Key Insights

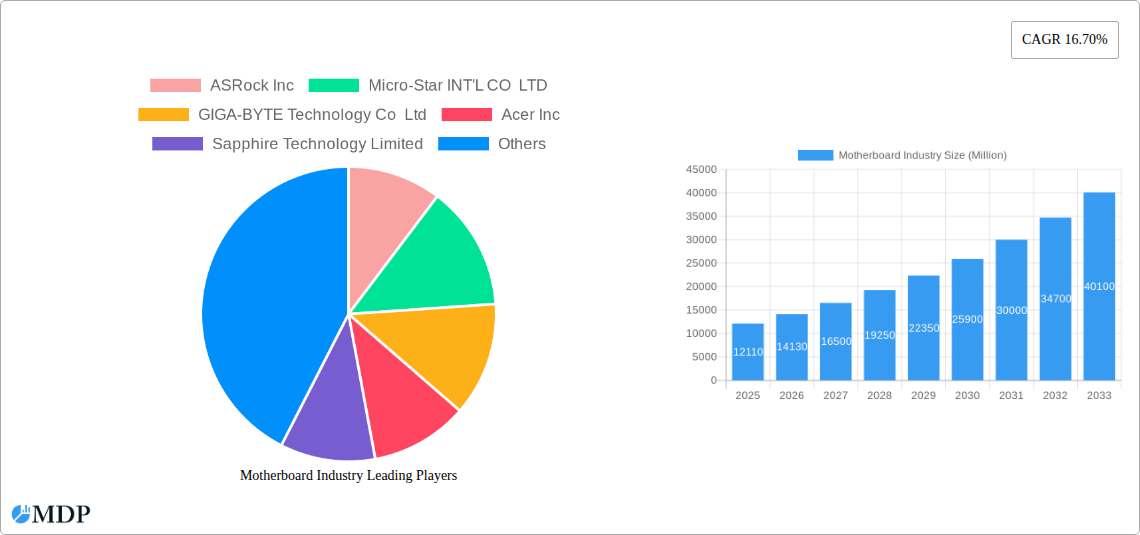

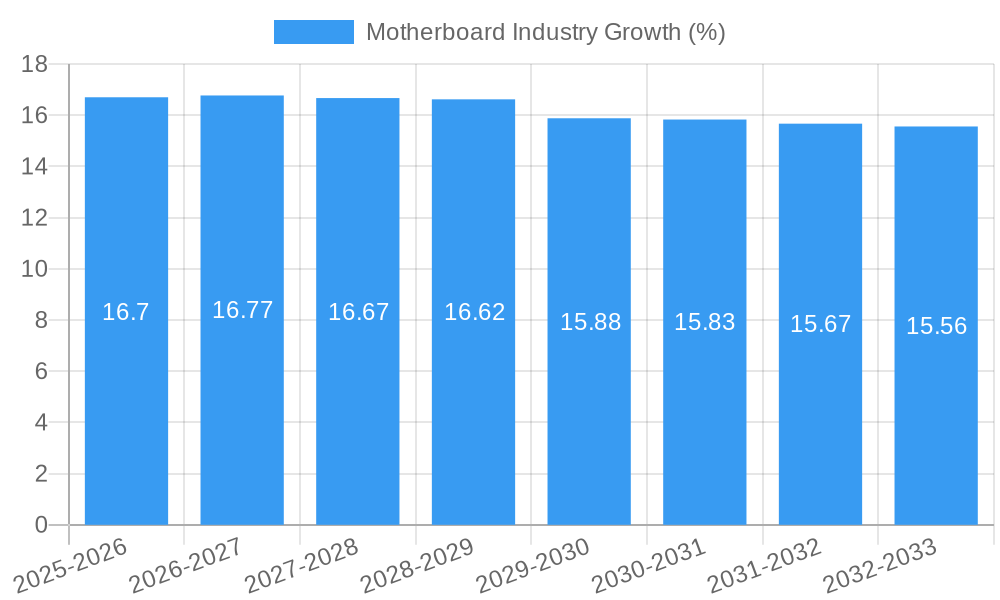

The global motherboard market is experiencing robust expansion, projected to reach $12.11 billion in 2025 and exhibiting a compelling Compound Annual Growth Rate (CAGR) of 16.70% through 2033. This significant growth is propelled by a confluence of dynamic drivers, chief among them the relentless evolution of computing technology and the escalating demand for high-performance hardware across diverse sectors. The increasing sophistication of gaming, coupled with the burgeoning data center industry, is a primary catalyst, necessitating more powerful and feature-rich motherboards. Furthermore, the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) workloads demands advanced processing capabilities, directly translating to motherboard innovation and market uplift. The surge in consumer electronics, from advanced personal computers to sophisticated workstations and even specialized industrial systems, further fuels this demand, ensuring a consistent market for motherboard manufacturers.

Navigating this expanding landscape, the motherboard industry is characterized by key trends including the miniaturization of form factors like Mini-ITX, catering to the growing demand for compact yet powerful systems in both consumer and industrial applications. This is complemented by a parallel trend towards enhanced connectivity and integration of next-generation chipsets, supporting faster data transfer rates and more efficient power management. While the market is largely driven by technological advancements and expanding end-user industries such as Industrial and Commercial, it faces certain restraints. These include the increasing commoditization of certain market segments, which can put pressure on profit margins, and the significant research and development costs associated with staying at the forefront of technological innovation. Nonetheless, the inherent necessity of motherboards as the central nervous system of any computing device, coupled with the continuous innovation cycle, positions the industry for sustained and impressive growth.

Gain unparalleled insights into the dynamic global Motherboard Industry with this in-depth market report. Covering the period from 2019 to 2033, with a deep dive into the Base Year 2025 and Forecast Period 2025-2033, this report provides essential data and analysis for industry stakeholders. We meticulously examine market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities, offering a strategic roadmap for navigating the evolving motherboard landscape. Discover critical trends, technological disruptions, consumer preferences, and competitive dynamics, underpinned by a robust analysis of leading markets, segments (including Form Factors like ATX, Micro-ATX, Mini-ITX, and End-user Industries such as Industrial and Commercial), and pioneering product developments. Understand the key growth drivers, inherent challenges, and emerging opportunities that will shape the future of the motherboard market. Featuring key players like ASRock Inc, Micro-Star INT'L CO LTD, GIGA-BYTE Technology Co Ltd, Acer Inc, Sapphire Technology Limited, EVGA Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Group, Advantech Co Ltd, Shenzhen Seavo Technology Co Ltd, and MiTAC Computing Technology Corporation (MiTAC Group), this report is an indispensable resource for informed decision-making.

Motherboard Industry Market Dynamics & Concentration

The global motherboard market exhibits a moderate to high concentration, with a few dominant players like ASUSTeK Computer Inc. and Micro-Star INT'L CO LTD holding significant market share, estimated to be upwards of 30% collectively. Innovation is a key driver, fueled by the relentless demand for enhanced performance, increased connectivity, and improved power efficiency in computing devices. Regulatory frameworks, primarily concerning environmental compliance and product safety standards, are increasingly influencing manufacturing processes and material sourcing. Product substitutes are limited in the direct motherboard market; however, the rise of System-on-Chip (SoC) solutions in certain embedded and mobile applications poses an indirect competitive threat. End-user trends indicate a growing preference for motherboards supporting the latest CPU generations, advanced graphics capabilities, and high-speed storage solutions. Mergers and acquisitions (M&A) activity in the sector has been steady but not exceptionally high, with an estimated 5-10 significant deals annually over the historical period, often driven by consolidation to enhance R&D capabilities or expand market reach. The market size is projected to reach approximately 150 Million units by 2025.

Motherboard Industry Industry Trends & Analysis

The motherboard industry is experiencing robust growth, driven by several interconnected factors. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be around 5.5%. This growth is propelled by the constant need for upgraded personal computing devices, gaming rigs, and high-performance workstations, alongside the expanding demand from industrial and commercial sectors for robust and specialized computing solutions. Technological disruptions are at the forefront, with the integration of PCIe 5.0, DDR5 memory, and advanced cooling solutions becoming standard features. The development of new CPU architectures by Intel and AMD consistently creates a demand for compatible, high-performance motherboards. Consumer preferences are increasingly leaning towards motherboards offering enhanced overclocking capabilities, advanced audio codecs, improved network connectivity (Wi-Fi 6E/7), and aesthetic designs for custom builds. Competitive dynamics are characterized by intense innovation, with companies striving to differentiate through unique feature sets, proprietary technologies, and aggressive pricing strategies. Market penetration for high-end motherboards is expected to rise as consumers seek more powerful and future-proof systems. The market size is anticipated to reach over 200 Million units by 2033.

Leading Markets & Segments in Motherboard Industry

The ATX form factor continues to dominate the motherboard market, accounting for an estimated 60% of global sales, primarily driven by its versatility and suitability for high-performance gaming PCs and workstations. Micro-ATX motherboards follow, capturing approximately 30% of the market, popular for their balance of size and expandability in mainstream desktop systems. The Mini-ITX form factor, though smaller in market share (around 10%), is experiencing significant growth, driven by the demand for compact, space-saving computing solutions in home theater PCs and small form factor builds. In terms of end-user industries, the Commercial segment holds a substantial market share, fueled by the ongoing demand for desktop computers in corporate environments, servers, and specialized industrial equipment. The Industrial segment, while smaller, is a crucial growth area, driven by the increasing adoption of edge computing, IoT devices, and automation in manufacturing, logistics, and healthcare. Key drivers for dominance in these segments include:

- ATX: Compatibility with a wide range of components, extensive expansion slots, and superior cooling capabilities, making it ideal for high-end gaming and professional workstations.

- Micro-ATX: A balance of affordability, compact size, and sufficient expansion options, appealing to a broad consumer base.

- Mini-ITX: The growing trend towards smaller, more aesthetically pleasing computing devices, and the increasing complexity of embedded systems.

- Commercial: The constant refresh cycle of corporate IT infrastructure, the need for reliable computing for business operations, and the deployment of specialized business machines.

- Industrial: The rapid expansion of IoT, the need for robust and reliable computing in harsh environments, and the integration of AI and machine learning at the edge.

Motherboard Industry Product Developments

Recent product developments underscore the industry's relentless pursuit of innovation. GIGABYTE TECHNOLOGY Co. Ltd's introduction of Z790 AORUS gaming motherboards, engineered for 13th Gen Intel Core processors and PCIe 5.0, exemplifies the focus on next-generation performance. Similarly, ASUS's upcoming PRO WS W790E-SAGE motherboard, designed for Intel's Sapphire Rapids Fishhawk Falls HEDT CPUs, highlights advancements in High-End Desktop (HEDT) computing. These innovations offer competitive advantages through enhanced power management, superior thermal solutions, and cutting-edge audio features, catering to enthusiasts and professionals demanding peak performance and future-proofing.

Key Drivers of Motherboard Industry Growth

Several factors are propelling the motherboard industry's growth trajectory. The constant evolution of CPU and GPU technologies by Intel, AMD, and NVIDIA necessitates frequent motherboard upgrades to leverage new performance potentials and architectural enhancements. The burgeoning demand for gaming PCs, driven by the growing popularity of esports and high-fidelity gaming experiences, is a significant market catalyst. Furthermore, the increasing adoption of AI, machine learning, and edge computing across various industrial and commercial sectors requires specialized motherboards with advanced processing capabilities and connectivity options. Government initiatives promoting digitalization and technological advancement in developing economies also contribute to market expansion.

Challenges in the Motherboard Industry Market

Despite robust growth, the motherboard industry faces several challenges. Stringent environmental regulations concerning e-waste and hazardous materials can increase manufacturing costs and necessitate adherence to complex compliance standards. Global supply chain disruptions, as witnessed in recent years, can lead to component shortages and price volatility, impacting production timelines and profitability. Intense competition among established players and the threat of commoditization in certain market segments put pressure on profit margins. Additionally, the rapid pace of technological change requires continuous investment in R&D, which can be a significant financial burden for smaller manufacturers. The estimated annual impact of these challenges on market growth is a reduction of approximately 1-2%.

Emerging Opportunities in Motherboard Industry

Emerging opportunities in the motherboard industry are primarily driven by technological breakthroughs and strategic market expansion. The growing demand for specialized motherboards for Artificial Intelligence (AI) inference at the edge, Internet of Things (IoT) applications, and advanced data analytics presents a significant growth avenue. The increasing interest in sustainable computing and the development of energy-efficient motherboards also offer a competitive edge. Strategic partnerships between motherboard manufacturers and component providers (CPUs, GPUs, chipsets) can lead to bundled solutions and exclusive innovations. Furthermore, the expansion into emerging markets with growing PC adoption rates and the development of niche motherboard solutions for emerging applications like virtual reality (VR) and augmented reality (AR) will fuel long-term growth.

Leading Players in the Motherboard Industry Sector

- ASRock Inc

- Micro-Star INT'L CO LTD

- GIGA-BYTE Technology Co Ltd

- Acer Inc

- Sapphire Technology Limited

- EVGA Corporation

- Super Micro Computer Inc

- ASUSTeK Computer Inc

- Biostar Group

- Advantech Co Ltd

- Shenzhen Seavo Technology Co Ltd

- MiTAC Computing Technology Corporation (MiTAC Group)

Key Milestones in Motherboard Industry Industry

- September 2022: GIGABYTE TECHNOLOGY Co. Ltd announced the introduction of the Z790 AORUS gaming motherboards, exclusively designed for the 13th Gen Intel Core processors. These motherboards are fully next-gen ready, engineered for PCIe 5.0 graphics cards and SSDs, and equipped with comprehensive performance, power management, thermal, and audio features, pushing computing firepower to the next level.

- June 2022: ASUS's upcoming PRO WS W790E-SAGE motherboard was spotted, expected to feature support for Intel's next-gen Sapphire Rapids Fishhawk Falls HEDT CPUs. The forthcoming hardware diagnostic utility was anticipated to add enhanced sensor monitoring support for this yet-to-be-released motherboard. The ASUS SAGE series is consistently designed for HEDT CPU families, following previous iterations for AMD's Ryzen Threadripper (WRX80) and Intel's Core-X lineup (X299 Chipset).

Strategic Outlook for Motherboard Industry Market

The strategic outlook for the motherboard industry is characterized by continued innovation and market expansion. Manufacturers will focus on developing motherboards that offer enhanced performance, greater power efficiency, and advanced connectivity features to meet the evolving demands of the PC, gaming, and professional markets. The growing importance of AI and edge computing will drive the development of specialized industrial motherboards. Strategic partnerships and a focus on sustainable manufacturing practices will become increasingly crucial for long-term success. The industry is poised for sustained growth, driven by technological advancements and the ever-present need for powerful and versatile computing platforms.

Motherboard Industry Segmentation

-

1. Form Factor

- 1.1. ATX

- 1.2. Micro-ATX

- 1.3. Mini-ITX

-

2. End-user Industry

- 2.1. Industrial

- 2.2. Commercial

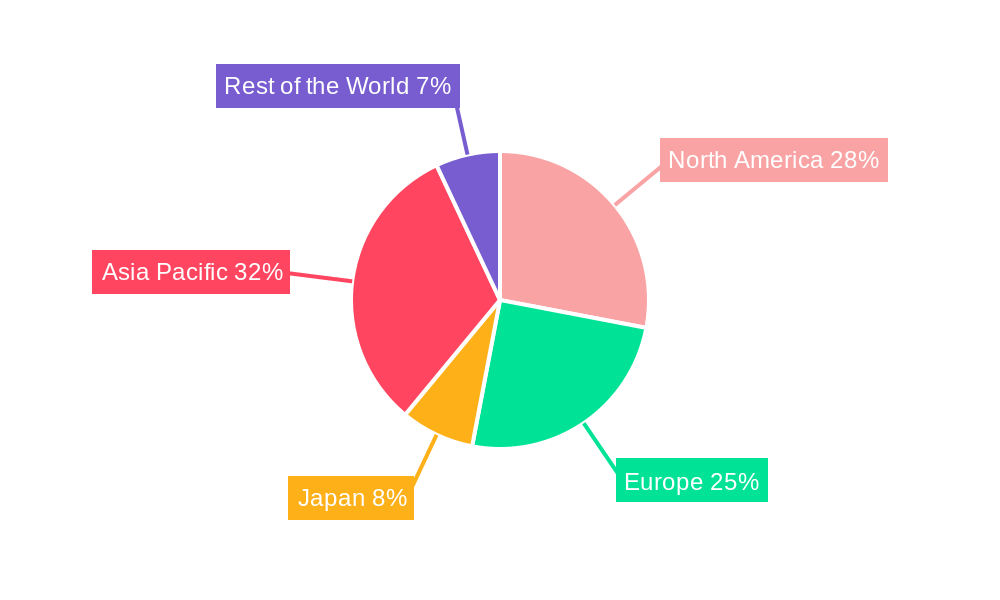

Motherboard Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Japan

- 4. Asia Pacific

- 5. Rest of the World

Motherboard Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continous Innovations of Motherboards; Increase in demand for ATX

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Design

- 3.4. Market Trends

- 3.4.1. Industrial Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. ATX

- 5.1.2. Micro-ATX

- 5.1.3. Mini-ITX

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Japan

- 5.3.4. Asia Pacific

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. North America Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. ATX

- 6.1.2. Micro-ATX

- 6.1.3. Mini-ITX

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. Europe Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. ATX

- 7.1.2. Micro-ATX

- 7.1.3. Mini-ITX

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Japan Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. ATX

- 8.1.2. Micro-ATX

- 8.1.3. Mini-ITX

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Asia Pacific Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 9.1.1. ATX

- 9.1.2. Micro-ATX

- 9.1.3. Mini-ITX

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 10. Rest of the World Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form Factor

- 10.1.1. ATX

- 10.1.2. Micro-ATX

- 10.1.3. Mini-ITX

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Industrial

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Form Factor

- 11. North America Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Motherboard Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 ASRock Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Micro-Star INT'L CO LTD

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 GIGA-BYTE Technology Co Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Acer Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Sapphire Technology Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 EVGA Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Super Micro Computer Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 ASUSTeK Computer Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Biostar Group

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Advantech Co Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Shenzhen Seavo Technology Co Ltd

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 MiTAC Computing Technology Corporation (MiTAC Group)

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 ASRock Inc

List of Figures

- Figure 1: Global Motherboard Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Motherboard Industry Revenue (Million), by Form Factor 2024 & 2032

- Figure 15: North America Motherboard Industry Revenue Share (%), by Form Factor 2024 & 2032

- Figure 16: North America Motherboard Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Motherboard Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Motherboard Industry Revenue (Million), by Form Factor 2024 & 2032

- Figure 21: Europe Motherboard Industry Revenue Share (%), by Form Factor 2024 & 2032

- Figure 22: Europe Motherboard Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Motherboard Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Japan Motherboard Industry Revenue (Million), by Form Factor 2024 & 2032

- Figure 27: Japan Motherboard Industry Revenue Share (%), by Form Factor 2024 & 2032

- Figure 28: Japan Motherboard Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Japan Motherboard Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Japan Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Japan Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Motherboard Industry Revenue (Million), by Form Factor 2024 & 2032

- Figure 33: Asia Pacific Motherboard Industry Revenue Share (%), by Form Factor 2024 & 2032

- Figure 34: Asia Pacific Motherboard Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Asia Pacific Motherboard Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Asia Pacific Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Motherboard Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Rest of the World Motherboard Industry Revenue (Million), by Form Factor 2024 & 2032

- Figure 39: Rest of the World Motherboard Industry Revenue Share (%), by Form Factor 2024 & 2032

- Figure 40: Rest of the World Motherboard Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Rest of the World Motherboard Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Rest of the World Motherboard Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Rest of the World Motherboard Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Motherboard Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Motherboard Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Motherboard Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 51: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 54: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 55: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 57: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 58: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 60: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 61: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 63: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 64: Global Motherboard Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motherboard Industry?

The projected CAGR is approximately 16.70%.

2. Which companies are prominent players in the Motherboard Industry?

Key companies in the market include ASRock Inc, Micro-Star INT'L CO LTD, GIGA-BYTE Technology Co Ltd, Acer Inc, Sapphire Technology Limited, EVGA Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Group, Advantech Co Ltd, Shenzhen Seavo Technology Co Ltd, MiTAC Computing Technology Corporation (MiTAC Group).

3. What are the main segments of the Motherboard Industry?

The market segments include Form Factor, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Continous Innovations of Motherboards; Increase in demand for ATX.

6. What are the notable trends driving market growth?

Industrial Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Complexity of Design.

8. Can you provide examples of recent developments in the market?

September 2022 - GIGABYTE TECHNOLOGY Co. Ltd, a manufacturer of motherboards, graphics cards, and hardware solutions, announced the introduction of the Z790 AORUS gaming motherboards, which are exclusively designed for the 13th Gen Intel Core processors. GIGABYTE Z790 AORUS motherboards are completely next-gen ready and are engineered for PCIe 5.0 graphics cards and SSDs. Equipped with an all-around performance, power management, thermals, and audio features, GIGABYTE Z790 AORUS motherboards definitively push computing firepower to the next level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motherboard Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motherboard Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motherboard Industry?

To stay informed about further developments, trends, and reports in the Motherboard Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence