Key Insights

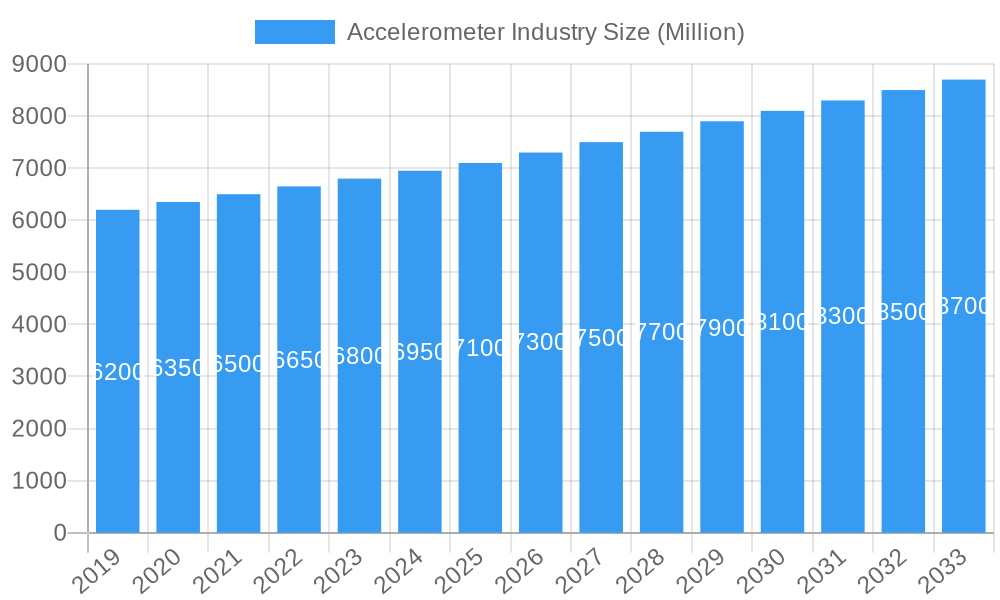

The global accelerometer market is set for robust expansion, projected to reach $7.92 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 9.8% through 2033. This growth is driven by the increasing integration of accelerometers across diverse industries, fueled by the demand for advanced motion sensing, vibration monitoring, and navigation. Key sectors include Aerospace and Defense, Automotive (for ADAS and autonomous driving), Consumer Electronics (smart devices, wearables), and Industrial Automation. These applications leverage accelerometers for critical functions such as flight control, inertial navigation, diagnostics, and predictive maintenance, optimizing efficiency and reducing downtime.

Accelerometer Industry Market Size (In Billion)

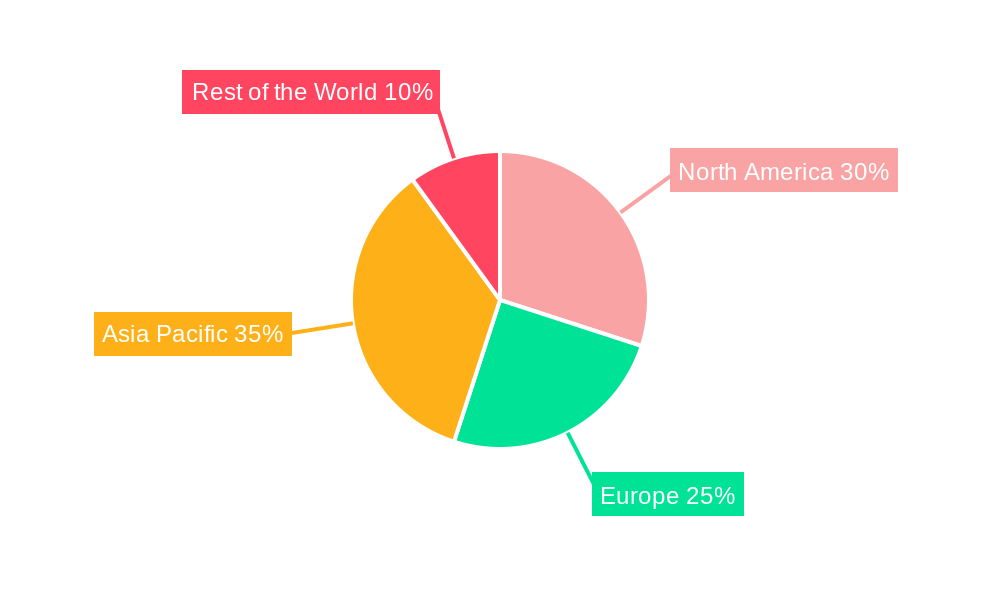

Market growth is characterized by continuous innovation in miniaturization and performance, including enhanced accuracy, reduced power consumption, and improved sensitivity. The development of MEMS accelerometers has been pivotal in enabling cost-effective and versatile sensor solutions. Geographically, North America and Europe will maintain strong positions due to established industries and R&D investment. The Asia Pacific region, particularly China and South Korea, offers significant growth potential driven by its expanding consumer electronics, automotive, and industrial manufacturing sectors. Challenges include the high cost of specialized accelerometers and price competition in consumer electronics. However, ongoing technological evolution and expanding applications ensure a resilient and growing accelerometer market.

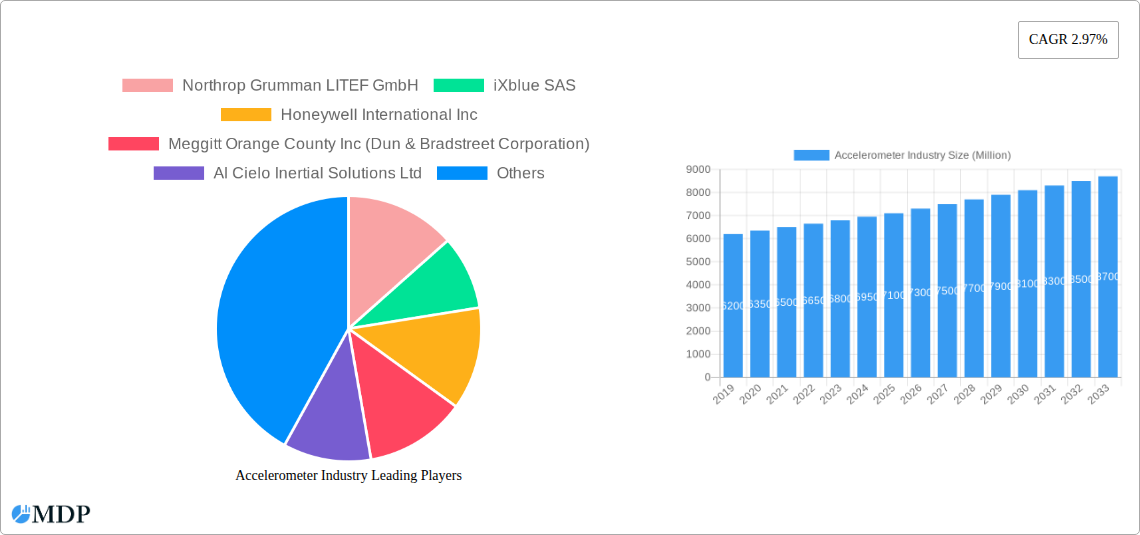

Accelerometer Industry Company Market Share

Accelerometer Industry Market Dynamics & Concentration

The accelerometer market is characterized by a moderate to high concentration, driven by a significant number of key players, including industry giants like Honeywell International Inc, Robert Bosch GmbH, and STMicroelectronics. These companies, alongside specialized manufacturers such as Northrop Grumman, LITEF GmbH, and iXblue SAS, command substantial market share through proprietary technologies and established supply chains. M&A activities, while not at an extreme level, play a crucial role in shaping the competitive landscape. Recent transactions have focused on acquiring innovative startups with advanced MEMS (Micro-Electro-Mechanical Systems) technologies or expanding into high-growth application areas like autonomous driving and advanced aerospace systems. The market share distribution is influenced by technological expertise, manufacturing scale, and strategic partnerships. For instance, companies with strong portfolios in inertial sensing for aerospace and defense, such as Kearfott Corporation and Meggitt Orange County Inc, often hold dominant positions within their specialized segments. The innovation driver remains paramount, with continuous advancements in miniaturization, power efficiency, and accuracy pushing the boundaries of what accelerometers can achieve. Regulatory frameworks, particularly in aerospace and automotive, also influence market dynamics by setting stringent performance and safety standards. The emergence of product substitutes, though limited, is being closely monitored, with advancements in other sensor technologies that might offer overlapping functionalities. End-user trends, such as the increasing demand for sophisticated motion tracking in consumer electronics and the critical need for precise navigation in defense applications, are key determinants of market focus and investment.

- Market Concentration: Moderate to High

- Innovation Drivers: MEMS technology advancements, miniaturization, power efficiency, accuracy enhancements.

- Regulatory Frameworks: Stringent standards in Aerospace, Defense, and Automotive sectors.

- Product Substitutes: Limited, but evolving alternative sensor technologies.

- End-User Trends: Growing demand from Aerospace & Defense, Industrial, Consumer Electronics, and Automotive.

- M&A Activities: Focused on acquiring innovative technologies and expanding into high-growth application areas.

- Estimated M&A Deal Count (2019-2033): xx Million

Accelerometer Industry Industry Trends & Analysis

The accelerometer industry is poised for robust growth over the forecast period (2025-2033), driven by a confluence of technological advancements, expanding application footprints, and increasing global demand for sophisticated motion sensing capabilities. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5%, reaching an estimated market size of over $7,000 Million by 2033. This growth is primarily fueled by the relentless pursuit of innovation in MEMS technology, leading to smaller, more power-efficient, and highly accurate accelerometers. The increasing penetration of accelerometers across various end-user segments, from smartphones and wearables in consumer electronics to advanced navigation systems in aerospace and defense, and the critical role in advanced driver-assistance systems (ADAS) and autonomous vehicles in the automotive sector, underscores their ubiquitous importance.

Technological disruptions, such as the development of new materials and fabrication techniques, are continually improving accelerometer performance and reducing costs, thereby broadening their accessibility and applicability. Consumer preferences are increasingly leaning towards smart devices and connected ecosystems, which rely heavily on accurate motion detection for user experience and functionality. This is evident in the surging demand for accelerometers in fitness trackers, gaming consoles, and virtual/augmented reality devices.

The competitive dynamics within the industry are intense, with established giants like Analog Devices Inc and InvenSense (TDK Group company) investing heavily in research and development to maintain their edge. Emerging players are also contributing to the innovation landscape, often focusing on niche applications or disruptive technologies. The industrial sector is a significant growth engine, with accelerometers finding critical applications in condition monitoring of machinery, structural health assessment of buildings and bridges, and advanced robotics. The "Industry 4.0" revolution, with its emphasis on automation and data-driven decision-making, further amplifies the need for reliable sensor data, including acceleration measurements. The automotive industry's transformation towards electric and autonomous vehicles is another major catalyst, as accelerometers are integral to safety systems, vehicle dynamics control, and navigation. The ongoing development of next-generation smartphones and other personal electronic devices also ensures a steady demand for accelerometers, reflecting their indispensable role in modern technology. The global market penetration of accelerometers is expected to continue its upward trajectory, driven by these multifaceted trends and the ever-expanding possibilities of motion sensing.

- Estimated Market Size (2025): $3,500 Million

- Estimated Market Size (2033): $7,000 Million

- CAGR (2025-2033): ~7.5%

- Market Penetration: High and increasing across multiple sectors.

- Key Growth Drivers: MEMS advancements, consumer electronics demand, automotive ADAS/EVs, industrial automation.

- Technological Disruptions: New materials, fabrication techniques, improved sensor performance.

- Consumer Preferences: Demand for smart devices, wearables, VR/AR.

- Competitive Dynamics: Intense competition among established players and emerging innovators.

Leading Markets & Segments in Accelerometer Industry

The accelerometer industry exhibits a clear dominance in the Aerospace and Defense segment, which consistently represents the largest market share. This is attributed to the stringent requirements for high precision, reliability, and robust performance in critical applications such as aircraft navigation systems, missile guidance, satellite stabilization, and unmanned aerial vehicle (UAV) control. Companies like Northrop Grumman, Kearfott Corporation, and LITEF GmbH are key suppliers in this sector, leveraging their expertise in inertial navigation systems. The segment's dominance is further bolstered by significant government investments in defense modernization and space exploration initiatives globally. Economic policies promoting national security and technological advancement directly translate into sustained demand for sophisticated accelerometer solutions. Infrastructure development in terms of advanced aerospace manufacturing capabilities and ongoing research in space technologies also contribute to this segment's leading position.

The Automotive segment is rapidly emerging as a significant growth driver, driven by the burgeoning adoption of Advanced Driver-Assistance Systems (ADAS) and the ongoing transition towards electric and autonomous vehicles. Accelerometers are crucial for applications like electronic stability control, anti-lock braking systems, airbag deployment, and increasingly, for sensing vehicle dynamics and enabling autonomous driving functionalities. Major automotive component suppliers and OEMs are investing heavily in integrating advanced accelerometer technologies. Regulatory mandates for vehicle safety and the global push for emission reduction through electric mobility further propel this segment's expansion. Infrastructure improvements related to smart cities and connected vehicle networks also indirectly support the increased demand for accelerometers.

The Industrial segment also presents substantial opportunities, fueled by the widespread implementation of Industry 4.0 initiatives and the growing need for condition monitoring, predictive maintenance, and robotics. Accelerometers are vital for tracking vibrations in heavy machinery, assessing structural integrity of infrastructure, and enabling precise motion control in automated manufacturing processes. The expansion of smart factories and the increasing automation across various manufacturing sectors directly contribute to the growth of this segment.

Consumer Electronics continues to be a foundational segment, with accelerometers being an integral component in smartphones, tablets, wearables, gaming consoles, and virtual/augmented reality devices. The continuous innovation in consumer gadgets and the increasing demand for intuitive user interfaces and enhanced interactive experiences ensure a steady and significant market presence for accelerometers. Economic growth and rising disposable incomes in emerging markets further stimulate demand for these devices.

- Dominant Region/Country: Global, with strong demand in North America and Europe for Aerospace & Defense and Automotive. Asia-Pacific shows rapid growth in Consumer Electronics and Industrial.

- Key Drivers for Aerospace and Defense:

- National security investments and defense modernization.

- Space exploration programs and satellite development.

- Strict performance and reliability standards.

- Advancements in UAV and autonomous systems.

- Key Drivers for Automotive:

- Mandatory safety regulations for ADAS.

- Rapid growth of electric and autonomous vehicle development.

- Demand for enhanced vehicle dynamics control and infotainment.

- Development of smart city infrastructure.

- Key Drivers for Industrial:

- Industry 4.0 and smart factory adoption.

- Demand for predictive maintenance and condition monitoring.

- Growth of robotics and automation in manufacturing.

- Infrastructure monitoring and structural health assessment.

- Key Drivers for Consumer Electronics:

- Ubiquitous integration in smartphones and wearables.

- Innovation in gaming, VR/AR, and smart home devices.

- Demand for intuitive user interfaces and motion-based interactions.

- Growth in emerging markets.

Accelerometer Industry Product Developments

Product development in the accelerometer industry is characterized by a relentless pursuit of higher performance, miniaturization, and enhanced functionality across various MEMS technologies. Innovations are focused on increasing accuracy, reducing noise, improving temperature stability, and lowering power consumption, making accelerometers suitable for increasingly demanding applications. The integration of advanced signal processing capabilities within the accelerometer chip itself is a significant trend, enabling smarter data interpretation and reduced system complexity. Furthermore, the development of multi-axis accelerometers and their integration with gyroscopes and magnetometers into inertial measurement units (IMUs) offers enhanced motion sensing solutions. These advancements provide competitive advantages by enabling smaller, more efficient, and more capable devices for sectors ranging from advanced aerospace navigation and automotive ADAS to consumer wearables and industrial automation, ensuring a strong market fit for next-generation sensing needs.

Key Drivers of Accelerometer Industry Growth

The accelerometer industry's growth is propelled by several interconnected drivers. Technologically, advancements in MEMS fabrication, sensor fusion, and miniaturization are creating more capable and cost-effective solutions. Economically, the increasing demand for smart devices across consumer electronics, the automotive sector's push towards electrification and autonomy, and the industrial revolution's focus on automation are significant growth catalysts. Regulatory factors, particularly stringent safety standards in automotive and aerospace, mandate the use of high-performance accelerometers, further fueling market expansion. The expanding use of IoT devices and the need for precise motion tracking in emerging applications like augmented reality and drone technology also contribute significantly to the industry's upward trajectory.

Challenges in the Accelerometer Industry Market

Despite its strong growth prospects, the accelerometer industry faces several challenges. Intense competition can lead to price pressures and reduced profit margins, especially in high-volume consumer electronics markets. Regulatory hurdles, while driving adoption in some sectors, can also impose lengthy and costly certification processes for new product introductions, particularly in the aerospace and automotive industries. Supply chain disruptions, exacerbated by geopolitical events and raw material availability, can impact production timelines and costs. Furthermore, the constant need for significant R&D investment to keep pace with technological advancements and the emergence of potential, albeit limited, substitute technologies require companies to maintain a high level of innovation and agility.

Emerging Opportunities in Accelerometer Industry

Emerging opportunities in the accelerometer industry are vast and multifaceted. The continuous expansion of the Internet of Things (IoT) ecosystem presents a significant growth catalyst, with accelerometers being essential for a wide range of connected devices that require motion detection and environmental sensing. The burgeoning fields of virtual reality (VR) and augmented reality (AR) rely heavily on precise motion tracking, creating substantial demand for high-performance accelerometers and IMUs. Furthermore, advancements in medical devices, such as wearable health monitors and sophisticated diagnostic equipment, are opening new avenues for accelerometer applications. Strategic partnerships between accelerometer manufacturers and AI/ML companies are also creating opportunities for developing intelligent sensing solutions that can analyze motion data for predictive analytics and advanced control systems.

Leading Players in the Accelerometer Industry Sector

- Northrop Grumman

- LITEF GmbH

- Honeywell International Inc

- Meggitt Orange County Inc

- Al Cielo Inertial Solutions Ltd

- Atlantic Inertial Systems Ltd

- STMicroelectronics

- Silicon Sensing Systems Limited

- Robert Bosch GmbH

- Rockwell Automation Inc

- InvenSense

- Analog Devices Inc

- Kearfott Corporation

- STMicroelectronics (mentioned again for emphasis on its broad portfolio)

Key Milestones in Accelerometer Industry Industry

- 2019: Introduction of significantly more power-efficient MEMS accelerometers for always-on sensing in wearables.

- 2020: Major automotive Tier-1 supplier integrates advanced MEMS accelerometers into a new generation of ADAS platforms.

- 2021: Launch of ultra-high-accuracy inertial measurement units (IMUs) with integrated accelerometers for aerospace applications.

- 2022: Significant advancements in silicon-based accelerometers offering improved temperature stability and reduced drift.

- 2023: Increased adoption of solid-state accelerometers in consumer electronics for enhanced gaming and AR/VR experiences.

- 2024: Strategic partnerships formed to develop AI-powered inertial sensing modules for industrial robotics.

- 2025: Expected introduction of novel accelerometer designs for improved shock resistance and vibration analysis.

- 2026: Projected expansion of accelerometer applications in drone-based surveying and inspection.

- 2027: Anticipated breakthroughs in accelerometer technology enabling seamless human-machine interfaces for a wider range of devices.

- 2028-2033: Continued evolution of MEMS technology leading to even smaller, more accurate, and integrated accelerometer solutions across all end-user segments.

Strategic Outlook for Accelerometer Industry Market

The strategic outlook for the accelerometer industry is exceptionally positive, characterized by sustained innovation and expanding application horizons. The industry will continue to be driven by the relentless demand for motion sensing in the ever-growing consumer electronics market, coupled with the transformative role of accelerometers in the advancement of autonomous vehicles and sophisticated aerospace systems. Strategic investments in R&D, focusing on next-generation MEMS technologies, improved sensor fusion, and AI integration, will be crucial for maintaining competitive advantage. Furthermore, companies that can effectively navigate regulatory landscapes and establish robust supply chains will be well-positioned for long-term success. The exploration of new market segments, such as advanced medical devices and smart infrastructure, presents significant opportunities for growth and diversification.

Accelerometer Industry Segmentation

-

1. End User

- 1.1. Aerospace and Defense

- 1.2. Industrial

- 1.3. Consumer Electronics

- 1.4. Automotive

- 1.5. Other End users

Accelerometer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest Of The World

Accelerometer Industry Regional Market Share

Geographic Coverage of Accelerometer Industry

Accelerometer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Emergence of the MEMS Technology; Increasing Demand from Consumer Electronics; Developing Aerospace and Defense Sector (High-end Accelerometers)

- 3.3. Market Restrains

- 3.3.1. ; Costs and Complexity Concerns

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Industry to Account for a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Aerospace and Defense

- 5.1.2. Industrial

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive

- 5.1.5. Other End users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest Of The World

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Aerospace and Defense

- 6.1.2. Industrial

- 6.1.3. Consumer Electronics

- 6.1.4. Automotive

- 6.1.5. Other End users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Aerospace and Defense

- 7.1.2. Industrial

- 7.1.3. Consumer Electronics

- 7.1.4. Automotive

- 7.1.5. Other End users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Aerospace and Defense

- 8.1.2. Industrial

- 8.1.3. Consumer Electronics

- 8.1.4. Automotive

- 8.1.5. Other End users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest Of The World Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Aerospace and Defense

- 9.1.2. Industrial

- 9.1.3. Consumer Electronics

- 9.1.4. Automotive

- 9.1.5. Other End users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Northrop Grumman LITEF GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 iXblue SAS

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Meggitt Orange County Inc (Dun & Bradstreet Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Cielo Inertial Solutions Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Atlantic inertial systems Ltd(AIS Global Holdings LLC)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Silicon Sensing Systems Limited(Collins Aerospace and Sumitomo Precision Products)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 InvenSense (TDK Group company)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Analog Devices Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kearfott Corporation(Astronautics Corporation of America)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Northrop Grumman LITEF GmbH

List of Figures

- Figure 1: Global Accelerometer Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Accelerometer Industry Volume Breakdown (metres per second, %) by Region 2025 & 2033

- Figure 3: North America Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 4: North America Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 5: North America Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 9: North America Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: Europe Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 13: Europe Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 17: Europe Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 20: Asia Pacific Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 21: Asia Pacific Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 25: Asia Pacific Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest Of The World Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Rest Of The World Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 29: Rest Of The World Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Rest Of The World Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Rest Of The World Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Rest Of The World Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 33: Rest Of The World Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest Of The World Accelerometer Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 3: Global Accelerometer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Accelerometer Industry Volume metres per second Forecast, by Region 2020 & 2033

- Table 5: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 7: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 9: United States Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 11: Canada Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 13: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 15: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 17: Germany Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 21: France Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 25: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 27: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 29: China Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: China Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 31: Japan Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Japan Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 33: India Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: India Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 35: South Korea Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Korea Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Asia Pacific Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 39: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 41: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Accelerometer Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Accelerometer Industry?

Key companies in the market include Northrop Grumman LITEF GmbH, iXblue SAS, Honeywell International Inc, Meggitt Orange County Inc (Dun & Bradstreet Corporation), Al Cielo Inertial Solutions Ltd, Atlantic inertial systems Ltd(AIS Global Holdings LLC), STMicroelectronics, Silicon Sensing Systems Limited(Collins Aerospace and Sumitomo Precision Products), Robert Bosch GmbH, Rockwell Automation Inc, InvenSense (TDK Group company), Analog Devices Inc, Kearfott Corporation(Astronautics Corporation of America).

3. What are the main segments of the Accelerometer Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.92 billion as of 2022.

5. What are some drivers contributing to market growth?

; Emergence of the MEMS Technology; Increasing Demand from Consumer Electronics; Developing Aerospace and Defense Sector (High-end Accelerometers).

6. What are the notable trends driving market growth?

Aerospace and Defense Industry to Account for a Significant Share in the Market.

7. Are there any restraints impacting market growth?

; Costs and Complexity Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metres per second.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Accelerometer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Accelerometer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Accelerometer Industry?

To stay informed about further developments, trends, and reports in the Accelerometer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence