Key Insights

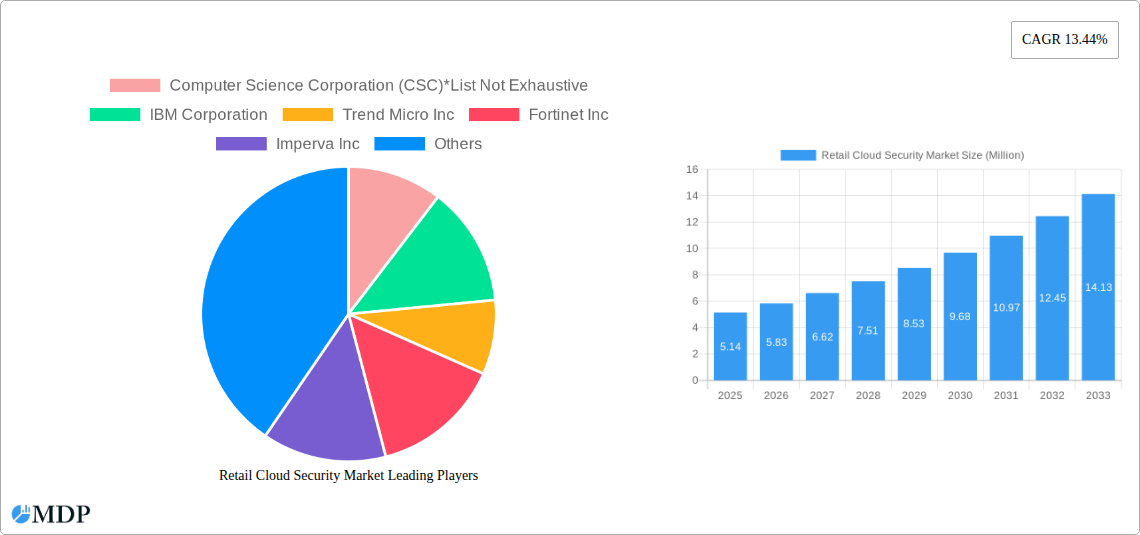

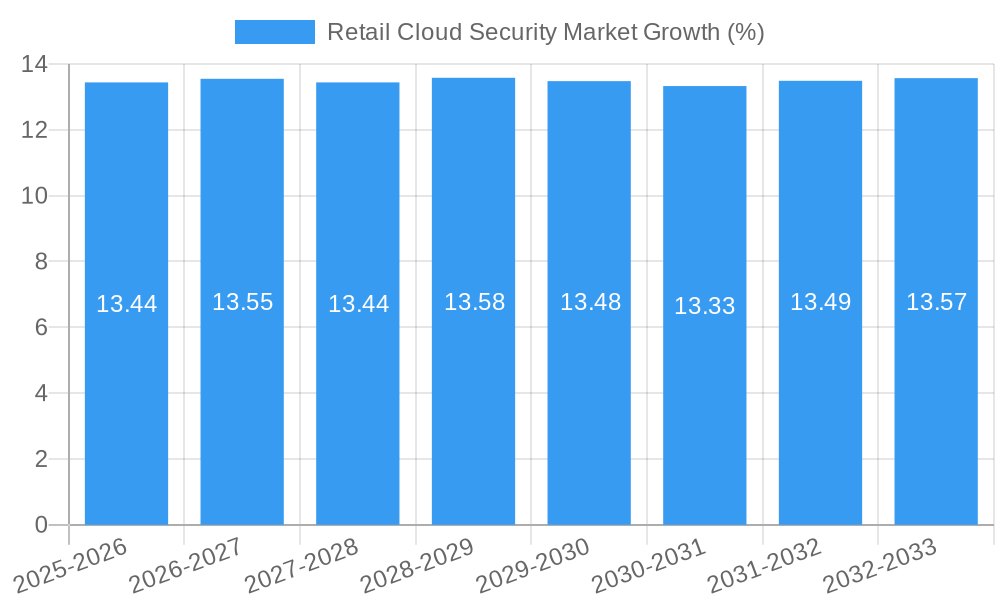

The global Retail Cloud Security Market is poised for significant expansion, projected to reach $5.14 million in the base year 2025 and grow at an impressive Compound Annual Growth Rate (CAGR) of 13.44% through 2033. This robust growth is propelled by the increasing adoption of cloud technologies within the retail sector to enhance scalability, agility, and customer experience. Key market drivers include the escalating sophistication of cyber threats targeting retail data, the growing volume of sensitive customer information stored and processed in the cloud, and stringent regulatory compliance requirements such as GDPR and CCPA, which necessitate robust security measures. Furthermore, the digital transformation initiatives across the retail landscape, including e-commerce expansion and the implementation of advanced analytics, contribute to the increased demand for cloud security solutions.

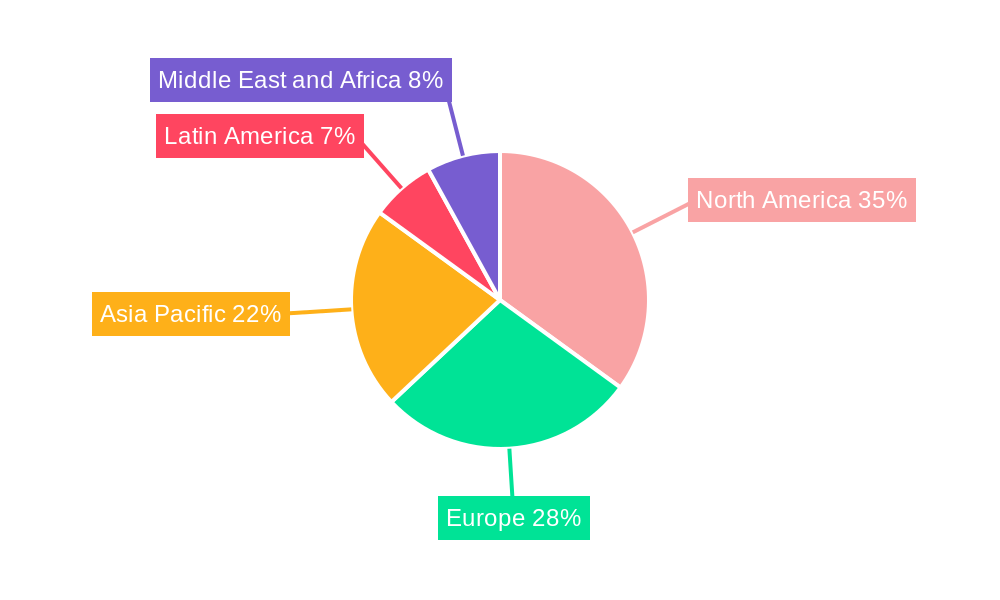

The market is segmented across various solutions like Identity and Access Management (IAM), Data Loss Prevention (DLP), Intrusion Detection and Prevention Systems (IDPS), Security Information and Event Management (SIEM), and Encryption. Application security, database security, endpoint security, network security, and web/email security represent critical security domains within the retail cloud ecosystem. Deployment modes are predominantly hybrid and public clouds, with private cloud adoption also contributing to the market's diversity. Leading companies such as IBM Corporation, Trend Micro Inc., Fortinet Inc., Imperva Inc., and Check Point Software Technologies Ltd. are at the forefront of innovation, offering comprehensive cloud security platforms to address the evolving needs of retailers. North America and Europe currently lead the market, driven by advanced technological adoption and a strong regulatory framework, with the Asia Pacific region showing substantial growth potential due to rapid digitalization.

Retail Cloud Security Market: Comprehensive Insights & Forecasts 2025-2033

Report Description:

Dive deep into the rapidly evolving Retail Cloud Security Market, a critical sector safeguarding sensitive consumer data and ensuring business continuity for retailers worldwide. This comprehensive report provides an in-depth analysis of market dynamics, industry trends, leading segments, and pivotal players shaping the future of retail cybersecurity. With the escalating threat landscape and increasing reliance on cloud infrastructure, robust cloud security solutions are no longer a luxury but a necessity for retailers. Explore key growth drivers, technological innovations, and regulatory frameworks influencing the market. This report is an essential resource for C-suite executives, IT security professionals, cloud architects, cybersecurity vendors, and investors seeking to understand and capitalize on the burgeoning opportunities within the retail cloud security ecosystem.

The study covers a comprehensive Study Period: 2019–2033, with 2025 serving as the Base Year and Estimated Year. The Forecast Period: 2025–2033 offers actionable insights into future market trajectory, while the Historical Period: 2019–2024 provides essential context. The global Retail Cloud Security Market is projected to reach approximately $60 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period.

Retail Cloud Security Market Market Dynamics & Concentration

The Retail Cloud Security Market is characterized by moderate to high concentration, driven by a blend of established cybersecurity giants and innovative specialized vendors. The increasing sophistication of cyber threats targeting retail operations, from point-of-sale systems to customer databases, is a primary innovation driver. Regulatory frameworks such as GDPR and CCPA mandate stringent data protection measures, further fueling the demand for advanced cloud security solutions. Product substitutes, while existing in the form of on-premises security solutions, are increasingly being overshadowed by the scalability and flexibility offered by cloud-based alternatives. End-user trends clearly indicate a preference for integrated security platforms that offer comprehensive protection across diverse cloud environments. Mergers and acquisitions (M&A) activities are on the rise as larger players seek to acquire specialized technologies and expand their market reach. For instance, an estimated 50 M&A deals are expected to occur within the forecast period, with an average deal size of $500 Million. Key market share players are projected to hold approximately 60% of the market by 2033.

Retail Cloud Security Market Industry Trends & Analysis

The Retail Cloud Security Market is experiencing significant growth, propelled by several converging industry trends. The accelerated adoption of digital transformation initiatives by retailers, including e-commerce expansion and the implementation of IoT devices, has exponentially increased the attack surface, creating an urgent need for robust cloud security. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into security solutions, are enabling more proactive threat detection and response mechanisms. These technologies are crucial for identifying anomalous behavior indicative of breaches in real-time. Consumer preferences are increasingly centered around data privacy and security, with shoppers actively choosing retailers that demonstrate a strong commitment to protecting their personal information. This has put immense pressure on retailers to invest in advanced security measures to build and maintain customer trust. Competitive dynamics are intensifying, with vendors differentiating themselves through specialized solutions, competitive pricing, and comprehensive service offerings. The market penetration of cloud security solutions within the retail sector is estimated to reach 75% by 2028. The overall market size is expected to grow from approximately $25 Billion in 2025 to $60 Billion by 2033, with a projected CAGR of 15.5%. This robust growth is attributed to the continuous evolution of cyber threats and the increasing value of data within the retail ecosystem. Furthermore, the shift towards omnichannel retail models necessitates unified security strategies across all customer touchpoints, further driving the adoption of cloud-based security services. The increasing reliance on third-party vendors and supply chain partners also introduces new security challenges, requiring comprehensive visibility and control over the entire ecosystem.

Leading Markets & Segments in Retail Cloud Security Market

North America currently dominates the Retail Cloud Security Market, driven by its advanced technological infrastructure, high e-commerce penetration, and stringent data privacy regulations. Within North America, the United States holds the largest market share, influenced by major retail hubs and a proactive stance on cybersecurity.

The market is segmented by Solution, Security, and Deployment Mode, each presenting unique growth dynamics.

Solution Dominance:

- Identity and Access Management (IAM): This segment is experiencing rapid growth due to the increasing need for granular control over user access to sensitive retail data and systems. Key drivers include the rise of remote work, the proliferation of cloud-based applications, and the necessity to comply with access control regulations. IAM solutions are crucial for preventing unauthorized access and mitigating insider threats.

- Security Information and Event Management (SIEM): SIEM solutions are vital for collecting, analyzing, and correlating security data from various sources, enabling real-time threat detection and incident response. The increasing volume of data generated by retail operations and the complexity of cloud environments make SIEM an indispensable component of any robust security strategy.

- Data Loss Prevention (DLP): With retailers handling vast amounts of sensitive customer data, DLP solutions are paramount to prevent data breaches and comply with data protection laws. The growth in e-commerce and loyalty programs, which generate significant personal data, directly fuels DLP adoption.

- Encryption: End-to-end encryption for data at rest and in transit is becoming a standard requirement for retailers. This segment is driven by the need to protect financial information, personal identifiable information (PII), and intellectual property from unauthorized access.

Security Focus Areas:

- Network Security: As retailers increasingly rely on interconnected networks for their operations, robust network security solutions are critical to protect against external threats and internal vulnerabilities. This includes firewalls, intrusion detection/prevention systems, and VPNs.

- Application Security: Securing customer-facing applications, such as e-commerce websites and mobile apps, is a top priority. Vulnerabilities in these applications can lead to significant data breaches and reputational damage.

- Endpoint Security: Protecting the vast number of endpoints, from in-store POS systems to employee laptops, is crucial. Advanced endpoint detection and response (EDR) solutions are gaining traction.

Deployment Mode:

- Hybrid Cloud: The hybrid cloud deployment model is the most prevalent in the retail sector, offering a balance of flexibility, control, and cost-effectiveness. Retailers often maintain sensitive data on-premises while leveraging public cloud services for scalability and innovation. This necessitates integrated security solutions that can manage security across both environments.

- Public Cloud: The adoption of public cloud services for various retail operations continues to grow, driven by cost efficiencies and scalability. Security solutions tailored for public cloud environments are crucial for managing shared responsibility models effectively.

- Private Cloud: While less common for primary operations, private cloud solutions are used by some larger retailers for highly sensitive data or specific compliance requirements, demanding dedicated security infrastructure.

Retail Cloud Security Market Product Developments

Recent product developments in the Retail Cloud Security Market focus on enhancing threat intelligence, automating security workflows, and providing unified visibility across multi-cloud environments. Vendors are increasingly integrating AI and ML capabilities to offer predictive threat detection and adaptive security policies. Innovations include advanced data encryption techniques for enhanced data privacy, robust identity and access management solutions for granular control, and comprehensive endpoint security platforms designed to combat emerging malware strains. These developments aim to provide retailers with agile, scalable, and proactive security solutions that address the evolving threat landscape and stringent regulatory demands, thereby offering a significant competitive advantage.

Key Drivers of Retail Cloud Security Market Growth

The Retail Cloud Security Market is propelled by several interconnected factors. Firstly, the escalating frequency and sophistication of cyberattacks targeting retail enterprises, including ransomware, phishing, and data breaches, create an immediate demand for robust protection. Secondly, stringent government regulations and compliance mandates like GDPR and CCPA impose significant penalties for data mishandling, compelling retailers to invest heavily in security. Thirdly, the accelerating digital transformation in retail, encompassing e-commerce growth, IoT adoption, and cloud migration, expands the attack surface, necessitating scalable cloud security solutions. Finally, increasing consumer awareness and demand for data privacy push retailers to adopt advanced security measures to build trust and retain customers, directly influencing market growth.

Challenges in the Retail Cloud Security Market Market

Despite robust growth, the Retail Cloud Security Market faces several significant challenges. The rapidly evolving threat landscape necessitates continuous updates and adaptation of security measures, which can be costly and complex. A persistent shortage of skilled cybersecurity professionals further exacerbates the challenge of implementing and managing advanced security solutions effectively. Integrating disparate security tools across hybrid and multi-cloud environments poses technical hurdles, leading to visibility gaps and potential vulnerabilities. Furthermore, the cost of advanced cloud security solutions can be a barrier for smaller retailers with limited budgets. Competitive pressures from numerous vendors offering overlapping solutions also create complexity in vendor selection and management.

Emerging Opportunities in Retail Cloud Security Market

Emerging opportunities in the Retail Cloud Security Market are primarily driven by technological advancements and strategic market shifts. The increasing adoption of AI and Machine Learning in security solutions presents a significant opportunity for predictive threat intelligence and automated incident response, enabling retailers to stay ahead of evolving cyber threats. The growing trend of supply chain security, where retailers are responsible for the security posture of their third-party vendors, opens avenues for specialized supply chain risk management platforms. Furthermore, the expanding global e-commerce market, especially in emerging economies, creates new frontiers for cloud security providers. Strategic partnerships between cloud providers, cybersecurity vendors, and retail technology solution providers will foster innovation and create integrated, end-to-end security offerings tailored to specific retail needs.

Leading Players in the Retail Cloud Security Market Sector

- Computer Science Corporation (CSC)

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- Imperva Inc

- Check Point Software Technologies Ltd

- McAfee LLC

- Cisco Systems Inc

- Broadcom Inc

- Qualys Inc

- Sophos PLC

Key Milestones in Retail Cloud Security Market Industry

- March 2023: IBM revised its Storage Defender solution by adding Cohesity data protection. Cohesive Data Protect’s integration into IBM Storage Defender will boost business resilience for organizations’ hybrid cloud systems by minimizing data fragmentation and maximizing availability. Cohesity DataProtect positions clients to copy and store data on numerous servers, on-site or off-site, or in various clouds. In the event of a disaster or cyber security breach, this helps to ensure that a current and exact copy of the data is available.

- January 2023: HDFC Bank adopted Microsoft’s Azure to consolidate and modernize its enterprise data landscape, scaling its information management capabilities across enterprise reporting and advanced analytics through artificial intelligence. Using the Microsoft Cloud Platform and technology built on AI/ML, uniform architecture, and security, the solution will provide consumers with stringent security and regulatory requirements.

- December 2022: Tata Motor signed a deal with Oracle for its cloud solutions that would provide enhanced business insights, improved security, increased flexibility, and reduced costs. The automotive player was to transform its Dealer Management System (DMS), which contains data of 60,000 customers, to Oracle Cloud Infrastructure. Oracle was expected to help the automotive leader monitor sales performance and share insights to improve collaboration across its dealer network.

Strategic Outlook for Retail Cloud Security Market Market

The strategic outlook for the Retail Cloud Security Market remains exceptionally positive, driven by sustained digital acceleration and an increasingly hazardous cyber threat environment. Key growth accelerators include the pervasive adoption of hybrid and multi-cloud strategies by retailers, demanding integrated and adaptive security frameworks. The continuous evolution of AI and ML will enable more sophisticated threat detection and automated remediation, shifting security from reactive to proactive. Furthermore, a heightened focus on regulatory compliance and data privacy will solidify the importance of comprehensive cloud security solutions. Strategic partnerships between cloud infrastructure providers, cybersecurity firms, and retail technology enablers will foster innovation, leading to more tailored and effective security offerings. Retailers prioritizing robust cloud security will not only mitigate risks but also build stronger customer trust, thereby securing a competitive advantage in the digital marketplace.

Retail Cloud Security Market Segmentation

-

1. Solution

- 1.1. Identity and Access Management

- 1.2. Data Loss Prevention

- 1.3. Intrusion Detection and Prevention

- 1.4. Security Information and Event Management

- 1.5. Encryption

-

2. Security

- 2.1. Application Security

- 2.2. Database Security

- 2.3. Endpoint Security

- 2.4. Network Security

- 2.5. Web and Email Security

-

3. Deployment Mode

- 3.1. Private

- 3.2. Hybrid

- 3.3. Public

Retail Cloud Security Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Cloud Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Threats of Cyber Attacks are Augmenting Market Growth

- 3.3. Market Restrains

- 3.3.1. Migration of Retail Processes from On-Premise to Cloud is a Major Challenge

- 3.4. Market Trends

- 3.4.1. Intrusion Detection and Prevention to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Identity and Access Management

- 5.1.2. Data Loss Prevention

- 5.1.3. Intrusion Detection and Prevention

- 5.1.4. Security Information and Event Management

- 5.1.5. Encryption

- 5.2. Market Analysis, Insights and Forecast - by Security

- 5.2.1. Application Security

- 5.2.2. Database Security

- 5.2.3. Endpoint Security

- 5.2.4. Network Security

- 5.2.5. Web and Email Security

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. Private

- 5.3.2. Hybrid

- 5.3.3. Public

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Identity and Access Management

- 6.1.2. Data Loss Prevention

- 6.1.3. Intrusion Detection and Prevention

- 6.1.4. Security Information and Event Management

- 6.1.5. Encryption

- 6.2. Market Analysis, Insights and Forecast - by Security

- 6.2.1. Application Security

- 6.2.2. Database Security

- 6.2.3. Endpoint Security

- 6.2.4. Network Security

- 6.2.5. Web and Email Security

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. Private

- 6.3.2. Hybrid

- 6.3.3. Public

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Identity and Access Management

- 7.1.2. Data Loss Prevention

- 7.1.3. Intrusion Detection and Prevention

- 7.1.4. Security Information and Event Management

- 7.1.5. Encryption

- 7.2. Market Analysis, Insights and Forecast - by Security

- 7.2.1. Application Security

- 7.2.2. Database Security

- 7.2.3. Endpoint Security

- 7.2.4. Network Security

- 7.2.5. Web and Email Security

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. Private

- 7.3.2. Hybrid

- 7.3.3. Public

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Identity and Access Management

- 8.1.2. Data Loss Prevention

- 8.1.3. Intrusion Detection and Prevention

- 8.1.4. Security Information and Event Management

- 8.1.5. Encryption

- 8.2. Market Analysis, Insights and Forecast - by Security

- 8.2.1. Application Security

- 8.2.2. Database Security

- 8.2.3. Endpoint Security

- 8.2.4. Network Security

- 8.2.5. Web and Email Security

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. Private

- 8.3.2. Hybrid

- 8.3.3. Public

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Identity and Access Management

- 9.1.2. Data Loss Prevention

- 9.1.3. Intrusion Detection and Prevention

- 9.1.4. Security Information and Event Management

- 9.1.5. Encryption

- 9.2. Market Analysis, Insights and Forecast - by Security

- 9.2.1. Application Security

- 9.2.2. Database Security

- 9.2.3. Endpoint Security

- 9.2.4. Network Security

- 9.2.5. Web and Email Security

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. Private

- 9.3.2. Hybrid

- 9.3.3. Public

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Identity and Access Management

- 10.1.2. Data Loss Prevention

- 10.1.3. Intrusion Detection and Prevention

- 10.1.4. Security Information and Event Management

- 10.1.5. Encryption

- 10.2. Market Analysis, Insights and Forecast - by Security

- 10.2.1. Application Security

- 10.2.2. Database Security

- 10.2.3. Endpoint Security

- 10.2.4. Network Security

- 10.2.5. Web and Email Security

- 10.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.3.1. Private

- 10.3.2. Hybrid

- 10.3.3. Public

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 US

- 11.1.2 Canada

- 12. Europe Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 UK

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Retail Cloud Security Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Computer Science Corporation (CSC)*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Trend Micro Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Fortinet Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Imperva Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Check Point Software Technologies Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mcafee LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cisco Systems Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Broadcom Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Qualys Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Sophos PLC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Computer Science Corporation (CSC)*List Not Exhaustive

List of Figures

- Figure 1: Global Retail Cloud Security Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Retail Cloud Security Market Revenue (Million), by Solution 2024 & 2032

- Figure 13: North America Retail Cloud Security Market Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Retail Cloud Security Market Revenue (Million), by Security 2024 & 2032

- Figure 15: North America Retail Cloud Security Market Revenue Share (%), by Security 2024 & 2032

- Figure 16: North America Retail Cloud Security Market Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 17: North America Retail Cloud Security Market Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 18: North America Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Retail Cloud Security Market Revenue (Million), by Solution 2024 & 2032

- Figure 21: Europe Retail Cloud Security Market Revenue Share (%), by Solution 2024 & 2032

- Figure 22: Europe Retail Cloud Security Market Revenue (Million), by Security 2024 & 2032

- Figure 23: Europe Retail Cloud Security Market Revenue Share (%), by Security 2024 & 2032

- Figure 24: Europe Retail Cloud Security Market Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 25: Europe Retail Cloud Security Market Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 26: Europe Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Retail Cloud Security Market Revenue (Million), by Solution 2024 & 2032

- Figure 29: Asia Pacific Retail Cloud Security Market Revenue Share (%), by Solution 2024 & 2032

- Figure 30: Asia Pacific Retail Cloud Security Market Revenue (Million), by Security 2024 & 2032

- Figure 31: Asia Pacific Retail Cloud Security Market Revenue Share (%), by Security 2024 & 2032

- Figure 32: Asia Pacific Retail Cloud Security Market Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 33: Asia Pacific Retail Cloud Security Market Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 34: Asia Pacific Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Retail Cloud Security Market Revenue (Million), by Solution 2024 & 2032

- Figure 37: Latin America Retail Cloud Security Market Revenue Share (%), by Solution 2024 & 2032

- Figure 38: Latin America Retail Cloud Security Market Revenue (Million), by Security 2024 & 2032

- Figure 39: Latin America Retail Cloud Security Market Revenue Share (%), by Security 2024 & 2032

- Figure 40: Latin America Retail Cloud Security Market Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 41: Latin America Retail Cloud Security Market Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 42: Latin America Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Retail Cloud Security Market Revenue (Million), by Solution 2024 & 2032

- Figure 45: Middle East and Africa Retail Cloud Security Market Revenue Share (%), by Solution 2024 & 2032

- Figure 46: Middle East and Africa Retail Cloud Security Market Revenue (Million), by Security 2024 & 2032

- Figure 47: Middle East and Africa Retail Cloud Security Market Revenue Share (%), by Security 2024 & 2032

- Figure 48: Middle East and Africa Retail Cloud Security Market Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 49: Middle East and Africa Retail Cloud Security Market Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 50: Middle East and Africa Retail Cloud Security Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Retail Cloud Security Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Retail Cloud Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 4: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 5: Global Retail Cloud Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: US Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: UK Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 24: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 25: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 26: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: US Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 30: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 31: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 32: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Germany Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: UK Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: France Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 38: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 39: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 40: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: India Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: China Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Retail Cloud Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 46: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 47: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 48: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Retail Cloud Security Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 50: Global Retail Cloud Security Market Revenue Million Forecast, by Security 2019 & 2032

- Table 51: Global Retail Cloud Security Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 52: Global Retail Cloud Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Cloud Security Market?

The projected CAGR is approximately 13.44%.

2. Which companies are prominent players in the Retail Cloud Security Market?

Key companies in the market include Computer Science Corporation (CSC)*List Not Exhaustive, IBM Corporation, Trend Micro Inc, Fortinet Inc, Imperva Inc, Check Point Software Technologies Ltd, Mcafee LLC, Cisco Systems Inc, Broadcom Inc, Qualys Inc, Sophos PLC.

3. What are the main segments of the Retail Cloud Security Market?

The market segments include Solution, Security, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Threats of Cyber Attacks are Augmenting Market Growth.

6. What are the notable trends driving market growth?

Intrusion Detection and Prevention to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Migration of Retail Processes from On-Premise to Cloud is a Major Challenge.

8. Can you provide examples of recent developments in the market?

March 2023: IBM revised its Storage Defender solution by adding Cohesity data protection. Cohesive Data Protect’s integration into IBM Storage Defender will boost business resilience for organizations’ hybrid cloud systems by minimizing data fragmentation and maximizing availability. Cohesity DataProtect positions clients to copy and store data on numerous servers, on-site or off-site, or in various clouds. In the event of a disaster or cyber security breach, this helps to ensure that a current and exact copy of the data is available.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Cloud Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Cloud Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Cloud Security Market?

To stay informed about further developments, trends, and reports in the Retail Cloud Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence