Key Insights

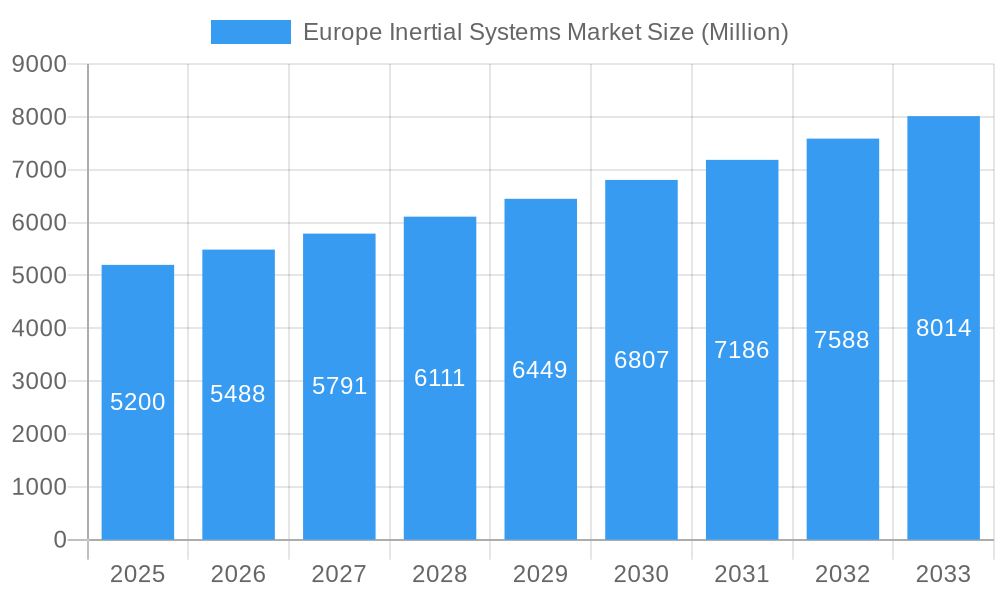

The Europe Inertial Systems Market is poised for significant expansion, projected to reach approximately $5,200 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.54% throughout the forecast period of 2025-2033. This growth is propelled by an increasing demand for sophisticated navigation, stabilization, and guidance solutions across a multitude of sectors. The defense industry remains a cornerstone, with ongoing modernization programs and the integration of advanced unmanned systems necessitating high-precision inertial measurement units (IMUs) and attitude heading and reference systems (AHRS). Similarly, the civil aviation sector is witnessing a surge in demand for enhanced flight control, navigation, and autopilot systems, fueled by fleet expansion and the adoption of new aircraft technologies. Consumer electronics, particularly in wearables and augmented reality devices, are also contributing to market expansion, albeit with a smaller but rapidly growing share. Automotive applications, especially in autonomous driving systems and advanced driver-assistance systems (ADAS), represent a substantial growth avenue, requiring reliable and accurate sensor data for vehicle positioning and control.

Europe Inertial Systems Market Market Size (In Billion)

The market's trajectory is further shaped by key trends such as the miniaturization and integration of inertial sensors, leading to smaller, lighter, and more power-efficient solutions. The increasing adoption of MEMS-based inertial sensors is a significant trend, offering cost-effectiveness and high performance for a broad range of applications. Advancements in sensor fusion algorithms and artificial intelligence are also playing a crucial role in enhancing the accuracy and reliability of inertial systems, allowing for greater resilience to environmental disturbances and GPS denial. However, certain restraints, such as the high cost of advanced inertial system development and the stringent certification processes in regulated industries like aviation and automotive, could temper the pace of growth. Furthermore, the dependence on supply chains and the potential for geopolitical disruptions may pose challenges. Despite these hurdles, the relentless pursuit of enhanced precision, autonomy, and efficiency across major European industries ensures a dynamic and expanding market for inertial systems.

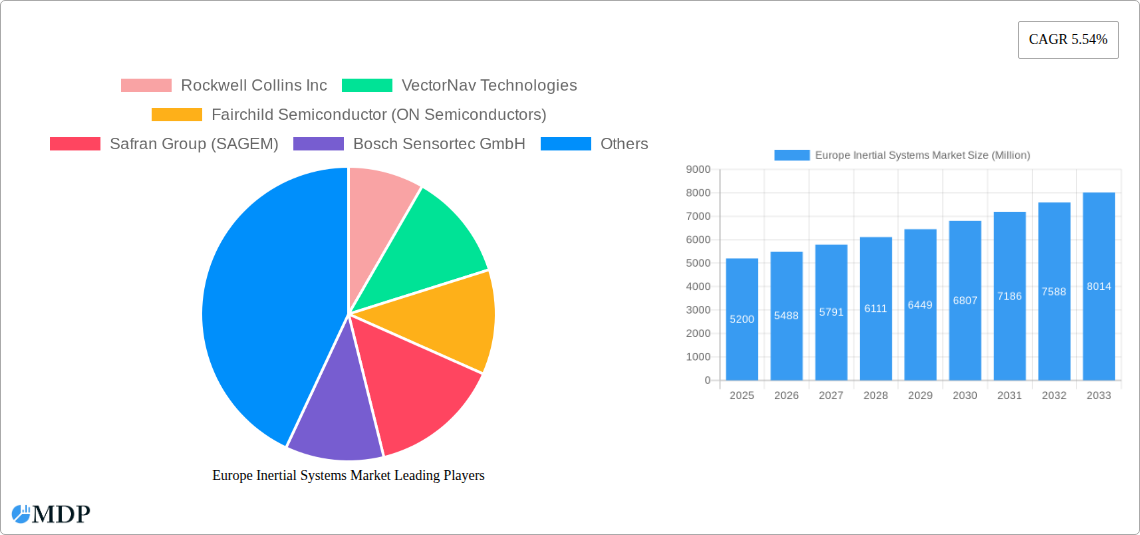

Europe Inertial Systems Market Company Market Share

Unlock unparalleled insights into the burgeoning Europe Inertial Systems Market with our in-depth report. Covering the study period of 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this analysis delves into critical market dynamics, industry trends, leading segments, and key players. Leveraging high-traffic keywords such as "inertial navigation systems," "MEMS accelerometers," "gyroscopes," "IMUs," "civil aviation," "defense technology," "automotive sensors," and "industrial automation," this report is designed to maximize search visibility and attract industry stakeholders seeking actionable intelligence. The market is projected to reach XXX Billion Euros by 2033.

Europe Inertial Systems Market Market Dynamics & Concentration

The Europe Inertial Systems Market exhibits a moderate to high concentration, with a few dominant players holding significant market share in specialized segments. Innovation is a primary driver, fueled by advancements in Micro-Electro-Mechanical Systems (MEMS) technology, miniaturization, and enhanced accuracy requirements across diverse applications. Regulatory frameworks, particularly within the aerospace and automotive industries, play a crucial role in dictating product development and adoption, emphasizing safety and performance standards. Product substitutes, while emerging, are largely limited by the superior accuracy and reliability offered by established inertial systems. End-user trends lean towards increasing demand for autonomous navigation, enhanced vehicle safety, and precise positioning in industrial settings. Merger and acquisition (M&A) activities, though not at an extremely high volume, are strategic, often aimed at acquiring niche technologies or expanding market reach. For instance, recent M&A activities in related sensor markets suggest a trend towards consolidation for technological synergy. The market's growth is underpinned by substantial R&D investments from key players, aiming to deliver more compact, power-efficient, and cost-effective inertial solutions.

Europe Inertial Systems Market Industry Trends & Analysis

The Europe Inertial Systems Market is poised for robust growth, driven by a confluence of technological advancements, expanding application landscapes, and evolving end-user demands. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at XX.X%, indicative of a dynamic and expanding market. Key growth drivers include the escalating adoption of autonomous driving systems in the automotive sector, where precise and reliable navigation is paramount. Similarly, the defense industry's persistent need for advanced guidance, navigation, and control (GNC) systems for drones, missiles, and other platforms significantly contributes to market expansion. In civil aviation, the integration of inertial systems in both commercial and general aviation aircraft for navigation, flight control, and stability enhancement continues to be a substantial market segment. The burgeoning consumer electronics sector, particularly in wearable technology and augmented reality (AR) devices, is also presenting new avenues for miniaturized and low-power inertial sensors.

Technological disruptions are primarily centered around the maturation and miniaturization of MEMS technology, enabling the development of highly accurate and cost-effective accelerometers, gyroscopes, and magnetometers. The integration of these components into Inertial Measurement Units (IMUs) and Attitude Heading and Navigation Systems (AHNS) is becoming increasingly sophisticated, offering enhanced data fusion and improved performance in challenging environments. Consumer preferences are shifting towards devices with superior tracking capabilities, longer battery life, and seamless integration into broader ecosystems, which directly influences the design and functionality of inertial systems. The competitive dynamics within the market are characterized by intense innovation, strategic partnerships, and a focus on cost optimization without compromising performance. As the market matures, there's a growing emphasis on software algorithms that can effectively process and interpret inertial data, further enhancing the overall utility and accuracy of these systems. The penetration of inertial systems in emerging applications like robotics and industrial automation is also a significant trend, showcasing the versatility and indispensable nature of this technology across various European industries.

Leading Markets & Segments in Europe Inertial Systems Market

The dominance within the Europe Inertial Systems Market is multifaceted, with distinct leadership observed across applications, components, and geographical sub-regions.

Dominant Application Segments:

- Defense: This sector consistently represents a significant portion of the market due to the perpetual requirement for high-precision, robust inertial navigation systems (INS) for military aircraft, naval vessels, ground vehicles, and unmanned aerial vehicles (UAVs).

- Key Drivers: Geopolitical stability concerns, modernization of defense fleets, increasing use of autonomous systems in warfare, and the demand for advanced targeting and reconnaissance capabilities.

- Civil Aviation: The continuous growth in air travel and the stringent safety regulations governing aviation propel the demand for inertial systems in commercial airliners, business jets, and helicopters for primary and secondary navigation.

- Key Drivers: Fleet expansion, integration of advanced avionics, need for enhanced fuel efficiency through optimal flight paths, and the development of next-generation air traffic management systems.

- Automotive: The rapidly expanding automotive sector, particularly with the advent of Advanced Driver-Assistance Systems (ADAS) and the pursuit of autonomous driving, is becoming a dominant force.

- Key Drivers: Increasing adoption of ADAS features (e.g., adaptive cruise control, lane keeping assist), development of autonomous vehicle technology, and the need for precise positioning for navigation and vehicle control.

Dominant Component Segments:

- IMUs (Inertial Measurement Units): These integrated units, combining accelerometers and gyroscopes, are the backbone of many inertial systems and are witnessing substantial demand across all major applications.

- Key Drivers: Miniaturization and cost reduction of MEMS sensors, improved data fusion algorithms, and their versatility in providing motion and orientation data.

- Accelerometers: Essential for measuring linear acceleration, accelerometers are critical components in a wide array of applications, from vehicle stability control to wearable fitness trackers.

- Key Drivers: Growing demand for vibration monitoring, tilt sensing, and impact detection in industrial, automotive, and consumer electronics.

- Gyroscopes: These devices, vital for measuring angular velocity, are integral to maintaining stability and orientation in navigation and control systems.

- Key Drivers: Increasing use in robotics, drone stabilization, and virtual/augmented reality applications.

Leading Geographical Markets:

- Germany: As the largest economy in Europe and a hub for automotive manufacturing and industrial automation, Germany holds a leading position. Its strong focus on R&D and advanced manufacturing technologies drives the demand for sophisticated inertial systems.

- Key Drivers: Robust automotive industry, significant aerospace and defense investments, and a strong presence of advanced manufacturing sectors.

- France: With a prominent aerospace and defense industry (e.g., Safran Group, Thales Group), France is a key market for high-performance inertial systems.

- Key Drivers: Strong legacy in aerospace and defense, government support for technological innovation, and a growing automotive sector.

- United Kingdom: The UK's established aerospace sector, coupled with its growing defense industry and increasing adoption of ADAS in vehicles, positions it as a significant market.

- Key Drivers: Active defense procurement programs, advancements in autonomous systems, and a growing market for intelligent transportation solutions.

The interplay of these application, component, and geographical segments defines the strategic landscape of the Europe Inertial Systems Market.

Europe Inertial Systems Market Product Developments

Product innovation in the Europe Inertial Systems Market is characterized by the relentless pursuit of miniaturization, enhanced accuracy, reduced power consumption, and lower costs. Recent developments include the introduction of nanowatt-power, 3-axis accelerometers designed for battery-powered, always-on edge sensing in healthcare, automotive, and industrial applications, reflecting a growing demand for low-power solutions. Concurrently, new accelerometers offering high performance and reliability in small, rugged, and low-cost packages are emerging, catering to the stringent requirements of the aerospace and defense sectors while also finding utility in industrial and marine applications needing precision navigation-grade sensors. These advancements aim to expand the applicability of inertial systems into new markets and improve the performance and efficiency of existing ones.

Key Drivers of Europe Inertial Systems Market Growth

Several key factors are propelling the growth of the Europe Inertial Systems Market. The escalating adoption of autonomous and semi-autonomous systems across the automotive, aerospace, and defense sectors is a primary driver, necessitating highly accurate and reliable navigation and control capabilities. Advancements in MEMS technology continue to enable the development of smaller, more precise, and cost-effective inertial sensors, making them accessible for a wider range of applications. Furthermore, the increasing demand for precision agriculture, robotics, and industrial automation is creating new market opportunities. Government initiatives and defense spending on modernization programs also significantly contribute to the market's expansion.

Challenges in the Europe Inertial Systems Market Market

Despite robust growth, the Europe Inertial Systems Market faces certain challenges. Stringent regulatory approvals, particularly in the aerospace and automotive industries, can lead to extended product development cycles and increased costs. The global supply chain complexities and potential disruptions can impact the availability of critical components and raw materials. Intense competition among established players and emerging entrants puts pressure on pricing and necessitates continuous innovation. Furthermore, the high initial investment required for R&D and manufacturing of advanced inertial systems can be a barrier for smaller companies.

Emerging Opportunities in Europe Inertial Systems Market

The Europe Inertial Systems Market presents several promising opportunities for long-term growth. The rapid evolution of smart cities and intelligent transportation systems will drive demand for accurate positioning and navigation solutions. The burgeoning Internet of Things (IoT) ecosystem, particularly in industrial and environmental monitoring, offers a vast potential for miniaturized and low-power inertial sensors. Advancements in augmented and virtual reality (AR/VR) technologies are creating new avenues for motion tracking and interactive experiences. Strategic partnerships between inertial system manufacturers and AI/software companies can unlock further value by enhancing data analytics and predictive capabilities. The growing focus on unmanned systems (drones and robotics) across various industries, from logistics to inspection, presents a significant growth catalyst.

Leading Players in the Europe Inertial Systems Market Sector

- Rockwell Collins Inc

- VectorNav Technologies

- Fairchild Semiconductor (ON Semiconductors)

- Safran Group (SAGEM)

- Bosch Sensortec GmbH

- Moog Inc

- Thales Group

- STMicroelectronics NV

- Meggitt PLC

- Analog Devices Inc

- Honeywell Aerospace Inc

- InvenSense Inc

- Northrop Grumman Corporation

Key Milestones in Europe Inertial Systems Market Industry

- May 2022: Analog Devices, Inc. (ADI) participated in SENSOR+TEST 2022 in Nuremberg, Germany, showcasing a broad range of sensor solutions, including a nanowatt-power, 3-axis accelerometer for battery-powered, always-on healthcare, automotive, and industrial edge sensing applications. This highlights ADI's focus on low-power and versatile sensor technology for emerging markets.

- March 2022: Honeywell introduced the MV60 MEMS accelerometer, providing high performance and reliability in a small, rugged, low-cost package. This development caters to the demanding requirements of aerospace and defense, while also offering potential for industrial and marine applications needing high-precision, navigation-grade accelerometers that are small, lightweight, and require little power to operate.

Strategic Outlook for Europe Inertial Systems Market Market

The strategic outlook for the Europe Inertial Systems Market is exceptionally positive, driven by sustained innovation and expanding applications. Continued investment in MEMS technology and advanced sensor fusion algorithms will be crucial for maintaining a competitive edge. Strategic collaborations between inertial system providers and end-users, particularly in the automotive and defense sectors, will foster the development of tailored solutions that meet evolving performance and integration needs. The market is expected to witness increased adoption of high-accuracy, low-cost inertial systems in emerging areas like robotics, drones, and the broader industrial IoT landscape. Companies focusing on miniaturization, power efficiency, and robust software integration will be best positioned to capitalize on the significant growth opportunities in this dynamic market.

Europe Inertial Systems Market Segmentation

-

1. Application

- 1.1. Civil Aviation

- 1.2. Defense

- 1.3. Consumer Electronics

- 1.4. Automotive

- 1.5. Energy & Infrastructure

- 1.6. Medical

- 1.7. Other Applications

-

2. Component

- 2.1. Accelerometer

- 2.2. Gyroscope

- 2.3. IMU

- 2.4. Magnetometer

- 2.5. Attitude Heading and Navigation System

- 2.6. Other Components

Europe Inertial Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

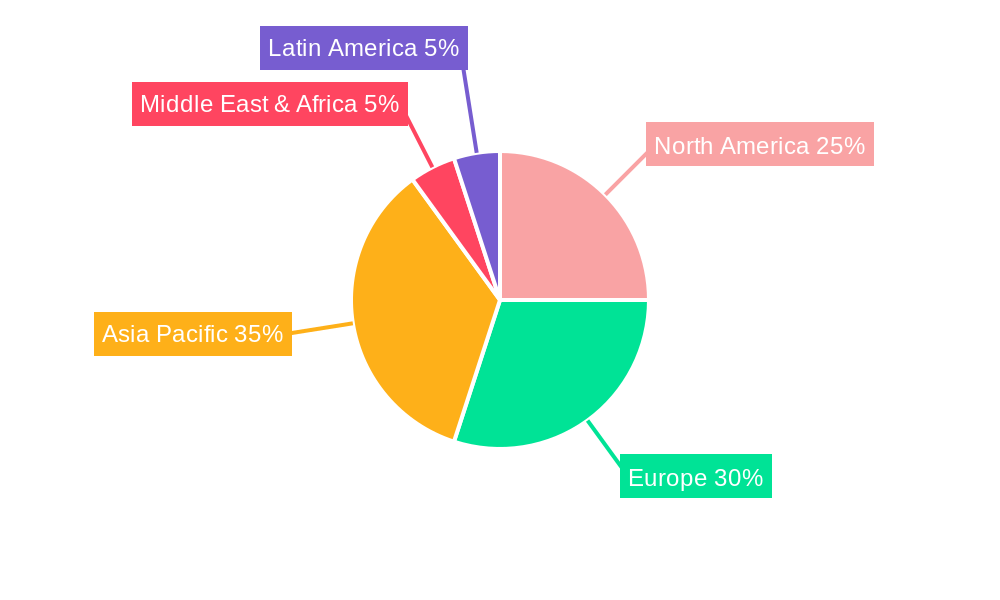

Europe Inertial Systems Market Regional Market Share

Geographic Coverage of Europe Inertial Systems Market

Europe Inertial Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of MEMS Technology; Inclination of Growth toward Defense and Aerospace; Technological Advancements in Navigation Systems

- 3.3. Market Restrains

- 3.3.1 Operational Complexity

- 3.3.2 coupled with High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Defense segment expected to account for a significant market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inertial Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil Aviation

- 5.1.2. Defense

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive

- 5.1.5. Energy & Infrastructure

- 5.1.6. Medical

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Accelerometer

- 5.2.2. Gyroscope

- 5.2.3. IMU

- 5.2.4. Magnetometer

- 5.2.5. Attitude Heading and Navigation System

- 5.2.6. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Collins Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VectorNav Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fairchild Semiconductor (ON Semiconductors)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran Group (SAGEM)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sensortec GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moog Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 STMicroelectronics NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meggitt PLC*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Analog Devices Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honeywell Aerospace Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 InvenSense Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Northrop Grumman Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Rockwell Collins Inc

List of Figures

- Figure 1: Europe Inertial Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Inertial Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Inertial Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Europe Inertial Systems Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 3: Europe Inertial Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Inertial Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Europe Inertial Systems Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: Europe Inertial Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Inertial Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inertial Systems Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Europe Inertial Systems Market?

Key companies in the market include Rockwell Collins Inc, VectorNav Technologies, Fairchild Semiconductor (ON Semiconductors), Safran Group (SAGEM), Bosch Sensortec GmbH, Moog Inc, Thales Group, STMicroelectronics NV, Meggitt PLC*List Not Exhaustive, Analog Devices Inc, Honeywell Aerospace Inc, InvenSense Inc, Northrop Grumman Corporation.

3. What are the main segments of the Europe Inertial Systems Market?

The market segments include Application, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence of MEMS Technology; Inclination of Growth toward Defense and Aerospace; Technological Advancements in Navigation Systems.

6. What are the notable trends driving market growth?

Defense segment expected to account for a significant market.

7. Are there any restraints impacting market growth?

Operational Complexity. coupled with High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

May 2022 - Analog Devices, Inc. (ADI) participated in SENSOR+TEST 2022, held in Nuremberg, Germany, and showcased a broad range of sensor solutions. This included a nanowatt-power, 3-axis accelerometer for battery-powered, always-on healthcare, automotive and industrial edge sensing applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inertial Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inertial Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inertial Systems Market?

To stay informed about further developments, trends, and reports in the Europe Inertial Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence