Key Insights

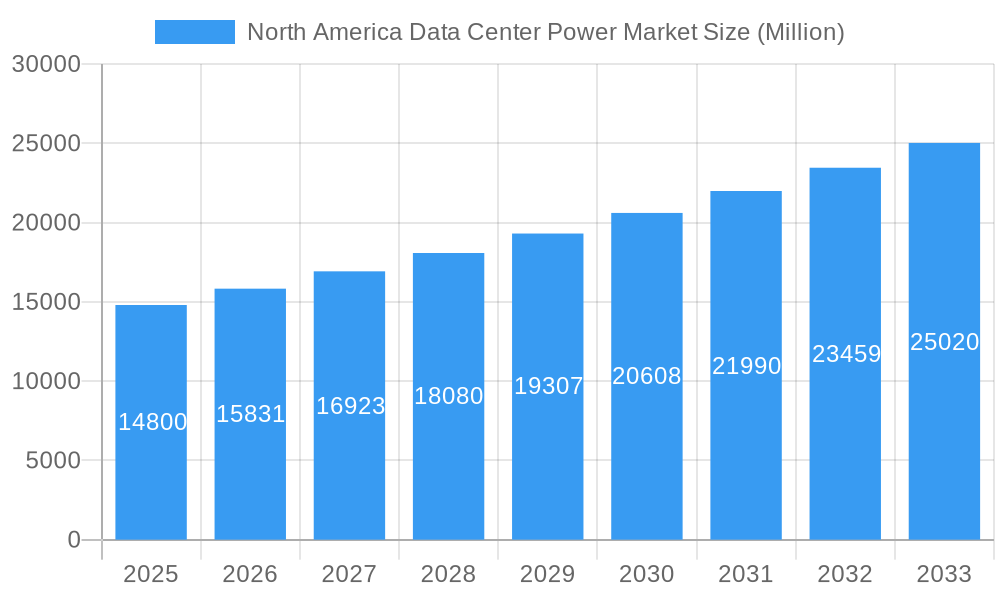

The North American Data Center Power Market is poised for robust expansion, projected to reach a substantial valuation of $14.80 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.83% through 2033. This significant growth is primarily fueled by the relentless digital transformation across industries, leading to an escalating demand for robust and reliable power infrastructure. Key drivers include the exponential increase in data generation and consumption, the widespread adoption of cloud computing services, and the burgeoning growth of hyperscale data centers to support AI, IoT, and big data analytics. The market is segmented into Power Distribution Solutions and Power Back-Up Solutions, with both segments expected to witness considerable advancements in efficiency and resilience. The increasing complexity and power demands of modern data centers, from colocation facilities to enterprise and cloud environments, necessitate sophisticated power management and protection systems.

North America Data Center Power Market Market Size (In Billion)

Emerging trends further underscore the market's upward trajectory. The increasing focus on energy efficiency and sustainability is driving innovation in power solutions, with a growing preference for intelligent power distribution and advanced uninterruptible power supply (UPS) systems that minimize energy loss and environmental impact. The burgeoning digital economy, encompassing sectors like BFSI, IT and Telecom, Government, Manufacturing, and Media & Entertainment, all rely heavily on secure and uninterrupted data center operations, thereby creating sustained demand. While the market presents immense opportunities, potential restraints such as rising energy costs and evolving regulatory landscapes related to data center operations will require strategic navigation by market players. Geographically, North America, particularly the United States, remains a dominant region, characterized by a high concentration of data center infrastructure and continuous investment in upgrading and expanding these facilities. Companies like Siemens AG, Schneider Electric, and Vertiv Group Corp are at the forefront, offering advanced power solutions to meet the evolving needs of this dynamic market.

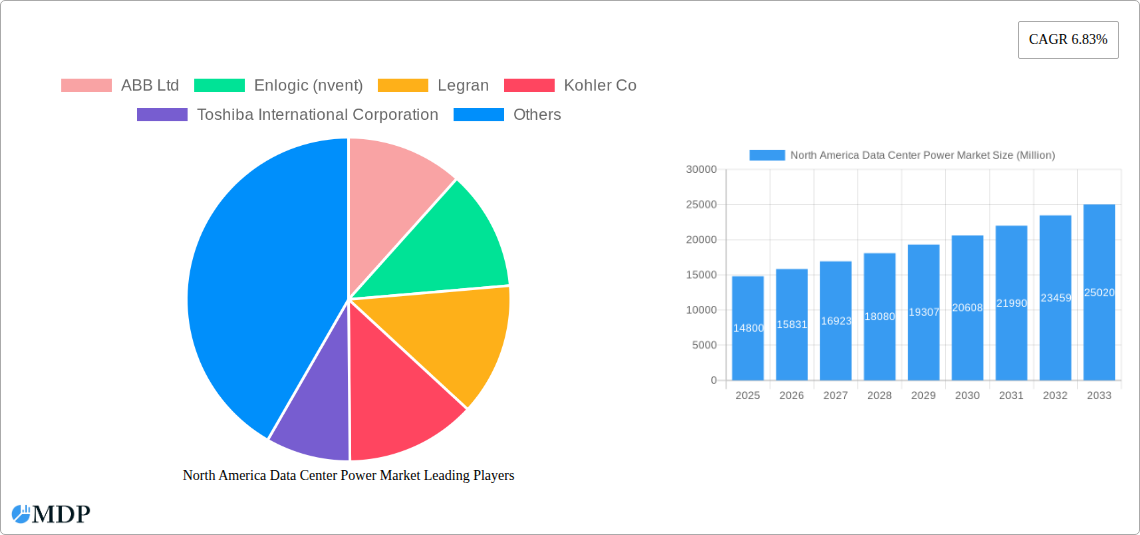

North America Data Center Power Market Company Market Share

North America Data Center Power Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the North America Data Center Power Market, offering critical insights into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for data center operators, power equipment manufacturers, investors, and industry stakeholders seeking to navigate and capitalize on this rapidly evolving market. We delve into the strategic landscapes of key players, analyze market concentration, and project future growth trajectories, equipping you with actionable intelligence for informed decision-making.

North America Data Center Power Market Market Dynamics & Concentration

The North America Data Center Power Market is characterized by a moderate to high concentration, with key players like Schneider Electric, Vertiv Group Corp, and ABB Ltd holding significant market shares. Innovation remains a primary driver, fueled by the escalating demand for higher power densities, energy efficiency, and enhanced reliability in data centers. Regulatory frameworks, particularly those focusing on energy conservation and sustainability, are increasingly shaping product development and market strategies. While direct product substitutes are limited, advancements in power management software and integration with broader IT infrastructure can be considered indirect substitutes. End-user trends highlight a continuous demand for robust power solutions to support the burgeoning digital economy, including cloud computing, AI, and IoT. Mergers and acquisitions (M&A) activity has been observed as companies seek to expand their portfolios, gain technological expertise, and consolidate their market positions. For instance, there have been approximately 5-7 significant M&A deals in the past two years within the broader data center infrastructure space, indicating a trend towards consolidation and strategic partnerships. The market share of the top 3 players is estimated to be around 60-65%.

North America Data Center Power Market Industry Trends & Analysis

The North America Data Center Power Market is experiencing robust growth, driven by an insatiable demand for digital services and the exponential increase in data generation. The average annual growth rate (CAGR) for the forecast period is projected to be between 8.5% and 9.5%. This expansion is primarily fueled by the relentless adoption of cloud computing, big data analytics, artificial intelligence, and the Internet of Things (IoT), all of which necessitate massive and highly reliable data center infrastructure. The shift towards hyperscale data centers, built by major cloud providers, is a significant trend, demanding high-capacity power distribution and backup solutions. Similarly, the growth in colocation facilities to serve a wider range of businesses, from startups to large enterprises, contributes to market expansion. Enterprise and cloud data centers are also undergoing upgrades and expansions to accommodate evolving IT workloads.

Technological disruptions are continuously reshaping the market. Innovations in Uninterruptible Power Supplies (UPS) systems, including modular and highly efficient designs, are becoming standard. Power Distribution Units (PDUs) are evolving from simple outlets to intelligent, software-controlled devices offering granular monitoring, remote management, and predictive maintenance capabilities. The integration of advanced cooling technologies with power management systems is another key trend, aiming to optimize energy consumption and operational efficiency. Consumer preferences are increasingly leaning towards sustainable and energy-efficient power solutions, pushing manufacturers to develop greener technologies and adopt renewable energy sources for data center operations. Cybersecurity is also a growing concern, with power infrastructure needing to incorporate robust security features to protect against cyber threats. Competitive dynamics are intensifying, with established players investing heavily in research and development to maintain their market leadership, while new entrants focus on niche markets and innovative solutions. Market penetration for intelligent PDUs is estimated to reach 70-75% in hyperscale and colocation segments by 2028.

Leading Markets & Segments in North America Data Center Power Market

The United States dominates the North America Data Center Power Market, driven by its advanced technological infrastructure, significant concentration of hyperscale and enterprise data centers, and favorable investment climate. Canada and Mexico also represent substantial markets, with growing investments in digital infrastructure.

By Solution Type:

- Power Distribution Solution: This segment is a significant contributor, encompassing PDUs, switchgear, and busway systems. The increasing demand for higher power densities within racks, driven by AI and HPC applications, fuels the growth of advanced power distribution solutions. Key drivers include the need for efficient power delivery, rack-level monitoring, and the flexibility to adapt to changing IT loads.

- Dominance Drivers: The proliferation of high-density computing, the expansion of hyperscale facilities requiring scalable power distribution, and the growing adoption of intelligent PDUs for enhanced management.

- Power Back Up Solutions: This segment includes UPS systems, generators, and battery storage. The criticality of uptime for data center operations ensures continuous demand for robust backup power solutions.

- Dominance Drivers: The increasing emphasis on data integrity, the growing number of sophisticated cyber threats, and the need to meet stringent Service Level Agreements (SLAs) for data center availability.

By Data Center Type:

- Hyperscalers: This segment leads the market in terms of power consumption and demand for high-capacity, reliable power infrastructure. The sheer scale of hyperscale data centers necessitates massive investments in power distribution and backup systems.

- Dominance Drivers: Aggressive expansion by major cloud providers, the massive growth in cloud services, and the ongoing demand for data processing and storage.

- Colocation: This segment is witnessing rapid growth as businesses outsource their IT infrastructure. Colocation providers require scalable and efficient power solutions to cater to a diverse client base.

- Dominance Drivers: Cost-effectiveness of outsourcing for businesses, demand for flexible IT solutions, and the increasing need for specialized data center services.

- Enterprise & Cloud: While hyperscalers dominate, enterprise and cloud data centers continue to invest in upgrades and expansions, particularly those focused on private cloud and hybrid cloud solutions.

- Dominance Drivers: Growing adoption of hybrid cloud strategies, the need for localized data processing, and regulatory compliance requirements.

By End-user Application:

- IT and Telecom: This sector is the largest consumer of data center power solutions due to the extensive infrastructure required for network operations, cloud services, and communication technologies.

- Dominance Drivers: Explosive growth in mobile data, streaming services, and the rollout of 5G networks.

- BFSI: The banking, financial services, and insurance sector relies heavily on data centers for critical operations, transactions, and data security, demanding highly reliable power.

- Dominance Drivers: Digital transformation initiatives, increased online transactions, and stringent regulatory requirements for data availability and security.

- Government: Government agencies are increasingly digitizing services, leading to the expansion of data center needs for secure data storage and processing.

- Dominance Drivers: Initiatives for smart cities, e-governance programs, and the need for secure national data infrastructure.

- Manufacturing: The adoption of Industry 4.0, IoT devices on the factory floor, and automation are driving the need for on-premises or edge data center power solutions.

- Dominance Drivers: Increased adoption of automation, AI-driven manufacturing processes, and the need for real-time data analysis.

- Media & Entertainment: The growing demand for streaming services, high-definition content, and virtual reality experiences necessitates robust data center power capabilities.

- Dominance Drivers: Proliferation of digital content, increasing use of AI in content creation and delivery, and the demand for high-performance computing for rendering.

North America Data Center Power Market Product Developments

Recent product developments in the North America Data Center Power Market underscore a strong focus on enhanced intelligence, efficiency, and security. In June 2023, CyberPower released a significant update for its Three-Phase Intelligent LCD PDU firmware, introducing support for a new environmental sensor (SNEV001) and enabling users to fine-tune SSL Server cipher suites for improved security. This highlights the trend towards more sophisticated environmental monitoring and granular control over network security protocols within power infrastructure. Concurrently, also in June 2023, Legrand launched its next-generation intelligent rack Power Distribution Units (PDUs), including the Server Technology PRO4X and Raritan PX4 series. These advancements are set to redefine power management by offering superior visibility into power usage, cutting-edge hardware for enhanced performance, and robust security features, reflecting the industry's commitment to delivering data center power solutions that are not only reliable but also intelligent and secure.

Key Drivers of North America Data Center Power Market Growth

The North America Data Center Power Market is propelled by several key drivers. The relentless surge in data generation, fueled by cloud computing, AI, and IoT, necessitates continuous expansion of data center capacity, thereby increasing demand for power infrastructure. Digital transformation initiatives across all industries are a significant catalyst, as businesses increasingly rely on data-driven operations. Furthermore, government investments in digital infrastructure and smart city projects contribute to market growth. Technological advancements, such as the development of more energy-efficient UPS systems and intelligent PDUs, are also key growth accelerators, enabling data centers to manage power more effectively and reduce operational costs. The growing emphasis on sustainability and corporate ESG goals is further driving the adoption of greener power solutions and renewable energy integration.

Challenges in the North America Data Center Power Market Market

Despite robust growth, the North America Data Center Power Market faces several challenges. The increasing power demands of modern data centers are straining existing grid capacities in some regions, leading to concerns about reliability and the need for substantial grid upgrades. Escalating electricity costs can impact operational expenditures, pushing for more energy-efficient solutions. Supply chain disruptions, as seen in recent years, can lead to delays in equipment delivery and increased component costs. Evolving cybersecurity threats require constant vigilance and investment in secure power infrastructure, adding complexity and cost. Additionally, stringent regulatory requirements related to energy efficiency and environmental impact can necessitate significant upfront investment and compliance efforts from market players.

Emerging Opportunities in North America Data Center Power Market

Several emerging opportunities are poised to shape the future of the North America Data Center Power Market. The burgeoning edge computing market presents a significant opportunity for compact, intelligent power solutions designed for decentralized deployments. The increasing adoption of renewable energy sources, coupled with advanced energy storage systems, offers a pathway for more sustainable and resilient data center operations. Strategic partnerships between power equipment manufacturers and cloud providers, as well as utility companies, can unlock new avenues for innovation and optimized power delivery. Furthermore, the growing demand for predictive maintenance and AI-powered energy management solutions presents an opportunity for service-based revenue models and enhanced operational efficiency. The development of advanced cooling technologies integrated with power management systems also offers a synergistic growth avenue.

Leading Players in the North America Data Center Power Market Sector

- ABB Ltd

- Enlogic (nvent)

- Legrand

- Kohler Co

- Toshiba International Corporation

- LayerZero Power Systems

- Raritan Inc (Legrand)

- Siemens AG

- Tripp Lite (Eaton)

- Schneider Electric

- Cummins Inc

- Vertiv Group Corp

Key Milestones in North America Data Center Power Market Industry

- June 2023: CyberPower released an update for its Three-Phase Intelligent LCD PDU firmware, enhancing functionality with support for a new environmental sensor, SNEV001, and enabling users to enable/disable cipher suites for the SSL Server, bolstering security and monitoring capabilities.

- June 2023: Legrand introduced its next-generation intelligent rack Power Distribution Units (PDUs), the Server Technology PRO4X and Raritan PX4 series, poised to redefine power management with exceptional visibility, cutting-edge hardware, and enhanced security features for data centers.

Strategic Outlook for North America Data Center Power Market Market

The strategic outlook for the North America Data Center Power Market is exceptionally positive, driven by the continued digital transformation and the insatiable demand for data processing and storage. Key growth accelerators include the ongoing expansion of hyperscale data centers, the proliferation of edge computing deployments, and the increasing integration of renewable energy sources. Companies that focus on developing highly efficient, intelligent, and secure power solutions will be well-positioned for success. Strategic investments in research and development for advanced UPS technologies, intelligent PDUs with comprehensive monitoring and control capabilities, and integrated cooling solutions will be crucial. Furthermore, forming strategic alliances with cloud providers and utility companies to ensure grid stability and facilitate renewable energy integration will be a vital strategy for long-term market leadership and sustainable growth. The market is expected to witness increased adoption of predictive maintenance and AI-driven optimization tools to enhance operational efficiency.

North America Data Center Power Market Segmentation

-

1. Type

-

1.1. By Solution Type

- 1.1.1. Power Distribution Solution

- 1.1.2. Power Back Up Solutions

- 1.2. By Servi

-

1.1. By Solution Type

-

2. Data Center Type

- 2.1. Colocation

- 2.2. Enterprise & Cloud

- 2.3. Hyperscalers

-

3. End-user Application

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Manufacturing

- 3.5. Media & Entertainment

- 3.6. Other End User

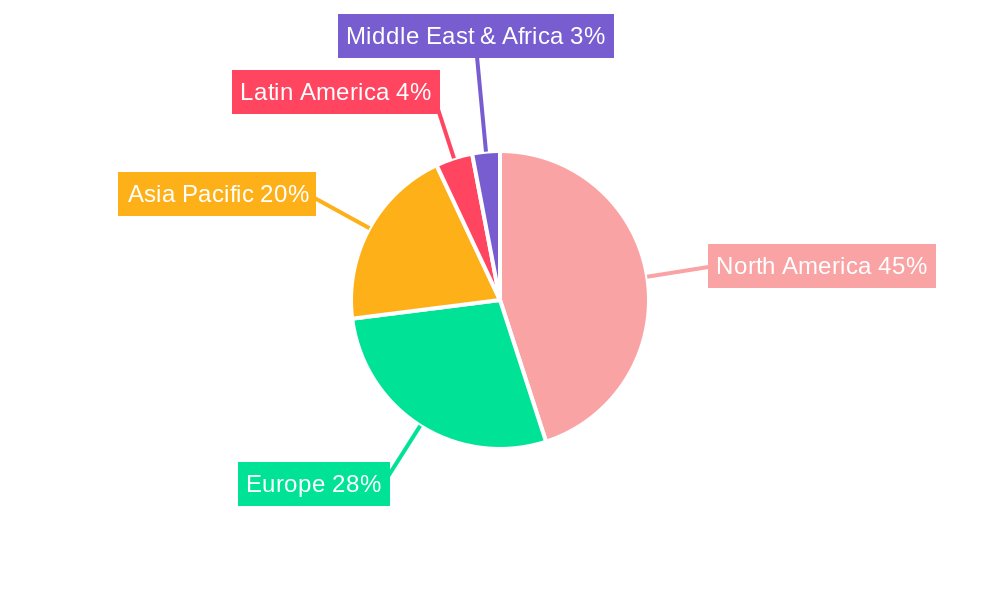

North America Data Center Power Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Data Center Power Market Regional Market Share

Geographic Coverage of North America Data Center Power Market

North America Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns will Remain a Challenge to the Growth of the Market

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. By Solution Type

- 5.1.1.1. Power Distribution Solution

- 5.1.1.2. Power Back Up Solutions

- 5.1.2. By Servi

- 5.1.1. By Solution Type

- 5.2. Market Analysis, Insights and Forecast - by Data Center Type

- 5.2.1. Colocation

- 5.2.2. Enterprise & Cloud

- 5.2.3. Hyperscalers

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Manufacturing

- 5.3.5. Media & Entertainment

- 5.3.6. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enlogic (nvent)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Legran

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba International Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LayerZero Power Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raritan Inc (Legrand)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tripp Lite (Eaton)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schneider Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cummins Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Vertiv Group Corp

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: North America Data Center Power Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Data Center Power Market Share (%) by Company 2025

List of Tables

- Table 1: North America Data Center Power Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Data Center Power Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 3: North America Data Center Power Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 4: North America Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Data Center Power Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Data Center Power Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 7: North America Data Center Power Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 8: North America Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Data Center Power Market?

The projected CAGR is approximately 6.83%.

2. Which companies are prominent players in the North America Data Center Power Market?

Key companies in the market include ABB Ltd, Enlogic (nvent), Legran, Kohler Co, Toshiba International Corporation, LayerZero Power Systems, Raritan Inc (Legrand), Siemens AG, Tripp Lite (Eaton), Schneider Electric, Cummins Inc, Vertiv Group Corp.

3. What are the main segments of the North America Data Center Power Market?

The market segments include Type, Data Center Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Data Security Concerns will Remain a Challenge to the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023 - CyberPower released an update for its Three-Phase Intelligent LCD PDU firmware. It adds support for a new environmental sensor, SNEV001, and allows users to enable/disable cipher suites for the SSL Server.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Data Center Power Market?

To stay informed about further developments, trends, and reports in the North America Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence