Key Insights

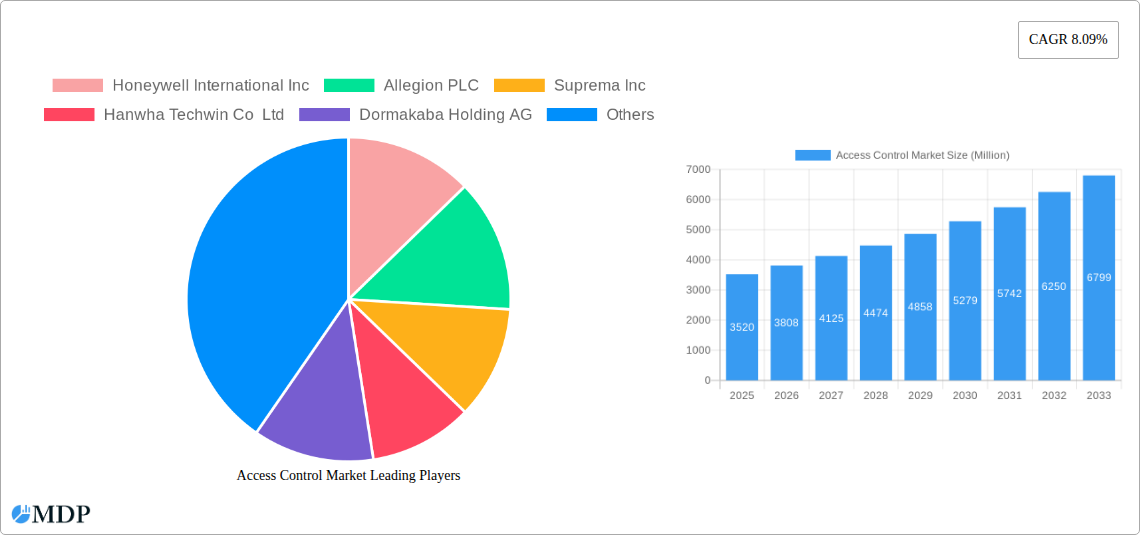

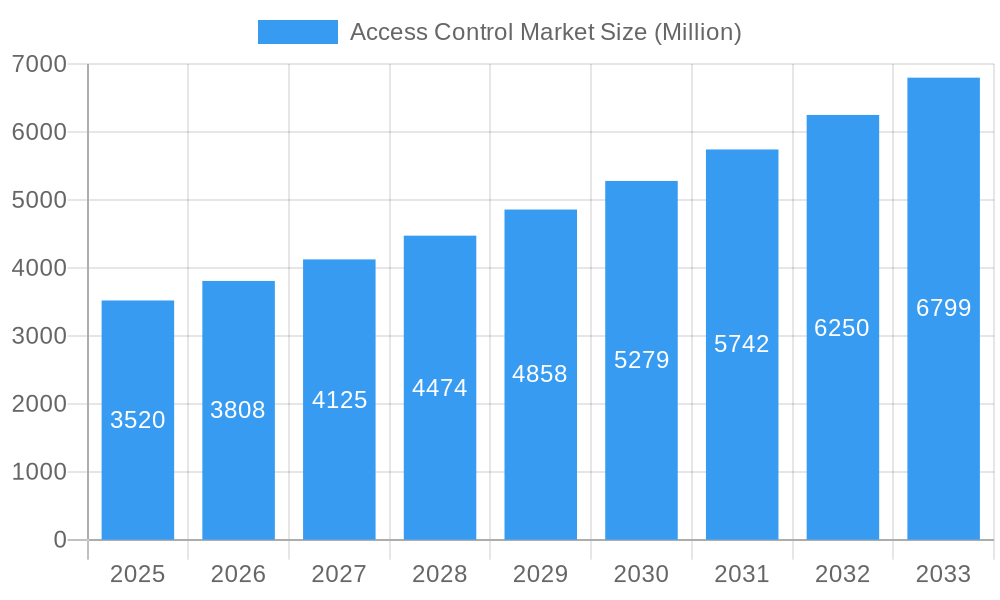

The global access control market, valued at $3.52 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.09% from 2025 to 2033. This expansion is fueled by several key factors. Increasing security concerns across various sectors, including commercial, residential, and governmental entities, are prompting significant investments in advanced access control systems. The rising adoption of smart technologies, such as biometric readers and contactless smart cards, is further accelerating market growth. Furthermore, the increasing integration of access control systems with other security solutions, like video surveillance and intrusion detection, is creating new opportunities for market expansion. The market's segmentation reveals strong demand across diverse end-user verticals. Commercial applications, driven by the need for robust security in offices and retail spaces, represent a significant portion of the market. Residential applications are also experiencing growth, fueled by increased consumer awareness of home security and the availability of user-friendly smart home access control solutions. Government and industrial sectors contribute substantially, owing to stringent security protocols and the need for efficient workforce management.

Access Control Market Market Size (In Billion)

The market's growth trajectory, however, isn't without its challenges. High initial investment costs associated with implementing sophisticated access control systems can serve as a restraint, particularly for smaller businesses and residential users. Furthermore, concerns surrounding data privacy and security, especially with biometric systems, necessitate robust cybersecurity measures and can potentially dampen growth in certain segments. Despite these restraints, the market is poised for significant expansion, propelled by ongoing technological advancements, increasing demand for enhanced security, and the emergence of integrated security solutions. Key players like Honeywell, Allegion, and Suprema are actively shaping the market landscape through innovation and strategic partnerships, further solidifying the market's upward trajectory. The continued integration of AI and machine learning into access control systems is poised to further enhance security and efficiency, driving future growth.

Access Control Market Company Market Share

Access Control Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Access Control Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a holistic view of market dynamics, trends, and future projections. The global market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Access Control Market Market Dynamics & Concentration

The Access Control Market is characterized by a moderately concentrated landscape with several major players holding significant market share. Honeywell International Inc, Allegion PLC, and ASSA ABLOY AB Group are among the leading companies, collectively commanding an estimated xx% market share in 2025. Market concentration is influenced by factors such as high initial investment costs for technology development and deployment, stringent regulatory compliance requirements, and the need for specialized expertise in integration and maintenance.

Innovation Drivers: The market witnesses continuous innovation driven by advancements in biometric technology, cloud-based access control systems, and integration with IoT platforms. This leads to enhanced security, improved user experience, and increased operational efficiency.

Regulatory Frameworks: Stringent government regulations regarding data privacy and security are shaping the market landscape, driving demand for compliant and secure access control solutions. Compliance costs and the complexity of regulations can impact market growth.

Product Substitutes: While few direct substitutes exist, alternative security measures such as traditional lock-and-key systems still hold a presence, particularly in low-security applications. However, the increasing need for sophisticated security and remote management capabilities are driving adoption of access control systems.

End-User Trends: The increasing adoption of smart building technologies and the rising demand for enhanced security in commercial, residential, and government sectors are significant growth drivers. The preference for user-friendly interfaces and integrated security solutions is also influencing market trends.

M&A Activities: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with approximately xx M&A deals recorded between 2019 and 2024. These activities are primarily driven by companies seeking to expand their product portfolio, enhance their technological capabilities, and gain market share.

Access Control Market Industry Trends & Analysis

The Access Control Market is experiencing robust growth, fueled by several key trends. The increasing adoption of smart technologies, the growing awareness of security threats, and rising demand for remote access capabilities are primary growth drivers. The market shows a strong preference for integrated solutions that seamlessly combine various security technologies such as video surveillance, intrusion detection, and access control. This trend is further accentuated by the increasing adoption of cloud-based platforms that provide centralized management and remote monitoring capabilities. The global market exhibits a CAGR of xx% during the forecast period (2025-2033), with a projected market penetration rate of xx% by 2033.

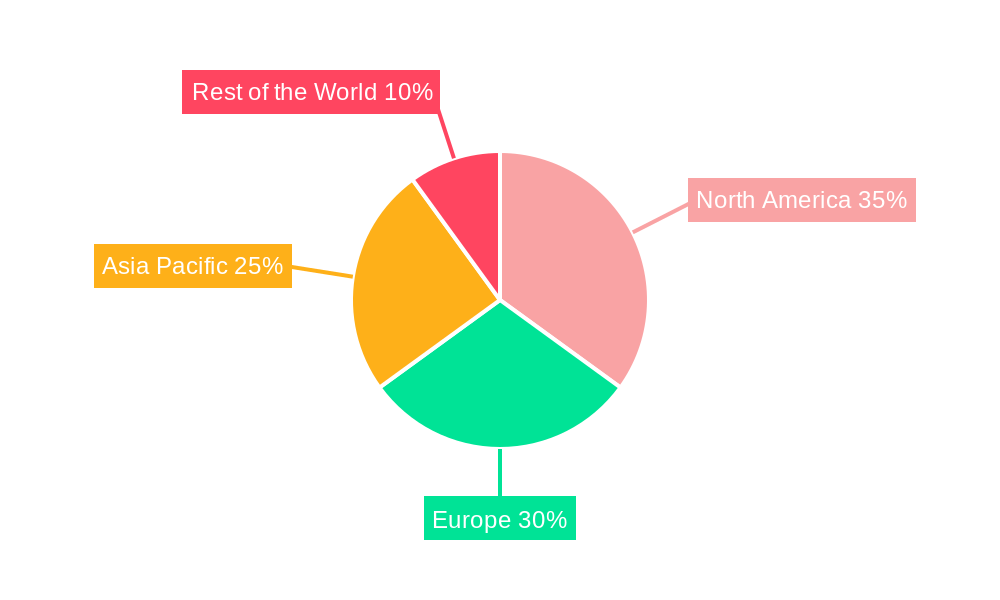

Leading Markets & Segments in Access Control Market

The commercial sector currently dominates the Access Control Market, accounting for approximately xx% of the total market revenue in 2025. North America and Europe are the leading regional markets, driven by high adoption rates in commercial buildings and robust government investments in security infrastructure. Among the different product types, Card Reader and Access Control Devices currently holds the largest market share, although the Biometric Readers segment is expected to experience significant growth due to increasing adoption in high-security applications.

Key Drivers in Commercial Segment: High security concerns, stringent regulatory requirements, and increasing adoption of smart building technologies.

Key Drivers in North America: High disposable incomes, advanced technological infrastructure, and strong government initiatives to enhance security.

Key Drivers in Biometric Readers Segment: Enhanced security, user convenience, and increasing integration with other security systems.

Access Control Market Product Developments

Recent product innovations in the Access Control Market include the integration of advanced biometric technologies such as facial recognition and fingerprint scanning, along with cloud-based platforms for remote management and monitoring. The development of user-friendly interfaces and interoperable systems is also enhancing market competitiveness. These advancements improve security, simplify management, and provide cost-effective solutions. Moreover, the integration with other security systems enhances the overall security infrastructure.

Key Drivers of Access Control Market Growth

Technological advancements, including the development of more sophisticated biometric technologies and improved software solutions, are driving significant market growth. Stringent government regulations related to security and data privacy also contribute to increased demand. Furthermore, the rising adoption of smart building technologies and the expansion of the Internet of Things (IoT) are creating new opportunities for the growth of the access control market. Economic factors such as rising disposable incomes, especially in developing countries, also contribute significantly to market expansion.

Challenges in the Access Control Market Market

The Access Control Market faces several challenges including the high initial investment cost for implementing sophisticated access control systems, particularly in smaller organizations. Supply chain disruptions, especially with the increasing reliance on electronic components, can impact the availability of products and result in increased costs. Finally, intense competition among established players and the entry of new entrants in the market creates significant pricing pressures. This intensifies the need for companies to constantly innovate and differentiate their offerings.

Emerging Opportunities in Access Control Market

The integration of AI and machine learning technologies into access control systems offers significant opportunities for enhanced security and operational efficiency. Strategic partnerships between technology providers and system integrators will drive the adoption of advanced solutions. Moreover, the expansion into emerging markets, particularly in developing countries with increasing urbanization and infrastructure development, promises significant growth potential for access control system providers.

Leading Players in the Access Control Market Sector

- Honeywell International Inc

- Allegion PLC

- Suprema Inc

- Hanwha Techwin Co Ltd

- Dormakaba Holding AG

- Tyco International Plc (Johnson Controls)

- Schneider Electric SE

- NEC Corporation

- Nedap NV

- Axis Communications AB

- ASSA ABLOY AB Group

- Thales Group (Gemalto NV)

- Idemia Group

- Identiv Inc

- Bosch Security System Inc

- Brivo Systems LLC

- Panasonic Corporation

Key Milestones in Access Control Market Industry

February 2023: Air Canada launches a digital facial recognition pilot program for selected flights and airport lounges, showcasing the adoption of biometric technology in the transportation sector.

March 2023: Axis Communications and Genetec Inc. partner to launch a new enterprise-level access control solution, highlighting the trend towards integrated security systems and ease of deployment.

Strategic Outlook for Access Control Market Market

The Access Control Market is poised for continued growth, driven by technological innovation, increased security concerns, and expanding applications across various sectors. Strategic partnerships, expansion into emerging markets, and the development of innovative, user-friendly, and integrated solutions will be key to success in this dynamic market. The focus on cloud-based solutions, biometric technologies, and interoperability will define the future landscape.

Access Control Market Segmentation

-

1. Type

-

1.1. Card Reader and Access Control Devices

- 1.1.1. Card-based

- 1.1.2. Proximity

- 1.1.3. Smart Card (Contact and Contactless)

- 1.2. Biometric Readers

- 1.3. Electronic Locks

- 1.4. Software

- 1.5. Other Types

-

1.1. Card Reader and Access Control Devices

-

2. End User Vertical

- 2.1. Commercial

- 2.2. Residential

- 2.3. Government

- 2.4. Industrial

- 2.5. Transport and Logistics

- 2.6. Healthcare

- 2.7. Military and Defense

- 2.8. Other End User Verticals

Access Control Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of the Asia Pacific

- 4. Rest of the World

Access Control Market Regional Market Share

Geographic Coverage of Access Control Market

Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Performance Constraint of Cryocoolers

- 3.4. Market Trends

- 3.4.1. Commercial Segment to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Access Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Reader and Access Control Devices

- 5.1.1.1. Card-based

- 5.1.1.2. Proximity

- 5.1.1.3. Smart Card (Contact and Contactless)

- 5.1.2. Biometric Readers

- 5.1.3. Electronic Locks

- 5.1.4. Software

- 5.1.5. Other Types

- 5.1.1. Card Reader and Access Control Devices

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Government

- 5.2.4. Industrial

- 5.2.5. Transport and Logistics

- 5.2.6. Healthcare

- 5.2.7. Military and Defense

- 5.2.8. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Access Control Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Card Reader and Access Control Devices

- 6.1.1.1. Card-based

- 6.1.1.2. Proximity

- 6.1.1.3. Smart Card (Contact and Contactless)

- 6.1.2. Biometric Readers

- 6.1.3. Electronic Locks

- 6.1.4. Software

- 6.1.5. Other Types

- 6.1.1. Card Reader and Access Control Devices

- 6.2. Market Analysis, Insights and Forecast - by End User Vertical

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.2.3. Government

- 6.2.4. Industrial

- 6.2.5. Transport and Logistics

- 6.2.6. Healthcare

- 6.2.7. Military and Defense

- 6.2.8. Other End User Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Access Control Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Card Reader and Access Control Devices

- 7.1.1.1. Card-based

- 7.1.1.2. Proximity

- 7.1.1.3. Smart Card (Contact and Contactless)

- 7.1.2. Biometric Readers

- 7.1.3. Electronic Locks

- 7.1.4. Software

- 7.1.5. Other Types

- 7.1.1. Card Reader and Access Control Devices

- 7.2. Market Analysis, Insights and Forecast - by End User Vertical

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.2.3. Government

- 7.2.4. Industrial

- 7.2.5. Transport and Logistics

- 7.2.6. Healthcare

- 7.2.7. Military and Defense

- 7.2.8. Other End User Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Access Control Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Card Reader and Access Control Devices

- 8.1.1.1. Card-based

- 8.1.1.2. Proximity

- 8.1.1.3. Smart Card (Contact and Contactless)

- 8.1.2. Biometric Readers

- 8.1.3. Electronic Locks

- 8.1.4. Software

- 8.1.5. Other Types

- 8.1.1. Card Reader and Access Control Devices

- 8.2. Market Analysis, Insights and Forecast - by End User Vertical

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.2.3. Government

- 8.2.4. Industrial

- 8.2.5. Transport and Logistics

- 8.2.6. Healthcare

- 8.2.7. Military and Defense

- 8.2.8. Other End User Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Access Control Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Card Reader and Access Control Devices

- 9.1.1.1. Card-based

- 9.1.1.2. Proximity

- 9.1.1.3. Smart Card (Contact and Contactless)

- 9.1.2. Biometric Readers

- 9.1.3. Electronic Locks

- 9.1.4. Software

- 9.1.5. Other Types

- 9.1.1. Card Reader and Access Control Devices

- 9.2. Market Analysis, Insights and Forecast - by End User Vertical

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.2.3. Government

- 9.2.4. Industrial

- 9.2.5. Transport and Logistics

- 9.2.6. Healthcare

- 9.2.7. Military and Defense

- 9.2.8. Other End User Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Allegion PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Suprema Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hanwha Techwin Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dormakaba Holding AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tyco International Plc (Johnson Controls)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NEC Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nedap NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Axis Communications AB*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ASSA ABLOY AB Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Thales Group (Gemalto NV)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Idemia Group

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Identiv Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Bosch Security System Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Brivo Systems LLC

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Panasonic Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Access Control Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Access Control Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Access Control Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Access Control Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 5: North America Access Control Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 6: North America Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Access Control Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Access Control Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Access Control Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 11: Europe Access Control Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 12: Europe Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Access Control Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Access Control Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Access Control Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 17: Asia Pacific Access Control Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 18: Asia Pacific Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Access Control Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Access Control Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Access Control Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 23: Rest of the World Access Control Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 24: Rest of the World Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Access Control Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Access Control Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 3: Global Access Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Access Control Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 6: Global Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Access Control Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 11: Global Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of the Europe Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Access Control Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 18: Global Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of the Asia Pacific Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Access Control Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 26: Global Access Control Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Access Control Market?

The projected CAGR is approximately 8.09%.

2. Which companies are prominent players in the Access Control Market?

Key companies in the market include Honeywell International Inc, Allegion PLC, Suprema Inc, Hanwha Techwin Co Ltd, Dormakaba Holding AG, Tyco International Plc (Johnson Controls), Schneider Electric SE, NEC Corporation, Nedap NV, Axis Communications AB*List Not Exhaustive, ASSA ABLOY AB Group, Thales Group (Gemalto NV), Idemia Group, Identiv Inc, Bosch Security System Inc, Brivo Systems LLC, Panasonic Corporation.

3. What are the main segments of the Access Control Market?

The market segments include Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

6. What are the notable trends driving market growth?

Commercial Segment to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Performance Constraint of Cryocoolers.

8. Can you provide examples of recent developments in the market?

March 2023: In Axis Communications and Genetec Inc. partnered to launch Axis, an enterprise-level access control solution that combines Genetec access control software and Axis network door controllers in a single, easy-to-deploy package. This solution is the first of its kind on the market and utilizes Genetec technology to provide unified security, public safety, operations, and business intelligence solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Access Control Market?

To stay informed about further developments, trends, and reports in the Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence