Key Insights

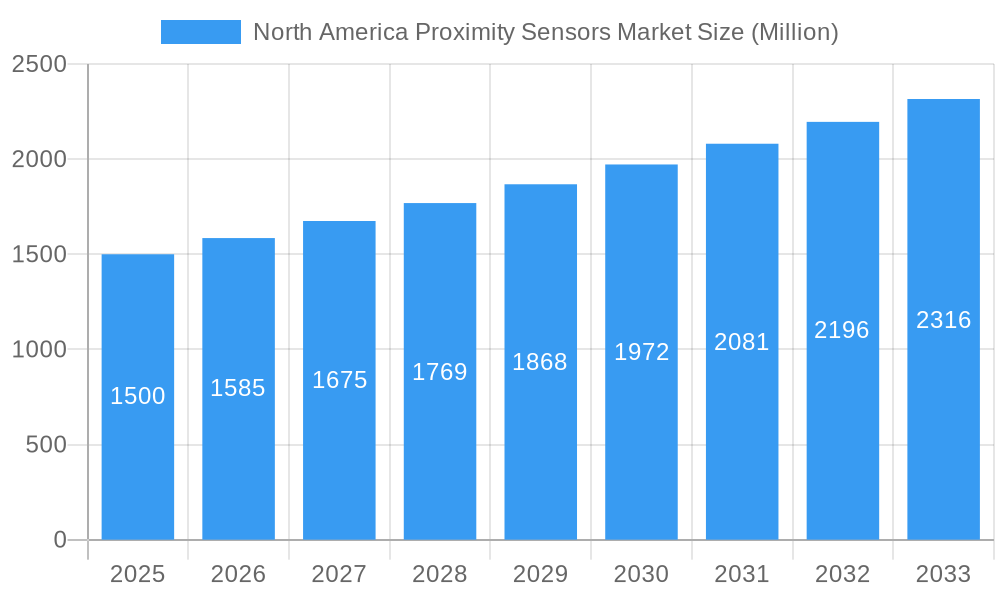

The North America Proximity Sensors Market is projected for significant growth, driven by the widespread adoption of automation across key industrial sectors. With an estimated market size of $1.24 billion in the base year 2025, and an anticipated Compound Annual Growth Rate (CAGR) of 5.2%, the market is expected to expand considerably by 2033. This growth is fundamentally linked to industrial modernization and the expansion of smart manufacturing. Key drivers include the increasing implementation of Industry 4.0 technologies, the imperative for enhanced operational efficiency, and stringent safety regulations demanding precise object detection and positional monitoring. Major contributing sectors include automotive, with its focus on advanced driver-assistance systems (ADAS) and automated production, and electronics and semiconductor manufacturing, which rely on precise assembly and quality control. The aerospace and defense sector's requirement for reliable sensing solutions in critical applications will also sustain market momentum.

North America Proximity Sensors Market Market Size (In Billion)

Emerging trends, such as the integration of IoT capabilities into proximity sensors for real-time data exchange and predictive maintenance, are further shaping market trajectory. Technological advancements in inductive, photoelectric, and magnetic sensors, leading to improved accuracy, durability, and versatility, are also propelling market expansion. While significant growth is evident, potential restraints include the initial investment cost for advanced sensor technologies and the requirement for skilled personnel. Nevertheless, the substantial benefits of increased productivity, reduced downtime, and superior product quality are poised to outweigh these challenges, ensuring a robust growth trajectory for the North America proximity sensors market throughout the forecast period.

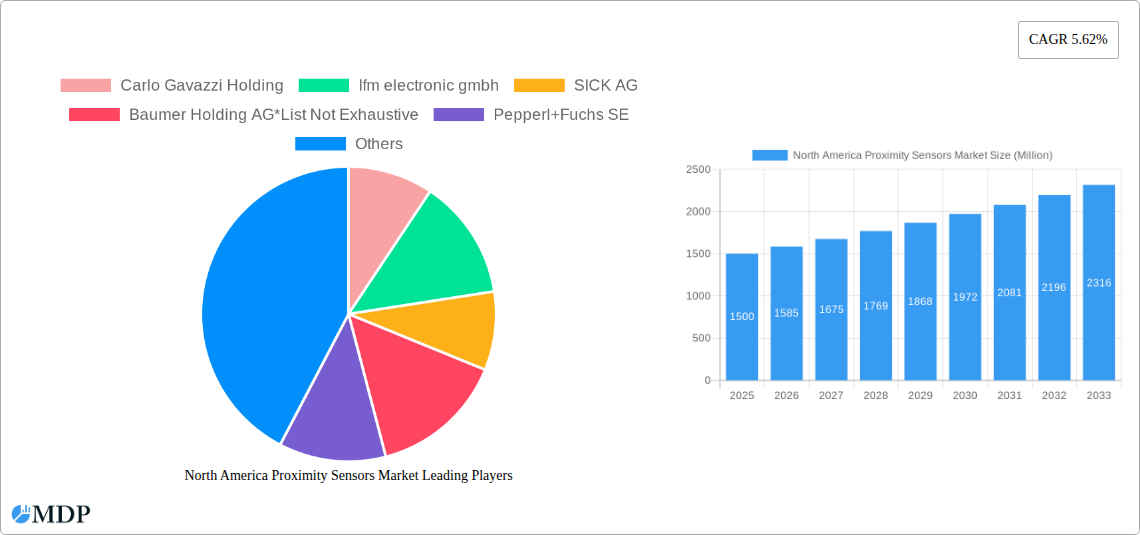

North America Proximity Sensors Market Company Market Share

This report provides a comprehensive analysis of the North America Proximity Sensors Market, offering critical insights into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and strategic outlooks. Our research covers the historical period of 2019–2024, using 2025 as the base year and projecting through 2033. We examine the applications of inductive, capacitive, photoelectric, and magnetic proximity sensors across industrial, automotive, electronics and semiconductor manufacturing, aerospace and defense, packaging, and other end-use industries.

North America Proximity Sensors Market Market Dynamics & Concentration

The North America Proximity Sensors Market is characterized by moderate to high concentration, with a few key players dominating a significant portion of the market share. Leading companies like OMRON Corporation, Rockwell Automation Inc., Pepperl+Fuchs SE, and SICK AG hold substantial sway, driven by their extensive product portfolios and strong distribution networks. Innovation remains a primary driver, fueled by the relentless pursuit of enhanced sensing accuracy, miniaturization, and integration capabilities for Industry 4.0 applications. The regulatory landscape, while generally supportive of industrial automation, can influence product development and adoption, particularly concerning safety and environmental standards. Product substitutes, though less sophisticated, exist in certain niche applications, but the advanced capabilities of modern proximity sensors often outweigh their cost. End-user trends are overwhelmingly in favor of increased automation, smart manufacturing, and the deployment of IoT devices, directly boosting demand for proximity sensors. Merger and acquisition (M&A) activities, while not overtly frequent, have been strategic, often aimed at acquiring new technologies or expanding market reach. For instance, there have been 3 notable M&A deals in the historical period, contributing to market consolidation.

North America Proximity Sensors Market Industry Trends & Analysis

The North America Proximity Sensors Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033. This expansion is primarily driven by the accelerating adoption of automation across various industries, particularly in manufacturing, automotive, and electronics. The push towards Industry 4.0 and the Industrial Internet of Things (IIoT) is a significant catalyst, demanding intelligent and connected sensing solutions for real-time data acquisition and process optimization. Technological disruptions, such as the increasing prevalence of AI and machine learning in sensor data analysis, are enhancing the functionality and predictive capabilities of proximity sensors, making them indispensable for predictive maintenance and quality control. Consumer preferences are shifting towards higher precision, smaller form factors, and enhanced durability in sensor technologies, catering to the evolving needs of advanced manufacturing processes and robotics. The competitive landscape is characterized by continuous innovation in sensor technology, with companies investing heavily in research and development to offer differentiated products. This includes advancements in wireless connectivity, self-diagnostics, and improved resistance to harsh environmental conditions. Market penetration is steadily increasing as industries recognize the tangible benefits of proximity sensors in improving efficiency, reducing operational costs, and enhancing safety. The automotive sector, in particular, is a major consumer, integrating proximity sensors for advanced driver-assistance systems (ADAS) and in-vehicle diagnostics. Similarly, the electronics and semiconductor manufacturing segments are leveraging these sensors for highly precise assembly and quality inspection.

Leading Markets & Segments in North America Proximity Sensors Market

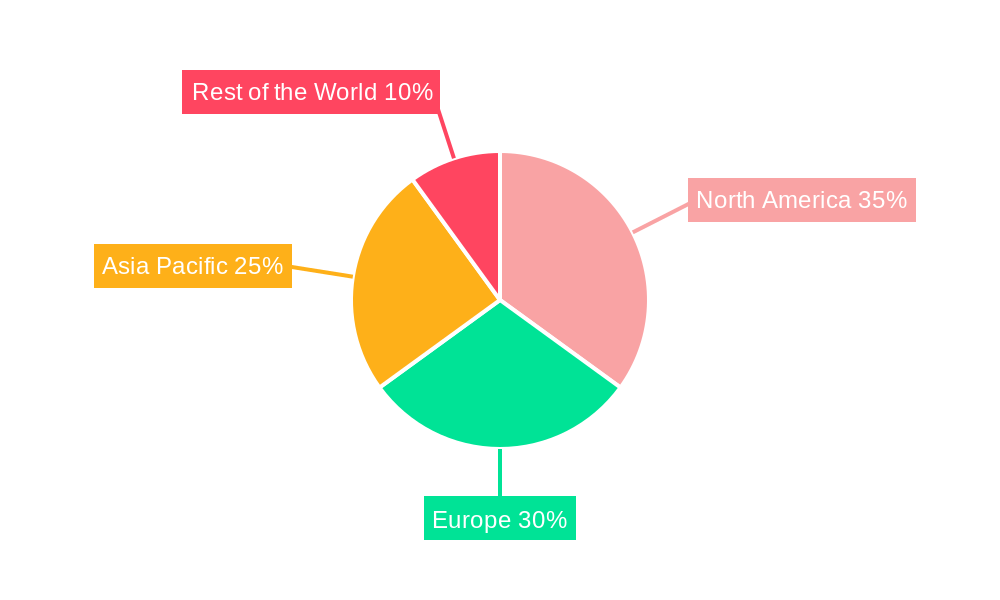

The Industrial segment stands as the dominant end-user across the North America Proximity Sensors Market, driven by widespread automation initiatives and the need for robust sensing solutions in factory settings. Within this segment, Inductive proximity sensors represent the largest technology category due to their reliability, cost-effectiveness, and suitability for detecting metallic objects in demanding industrial environments. The United States is the leading market country, owing to its advanced manufacturing base, significant automotive production, and substantial investments in technological innovation and automation. Canada and Mexico also contribute significantly, fueled by growing manufacturing sectors and cross-border trade in automotive and industrial goods.

Key Drivers for Dominance (Industrial Segment):

- Industry 4.0 Adoption: The ongoing digital transformation of manufacturing facilities necessitates advanced sensing for real-time data and control.

- Automation Expansion: Companies are increasingly automating processes to boost productivity, reduce labor costs, and improve consistency.

- Safety Regulations: Stricter workplace safety mandates drive the adoption of proximity sensors for emergency stops and proximity detection.

- Maintenance and Predictive Analytics: Sensors are crucial for gathering data that enables predictive maintenance, minimizing downtime.

Key Drivers for Dominance (Inductive Technology):

- Cost-Effectiveness: Inductive sensors offer a favorable price-to-performance ratio for many industrial applications.

- Durability: Their solid-state nature and lack of moving parts make them resistant to dust, moisture, and vibrations.

- Versatility: Capable of detecting a wide range of ferrous and non-ferrous metals, they are suitable for diverse detection tasks.

Key Drivers for Dominance (United States Market):

- Manufacturing Hub: A large and diversified manufacturing base across numerous sectors.

- Automotive Industry: Significant production volume and a strong focus on ADAS and manufacturing automation.

- R&D Investment: Substantial investment in research and development for new sensing technologies.

- Government Initiatives: Policies supporting advanced manufacturing and technological adoption.

North America Proximity Sensors Market Product Developments

Recent product developments in the North America Proximity Sensors Market are heavily focused on enhancing intelligent sensing capabilities and seamless integration into IoT ecosystems. Innovations include miniaturized sensors with improved environmental resistance, advanced diagnostic features for predictive maintenance, and expanded communication protocols for better interoperability. Companies are developing proximity sensors with integrated machine learning algorithms for object recognition and anomaly detection, providing richer data beyond simple presence detection. These advancements offer manufacturers greater control, efficiency, and flexibility in their automated processes.

Key Drivers of North America Proximity Sensors Market Growth

The North America Proximity Sensors Market is propelled by several key drivers. The relentless march of Industry 4.0 and IoT adoption necessitates sophisticated sensing for connected operations. Technological advancements in miniaturization, accuracy, and communication protocols are expanding application possibilities. The automotive sector's demand for ADAS and automation is a significant growth engine. Furthermore, government initiatives promoting advanced manufacturing and digital transformation are fostering a conducive environment for sensor deployment.

Challenges in the North America Proximity Sensors Market Market

Despite the positive outlook, the North America Proximity Sensors Market faces several challenges. Supply chain disruptions, as seen in recent global events, can impact raw material availability and lead times. Increasing price sensitivity in certain market segments can create pressure on profit margins. The need for skilled labor to install, maintain, and integrate complex sensing systems can also be a constraint. Lastly, evolving cybersecurity threats in connected industrial environments require robust security measures for sensor networks.

Emerging Opportunities in North America Proximity Sensors Market

Emerging opportunities lie in the expansion of smart warehousing and logistics, where proximity sensors are crucial for automated material handling and inventory management. The growing adoption of collaborative robots (cobots) in manufacturing environments presents a significant opportunity for safety and proximity sensing solutions. Furthermore, the development of energy-efficient proximity sensors catering to sustainability initiatives and the increasing demand for specialized sensors in harsh or extreme environments (e.g., oil and gas, mining) offer substantial growth avenues.

Leading Players in the North America Proximity Sensors Market Sector

- Carlo Gavazzi Holding

- Ifm electronic gmbh

- SICK AG

- Baumer Holding AG

- Pepperl+Fuchs SE

- Hans Turck GmbH & Co KG

- Banner Engineering Corp

- OMRON Corporation

- Rockwell Automation Inc

Key Milestones in North America Proximity Sensors Market Industry

- 2019: Increased integration of wireless capabilities in inductive and photoelectric sensors for easier deployment in smart factories.

- 2020: Introduction of AI-powered algorithms for enhanced object recognition in photoelectric proximity sensors.

- 2021: Significant surge in demand for proximity sensors in automotive manufacturing due to the ramp-up of ADAS features.

- 2022: Development of highly robust and compact magnetic proximity sensors for extreme environmental applications.

- 2023: Expansion of IoT-enabled proximity sensors with advanced diagnostic and predictive maintenance features.

- 2024: Growing adoption of IO-Link technology for simplified parameterization and data management of proximity sensors.

Strategic Outlook for North America Proximity Sensors Market Market

The strategic outlook for the North America Proximity Sensors Market is exceptionally strong, driven by continued technological innovation and the ubiquitous demand for automation. Future growth will be fueled by the integration of advanced analytics, AI, and enhanced connectivity into sensor technologies, creating more intelligent and self-optimizing industrial systems. Strategic partnerships between sensor manufacturers and automation solution providers, along with a focus on niche application development, will be crucial for sustained market expansion and competitive advantage in the coming years.

North America Proximity Sensors Market Segmentation

-

1. Technology

- 1.1. Inductive

- 1.2. Capacitive

- 1.3. Photoelectric

- 1.4. Magnetic

-

2. End-User

- 2.1. Industrial

- 2.2. Automotive

- 2.3. Electronics and Semiconductor Manufacturing

- 2.4. Aerospace and Defense

- 2.5. Packaging

- 2.6. Other End-use Applications

North America Proximity Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Proximity Sensors Market Regional Market Share

Geographic Coverage of North America Proximity Sensors Market

North America Proximity Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Industrial Automation; Increase in Demand for Non-contact Sensing Technology

- 3.3. Market Restrains

- 3.3.1. ; Limitations in Sensing Capabilities

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Proximity Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Inductive

- 5.1.2. Capacitive

- 5.1.3. Photoelectric

- 5.1.4. Magnetic

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Industrial

- 5.2.2. Automotive

- 5.2.3. Electronics and Semiconductor Manufacturing

- 5.2.4. Aerospace and Defense

- 5.2.5. Packaging

- 5.2.6. Other End-use Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carlo Gavazzi Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ifm electronic gmbh

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SICK AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Baumer Holding AG*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pepperl+Fuchs SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hans Turck GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Banner Engineering Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OMRON Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rockwell Automation Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Carlo Gavazzi Holding

List of Figures

- Figure 1: North America Proximity Sensors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Proximity Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: North America Proximity Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: North America Proximity Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: North America Proximity Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Proximity Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: North America Proximity Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: North America Proximity Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Proximity Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Proximity Sensors Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the North America Proximity Sensors Market?

Key companies in the market include Carlo Gavazzi Holding, Ifm electronic gmbh, SICK AG, Baumer Holding AG*List Not Exhaustive, Pepperl+Fuchs SE, Hans Turck GmbH & Co KG, Banner Engineering Corp, OMRON Corporation, Rockwell Automation Inc.

3. What are the main segments of the North America Proximity Sensors Market?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.24 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Industrial Automation; Increase in Demand for Non-contact Sensing Technology.

6. What are the notable trends driving market growth?

Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; Limitations in Sensing Capabilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Proximity Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Proximity Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Proximity Sensors Market?

To stay informed about further developments, trends, and reports in the North America Proximity Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence