Key Insights

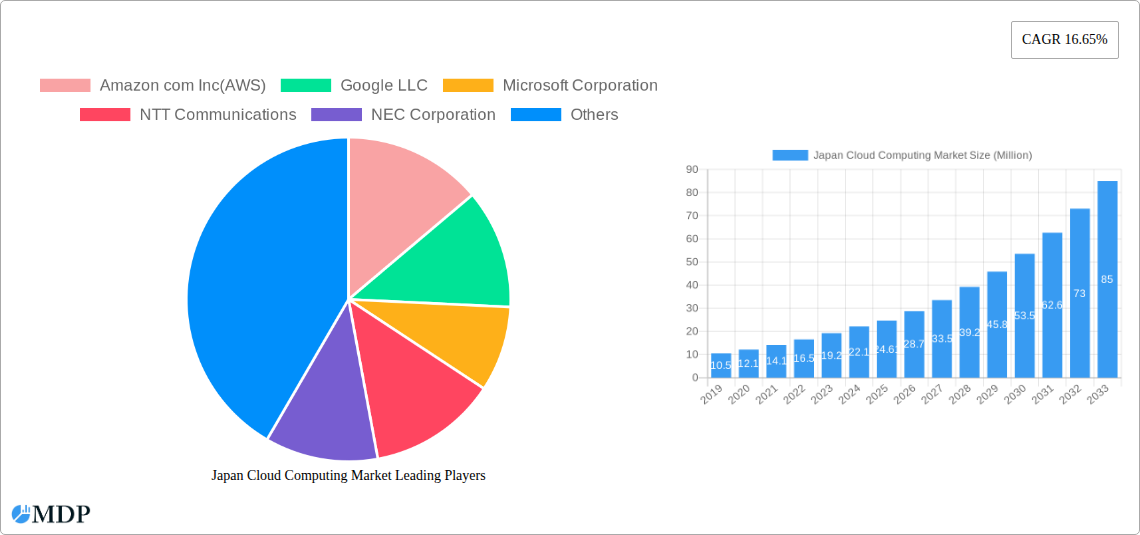

The Japan Cloud Computing Market is poised for substantial expansion, projected to reach approximately USD 24.61 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 16.65%. This impressive growth trajectory is fueled by several key drivers, primarily the accelerating digital transformation initiatives across Japanese businesses, a strong push towards remote work infrastructures, and the increasing adoption of advanced technologies like AI and IoT, all of which necessitate scalable and agile cloud solutions. Furthermore, government initiatives promoting digitalization and cybersecurity are providing a significant tailwind. The market's dynamism is further evidenced by the strong demand for hybrid and public cloud solutions, with IaaS, PaaS, and SaaS models collectively dominating adoption. SMEs are increasingly leveraging cloud services to enhance their competitiveness, while large enterprises are migrating complex workloads to gain efficiency and innovation capabilities.

Japan Cloud Computing Market Market Size (In Million)

Emerging trends such as the rise of specialized industry clouds, particularly within the manufacturing, healthcare, and BFSI sectors, are shaping market dynamics. The increasing focus on data sovereignty and compliance within Japan is driving the adoption of private and hybrid cloud solutions for sensitive data. While the market experiences rapid growth, potential restraints include a persistent cybersecurity skills gap and the initial costs associated with migrating legacy systems. However, the continuous innovation from leading cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, coupled with strategic partnerships and local investments, is expected to mitigate these challenges. The extensive range of end-user industries, including telecommunications, IT, retail, and government, all actively seeking cloud-native solutions, underscores the broad and sustained demand expected throughout the forecast period of 2025-2033.

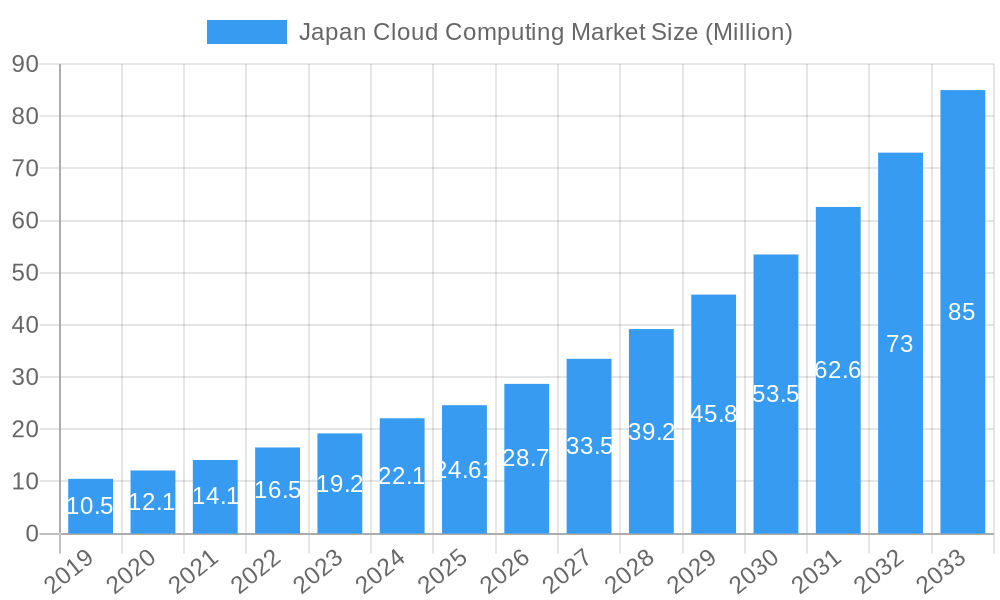

Japan Cloud Computing Market Company Market Share

This comprehensive report offers an in-depth analysis of the Japan Cloud Computing Market, a sector experiencing rapid digital transformation and significant investment. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides critical insights into market dynamics, industry trends, leading players, and future growth prospects. The report is meticulously structured to deliver actionable intelligence for stakeholders seeking to navigate and capitalize on this burgeoning market, encompassing Public Cloud (IaaS, PaaS, SaaS), Private Cloud, and Hybrid Cloud solutions, and catering to SMEs and Large Enterprises across diverse end-user industries like Manufacturing, Education, Retail, Transportation & Logistics, Healthcare, BFSI, Telecom & IT, and Government & Public Sector.

Japan Cloud Computing Market Market Dynamics & Concentration

The Japan Cloud Computing Market is characterized by increasing market concentration, driven by substantial investments from global technology giants and a strong push towards digital transformation within domestic enterprises. Innovation drivers are primarily fueled by the relentless pursuit of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT), which are heavily reliant on robust cloud infrastructure. Regulatory frameworks, particularly concerning data sovereignty and security, are shaping the market's landscape, encouraging localized data centers and compliance-focused solutions. Product substitutes, such as on-premise solutions, are gradually losing ground to the scalability, flexibility, and cost-efficiency offered by cloud services. End-user trends showcase a growing preference for managed cloud services, hybrid cloud adoption for a balanced approach to security and scalability, and a significant demand for specialized SaaS solutions tailored to industry-specific needs. Mergers & Acquisitions (M&A) activities, while perhaps less frequent than in more mature markets, are strategically focused on acquiring niche technologies or expanding service portfolios to capture market share. Key players like Amazon com Inc (AWS), Google LLC, and Microsoft Corporation hold significant market share, leveraging their extensive global infrastructure and service offerings. The M&A landscape is expected to witness targeted acquisitions to enhance capabilities in areas such as edge computing and specialized AI services. The overall market share distribution points towards a duopoly and oligopoly in certain segments, with continuous efforts from other players to carve out their niches.

Japan Cloud Computing Market Industry Trends & Analysis

The Japan Cloud Computing Market is poised for substantial growth, propelled by a confluence of accelerating market growth drivers, transformative technological disruptions, evolving consumer preferences, and intense competitive dynamics. The ongoing digital transformation initiatives across various Japanese industries are a primary catalyst, with businesses increasingly migrating their workloads to the cloud to enhance operational efficiency, foster innovation, and improve customer experiences. The Compound Annual Growth Rate (CAGR) of this market is projected to be robust throughout the forecast period (2025-2033), reflecting this sustained demand. Technological disruptions, particularly the rapid advancements in AI and machine learning, are creating new avenues for cloud service providers. The ability to leverage powerful cloud computing resources for complex AI model training and deployment is a significant market differentiator. Furthermore, the proliferation of edge computing, driven by the need for low-latency data processing in applications like autonomous vehicles and smart manufacturing, is creating opportunities for hybrid and distributed cloud solutions. Consumer preferences are shifting towards more sophisticated, data-driven services, with an emphasis on security, reliability, and seamless integration. Businesses are actively seeking cloud solutions that can support their digital-first strategies and provide a competitive edge. Competitive dynamics are characterized by intense rivalry among global hyperscale providers and a growing number of domestic players offering specialized solutions. The market penetration of cloud services is steadily increasing across all industry verticals, indicating a maturing market where cloud adoption is becoming the norm rather than the exception. The demand for highly scalable, secure, and cost-effective cloud infrastructure is a constant, driving innovation and service enhancements.

Leading Markets & Segments in Japan Cloud Computing Market

Within the Japan Cloud Computing Market, Public Cloud emerges as the dominant segment, encompassing Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). This dominance is attributed to the inherent advantages of public cloud, including scalability, cost-effectiveness, and rapid deployment, which align perfectly with the agile operational needs of many Japanese businesses.

Public Cloud (IaaS, PaaS, SaaS):

- Key Drivers: Government initiatives promoting digitalization, the proliferation of startups requiring flexible IT resources, and the increasing adoption of cloud-native applications by large enterprises. The demand for advanced analytics and AI capabilities further fuels the PaaS and SaaS segments.

- Dominance Analysis: IaaS provides the foundational computing resources, enabling organizations to build and deploy applications without significant upfront capital expenditure. PaaS offerings simplify application development and deployment by providing pre-built platforms and tools, fostering faster innovation cycles. SaaS solutions, covering a wide array of business applications from CRM to ERP, offer immediate utility and operational efficiency, making them highly attractive across all organization sizes. The robust growth in demand for AI/ML services directly translates into increased adoption of IaaS and PaaS for training and deployment.

Hybrid Cloud:

- Key Drivers: The need for a balanced approach to data security, regulatory compliance, and operational flexibility. Many organizations prefer to keep sensitive data on-premise while leveraging the scalability of the public cloud for other workloads.

- Dominance Analysis: Hybrid cloud solutions are gaining significant traction as they offer the best of both worlds. This approach allows businesses to maintain control over critical data and applications while utilizing the agility and cost-efficiency of public cloud for less sensitive workloads. The growing focus on data sovereignty further bolsters the appeal of hybrid cloud models.

Organization Size:

- Large Enterprises: These organizations are major adopters of cloud services, driving significant demand for comprehensive solutions across IaaS, PaaS, and SaaS. Their adoption is often driven by the need for digital transformation, advanced analytics, and global scalability.

- SMEs: Increasingly embracing cloud solutions to level the playing field with larger competitors, leveraging cost-effective SaaS applications and scalable IaaS/PaaS offerings to enhance productivity and innovation without substantial IT investment.

End-user Industries:

- BFSI (Banking, Financial Services, and Insurance): A leading adopter, driven by the need for secure, scalable, and compliant cloud solutions for data analytics, fraud detection, and customer-facing applications.

- Telecom and IT: Naturally at the forefront of cloud adoption, utilizing cloud services for network virtualization, service delivery platforms, and internal IT operations.

- Manufacturing: Increasingly leveraging cloud for IoT integration, supply chain optimization, predictive maintenance, and smart factory initiatives.

- Retail: Adopting cloud for e-commerce platforms, customer analytics, inventory management, and personalized marketing.

- Government and Public Sector: Migrating critical services to the cloud for enhanced efficiency, citizen engagement, and disaster recovery capabilities, with a strong emphasis on data security and sovereignty.

- Healthcare: Cloud adoption is accelerating for electronic health records (EHRs), telemedicine, medical imaging analysis, and research, with stringent regulatory compliance being a key consideration.

- Education: Utilizing cloud for online learning platforms, research collaboration, and administrative systems.

Japan Cloud Computing Market Product Developments

Product developments in the Japan Cloud Computing Market are heavily influenced by the demand for advanced capabilities in AI, machine learning, and data analytics. Key innovations include the introduction of more powerful GPU-accelerated cloud instances for AI training, enhanced security features for hybrid and multi-cloud environments, and specialized SaaS solutions tailored for industry-specific use cases, such as hyper-personalization in retail or predictive maintenance in manufacturing. Companies are focusing on developing services that simplify AI model deployment and management, alongside robust data governance and compliance tools to meet stringent Japanese regulations. The competitive advantage lies in offering integrated solutions that seamlessly combine compute, storage, networking, and advanced software services, enabling businesses to accelerate their digital transformation and gain a competitive edge through data-driven insights and agile operations.

Key Drivers of Japan Cloud Computing Market Growth

The Japan Cloud Computing Market's growth is propelled by several key factors. A primary driver is the Japanese government's strong push for digital transformation (DX) across all sectors, incentivizing businesses to adopt cloud technologies for enhanced productivity and innovation. The increasing demand for AI and Big Data analytics capabilities fuels the need for scalable and powerful cloud infrastructure. Furthermore, the growing adoption of IoT devices, especially in manufacturing and smart city initiatives, necessitates robust cloud platforms for data processing and analysis. The cost-effectiveness and scalability offered by cloud services, compared to traditional on-premise solutions, make them an attractive proposition for both SMEs and large enterprises looking to optimize IT spending and accelerate time-to-market for new services and products. The ongoing digital skills gap is also being addressed by cloud providers offering managed services and training programs, further accelerating adoption.

Challenges in the Japan Cloud Computing Market Market

Despite its strong growth trajectory, the Japan Cloud Computing Market faces several challenges. Regulatory hurdles, particularly concerning data sovereignty and privacy, can be complex and require careful navigation by cloud providers and their clients. The lingering concerns around cybersecurity and data breaches, although mitigated by advanced security measures, remain a significant consideration for risk-averse organizations. The substantial upfront investment required for some large-scale cloud migrations can be a barrier for smaller businesses. Furthermore, the digital skills gap, while being addressed, can still pose a challenge in effectively managing and optimizing complex cloud environments. Intense competition among established global players and emerging domestic providers can also lead to pricing pressures and a need for continuous differentiation.

Emerging Opportunities in Japan Cloud Computing Market

The Japan Cloud Computing Market presents significant emerging opportunities. The rapid advancement and adoption of Artificial Intelligence (AI) and Machine Learning (ML) are creating immense demand for high-performance cloud computing resources, particularly for training complex models and deploying AI-powered applications. The growing focus on sustainability and ESG initiatives is driving demand for energy-efficient cloud solutions and carbon footprint tracking services. Furthermore, the increasing adoption of edge computing, driven by the need for real-time data processing in sectors like autonomous driving and smart manufacturing, opens avenues for distributed cloud architectures. Strategic partnerships between cloud providers and Japanese enterprises to develop bespoke industry-specific solutions, coupled with the expansion of cloud services into underserved regions and sectors, represent significant growth catalysts for the future.

Leading Players in the Japan Cloud Computing Market Sector

- Amazon com Inc (AWS)

- Google LLC

- Microsoft Corporation

- NTT Communications

- NEC Corporation

- Rackspace Technology Inc

- Oracle Corporation

- IBM Corporation

- Fujitsu Limited

- Salesforce Inc

- SAP S

Key Milestones in Japan Cloud Computing Market Industry

- April 2024: Microsoft announced plans to invest USD2.9 billion over the next two years, bolstering its hyperscale cloud computing and AI infrastructure in Japan. The tech giant aimed to enhance its digital skilling initiatives, targeting AI training for over 3 million individuals in the next three years. In addition, Microsoft planned to inaugurate its inaugural Microsoft Research Asia lab in Japan and intensify its cybersecurity partnership with the Japanese government.

- April 2024: Oracle Corporation Japan announced a bold investment exceeding USD 8 billion, spread over the next decade, in response to Japan's burgeoning appetite for cloud computing and AI infrastructure. This financial commitment was poised to expand the footprint of Oracle Cloud Infrastructure (OCI) across Japan. In addition, Oracle enhanced its operations and support engineering teams with local personnel to guide clients and partners through Japan's digital sovereignty mandates.

Strategic Outlook for Japan Cloud Computing Market Market

The strategic outlook for the Japan Cloud Computing Market is exceptionally promising, driven by continued strong demand for digital transformation and cutting-edge technologies. Key growth accelerators include the ongoing expansion of AI and ML capabilities, with providers focusing on offering specialized hardware and software for advanced analytics and intelligent automation. The emphasis on data sovereignty and security will continue to drive the adoption of hybrid and private cloud solutions, alongside robust compliance frameworks. Furthermore, strategic partnerships and collaborations between global cloud giants and Japanese enterprises are expected to foster innovation and the development of tailored solutions for specific industry needs. The increasing integration of edge computing with cloud services will unlock new use cases and expand the market's reach into emerging sectors. Investments in digital skilling and talent development will be crucial for sustained growth and widespread adoption of advanced cloud services.

Japan Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industries

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. Telecom and IT

- 3.8. Government and Public Sector

- 3.9. Others (Utilities, Media & Entertainment etc)

Japan Cloud Computing Market Segmentation By Geography

- 1. Japan

Japan Cloud Computing Market Regional Market Share

Geographic Coverage of Japan Cloud Computing Market

Japan Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.3. Market Restrains

- 3.3.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.4. Market Trends

- 3.4.1. Major Advancements in Digital Change Nationwide

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. Telecom and IT

- 5.3.8. Government and Public Sector

- 5.3.9. Others (Utilities, Media & Entertainment etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon com Inc(AWS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NTT Communications

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NEC Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rackspace Technology Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IBM Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Salesforce Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAP S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amazon com Inc(AWS)

List of Figures

- Figure 1: Japan Cloud Computing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Cloud Computing Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Japan Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Japan Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: Japan Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Japan Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 7: Japan Cloud Computing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Cloud Computing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Japan Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Japan Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Japan Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Japan Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: Japan Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 14: Japan Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Japan Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Cloud Computing Market?

The projected CAGR is approximately 16.65%.

2. Which companies are prominent players in the Japan Cloud Computing Market?

Key companies in the market include Amazon com Inc(AWS), Google LLC, Microsoft Corporation, NTT Communications, NEC Corporation, Rackspace Technology Inc, Oracle Corporation, IBM Corporation, Fujitsu Limited, Salesforce Inc, SAP S.

3. What are the main segments of the Japan Cloud Computing Market?

The market segments include Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

6. What are the notable trends driving market growth?

Major Advancements in Digital Change Nationwide.

7. Are there any restraints impacting market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

8. Can you provide examples of recent developments in the market?

April 2024: Microsoft announced plans to invest USD2.9 billion over the next two years, bolstering its hyperscale cloud computing and AI infrastructure in Japan. The tech giant aimed to enhance its digital skilling initiatives, targeting AI training for over 3 million individuals in the next three years. In addition, Microsoft planned to inaugurate its inaugural Microsoft Research Asia lab in Japan and intensify its cybersecurity partnership with the Japanese government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Cloud Computing Market?

To stay informed about further developments, trends, and reports in the Japan Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence