Key Insights

The global Incident and Emergency Management market is projected to reach $159.7 billion by 2033, expanding at a compound annual growth rate (CAGR) of 6.4%. This growth is driven by heightened global awareness of diverse threats, including natural disasters, public health crises, cyberattacks, and industrial accidents. Organizations are increasingly prioritizing business continuity, asset protection, and life safety through proactive and reactive management systems. The integration of AI, IoT, and cloud computing is transforming the sector, enabling real-time situational awareness, enhanced communication, and optimized response coordination. Web-based platforms, mass notification systems, and disaster recovery solutions are now essential tools for both governmental and enterprise entities navigating complex events.

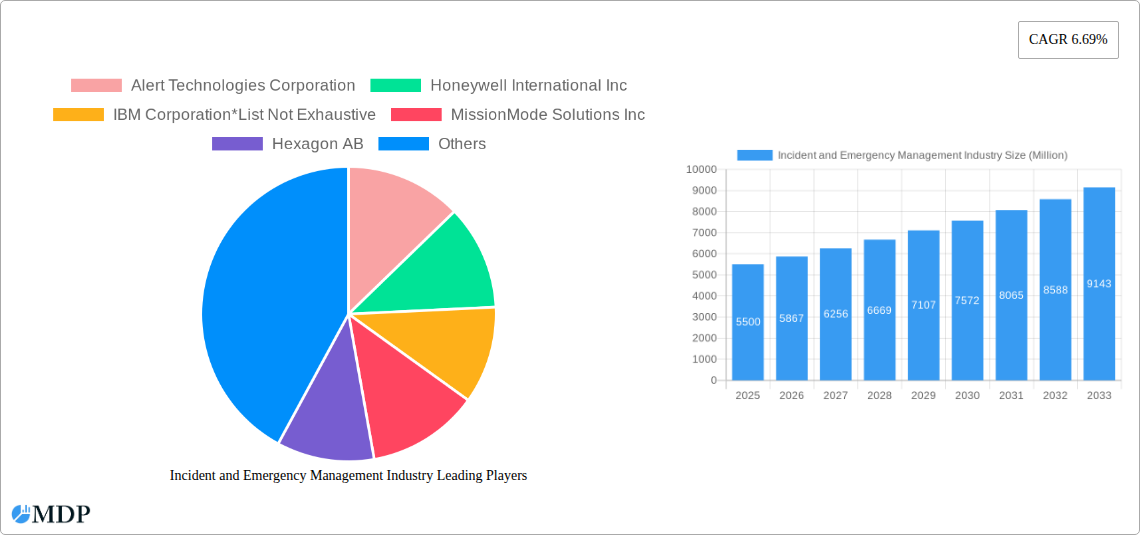

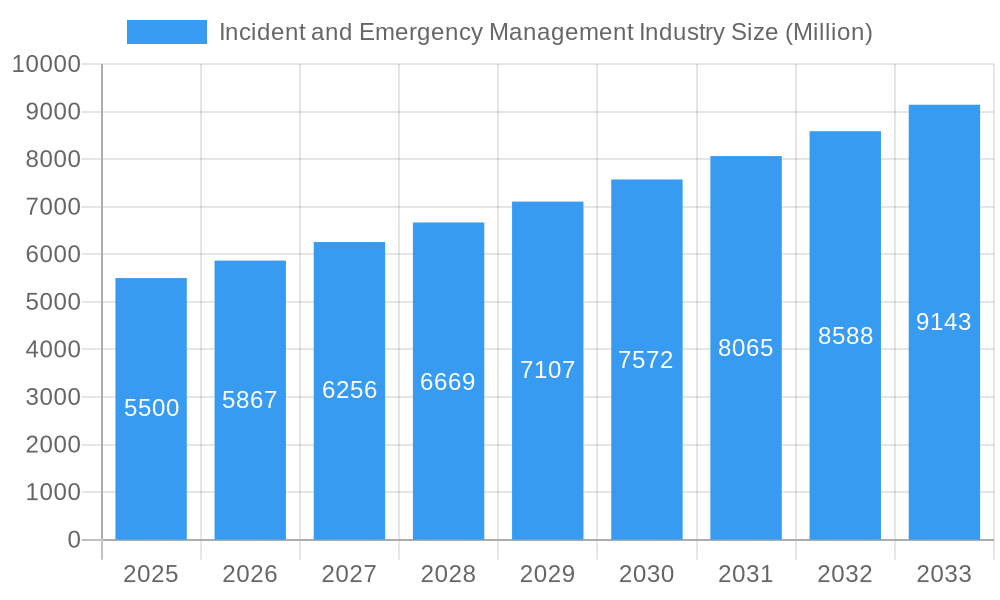

Incident and Emergency Management Industry Market Size (In Billion)

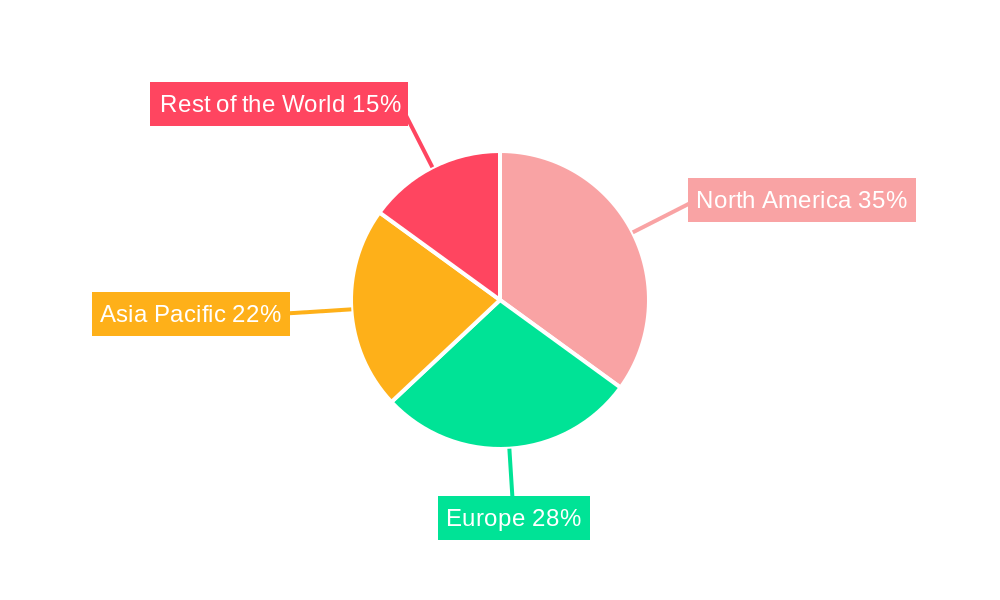

Key market segments exhibit varied growth trajectories. The "System" segment is experiencing robust demand for integrated Emergency/Mass Notification Systems and advanced Web-based Emergency Management Systems, vital for rapid information dissemination and streamlined response efforts. Within "Solution" categories, Geospatial Solutions are gaining traction for their ability to provide critical location-based intelligence, significantly improving situational awareness during emergencies. The "Service" segment, particularly Managed Services, is expanding as organizations increasingly delegate the deployment and management of complex incident and emergency management infrastructure to expert providers. Geographically, North America and Europe currently dominate the market, benefiting from established regulatory frameworks and high adoption rates of advanced technologies. However, the Asia Pacific region is anticipated to be the fastest-growing market, propelled by rapid industrialization, increasing urbanization, and a rising incidence of natural disasters, underscoring the need for effective emergency preparedness.

Incident and Emergency Management Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Incident and Emergency Management market. Covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis provides actionable insights into market dynamics, emerging trends, key players, and future opportunities. Discover how web-based emergency management systems, emergency/mass notification systems, and advanced geospatial solutions are revolutionizing public safety and business continuity. This report is essential for government agencies, BFSI institutions, transportation and logistics providers, healthcare organizations, manufacturing firms, and IT and telecom companies seeking to enhance their disaster recovery and backup systems and overall situational awareness solutions.

Incident and Emergency Management Industry Market Dynamics & Concentration

The Incident and Emergency Management Industry exhibits a dynamic market concentration, characterized by a blend of established players and emerging innovators. Key drivers of innovation include the escalating frequency and severity of natural disasters, increasing geopolitical instability, and the growing adoption of cloud-based solutions. Regulatory frameworks are also playing a pivotal role, with governments worldwide implementing stricter mandates for emergency preparedness and response. Product substitutes, while present in the form of manual processes or fragmented solutions, are steadily being outpaced by integrated digital platforms. End-user trends highlight a strong demand for proactive risk assessment, real-time communication, and data-driven decision-making. Mergers and acquisition (M&A) activities are on the rise, with an estimated 20+ M&A deals recorded in the historical period, indicating strategic consolidation and a drive for market share. Leading companies like Alert Technologies Corporation, Honeywell International Inc, and IBM Corporation are actively shaping the market landscape. The market share of top 5 players is estimated to be 40%, demonstrating moderate concentration with ample room for niche players.

Incident and Emergency Management Industry Industry Trends & Analysis

The Incident and Emergency Management Industry is experiencing robust growth, driven by a confluence of technological advancements and a heightened global awareness of risk. The projected Compound Annual Growth Rate (CAGR) for the forecast period is an impressive 12.5%. This surge is fueled by the increasing adoption of sophisticated emergency/mass notification systems and advanced web-based emergency management systems that offer real-time data analytics and communication capabilities. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analysis of potential incidents, are transforming reactive responses into proactive strategies. Consumer preferences are shifting towards integrated, scalable, and user-friendly platforms that can manage a diverse range of emergencies, from natural disasters to cyber threats. The competitive dynamics are intensifying, with companies focusing on developing comprehensive situational awareness solutions and robust disaster recovery solutions. Market penetration for advanced emergency management software is estimated to reach 65% by the end of the forecast period, indicating a significant shift from traditional methods. The increasing complexity of global risks necessitates continuous investment in resilient infrastructure and preparedness protocols.

Leading Markets & Segments in Incident and Emergency Management Industry

The Government sector emerges as the dominant end-user segment within the Incident and Emergency Management Industry, driven by national security imperatives, public safety mandates, and the need to manage large-scale disaster relief efforts. Within this segment, Emergency/Mass Notification Systems are experiencing unparalleled demand, facilitating rapid communication with citizens during critical events. Regionally, North America is projected to lead the market, attributed to substantial government investment in homeland security, advanced technological infrastructure, and a high prevalence of natural disaster occurrences.

Key drivers for this dominance include:

- Economic Policies: Government funding allocated to emergency preparedness and public safety initiatives.

- Infrastructure: Robust digital infrastructure supporting the deployment and operation of sophisticated emergency management platforms.

- Regulatory Frameworks: Stringent regulations mandating emergency communication and response protocols for public entities.

- Technological Adoption: High receptiveness to adopting new technologies for enhanced incident management.

Among the system segments, Web-based Emergency Management Systems are gaining significant traction due to their scalability, accessibility, and integration capabilities. These systems provide a centralized platform for managing all aspects of incident response, from initial detection to post-event analysis. The Transportation and Logistics sector is also a rapidly growing end-user, requiring sophisticated traffic management systems and disaster recovery solutions to ensure supply chain continuity. The increasing reliance on digital solutions across industries underscores the critical role of effective incident and emergency management in maintaining operational resilience.

Incident and Emergency Management Industry Product Developments

Product development in the Incident and Emergency Management Industry is rapidly advancing, with a focus on AI-powered analytics, enhanced interoperability, and user-centric design. Innovations in geospatial solutions are enabling more precise threat mapping and resource allocation, while integrated situational awareness solutions provide real-time visibility into evolving crises. Companies are developing advanced emergency/mass notification systems capable of multi-channel communication and personalized alerts. The emphasis is on creating comprehensive, cloud-based platforms that offer seamless integration with existing IT infrastructure, thereby enhancing response efficiency and minimizing operational disruptions. Competitive advantages are being gained through specialized features such as predictive modeling for disaster impact, automated workflow management, and advanced data visualization tools.

Key Drivers of Incident and Emergency Management Industry Growth

Several key factors are propelling the growth of the Incident and Emergency Management Industry. Firstly, the increasing frequency and severity of natural disasters globally, including hurricanes, earthquakes, and wildfires, necessitate robust preparedness and response mechanisms. Secondly, rising geopolitical tensions and the threat of terrorism underscore the need for advanced security and emergency management solutions. Thirdly, rapid technological advancements, particularly in AI, IoT, and cloud computing, are enabling the development of more sophisticated and effective emergency management platforms. Finally, stringent government regulations and corporate mandates for business continuity and disaster recovery are driving the adoption of these solutions across various sectors. The projected market size is estimated to reach $150 Billion by 2033.

Challenges in the Incident and Emergency Management Industry Market

Despite its growth trajectory, the Incident and Emergency Management Industry faces several challenges. Regulatory hurdles, particularly differing standards and compliance requirements across various jurisdictions, can impede widespread adoption. The high cost of implementing and maintaining advanced emergency management systems can be a significant barrier for small and medium-sized enterprises. Furthermore, ensuring seamless interoperability between disparate systems and legacy infrastructure poses a technical challenge. Cybersecurity threats also present a constant concern, as these systems often handle sensitive data and critical communication channels. Competitive pressures from numerous vendors offering fragmented solutions can also lead to market fragmentation and customer confusion, impacting the overall effectiveness of emergency response strategies.

Emerging Opportunities in Incident and Emergency Management Industry

Emerging opportunities in the Incident and Emergency Management Industry are primarily driven by technological innovation and the growing recognition of resilience as a strategic imperative. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive risk assessment and real-time scenario modeling presents a significant growth catalyst. The expansion of the Internet of Things (IoT) ecosystem, with its vast network of sensors, offers unprecedented opportunities for enhanced data collection and situational awareness. Strategic partnerships between technology providers, government agencies, and private enterprises are fostering the development of comprehensive, end-to-end solutions. Furthermore, the increasing demand for specialized solutions in sectors like healthcare and critical infrastructure, coupled with the ongoing digital transformation across industries, opens new avenues for market penetration and expansion. The global market is projected to exceed $150 Billion by the end of the forecast period.

Leading Players in the Incident and Emergency Management Industry Sector

The Incident and Emergency Management Industry is shaped by a diverse range of leading companies that offer specialized solutions and comprehensive platforms. These key players are instrumental in driving innovation and market growth. The list of prominent companies includes:

- Alert Technologies Corporation

- Honeywell International Inc

- IBM Corporation

- MissionMode Solutions Inc

- Hexagon AB

- MetricStream Inc

- Resolver Inc

- Haystax Technology

- Eccentex Corporation

- NEC Corporation

- Veoci (Grey Wall Software LLC)

- The Response Group

- NC4 Inc

This list is not exhaustive, as the market continues to evolve with new entrants and strategic collaborations.

Key Milestones in Incident and Emergency Management Industry Industry

The Incident and Emergency Management Industry has witnessed significant developments shaping its trajectory. These milestones highlight the increasing sophistication and strategic importance of the sector:

- January 2023: Genasys Inc. announced a Zonehaven software-as-a-service (SaaS) and Genasys Emergency Management (GEM) contract with three contiguous Utah counties. Emergency management officials will leverage GEM and Zonehaven to alert and evacuate individuals facing life safety hazards such as flooding, wildfires, and oil and natural gas incidents.

- December 2022: Motorola Solutions completed the acquisition of Rave Mobile Safety, a prominent leader in mass notification and incident management solutions that aid organizations and public safety agencies in communication and collaboration during emergencies.

These events underscore the ongoing consolidation, innovation, and strategic investments within the industry, reflecting its growing significance in ensuring public safety and organizational resilience.

Strategic Outlook for Incident and Emergency Management Industry Market

The strategic outlook for the Incident and Emergency Management Industry market is exceptionally positive, driven by an escalating global need for robust resilience and rapid response capabilities. Key growth accelerators include the continuous advancement of AI and IoT technologies, enabling predictive analytics and enhanced real-time situational awareness. The increasing adoption of cloud-based solutions is facilitating greater scalability, accessibility, and interoperability across diverse emergency management platforms. Furthermore, a heightened awareness of climate change impacts and evolving security threats is compelling governments and private organizations to prioritize investments in comprehensive emergency preparedness strategies. Strategic partnerships and mergers are expected to continue, leading to more integrated and holistic solutions. The market is poised for sustained expansion as organizations across all sectors recognize the indispensable value of proactive incident and emergency management.

Incident and Emergency Management Industry Segmentation

-

1. System

- 1.1. Web-based Emergency Management System

- 1.2. Emergency/Mass Notification System

- 1.3. Traffic Management System

- 1.4. Safety Management System

- 1.5. Disaster Recovery and Backup Systems

- 1.6. Other Systems

-

2. Solution

- 2.1. Geospatial Solution

- 2.2. Disaster Recovery Solution

- 2.3. Situational Awareness Solution

-

3. Service

- 3.1. Professional Service

- 3.2. Managed Service

-

4. End-User

- 4.1. Government

- 4.2. BFSI

- 4.3. Transportation and Logistics

- 4.4. Healthcare

- 4.5. Manufacturing

- 4.6. IT and Telecom

- 4.7. Other End-Users

Incident and Emergency Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Incident and Emergency Management Industry Regional Market Share

Geographic Coverage of Incident and Emergency Management Industry

Incident and Emergency Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Threats from Extremists and Natural Disasters; Revamp of Legacy Incident and Emergency Management Solutions; Favorable Government Polices and Increased Financial Outlay from the Public Sector

- 3.3. Market Restrains

- 3.3.1. Cost and Infrastructural Issues remain a Key Challenge in New Markets; Low Awareness Levels and Disconnection between the Disaster Risk Reduction Policy and the Emergency Management in Practice

- 3.4. Market Trends

- 3.4.1. Increase in Natural Disasters Worldwide to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Incident and Emergency Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Web-based Emergency Management System

- 5.1.2. Emergency/Mass Notification System

- 5.1.3. Traffic Management System

- 5.1.4. Safety Management System

- 5.1.5. Disaster Recovery and Backup Systems

- 5.1.6. Other Systems

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Geospatial Solution

- 5.2.2. Disaster Recovery Solution

- 5.2.3. Situational Awareness Solution

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Professional Service

- 5.3.2. Managed Service

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Government

- 5.4.2. BFSI

- 5.4.3. Transportation and Logistics

- 5.4.4. Healthcare

- 5.4.5. Manufacturing

- 5.4.6. IT and Telecom

- 5.4.7. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Incident and Emergency Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Web-based Emergency Management System

- 6.1.2. Emergency/Mass Notification System

- 6.1.3. Traffic Management System

- 6.1.4. Safety Management System

- 6.1.5. Disaster Recovery and Backup Systems

- 6.1.6. Other Systems

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Geospatial Solution

- 6.2.2. Disaster Recovery Solution

- 6.2.3. Situational Awareness Solution

- 6.3. Market Analysis, Insights and Forecast - by Service

- 6.3.1. Professional Service

- 6.3.2. Managed Service

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Government

- 6.4.2. BFSI

- 6.4.3. Transportation and Logistics

- 6.4.4. Healthcare

- 6.4.5. Manufacturing

- 6.4.6. IT and Telecom

- 6.4.7. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Incident and Emergency Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Web-based Emergency Management System

- 7.1.2. Emergency/Mass Notification System

- 7.1.3. Traffic Management System

- 7.1.4. Safety Management System

- 7.1.5. Disaster Recovery and Backup Systems

- 7.1.6. Other Systems

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Geospatial Solution

- 7.2.2. Disaster Recovery Solution

- 7.2.3. Situational Awareness Solution

- 7.3. Market Analysis, Insights and Forecast - by Service

- 7.3.1. Professional Service

- 7.3.2. Managed Service

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Government

- 7.4.2. BFSI

- 7.4.3. Transportation and Logistics

- 7.4.4. Healthcare

- 7.4.5. Manufacturing

- 7.4.6. IT and Telecom

- 7.4.7. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Incident and Emergency Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Web-based Emergency Management System

- 8.1.2. Emergency/Mass Notification System

- 8.1.3. Traffic Management System

- 8.1.4. Safety Management System

- 8.1.5. Disaster Recovery and Backup Systems

- 8.1.6. Other Systems

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Geospatial Solution

- 8.2.2. Disaster Recovery Solution

- 8.2.3. Situational Awareness Solution

- 8.3. Market Analysis, Insights and Forecast - by Service

- 8.3.1. Professional Service

- 8.3.2. Managed Service

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Government

- 8.4.2. BFSI

- 8.4.3. Transportation and Logistics

- 8.4.4. Healthcare

- 8.4.5. Manufacturing

- 8.4.6. IT and Telecom

- 8.4.7. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Rest of the World Incident and Emergency Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Web-based Emergency Management System

- 9.1.2. Emergency/Mass Notification System

- 9.1.3. Traffic Management System

- 9.1.4. Safety Management System

- 9.1.5. Disaster Recovery and Backup Systems

- 9.1.6. Other Systems

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Geospatial Solution

- 9.2.2. Disaster Recovery Solution

- 9.2.3. Situational Awareness Solution

- 9.3. Market Analysis, Insights and Forecast - by Service

- 9.3.1. Professional Service

- 9.3.2. Managed Service

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Government

- 9.4.2. BFSI

- 9.4.3. Transportation and Logistics

- 9.4.4. Healthcare

- 9.4.5. Manufacturing

- 9.4.6. IT and Telecom

- 9.4.7. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Alert Technologies Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MissionMode Solutions Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hexagon AB

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 MetricStream Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Resolver Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Haystax Technology

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Eccentex Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NEC Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Veoci (Grey Wall Software LLC)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Response Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 NC4 Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Alert Technologies Corporation

List of Figures

- Figure 1: Global Incident and Emergency Management Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Incident and Emergency Management Industry Revenue (billion), by System 2025 & 2033

- Figure 3: North America Incident and Emergency Management Industry Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Incident and Emergency Management Industry Revenue (billion), by Solution 2025 & 2033

- Figure 5: North America Incident and Emergency Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 6: North America Incident and Emergency Management Industry Revenue (billion), by Service 2025 & 2033

- Figure 7: North America Incident and Emergency Management Industry Revenue Share (%), by Service 2025 & 2033

- Figure 8: North America Incident and Emergency Management Industry Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America Incident and Emergency Management Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Incident and Emergency Management Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Incident and Emergency Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Incident and Emergency Management Industry Revenue (billion), by System 2025 & 2033

- Figure 13: Europe Incident and Emergency Management Industry Revenue Share (%), by System 2025 & 2033

- Figure 14: Europe Incident and Emergency Management Industry Revenue (billion), by Solution 2025 & 2033

- Figure 15: Europe Incident and Emergency Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 16: Europe Incident and Emergency Management Industry Revenue (billion), by Service 2025 & 2033

- Figure 17: Europe Incident and Emergency Management Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Incident and Emergency Management Industry Revenue (billion), by End-User 2025 & 2033

- Figure 19: Europe Incident and Emergency Management Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Europe Incident and Emergency Management Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Incident and Emergency Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Incident and Emergency Management Industry Revenue (billion), by System 2025 & 2033

- Figure 23: Asia Pacific Incident and Emergency Management Industry Revenue Share (%), by System 2025 & 2033

- Figure 24: Asia Pacific Incident and Emergency Management Industry Revenue (billion), by Solution 2025 & 2033

- Figure 25: Asia Pacific Incident and Emergency Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 26: Asia Pacific Incident and Emergency Management Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Asia Pacific Incident and Emergency Management Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific Incident and Emergency Management Industry Revenue (billion), by End-User 2025 & 2033

- Figure 29: Asia Pacific Incident and Emergency Management Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Incident and Emergency Management Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Incident and Emergency Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Incident and Emergency Management Industry Revenue (billion), by System 2025 & 2033

- Figure 33: Rest of the World Incident and Emergency Management Industry Revenue Share (%), by System 2025 & 2033

- Figure 34: Rest of the World Incident and Emergency Management Industry Revenue (billion), by Solution 2025 & 2033

- Figure 35: Rest of the World Incident and Emergency Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Rest of the World Incident and Emergency Management Industry Revenue (billion), by Service 2025 & 2033

- Figure 37: Rest of the World Incident and Emergency Management Industry Revenue Share (%), by Service 2025 & 2033

- Figure 38: Rest of the World Incident and Emergency Management Industry Revenue (billion), by End-User 2025 & 2033

- Figure 39: Rest of the World Incident and Emergency Management Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Rest of the World Incident and Emergency Management Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Incident and Emergency Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Incident and Emergency Management Industry Revenue billion Forecast, by System 2020 & 2033

- Table 2: Global Incident and Emergency Management Industry Revenue billion Forecast, by Solution 2020 & 2033

- Table 3: Global Incident and Emergency Management Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 4: Global Incident and Emergency Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global Incident and Emergency Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Incident and Emergency Management Industry Revenue billion Forecast, by System 2020 & 2033

- Table 7: Global Incident and Emergency Management Industry Revenue billion Forecast, by Solution 2020 & 2033

- Table 8: Global Incident and Emergency Management Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 9: Global Incident and Emergency Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global Incident and Emergency Management Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Incident and Emergency Management Industry Revenue billion Forecast, by System 2020 & 2033

- Table 14: Global Incident and Emergency Management Industry Revenue billion Forecast, by Solution 2020 & 2033

- Table 15: Global Incident and Emergency Management Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 16: Global Incident and Emergency Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 17: Global Incident and Emergency Management Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Incident and Emergency Management Industry Revenue billion Forecast, by System 2020 & 2033

- Table 23: Global Incident and Emergency Management Industry Revenue billion Forecast, by Solution 2020 & 2033

- Table 24: Global Incident and Emergency Management Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 25: Global Incident and Emergency Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Incident and Emergency Management Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: China Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Japan Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: South Korea Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Incident and Emergency Management Industry Revenue billion Forecast, by System 2020 & 2033

- Table 33: Global Incident and Emergency Management Industry Revenue billion Forecast, by Solution 2020 & 2033

- Table 34: Global Incident and Emergency Management Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 35: Global Incident and Emergency Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Global Incident and Emergency Management Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Latin America Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Middle East and Africa Incident and Emergency Management Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Incident and Emergency Management Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Incident and Emergency Management Industry?

Key companies in the market include Alert Technologies Corporation, Honeywell International Inc, IBM Corporation*List Not Exhaustive, MissionMode Solutions Inc, Hexagon AB, MetricStream Inc, Resolver Inc, Haystax Technology, Eccentex Corporation, NEC Corporation, Veoci (Grey Wall Software LLC), The Response Group, NC4 Inc.

3. What are the main segments of the Incident and Emergency Management Industry?

The market segments include System, Solution, Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 159.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Threats from Extremists and Natural Disasters; Revamp of Legacy Incident and Emergency Management Solutions; Favorable Government Polices and Increased Financial Outlay from the Public Sector.

6. What are the notable trends driving market growth?

Increase in Natural Disasters Worldwide to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Cost and Infrastructural Issues remain a Key Challenge in New Markets; Low Awareness Levels and Disconnection between the Disaster Risk Reduction Policy and the Emergency Management in Practice.

8. Can you provide examples of recent developments in the market?

January 2023: Genasys Inc., one of the global leaders in critical communications systems and solutions that help protect and keep people safe, announced a Zonehaven software-as-a-service (SaaS) and Genasys Emergency Management (GEM) contract from three contiguous Utah counties. Emergency management officials will use Genasys Emergency Management (GEM) and Zonehaven to alert and evacuate people endangered by flooding, wildfires, oil and natural gas incidents, and other life safety hazards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Incident and Emergency Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Incident and Emergency Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Incident and Emergency Management Industry?

To stay informed about further developments, trends, and reports in the Incident and Emergency Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence