Key Insights

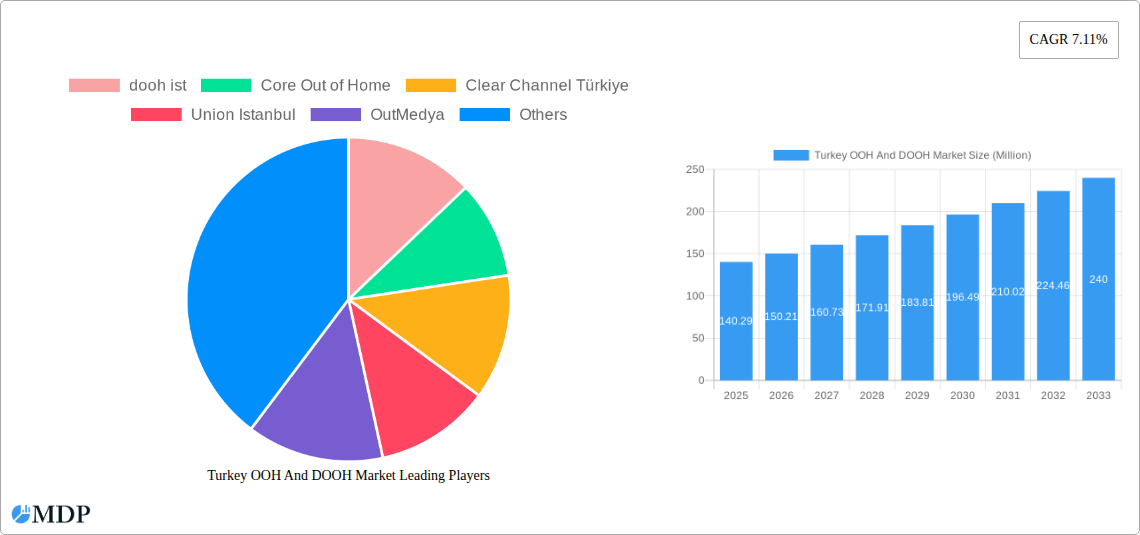

The Turkish Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for substantial growth, projected to reach a market size of USD 140.29 million with a compelling Compound Annual Growth Rate (CAGR) of 7.11% over the forecast period of 2025-2033. This robust expansion is fueled by significant drivers, including the increasing adoption of programmatic DOOH, which allows for more targeted and efficient ad placements, and the continuous modernization of OOH infrastructure. The shift towards digital screens, particularly LED displays, is a major trend, offering greater flexibility, dynamic content, and enhanced viewer engagement. Additionally, the expansion of transit advertising in airports and buses, alongside the growth in street furniture and other place-based media, signifies a broadening OOH landscape. The automotive, retail and consumer goods, and healthcare sectors are anticipated to be key end-users, leveraging OOH and DOOH to reach a diverse consumer base. This dynamic market environment is expected to attract significant investment, driving innovation and competition among key players like DOOH IST, Core Out of Home, and Clear Channel Türkiye.

Turkey OOH And DOOH Market Market Size (In Million)

The market's trajectory is not without its challenges. Restraints such as the initial cost of digital infrastructure deployment and the evolving regulatory landscape for outdoor advertising could temper growth. However, the overarching trend towards data-driven advertising and the increasing demand for measurable campaign results are expected to outweigh these limitations. The integration of programmatic buying in DOOH is a game-changer, enabling advertisers to optimize campaigns in real-time and achieve better ROI, thus mitigating cost concerns. Furthermore, the inherent ability of OOH to create impactful, large-scale brand experiences, combined with the hyper-targeting capabilities of DOOH, positions it as a vital component of integrated marketing strategies. As urbanization continues and consumer lifestyles become more mobile, the reach and relevance of OOH and DOOH advertising are set to amplify, solidifying its importance in the Turkish media ecosystem. The strategic expansion across various applications like billboards, transit, and street furniture, coupled with the diverse end-user base, underscores the market's resilience and potential for sustained advancement.

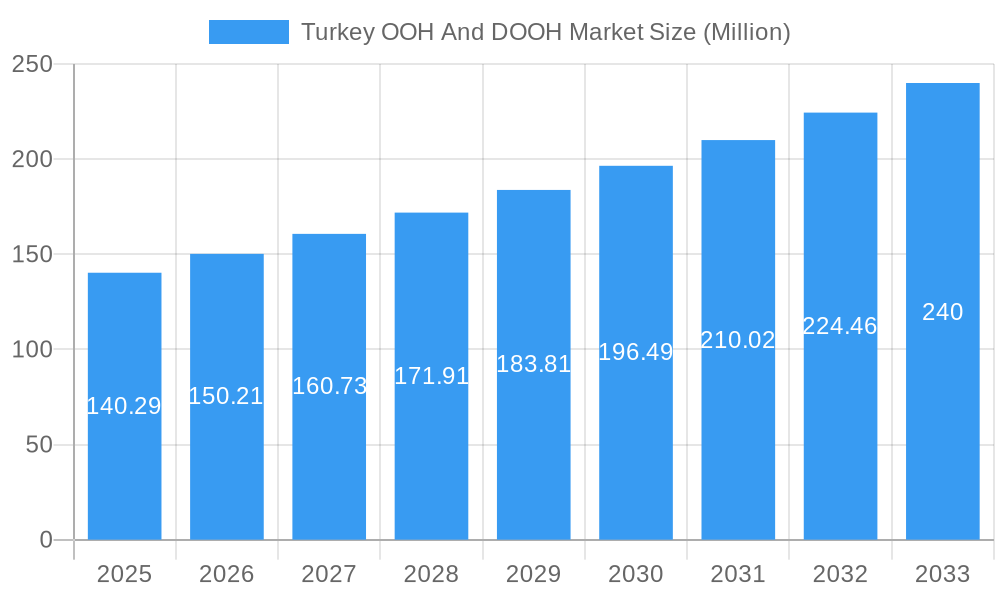

Turkey OOH And DOOH Market Company Market Share

Here is an SEO-optimized and engaging report description for the Turkey OOH and DOOH Market, designed for immediate use without modification:

Turkey OOH And DOOH Market Market Dynamics & Concentration

The Turkey Out-of-Home (OOH) and Digital Out-of-Home (DOOH) market is characterized by a dynamic interplay of established players and emerging innovators, driving significant concentration and evolution. Innovation is a key differentiator, fueled by advancements in programmatic buying, programmatic OOH, and interactive digital screens. Regulatory frameworks, while providing structure, also influence market entry and operational strategies. Product substitutes, though present, are increasingly challenged by the superior engagement offered by DOOH solutions. End-user trends are heavily influenced by the digital transformation across sectors like Automotive, Retail and Consumer Goods, Healthcare, and BFSI. Mergers and acquisitions (M&A) are a critical component of market consolidation, with recent activity indicating a drive towards larger, more integrated advertising portfolios. For instance, the partnership between 7amdaan.io, Wilyer MENA, and Du-Du Ads, involving over 5,000 screens, signifies a major strategic consolidation. While specific market share data for individual companies like dooh ist, Core Out of Home, Clear Channel Türkiye, Union Istanbul, OutMedya, Künye Reklam Ajansı, Kantar Media Turkey, Elitmedya, Square Group, and Scarlet Media are proprietary, their collective efforts are reshaping the competitive landscape. M&A deal counts are anticipated to increase as companies seek to expand their digital footprints and programmatic capabilities.

Turkey OOH And DOOH Market Industry Trends & Analysis

The Turkey OOH and DOOH market is experiencing robust growth, driven by a confluence of factors including increasing digital adoption, a burgeoning tourism sector, and evolving consumer behavior. The shift towards Digital Out-of-Home, particularly LED screens and programmatic OOH, is a dominant trend, offering advertisers unprecedented flexibility, real-time targeting, and measurable campaign performance. This technological disruption is reshaping how brands connect with audiences, moving from static impressions to dynamic, data-driven storytelling. Consumer preferences are increasingly aligned with engaging and interactive media experiences, making DOOH platforms highly attractive. The rise of programmatic OOH allows for automated buying and selling of ad inventory, mirroring the efficiency of online advertising and opening new avenues for smaller advertisers and niche campaigns. This is further amplified by the integration of mobile data and AI, enabling highly personalized messaging based on location, time of day, and audience demographics. The market penetration of digital screens is steadily increasing, transforming urban landscapes into vibrant advertising canvases. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a growing emphasis on data analytics to demonstrate ROI. While traditional OOH formats like billboards and street furniture continue to hold relevance, their integration with digital capabilities is becoming essential for sustained competitiveness. The overall CAGR for the Turkey OOH and DOOH market is projected to be substantial over the forecast period, reflecting sustained demand and technological advancements. Key growth drivers include increased outdoor advertising spend from sectors like Automotive and Retail, coupled with ongoing infrastructure development that expands the reach of OOH advertising.

Leading Markets & Segments in Turkey OOH And DOOH Market

Within the Turkey OOH and DOOH market, Digital Out-of-Home (DOOH) is emerging as the dominant segment, outpacing the growth of Static (Traditional) OOH. This shift is primarily fueled by the inherent advantages of DOOH, including its dynamic content capabilities, enhanced engagement potential, and sophisticated programmatic buying options. Among the various applications, Transportation (Transit) advertising, encompassing airports and buses, is a significant growth area due to high audience dwell times and captive audiences. Billboards continue to command a substantial share, especially in high-traffic urban areas, but their effectiveness is increasingly being augmented with digital extensions. Street Furniture advertising also plays a crucial role, offering localized reach and consistent visibility.

Digital OOH (DOOH): This segment's dominance is driven by technological innovation, including:

- LED Screens: Their visual impact and ability to display high-resolution, dynamic content make them ideal for brand storytelling and promotions.

- Programmatic OOH: This allows for automated, data-driven ad buying, enabling precise audience targeting and campaign optimization, a key factor for advertisers seeking efficiency and ROI.

- Others: This includes innovative digital formats and interactive installations that create memorable brand experiences.

By Application:

- Transportation (Transit): Airports are a particularly lucrative segment due to the presence of affluent and globally mobile audiences, offering premium advertising opportunities. The extensive reach of buses and other transit vehicles ensures broad demographic penetration.

- Billboards: Remain a foundational element of the OOH landscape, providing large-scale visibility and brand presence in key locations.

- Street Furniture: Offers localized and consistent brand exposure, particularly effective for driving foot traffic and local sales.

- Other Place-based Media: Encompasses advertising in malls, cinemas, and other high-footfall venues, allowing for targeted audience engagement within specific environments.

By End-User:

- Retail and Consumer Goods: This sector is a major advertiser, leveraging OOH and DOOH to drive brand awareness, announce new products, and promote sales, capitalizing on impulse purchasing decisions.

- Automotive: Vehicle manufacturers frequently utilize OOH and DOOH for product launches and brand building, targeting a broad consumer base.

- Healthcare: With increasing awareness and product launches, the healthcare sector is expanding its OOH advertising efforts to reach target demographics.

- BFSI (Banking, Financial Services, and Insurance): This sector uses OOH to build trust, promote services, and reach a diverse audience seeking financial solutions.

Turkey OOH And DOOH Market Product Developments

Product innovations in the Turkey OOH and DOOH market are largely centered on enhancing interactivity, data integration, and programmatic capabilities. The introduction of smart screens with audience measurement sensors, interactive touch capabilities, and integration with mobile advertising platforms are transforming static placements into dynamic advertising hubs. Programmatic OOH platforms are continuously evolving, offering greater transparency, real-time campaign management, and sophisticated targeting options, making DOOH a more data-centric and accountable advertising channel. Companies are developing integrated solutions that combine physical OOH assets with digital overlays, creating richer brand experiences. These advancements provide advertisers with competitive advantages by enabling more personalized messaging, optimizing campaign spend, and delivering measurable results in diverse environments.

Key Drivers of Turkey OOH And DOOH Market Growth

Several key drivers are propelling the growth of the Turkey OOH and DOOH market. Technological advancements, particularly the widespread adoption of digital screens and the maturation of programmatic OOH platforms, are fundamental. Economic growth and increased consumer spending, especially in sectors like retail and automotive, translate into higher advertising budgets allocated to outdoor media. Furthermore, government initiatives promoting smart city development and infrastructure upgrades are creating more prime locations for OOH and DOOH installations. The evolving consumer landscape, with its increasing reliance on digital touchpoints, makes OOH and DOOH a vital component of integrated marketing campaigns, bridging the gap between online and offline consumer journeys.

Challenges in the Turkey OOH And DOOH Market Market

The Turkey OOH and DOOH market faces several challenges that could impede its growth trajectory. Regulatory hurdles and complex permitting processes for new installations, especially digital screens, can lead to project delays and increased costs. Supply chain disruptions for hardware components and skilled labor shortages for installation and maintenance can impact deployment timelines. Intense competition among OOH operators and a gradual shift in advertising budgets towards digital channels necessitate continuous innovation and demonstrable ROI to retain market share. Furthermore, the economic sensitivity of advertising spend means that any downturn in the broader economy can directly affect OOH and DOOH advertising investment.

Emerging Opportunities in Turkey OOH And DOOH Market

Emerging opportunities in the Turkey OOH and DOOH market are significant, driven by technological breakthroughs and evolving market needs. The expansion of programmatic buying into the DOOH space presents a massive opportunity for increased ad spend and advertiser accessibility, enabling hyper-targeted campaigns. Strategic partnerships, such as the one between 7amdaan.io, Wilyer MENA, and Du-Du Ads, are crucial for consolidating inventory and offering expansive regional coverage. The increasing demand for data-driven advertising solutions offers avenues for developing more sophisticated audience measurement and analytics tools. Market expansion strategies, focusing on underserved regions and developing innovative ad formats, also hold substantial potential for long-term growth.

Leading Players in the Turkey OOH And DOOH Market Sector

- dooh ist

- Core Out of Home

- Clear Channel Türkiye

- Union Istanbul

- OutMedya

- Künye Reklam Ajansı

- Kantar Media Turkey

- Elitmedya

- Square Group

- Scarlet Media

Key Milestones in Turkey OOH And DOOH Market Industry

- July 2024: 7amdaan.io, a Bahrain-based company, forged a strategic partnership with Wilyer MENA and Du-Du Ads. Their collective goal is to transform advertising spaces in the MENAT region, which includes Turkey, amid the DOOH industry's rapid evolution. With a combined portfolio boasting over 5,000 advertising screens, this collaboration emerges as a dominant player in the DOOH market. The newly established entity does not just aim to consolidate its current assets but is also poised to aggressively broaden its reach, with plans to notably boost the screen count across the region.

- January 2024: Eskimi, with a presence in Turkey, introduces the 'Disable Made For Advertising' Feature. Eskimi's introduction of an ON/OFF feature for MFA underscores the platform's dedication to providing advertisers with a personalized, streamlined, and data-centric experience. In an arena where control, efficiency, and adaptability are paramount, Eskimi is reshaping industry benchmarks.

Strategic Outlook for Turkey OOH And DOOH Market Market

The strategic outlook for the Turkey OOH and DOOH market is exceptionally positive, driven by ongoing technological advancements and a growing demand for integrated advertising solutions. Continued investment in digital infrastructure, particularly in programmatic DOOH capabilities and smart screen technology, will be crucial for capitalizing on future market potential. Strategic partnerships and consolidations, like the one involving 7amdaan.io, will play a vital role in expanding reach and offering comprehensive advertising solutions. The market is poised for significant growth as advertisers increasingly recognize the unique value proposition of OOH and DOOH in delivering impactful, measurable, and engaging campaigns that complement their digital strategies.

Turkey OOH And DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

1.3. By Appli

- 1.3.1. Billboard

-

1.3.2. Transportation (Transit)

- 1.3.2.1. Airports

- 1.3.2.2. Others (Buses, etc.)

- 1.3.3. Street Furniture

- 1.3.4. Other Place-based Media

-

1.4. By End-u

- 1.4.1. Automotive

- 1.4.2. Retail and Consumer Goods

- 1.4.3. Healthcare

- 1.4.4. BFSI

- 1.4.5. Other End-user Industry

Turkey OOH And DOOH Market Segmentation By Geography

- 1. Turkey

Turkey OOH And DOOH Market Regional Market Share

Geographic Coverage of Turkey OOH And DOOH Market

Turkey OOH And DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in the Tourism Industry Has Aided the Spending on Airport Advertisement in the United States

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in the Tourism Industry Has Aided the Spending on Airport Advertisement in the United States

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey OOH And DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.1.3. By Appli

- 5.1.3.1. Billboard

- 5.1.3.2. Transportation (Transit)

- 5.1.3.2.1. Airports

- 5.1.3.2.2. Others (Buses, etc.)

- 5.1.3.3. Street Furniture

- 5.1.3.4. Other Place-based Media

- 5.1.4. By End-u

- 5.1.4.1. Automotive

- 5.1.4.2. Retail and Consumer Goods

- 5.1.4.3. Healthcare

- 5.1.4.4. BFSI

- 5.1.4.5. Other End-user Industry

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 dooh ist

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Core Out of Home

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clear Channel Türkiye

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Union Istanbul

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OutMedya

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Künye Reklam Ajansı

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kantar Media Turkey

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Elitmedya

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Square Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scarlet Media*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 dooh ist

List of Figures

- Figure 1: Turkey OOH And DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey OOH And DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Turkey OOH And DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Turkey OOH And DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Turkey OOH And DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Turkey OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Turkey OOH And DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 7: Turkey OOH And DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Turkey OOH And DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey OOH And DOOH Market?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the Turkey OOH And DOOH Market?

Key companies in the market include dooh ist, Core Out of Home, Clear Channel Türkiye, Union Istanbul, OutMedya, Künye Reklam Ajansı, Kantar Media Turkey, Elitmedya, Square Group, Scarlet Media*List Not Exhaustive.

3. What are the main segments of the Turkey OOH And DOOH Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 140.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in the Tourism Industry Has Aided the Spending on Airport Advertisement in the United States.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in the Tourism Industry Has Aided the Spending on Airport Advertisement in the United States.

8. Can you provide examples of recent developments in the market?

July 2024: 7amdaan.io, a Bahrain-based company, forged a strategic partnership with Wilyer MENA and Du-Du Ads. Their collective goal is to transform advertising spaces in the MENAT region, which includes Turkey, amid the DOOH industry's rapid evolution. With a combined portfolio boasting over 5,000 advertising screens, this collaboration emerges as a dominant player in the DOOH market. The newly established entity does not just aim to consolidate its current assets but is also poised to aggressively broaden its reach, with plans to notably boost the screen count across the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey OOH And DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey OOH And DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey OOH And DOOH Market?

To stay informed about further developments, trends, and reports in the Turkey OOH And DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence