Key Insights

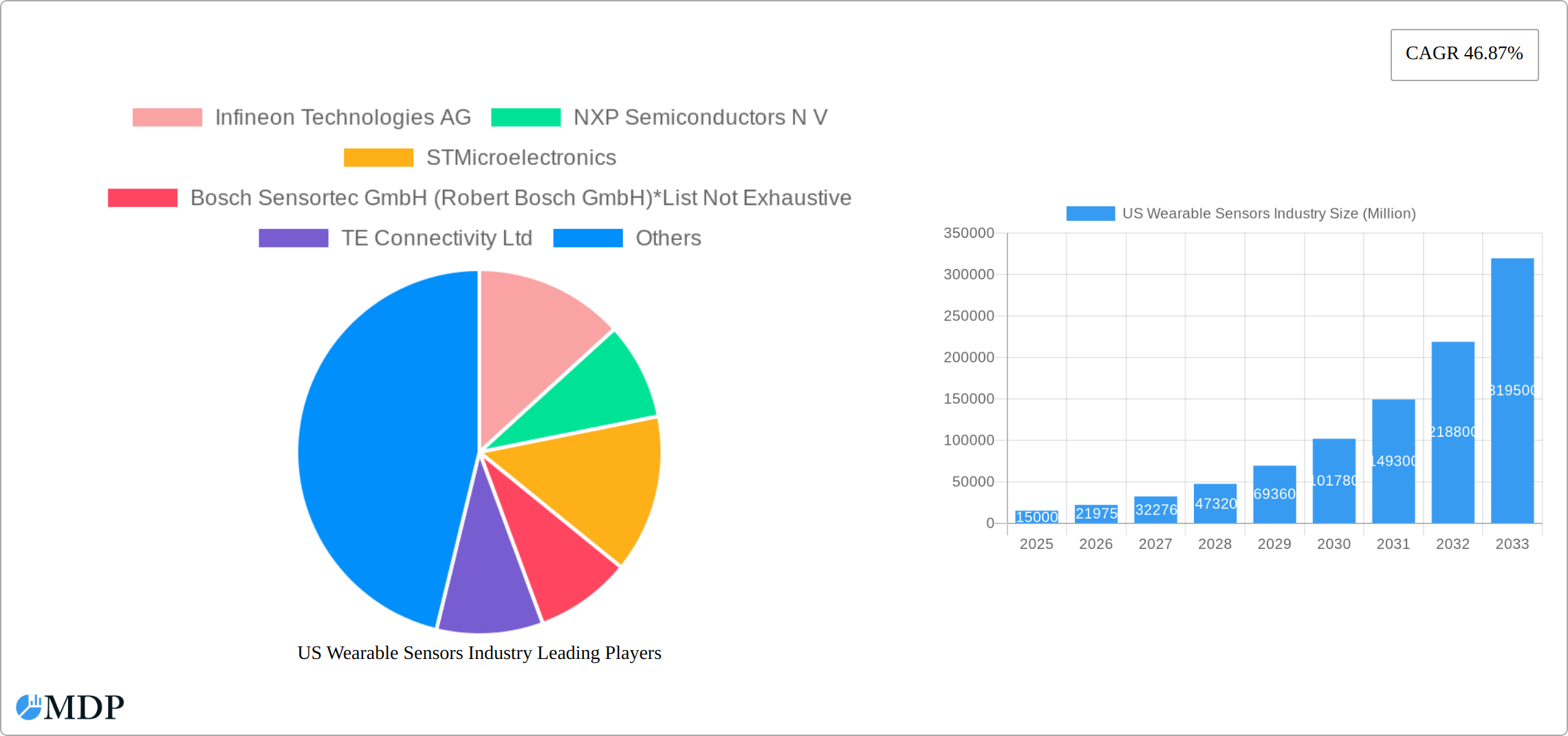

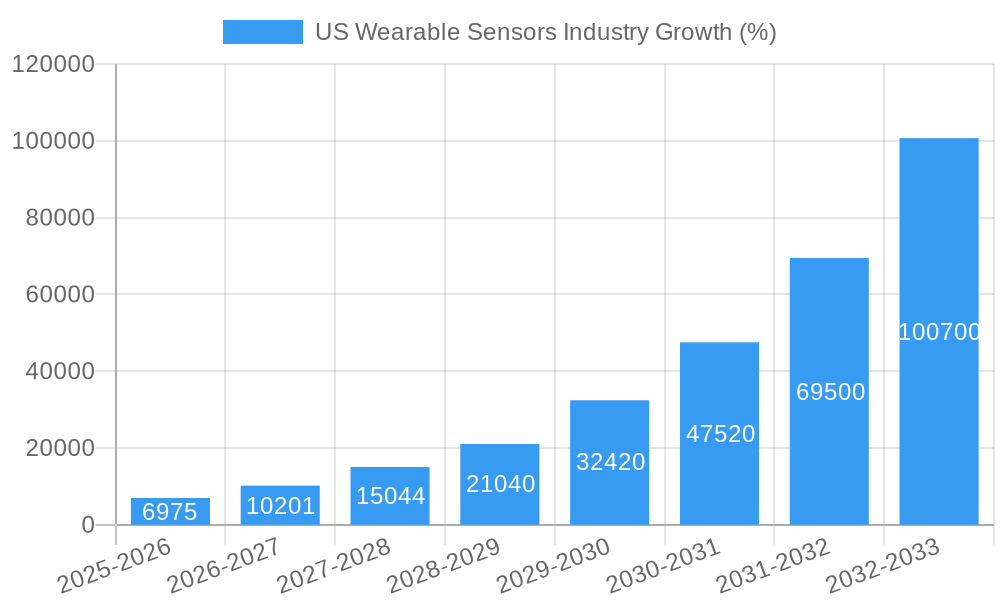

The US wearable sensors market is experiencing robust growth, driven by increasing demand for health and wellness tracking, safety monitoring, and home rehabilitation applications. The market's Compound Annual Growth Rate (CAGR) of 46.87% from 2019 to 2024 suggests a significant expansion, projected to continue into the forecast period (2025-2033). This growth is fueled by technological advancements in sensor miniaturization and power efficiency, leading to more comfortable and versatile wearable devices. The diverse range of applications, including fitness trackers, smartwatches, and medical devices, further contributes to market expansion. Health sensors dominate the type segment, driven by the growing awareness of personal health management and the increasing adoption of preventative healthcare measures. Wristwear currently holds the largest share within the device segment, owing to its convenience and widespread acceptance among consumers. However, bodywear and footwear segments are projected to experience significant growth, fueled by innovation in textile integration and the development of more sophisticated sensor systems embedded directly into clothing.

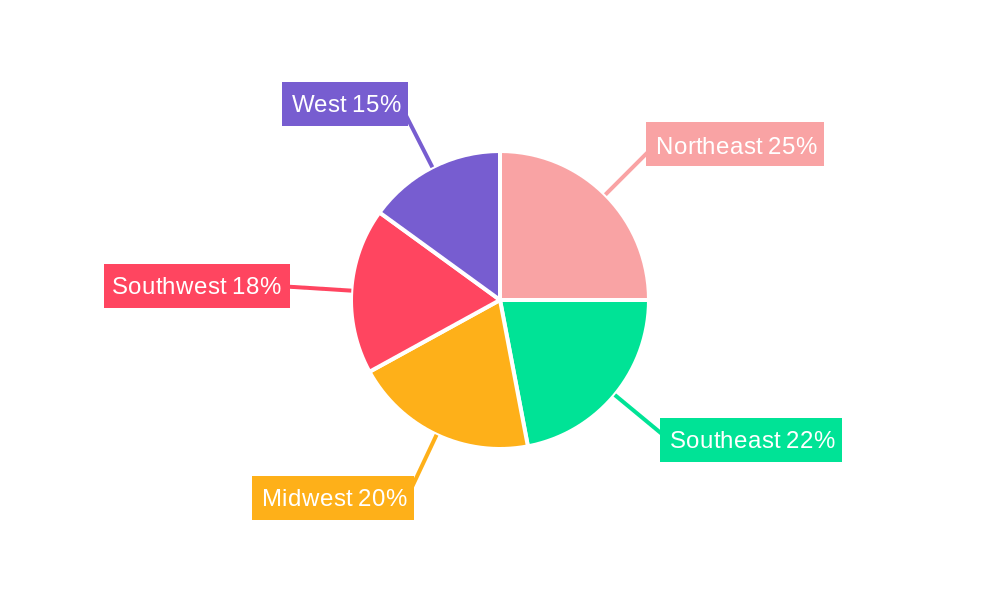

The market segmentation reveals key growth areas. While health and wellness applications currently dominate the application segment, the safety monitoring and home rehabilitation segments are anticipated to show strong growth due to an aging population and rising demand for assistive technologies. This segmental growth is further propelled by the increased integration of wearable sensors into IoT ecosystems, providing enhanced data collection and analysis capabilities. Major players like Infineon, NXP, STMicroelectronics, and Texas Instruments are actively investing in R&D and strategic partnerships to capture market share. Regional analysis suggests that the Northeast, Southeast, Midwest, Southwest, and West regions of the United States will all contribute significantly to the overall market growth, reflecting a nationwide adoption trend. The continued evolution of sensor technology, coupled with rising consumer demand for personalized health and safety solutions, promises continued expansion for the US wearable sensors market in the coming years.

US Wearable Sensors Industry Market Report: 2019-2033

Dive deep into the dynamic US Wearable Sensors market with this comprehensive report, providing actionable insights for strategic decision-making. This in-depth analysis covers market size, segmentation, key players, and future trends, offering a complete understanding of this rapidly evolving sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The study encompasses historical data from 2019-2024. Expect detailed analysis of market dynamics, leading segments, technological advancements, and key players like Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics, Bosch Sensortec GmbH, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Freescale Semiconductor Inc, InvenSense Inc, and Panasonic Corporation. This report is essential for investors, manufacturers, and industry stakeholders seeking to navigate this lucrative market.

US Wearable Sensors Industry Market Dynamics & Concentration

The US wearable sensors market is characterized by a **moderately concentrated competitive landscape**, where a select group of prominent players commands a substantial market share. This dynamism is largely propelled by relentless **innovation**, driven by breakthroughs in sensor miniaturization, enhanced power efficiency, and sophisticated sensor integration. The market's trajectory is also significantly shaped by **stringent regulatory frameworks**, particularly concerning data privacy and the rigorous approval processes for medical devices. While traditional diagnostic methods represent a notable competitive substitute, emerging technologies such as advanced bio-integrated sensors and flexible electronics are opening up exciting new avenues for growth. End-users are increasingly prioritizing **seamless integration**, intuitive ease of use, and the delivery of actionable, personalized data insights. M&A activity has been a moderate yet strategic force, with an estimated **[Insert Approximate Number]** deals occurring between 2019 and 2024, primarily aimed at bolstering technological capabilities and extending market reach. In 2024, the market share held by the top 5 players is estimated to be around **[Insert Estimated Percentage]%**.

- Market Concentration: Moderately concentrated, with the top 5 players collectively holding an estimated [Insert Estimated Percentage]% market share in 2024.

- Key Innovation Drivers: Continued advancements in miniaturization, extended power efficiency, sophisticated sensor integration, and the growing incorporation of Artificial Intelligence (AI) and Machine Learning (ML) for advanced data analysis.

- Regulatory Landscape: Navigating stringent data privacy regulations (e.g., HIPAA) and the comprehensive medical device approval pathways mandated by agencies like the FDA.

- Product Substitutes: Traditional diagnostic methods and non-wearable health monitoring devices.

- End-User Trends: A strong emphasis on seamless integration with existing ecosystems, intuitive user interfaces, and the generation of highly personalized, actionable data insights.

- M&A Activity: Approximately [Insert Approximate Number] strategic deals were observed between 2019 and 2024, focusing on technology acquisition and market expansion.

US Wearable Sensors Industry Trends & Analysis

The US wearable sensors market is experiencing robust growth, driven by increasing health consciousness, advancements in sensor technology, and the rising adoption of connected devices. The CAGR for the period 2025-2033 is projected to be xx%, reflecting strong market penetration, particularly in the health and wellness segment. Technological disruptions, such as the integration of AI and machine learning for data analysis and personalized health insights, are reshaping the competitive landscape. Consumer preferences are shifting towards smaller, more comfortable devices with longer battery life and enhanced data security features. Intense competition among established players and emerging startups is fostering innovation and driving down prices. Market penetration in the health and wellness sector is estimated to reach xx% by 2033.

Leading Markets & Segments in US Wearable Sensors Industry

The Health and Wellness segment dominates the US wearable sensors market, accounting for xx% of the total market value in 2024, driven by the rising demand for fitness trackers, smartwatches, and other health monitoring devices. Within sensor types, Health Sensors hold a leading position, followed by MEMS Sensors. Wristwear remains the dominant device category due to its convenience and ease of use.

- By Application: Health and Wellness (xx%), Safety Monitoring (xx%), Home Rehabilitation (xx%), Others (xx%).

- By Type: Health Sensors (xx%), MEMS Sensors (xx%), Environmental Sensors (xx%), Motion Sensors (xx%), Others (xx%).

- By Device: Wristwear (xx%), Bodywear (xx%), Footwear (xx%), Others (xx%).

- Key Drivers (Health and Wellness): Increasing health consciousness, rising disposable incomes, technological advancements.

US Wearable Sensors Industry Product Developments

Recent product innovations focus on miniaturized sensors with improved accuracy, power efficiency, and multi-sensor integration. Wearable devices are increasingly incorporating advanced functionalities, such as continuous health monitoring, AI-powered diagnostics, and seamless integration with smartphones and healthcare platforms. These advancements cater to the growing demand for personalized healthcare and proactive health management. The market fit is strong, fueled by expanding consumer awareness and technological advancements driving market adoption.

Key Drivers of US Wearable Sensors Industry Growth

The robust growth of the US wearable sensors industry is underpinned by several converging factors. Paramount among these are **technological advancements** that consistently yield smaller, more power-efficient, and remarkably accurate sensors, enabling a wider array of applications. The pervasive adoption of smartphones and a burgeoning ecosystem of connected devices provide a crucial **infrastructure for seamless data transmission and sophisticated analysis**. Furthermore, a supportive **regulatory environment and proactive government initiatives** aimed at fostering digital health solutions are significantly contributing to market expansion. The escalating consumer and healthcare provider focus on **preventive healthcare strategies and the pursuit of personalized medicine** are also powerful catalysts driving demand for advanced wearable sensor solutions.

Challenges in the US Wearable Sensors Industry Market

The industry faces challenges including stringent regulatory requirements for data privacy and medical device approval, creating hurdles for new entrants and impacting product development timelines. Supply chain disruptions, particularly related to semiconductor components, can impact production and lead to price increases. Intense competition among established players and new entrants puts pressure on margins and necessitates continuous innovation. These factors collectively impact market growth.

Emerging Opportunities in US Wearable Sensors Industry

The future of the US wearable sensors industry is brimming with **significant growth opportunities**. Pioneering **technological breakthroughs**, particularly in the realm of bio-integrated sensors, novel advanced materials, and intelligent AI-powered analytics, are poised to unlock entirely new applications and dramatically expand the market's reach. Cultivating **strategic partnerships** between sensor manufacturers, leading technology firms, and established healthcare providers will be instrumental in accelerating innovation cycles and facilitating deeper market penetration. Beyond traditional health and wellness, exploring and capitalizing on new market verticals, such as comprehensive **remote patient monitoring (RPM) solutions** and specialized **industrial applications**, presents substantial untapped potential for sustained growth.

Leading Players in the US Wearable Sensors Industry Sector

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics

- Bosch Sensortec GmbH

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Freescale Semiconductor Inc

- InvenSense Inc

- Panasonic Corporation

Key Milestones in US Wearable Sensors Industry Industry

- September 2020: Apple's introduction of the Apple Watch Series 6, featuring groundbreaking blood oxygen monitoring capabilities, significantly elevated consumer interest in advanced health tracking and the potential of wearable sensors.

- January 2021: NeuTigers launched CovidDeep, a clinically validated AI-powered solution that leverages wearable sensor data for COVID-19 patient triage, powerfully demonstrating the transformative potential of AI in conjunction with sensor technology for critical healthcare applications.

Strategic Outlook for US Wearable Sensors Industry Market

The US wearable sensors market is strategically positioned for **sustained and significant expansion**. This optimistic outlook is fueled by the continuous evolution of groundbreaking technological advancements, a surging demand for personalized and proactive healthcare solutions, and the ever-increasing integration of connected devices into daily life. Key strategic avenues for growth include the development of **next-generation sensor technologies** with enhanced functionalities, the proactive exploration and penetration of **untapped application areas** beyond consumer health, and the cultivation of **strategic alliances** to synergize technological prowess and market insights. Furthermore, a steadfast commitment to **data security and user privacy** will remain a critical determinant for fostering enduring market growth and cultivating robust consumer trust.

US Wearable Sensors Industry Segmentation

-

1. Type

- 1.1. Health Sensors

- 1.2. Environmental Sensors

- 1.3. MEMS Sensors

- 1.4. Motion Sensors

- 1.5. Others

-

2. Device

- 2.1. Wristwear

- 2.2. Bodywear and Footwear

- 2.3. Others

-

3. Application

- 3.1. Health and Wellness

- 3.2. Safety Monitoring

- 3.3. Home Rehabilitation

- 3.4. Others

US Wearable Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Wearable Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 46.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector

- 3.3. Market Restrains

- 3.3.1. High initial costs for large scale implementation in industries

- 3.4. Market Trends

- 3.4.1. Increase in demand of wearable fitness devices is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Health Sensors

- 5.1.2. Environmental Sensors

- 5.1.3. MEMS Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Wristwear

- 5.2.2. Bodywear and Footwear

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Health and Wellness

- 5.3.2. Safety Monitoring

- 5.3.3. Home Rehabilitation

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Health Sensors

- 6.1.2. Environmental Sensors

- 6.1.3. MEMS Sensors

- 6.1.4. Motion Sensors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Wristwear

- 6.2.2. Bodywear and Footwear

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Health and Wellness

- 6.3.2. Safety Monitoring

- 6.3.3. Home Rehabilitation

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Health Sensors

- 7.1.2. Environmental Sensors

- 7.1.3. MEMS Sensors

- 7.1.4. Motion Sensors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Wristwear

- 7.2.2. Bodywear and Footwear

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Health and Wellness

- 7.3.2. Safety Monitoring

- 7.3.3. Home Rehabilitation

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Health Sensors

- 8.1.2. Environmental Sensors

- 8.1.3. MEMS Sensors

- 8.1.4. Motion Sensors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Wristwear

- 8.2.2. Bodywear and Footwear

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Health and Wellness

- 8.3.2. Safety Monitoring

- 8.3.3. Home Rehabilitation

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Health Sensors

- 9.1.2. Environmental Sensors

- 9.1.3. MEMS Sensors

- 9.1.4. Motion Sensors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Wristwear

- 9.2.2. Bodywear and Footwear

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Health and Wellness

- 9.3.2. Safety Monitoring

- 9.3.3. Home Rehabilitation

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Health Sensors

- 10.1.2. Environmental Sensors

- 10.1.3. MEMS Sensors

- 10.1.4. Motion Sensors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Wristwear

- 10.2.2. Bodywear and Footwear

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Health and Wellness

- 10.3.2. Safety Monitoring

- 10.3.3. Home Rehabilitation

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Northeast US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Wearable Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infineon Technologies AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NXP Semiconductors N V

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 STMicroelectronics

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 TE Connectivity Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Texas Instruments Incorporated

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Analog Devices Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Freescale Semiconductor Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 InvenSense Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Panasonic Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global US Wearable Sensors Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Wearable Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America US Wearable Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America US Wearable Sensors Industry Revenue (Million), by Device 2024 & 2032

- Figure 7: North America US Wearable Sensors Industry Revenue Share (%), by Device 2024 & 2032

- Figure 8: North America US Wearable Sensors Industry Revenue (Million), by Application 2024 & 2032

- Figure 9: North America US Wearable Sensors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Wearable Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: South America US Wearable Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America US Wearable Sensors Industry Revenue (Million), by Device 2024 & 2032

- Figure 15: South America US Wearable Sensors Industry Revenue Share (%), by Device 2024 & 2032

- Figure 16: South America US Wearable Sensors Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: South America US Wearable Sensors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Wearable Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe US Wearable Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe US Wearable Sensors Industry Revenue (Million), by Device 2024 & 2032

- Figure 23: Europe US Wearable Sensors Industry Revenue Share (%), by Device 2024 & 2032

- Figure 24: Europe US Wearable Sensors Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe US Wearable Sensors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Wearable Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa US Wearable Sensors Industry Revenue (Million), by Device 2024 & 2032

- Figure 31: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Device 2024 & 2032

- Figure 32: Middle East & Africa US Wearable Sensors Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East & Africa US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Wearable Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific US Wearable Sensors Industry Revenue (Million), by Device 2024 & 2032

- Figure 39: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Device 2024 & 2032

- Figure 40: Asia Pacific US Wearable Sensors Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Asia Pacific US Wearable Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Wearable Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global US Wearable Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 14: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 21: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 28: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 41: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global US Wearable Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global US Wearable Sensors Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 51: Global US Wearable Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global US Wearable Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific US Wearable Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Wearable Sensors Industry?

The projected CAGR is approximately 46.87%.

2. Which companies are prominent players in the US Wearable Sensors Industry?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Freescale Semiconductor Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the US Wearable Sensors Industry?

The market segments include Type, Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector.

6. What are the notable trends driving market growth?

Increase in demand of wearable fitness devices is driving the market.

7. Are there any restraints impacting market growth?

High initial costs for large scale implementation in industries.

8. Can you provide examples of recent developments in the market?

September 2020: Apple launched the Apple watch series 6, which is the latest smartwatch that enables blood oxygen monitoring and measures oxygen saturation in the blood for a better understanding of fitness and wellness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Wearable Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Wearable Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Wearable Sensors Industry?

To stay informed about further developments, trends, and reports in the US Wearable Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence