Key Insights

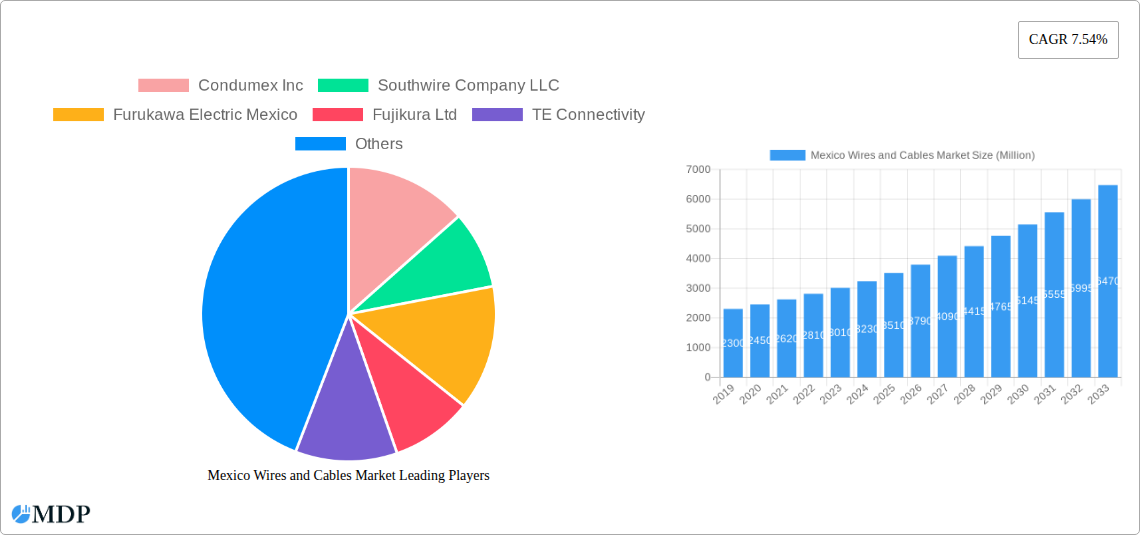

The Mexican wires and cables market is poised for robust expansion, projected to reach a substantial USD 3.51 billion by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.54% during the forecast period of 2025-2033. This impressive growth trajectory is primarily propelled by significant investments in infrastructure development across key sectors. The telecommunications industry, driven by the escalating demand for high-speed internet and 5G deployment, is a major catalyst, necessitating the widespread adoption of advanced fiber optic cables. Simultaneously, the construction sector, encompassing both residential and commercial projects, continues to be a substantial contributor, with increasing needs for power cables across low, medium, and high voltage applications. The energy sector's ongoing modernization and expansion projects, coupled with a growing emphasis on renewable energy sources, further amplify the demand for reliable and efficient power transmission and distribution solutions.

Mexico Wires and Cables Market Market Size (In Billion)

Several key trends are shaping the dynamics of the Mexican wires and cables market. The increasing adoption of smart grid technologies is driving the demand for advanced signaling and control cables that can support sophisticated monitoring and management systems. Furthermore, there's a noticeable shift towards high-performance and specialized cables designed to withstand harsh environmental conditions and meet stringent industry standards, particularly in demanding industrial applications. The integration of automation and digitalization in manufacturing processes is also enhancing production efficiency and product quality. However, the market faces certain restraints, including fluctuating raw material prices, particularly copper and aluminum, which can impact manufacturing costs and profitability. Additionally, intense competition among established players and the emergence of new entrants necessitate continuous innovation and cost-effective solutions to maintain market share. Navigating these challenges while capitalizing on the burgeoning opportunities within the telecommunications, construction, and power sectors will be crucial for sustained market growth in Mexico.

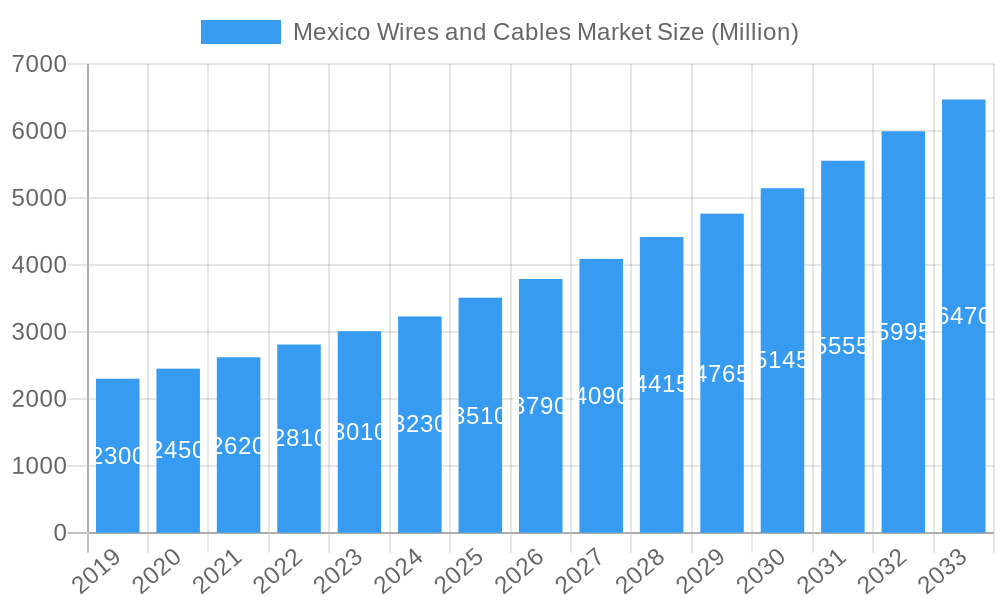

Mexico Wires and Cables Market Company Market Share

This in-depth report offers a definitive analysis of the Mexico wires and cables market, exploring its intricate dynamics, growth trajectories, and future potential. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this research provides actionable insights for industry stakeholders. We meticulously examine key segments including Fiber Optic Cable, Signal & Control Cable, Power Cable (LV, MV, HV, UHV), and Other Cable Types, alongside critical end-user verticals such as Construction (Residential & Commercial), Telecommunications (IT & Telecom), Power Infrastructure, and Other End-user Verticals. Leveraging high-traffic keywords like "Mexico electrical cable market," "Latin America wire and cable industry," "power cable market Mexico," and "fiber optic cable demand Mexico," this report aims to maximize search visibility and attract decision-makers.

Mexico Wires and Cables Market Market Dynamics & Concentration

The Mexico wires and cables market exhibits a moderate to high concentration, with key players like Condumex Inc, Southwire Company LLC, Furukawa Electric Mexico, Fujikura Ltd, TE Connectivity, Belden Inc, LS Cables & System Ltd, Leviton Manufacturing Co Inc, Leoni AG, and Sumitomo Electric Industries Ltd holding significant market share. Innovation is primarily driven by advancements in material science for enhanced cable performance, such as increased fire resistance and higher temperature tolerance, as evidenced by recent product launches. Regulatory frameworks, particularly those related to electrical safety standards and infrastructure development projects, play a crucial role in shaping market access and product adoption. The threat of product substitutes is relatively low for essential applications like power transmission and telecommunications infrastructure, where specialized cables are indispensable. End-user trends are leaning towards higher bandwidth demands in telecommunications and increased energy efficiency in power distribution. Mergers and acquisitions (M&A) activities, while not excessively frequent, are strategic, aimed at consolidating market presence and expanding product portfolios. For instance, the acquisition of Gen-Pro by AZ Wire & Cable in May 2024 signifies a trend towards strengthening distribution networks and broadening service offerings within the electrical distribution landscape. The market is characterized by a competitive landscape where technological prowess and cost-effectiveness are paramount for sustained growth.

Mexico Wires and Cables Market Industry Trends & Analysis

The Mexico wires and cables market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025–2033). This expansion is underpinned by a confluence of factors, including the robust demand from the construction sector, fueled by ongoing urbanization and infrastructure development initiatives across the country. The telecommunications industry, driven by the burgeoning demand for high-speed internet and the continuous rollout of 5G networks, is a significant growth catalyst. The deployment of advanced Fiber Optic Cables is witnessing unprecedented adoption, directly supporting these telecommunication infrastructure upgrades. Power cables, encompassing Low Voltage (LV), Medium Voltage (MV), High Voltage (HV), and Ultra-High Voltage (UHV) segments, are experiencing sustained demand due to the modernization of the national power grid and the increasing integration of renewable energy sources, necessitating robust and efficient power transmission and distribution solutions.

Technological disruptions are continuously reshaping the industry. The development of advanced insulation materials and conductor technologies is leading to cables with improved durability, enhanced conductivity, and superior fire safety characteristics, directly addressing the evolving needs of end-users for reliability and safety. The adoption of electron beam cross-linking technology, as highlighted by RR Kabel's Firex LS0H-EBXL product, exemplifies a key trend towards halogen-free and low-smoke solutions, aligning with stringent environmental and safety regulations. Consumer preferences are increasingly tilting towards products that offer enhanced performance, energy efficiency, and compliance with international safety standards. This is creating opportunities for manufacturers who can deliver innovative and sustainable wire and cable solutions.

The competitive dynamics within the market are intense, with both established global players and emerging local manufacturers vying for market share. Strategic partnerships, technological collaborations, and focused product development are key strategies employed by companies to maintain a competitive edge. The market penetration of specialized cables, such as those designed for renewable energy applications and intelligent grid systems, is expected to rise significantly. The overall outlook for the Mexico wires and cables market is highly optimistic, driven by a strong foundational demand and the continuous integration of innovative technologies that cater to the evolving industrial and residential needs of the nation.

Leading Markets & Segments in Mexico Wires and Cables Market

The Mexico wires and cables market is characterized by the dominance of specific segments and end-user verticals, driven by distinct economic and infrastructural factors.

Dominant Cable Type: Power Cable (including LV, MV, HV, UHV)

- Key Drivers:

- Infrastructure Development: Ongoing investments in electricity generation, transmission, and distribution networks, including the expansion of the national grid to accommodate growing energy demands and integrate renewable energy sources.

- Industrial Growth: The sustained expansion of manufacturing and industrial sectors across Mexico necessitates robust and reliable power supply, driving demand for LV, MV, and HV cables.

- Urbanization: Growing urban populations require expanded and modernized electrical infrastructure, particularly for residential and commercial power distribution.

- Dominance Analysis: Power cables, in their entirety, represent the largest segment by revenue. The LV segment is driven by residential and commercial construction, while MV and HV cables are crucial for industrial operations and the backbone of the national power infrastructure. The increasing focus on grid modernization and the integration of smart grid technologies further bolster the demand for advanced power cables, including those capable of handling higher voltages and increased data transmission for grid monitoring.

- Key Drivers:

Dominant End-user Vertical: Construction (Residential & Commercial)

- Key Drivers:

- Economic Growth & Investment: A stable economic environment and increased foreign direct investment stimulate new construction projects, from housing developments to commercial complexes.

- Government Initiatives: Public sector investments in infrastructure and affordable housing programs directly translate to increased demand for construction materials, including wires and cables.

- Growing Middle Class: An expanding middle class with increased disposable income fuels demand for new housing and upgrades to existing properties.

- Dominance Analysis: The construction sector, encompassing both residential and commercial projects, consistently remains the largest consumer of wires and cables in Mexico. The sheer volume of building activity, from foundational electrical wiring in homes to complex cabling systems in large commercial establishments and industrial facilities, drives this segment's dominance. The need for safe, reliable, and compliant electrical infrastructure within all construction projects makes this a foundational market for wire and cable manufacturers.

- Key Drivers:

Significant Growth Segment: Telecommunications (IT & Telecom)

- Key Drivers:

- 5G Network Deployment: The ongoing rollout and expansion of 5G infrastructure across Mexico is a primary driver for Fiber Optic Cables and specialized data transmission cables.

- Digital Transformation: Increased adoption of cloud computing, IoT devices, and digital services across businesses and households necessitates higher bandwidth and reliable connectivity solutions.

- Broadband Expansion: Government and private sector initiatives to improve broadband internet access in underserved areas further boost demand for telecommunication cables.

- Dominance Analysis: While power cables currently hold the largest market share, the telecommunications segment, particularly with the proliferation of Fiber Optic Cables, is experiencing the most rapid growth. The shift towards higher data speeds and the increasing reliance on digital communication are fundamentally reshaping the demand for advanced networking infrastructure, positioning this segment for significant future expansion.

- Key Drivers:

Mexico Wires and Cables Market Product Developments

Recent product developments in the Mexico wires and cables market highlight a strong focus on enhanced safety, performance, and specialized applications. The introduction of RR Kabel Ltd's Firex LS0H-EBXL in June 2024 signifies a major leap in electrical safety for both residential and commercial settings. This product's electron beam cross-linked, halogen-free compound capable of withstanding temperatures up to 900°C sets a new benchmark for fire-resistant wiring. Furthermore, AZ Wire & Cable's acquisition of Gen-Pro in May 2024, integrating generator installation cables into their portfolio, demonstrates a strategic move towards offering comprehensive electrical distribution solutions. These innovations are driven by evolving regulatory standards, increasing demand for resilient infrastructure, and the growing awareness of the critical role of advanced cabling in ensuring operational continuity and safety across diverse end-user verticals.

Key Drivers of Mexico Wires and Cables Market Growth

The Mexico wires and cables market is experiencing robust growth driven by several key factors. The significant investments in infrastructure development, including the expansion and modernization of the national power grid and the ongoing rollout of 5G telecommunications networks, are primary accelerators. Economic stability and a favorable business environment continue to attract foreign direct investment, stimulating construction across residential, commercial, and industrial sectors, all of which rely heavily on electrical cabling. Technological advancements in materials science and manufacturing processes are enabling the production of higher-performing, more durable, and safer wires and cables. Furthermore, increasing government focus on energy efficiency and the adoption of renewable energy sources necessitate advanced cabling solutions for seamless integration and reliable power transmission.

Challenges in the Mexico Wires and Cables Market Market

Despite strong growth prospects, the Mexico wires and cables market faces several challenges. Intense competition, both from domestic and international players, can exert downward pressure on pricing and profit margins. Fluctuations in raw material prices, particularly copper and aluminum, can impact production costs and supply chain stability. Regulatory complexities and the need for continuous compliance with evolving safety and environmental standards can add to operational expenses. Supply chain disruptions, including logistical challenges and the availability of specific components, can also hinder timely delivery. Furthermore, the presence of counterfeit products in certain market segments poses a risk to product quality and brand reputation, necessitating vigilant market surveillance and enforcement.

Emerging Opportunities in Mexico Wires and Cables Market

Emerging opportunities in the Mexico wires and cables market are numerous and diverse. The accelerating digital transformation and the continuous expansion of broadband connectivity present a significant growth avenue for fiber optic and high-speed data cables. The increasing adoption of electric vehicles (EVs) and the development of EV charging infrastructure will create substantial demand for specialized charging cables. The transition towards renewable energy sources, such as solar and wind power, requires specialized cabling solutions for efficient energy transmission and grid integration. Furthermore, the growing emphasis on smart city initiatives and the development of advanced automation in industrial settings will drive demand for intelligent and high-performance cable systems. Strategic partnerships with technology providers and end-users will be crucial for capitalizing on these emerging trends.

Leading Players in the Mexico Wires and Cables Market Sector

- Condumex Inc

- Southwire Company LLC

- Furukawa Electric Mexico

- Fujikura Ltd

- TE Connectivity

- Belden Inc

- LS Cables & System Ltd

- Leviton Manufacturing Co Inc

- Leoni AG

- Sumitomo Electric Industries Lt

Key Milestones in Mexico Wires and Cables Market Industry

- June 2024: RR Kabel Ltd introduced the Firex LS0H-EBXL in the electrical wiring segment, aiming to establish a new safety standard in residential and commercial settings. This product features electron beam cross-linked, halogen-free compound withstanding temperatures up to 900°C, signifying a major advancement in electrical safety.

- May 2024: AZ Wire & Cable acquired Gen-Pro, a company known for its generator-related products, including generator installation cables. This acquisition strengthens AZ Wire & Cable’s position as a comprehensive solution provider for electrical distribution requirements.

Strategic Outlook for Mexico Wires and Cables Market Market

The strategic outlook for the Mexico wires and cables market is highly positive, driven by sustained demand from key sectors and the embrace of technological innovation. Focus areas for growth acceleration include the continued expansion of telecommunications infrastructure, particularly the deployment of 5G and fiber optic networks, which will significantly boost demand for high-bandwidth cabling solutions. The increasing investments in renewable energy projects and the modernization of the power grid present substantial opportunities for advanced power cables and specialized transmission solutions. The construction sector, fueled by ongoing urbanization and infrastructure development, will remain a cornerstone of market growth. Manufacturers that prioritize product differentiation through superior safety features, energy efficiency, and compliance with international standards will be well-positioned for success. Strategic collaborations, targeted product development, and a robust distribution network will be crucial for navigating the competitive landscape and capitalizing on the evolving market dynamics.

Mexico Wires and Cables Market Segmentation

-

1. Cable Type

- 1.1. Fiber Optic Cable

- 1.2. Signal & Control Cable

- 1.3. Power Cable (including LV, MV, HV, UHV)

- 1.4. Other Cable Types

-

2. End-user Vertical

- 2.1. Construction (Residential & Commercial)

- 2.2. Telecommunications (IT & Telecom)

- 2.3. Power In

- 2.4. Other End-user Verticals

Mexico Wires and Cables Market Segmentation By Geography

- 1. Mexico

Mexico Wires and Cables Market Regional Market Share

Geographic Coverage of Mexico Wires and Cables Market

Mexico Wires and Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry

- 3.3. Market Restrains

- 3.3.1. Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry

- 3.4. Market Trends

- 3.4.1. Rapid Infrastructure Development and Continuing Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Wires and Cables Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Fiber Optic Cable

- 5.1.2. Signal & Control Cable

- 5.1.3. Power Cable (including LV, MV, HV, UHV)

- 5.1.4. Other Cable Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction (Residential & Commercial)

- 5.2.2. Telecommunications (IT & Telecom)

- 5.2.3. Power In

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Condumex Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Southwire Company LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Furukawa Electric Mexico

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujikura Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TE Connectivity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Belden Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LS Cables & System Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leviton Manufacturing Co Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Leoni AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sumitomo Electric Industries Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Condumex Inc

List of Figures

- Figure 1: Mexico Wires and Cables Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Wires and Cables Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Wires and Cables Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 2: Mexico Wires and Cables Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 3: Mexico Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Mexico Wires and Cables Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Mexico Wires and Cables Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Wires and Cables Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Wires and Cables Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 8: Mexico Wires and Cables Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 9: Mexico Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Mexico Wires and Cables Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Mexico Wires and Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Wires and Cables Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Wires and Cables Market?

The projected CAGR is approximately 7.54%.

2. Which companies are prominent players in the Mexico Wires and Cables Market?

Key companies in the market include Condumex Inc, Southwire Company LLC, Furukawa Electric Mexico, Fujikura Ltd, TE Connectivity, Belden Inc, LS Cables & System Ltd, Leviton Manufacturing Co Inc, Leoni AG, Sumitomo Electric Industries Lt.

3. What are the main segments of the Mexico Wires and Cables Market?

The market segments include Cable Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry.

6. What are the notable trends driving market growth?

Rapid Infrastructure Development and Continuing Smart City Projects.

7. Are there any restraints impacting market growth?

Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry.

8. Can you provide examples of recent developments in the market?

June 2024: RR Kabel Ltd, a manufacturer of wires and cables, announced the introduction of the Firex LS0H-EBXL in the electrical wiring segment. The company stated that this product will establish a 'new safety standard in both residential and commercial settings.' “Firex LS0H-EBXL (Low Smoke Zero Halogen) –EBXL (Electron Beam Cross Linked) signifies a major advancement in electrical safety. It employs an electron beam cross-linked compound that is entirely halogen-free and can endure temperatures up to 900°C.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Wires and Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Wires and Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Wires and Cables Market?

To stay informed about further developments, trends, and reports in the Mexico Wires and Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence