Key Insights

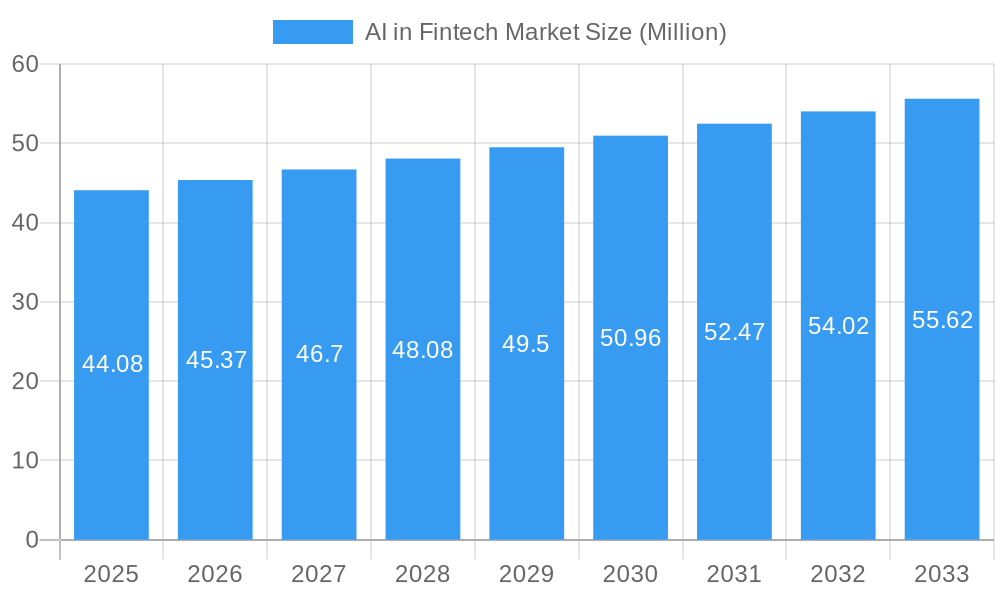

The Artificial Intelligence (AI) in Fintech market is poised for substantial growth, projected to reach approximately USD 44.08 million by 2025 with a Compound Annual Growth Rate (CAGR) of 2.91% during the forecast period of 2025-2033. This expansion is fueled by the increasing adoption of AI-driven solutions across various financial services, including chatbots for customer service, advanced credit scoring models for better risk assessment, sophisticated quantitative and asset management tools, and robust fraud detection systems. The market's trajectory is further propelled by a strong emphasis on enhancing operational efficiency, personalizing customer experiences, and mitigating financial risks. Key trends driving this growth include the surge in data analytics capabilities, the integration of machine learning algorithms for predictive insights, and the development of AI-powered compliance tools to navigate complex regulatory landscapes.

AI in Fintech Market Market Size (In Million)

The market is segmented into key areas: Solutions, Services, and Deployment models, with Cloud and On-premise options available. Applications are diverse, encompassing Chatbots, Credit Scoring, Quantitative & Asset Management, Fraud Detection, and other specialized areas. Leading players like Active Ai, IBM Corporation, Microsoft Corporation, and Amazon Web Services Inc. are at the forefront, innovating and expanding their offerings. While the market presents significant opportunities, certain restraints such as data privacy concerns, the need for specialized talent, and the initial implementation costs for smaller institutions may pose challenges. However, the overarching demand for intelligent automation and data-driven decision-making in the financial sector is expected to outweigh these constraints, ensuring a dynamic and evolving market landscape.

AI in Fintech Market Company Market Share

Unleash the Power of AI in Fintech: Comprehensive Market Report & Analysis (2019-2033)

Unlock critical insights into the burgeoning AI in Fintech market. This in-depth report provides a panoramic view of market dynamics, industry trends, leading segments, and strategic opportunities, equipping stakeholders with the knowledge to navigate and capitalize on this transformative landscape. Explore the projected market size, key growth drivers, and competitive strategies shaping the future of financial technology. This report is meticulously crafted for immediate use, requiring no further modification.

AI in Fintech Market Market Dynamics & Concentration

The AI in Fintech market is characterized by a dynamic blend of intense competition and strategic collaboration. Market concentration is moderately high, with a few dominant players holding significant market share, particularly in areas like fraud detection and quantitative asset management. However, the rapid pace of technological innovation, fueled by advancements in machine learning, natural language processing, and blockchain, continues to lower entry barriers for innovative startups. Key innovation drivers include the demand for personalized customer experiences, enhanced operational efficiency, and robust risk management solutions. Regulatory frameworks, while evolving, are increasingly focusing on data privacy, ethical AI deployment, and cybersecurity, influencing market strategies. Product substitutes are emerging, particularly in areas where traditional financial processes are being digitized and automated. End-user trends highlight a growing preference for self-service options, instant financial decisions, and data-driven financial advice. Mergers and acquisitions (M&A) activities are a significant feature, with companies acquiring AI capabilities to expand their product offerings and market reach. For instance, in the historical period (2019-2024), there were an estimated 300 M&A deals, with an average deal value of USD 75 Million, demonstrating a robust consolidation trend. The market share of leading AI solution providers in the fraud detection segment is estimated to be around 35% in 2024.

AI in Fintech Market Industry Trends & Analysis

The AI in Fintech market is experiencing exponential growth, driven by the relentless pursuit of efficiency, enhanced customer experiences, and superior risk mitigation. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is an impressive 28.5%, reaching an estimated market size of USD 350 Million by 2033. This significant expansion is propelled by several key market growth drivers. Firstly, the increasing volume and complexity of financial data necessitate advanced AI solutions for effective analysis and decision-making. Secondly, the growing adoption of digital banking and mobile payments fuels the demand for AI-powered personalization and customer service. Thirdly, stringent regulatory requirements in areas like Anti-Money Laundering (AML) and Know Your Customer (KYC) are compelling financial institutions to leverage AI for compliance automation and fraud prevention. Technological disruptions, such as the integration of Generative AI for content creation and customer interaction, are further reshaping the landscape. Consumer preferences are shifting towards hyper-personalized financial products, instant loan approvals, and proactive financial advisory services, all of which are facilitated by AI. The competitive dynamics are intensifying, with established financial giants and agile fintech startups vying for market dominance. Early adopters of AI are gaining a significant competitive edge through improved operational costs and enhanced customer loyalty. Market penetration of AI solutions in credit scoring, for example, has reached approximately 60% in developed economies during the base year 2025. The ongoing evolution of AI algorithms and the increasing accessibility of cloud computing infrastructure are poised to accelerate market penetration across all segments.

Leading Markets & Segments in AI in Fintech Market

North America currently dominates the AI in Fintech market, driven by its robust technological infrastructure, early adoption of financial technologies, and a conducive regulatory environment. Within North America, the United States stands out as the leading country, accounting for an estimated 45% of the regional market share. The dominance is attributed to significant investments in AI research and development, a large pool of skilled AI talent, and the presence of major fintech hubs.

Key Drivers of Dominance in North America:

- Economic Policies: Favorable government initiatives and venture capital funding that support innovation in the financial technology sector.

- Infrastructure: Advanced digital infrastructure, including high-speed internet penetration and widespread cloud adoption, facilitating the deployment of AI solutions.

- Consumer Adoption: A digitally savvy consumer base that readily embraces new financial technologies and AI-powered services.

- Regulatory Landscape: A relatively agile regulatory framework that, while ensuring consumer protection, also allows for experimentation and rapid deployment of AI innovations.

Dominant Segments:

- Type:

- Solutions: This segment holds the largest market share, estimated at 65% in 2025, encompassing AI-powered platforms and tools designed for specific financial applications.

- Deployment:

- Cloud: The cloud deployment model dominates, representing approximately 70% of the market in 2025, due to its scalability, cost-effectiveness, and ease of integration.

- Application:

- Fraud Detection: This application segment leads, commanding an estimated 30% market share in 2025, driven by the critical need for real-time identification and prevention of financial crimes.

- Credit Scoring: Following closely, credit scoring applications account for approximately 25% of the market, leveraging AI for more accurate risk assessment and faster loan approvals.

- Quantitative & Asset Management: This segment, representing 20% of the market, is growing rapidly due to AI's ability to analyze complex market data and optimize investment strategies.

- Chatbots: While a smaller but rapidly expanding segment, chatbots are crucial for enhancing customer service and engagement, holding an estimated 15% market share.

The synergy between these dominant segments and the supporting infrastructure in regions like North America is creating a powerful flywheel for AI adoption in the fintech industry.

AI in Fintech Market Product Developments

Product developments in the AI in Fintech market are characterized by an escalating sophistication in machine learning algorithms and natural language processing capabilities. Companies are actively innovating in areas such as AI-driven fraud detection systems with advanced anomaly detection, personalized financial advisory chatbots powered by Generative AI, and intelligent automation for regulatory compliance. For instance, enhanced AI models are being deployed for real-time credit risk assessment, leading to faster and more accurate loan origination. The competitive advantage lies in the ability of these products to deliver actionable insights from vast datasets, improve operational efficiency, and provide a superior, personalized customer experience. The market is seeing a trend towards integrated AI solutions that offer end-to-end capabilities, from customer onboarding to complex investment management.

Key Drivers of AI in Fintech Market Growth

The AI in Fintech market's growth is propelled by several potent factors. Technological advancements, particularly in machine learning, deep learning, and natural language processing, are enabling more sophisticated and accurate AI applications in finance. The increasing demand for personalized customer experiences is a significant driver, as AI can analyze individual financial behavior to offer tailored products and advice. Furthermore, the persistent need to combat financial crime, including fraud and money laundering, fuels the adoption of AI-powered security solutions. Regulatory pressures to enhance compliance and data security also necessitate the implementation of AI technologies. The expanding volume of financial data provides a rich resource for AI algorithms to learn from, leading to continuous improvement in performance and accuracy.

Challenges in the AI in Fintech Market Market

Despite its immense potential, the AI in Fintech market faces several considerable challenges. Regulatory hurdles and the evolving nature of compliance frameworks can create uncertainty and slow down the adoption of new AI technologies. Concerns regarding data privacy and security remain paramount, requiring robust safeguards to protect sensitive financial information. The implementation of AI systems often necessitates significant upfront investment in technology infrastructure and skilled personnel, which can be a barrier for smaller institutions. Furthermore, the "black box" nature of some AI algorithms can lead to a lack of transparency and explainability, posing challenges for regulatory audits and building trust with end-users. The need for continuous retraining and updating of AI models to adapt to changing market conditions and evolving threats also presents an ongoing operational challenge.

Emerging Opportunities in AI in Fintech Market

The AI in Fintech market is ripe with emerging opportunities driven by ongoing technological breakthroughs and strategic market expansion. The advent of explainable AI (XAI) presents a significant opportunity to address transparency concerns, fostering greater trust and regulatory acceptance. The increasing focus on financial inclusion is creating demand for AI solutions that can assess the creditworthiness of underserved populations. Strategic partnerships between AI technology providers and traditional financial institutions are crucial for accelerating innovation and market penetration. Furthermore, the burgeoning demand for personalized financial wellness and retirement planning tools, powered by AI, represents a substantial long-term growth avenue. The integration of AI with blockchain technology also holds promise for enhancing security and efficiency in financial transactions.

Leading Players in the AI in Fintech Market Sector

- Active Ai

- IBM Corporation

- Trifacta Software Inc

- TIBCO Software (Alpine Data Labs)

- Betterment Holdings

- WealthFront Inc

- Microsoft Corporation

- Pefin Holdings LLC

- Sift Science Inc

- IPsoft Inc

- Amazon Web Services Inc

- Ripple Labs Inc

- Next IT Corporation

- Narrative Science

- Data Minr Inc

- Onfido

- Intel Corporation

- ComplyAdvantage com

- Zeitgold

Key Milestones in AI in Fintech Market Industry

- Mar 2023: CSI, an end-to-end fintech and regtech solution provider, partnered with Hawk AI, a global anti-money laundering (AML) and fraud prevention technologies for banks and payment processors, to provide its latest products, WatchDOG Fraud and WatchDOG AML. Artificial intelligence (AI) and machine learning (ML) models in the products enable multilayered, automated oversight that monitors, detects, and reports fraudulent or suspect activity in real time. WatchDOG Fraud detects fraudulent trends across all channels and payment types by monitoring transaction behavior.

- Jan 2023: Inscribe raised USD 25 million to fight financial fraud with artificial intelligence. Inscribe parses, classifies, and data-matches financial onboarding documents, emphasizing any inconsistencies between the papers provided and documents recovered using its AI-powered fraud detection. Individual customer risk profiles, which include snapshots of bank statements and transactions, are generated automatically using document details such as names, addresses, and bank statement transactions.

Strategic Outlook for AI in Fintech Market Market

The strategic outlook for the AI in Fintech market is exceptionally robust, indicating sustained and accelerated growth. Future market potential will be significantly shaped by the deepening integration of AI into core financial operations, driving greater automation and predictive capabilities. Key growth accelerators include the development of more sophisticated AI models for hyper-personalization, enabling financial institutions to offer truly bespoke products and services. Strategic opportunities lie in leveraging AI for proactive risk management, moving beyond detection to prediction of potential financial distress. The ongoing evolution of regulatory frameworks will also play a crucial role, with AI being instrumental in ensuring compliance efficiently. Furthermore, the expansion of AI into emerging markets and the development of AI-powered solutions for sustainable finance will open up new avenues for market players. Continued investment in AI research and development, coupled with strategic collaborations, will be paramount for maintaining a competitive edge.

AI in Fintech Market Segmentation

-

1. Type

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Application

- 3.1. Chatbots

- 3.2. Credit Scoring

- 3.3. Quantitative & Asset Management

- 3.4. Fraud Detection

- 3.5. Other Applications

AI in Fintech Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

AI in Fintech Market Regional Market Share

Geographic Coverage of AI in Fintech Market

AI in Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Process Automation Among Financial Organizations; Increasing Availability of Data Sources

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Fraud Detection is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Chatbots

- 5.3.2. Credit Scoring

- 5.3.3. Quantitative & Asset Management

- 5.3.4. Fraud Detection

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Chatbots

- 6.3.2. Credit Scoring

- 6.3.3. Quantitative & Asset Management

- 6.3.4. Fraud Detection

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Chatbots

- 7.3.2. Credit Scoring

- 7.3.3. Quantitative & Asset Management

- 7.3.4. Fraud Detection

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Chatbots

- 8.3.2. Credit Scoring

- 8.3.3. Quantitative & Asset Management

- 8.3.4. Fraud Detection

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Chatbots

- 9.3.2. Credit Scoring

- 9.3.3. Quantitative & Asset Management

- 9.3.4. Fraud Detection

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Chatbots

- 10.3.2. Credit Scoring

- 10.3.3. Quantitative & Asset Management

- 10.3.4. Fraud Detection

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Active Ai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trifacta Software Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TIBCO Software (Alpine Data Labs)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Betterment Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WealthFront Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pefin Holdings LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sift Science Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IPsoft Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon Web Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ripple Labs Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Next IT Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Narrative Science

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Data Minr Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Onfido

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Intel Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ComplyAdvantage com

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Zeitgold

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Active Ai

List of Figures

- Figure 1: Global AI in Fintech Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 13: Europe AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Europe AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Asia Pacific AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Asia Pacific AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Latin America AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Latin America AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Middle East and Africa AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Middle East and Africa AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global AI in Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AI in Fintech Market?

The projected CAGR is approximately 2.91%.

2. Which companies are prominent players in the AI in Fintech Market?

Key companies in the market include Active Ai, IBM Corporation, Trifacta Software Inc, TIBCO Software (Alpine Data Labs), Betterment Holdings, WealthFront Inc *List Not Exhaustive, Microsoft Corporation, Pefin Holdings LLC, Sift Science Inc, IPsoft Inc, Amazon Web Services Inc, Ripple Labs Inc, Next IT Corporation, Narrative Science, Data Minr Inc, Onfido, Intel Corporation, ComplyAdvantage com, Zeitgold.

3. What are the main segments of the AI in Fintech Market?

The market segments include Type, Deployment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Process Automation Among Financial Organizations; Increasing Availability of Data Sources.

6. What are the notable trends driving market growth?

Fraud Detection is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce.

8. Can you provide examples of recent developments in the market?

Mar 2023: CSI, an end-to-end fintech and regtech solution provider, partnered with Hawk AI, a global anti-money laundering (AML) and fraud prevention technologies for banks and payment processors, to provide its latest products, WatchDOG Fraud and WatchDOG AML. Artificial intelligence (AI) and machine learning (ML) models in the products enable multilayered, automated oversight that monitors, detects, and reports fraudulent or suspect activity in real time. WatchDOG Fraud detects fraudulent trends across all channels and payment types by monitoring transaction behavior.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AI in Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AI in Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AI in Fintech Market?

To stay informed about further developments, trends, and reports in the AI in Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence