Key Insights

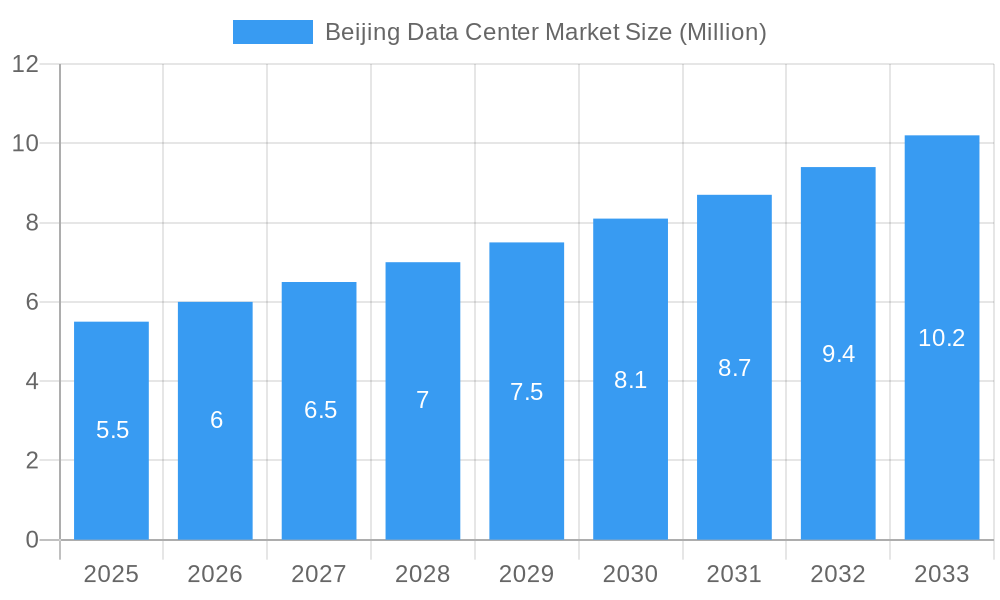

The Beijing Data Center Market is projected for substantial growth, with an estimated market size of 237.18 million by 2025, driven by a compelling compound annual growth rate (CAGR) of 9.05%. This expansion is fueled by increasing digital infrastructure demand, propelled by rapid industry digitalization and widespread cloud computing adoption. Key drivers include the growing reliance on hyperscale data centers for cloud providers and expanding colocation service adoption across various end-users. The proliferation of 5G networks, the surge in IoT devices, and increasing data generation from smart city initiatives in Beijing are accelerating this demand. Furthermore, government initiatives promoting digital transformation and establishing Beijing as a technology hub significantly contribute to market dynamism. The market's growth is marked by a trend towards larger data center footprints and an emphasis on higher tier classifications, indicating a shift towards more reliable and sophisticated infrastructure.

Beijing Data Center Market Market Size (In Million)

The market landscape is shaped by evolving trends such as the increasing demand for edge computing solutions to reduce latency and the growing importance of sustainability in data center operations, focusing on energy efficiency and renewable energy sources. While significant opportunities exist, the market also faces restraints including high capital expenditure for data center development, stringent regulatory compliances, and potential scarcity of suitable land and power resources in prime Beijing locations. However, these challenges are being addressed through strategic investments and innovative solutions. The competitive landscape features prominent players such as GDS, KDDI Telehouse, Princeton Digital Group, China Telecom Corporation Ltd, and Chindata Group Holdings Ltd, actively contributing to market development through specialized services and catering to diverse client needs, from retail colocation to hyperscale deployments. Market segmentation by DC size (Small to Mega), Tier Type (Tier 1 & 2 to Tier 4), and Absorption (Utilized/Non-Utilized) reflects the varied requirements of its user base, including Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, and E-Commerce sectors.

Beijing Data Center Market Company Market Share

Gain critical insights into the dynamic Beijing data center market. This comprehensive report offers a 360-degree view of market dynamics, industry trends, competitive landscape, and future projections. Covering a study period from 2019 to 2033, with a base year of 2025, this report is essential for data center operators, investors, cloud service providers, and enterprises aiming to capitalize on the burgeoning digital infrastructure needs of China's capital. We analyze market segmentation, technological advancements, and strategic imperatives, providing actionable intelligence for navigating this sector. Discover key players, emerging opportunities, and the challenges shaping the future of Beijing's data center ecosystem, focusing on high-traffic keywords such as "Beijing data center market," "China data center growth," "hyperscale data centers," "colocation Beijing," and "cloud infrastructure China."

Beijing Data Center Market Market Dynamics & Concentration

The Beijing data center market is characterized by a moderate to high concentration, with a few dominant players controlling a significant portion of the market share. Innovation drivers are primarily fueled by the escalating demand for digital services, including cloud computing, artificial intelligence, and big data analytics. Regulatory frameworks, while evolving, are crucial in shaping market access and operational standards, with government initiatives often promoting digital transformation. Product substitutes are limited in the context of physical data center infrastructure, but advancements in network efficiency and cloud-native architectures present indirect competition. End-user trends show a pronounced shift towards hyperscale deployments driven by major cloud providers and a growing need for massive data processing capabilities. Merger and acquisition (M&A) activities have been observed, indicating a consolidation phase where strategic partnerships and acquisitions aim to expand capacity and market reach. The market has witnessed approximately 10-15 significant M&A deals over the historical period, with key players actively seeking to bolster their portfolios. For instance, leading companies are continually assessing strategic acquisitions to enhance their presence and service offerings within this competitive landscape.

Beijing Data Center Market Industry Trends & Analysis

The Beijing data center market is poised for substantial growth, driven by a confluence of factors that are reshaping the digital infrastructure landscape. The CAGR (Compound Annual Growth Rate) for the Beijing data center market is projected to be in the range of 15% to 20% over the forecast period (2025–2033). This robust growth is underpinned by the accelerating adoption of cloud computing services across all industry verticals. Enterprises are increasingly migrating their IT workloads to the cloud, necessitating a greater number of advanced data centers to support these operations. The "Digital China" initiative and government-backed policies promoting technological self-reliance and innovation are significant catalysts. These policies encourage investment in high-performance computing, AI research, and the development of domestic technology solutions, all of which require substantial data center capacity.

Technological disruptions are playing a pivotal role, with advancements in cooling technologies, power efficiency, and network connectivity enhancing the performance and sustainability of data centers. The rise of 5G networks is also a major driver, as it creates a demand for edge computing facilities closer to end-users, thereby reducing latency and improving user experience for applications like augmented reality, virtual reality, and real-time data processing. Consumer preferences are increasingly leaning towards on-demand access to digital services, fueling the expansion of hyperscale data centers operated by major cloud providers. The media and entertainment sector, with its ever-increasing data demands for streaming and content creation, is a significant contributor to this trend. Furthermore, the financial sector (BFSI) is undergoing a digital transformation, with a growing need for secure, low-latency data processing for trading and analytics.

The competitive dynamics within the Beijing data center market are intense. Leading players are investing heavily in expanding their existing facilities and developing new ones to meet the soaring demand. Market penetration for hyperscale data centers is steadily increasing, indicating a strategic shift towards larger, more efficient deployments. The manufacturing sector is also embracing digital transformation, with increased adoption of IoT devices and smart factory initiatives, which in turn require robust data center infrastructure. The e-commerce sector, a cornerstone of China's digital economy, continues to drive demand for scalable and reliable data center solutions to handle massive transaction volumes and customer data. This interplay of technological innovation, government support, and evolving end-user demands creates a dynamic and high-growth environment for the Beijing data center market.

Leading Markets & Segments in Beijing Data Center Market

The Beijing data center market exhibits dominance across several key segments, reflecting the evolving digital demands of the region.

- DC Size: The Massive and Mega segments are experiencing the most significant growth and investment. This is driven by hyperscale cloud providers and large enterprises requiring extensive computing power and storage. These large-scale facilities are crucial for supporting the massive data processing needs of AI, big data analytics, and global cloud services. The Large segment also remains vital, catering to mid-sized enterprises and specific industry needs.

- Tier Type: Tier 3 and Tier 4 data centers are the most sought-after. Their high availability, redundancy, and uptime capabilities are essential for mission-critical applications in sectors like finance, government, and telecommunications. While Tier 1 & 2 facilities may serve less critical functions, the trend is overwhelmingly towards higher-tier certifications to ensure business continuity and resilience.

- Absorption - Utilized:

- Colocation Type: Hyperscale colocation is the dominant and fastest-growing sub-segment. Major cloud providers and large tech companies are leasing vast amounts of space and power within these facilities. Wholesale colocation also commands a significant share, serving enterprises with dedicated infrastructure needs. Retail colocation is growing but represents a smaller portion, typically for smaller businesses and specialized applications.

- End-User: The Cloud & IT segment is the largest consumer of data center capacity, reflecting the pervasive shift towards cloud adoption. The Telecom sector is also a significant user, supporting the expansion of 5G networks and digital communication services. Media & Entertainment and E-Commerce are rapidly growing segments, fueled by content streaming and online retail. The Government sector is a consistent and substantial user, driven by national digital initiatives and data security requirements. BFSI (Banking, Financial Services, and Insurance) and Manufacturing are also key segments, with increasing digital footprints and the adoption of IoT in manufacturing.

- Absorption - Non-Utilized: While a certain level of non-utilized capacity is always present to ensure flexibility and rapid deployment, the trend in Beijing is towards minimizing this due to strong demand. The absorption rates for utilized capacity are exceptionally high, particularly in the hyperscale and wholesale colocation segments, indicating a market that is consistently expanding to meet demand.

Economic policies in Beijing strongly favor the development of advanced digital infrastructure, including tax incentives and streamlined regulatory processes for data center construction. Infrastructure development, such as reliable power grids and high-speed network connectivity, is paramount and continues to be a focus for government investment. The dominance of these segments is a direct consequence of Beijing's status as a major economic and technological hub, attracting significant investment in digital services and requiring world-class data center facilities to support these activities.

Beijing Data Center Market Product Developments

Product developments in the Beijing data center market are focused on enhancing efficiency, sustainability, and performance. Innovations include advancements in liquid cooling technologies to manage the heat generated by high-density server racks, critical for AI and high-performance computing. The integration of AI-powered management systems is becoming more prevalent, optimizing power consumption, security, and operational workflows. Furthermore, the development of modular and prefabricated data center solutions is gaining traction, enabling faster deployment and scalability. Green data center initiatives, focusing on renewable energy sources and advanced power usage effectiveness (PUE) metrics, are also key differentiators, offering competitive advantages by appealing to environmentally conscious clients and meeting evolving regulatory standards.

Key Drivers of Beijing Data Center Market Growth

The Beijing data center market is experiencing robust growth driven by several interconnected factors. The digital transformation initiatives across all sectors of the Chinese economy, championed by the government, are a primary catalyst. This includes the widespread adoption of cloud computing, which requires substantial and scalable data center infrastructure. The rapid expansion of 5G networks necessitates a distributed network of edge data centers for low-latency applications and services. Furthermore, the burgeoning AI and big data analytics industries demand immense processing power and storage capabilities, directly translating into increased data center demand. Economic growth and increasing consumer spending on digital services further fuel this expansion.

Challenges in the Beijing Data Center Market Market

Despite its strong growth, the Beijing data center market faces several challenges. Land acquisition and high real estate costs in a prime urban location present significant financial hurdles for new developments. Stringent environmental regulations regarding power consumption and carbon emissions require operators to invest in energy-efficient technologies and sustainable practices, increasing operational expenses. Supply chain disruptions, particularly for specialized equipment, can lead to project delays and cost overruns. Intense competition among a growing number of players, including both domestic and international operators, puts pressure on pricing and margins. Navigating the complex and evolving regulatory landscape also requires constant vigilance and adaptation.

Emerging Opportunities in Beijing Data Center Market

Emerging opportunities in the Beijing data center market are centered on innovation and strategic expansion. The increasing demand for edge computing facilities to support 5G, IoT, and real-time applications presents a significant growth avenue. Strategic partnerships between data center providers and cloud service providers can unlock new revenue streams and expand market reach. Sustainable data center development, leveraging renewable energy and advanced cooling solutions, is becoming a key differentiator and an area of increasing investment. The growing demand for specialized data centers catering to specific industries, such as high-performance computing for AI research or secure facilities for BFSI, offers niche market opportunities. Furthermore, the ongoing digitalization of traditional industries creates a pipeline of demand for modern data center services.

Leading Players in the Beijing Data Center Market Sector

- GDS

- KDDI Telehouse

- Princeton Digital Group

- China Telecom Corporation Ltd

- Chindata Group Holdings Ltd

Key Milestones in Beijing Data Center Market Industry

- February 2023: CapitaLand Investment Limited (CLI) announced the establishment of a Chinese data center development fund called CapitaLand China Data Centre Partners (CDCP). The fund is anticipated to aid the growth of data centers in Beijing and other regions.

- July 2022: Kappel announced its data center development plans in Beijing. The data center development decision was made after the company acquired Huailai Data Centre, and it expects to develop the site in the Beijing region with Heying jointly.

Strategic Outlook for Beijing Data Center Market Market

The strategic outlook for the Beijing data center market remains exceptionally strong, driven by continuous technological advancements and unwavering demand for digital infrastructure. Key growth accelerators include the sustained expansion of cloud services, the proliferation of AI and big data applications, and the ongoing rollout of 5G networks. Future market potential lies in the development of more intelligent, sustainable, and distributed data center solutions, including robust edge computing capabilities. Strategic opportunities involve forging deeper collaborations with technology providers and end-users, focusing on green energy integration, and capitalizing on government support for digital innovation. The market is anticipated to witness further consolidation and specialized development as players seek to optimize their offerings and capture market share.

Beijing Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

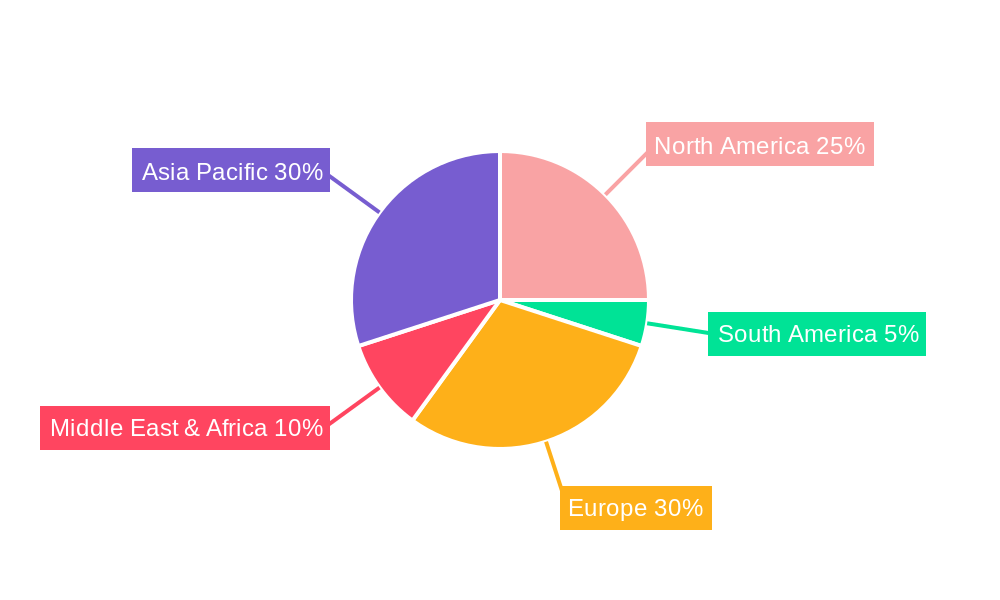

Beijing Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Beijing Data Center Market Regional Market Share

Geographic Coverage of Beijing Data Center Market

Beijing Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Large data centers are anticipated to grow in the region during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Beijing Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GDS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KDDI Telehouse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Princeton Digital Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Telecom Corporation Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chindata Group Holdings Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 GDS

List of Figures

- Figure 1: Global Beijing Data Center Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Beijing Data Center Market Revenue (million), by DC Size 2025 & 2033

- Figure 3: North America Beijing Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Beijing Data Center Market Revenue (million), by Tier Type 2025 & 2033

- Figure 5: North America Beijing Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Beijing Data Center Market Revenue (million), by Absorption 2025 & 2033

- Figure 7: North America Beijing Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Beijing Data Center Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Beijing Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Beijing Data Center Market Revenue (million), by DC Size 2025 & 2033

- Figure 11: South America Beijing Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Beijing Data Center Market Revenue (million), by Tier Type 2025 & 2033

- Figure 13: South America Beijing Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Beijing Data Center Market Revenue (million), by Absorption 2025 & 2033

- Figure 15: South America Beijing Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Beijing Data Center Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Beijing Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Beijing Data Center Market Revenue (million), by DC Size 2025 & 2033

- Figure 19: Europe Beijing Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Beijing Data Center Market Revenue (million), by Tier Type 2025 & 2033

- Figure 21: Europe Beijing Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Beijing Data Center Market Revenue (million), by Absorption 2025 & 2033

- Figure 23: Europe Beijing Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Beijing Data Center Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Beijing Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Beijing Data Center Market Revenue (million), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Beijing Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Beijing Data Center Market Revenue (million), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Beijing Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Beijing Data Center Market Revenue (million), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Beijing Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Beijing Data Center Market Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Beijing Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Beijing Data Center Market Revenue (million), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Beijing Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Beijing Data Center Market Revenue (million), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Beijing Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Beijing Data Center Market Revenue (million), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Beijing Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Beijing Data Center Market Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Beijing Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 2: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 3: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 4: Global Beijing Data Center Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 6: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 7: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 8: Global Beijing Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 13: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 14: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 15: Global Beijing Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 20: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 21: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 22: Global Beijing Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 33: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 34: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 35: Global Beijing Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Beijing Data Center Market Revenue million Forecast, by DC Size 2020 & 2033

- Table 43: Global Beijing Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 44: Global Beijing Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 45: Global Beijing Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Beijing Data Center Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beijing Data Center Market?

The projected CAGR is approximately 9.05%.

2. Which companies are prominent players in the Beijing Data Center Market?

Key companies in the market include GDS, KDDI Telehouse, Princeton Digital Group, China Telecom Corporation Ltd, Chindata Group Holdings Ltd.

3. What are the main segments of the Beijing Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD 237.18 million as of 2022.

5. What are some drivers contributing to market growth?

The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Large data centers are anticipated to grow in the region during the forecast period..

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

February 2023: CapitaLand Investment Limited (CLI) announced the establishment of a Chinese data center development fund called CapitaLand China Data Centre Partners (CDCP). The fund is anticipated to aid the growth of data centers in Beijing and other regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beijing Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beijing Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beijing Data Center Market?

To stay informed about further developments, trends, and reports in the Beijing Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence