Key Insights

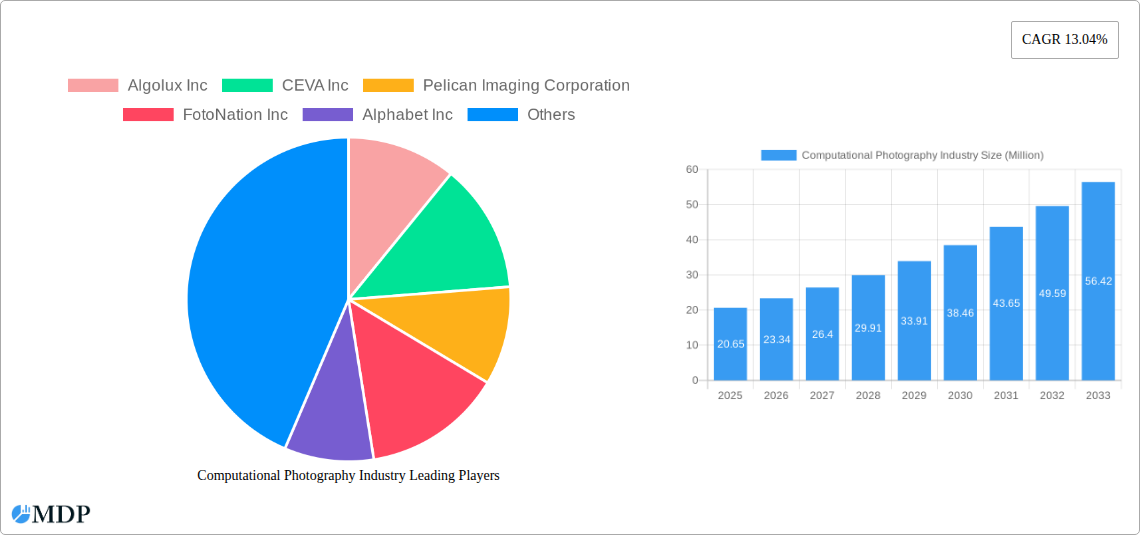

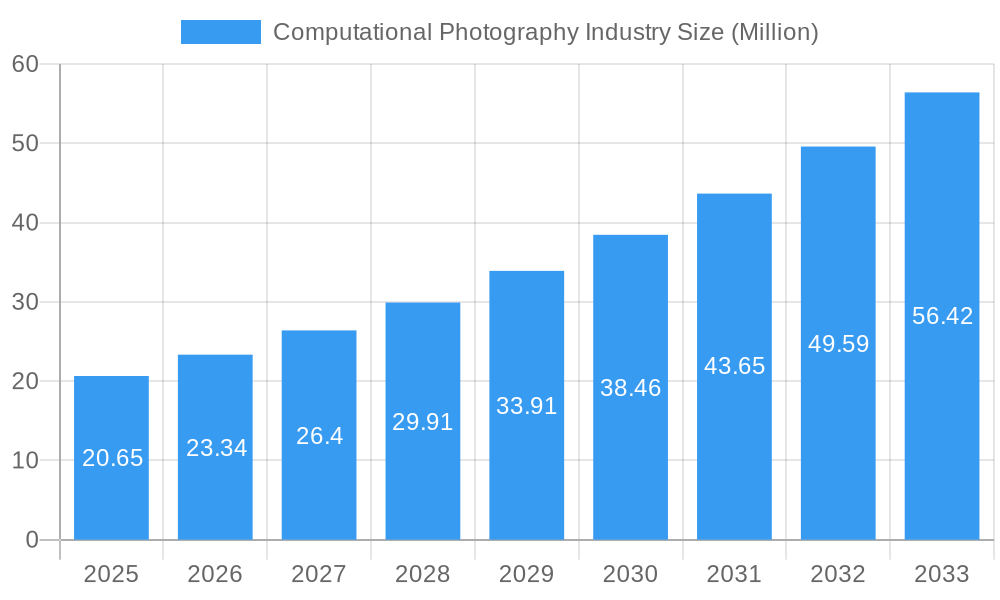

The computational photography market is poised for significant expansion, with a projected market size of $20.65 million in 2025 and an impressive Compound Annual Growth Rate (CAGR) of 13.04%. This robust growth is primarily fueled by the increasing demand for advanced imaging capabilities across a wide range of applications, most notably in smartphones. The insatiable consumer desire for higher quality photos and videos, coupled with the integration of sophisticated camera systems into mobile devices, serves as a primary driver. Furthermore, the burgeoning adoption of machine vision technologies in industries such as automotive, healthcare, and industrial automation is creating substantial opportunities. The evolution of camera modules, from single- and dual-lens systems to more complex multi-lens arrays (e.g., 16-lens cameras), directly contributes to the market's upward trajectory. The software component of computational photography is also critical, enabling advanced image processing, AI-driven enhancements, and novel imaging techniques that are redefining visual experiences.

Computational Photography Industry Market Size (In Million)

Key trends shaping this dynamic market include the relentless pursuit of enhanced low-light performance, advanced zoom capabilities, and the development of novel imaging sensors. The integration of artificial intelligence and machine learning algorithms for real-time image optimization, scene recognition, and personalized photographic effects is a dominant trend. Moreover, the growing interest in augmented reality (AR) and virtual reality (VR) applications is further stimulating innovation in computational photography, requiring more sophisticated depth sensing and 3D reconstruction capabilities. While the market is characterized by strong growth, potential restraints could emerge from the high cost of advanced hardware components and the ongoing need for skilled talent in specialized areas of image processing and AI. However, the continuous advancements in processing power and the increasing accessibility of sophisticated imaging solutions are expected to mitigate these challenges, ensuring sustained market momentum throughout the forecast period.

Computational Photography Industry Company Market Share

This in-depth report provides a holistic analysis of the global Computational Photography Industry, encompassing market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook. Covering the historical period from 2019 to 2024, a base and estimated year of 2025, and a forecast period extending to 2033, this study is an indispensable resource for industry stakeholders seeking actionable insights and competitive intelligence.

Computational Photography Industry Market Dynamics & Concentration

The Computational Photography Industry exhibits a dynamic and evolving market concentration, driven by intense innovation and strategic alliances among key players. Major companies like Alphabet Inc., Apple Inc., and Qualcomm Technologies Inc. command significant market share, estimated to be in the hundreds of millions, influencing technological advancements and market direction. The innovation drivers are primarily the relentless pursuit of superior image quality, enhanced user experience, and novel imaging capabilities across diverse applications. Regulatory frameworks, while still nascent in some regions, are beginning to focus on data privacy and algorithm transparency, impacting product development and market entry strategies. Product substitutes are increasingly sophisticated, with advancements in traditional camera hardware and software integration posing a competitive challenge. End-user trends lean towards camera-agnostic image enhancement, demand for multi-modal imaging, and seamless integration into smart devices. Mergers and acquisitions (M&A) activity is a key indicator of market consolidation and strategic expansion, with an estimated XX M&A deals in the historical period, shaping the competitive landscape.

Computational Photography Industry Industry Trends & Analysis

The Computational Photography Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is fueled by a confluence of technological disruptions, evolving consumer preferences, and expanding applications. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing image processing, enabling features like advanced noise reduction, semantic segmentation, and realistic HDR, thereby pushing the boundaries of what's possible with digital imaging. The increasing demand for high-quality visual content across social media, content creation, and professional photography continues to be a significant market penetration driver. Furthermore, the proliferation of AI-powered features in smartphones, from computational bokeh to advanced night modes, has democratized sophisticated imaging capabilities, making them accessible to a wider consumer base. The competitive dynamics are characterized by an arms race for superior image processing pipelines and the development of proprietary AI models. Companies are investing heavily in R&D to create more efficient and accurate algorithms, leading to a continuous stream of innovative products and services. The market penetration of computational photography techniques is expected to reach XX% by the end of the forecast period, underscoring its transformative impact on the imaging sector.

Leading Markets & Segments in Computational Photography Industry

The Computational Photography Industry is segmented across various offerings, types, and applications, with certain regions and segments demonstrating dominant growth.

Offerings:

- Software: This segment is experiencing robust expansion due to the increasing complexity and efficacy of AI-driven image processing algorithms. Software solutions enable advanced features without requiring significant hardware upgrades.

- Camera Modules: While software is a key differentiator, optimized camera modules that integrate advanced sensors and optics remain crucial for capturing high-quality raw data, forming the foundation for computational enhancements.

Type:

- Single- and Dual-Lens Cameras: These remain prevalent in mainstream consumer devices like smartphones due to cost-effectiveness and widespread adoption. Computational photography techniques are instrumental in maximizing their imaging potential.

- 16-Lens Cameras: While more niche, these advanced multi-lens systems, as pioneered by companies like Light Labs Inc., offer unparalleled depth-of-field control and sophisticated multi-spectral imaging capabilities, catering to professional and specialized applications.

Application:

- Smartphone Cameras: This is by far the largest and most influential application segment, with computational photography being a key selling point for leading smartphone brands. Market drivers include consumer demand for professional-grade photos and videos from a pocket-sized device. Economic policies supporting consumer electronics growth and robust smartphone infrastructure in major regions like Asia-Pacific fuel this dominance.

- Machine Vision Cameras: With the rise of AI in industrial automation, robotics, and autonomous systems, machine vision cameras are increasingly leveraging computational photography for enhanced object recognition, scene understanding, and quality control. The need for accurate and reliable visual data processing in these sectors is a significant driver.

- Other Applications: This encompasses emerging areas such as augmented reality (AR) and virtual reality (VR) headsets, automotive imaging (ADAS), drones, and medical imaging, all of which benefit from advanced computational image processing.

The dominance of the Smartphone Cameras segment is driven by the sheer volume of devices and the continuous innovation cycle spurred by competitive pressures and consumer expectations. Regions with high smartphone penetration and a strong consumer appetite for advanced imaging features, such as North America and Asia-Pacific, are leading this segment.

Computational Photography Industry Product Developments

Product developments in computational photography are characterized by a relentless focus on enhancing image quality, reducing noise, improving low-light performance, and enabling novel imaging effects through sophisticated algorithms. Companies are integrating AI and ML models directly into camera pipelines, allowing for real-time processing and intelligent scene analysis. This leads to advanced features like semantic segmentation for background blur, super-resolution for sharper details, and AI-powered object tracking for smoother video. Competitive advantages are derived from the efficiency and accuracy of these algorithms, offering users professional-grade imaging capabilities in accessible devices and applications.

Key Drivers of Computational Photography Industry Growth

The growth of the Computational Photography Industry is propelled by several interconnected factors. Technologically, the advancement of AI and ML algorithms, coupled with increased processing power in mobile devices and edge computing platforms, is fundamental. Economically, the global demand for high-quality visual content across various platforms, from social media to professional media, fuels investment and innovation. Furthermore, the increasing affordability and accessibility of sophisticated imaging technologies, driven by mass production of components and software optimization, democratize advanced photography. Regulatory frameworks that encourage innovation in AI and data processing also play a supportive role.

Challenges in the Computational Photography Industry Market

Despite its rapid growth, the Computational Photography Industry faces several challenges. Regulatory hurdles concerning data privacy and algorithm bias can impede development and deployment, particularly as AI becomes more integrated into image processing. Supply chain issues, especially concerning specialized sensors and high-performance processing units, can affect production volumes and costs. Competitive pressures are intense, with a constant need for innovation to stay ahead, leading to significant R&D investments. Furthermore, the computational power required for advanced processing can still be a constraint for certain embedded systems, impacting the feasibility of deploying complex algorithms.

Emerging Opportunities in Computational Photography Industry

Catalysts driving long-term growth in the Computational Photography Industry include technological breakthroughs in specialized AI hardware designed for imaging tasks, such as neural processing units (NPUs). Strategic partnerships between hardware manufacturers and AI software developers are crucial for creating integrated solutions. Market expansion into emerging applications like autonomous driving, advanced medical imaging, and immersive AR/VR experiences presents significant opportunities. The increasing adoption of computational photography in industrial IoT and robotics for enhanced perception and decision-making also represents a vast untapped potential.

Leading Players in the Computational Photography Industry Sector

- Algolux Inc.

- CEVA Inc.

- Pelican Imaging Corporation

- FotoNation Inc.

- Alphabet Inc.

- Light Labs Inc.

- Qualcomm Technologies Inc.

- Almalence Inc.

- Nvidia Corporation

- Apple Inc.

Key Milestones in Computational Photography Industry Industry

- February 2023: Qualcomm Technologies announced its 6th generation modem-to-antenna solution, the first ready to support 5G Advanced. This innovation introduces a new architecture and software suite with numerous world's first features to enhance connectivity, including coverage, latency, power efficiency, and mobility. Snapdragon X75 technologies and innovations empower OEMs to create next-generation experiences across segments, including smartphones, mobile broadband, automotive, compute, industrial IoT, fixed wireless access, and 5G private networks.

- September 2022: Nvidia Corporation announced the introduction of new Jetson Orin Nano system-on-modules, delivering up to 80x the performance of the previous generation. This expansion of the Nvidia Jetson family establishes a new benchmark for entry-level edge AI and robotics.

Strategic Outlook for Computational Photography Industry Market

The strategic outlook for the Computational Photography Industry is exceptionally positive, characterized by continuous innovation and market expansion. Future market potential lies in the deeper integration of AI across the entire imaging pipeline, from capture to post-processing, leading to more intuitive and powerful user experiences. Strategic opportunities include the development of specialized computational imaging solutions for niche markets such as scientific research, agriculture, and defense. The growth accelerators will be driven by the increasing demand for real-time, AI-powered visual analytics, the metaverse, and the growing need for enhanced perception in autonomous systems, further solidifying computational photography's indispensable role.

Computational Photography Industry Segmentation

-

1. Offerings

- 1.1. Camera Modules

- 1.2. Software

-

2. Type

- 2.1. Single- and Dual-Lens Cameras

- 2.2. 16-Lens Cameras

-

3. Application

- 3.1. Smartphone Cameras

- 3.2. Machine Vision Cameras

- 3.3. Other Applications

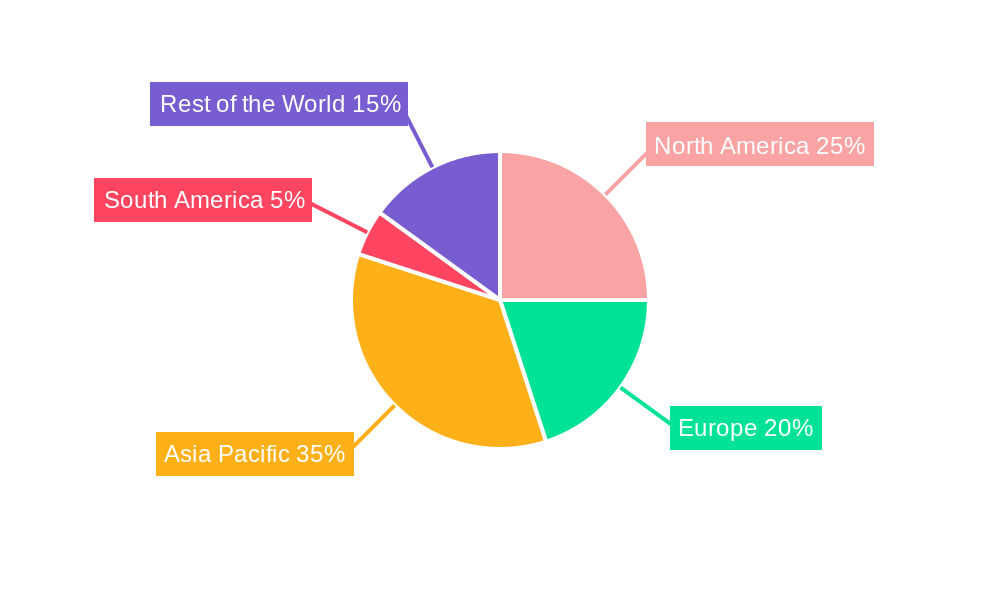

Computational Photography Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Rest of the World

Computational Photography Industry Regional Market Share

Geographic Coverage of Computational Photography Industry

Computational Photography Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Image Fusion Technique to Achieve High-quality Image; Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Smartphone Cameras to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 5.1.1. Camera Modules

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single- and Dual-Lens Cameras

- 5.2.2. 16-Lens Cameras

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Smartphone Cameras

- 5.3.2. Machine Vision Cameras

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 6. North America Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 6.1.1. Camera Modules

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single- and Dual-Lens Cameras

- 6.2.2. 16-Lens Cameras

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Smartphone Cameras

- 6.3.2. Machine Vision Cameras

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 7. Europe Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 7.1.1. Camera Modules

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single- and Dual-Lens Cameras

- 7.2.2. 16-Lens Cameras

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Smartphone Cameras

- 7.3.2. Machine Vision Cameras

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 8. Asia Pacific Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 8.1.1. Camera Modules

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single- and Dual-Lens Cameras

- 8.2.2. 16-Lens Cameras

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Smartphone Cameras

- 8.3.2. Machine Vision Cameras

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 9. South America Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 9.1.1. Camera Modules

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single- and Dual-Lens Cameras

- 9.2.2. 16-Lens Cameras

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Smartphone Cameras

- 9.3.2. Machine Vision Cameras

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 10. Rest of the World Computational Photography Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 10.1.1. Camera Modules

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single- and Dual-Lens Cameras

- 10.2.2. 16-Lens Cameras

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Smartphone Cameras

- 10.3.2. Machine Vision Cameras

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Algolux Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CEVA Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pelican Imaging Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FotoNation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alphabet Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Light Labs Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qualcomm Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Almalence Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nvidia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Algolux Inc

List of Figures

- Figure 1: Global Computational Photography Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 3: North America Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 4: North America Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 11: Europe Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 12: Europe Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 19: Asia Pacific Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 20: Asia Pacific Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 27: South America Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 28: South America Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Computational Photography Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 35: Rest of the World Computational Photography Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 36: Rest of the World Computational Photography Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Rest of the World Computational Photography Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Rest of the World Computational Photography Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Rest of the World Computational Photography Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World Computational Photography Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Computational Photography Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 2: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Computational Photography Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 6: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 10: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 14: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 18: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Computational Photography Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 22: Global Computational Photography Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Computational Photography Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Computational Photography Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computational Photography Industry?

The projected CAGR is approximately 13.04%.

2. Which companies are prominent players in the Computational Photography Industry?

Key companies in the market include Algolux Inc, CEVA Inc, Pelican Imaging Corporation, FotoNation Inc, Alphabet Inc, Light Labs Inc, Qualcomm Technologies Inc, Almalence Inc, Nvidia Corporation, Apple Inc.

3. What are the main segments of the Computational Photography Industry?

The market segments include Offerings, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Image Fusion Technique to Achieve High-quality Image; Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle.

6. What are the notable trends driving market growth?

Smartphone Cameras to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

High Manufacturing and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

February 2023: Qualcomm Technologies has announced the 6th generation modem-to-antenna solution is the first ready to support 5G Advanced, the next phase of 5G. It introduces a new architecture and software suite and includes numerous world's first features to push the boundaries of connectivity, including coverage, latency, power efficiency, and mobility. Snapdragon X75 technologies and innovations empower OEMs to create next-generation experiences across segments, including smartphones, mobile broadband, automotive, compute, industrial IoT, fixed wireless access, and 5G private networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computational Photography Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computational Photography Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computational Photography Industry?

To stay informed about further developments, trends, and reports in the Computational Photography Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence