Key Insights

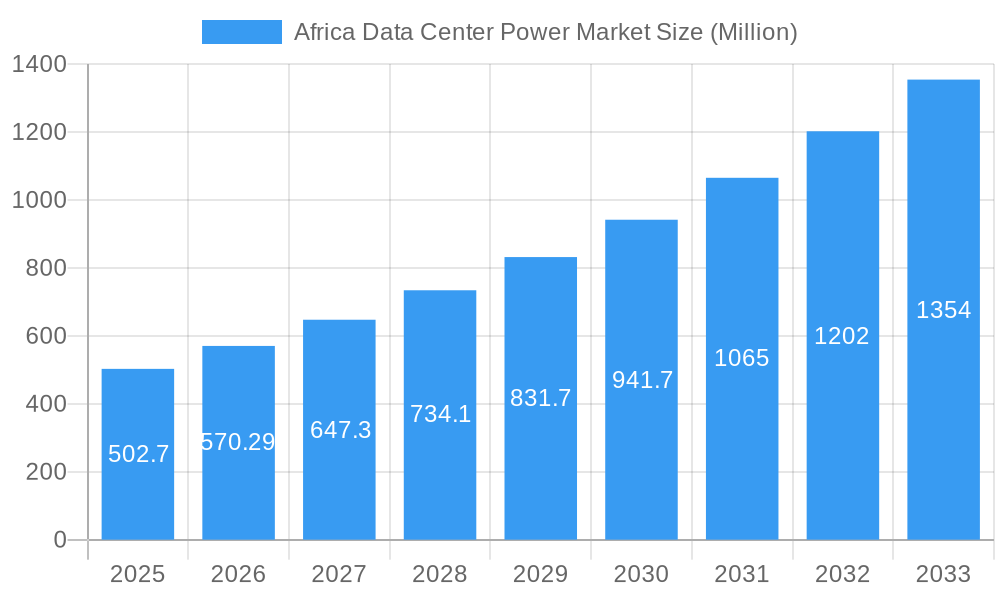

The Africa Data Center Power Market is poised for remarkable expansion, projected to reach a substantial USD 502.70 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 13.40% during the study period of 2019-2033. This significant growth is primarily fueled by the escalating demand for reliable and efficient power solutions to support the burgeoning data center infrastructure across the continent. Key drivers include the rapid digitalization initiatives, the increasing adoption of cloud computing services, and the proliferation of Internet of Things (IoT) devices, all of which necessitate advanced power management to ensure uninterrupted operations. Furthermore, government investments in digital transformation and the expansion of IT and telecommunication networks are creating a fertile ground for data center development, directly boosting the demand for UPS systems, generators, and sophisticated power distribution solutions.

Africa Data Center Power Market Market Size (In Million)

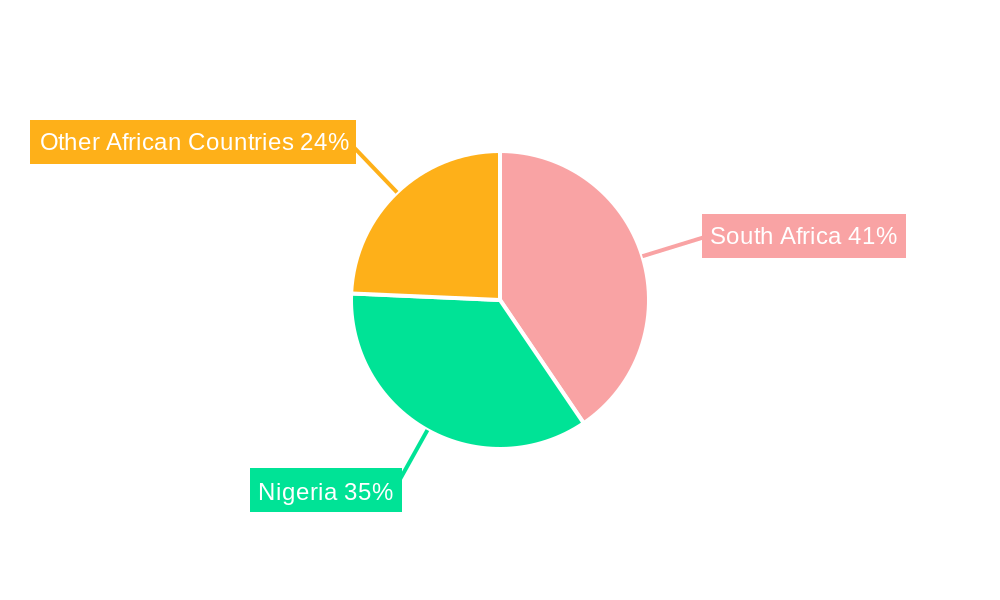

The market's dynamism is further characterized by several strategic trends and evolving segments. The Power Infrastructure segment is witnessing a surge in demand for advanced UPS systems and generators, critical for maintaining uptime in data centers. Power distribution solutions, including PDUs, switchgear, and transfer switches, are also seeing substantial growth as operators focus on optimizing power delivery and redundancy. The Service segment is gaining prominence, with an increasing focus on maintenance, monitoring, and energy efficiency solutions, reflecting a shift towards operational excellence. Key end-user industries like IT and Telecommunication, BFSI, and Government are leading this charge, heavily investing in data center upgrades and new builds. Geographically, South Africa and Nigeria are emerging as primary hubs, attracting significant investment due to their established digital economies and strategic locations. While the market enjoys strong growth prospects, potential restraints such as the high initial investment costs for advanced power solutions and intermittent grid reliability in some regions could pose challenges, necessitating robust hybrid power solutions and resilient infrastructure development.

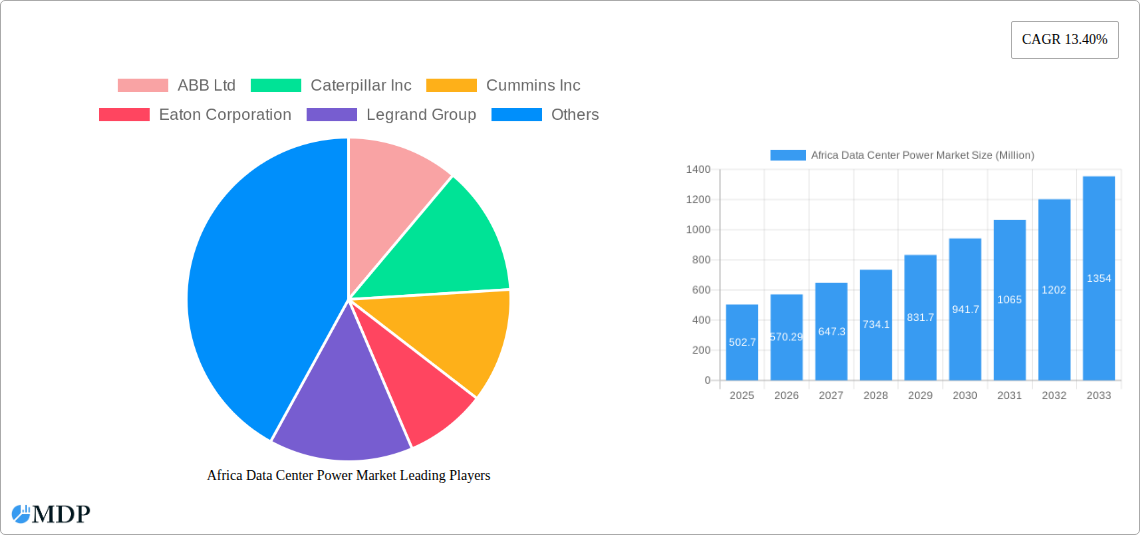

Africa Data Center Power Market Company Market Share

This in-depth report provides a definitive analysis of the Africa Data Center Power Market, spanning the historical period of 2019-2024 and extending through a comprehensive forecast period of 2025-2033, with the base and estimated year being 2025. We delve into the critical power infrastructure solutions, essential services, and key end-user industries that are shaping the rapid evolution of data center capacity across the African continent. With an estimated market size projected to reach $XX Billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of XX%, this report is an indispensable resource for industry stakeholders, investors, and decision-makers seeking to capitalize on this burgeoning market.

Gain crucial insights into market concentration, innovation drivers, regulatory landscapes, product substitutes, evolving end-user needs, and strategic M&A activities. Understand the competitive dynamics, technological disruptions, and consumer preferences that are fueling Africa's data center power market growth. Discover the leading markets and segments within Power Infrastructure, including UPS Systems, Generators, and Power Distribution Solutions (PDU, Switchgear, Critical Power Distribution, Transfer Switches, Remote Power Panels, Others), alongside the vital Service sector and key End Users like IT and Telecommunication, BFSI, Government, Media and Entertainment, and Other End Users. Uncover critical product developments, identify key growth drivers, analyze market challenges, and explore emerging opportunities to inform your strategic planning.

This report meticulously examines the data center power solutions in South Africa and Nigeria, two pivotal geographical markets. Featuring analyses of prominent companies such as ABB Ltd, Caterpillar Inc, Cummins Inc, Eaton Corporation, Legrand Group, Rolls-Royce PLC, Vertiv Group Corp, Schneider Electric SE, Rittal GmbH & Co KG, Fujitsu Limited, and Cisco Systems Inc (list not exhaustive), you will gain a comprehensive understanding of the competitive landscape and key industry developments, including significant milestones from December 2023 and November 2023.

Africa Data Center Power Market Market Dynamics & Concentration

The Africa Data Center Power Market is characterized by increasing concentration among a few key players, particularly in the provision of critical power infrastructure and associated services. While the market exhibits robust growth, driving innovation, a significant portion of market share is held by established multinational corporations offering advanced UPS systems, generators, and power distribution solutions. The innovation landscape is heavily influenced by the demand for higher energy efficiency, enhanced redundancy, and intelligent monitoring capabilities to ensure business continuity for data centers. Regulatory frameworks are evolving across various African nations, with a growing emphasis on power quality, safety standards, and increasingly, sustainability. Product substitutes exist, but the criticality of reliable power in data center operations limits their widespread adoption. End-user trends clearly indicate a surge in demand from the IT and Telecommunication sector, followed by BFSI and Government, due to digital transformation initiatives and cloud adoption. Mergers and Acquisitions (M&A) activities, while not as frequent as in more mature markets, are on the rise as larger players seek to consolidate their presence and acquire regional expertise. The market share distribution is dynamic, with top players holding significant portions of the UPS systems market and generator sets market. M&A deal counts are projected to increase in the coming years as companies aim for strategic expansion.

Africa Data Center Power Market Industry Trends & Analysis

The Africa Data Center Power Market is experiencing an unprecedented surge, driven by a confluence of factors that are accelerating digital transformation and cloud adoption across the continent. One of the primary market growth drivers is the exponential increase in data generation and consumption, fueled by the expanding internet penetration, the proliferation of mobile devices, and the growing adoption of 5G technology. This necessitates the construction and expansion of data center facilities, directly impacting the demand for robust and reliable power infrastructure. Technological disruptions are playing a pivotal role, with advancements in UPS systems offering higher power densities, improved energy efficiency, and enhanced battery technologies, such as lithium-ion. Furthermore, the integration of digital monitoring and control systems within power distribution solutions is becoming a standard, enabling real-time performance tracking, predictive maintenance, and optimized energy management. Consumer preferences are increasingly tilting towards solutions that guarantee high availability and minimal downtime, pushing manufacturers to develop more resilient and fault-tolerant power systems. The competitive dynamics are intensifying, with both global leaders and emerging regional players vying for market share. Companies are focusing on offering integrated solutions that encompass not only hardware but also comprehensive services, including installation, maintenance, and managed power solutions. The market penetration of advanced data center power solutions is expected to rise significantly as cloud providers and colocation facilities prioritize Tier-rated infrastructure. The projected CAGR of XX% for the forecast period underscores the substantial growth trajectory of this market.

Leading Markets & Segments in Africa Data Center Power Market

The Africa Data Center Power Market is witnessing dominant growth in specific geographical regions and segments, driven by a combination of economic policies, infrastructure development, and burgeoning digital economies.

Dominant Geography:

South Africa: This country remains a cornerstone of the African data center landscape, benefiting from relatively established infrastructure, a mature IT sector, and significant foreign investment. Its dominance is fueled by:

- Economic Policies: Government initiatives promoting digital infrastructure and investment.

- Infrastructure: Existing power grids, though facing challenges, are more developed compared to many other regions.

- Market Maturity: A higher density of existing data centers and a strong demand from established enterprises.

- Colocation Growth: Significant expansion of colocation facilities catering to local and international cloud providers.

Nigeria: As Africa's largest economy and most populous nation, Nigeria presents a rapidly growing market. Key drivers for its ascent include:

- Digital Transformation: Aggressive adoption of digital services across various sectors.

- Investment Inflow: Increasing interest from global data center operators and investors.

- Demand from Telecom: The booming telecommunications sector requires substantial data processing and storage capabilities.

Dominant Segments:

Power Infrastructure: Electrical Solution: This is the most crucial segment, encompassing the core components required for data center power.

- UPS Systems: The demand for Uninterruptible Power Supply (UPS) systems is paramount, with a focus on high-capacity, scalable solutions to ensure uninterrupted operations during power fluctuations.

- Generators: Critical for providing backup power, the market for generator sets, particularly diesel and increasingly, hybrid solutions, is robust. Reliability and fuel efficiency are key considerations.

- Power Distribution Solutions: This sub-segment is critical for managing and distributing power effectively.

- PDU (Power Distribution Units): Intelligent PDUs with remote monitoring and control capabilities are in high demand.

- Switchgear: Essential for protection and control of electrical power circuits.

- Critical Power Distribution: Solutions designed for high-density power delivery and redundancy.

- Transfer Switches: Automatic Transfer Switches (ATS) are vital for seamless switching between utility power and backup sources.

- Remote Power Panels (RPPs): Increasingly used in larger data center facilities for localized power distribution.

- Others: This includes a range of specialized power management and distribution components.

Service: The demand for associated services is growing in tandem with infrastructure sales.

- Installation and Maintenance: Ensuring the proper functioning and longevity of power systems.

- Consulting and Design: Expertise in designing efficient and reliable power architectures.

- Managed Power Solutions: Offering end-to-end power management for data centers.

End User: IT and Telecommunication: This sector consistently represents the largest consumer of data center power solutions, driven by the relentless expansion of cloud services, mobile networks, and digital platforms.

End User: BFSI (Banking, Financial Services, and Insurance): The increasing reliance on digital banking, fintech, and secure data management makes this sector a significant driver for data center power investments.

End User: Government: Governments are investing in e-governance initiatives, smart city projects, and national data infrastructure, all of which contribute to data center power demand.

Africa Data Center Power Market Product Developments

Product development in the Africa Data Center Power Market is heavily focused on enhancing reliability, efficiency, and intelligence. Innovations in UPS systems are emphasizing modular designs for scalability and the integration of advanced battery technologies like lithium-ion for longer lifespans and faster charging. Generator sets are seeing advancements in fuel efficiency and emissions control, with a growing interest in hybrid solutions. Within Power Distribution Solutions, the trend is towards intelligent PDUs offering granular power monitoring, remote management capabilities, and advanced security features. The development of integrated digital monitoring and control technology is a significant trend, allowing for predictive maintenance and optimized energy usage. These product advancements are crucial for meeting the stringent uptime requirements of modern data centers and addressing the growing concern for energy sustainability across the continent.

Key Drivers of Africa Data Center Power Market Growth

The rapid expansion of the Africa Data Center Power Market is propelled by several interconnected drivers. The escalating demand for digital services, driven by increasing internet penetration and mobile adoption, is a primary catalyst. This fuels the need for new data center builds and expansions. Furthermore, significant investments in cloud computing and colocation facilities by both local and international providers are creating substantial market opportunities. Government initiatives aimed at fostering digital economies and attracting foreign investment also play a crucial role. The increasing adoption of technologies like AI and IoT necessitates greater data processing and storage capabilities, further boosting demand for reliable power infrastructure.

Challenges in the Africa Data Center Power Market Market

Despite its promising growth, the Africa Data Center Power Market faces several significant challenges. The unreliable nature of existing power grids in many regions leads to a heightened reliance on expensive backup power solutions like generators, increasing operational costs. Regulatory hurdles and complex permitting processes can also slow down project development. Supply chain disruptions, exacerbated by logistical complexities and import duties, can impact the timely delivery of critical power equipment. Furthermore, the scarcity of skilled labor for installation, maintenance, and operation of advanced power systems poses a restraint. Intense competition from established global players and emerging local entities can also put pressure on pricing and profit margins.

Emerging Opportunities in Africa Data Center Power Market

Emerging opportunities in the Africa Data Center Power Market are primarily driven by technological breakthroughs and strategic market expansion. The increasing adoption of renewable energy sources, such as solar and wind power, presents an opportunity for hybrid power solutions that integrate with traditional backup systems, enhancing sustainability and reducing operational costs. The development of edge data centers, closer to end-users for reduced latency, is creating new demand pockets. Strategic partnerships between power equipment manufacturers, data center developers, and local utility providers are crucial for overcoming infrastructure challenges and unlocking new markets. Furthermore, the growing demand for hyperscale data centers to support cloud giants offers significant potential for large-scale power infrastructure projects.

Leading Players in the Africa Data Center Power Market Sector

- ABB Ltd

- Caterpillar Inc

- Cummins Inc

- Eaton Corporation

- Legrand Group

- Rolls-Royce PLC

- Vertiv Group Corp

- Schneider Electric SE

- Rittal GmbH & Co KG

- Fujitsu Limited

- Cisco Systems Inc

Key Milestones in Africa Data Center Power Market Industry

- December 2023: Eaton Corporation announced the launch of its new Rack PDU G4 (4th generation), designed for high-security and business continuity data centers. This product features C39 outlets that securely connect both C14 and C20 power cords, incorporating a locking mechanism and a built-in high retention system for robust power cord security.

- November 2023: ABB Ltd launched the Protecta Power panel board, tailored for industrial, commercial, and institutional buildings. This innovative panel board integrates digital monitoring and control technology, significantly enhancing durability and safety in power distribution.

Strategic Outlook for Africa Data Center Power Market Market

The strategic outlook for the Africa Data Center Power Market is overwhelmingly positive, characterized by a consistent growth trajectory fueled by digitalization and infrastructure development. Key growth accelerators include the continued expansion of cloud services, the deployment of 5G networks, and the increasing adoption of IoT and AI. Strategic opportunities lie in the development of more sustainable and energy-efficient power solutions, including the integration of renewable energy sources and advanced battery storage. Furthermore, companies that can offer comprehensive, end-to-end power management services, coupled with localized expertise and support, will be well-positioned to capitalize on the market's potential. Investments in modular and scalable power infrastructure will be crucial to meet the dynamic demands of Africa's rapidly growing data center sector.

Africa Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Others

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT and Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media and Entertainment

- 2.5. Other End Users

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

Africa Data Center Power Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

Africa Data Center Power Market Regional Market Share

Geographic Coverage of Africa Data Center Power Market

Africa Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Others

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media and Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. South Africa Africa Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6.1.1. Electrical Solution

- 6.1.1.1. UPS Systems

- 6.1.1.2. Generators

- 6.1.1.3. Power Distribution Solutions

- 6.1.1.3.1. PDU

- 6.1.1.3.2. Switchgear

- 6.1.1.3.3. Critical Power Distribution

- 6.1.1.3.4. Transfer Switches

- 6.1.1.3.5. Remote Power Panels

- 6.1.1.3.6. Others

- 6.1.2. Service

- 6.1.1. Electrical Solution

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media and Entertainment

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 7. Nigeria Africa Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 7.1.1. Electrical Solution

- 7.1.1.1. UPS Systems

- 7.1.1.2. Generators

- 7.1.1.3. Power Distribution Solutions

- 7.1.1.3.1. PDU

- 7.1.1.3.2. Switchgear

- 7.1.1.3.3. Critical Power Distribution

- 7.1.1.3.4. Transfer Switches

- 7.1.1.3.5. Remote Power Panels

- 7.1.1.3.6. Others

- 7.1.2. Service

- 7.1.1. Electrical Solution

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media and Entertainment

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 ABB Ltd

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Caterpillar Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Cummins Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Eaton Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Legrand Group

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Rolls-Royce PLC

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Vertiv Group Corp

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Schneider Electric SE

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Rittal GmbH & Co KG

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Fujitsu Limited

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Cisco Systems Inc *List Not Exhaustive

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 ABB Ltd

List of Figures

- Figure 1: Global Africa Data Center Power Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Africa Data Center Power Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: South Africa Africa Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 4: South Africa Africa Data Center Power Market Volume (Million), by Power Infrastructure 2025 & 2033

- Figure 5: South Africa Africa Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 6: South Africa Africa Data Center Power Market Volume Share (%), by Power Infrastructure 2025 & 2033

- Figure 7: South Africa Africa Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 8: South Africa Africa Data Center Power Market Volume (Million), by End User 2025 & 2033

- Figure 9: South Africa Africa Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: South Africa Africa Data Center Power Market Volume Share (%), by End User 2025 & 2033

- Figure 11: South Africa Africa Data Center Power Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: South Africa Africa Data Center Power Market Volume (Million), by Geography 2025 & 2033

- Figure 13: South Africa Africa Data Center Power Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: South Africa Africa Data Center Power Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: South Africa Africa Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South Africa Africa Data Center Power Market Volume (Million), by Country 2025 & 2033

- Figure 17: South Africa Africa Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South Africa Africa Data Center Power Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Nigeria Africa Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 20: Nigeria Africa Data Center Power Market Volume (Million), by Power Infrastructure 2025 & 2033

- Figure 21: Nigeria Africa Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 22: Nigeria Africa Data Center Power Market Volume Share (%), by Power Infrastructure 2025 & 2033

- Figure 23: Nigeria Africa Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 24: Nigeria Africa Data Center Power Market Volume (Million), by End User 2025 & 2033

- Figure 25: Nigeria Africa Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 26: Nigeria Africa Data Center Power Market Volume Share (%), by End User 2025 & 2033

- Figure 27: Nigeria Africa Data Center Power Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Nigeria Africa Data Center Power Market Volume (Million), by Geography 2025 & 2033

- Figure 29: Nigeria Africa Data Center Power Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Nigeria Africa Data Center Power Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Nigeria Africa Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Nigeria Africa Data Center Power Market Volume (Million), by Country 2025 & 2033

- Figure 33: Nigeria Africa Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Nigeria Africa Data Center Power Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Africa Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 2: Global Africa Data Center Power Market Volume Million Forecast, by Power Infrastructure 2020 & 2033

- Table 3: Global Africa Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Africa Data Center Power Market Volume Million Forecast, by End User 2020 & 2033

- Table 5: Global Africa Data Center Power Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Africa Data Center Power Market Volume Million Forecast, by Geography 2020 & 2033

- Table 7: Global Africa Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Africa Data Center Power Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global Africa Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 10: Global Africa Data Center Power Market Volume Million Forecast, by Power Infrastructure 2020 & 2033

- Table 11: Global Africa Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Africa Data Center Power Market Volume Million Forecast, by End User 2020 & 2033

- Table 13: Global Africa Data Center Power Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global Africa Data Center Power Market Volume Million Forecast, by Geography 2020 & 2033

- Table 15: Global Africa Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Africa Data Center Power Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Global Africa Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 18: Global Africa Data Center Power Market Volume Million Forecast, by Power Infrastructure 2020 & 2033

- Table 19: Global Africa Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Africa Data Center Power Market Volume Million Forecast, by End User 2020 & 2033

- Table 21: Global Africa Data Center Power Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Africa Data Center Power Market Volume Million Forecast, by Geography 2020 & 2033

- Table 23: Global Africa Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Africa Data Center Power Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Power Market?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Africa Data Center Power Market?

Key companies in the market include ABB Ltd, Caterpillar Inc, Cummins Inc, Eaton Corporation, Legrand Group, Rolls-Royce PLC, Vertiv Group Corp, Schneider Electric SE, Rittal GmbH & Co KG, Fujitsu Limited, Cisco Systems Inc *List Not Exhaustive.

3. What are the main segments of the Africa Data Center Power Market?

The market segments include Power Infrastructure, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 502.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

8. Can you provide examples of recent developments in the market?

December 2023: Eaton Corporation announced the launch of its new Rack PDU G4 (4th generation), which provides a high-security and business continuity data center. It also combines with C39 outlets that securely connect both C14 and C20 power cords, backed by a locking mechanism and a built-in high retention system that secures the power cord.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Power Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence