Key Insights

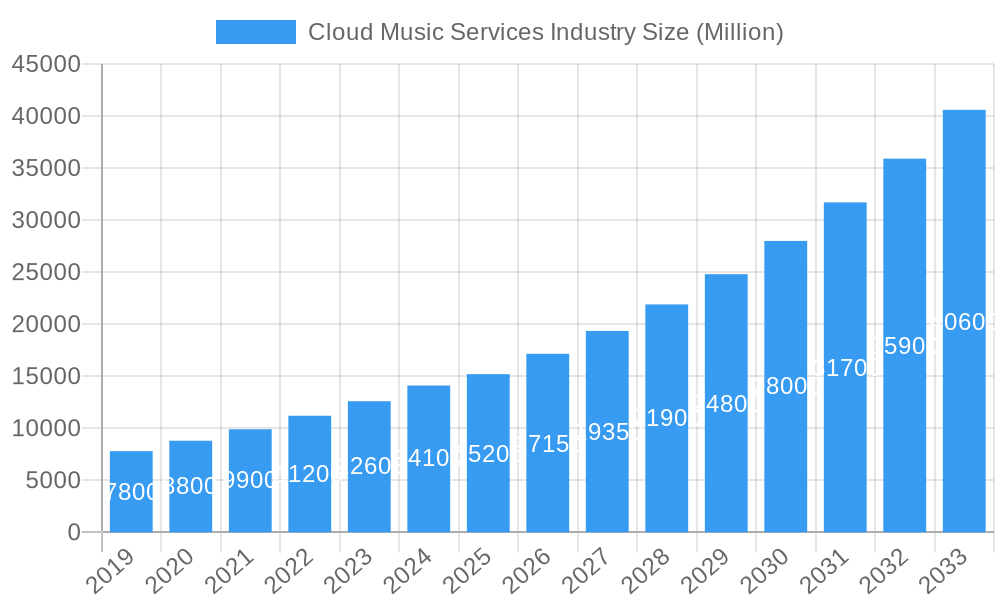

The Cloud Music Services market is projected for significant expansion, with an estimated market size of $17.77 billion by 2025. This growth trajectory is supported by a robust Compound Annual Growth Rate (CAGR) of 11.3%. Key drivers include increasing smartphone penetration, widespread internet access, and the growing consumer demand for on-demand entertainment and personalized music experiences. Advancements in cloud infrastructure and AI-driven analytics are enabling service providers to enhance user engagement with features like personalized recommendations and high-fidelity audio. The integration of music streaming with smart home devices further expands market reach.

Cloud Music Services Industry Market Size (In Billion)

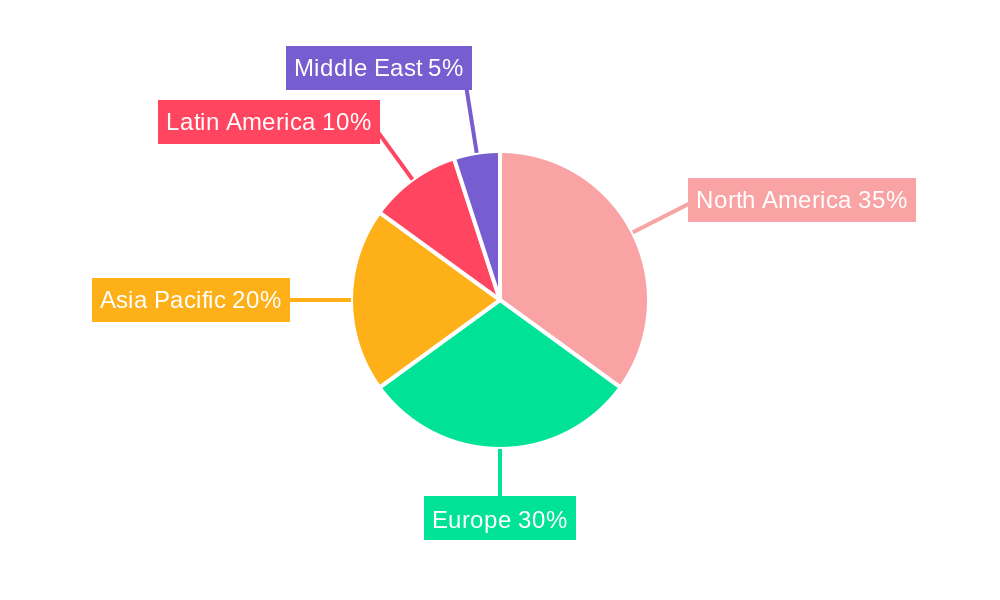

The competitive environment features major technology companies and specialized streaming platforms contending for market share through innovation, exclusive content, and varied subscription plans. While growth prospects are strong, the industry faces challenges including intense competition, artist royalty management, and content licensing complexities. Continuous investment in technology and infrastructure is vital for maintaining a competitive edge. Emerging trends encompass short-form video integration, social music sharing, and exploration of NFTs for music ownership and fan engagement. North America and Europe currently lead the market, with the Asia Pacific region anticipated to experience the fastest growth due to its expanding digital infrastructure and tech-savvy population.

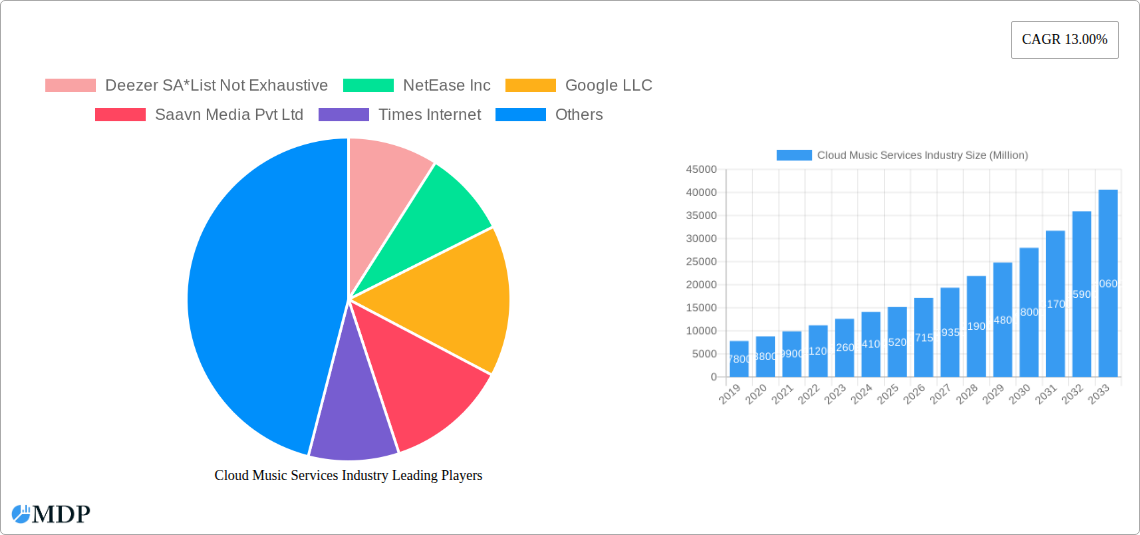

Cloud Music Services Industry Company Market Share

Cloud Music Services Industry Analysis: Market Size, Growth, and Forecast

This comprehensive report offers critical insights into the global Cloud Music Services industry, serving investors, music labels, technology providers, and content creators. Covering 2019 to 2033, with a base year of 2025, this analysis details market dynamics, including production, consumption, trade, pricing, and key industry developments. Gain strategic advantage by understanding the approaches of leading players such as Spotify AB, Apple Inc., Amazon.com Inc., Google LLC, Deezer SA, NetEase Inc, Aspiro AB, Pandora Media Inc, and Saavn Media Pvt Ltd as the digital music landscape evolves.

Cloud Music Services Industry Market Dynamics & Concentration

The Cloud Music Services Industry is characterized by a high degree of concentration, with a few dominant players controlling a significant market share, estimated to be over 75% of the global subscription revenue. Innovation drivers, such as the integration of AI for personalized recommendations and the adoption of high-fidelity audio formats, are crucial for competitive advantage. Regulatory frameworks, including copyright laws and data privacy regulations, continue to shape market entry and operational strategies. Product substitutes, such as radio, physical media, and live concerts, pose a secondary competitive threat but are increasingly being integrated or overshadowed by streaming services. End-user trends show a strong preference for subscription-based models, ad-supported tiers, and on-demand access to vast music libraries and exclusive content like podcasts. Mergers and acquisitions (M&A) activities, while moderating, remain a key strategy for market consolidation and expansion. For instance, recent M&A deal counts indicate a focus on niche streaming platforms and audio technology companies to enhance user experience and diversify revenue streams.

- Market Concentration: Dominated by a few key players, accounting for a substantial portion of market revenue.

- Innovation Drivers: AI-powered personalization, lossless audio, and exclusive content offerings.

- Regulatory Frameworks: Evolving copyright, licensing, and data privacy laws.

- Product Substitutes: Traditional radio, physical media, and live events.

- End-User Trends: Growth in subscriptions, ad-supported tiers, and podcast consumption.

- M&A Activities: Strategic acquisitions for market expansion and technological enhancement.

Cloud Music Services Industry Industry Trends & Analysis

The Cloud Music Services Industry is experiencing robust growth, driven by increasing internet penetration and the widespread adoption of smartphones globally. The Compound Annual Growth Rate (CAGR) is projected to be a significant XX% over the forecast period, indicating a highly dynamic market. Technological disruptions are continuously reshaping the industry, with advancements in AI and machine learning enhancing music discovery and user engagement. Personalized playlists, mood-based recommendations, and adaptive streaming quality are becoming standard features. Consumer preferences are shifting towards seamless integration across devices, social sharing capabilities, and high-quality audio experiences. The competitive landscape is intense, with established giants and emerging players vying for subscriber attention. Market penetration is still expanding in developing economies, presenting substantial growth opportunities. The rise of niche streaming services catering to specific genres or demographics also contributes to the market's diversification. Furthermore, the integration of music streaming with other entertainment platforms, such as gaming and social media, is a growing trend, creating synergistic growth opportunities. The increasing availability of affordable data plans and smart devices further propels market accessibility and adoption.

- Market Growth Drivers: Increasing internet penetration, smartphone adoption, and affordable data plans.

- Technological Disruptions: AI-driven personalization, high-fidelity audio, and cross-device integration.

- Consumer Preferences: On-demand access, personalized experiences, social sharing, and integrated platforms.

- Competitive Dynamics: Intense competition among global players and the emergence of niche services.

- Market Penetration: Significant growth potential in emerging markets.

- CAGR: Projected XX% over the forecast period, highlighting substantial expansion.

Leading Markets & Segments in Cloud Music Services Industry

North America and Europe currently represent the dominant regions in the Cloud Music Services Industry, accounting for a significant portion of global revenue and subscriber numbers. This dominance is fueled by high disposable incomes, advanced digital infrastructure, and a strong consumer appetite for digital entertainment.

Production Analysis: The production segment is heavily influenced by the licensing of music rights, which is a complex and costly endeavor. Key drivers include robust copyright enforcement, established music industry infrastructure, and the presence of major record labels. The concentration of music production in North America and Europe significantly impacts global availability.

Consumption Analysis: Consumption is driven by factors such as smartphone penetration, internet affordability, and cultural trends. Emerging markets in Asia-Pacific and Latin America are exhibiting rapid growth in consumption due to increasing digital access and a young, tech-savvy population.

- Key Drivers for Consumption Growth in Asia-Pacific & Latin America:

- Rapidly expanding middle class.

- Increasing smartphone ownership.

- Favorable demographic trends with a high proportion of young users.

- Growing adoption of e-commerce and digital services.

Import Market Analysis (Value & Volume): The import market is largely driven by the demand for music content from established markets. Countries with limited local music production often import a significant volume of music. Economic policies that facilitate digital trade and reduce import tariffs play a crucial role. The value of imports is often higher in regions with a strong demand for premium or exclusive content.

Export Market Analysis (Value & Volume): Major music-producing nations, primarily in North America and Europe, are significant exporters of music content. Factors influencing exports include the global popularity of artists, effective distribution channels, and favorable trade agreements for digital content. The volume of exports is high, but the value is often concentrated in major hits and artist catalog sales.

Price Trend Analysis: Price trends are influenced by competitive pricing strategies, promotional offers, and the perceived value of subscription tiers. Freemium models and bundled offers are common to attract new users and increase market penetration. The price elasticity of demand for music streaming remains a critical consideration for service providers.

- Dominant Regions: North America and Europe, with Asia-Pacific and Latin America showing rapid growth.

- Key Segments: Subscription services, ad-supported tiers, and premium audio offerings.

Cloud Music Services Industry Product Developments

Recent product developments in the Cloud Music Services Industry focus on enhancing user experience and expanding content offerings. Innovations include AI-powered music curation, integration of spatial audio for immersive listening, and the seamless incorporation of podcasts and audiobooks. Companies are also investing in exclusive content, such as artist-produced shows and live-streamed concerts, to differentiate their platforms. The competitive advantage lies in providing a comprehensive audio ecosystem that caters to diverse user preferences, from casual listeners to audiophiles.

Key Drivers of Cloud Music Services Industry Growth

Several key drivers are fueling the growth of the Cloud Music Services Industry. Technologically, the widespread availability of high-speed internet and affordable smartphones is paramount. Economically, rising disposable incomes in emerging markets are increasing the addressable subscriber base. Furthermore, the continued shift in consumer behavior towards digital entertainment and the increasing popularity of on-demand content consumption are significant accelerators. Regulatory support for digital content and intellectual property rights also plays a crucial role in fostering a stable market environment.

Challenges in the Cloud Music Services Industry Market

The Cloud Music Services Industry faces several challenges. Regulatory hurdles related to copyright, licensing, and artist royalties can be complex and costly to navigate. Supply chain issues, particularly concerning the distribution of exclusive content and the integration of new technologies, can impact service delivery. Intense competitive pressures from established players and the constant need for innovation to retain subscribers also present significant challenges. Furthermore, the substantial investment required for content acquisition and marketing limits profitability for smaller players.

Emerging Opportunities in Cloud Music Services Industry

Emerging opportunities in the Cloud Music Services Industry lie in technological breakthroughs, strategic partnerships, and untapped market expansion. The continued evolution of AI for hyper-personalized content recommendations and the adoption of blockchain for transparent royalty distribution present significant growth avenues. Strategic partnerships with hardware manufacturers, social media platforms, and gaming companies can unlock new user acquisition channels. Furthermore, the untapped potential of emerging economies and the growing demand for localized content offer substantial market expansion opportunities. The integration of fitness and wellness with music streaming also represents a promising new frontier.

Leading Players in the Cloud Music Services Industry Sector

- Spotify AB

- Apple Inc.

- Amazon com Inc.

- Google LLC

- Deezer SA

- NetEase Inc

- ASPIRO AB

- Pandora Media Inc

- Saavn Media Pvt Ltd

- Times Internet

Key Milestones in Cloud Music Services Industry Industry

- January 2023: Spotify announced a 14% YoY growth, reaching 205 million premium subscribers, becoming the first music streaming platform with such a large user base. In early 2022, Spotify invested $100 million in licensing, development, and marketing of music and audio content from historically underrepresented creators, boosting its market position.

- November 2022: Amazon Prime expanded its music offering to 100 million songs, aligning with Apple Music Stream. Prime members gained access to ad-free 'All-Access' playlists and Amazon-exclusive podcasts, enhancing the value proposition.

- November 2022: Deezer partnered with Dazn in Italy, allowing Dazn subscribers to access Deezer's music catalog alongside premium sports content, creating a bundled entertainment offering.

Strategic Outlook for Cloud Music Services Industry Market

The strategic outlook for the Cloud Music Services Industry remains exceptionally bright, driven by ongoing technological advancements and expanding global reach. Growth accelerators include the continued development of AI for hyper-personalized user experiences, the integration of spatial audio for enhanced immersion, and the expansion of diverse content portfolios beyond music, such as podcasts and audiobooks. Strategic alliances with hardware manufacturers and smart device providers will further embed music streaming into everyday life. The focus will increasingly be on creating holistic audio ecosystems that cater to a wide range of consumer needs and preferences, ensuring sustained subscriber growth and revenue diversification in the long term.

Cloud Music Services Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Cloud Music Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Music Services Industry Regional Market Share

Geographic Coverage of Cloud Music Services Industry

Cloud Music Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Smartphones and Tablets drives the Market for Cloud Music Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Latin America Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East Cloud Music Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Deezer SA*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NetEase Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saavn Media Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Times Internet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spotify AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ASPIRO AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amazon com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apple Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pandora Media Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Deezer SA*List Not Exhaustive

List of Figures

- Figure 1: Cloud Music Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Cloud Music Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Cloud Music Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Cloud Music Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Cloud Music Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Cloud Music Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Cloud Music Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Cloud Music Services Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 32: Cloud Music Services Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Cloud Music Services Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Cloud Music Services Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Cloud Music Services Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Cloud Music Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Music Services Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the Cloud Music Services Industry?

Key companies in the market include Deezer SA*List Not Exhaustive, NetEase Inc, Google LLC, Saavn Media Pvt Ltd, Times Internet, Spotify AB, ASPIRO AB, Amazon com Inc, Apple Inc, Pandora Media Inc.

3. What are the main segments of the Cloud Music Services Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage.

6. What are the notable trends driving market growth?

Increasing Penetration of Smartphones and Tablets drives the Market for Cloud Music Services.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

January 2023: With 14% YoY growth, Spotify announced its premium subscriber base touched 205 million, making it the world's first music streaming player with such a large user base. At the beginning of 2022, Spotify announced an investment of $100 million in the licensing, development, and marketing of music and audio content from historically underrepresented creators. These factors helped Spotify reach a milestone in the music industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Music Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Music Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Music Services Industry?

To stay informed about further developments, trends, and reports in the Cloud Music Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence