Key Insights

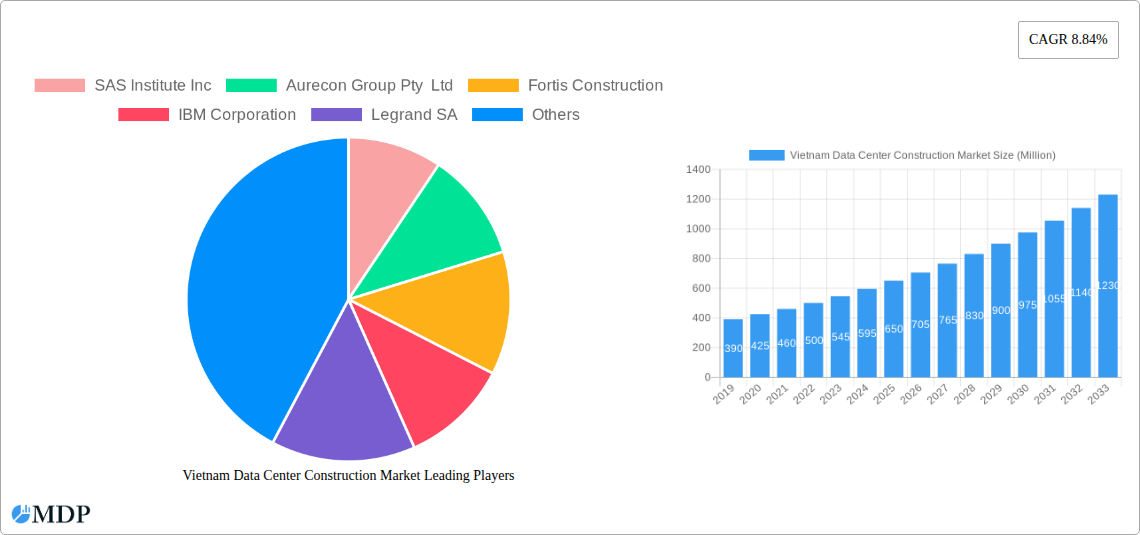

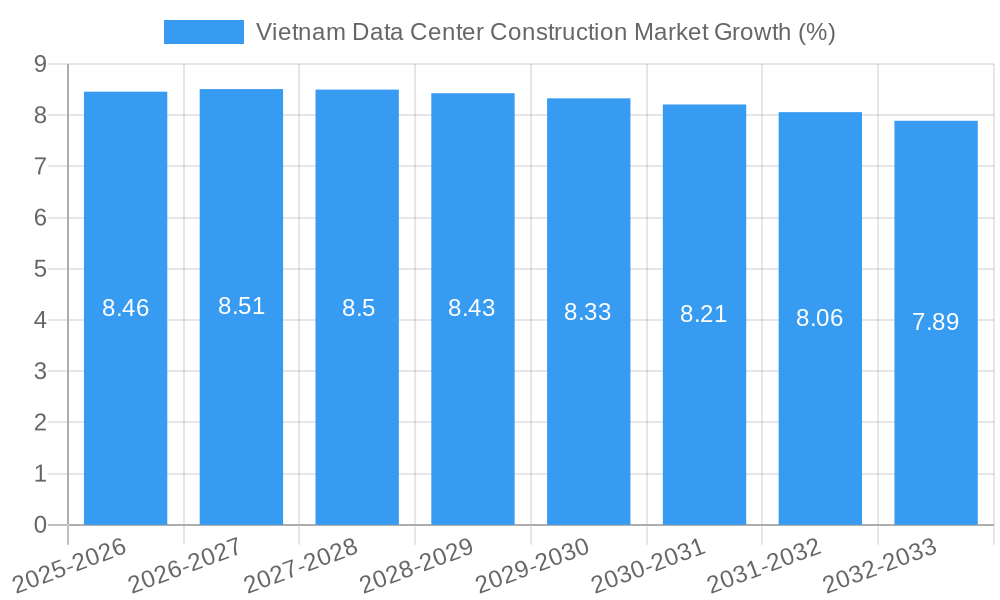

The Vietnam Data Center Construction Market is poised for substantial growth, projected to reach a market size of approximately $650 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.84% expected throughout the forecast period of 2025-2033. This expansion is primarily fueled by the accelerating digital transformation across various sectors in Vietnam. The burgeoning demand for cloud services, the proliferation of big data analytics, and the increasing adoption of IoT devices are creating an unprecedented need for advanced and scalable data center infrastructure. Furthermore, the government's supportive policies for digital economy development and foreign direct investment in technology are acting as significant catalysts. The IT and Telecommunications sector, followed by Banking, Financial Services, and Insurance (BFSI), are leading the charge in data center investments, driven by the critical need for secure and efficient data management and processing capabilities.

The market's growth will be further propelled by ongoing advancements in data center technologies. Key segments like Electrical Infrastructure, particularly Power Distribution Solutions encompassing PDUs, Transfer Switches, and Switchgear, are experiencing high demand to ensure reliable power supply. Similarly, Power Backup Solutions, including UPS and Generators, are crucial for maintaining operational continuity. Mechanical Infrastructure, especially advanced Cooling Systems like Immersion Cooling and Direct-to-chip Cooling, is gaining traction as data centers strive for greater energy efficiency and higher compute densities. While the market exhibits strong upward momentum, potential restraints such as the availability of skilled labor for complex construction projects and the increasing costs of raw materials could pose challenges. However, strategic investments in infrastructure development and the emergence of hyperscale data center projects are expected to mitigate these risks, positioning Vietnam as a significant player in the Southeast Asian data center landscape.

Unlocking the potential of Vietnam's burgeoning digital infrastructure, this comprehensive report delves into the dynamic Vietnam Data Center Construction Market. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this analysis offers granular insights into market dynamics, key trends, and strategic imperatives. We explore critical segments including Electrical Infrastructure (Power Distribution Solutions like PDUs, Transfer Switches, Switchgear, Power Panels, and Power Backup Solutions such as UPS and Generators), Mechanical Infrastructure (Cooling Systems, Racks, and Other Mechanical Infrastructure), and General Construction. Furthermore, we dissect market performance by Tier Type (Tier 1 and 2, Tier 3, Tier 4) and End User verticals (Banking, Financial Services, and Insurance; IT and Telecommunications; Government and Defense; Healthcare; and Other End Users).

The Vietnam Data Center Construction Market is projected to witness significant expansion, driven by escalating demand for digital services, cloud computing adoption, and the government's push towards digital transformation. This report provides an in-depth analysis of market size, segmentation, competitive landscape, and future outlook, empowering stakeholders to make informed strategic decisions. The report incorporates detailed breakdowns of Electrical Infrastructure including Power Distribution Solution encompassing PDU - Ba, Transfer Switches (Static, Automatic (ATS)), Switchgear (Low-voltage, Medium-voltage), Power Panels and Components, and Other Power Panels and Components. It also covers Power Backup Solutions such as UPS and Generators, alongside Service offerings. The Mechanical Infrastructure segment details Cooling Systems (Immersion Cooling, Direct-to-chip Cooling, Rear Door Heat Exchanger, In-row and In-rack Cooling), Racks, and Other Mechanical Infrastructure. General Construction is also thoroughly examined. The report further segments the market by Tier Type (Tier 1 and 2, Tier 3, Tier 4) and End User verticals including Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, and Other End Users.

Vietnam Data Center Construction Market Market Dynamics & Concentration

The Vietnam Data Center Construction Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share, particularly in large-scale projects. Innovation drivers are predominantly centered on energy efficiency, advanced cooling technologies like immersion cooling and direct-to-chip solutions, and the integration of AI and IoT for smarter data center management. Regulatory frameworks are evolving, with increasing government focus on data localization, security, and sustainability standards, which are shaping construction practices and compliance requirements. Product substitutes are limited in the core construction aspect but exist in the form of edge computing solutions and distributed cloud architectures, potentially impacting the demand for large centralized data centers in the long term. End-user trends showcase a strong demand for hyperscale and colocation facilities from the booming IT and Telecommunications sector, as well as growing interest from BFSI and Government entities for enhanced data security and processing capabilities. Mergers and Acquisition (M&A) activities, while not as prevalent as in mature markets, are expected to increase as foreign investment seeks to capitalize on Vietnam's growth trajectory, with an estimated XX M&A deal count expected over the forecast period. Market share for key infrastructure components is gradually shifting towards more sustainable and high-performance solutions.

Vietnam Data Center Construction Market Industry Trends & Analysis

The Vietnam Data Center Construction Market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including the nation's accelerated digital transformation initiatives, a rapidly growing internet user base, and the increasing adoption of cloud computing services by enterprises across various sectors. The burgeoning e-commerce landscape and the proliferation of mobile data consumption are creating an insatiable demand for data storage and processing capabilities, directly translating into a need for new and expanded data center facilities. Technological advancements are playing a pivotal role, with a growing emphasis on sustainable construction practices and energy-efficient operations. This includes the adoption of advanced cooling systems such as In-row and In-rack cooling, and a nascent but growing interest in immersion cooling technologies for high-density computing environments. Furthermore, the deployment of 5G networks is accelerating the demand for edge data centers, bringing processing power closer to end-users and enabling real-time applications. The competitive dynamics are intensifying, with both domestic and international players vying for market share. Companies are increasingly focusing on offering modular data center solutions, pre-fabricated components, and integrated services to expedite deployment and reduce project timelines. Consumer preferences are leaning towards facilities that offer higher power density, enhanced security, lower latency, and a commitment to environmental sustainability. The market penetration of advanced data center technologies is expected to rise significantly as Vietnam continues to solidify its position as a key digital hub in Southeast Asia. The ongoing development of robust electrical infrastructure, including reliable power distribution solutions and advanced power backup systems like UPS and Generators, is crucial for meeting the demands of these high-availability facilities. Similarly, the mechanical infrastructure, particularly efficient cooling systems, is becoming a critical differentiator. The market is expected to see substantial investments in Tier 3 and Tier 4 facilities to cater to the stringent uptime and reliability requirements of enterprise and hyperscale clients.

Leading Markets & Segments in Vietnam Data Center Construction Market

The dominant segment within the Vietnam Data Center Construction Market is Electrical Infrastructure, primarily driven by the escalating need for robust Power Distribution Solutions and Power Backup Solutions. Within Power Distribution Solution, Switchgear (both Low-voltage and Medium-voltage) commands a significant market share due to the fundamental requirement for safe and efficient power distribution across data center facilities. Power Panels and Components also represent a substantial portion of this segment. In terms of Power Backup Solutions, UPS systems are critical for ensuring uninterrupted power supply, a non-negotiable requirement for data centers, followed by Generators for longer-duration outages. The IT and Telecommunications end-user segment is the leading market driver, accounting for over 60% of the total market demand. This is directly attributable to the rapid expansion of cloud services, the growth of internet service providers, and the increasing adoption of 5G technology. General Construction is another crucial segment, encompassing the entire physical build of the data center, from foundation to structural integrity.

- Infrastructure: Electrical Infrastructure is the leading segment due to the fundamental need for reliable power.

- Power Distribution Solution is critical, with Switchgear and Power Panels and Components being high-demand sub-segments.

- Power Backup Solutions, particularly UPS, are indispensable for high availability.

- End User: IT and Telecommunications is the dominant end-user vertical, driven by cloud computing and 5G deployment.

- The demand from this sector necessitates the construction of large-scale hyperscale and colocation facilities.

- Tier Type: Tier 3 facilities represent a substantial and growing market share, offering a balance of redundancy and cost-effectiveness required by many enterprises.

- While Tier 4 facilities are being constructed for highly critical operations, Tier 3 offers broader appeal.

- Mechanical Infrastructure is gaining traction as data center densities increase, with Cooling Systems like In-row and In-rack Cooling becoming increasingly important.

Vietnam Data Center Construction Market Product Developments

Product developments in the Vietnam Data Center Construction Market are increasingly focusing on enhancing energy efficiency and operational resilience. Innovations in Cooling Systems such as advanced Rear Door Heat Exchangers and more efficient In-row and In-rack Cooling solutions are being introduced to manage the thermal load of high-density server deployments. There is also a growing awareness and initial exploration of Immersion Cooling and Direct-to-chip Cooling technologies for future-proofing facilities. In the realm of Power Distribution Solution, manufacturers are developing more intelligent Power Distribution Units (PDUs) with advanced monitoring and control capabilities, alongside more reliable Transfer Switches and compact Switchgear. The integration of IoT sensors and AI-driven analytics into construction materials and equipment is also a key trend, enabling predictive maintenance and optimized performance. These advancements offer competitive advantages by reducing operational costs, improving uptime, and meeting stringent environmental regulations.

Key Drivers of Vietnam Data Center Construction Market Growth

Several key drivers are propelling the growth of the Vietnam Data Center Construction Market. Foremost is the accelerated digital transformation agenda of the Vietnamese government, aimed at creating a digital economy and smart cities. This has led to increased investment in IT infrastructure, including data centers. The rapid adoption of cloud computing services by businesses, driven by cost-efficiency and scalability, is creating sustained demand for colocation and hyperscale facilities. The expansion of 5G networks and the proliferation of IoT devices are generating vast amounts of data that require localized processing and storage. Furthermore, Vietnam's strategic geographical location, favorable investment policies for foreign direct investment (FDI), and a growing pool of skilled labor make it an attractive destination for data center development.

Challenges in the Vietnam Data Center Construction Market Market

Despite its promising outlook, the Vietnam Data Center Construction Market faces certain challenges. Navigating the evolving regulatory landscape, particularly concerning data privacy and localization, can pose complexities for developers. Ensuring a consistent and reliable supply of high-quality construction materials and specialized equipment, such as advanced cooling systems and uninterruptible power supply units, can be a logistical hurdle, potentially leading to supply chain disruptions and increased project costs. Moreover, attracting and retaining a sufficiently skilled workforce with expertise in modern data center construction techniques and operations remains a challenge. Competitive pressures from established players and the need for significant upfront capital investment also present barriers to entry for new market participants.

Emerging Opportunities in Vietnam Data Center Construction Market

The Vietnam Data Center Construction Market presents significant emerging opportunities for growth and innovation. The increasing demand for edge computing facilities to support low-latency applications like autonomous vehicles and real-time analytics presents a new frontier. The development of green data centers, powered by renewable energy sources and incorporating sustainable construction practices, is an avenue for differentiation and attracting environmentally conscious clients. Strategic partnerships between global technology providers, construction firms, and local Vietnamese enterprises can accelerate project development and knowledge transfer. Furthermore, the government's continued support for the digital economy and investments in smart city initiatives are expected to create ongoing demand for advanced data center infrastructure across the country, including specialized facilities for healthcare and BFSI sectors.

Leading Players in the Vietnam Data Center Construction Market Sector

- SAS Institute Inc

- Aurecon Group Pty Ltd

- Fortis Construction

- IBM Corporation

- Legrand SA

- Archetype Group

- Delta Group

- NEC Vietnam Co Ltd

- Schneider Electric SE

- Turner Construction Co

- Dell Inc

- Cisco Systems Inc

- AECOM

- NTT Ltd

- Iris Global

Key Milestones in Vietnam Data Center Construction Market Industry

- September 2021: Viettel jointly conducted trials with Samsung in Da Nang, in early September 2021, showcasing advancements in mobile technology infrastructure.

- September 2021: Viettel partnered with Ericsson and Qualcomm to test and achieve 5G data transmission speeds over 4.7 Gbps, signaling a significant step towards 5G network deployment, which will necessitate increased data center capacity.

- September 2021: VNPT upgraded its backbone and core networks, and developed 4G, 5G, and M2M/IoT platforms.

- September 2021: VNPT conducted commercial tests of 5G services and signed an agreement with Nokia to develop and apply new networking technologies, underscoring the strategic importance of robust network infrastructure and the underlying data center support.

Strategic Outlook for Vietnam Data Center Construction Market Market

- September 2021: Viettel jointly conducted trials with Samsung in Da Nang, in early September 2021, showcasing advancements in mobile technology infrastructure.

- September 2021: Viettel partnered with Ericsson and Qualcomm to test and achieve 5G data transmission speeds over 4.7 Gbps, signaling a significant step towards 5G network deployment, which will necessitate increased data center capacity.

- September 2021: VNPT upgraded its backbone and core networks, and developed 4G, 5G, and M2M/IoT platforms.

- September 2021: VNPT conducted commercial tests of 5G services and signed an agreement with Nokia to develop and apply new networking technologies, underscoring the strategic importance of robust network infrastructure and the underlying data center support.

Strategic Outlook for Vietnam Data Center Construction Market Market

The strategic outlook for the Vietnam Data Center Construction Market is highly positive, driven by consistent demand from the IT and Telecommunications sector, coupled with government impetus for digitalization. Future growth will be significantly shaped by the adoption of hyperscale and edge data center models to cater to diverse application needs. Investments in energy-efficient infrastructure, including advanced cooling systems and renewable energy integration, will be crucial for long-term sustainability and cost competitiveness. Strategic collaborations between international and domestic entities will facilitate knowledge sharing and accelerate project execution. Companies focusing on modular construction, intelligent infrastructure management, and resilient power solutions are best positioned to capitalize on the evolving market dynamics and contribute to Vietnam's digital future. The market is anticipated to continue its upward trajectory, supported by a stable economic environment and a clear vision for technological advancement.

Vietnam Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Panels and Components

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Panels and Components

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Panels and Components

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Vietnam Data Center Construction Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Migration to Cloud-based Business Operations; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments and Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Tier 3 is the Largest Tier Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Panels and Components

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Panels and Components

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Panels and Components

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aurecon Group Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortis Construction

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Archetype Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Delta Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Vietnam Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turner Construction Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dell Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cisco Systems Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AECOM

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NTT Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Iris Global

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: Vietnam Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Vietnam Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 4: Vietnam Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 5: Vietnam Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 6: Vietnam Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 7: Vietnam Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 8: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 9: Vietnam Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 10: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2019 & 2032

- Table 11: Vietnam Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: Vietnam Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 13: Vietnam Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 14: Vietnam Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 15: Vietnam Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 16: Vietnam Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 17: Vietnam Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 18: Vietnam Data Center Construction Market Volume K Unit Forecast, by Racks 2019 & 2032

- Table 19: Vietnam Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 20: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 21: Vietnam Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 22: Vietnam Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 23: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 26: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 27: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 28: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 29: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 30: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 31: Vietnam Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Vietnam Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 33: Vietnam Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 34: Vietnam Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 35: Vietnam Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 36: Vietnam Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 37: Vietnam Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 38: Vietnam Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 39: Vietnam Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 40: Vietnam Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 41: Vietnam Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 42: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 43: Vietnam Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 44: Vietnam Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 45: Vietnam Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Vietnam Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Vietnam Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 48: Vietnam Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 49: Vietnam Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 50: Vietnam Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 51: Vietnam Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 52: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 53: Vietnam Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 54: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2019 & 2032

- Table 55: Vietnam Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 56: Vietnam Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 57: Vietnam Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 58: Vietnam Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 59: Vietnam Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 60: Vietnam Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 61: Vietnam Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 62: Vietnam Data Center Construction Market Volume K Unit Forecast, by Racks 2019 & 2032

- Table 63: Vietnam Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 64: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 65: Vietnam Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 66: Vietnam Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 67: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 68: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 69: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 70: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 71: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 72: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 73: Vietnam Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 74: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 75: Vietnam Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 76: Vietnam Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 77: Vietnam Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 78: Vietnam Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 79: Vietnam Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 80: Vietnam Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 81: Vietnam Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 82: Vietnam Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 83: Vietnam Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 84: Vietnam Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 85: Vietnam Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 86: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 87: Vietnam Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Vietnam Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Construction Market?

The projected CAGR is approximately 8.84%.

2. Which companies are prominent players in the Vietnam Data Center Construction Market?

Key companies in the market include SAS Institute Inc, Aurecon Group Pty Ltd, Fortis Construction, IBM Corporation, Legrand SA, Archetype Group, Delta Group, NEC Vietnam Co Ltd, Schneider Electric SE, Turner Construction Co, Dell Inc, Cisco Systems Inc, AECOM, NTT Ltd, Iris Global.

3. What are the main segments of the Vietnam Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Migration to Cloud-based Business Operations; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers.

6. What are the notable trends driving market growth?

Tier 3 is the Largest Tier Type.

7. Are there any restraints impacting market growth?

Higher Initial Investments and Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

September 2021: Viettel jointly conducted trials with Samsung in Da Nang, in early September 2021. Viettel partnered with Ericsson and Qualcomm to test and achieve 5G data transmission speeds over 4.7 Gbps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence