Key Insights

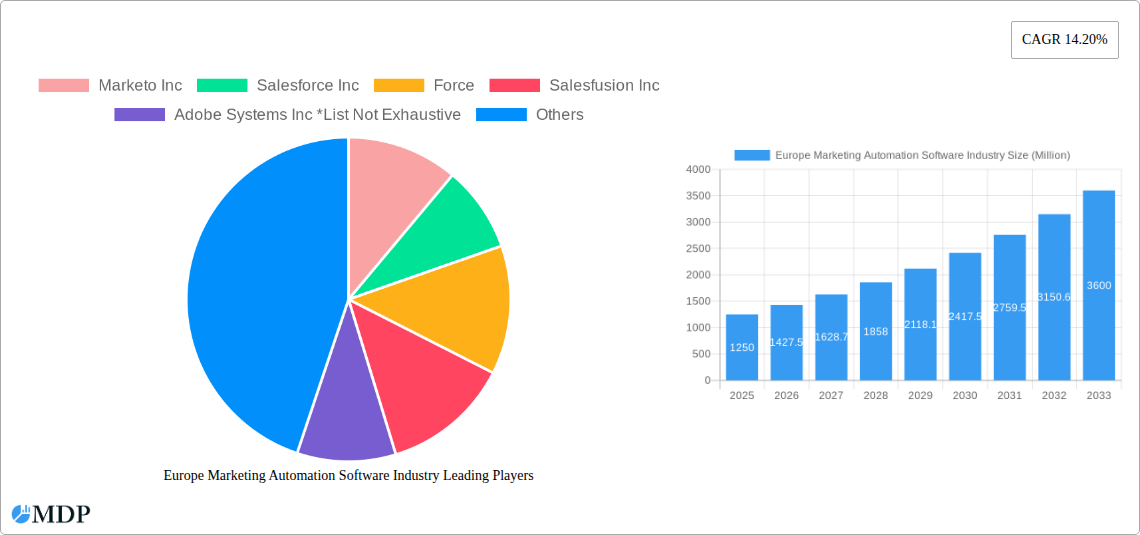

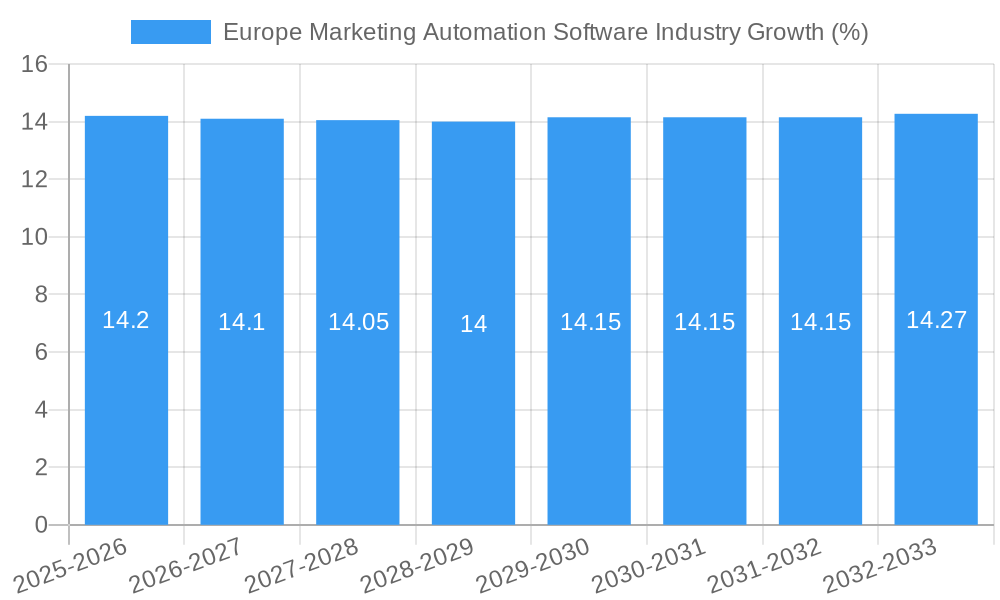

The Europe Marketing Automation Software market is poised for robust expansion, projected to reach a significant XX million by 2033, with a compelling Compound Annual Growth Rate (CAGR) of 14.20% between 2025 and 2033. This dynamic growth is fueled by several key drivers, primarily the increasing need for businesses across Europe to streamline their marketing efforts, personalize customer engagement, and measure campaign ROI effectively. The accelerating digital transformation across industries, coupled with the growing adoption of cloud-based solutions, is providing a fertile ground for marketing automation. Furthermore, the demand for sophisticated features like AI-driven analytics, predictive modeling, and advanced segmentation is pushing the market forward, enabling companies to achieve greater efficiency and deliver more targeted campaigns. This heightened focus on data-driven marketing and customer experience optimization is a cornerstone of this market's upward trajectory.

The market's segmentation reveals a strong preference for cloud-based deployment models, reflecting the scalability, flexibility, and cost-effectiveness they offer to businesses of all sizes. Within applications, Campaign Management and E-mail Marketing remain foundational, but Mobile Marketing and Social Media Marketing are rapidly gaining traction as businesses seek to connect with consumers across diverse digital touchpoints. Key end-user verticals driving adoption include Retail, Financial Services, and Entertainment & Media, all of whom are leveraging marketing automation to enhance customer loyalty and drive revenue. While the market is characterized by intense competition among established players like Salesforce Inc, Adobe Systems Inc, and Oracle Corporation, emerging vendors are also carving out niches. Restraints such as data privacy concerns and the initial investment cost for smaller enterprises are being addressed through evolving compliance frameworks and the increasing availability of tiered pricing models, ensuring sustained momentum for the Europe Marketing Automation Software industry.

Europe Marketing Automation Software Industry Market Dynamics & Concentration

The Europe Marketing Automation Software industry is characterized by a dynamic landscape with key players vying for market share. Innovation remains a significant driver, with companies consistently enhancing their platforms to meet evolving digital marketing needs. Regulatory frameworks, particularly GDPR compliance, play a crucial role in shaping product development and go-to-market strategies across the continent. While a few dominant players hold substantial market share, the presence of niche providers and emerging technologies fosters a moderately concentrated market. Product substitutes, such as standalone CRM solutions or manual marketing efforts, exist but are increasingly being displaced by the integrated capabilities of marketing automation. End-user adoption is on an upward trajectory, driven by the need for personalized customer engagement and efficient campaign management. Mergers and acquisitions (M&A) activity, while not at peak levels, indicates strategic consolidation and expansion efforts within the sector. For instance, the acquisition of Wilco Source by CitiusTech London highlights the trend of deepening domain expertise and expanding service offerings.

Europe Marketing Automation Software Industry Industry Trends & Analysis

The Europe Marketing Automation Software industry is poised for robust growth, fueled by a confluence of technological advancements and evolving consumer preferences. The increasing adoption of cloud-based solutions is a significant market growth driver, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes. Artificial intelligence (AI) and machine learning (ML) are revolutionizing the industry by enabling hyper-personalization, predictive analytics, and automated content generation. This technological disruption allows businesses to deliver highly targeted campaigns, optimize customer journeys, and improve conversion rates. Consumer preferences are shifting towards seamless, omnichannel experiences, compelling companies to invest in marketing automation platforms that can integrate across various touchpoints, including email, social media, mobile, and websites. The competitive dynamics within the market are intense, with established vendors like Salesforce Inc., Oracle Corporation, and Adobe Systems Inc. facing competition from agile, digitally native players. The overall compound annual growth rate (CAGR) for the market is projected to be substantial, estimated at xx% during the forecast period of 2025–2033. Market penetration is steadily increasing as more businesses recognize the ROI of automated marketing processes, leading to enhanced customer acquisition, retention, and lifetime value. The ongoing digital transformation across various European economies further underscores the demand for sophisticated marketing automation tools.

Leading Markets & Segments in Europe Marketing Automation Software Industry

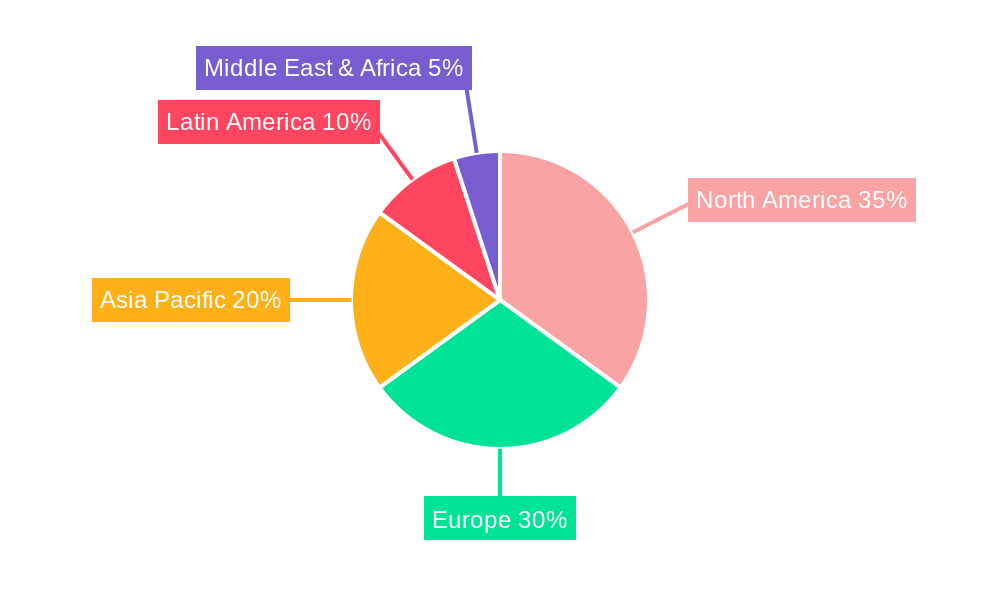

The European Marketing Automation Software industry exhibits strong dominance in Western and Northern European regions, driven by advanced digital infrastructure and a high concentration of digitally mature businesses. Countries like Germany, the United Kingdom, France, and the Nordics lead in adoption rates, influenced by proactive economic policies supporting digital innovation and robust IT infrastructure.

Deployment: Cloud-based deployment is the undisputed leader, accounting for an estimated xx% of the market. This preference is driven by:

- Scalability and Flexibility: Businesses can easily adjust resources based on demand.

- Reduced IT Overhead: Lower upfront investment and ongoing maintenance costs.

- Accessibility and Collaboration: Enabling remote work and cross-team collaboration.

- Frequent Updates: Vendors provide continuous feature enhancements and security patches.

Application: Campaign Management and E-mail Marketing remain foundational applications, but In-bound Marketing is rapidly gaining traction.

- Campaign Management: Dominant due to its central role in orchestrating multi-channel marketing efforts and measuring ROI.

- E-mail Marketing: Continues to be a cost-effective and highly effective channel for customer communication and nurturing.

- In-bound Marketing: Experiencing significant growth as businesses focus on attracting customers through valuable content and personalized experiences. This includes SEO optimization, content marketing, and social media engagement, all facilitated by automation.

End-User Verticals: Retail and Financial Services are currently the largest end-user verticals, driven by their direct customer interaction models and the need for personalized engagement and loyalty programs.

- Retail: High demand for personalized offers, abandoned cart recovery, and loyalty program automation.

- Financial Services: Critical need for secure, compliant, and personalized customer communication for onboarding, product offerings, and customer support.

- Healthcare: Emerging as a significant growth segment, with a growing need for patient engagement, appointment reminders, and personalized health communications, as evidenced by CitiusTech London's strategic moves.

- Manufacturing: Increasing adoption for lead nurturing, sales enablement, and post-sale customer service automation.

Europe Marketing Automation Software Industry Product Developments

Recent product developments in the Europe Marketing Automation Software industry underscore a strong focus on AI-driven personalization, seamless integration, and enhanced user experience for businesses of all sizes. Innovations are geared towards simplifying complex marketing tasks, enabling hyper-targeted campaigns, and providing deeper customer insights. The launch of LocaliQ's scheduling management software for small businesses exemplifies this trend, offering integrated CRM, campaign management, and insight tools to connect businesses with clients effectively through preferred channels. These advancements aim to provide a competitive edge by automating workflows, optimizing customer journeys, and improving overall marketing ROI.

Key Drivers of Europe Marketing Automation Software Industry Growth

Several factors are propelling the growth of the Europe Marketing Automation Software industry. The increasing digital transformation across businesses is a primary driver, compelling organizations to adopt efficient digital marketing strategies. The escalating demand for personalized customer experiences fuels the need for sophisticated automation tools that can segment audiences and deliver tailored content. Technological advancements, particularly in AI and machine learning, are enabling more intelligent automation, predictive analytics, and hyper-personalization, thereby enhancing campaign effectiveness. Furthermore, the imperative for businesses to improve operational efficiency and demonstrate clear marketing ROI necessitates the adoption of automation solutions to streamline workflows and optimize resource allocation.

Challenges in the Europe Marketing Automation Software Industry Market

Despite robust growth, the Europe Marketing Automation Software industry faces several challenges. A significant barrier is the complexity associated with implementing and effectively utilizing these sophisticated platforms, requiring skilled personnel and ongoing training. Data privacy regulations, such as GDPR, necessitate strict adherence, adding a layer of compliance complexity and potential costs for businesses. Integration challenges with existing legacy systems and other software stacks can hinder seamless operation. Moreover, the market is highly competitive, with a crowded vendor landscape that can lead to price pressures and make it difficult for smaller players to gain traction.

Emerging Opportunities in Europe Marketing Automation Software Industry

The Europe Marketing Automation Software industry is ripe with emerging opportunities, driven by evolving technological landscapes and market demands. The growing adoption of AI and machine learning is unlocking new possibilities for predictive analytics, hyper-personalization, and sophisticated customer journey mapping. The increasing demand for omnichannel marketing strategies presents an opportunity for platforms that can seamlessly integrate across diverse digital touchpoints. Furthermore, the expansion of e-commerce and digital services across emerging European markets offers significant potential for market penetration. Strategic partnerships and collaborations between software providers and other technology companies are also expected to drive innovation and create new value propositions for businesses.

Leading Players in the Europe Marketing Automation Software Industry Sector

- Marketo Inc

- Salesforce Inc

- Force

- Salesfusion Inc

- Adobe Systems Inc

- Microsoft Corporation

- SAS Institute

- Oracle Corporation

- Dotmailer Ltd

- Hubspot Inc

- Act-on Software Inc

Key Milestones in Europe Marketing Automation Software Industry Industry

- December 2022: LocaliQ, a digital marketing solutions company, launched a new scheduling management software for small businesses. This software enables small businesses to set up customized scheduling links by setting hours of availability, configuring types of appointments, and even integrating with Google calendar. Additionally, it offers a variety of marketing automation, channel campaign management, customer relationship management (CRM), insight tools, and customized services to support companies and make their resources connect with clients through the most effective channels.

- November 2022: CitiusTech London, a leader in healthcare technology and consulting services, acquired Wilco Source, a salesforce consulting and implementation services provider for healthcare and life sciences companies, and developed multiple accelerators and solutions for marketing automation called Salesforce Marketing Cloud. This acquisition could deepen CitiusTech's healthcare domain expertise, build complementary technology capabilities, expand into new geographies, and strengthen relationships with key clients.

Strategic Outlook for Europe Marketing Automation Software Industry Market

The strategic outlook for the Europe Marketing Automation Software industry is exceptionally positive, characterized by continuous innovation and market expansion. The increasing emphasis on customer-centricity and data-driven marketing will drive the adoption of advanced automation tools. Opportunities lie in developing more integrated and intelligent platforms that leverage AI for predictive analytics and hyper-personalization. Strategic partnerships and a focus on providing tailored solutions for specific industry verticals, such as the growing healthcare segment, will be crucial for sustained growth. As businesses across Europe continue their digital transformation journeys, the demand for efficient, scalable, and impactful marketing automation software is set to surge, creating a fertile ground for market players to thrive.

Europe Marketing Automation Software Industry Segmentation

-

1. Deployment

- 1.1. Cloud-based

- 1.2. On-premise

-

2. Application

- 2.1. Campaign Management

- 2.2. E-mail Marketing

- 2.3. In-bound Marketing

- 2.4. Mobile Marketing

- 2.5. Social Media Marketing

- 2.6. Other Applications

-

3. End-User Verticals

- 3.1. Entertainment and Media

- 3.2. Financial Services

- 3.3. Government

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Retail

- 3.7. Other End-User Verticals

Europe Marketing Automation Software Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Marketing Automation Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Digital Marketing; Rising Demand to Integrate Marketing Efforts

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals Across the Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Digital Marketing is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud-based

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Campaign Management

- 5.2.2. E-mail Marketing

- 5.2.3. In-bound Marketing

- 5.2.4. Mobile Marketing

- 5.2.5. Social Media Marketing

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User Verticals

- 5.3.1. Entertainment and Media

- 5.3.2. Financial Services

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Retail

- 5.3.7. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Germany Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Marketing Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Marketo Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Salesforce Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Force

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Salesfusion Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Adobe Systems Inc *List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Microsoft Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SAS Institute

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Oracle Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dotmailer Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hubspot Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Act-on Software Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Marketo Inc

List of Figures

- Figure 1: Europe Marketing Automation Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Marketing Automation Software Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Marketing Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Marketing Automation Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Europe Marketing Automation Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Marketing Automation Software Industry Revenue Million Forecast, by End-User Verticals 2019 & 2032

- Table 5: Europe Marketing Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Marketing Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Marketing Automation Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 15: Europe Marketing Automation Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Marketing Automation Software Industry Revenue Million Forecast, by End-User Verticals 2019 & 2032

- Table 17: Europe Marketing Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Marketing Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Marketing Automation Software Industry?

The projected CAGR is approximately 14.20%.

2. Which companies are prominent players in the Europe Marketing Automation Software Industry?

Key companies in the market include Marketo Inc, Salesforce Inc, Force, Salesfusion Inc, Adobe Systems Inc *List Not Exhaustive, Microsoft Corporation, SAS Institute, Oracle Corporation, Dotmailer Ltd, Hubspot Inc, Act-on Software Inc.

3. What are the main segments of the Europe Marketing Automation Software Industry?

The market segments include Deployment, Application, End-User Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digital Marketing; Rising Demand to Integrate Marketing Efforts.

6. What are the notable trends driving market growth?

Increasing Demand for Digital Marketing is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals Across the Industry.

8. Can you provide examples of recent developments in the market?

December 2022: LocaliQ, the digital marketing solutions company, launched a new scheduling management software for small businesses. This software enables small businesses to set up customized scheduling links by setting hours of availability, configuring types of appointments, and even integrating with Google calendar. Additionally, it offers a variety of marketing automation, channel campaign management, customer relationship management (CRM), insight tools, and customized services to support companies and make their resources connect with clients through the most effective channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Marketing Automation Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Marketing Automation Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Marketing Automation Software Industry?

To stay informed about further developments, trends, and reports in the Europe Marketing Automation Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence