Key Insights

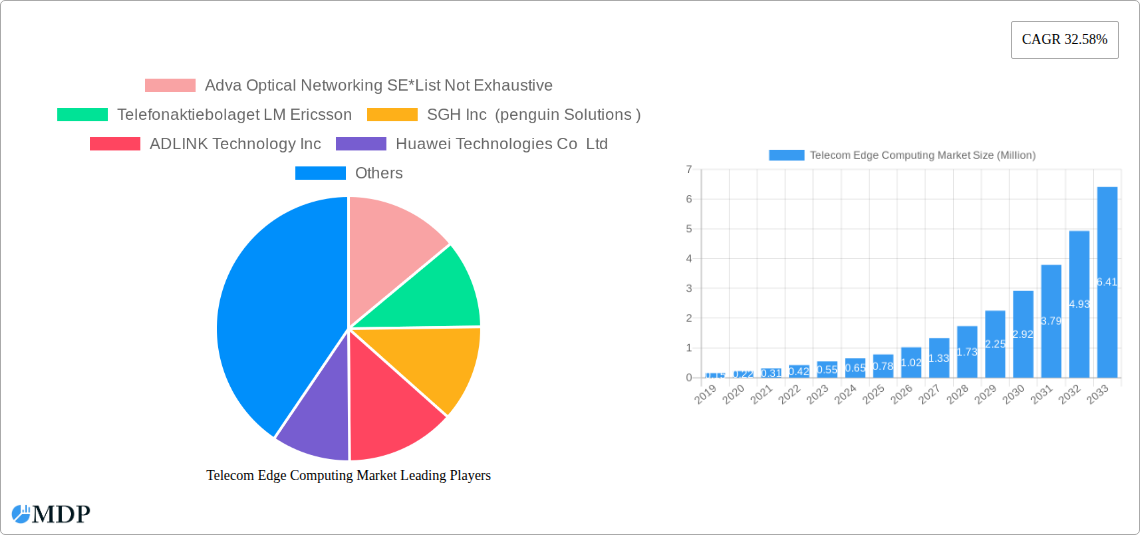

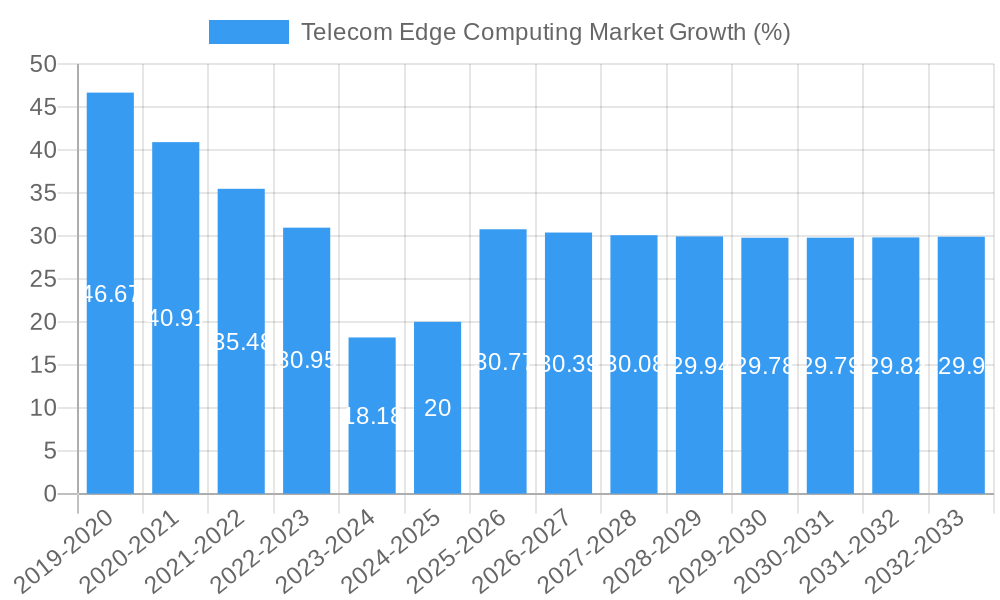

The Telecom Edge Computing Market is poised for explosive growth, projected to reach a substantial USD 0.6 million in its base year of 2025 and surge at an impressive Compound Annual Growth Rate (CAGR) of 32.58% throughout the forecast period of 2025-2033. This rapid expansion is primarily driven by the burgeoning demand for real-time data processing and ultra-low latency applications that are essential for next-generation telecommunications. Key catalysts include the widespread deployment of 5G networks, the increasing adoption of IoT devices across various industries, and the growing need for localized data analytics to improve efficiency and user experience. The market's trajectory is further bolstered by advancements in hardware and software solutions specifically tailored for edge environments, enabling telcos to deliver more responsive and scalable services.

The competitive landscape is characterized by the presence of major telecommunications players and technology providers, including Telefonaktiebolaget LM Ericsson, Nokia Corporation, Huawei Technologies Co Ltd, and AT&T Inc. These companies are actively investing in research and development to innovate and capture market share in this rapidly evolving sector. The market is segmented by end-users, with the Financial and Banking Industry, Retail, and Healthcare and Life Sciences sectors expected to be significant adopters, leveraging edge computing for enhanced security, personalized services, and critical operational improvements. While robust growth is anticipated, potential restraints such as high initial investment costs for infrastructure deployment and evolving regulatory frameworks for data privacy and security could influence the pace of adoption in certain regions. However, the overwhelming benefits of reduced latency, increased bandwidth efficiency, and enhanced data security are expected to propel the market forward.

Unlock the immense potential of the Telecom Edge Computing Market with this in-depth, SEO-optimized report. Delve into the critical trends, technological advancements, and strategic initiatives shaping the future of connectivity. This report provides actionable insights for stakeholders, including network operators, technology providers, and enterprises across diverse industries, seeking to leverage the power of edge computing. Understand market dynamics, identify growth opportunities, and gain a competitive edge in this rapidly evolving landscape. With a forecast period extending to 2033, this research offers a forward-looking perspective on market penetration, technological disruptions, and strategic partnerships. Explore the impact of key players and industry developments on the global 5G edge computing market, telco edge solutions, and distributed cloud infrastructure.

Telecom Edge Computing Market Market Dynamics & Concentration

The Telecom Edge Computing Market is characterized by a dynamic interplay of innovation, strategic alliances, and evolving end-user demands. Market concentration is moderately fragmented, with a few dominant players alongside a growing number of specialized solution providers. Innovation drivers are primarily centered around the increasing demand for ultra-low latency applications, real-time data processing, enhanced security, and the massive deployment of IoT devices. Regulatory frameworks are gradually adapting to facilitate edge deployments, with a focus on data privacy, network neutrality, and spectrum allocation for enhanced connectivity. Product substitutes, while emerging, are largely complementary rather than direct replacements, such as localized data centers or private cloud solutions.

End-user trends reveal a significant surge in adoption across industries like Telecommunications, Industrial, Healthcare and Life Sciences, and Financial and Banking Industry, driven by the need for immediate data analysis and localized control. Mergers and acquisitions (M&A) activities are a key indicator of market consolidation and strategic positioning. For instance, the historical period (2019-2024) has witnessed numerous strategic partnerships and smaller acquisitions focused on enhancing edge infrastructure capabilities and expanding service offerings. While specific M&A deal counts are proprietary, the trend indicates a strong investor interest in the edge computing ecosystem. Market share distribution is influenced by the ability of companies to offer integrated hardware and software solutions, coupled with robust network infrastructure.

Telecom Edge Computing Market Industry Trends & Analysis

The Telecom Edge Computing Market is experiencing robust growth, propelled by a confluence of technological advancements and escalating industry demands. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is approximately xx%, indicating substantial market expansion. This growth is significantly fueled by the widespread adoption of 5G networks, which provide the high bandwidth and low latency essential for effective edge deployments. The proliferation of IoT devices, generating vast amounts of data at the source, necessitates localized processing capabilities, driving the demand for edge solutions. Furthermore, the increasing need for real-time analytics, artificial intelligence (AI) at the edge, and enhanced cybersecurity measures are key market penetration drivers. Consumer preferences are shifting towards immersive experiences, autonomous systems, and personalized services, all of which are underpinned by efficient edge computing.

Technological disruptions are playing a pivotal role, with advancements in edge hardware, software-defined networking (SDN), network function virtualization (NFV), and containerization technologies enabling more flexible and scalable edge deployments. The integration of AI and machine learning (ML) at the edge is enabling predictive maintenance, intelligent automation, and advanced analytics directly where data is generated, reducing reliance on centralized cloud infrastructure. Competitive dynamics are intensifying, with established telecommunication providers, cloud giants, and hardware manufacturers vying for market leadership. Strategic alliances and partnerships are becoming crucial for players to offer comprehensive end-to-end solutions. The market penetration of edge computing solutions is expected to rise significantly as businesses recognize its potential to reduce operational costs, improve efficiency, and unlock new revenue streams. The edge cloud market and telco edge solutions are at the forefront of this transformation, offering compelling value propositions for a wide range of applications.

Leading Markets & Segments in Telecom Edge Computing Market

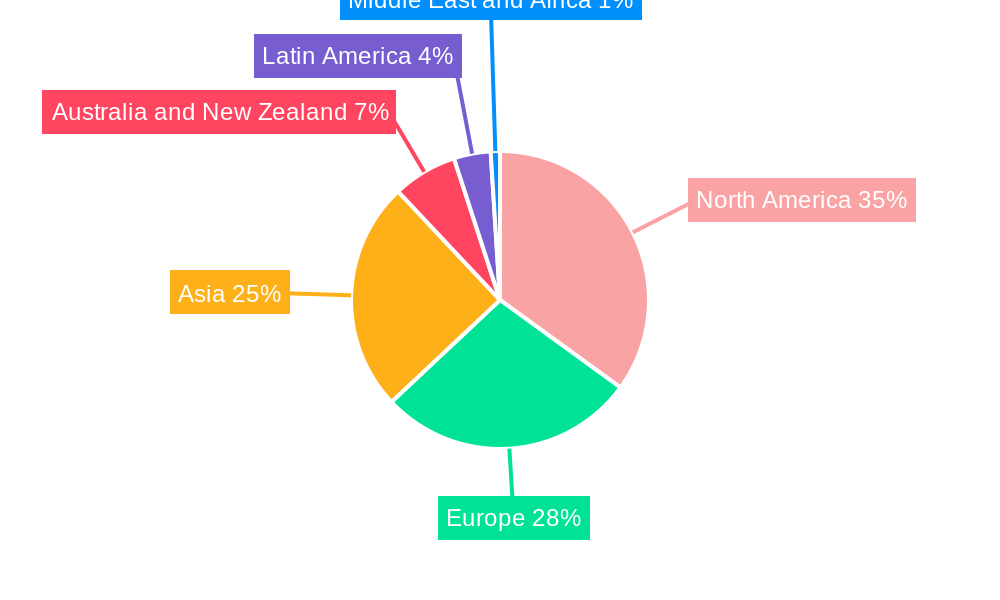

The Telecom Edge Computing Market exhibits strong dominance in specific regions and segments, driven by diverse economic policies, robust infrastructure development, and specialized industry needs.

Dominant Region: North America and Europe currently lead the market due to their advanced telecommunications infrastructure, high adoption rates of new technologies, and significant investments in digital transformation across various sectors. Asia-Pacific is rapidly emerging as a key growth region, fueled by increasing 5G deployments and a burgeoning manufacturing sector embracing Industry 4.0 principles.

Dominant Segment - Component:

- Hardware: The hardware segment, encompassing edge servers, gateways, and network interface devices, is currently the largest contributor. Key drivers include the increasing density of IoT deployments and the need for powerful, yet compact, computing resources at the network edge. The demand for specialized hardware designed for harsh environments and industrial applications is also a significant factor.

- Software: The software segment, including operating systems, middleware, orchestration platforms, and AI/ML frameworks for the edge, is experiencing rapid growth. This is driven by the need for intelligent management of distributed resources, secure data processing, and seamless integration of edge applications. The development of containerized edge applications and edge AI platforms is accelerating adoption.

Dominant Segment - End-user:

- Telecommunications: This is the foundational segment, as telcos are deploying edge infrastructure to enhance their own network capabilities, offer new services like edge-based content delivery networks (CDNs), and support private 5G networks for enterprises.

- Industrial: The Industrial sector, including manufacturing, oil & gas, and utilities, is a major adopter. Edge computing enables real-time monitoring, predictive maintenance, automated quality control, and optimized operational efficiency. Initiatives like Industry 4.0 are heavily reliant on edge capabilities for intelligent automation.

- Financial and Banking Industry: This segment leverages edge computing for enhanced transaction processing, fraud detection, personalized customer experiences, and secure data analytics closer to the point of customer interaction.

- Healthcare and Life Sciences: Edge computing is crucial for real-time patient monitoring, remote diagnostics, AI-powered medical imaging analysis, and secure handling of sensitive patient data.

- Retail: The retail sector utilizes edge computing for inventory management, personalized in-store experiences, smart checkout systems, and optimizing supply chain logistics.

- Energy and Utilities: This sector benefits from edge computing for grid management, smart metering, renewable energy integration, and remote asset monitoring.

The dominance of these segments is further supported by government initiatives promoting digital infrastructure, economic policies encouraging innovation, and the inherent need for localized data processing to minimize latency and maximize efficiency across these critical industries.

Telecom Edge Computing Market Product Developments

Product developments in the Telecom Edge Computing Market are centered on enhancing performance, scalability, and manageability of distributed computing resources. Innovations include the development of compact, ruggedized edge servers designed for deployment in diverse environments, from factory floors to remote cell sites. Software advancements focus on orchestration platforms that enable seamless deployment, monitoring, and management of applications across a vast network of edge nodes. Furthermore, the integration of AI and machine learning capabilities directly into edge devices is a significant trend, allowing for real-time data analysis and intelligent decision-making at the source. Competitive advantages are being built on offering integrated hardware and software solutions that simplify deployment and reduce operational complexity for enterprises and telcos alike, catering to the growing demand for edge AI solutions and telco edge solutions.

Key Drivers of Telecom Edge Computing Market Growth

The growth of the Telecom Edge Computing Market is propelled by several interconnected factors. The ubiquitous expansion of 5G networks provides the necessary high-speed, low-latency connectivity, which is fundamental for edge deployments. The exponential growth of the Internet of Things (IoT) ecosystem, generating massive volumes of data at the edge, necessitates localized processing to avoid bandwidth constraints and ensure real-time insights. Furthermore, the increasing demand for latency-sensitive applications, such as augmented reality (AR), virtual reality (VR), autonomous vehicles, and industrial automation, directly benefits from the reduced latency offered by edge computing. Government initiatives promoting digital transformation and the development of smart cities are also significant catalysts.

Challenges in the Telecom Edge Computing Market Market

Despite its immense potential, the Telecom Edge Computing Market faces several significant challenges. The complexity of managing a distributed network of edge nodes, often thousands or millions, presents considerable operational hurdles, requiring robust orchestration and automation tools. Security remains a paramount concern, as edge devices are more exposed to physical and cyber threats due to their distributed nature. Ensuring consistent data privacy and compliance across various jurisdictions can be challenging. Furthermore, the initial investment cost for deploying edge infrastructure can be substantial, acting as a barrier for some smaller enterprises. The availability of skilled personnel to design, deploy, and manage edge computing solutions is also a growing concern.

Emerging Opportunities in Telecom Edge Computing Market

Emerging opportunities in the Telecom Edge Computing Market are ripe for innovation and strategic expansion. The growing demand for edge AI solutions presents a significant avenue, enabling real-time intelligence for applications ranging from predictive maintenance in industrial settings to personalized customer experiences in retail. Strategic partnerships between telecommunication companies, cloud providers, and application developers are crucial for creating end-to-end edge solutions that address specific industry needs. The expansion of private 5G networks for enterprises, facilitated by edge computing, opens up new revenue streams for telcos. Furthermore, the development of specialized edge solutions for emerging sectors like immersive gaming, advanced robotics, and decentralized finance will drive long-term market growth.

Leading Players in the Telecom Edge Computing Market Sector

- Adva Optical Networking SE

- Telefonaktiebolaget LM Ericsson

- SGH Inc (penguin Solutions )

- ADLINK Technology Inc

- Huawei Technologies Co Ltd

- Nokia Corporation

- Verizon Communication Ltd

- AT&T Inc

- Comsovereign Holding Corp

- Vodafone Group PLC

Key Milestones in Telecom Edge Computing Market Industry

- April 2024 - Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024 - Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Outlook for Telecom Edge Computing Market Market

- April 2024 - Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024 - Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Outlook for Telecom Edge Computing Market Market

The strategic outlook for the Telecom Edge Computing Market is exceptionally promising, driven by sustained technological advancements and expanding market applications. The increasing convergence of 5G, AI, and IoT will continue to be the primary growth accelerators, enabling more sophisticated and real-time processing capabilities at the edge. Future market potential lies in the development of industry-specific edge solutions, such as intelligent transportation systems, smart agriculture, and advanced telemedicine. Strategic opportunities will arise from fostering deeper collaborations between telcos, cloud providers, and software developers to create integrated, end-to-end offerings. The ongoing investment in research and development for next-generation edge hardware and software will further enhance performance and reduce costs, making edge computing more accessible and indispensable across a wider array of industries.

Telecom Edge Computing Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. End-user

- 2.1. Financial and Banking Industry

- 2.2. Retail

- 2.3. Healthcare and Life Sciences

- 2.4. Industrial

- 2.5. Energy and Utilities

- 2.6. Telecommunications

- 2.7. Other End-users

Telecom Edge Computing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Telecom Edge Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Lack of a Common Security Framework

- 3.4. Market Trends

- 3.4.1. Rising Application of 5G and Industrial IoT Services Among End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Financial and Banking Industry

- 5.2.2. Retail

- 5.2.3. Healthcare and Life Sciences

- 5.2.4. Industrial

- 5.2.5. Energy and Utilities

- 5.2.6. Telecommunications

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Financial and Banking Industry

- 6.2.2. Retail

- 6.2.3. Healthcare and Life Sciences

- 6.2.4. Industrial

- 6.2.5. Energy and Utilities

- 6.2.6. Telecommunications

- 6.2.7. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Financial and Banking Industry

- 7.2.2. Retail

- 7.2.3. Healthcare and Life Sciences

- 7.2.4. Industrial

- 7.2.5. Energy and Utilities

- 7.2.6. Telecommunications

- 7.2.7. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Financial and Banking Industry

- 8.2.2. Retail

- 8.2.3. Healthcare and Life Sciences

- 8.2.4. Industrial

- 8.2.5. Energy and Utilities

- 8.2.6. Telecommunications

- 8.2.7. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Financial and Banking Industry

- 9.2.2. Retail

- 9.2.3. Healthcare and Life Sciences

- 9.2.4. Industrial

- 9.2.5. Energy and Utilities

- 9.2.6. Telecommunications

- 9.2.7. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Financial and Banking Industry

- 10.2.2. Retail

- 10.2.3. Healthcare and Life Sciences

- 10.2.4. Industrial

- 10.2.5. Energy and Utilities

- 10.2.6. Telecommunications

- 10.2.7. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Financial and Banking Industry

- 11.2.2. Retail

- 11.2.3. Healthcare and Life Sciences

- 11.2.4. Industrial

- 11.2.5. Energy and Utilities

- 11.2.6. Telecommunications

- 11.2.7. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Telefonaktiebolaget LM Ericsson

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 SGH Inc (penguin Solutions )

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 ADLINK Technology Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Huawei Technologies Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Nokia Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Verizon Communication Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 AT&T Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Comsovereign Holding Corp

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Vodafone Group PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

List of Figures

- Figure 1: Global Telecom Edge Computing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 17: North America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 18: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 23: Europe Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 24: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 29: Asia Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 30: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 35: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 36: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 41: Latin America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 42: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 47: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 48: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 19: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 25: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 28: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 31: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 34: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Edge Computing Market?

The projected CAGR is approximately 32.58%.

2. Which companies are prominent players in the Telecom Edge Computing Market?

Key companies in the market include Adva Optical Networking SE*List Not Exhaustive, Telefonaktiebolaget LM Ericsson, SGH Inc (penguin Solutions ), ADLINK Technology Inc, Huawei Technologies Co Ltd, Nokia Corporation, Verizon Communication Ltd, AT&T Inc, Comsovereign Holding Corp, Vodafone Group PLC.

3. What are the main segments of the Telecom Edge Computing Market?

The market segments include Component, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.6 Million as of 2022.

5. What are some drivers contributing to market growth?

Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries.

6. What are the notable trends driving market growth?

Rising Application of 5G and Industrial IoT Services Among End-user Industries.

7. Are there any restraints impacting market growth?

Lack of a Common Security Framework.

8. Can you provide examples of recent developments in the market?

April 2024 - Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Edge Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Edge Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Edge Computing Market?

To stay informed about further developments, trends, and reports in the Telecom Edge Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence