Key Insights

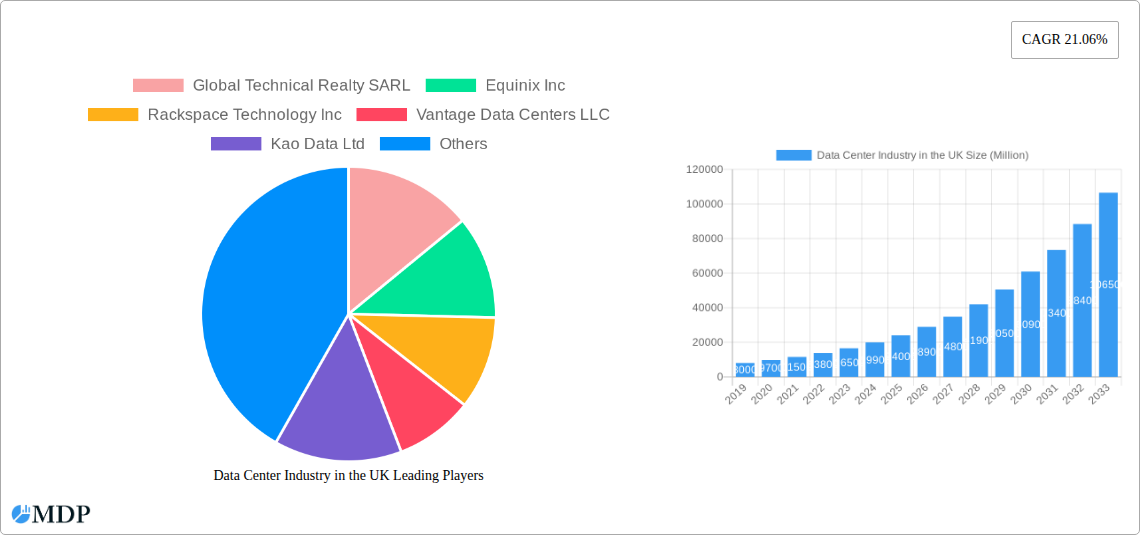

The United Kingdom's data center industry is projected for substantial growth, with an estimated market size of $15.23 billion by 2025, and a Compound Annual Growth Rate (CAGR) of 23.7% through 2033. This expansion is driven by the proliferation of cloud computing, the booming e-commerce sector, and widespread digital transformation across government and enterprise. Hyperscale data center demand is particularly high, supported by major cloud providers and the need for advanced computing power for AI and big data analytics. Significant investments are being made in London and across the UK, focusing on large-scale facilities with Tier 3 and Tier 4 certifications for reliability. The colocation trend is strengthening, with wholesale and hyperscale models attracting major investments as businesses seek scalable and cost-effective data infrastructure solutions.

Data Center Industry in the UK Market Size (In Billion)

The UK data center market growth is further propelled by sustainable practices and edge data center deployments for reduced latency. However, the industry faces challenges including rising operational costs, energy consumption, and securing adequate power supply, alongside cybersecurity threats. Despite these obstacles, data center space demand is expected to exceed supply in key regions. The BFSI, Telecom, and Media & Entertainment sectors are primary end-users driving demand for secure, high-performance data solutions. Key players like Equinix, Digital Realty Trust, and NTT Ltd. are expanding their UK operations, highlighting the market's strategic importance. Continuous technological evolution and increasing reliance on digital services ensure a robust future for the UK data center industry.

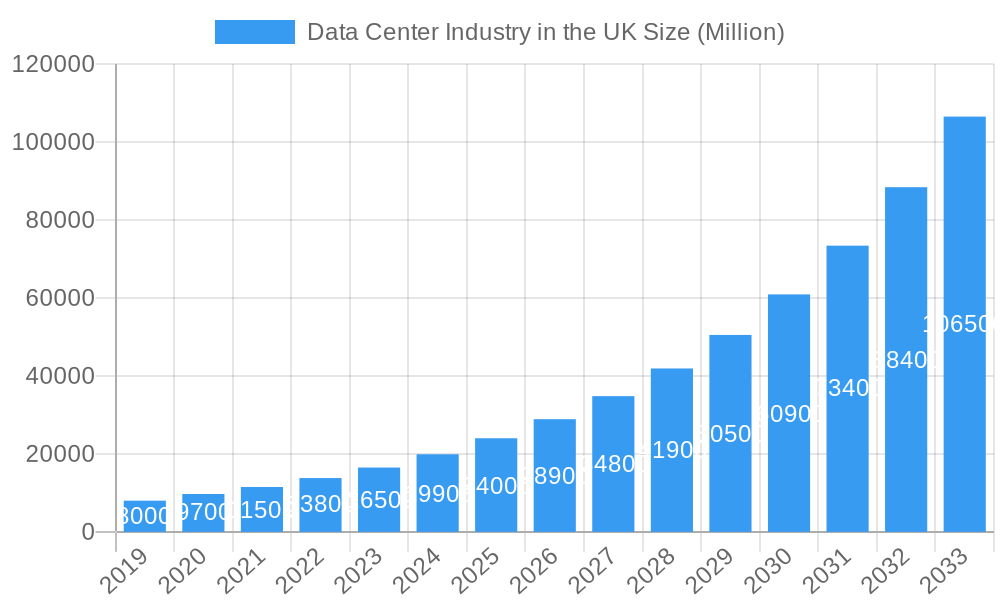

Data Center Industry in the UK Company Market Share

This comprehensive report offers deep insights into the dynamic UK Data Center market, covering 2019-2024 and projecting growth through 2033. It provides critical intelligence on market dynamics, key trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities for industry stakeholders, investors, and decision-makers. Featuring an in-depth analysis of key players and significant industry milestones, this report equips you with actionable intelligence to navigate and capitalize on the expanding UK digital infrastructure landscape. Explore the future of UK data centers.

Data Center Industry in the UK Market Dynamics & Concentration

The UK data center market is characterized by a significant concentration of key players, driving intense competition and innovation. Global Technical Realty SARL, Equinix Inc., Rackspace Technology Inc., Vantage Data Centers LLC, Kao Data Ltd, Colt Technology Services, Digital Realty Trust Inc., CyrusOne Inc., Telehouse (KDDI Corporation), Virtus Data Centres Properties Ltd (STT GDC), and Global Switch Holdings Limited are among the prominent entities shaping the landscape. While precise market share figures are proprietary, the top 5 players are estimated to control a substantial portion of the market capacity. M&A activities have been a constant feature, with several significant deals aimed at consolidating market presence and expanding service offerings. Innovation drivers include the relentless demand for cloud computing, AI, and the Internet of Things (IoT), pushing the boundaries of performance and efficiency. Regulatory frameworks, particularly those related to data privacy (e.g., GDPR) and energy efficiency, play a crucial role in shaping operational standards. Product substitutes, such as edge computing and on-premise solutions, are present but are increasingly integrated or outpaced by the scalability and flexibility offered by modern data centers. End-user trends show a growing demand from BFSI, Cloud, E-Commerce, and Telecom sectors, fueling the need for more sophisticated and high-capacity facilities.

Data Center Industry in the UK Industry Trends & Analysis

The UK data center industry is on an upward trajectory, driven by a confluence of technological advancements and escalating digital demands. The market is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period (2025-2033). This growth is primarily fueled by the accelerating adoption of cloud services across all sectors, the burgeoning demand for AI and machine learning applications, and the expansion of 5G networks, all of which necessitate significant data processing and storage capabilities. Technological disruptions, such as advancements in cooling technologies, liquid cooling solutions, and the integration of renewable energy sources, are not only enhancing operational efficiency but also addressing the growing concerns around sustainability. Consumer preferences are increasingly leaning towards hyperscale and wholesale colocation models, driven by businesses seeking cost-effective and scalable solutions to manage their ever-growing data footprints. Competitive dynamics are intense, with established players continuously investing in expanding their capacity and geographical reach, while new entrants are exploring niche markets and innovative service models. Market penetration for advanced data center services continues to grow as businesses recognize the strategic importance of robust digital infrastructure for their operations and competitive advantage. The increasing reliance on data for business intelligence, operational efficiency, and customer engagement further solidifies the growth outlook for the UK data center market.

Leading Markets & Segments in Data Center Industry in the UK

London Hotspot Dominance: London remains the undisputed epicenter of the UK data center market. Its strategic location, established connectivity, and high concentration of businesses in BFSI, Media & Entertainment, and Telecom sectors make it the most sought-after region. The city's robust financial services industry, coupled with a thriving tech startup ecosystem, fuels a perpetual demand for high-density, low-latency data center solutions.

Dominance by Data Center Size and Tier Type:

- Massive and Mega-sized Data Centers: The demand for Massive and Mega-sized data centers is significantly driven by hyperscale cloud providers and large enterprises requiring vast amounts of capacity. These facilities are crucial for supporting global cloud infrastructure and large-scale data analytics.

- Tier 3 and Tier 4 Facilities: Tier 3 and Tier 4 data centers are the preferred choice for most end-users, including BFSI, Government, and Cloud sectors, due to their high availability, fault tolerance, and uptime guarantees. The stringent requirements of these industries necessitate the reliability and redundancy offered by these advanced tier types.

Colocation and End-User Preferences:

- Hyperscale and Wholesale Colocation: The shift towards hyperscale and wholesale colocation models is a dominant trend. This is driven by the need for dedicated, customizable infrastructure for large-scale deployments by cloud service providers and major enterprises seeking economies of scale.

- BFSI and Cloud Sectors: The BFSI (Banking, Financial Services, and Insurance) and Cloud sectors are the leading end-users, demanding secure, compliant, and highly performant data center environments for their critical operations and services. E-Commerce and Telecom also represent significant and growing segments.

Absorption and Capacity Utilization: While significant new capacity is being deployed, the market also shows a healthy level of Non-Utilized capacity, indicating a proactive approach to meeting future demand and allowing for flexibility for new entrants and expansions.

Data Center Industry in the UK Product Developments

Product developments in the UK data center industry are increasingly focused on enhancing efficiency, sustainability, and performance. Innovations in liquid cooling technologies are gaining traction, enabling higher power densities for AI and high-performance computing workloads. Furthermore, advancements in renewable energy integration and energy-efficient hardware are critical for reducing the carbon footprint of data centers. The development of modular and prefabricated data center solutions offers faster deployment times and greater scalability. Competitive advantages are being gained through offerings that combine advanced cooling, robust security, and flexible connectivity options, catering to the evolving needs of hyperscale providers and enterprise clients seeking specialized solutions.

Key Drivers of Data Center Industry in the UK Growth

The growth of the UK data center industry is propelled by several interconnected factors. The relentless expansion of cloud computing and digital transformation initiatives across all business sectors creates an insatiable demand for data storage and processing power. The burgeoning adoption of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) necessitates significant infrastructure investments. Furthermore, the ongoing rollout of 5G networks is expected to drive an explosion in data generation, requiring more localized and robust data center facilities. Government initiatives promoting digital infrastructure development and increasing foreign investment in the tech sector also provide a supportive economic environment.

Challenges in the Data Center Industry in the UK Market

Despite strong growth, the UK data center market faces significant challenges. The increasing demand for power and the ongoing transition to renewable energy sources present a considerable hurdle, requiring substantial investment in grid infrastructure and sustainable energy solutions. Stringent environmental regulations and the need for carbon neutrality are also driving up operational costs. Furthermore, the availability of suitable land for new developments, particularly in prime locations, is becoming scarce and expensive. Supply chain disruptions, particularly for critical hardware components, can impact project timelines and costs. Intense competition also puts pressure on pricing and margins for service providers.

Emerging Opportunities in Data Center Industry in the UK

Emerging opportunities in the UK data center market are primarily driven by the increasing demand for edge computing solutions, driven by the proliferation of IoT devices and low-latency application requirements. The growing focus on sustainability also presents an opportunity for data center operators to differentiate themselves through the adoption of renewable energy sources and innovative green technologies. Strategic partnerships with hyperscale cloud providers and telecommunications companies for network expansion and content delivery are also crucial. Furthermore, the development of specialized data centers for specific industry needs, such as secure government facilities or high-performance computing centers for research institutions, offers significant growth potential.

Leading Players in the Data Center Industry in the UK Sector

- Global Technical Realty SARL

- Equinix Inc.

- Rackspace Technology Inc.

- Vantage Data Centers LLC

- Kao Data Ltd

- Colt Technology Services

- Digital Realty Trust Inc.

- CyrusOne Inc.

- Telehouse (KDDI Corporation)

- Virtus Data Centres Properties Ltd (STT GDC)

- Global Switch Holdings Limited

- NTT Ltd.

Key Milestones in Data Center Industry in the UK Industry

- October 2022: CyrusOne announced a proposed new data center in Iver Heath, Buckinghamshire, UK. This project will feature 10 data halls with approximately 90MW of capacity and include a new on-site substation, signifying a substantial expansion in the region.

- August 2022: Colt announced its intention to open a new data center in Hayes, West London. This facility, known as 'London 4', will be a purpose-built, 50MW campus on a 2.1-hectare site, more than tripling Colt's existing UK capital footprint.

- March 2022: Kao Data announced plans for a second building at its Harlow campus in the UK. Construction is underway for this second 10 MW facility located outside London, highlighting continued investment in capacity expansion.

Strategic Outlook for Data Center Industry in the UK Market

The strategic outlook for the UK data center market remains exceptionally strong, driven by continued digital transformation and the escalating demand for compute and storage. Future growth will be accelerated by the adoption of advanced cooling technologies to support higher power densities, enabling the deployment of next-generation AI and HPC workloads. The emphasis on sustainability will drive further investment in renewable energy sources and energy-efficient designs, creating a competitive advantage for environmentally conscious operators. Strategic partnerships between colocation providers, cloud giants, and telecom infrastructure companies will be crucial for optimizing connectivity and service delivery. The market's ability to adapt to evolving regulatory landscapes and address power constraints will be key to unlocking its full long-term potential and securing the UK's position as a leading European digital hub.

Data Center Industry in the UK Segmentation

-

1. Hotspot

- 1.1. London

- 1.2. Rest of United Kingdom

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Data Center Industry in the UK Segmentation By Geography

- 1. United Kingdom

Data Center Industry in the UK Regional Market Share

Geographic Coverage of Data Center Industry in the UK

Data Center Industry in the UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Data Center Industry in the UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. London

- 5.1.2. Rest of United Kingdom

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Global Technical Realty SARL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rackspace Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vantage Data Centers LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kao Data Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Colt Technology Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Digital Realty Trust Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CyrusOne Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telehouse (KDDI Corporation)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virtus Data Centres Properties Ltd (STT GDC)5 4 LIST OF COMPANIES STUDIE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Global Switch Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NTT Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Global Technical Realty SARL

List of Figures

- Figure 1: Data Center Industry in the UK Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Data Center Industry in the UK Share (%) by Company 2025

List of Tables

- Table 1: Data Center Industry in the UK Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 2: Data Center Industry in the UK Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 3: Data Center Industry in the UK Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 4: Data Center Industry in the UK Revenue billion Forecast, by Absorption 2020 & 2033

- Table 5: Data Center Industry in the UK Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 6: Data Center Industry in the UK Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Data Center Industry in the UK Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Data Center Industry in the UK Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 9: Data Center Industry in the UK Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 10: Data Center Industry in the UK Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 11: Data Center Industry in the UK Revenue billion Forecast, by Absorption 2020 & 2033

- Table 12: Data Center Industry in the UK Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 13: Data Center Industry in the UK Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Data Center Industry in the UK Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Industry in the UK?

The projected CAGR is approximately 23.7%.

2. Which companies are prominent players in the Data Center Industry in the UK?

Key companies in the market include Global Technical Realty SARL, Equinix Inc, Rackspace Technology Inc, Vantage Data Centers LLC, Kao Data Ltd, Colt Technology Services, Digital Realty Trust Inc, CyrusOne Inc, Telehouse (KDDI Corporation), Virtus Data Centres Properties Ltd (STT GDC)5 4 LIST OF COMPANIES STUDIE, Global Switch Holdings Limited, NTT Ltd.

3. What are the main segments of the Data Center Industry in the UK?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

October 2022: CyrusOne announced that they proposed a new data center in Iver Heath, Buckinghamshire, UK. The site will have 10 data halls supporting around 90MW of capacity and the project would include a new on-site substation.August 2022: Coltannounced to open a new data center in Hayes, West London, that would more than triple its existing footprint in the UK capital. It will deliver a new purpose-built of 50MW in 2.1-hectare data center campus known as 'London 4'.March 2022: Kao Data announced plans for a second building for its Harlow campus in the UK. The company says construction is now underway on its second 10 MW facility outside London.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Industry in the UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Industry in the UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Industry in the UK?

To stay informed about further developments, trends, and reports in the Data Center Industry in the UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence