Key Insights

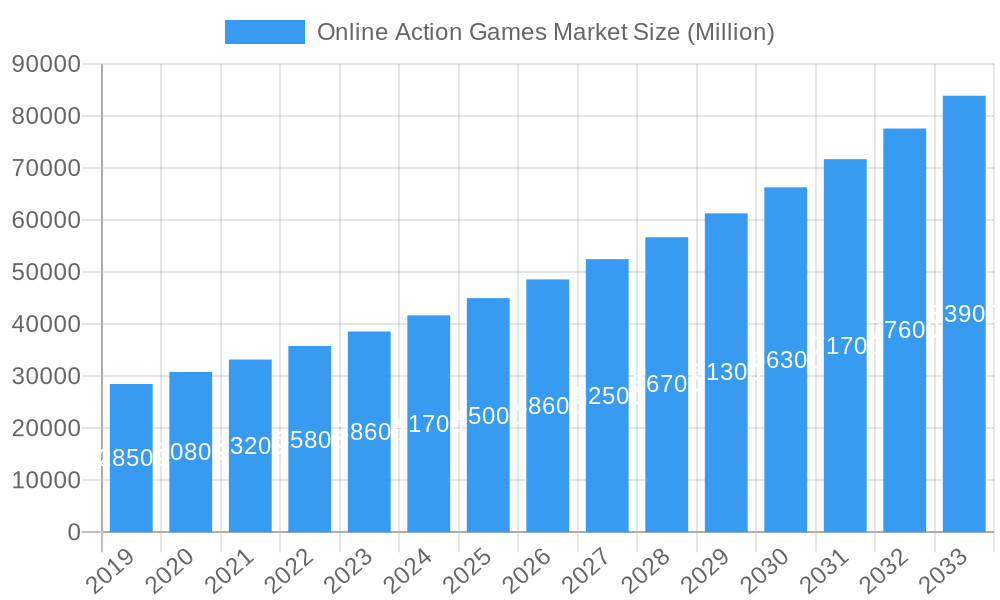

The global Online Action Games Market is projected to reach $6.39 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is driven by increasing digital adoption, rising disposable incomes, and continuous innovation in game development, offering more immersive experiences. Key growth factors include widespread high-speed internet access, the proliferation of advanced mobile devices, and the growing accessibility of cloud gaming services. Leading companies like Tencent, Sony Interactive Entertainment, and Ubisoft consistently release visually impressive titles with compelling narratives, attracting and retaining a broad player base.

Online Action Games Market Market Size (In Billion)

The market is segmented by revenue model into Free Gaming Services, monetized via in-game purchases and advertising, and Paid Gaming Services, including full game purchases and subscriptions. Mobile phones currently lead in platform dominance, followed by PCs and consoles. iOS and Android are the primary operating systems, with Windows significant for PC gaming. Geographically, the Asia Pacific region, particularly China and India, is a key growth area due to its large population and developing gaming culture. North America and Europe remain substantial, mature markets. The competitive landscape is robust, with both established players and emerging studios vying for market share through technological advancements and engaging content.

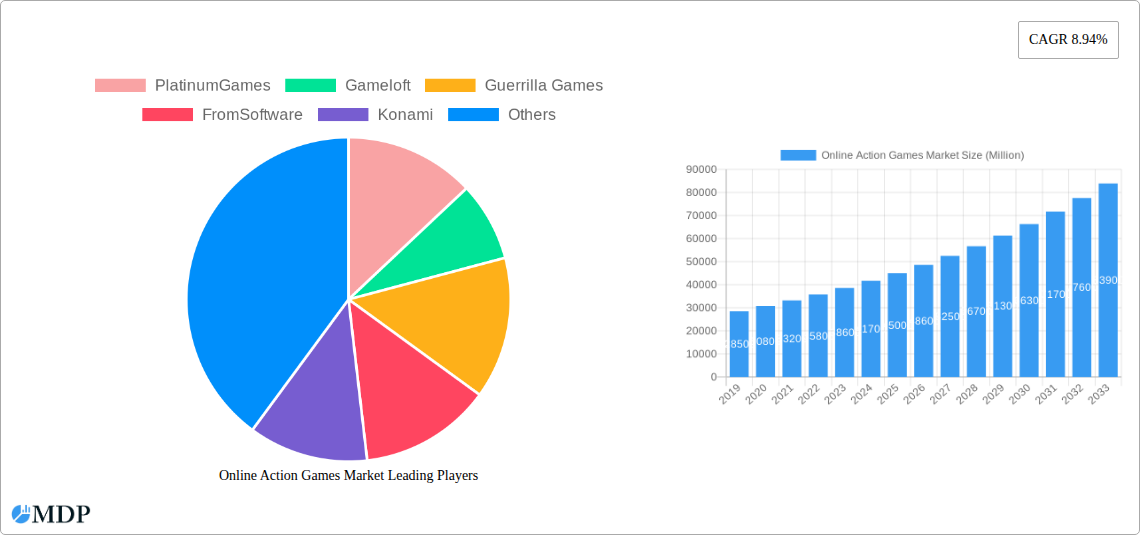

Online Action Games Market Company Market Share

Unleash the Future: Comprehensive Report on the Online Action Games Market

Dive deep into the electrifying world of online action games with this in-depth market analysis. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report provides actionable insights for stakeholders in the rapidly evolving gaming industry. Discover the lucrative opportunities and critical dynamics shaping the global online gaming market, esports growth, mobile gaming revenue, and PC gaming trends. With an estimated market size of over $150 Billion by 2025, this report is your essential guide to navigating the competitive landscape and capitalizing on emerging online gaming opportunities.

Online Action Games Market Market Dynamics & Concentration

The online action games market is characterized by a dynamic interplay of intense competition and significant innovation. Market concentration is moderate, with a few dominant players holding substantial market share, but a vast number of smaller developers and publishers continually challenge the status quo. Innovation drivers are primarily technological advancements, such as improved graphics, faster processing speeds, and immersive virtual reality (VR) and augmented reality (AR) integration, alongside evolving player engagement strategies like live-service models and robust community features. Regulatory frameworks, while generally supportive of the industry, are increasingly focusing on issues like in-game monetization practices, data privacy, and age-appropriate content, impacting game development and distribution. Product substitutes include other forms of digital entertainment and offline gaming experiences, but the interactive and social nature of online action games provides a strong competitive advantage. End-user trends reveal a growing demand for more immersive, story-driven experiences, cross-platform play, and a preference for free-to-play models with optional in-app purchases. Mergers and acquisitions (M&A) activities are a significant aspect of market concentration, with major publishers acquiring smaller studios to expand their intellectual property portfolios and reach new demographics. For instance, several high-value M&A deals in the past year indicate a consolidation trend. The market share of the top 5 companies is estimated at over 60%, with M&A deal counts reaching hundreds annually, signifying a competitive yet consolidating landscape.

Online Action Games Market Industry Trends & Analysis

The online action games market is experiencing a period of unprecedented growth, projected to witness a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033, reaching an estimated market value of over $300 Billion by the end of the forecast period. This robust expansion is fueled by several interconnected trends. Technological disruptions, including the widespread adoption of cloud gaming, the maturation of 5G networks enabling seamless mobile play, and advancements in AI for more sophisticated gameplay and NPC behavior, are continuously redefining player experiences. Consumer preferences are shifting towards hyper-realistic graphics, expansive open-world environments, and increasingly sophisticated narrative structures that rival those found in cinematic productions. The demand for social interaction within games, fostering strong online communities and competitive esports scenes, is also a major growth driver. Free-to-play models, supported by in-game purchases and battle passes, have achieved remarkable market penetration, making high-quality action games accessible to a wider audience, estimated at over 2 Billion active players globally. However, this accessibility also intensifies competition, pushing developers to focus on player retention and engagement through continuous content updates and live events. The rise of cross-platform compatibility is also breaking down traditional barriers, allowing players on PCs, consoles, and mobile devices to compete and collaborate, further expanding the addressable market. The integration of blockchain technology and NFTs, though still in its nascent stages, presents a potential future trend for digital ownership and unique player economies. The overall trend is towards more interconnected, accessible, and immersive gaming ecosystems, driven by both technological innovation and evolving player expectations.

Leading Markets & Segments in Online Action Games Market

The Free Gaming Services revenue model segment is projected to dominate the online action games market, driven by its widespread appeal and accessibility, projected to account for over 65% of the total market revenue by 2025. This segment's dominance is propelled by the "freemium" model, which attracts a massive player base, with subsequent monetization through in-game purchases, subscriptions, and cosmetic items. The Mobile Phones platform is emerging as the leading segment, with an estimated 45% market share, owing to the ubiquity of smartphones and the increasing sophistication of mobile gaming experiences. The iOS operating system is expected to hold a significant portion of the mobile gaming market, followed closely by Android, collectively representing over 90% of all mobile operating system usage in gaming. Key drivers for the mobile segment include the convenience of on-the-go gaming, a vast array of accessible titles, and the continued innovation in mobile hardware. The economic policies in emerging markets, which often favor mobile-first solutions due to lower PC and console penetration, further bolster this segment. Infrastructure development, particularly the expansion of high-speed mobile internet connectivity, plays a crucial role in enabling smooth gameplay for online action titles.

On the other hand, Consoles and PCs continue to be strong contenders, particularly for high-fidelity, AAA titles. Console gaming, with its dedicated gaming ecosystems and powerful hardware, is expected to maintain a substantial market share, driven by exclusive titles and a focus on immersive experiences. PC gaming, with its inherent flexibility and the prevalence of competitive esports titles, also represents a significant and enduring market. The dominance of Windows as an operating system for PC gaming remains undisputed, providing a stable and widely compatible platform for a vast library of action games. While Other Operating Systems like Linux and macOS are present, their market share in the action games segment is considerably smaller. The Paid Gaming Services segment, while smaller in terms of player numbers compared to free-to-play, generates substantial revenue through premium game purchases, expansions, and subscription services, catering to players seeking complete, uninterrupted gaming experiences. The interplay between these segments, driven by diverse player preferences and technological advancements, creates a dynamic and multi-faceted market.

Online Action Games Market Product Developments

Product developments in the online action games market are intensely focused on enhancing player immersion and engagement through technological innovation. Advancements in graphical fidelity, utilizing ray tracing and advanced rendering techniques, create breathtakingly realistic game worlds. The integration of AI is leading to more dynamic and responsive non-player characters (NPCs) and smarter enemy AI, providing a more challenging and unpredictable gameplay experience. Cloud gaming services are making high-end gaming accessible on a wider range of devices, lowering the barrier to entry. Furthermore, developers are increasingly experimenting with novel gameplay mechanics and narrative structures to differentiate their offerings. Competitive advantages are being forged through robust live-service models, offering continuous content updates, seasonal events, and battle passes that incentivize long-term player engagement and generate recurring revenue. Cross-platform play is also a key development, breaking down traditional player silos and fostering larger, more vibrant gaming communities.

Key Drivers of Online Action Games Market Growth

The online action games market is propelled by a confluence of powerful growth drivers. Technological advancements are paramount, with innovations in graphics processing, AI, and cloud streaming enabling more immersive and accessible gaming experiences. The widespread adoption of high-speed internet connectivity, particularly 5G, is crucial for seamless online gameplay and the growth of mobile action games. Economic factors, such as increasing disposable incomes in emerging markets and the growth of the middle class, are expanding the global consumer base for digital entertainment. Regulatory support for the digital economy and the entertainment sector, coupled with favorable intellectual property laws, fosters investment and development. The inherent social nature of online gaming, fostering communities and competitive esports, acts as a significant organic growth accelerator. Furthermore, the increasing acceptance of gaming as a legitimate form of entertainment and a viable career path for esports athletes and streamers broadens its appeal.

Challenges in the Online Action Games Market Market

Despite its robust growth, the online action games market faces several significant challenges. Intense competition leads to market saturation, making it difficult for new titles to gain traction and requiring substantial marketing investment. Rising development costs for AAA titles, coupled with the need for continuous post-launch support, place considerable financial pressure on publishers. Regulatory hurdles, including evolving data privacy laws and concerns over loot box monetization, can impact game design and revenue streams. Cybersecurity threats and the prevalence of cheating can undermine player trust and retention. Supply chain issues, particularly for physical console hardware, can affect accessibility. Quantifiable impacts include increased marketing budgets reaching over $500 Million for major releases and potential revenue loss of up to 15% due to cheating and server instability in the competitive landscape.

Emerging Opportunities in Online Action Games Market

Emerging opportunities in the online action games market are poised to catalyze long-term growth. The continued expansion of cloud gaming infrastructure promises to democratize access to high-fidelity gaming experiences, reaching new demographics and devices. Virtual reality (VR) and augmented reality (AR) technologies, while still developing, offer the potential for entirely new levels of immersion and interaction in action games. Strategic partnerships between game developers, hardware manufacturers, and streaming platforms are creating synergistic ecosystems that enhance player engagement. The increasing popularity of esports presents significant opportunities for revenue generation through tournaments, sponsorships, and media rights. Furthermore, the exploration of blockchain technology for in-game assets and player-owned economies could unlock novel monetization models and foster player investment in virtual worlds. Market expansion into untapped geographical regions with growing internet penetration also presents a substantial opportunity.

Leading Players in the Online Action Games Market Sector

- PlatinumGames

- Gameloft

- Guerrilla Games

- FromSoftware

- Konami

- SIE Santa Monica Studio

- Nintendo EPD

- Rocksteady Studios

- Tencent

- Rockstar North

- Sony Interactive Entertainment

- EA DICE

- Bethesda Game Studios

- Capcom

- Ubisoft

- id Software

Key Milestones in Online Action Games Market Industry

- July 2022: Ubisoft unveiled Tom Clancy's The Division® Resurgence, a new free-to-play third-person shooter RPG mobile game. The Division Resurgence features a fresh plot, a new storyline, and challenging enemy groups, accessible on iOS and Android devices. This launch signifies a continued investment in the lucrative mobile action game market and the expansion of established franchises into new platforms.

- 2021: The widespread adoption of cloud gaming services accelerated, with major players like Xbox Cloud Gaming and NVIDIA GeForce NOW expanding their libraries and improving performance, making AAA action titles accessible on a broader range of devices.

- 2020: The launch of next-generation consoles (PlayStation 5 and Xbox Series X/S) ushered in an era of significantly enhanced graphics and faster loading times, driving demand for visually impressive and performance-intensive online action games.

- 2019: The continued growth of battle royale titles, such as Fortnite and Apex Legends, solidified their dominance and pushed the boundaries of free-to-play monetization models and live-service content delivery.

Strategic Outlook for Online Action Games Market Market

The strategic outlook for the online action games market is exceptionally positive, driven by continuous technological innovation and expanding player demographics. The future will likely see a greater emphasis on cross-platform play, enabling seamless experiences across PCs, consoles, and mobile devices, fostering larger and more interconnected communities. The rise of cloud gaming will continue to lower entry barriers, making high-fidelity action games accessible to an even broader audience. Developers will focus on creating persistent, evolving game worlds through robust live-service models, ensuring long-term player engagement and recurring revenue streams. Strategic opportunities lie in leveraging emerging technologies like AI and VR to deliver unparalleled immersive experiences and in tapping into underserved markets through localized content and accessible pricing strategies. The continued growth of esports will also provide significant avenues for monetization and brand building.

Online Action Games Market Segmentation

-

1. Revenue Model

- 1.1. Free Gaming Services

- 1.2. Paid Gaming Services

-

2. Platform

- 2.1. PCs

- 2.2. Consoles

- 2.3. Mobile Phones

-

3. Operating System

- 3.1. iOS

- 3.2. Android

- 3.3. Windows

- 3.4. Other Operating Systems

Online Action Games Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of the Middle East

Online Action Games Market Regional Market Share

Geographic Coverage of Online Action Games Market

Online Action Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets

- 3.3. Market Restrains

- 3.3.1. Need for Expensive Graphic Cards

- 3.4. Market Trends

- 3.4.1. Surge in the usage of MMORPG Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 5.1.1. Free Gaming Services

- 5.1.2. Paid Gaming Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. PCs

- 5.2.2. Consoles

- 5.2.3. Mobile Phones

- 5.3. Market Analysis, Insights and Forecast - by Operating System

- 5.3.1. iOS

- 5.3.2. Android

- 5.3.3. Windows

- 5.3.4. Other Operating Systems

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6. North America Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6.1.1. Free Gaming Services

- 6.1.2. Paid Gaming Services

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. PCs

- 6.2.2. Consoles

- 6.2.3. Mobile Phones

- 6.3. Market Analysis, Insights and Forecast - by Operating System

- 6.3.1. iOS

- 6.3.2. Android

- 6.3.3. Windows

- 6.3.4. Other Operating Systems

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7. Europe Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7.1.1. Free Gaming Services

- 7.1.2. Paid Gaming Services

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. PCs

- 7.2.2. Consoles

- 7.2.3. Mobile Phones

- 7.3. Market Analysis, Insights and Forecast - by Operating System

- 7.3.1. iOS

- 7.3.2. Android

- 7.3.3. Windows

- 7.3.4. Other Operating Systems

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8. Asia Pacific Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8.1.1. Free Gaming Services

- 8.1.2. Paid Gaming Services

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. PCs

- 8.2.2. Consoles

- 8.2.3. Mobile Phones

- 8.3. Market Analysis, Insights and Forecast - by Operating System

- 8.3.1. iOS

- 8.3.2. Android

- 8.3.3. Windows

- 8.3.4. Other Operating Systems

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9. South America Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9.1.1. Free Gaming Services

- 9.1.2. Paid Gaming Services

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. PCs

- 9.2.2. Consoles

- 9.2.3. Mobile Phones

- 9.3. Market Analysis, Insights and Forecast - by Operating System

- 9.3.1. iOS

- 9.3.2. Android

- 9.3.3. Windows

- 9.3.4. Other Operating Systems

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10. Middle East Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10.1.1. Free Gaming Services

- 10.1.2. Paid Gaming Services

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. PCs

- 10.2.2. Consoles

- 10.2.3. Mobile Phones

- 10.3. Market Analysis, Insights and Forecast - by Operating System

- 10.3.1. iOS

- 10.3.2. Android

- 10.3.3. Windows

- 10.3.4. Other Operating Systems

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PlatinumGames

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gameloft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guerrilla Games

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FromSoftware

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Konami

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SIE Santa Monica Studio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nintendo EPD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rocksteady Studios

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tencent

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockstar North

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sony Interactive Entertainment

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 EA DICE*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bethesda Game Studios

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Capcom

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ubisoft

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 id Software

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PlatinumGames

List of Figures

- Figure 1: Global Online Action Games Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 3: North America Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 4: North America Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 5: North America Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 7: North America Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 8: North America Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 11: Europe Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 12: Europe Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 13: Europe Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 14: Europe Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 15: Europe Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 16: Europe Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 19: Asia Pacific Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 20: Asia Pacific Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: Asia Pacific Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Asia Pacific Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 23: Asia Pacific Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 24: Asia Pacific Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 27: South America Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 28: South America Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 29: South America Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: South America Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 31: South America Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 32: South America Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 35: Middle East Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 36: Middle East Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 37: Middle East Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 38: Middle East Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 39: Middle East Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 40: Middle East Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Online Action Games Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 2: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 4: Global Online Action Games Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 6: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 8: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 14: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 15: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 16: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: France Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 24: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 25: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 26: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: India Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: China Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 32: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 33: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 34: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Brazil Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Argentina Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 38: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 39: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 40: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of the Middle East Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Action Games Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Online Action Games Market?

Key companies in the market include PlatinumGames, Gameloft, Guerrilla Games, FromSoftware, Konami, SIE Santa Monica Studio, Nintendo EPD, Rocksteady Studios, Tencent, Rockstar North, Sony Interactive Entertainment, EA DICE*List Not Exhaustive, Bethesda Game Studios, Capcom, Ubisoft, id Software.

3. What are the main segments of the Online Action Games Market?

The market segments include Revenue Model, Platform, Operating System.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.39 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets.

6. What are the notable trends driving market growth?

Surge in the usage of MMORPG Games.

7. Are there any restraints impacting market growth?

Need for Expensive Graphic Cards.

8. Can you provide examples of recent developments in the market?

In July 2022 - Tom Clancy's The Division® Resurgence, a new free-to-play third-person shooter RPG mobile game from Tom Clancy's The Division franchise, was unveiled by Ubisoft. The Division Resurgence by Tom Clancy is a masterpiece with a fresh plot, a new storyline, and difficult opponent groups. The game is accessible for iOS and Android devices in the App Store® and Google PlayTM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Action Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Action Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Action Games Market?

To stay informed about further developments, trends, and reports in the Online Action Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence