Key Insights

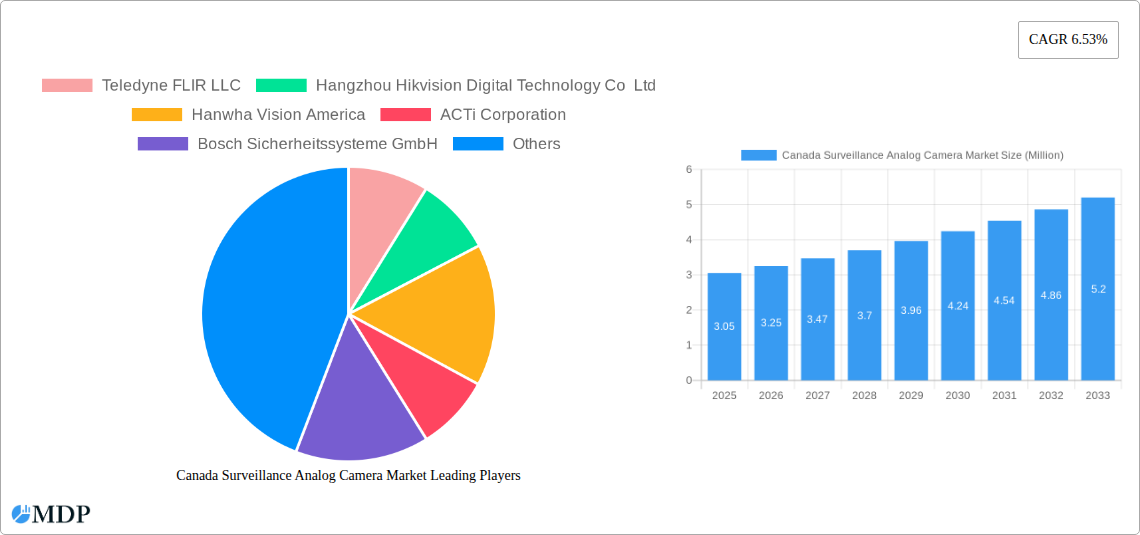

The Canadian surveillance analog camera market is poised for substantial growth, with a current market size of approximately USD 3.05 million and a projected Compound Annual Growth Rate (CAGR) of 6.53% from 2025 to 2033. This upward trajectory is primarily driven by increasing security concerns across various sectors and the ongoing need for cost-effective surveillance solutions. Government, banking, and transportation & logistics sectors are expected to be significant contributors to this growth, leveraging analog cameras for their robust performance and lower initial investment compared to digital counterparts, especially in retrofitting existing infrastructure. The industrial sector also presents a notable opportunity as businesses prioritize operational safety and asset protection. Despite the rise of IP cameras, analog technology continues to hold its ground due to its reliability and simplified installation, making it an attractive option for budget-conscious deployments.

Canada Surveillance Analog Camera Market Market Size (In Million)

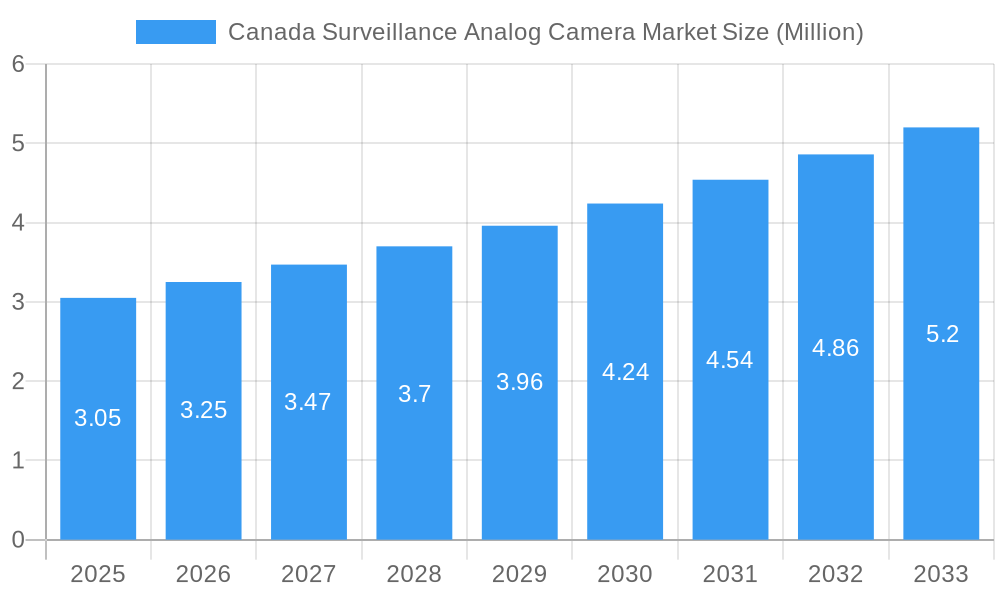

However, the market faces certain restraints, notably the evolving technological landscape favoring higher-resolution and feature-rich IP surveillance systems. While analog cameras offer a cost advantage, their limitations in terms of image clarity, scalability, and remote accessibility might hinder adoption in more advanced security applications. Nevertheless, strategic advancements in analog technology, such as higher resolution analog cameras and hybrid systems, are expected to mitigate some of these challenges. Key players like Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, and Honeywell International Inc. are actively innovating and adapting their product portfolios to cater to the diverse needs of the Canadian market, ensuring continued relevance and market share in the evolving security ecosystem.

Canada Surveillance Analog Camera Market Company Market Share

Report Description:

Dive deep into the dynamic Canada surveillance analog camera market with this definitive, SEO-optimized report. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report provides invaluable insights into market dynamics, industry trends, key players, and emerging opportunities. Leveraging high-traffic keywords such as analog CCTV Canada, security cameras Canada, surveillance systems Canada, hikvision Canada, and FLIR Canada, this analysis is designed to maximize search visibility for industry stakeholders, including manufacturers, distributors, integrators, and end-users. Understand the competitive landscape, technological advancements, and regulatory influences shaping the future of analog surveillance in Canada. With a projected market size of $500 Million by 2025 and a steady CAGR of 4.5% from 2025-2033, this report offers actionable intelligence for strategic decision-making.

Canada Surveillance Analog Camera Market Market Dynamics & Concentration

The Canada surveillance analog camera market is characterized by moderate concentration, with a few key players holding significant market share, yet offering ample space for niche players and system integrators. Innovation drivers are primarily fueled by the need for cost-effective and reliable surveillance solutions, particularly in legacy installations. Regulatory frameworks, while evolving, continue to mandate security measures across various sectors, indirectly supporting the analog camera market. Product substitutes, predominantly IP-based camera systems, present a growing challenge, pushing analog manufacturers to enhance features and compatibility. End-user trends reveal a sustained demand from sectors requiring robust, long-term surveillance infrastructure, often integrated with existing analog networks. Merger and acquisition activities, while not exceptionally high in number, have been strategic, aimed at consolidating portfolios or expanding technological capabilities. For instance, a hypothetical M&A deal in 2023 between a system integrator and a smaller analog camera manufacturer could represent a typical consolidation trend. The market share distribution sees major global players like Hangzhou Hikvision Digital Technology Co Ltd and Teledyne FLIR LLC occupying substantial portions, followed by regional distributors and manufacturers. The number of M&A deals in the last five years is estimated to be around 3-5, indicating a steady but not aggressive consolidation pace.

Canada Surveillance Analog Camera Market Industry Trends & Analysis

The Canada surveillance analog camera market is witnessing a fascinating interplay of established technology and ongoing innovation, driven by the persistent demand for cost-effective and reliable security solutions. While IP cameras have gained considerable traction, the inherent advantages of analog technology, such as lower infrastructure costs for upgrades and robust performance in challenging environmental conditions, continue to secure its market presence. The market is experiencing growth primarily fueled by the need for replacements and upgrades in existing analog surveillance systems across various sectors, including government, banking, and industrial facilities. The CAGR for the analog camera market in Canada is estimated at 4.5% between 2025 and 2033, reflecting a mature yet steady growth trajectory.

Technological disruptions are manifesting in advancements within the analog domain itself. Manufacturers are focusing on enhancing image quality through technologies like Turbo HD and ColorVu, enabling higher resolutions and better low-light performance, thereby narrowing the gap with IP systems. This allows users to leverage existing analog cabling for HD video transmission, a significant cost-saving for businesses upgrading their security infrastructure. Consumer preferences, while leaning towards advanced features, still prioritize simplicity of installation and maintenance, areas where analog cameras often excel. The competitive dynamics are shaped by global manufacturers competing on price, features, and brand reputation, alongside local distributors who offer tailored solutions and support. Market penetration of analog cameras, while facing competition from IP, remains substantial due to the vast installed base of older analog systems that are gradually being modernized with higher-definition analog equipment. The overall market penetration for analog cameras is estimated at around 55% in 2025, with a projected slight decrease as IP adoption accelerates, but still maintaining a strong presence.

Leading Markets & Segments in Canada Surveillance Analog Camera Market

The Canada surveillance analog camera market exhibits strong performance across several key end-user industries, each contributing to the overall market growth and adoption patterns. The Government sector stands out as a dominant segment, driven by the continuous need for public safety, border security, and infrastructure protection across federal, provincial, and municipal levels. Significant investments in public security initiatives and smart city projects often necessitate robust and reliable surveillance solutions, where analog cameras find application due to their cost-effectiveness and proven durability.

- Government:

- Economic Policies: Government funding for infrastructure development and public safety programs acts as a significant growth accelerator.

- Infrastructure: The extensive network of public facilities, transportation hubs, and critical infrastructure requires comprehensive and scalable surveillance.

- Regulatory Mandates: Strict security regulations for government buildings and public spaces drive the demand for surveillance equipment.

- Banking: The financial sector, comprising banks and credit unions, represents another crucial segment. The imperative to prevent fraud, protect assets, and ensure customer safety fuels the demand for high-resolution analog cameras, particularly in branch locations and ATMs. The ability to integrate analog systems with existing security infrastructure makes them an attractive option for upgrades.

- Asset Protection: High-value assets and sensitive data necessitate continuous monitoring and recording.

- Fraud Prevention: Advanced analog cameras with high-definition capabilities aid in identifying suspicious activities and verifying transactions.

- Transportation & Logistics: Airports, ports, railway stations, and logistics hubs require comprehensive surveillance for security and operational efficiency. Analog cameras are deployed to monitor passenger flow, secure cargo, and enhance overall safety within these complex environments.

- Operational Efficiency: Monitoring traffic flow, managing logistics, and ensuring timely deliveries.

- Security Enhancements: Protecting valuable cargo and critical infrastructure from theft and vandalism.

- Industrial: Manufacturing plants, warehouses, and industrial complexes utilize analog cameras for monitoring production processes, ensuring worker safety, and preventing theft or unauthorized access. The rugged nature of analog cameras makes them suitable for harsh industrial environments.

- Process Monitoring: Ensuring smooth and efficient production operations.

- Workplace Safety: Monitoring hazardous areas and ensuring compliance with safety protocols.

- Healthcare: Hospitals and healthcare facilities employ analog surveillance to ensure patient safety, monitor restricted areas, and secure medical equipment and pharmaceuticals. The reliable performance and ease of installation are key factors in this sector.

- Patient Safety: Protecting vulnerable individuals and monitoring critical care areas.

- Asset Security: Securing high-value medical equipment and pharmaceuticals.

- Other End-user Industries: This category encompasses a broad range of applications including retail, education, and hospitality, all of which contribute to the sustained demand for analog surveillance solutions.

The dominance of the Government sector is underscored by its large-scale deployment needs and consistent budget allocations for security infrastructure. The Banking sector's adoption is driven by a strong emphasis on loss prevention and compliance. Transportation and Industrial sectors benefit from the resilience and cost-effectiveness of analog systems in expansive and potentially harsh environments.

Canada Surveillance Analog Camera Market Product Developments

Product developments in the Canada surveillance analog camera market are focused on enhancing resolution, improving low-light performance, and expanding compatibility. Innovations like Hikvision's Turbo HD 8.0 lineup introduce advanced features such as real-time communication and 180-degree video coverage, elevating the interactive capabilities of analog systems. Furthermore, the introduction of cameras with F1.0 apertures, like Hikvision's ColorVu series, offers continuous, high-quality full-color imaging even in challenging low-light conditions. These advancements, coupled with 3D Digital Noise Reduction (DNR) technology, significantly improve image clarity and detail capture. The ability to support HD over analog cabling allows for seamless upgrades, providing a competitive advantage by leveraging existing infrastructure, thus making these product developments highly relevant to market demand for cost-effective yet high-performance surveillance.

Key Drivers of Canada Surveillance Analog Camera Market Growth

The growth of the Canada surveillance analog camera market is primarily driven by the substantial installed base of existing analog infrastructure, necessitating cost-effective upgrades and replacements. The inherent reliability and proven performance of analog technology in diverse environmental conditions remain a key advantage, particularly for applications requiring robust, long-term surveillance. Economic factors, such as ongoing investments in public safety by the government and security enhancements in sectors like banking and industrial facilities, further fuel demand. Regulatory mandates for security and surveillance across various industries also contribute to sustained adoption. Moreover, technological advancements within analog systems, such as higher resolutions and improved low-light capabilities through technologies like Turbo HD and ColorVu, are helping analog cameras remain competitive against IP solutions, especially when upgrading existing networks.

Challenges in the Canada Surveillance Analog Camera Market Market

Despite its resilience, the Canada surveillance analog camera market faces significant challenges. The primary restraint is the rapid advancement and increasing affordability of IP-based surveillance systems, which offer superior resolution, scalability, and advanced features like AI analytics. The perception of analog as an outdated technology can hinder new adoption. Furthermore, supply chain disruptions and fluctuating component costs can impact pricing and availability, affecting manufacturers and end-users alike. Regulatory changes that increasingly favor more advanced digital surveillance solutions could also pose a long-term challenge. Competition from a crowded market with numerous manufacturers, both global and local, intensifies price pressures and necessitates continuous innovation to maintain market share. The estimated impact of IP competition is a potential market share erosion of 1-2% annually.

Emerging Opportunities in Canada Surveillance Analog Camera Market

Emerging opportunities in the Canada surveillance analog camera market lie in the continued demand for hybrid surveillance solutions, where analog cameras are integrated with newer IP systems for cost-optimized upgrades. Manufacturers can capitalize on the vast existing analog infrastructure by offering high-definition analog cameras that provide significant improvements in image quality without requiring a complete overhaul of cabling. Strategic partnerships between analog camera manufacturers, system integrators, and IT solution providers can create comprehensive surveillance packages tailored to specific industry needs, such as smart city initiatives or enhanced retail security. Furthermore, exploring niche markets that highly value the simplicity, reliability, and cost-effectiveness of analog technology, such as remote industrial sites or older public infrastructure, presents significant growth potential. The development of advanced analog technologies that mimic some of the functionalities of IP systems, such as remote accessibility and improved analytics, can further invigorate the market.

Leading Players in the Canada Surveillance Analog Camera Market Sector

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Pelco

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Zosi Technology Lt

Key Milestones in Canada Surveillance Analog Camera Market Industry

- April 2024: Hikvision unveiled its cutting-edge Turbo HD 8.0 lineup, enhancing its analog security offerings. This latest iteration promises users an enriched and interactive security interface, empowering them to elevate their surveillance capabilities. Turbo HD 8.0 introduces four groundbreaking features: real-time communication, 180-degree video coverage, and an enhanced night vision capability.

- October 2023: Hikvision introduced the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras, pioneering the F1.0 aperture in this category. These 2 MP analog cameras offer continuous, high-quality, full-color imaging, support HD over analog cabling for easy upgrades, and feature 3D Digital Noise Reduction (DNR) technology. The F1.0 aperture on the ColorVu Cameras ensures vivid colors even in low-light settings. Coupled with 3D DNR technology, these cameras deliver enhanced image clarity by reducing interference and noise. With a white light distance of up to 65 feet, they excel in capturing detailed night scenes, ensuring no corner goes unnoticed even in the dark.

Strategic Outlook for Canada Surveillance Analog Camera Market Market

The strategic outlook for the Canada surveillance analog camera market remains focused on leveraging its inherent strengths while adapting to evolving technological landscapes. The key growth accelerator is the continued demand for cost-effective upgrades and maintenance of existing analog systems. Manufacturers will likely emphasize hybrid solutions, enabling seamless integration with IP technologies, thereby offering a transitional path for businesses. Emphasis on research and development for enhanced analog technologies, particularly in image quality, low-light performance, and remote accessibility, will be crucial for maintaining market relevance. Strategic partnerships with system integrators and IT solution providers will unlock opportunities for delivering comprehensive surveillance packages to diverse end-user industries, including government, banking, and industrial sectors. By highlighting the reliability, ease of deployment, and economic advantages of modern analog cameras, companies can continue to secure significant market share and capitalize on the enduring need for robust security solutions across Canada. The market is projected to reach $750 Million by 2033.

Canada Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Canada Surveillance Analog Camera Market Segmentation By Geography

- 1. Canada

Canada Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of Canada Surveillance Analog Camera Market

Canada Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.4. Market Trends

- 3.4.1. Ease of Use and Affordability is Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zosi Technology Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Canada Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Surveillance Analog Camera Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the Canada Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Zosi Technology Lt.

3. What are the main segments of the Canada Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

6. What are the notable trends driving market growth?

Ease of Use and Affordability is Driving the Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its cutting-edge Turbo HD 8.0 lineup, enhancing its analog security offerings. This latest iteration promises users an enriched and interactive security interface, empowering them to elevate their surveillance capabilities. Turbo HD 8.0 introduces four groundbreaking features: real-time communication, 180-degree video coverage, and an enhanced night vision capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Canada Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence