialization of spatial data; Increased smart city & infrastructure projects.

6. What are the notable trends driving market growth?

Commercialization of Spatial Data.

7. Are there any restraints impacting market growth?

High costs associated with geospatial technologies.

8. Can you provide examples of recent developments in the market?

November 2022: A Memorandum of Understanding (MOU) was signed by SaskTel and Axiom Exploration Group to jointly explore opportunities to assist organizations throughout Saskatchewan in enhancing and modernizing their operations through the gathering and analysis of geospatial and other geophysical data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the Africa Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence