Key Insights

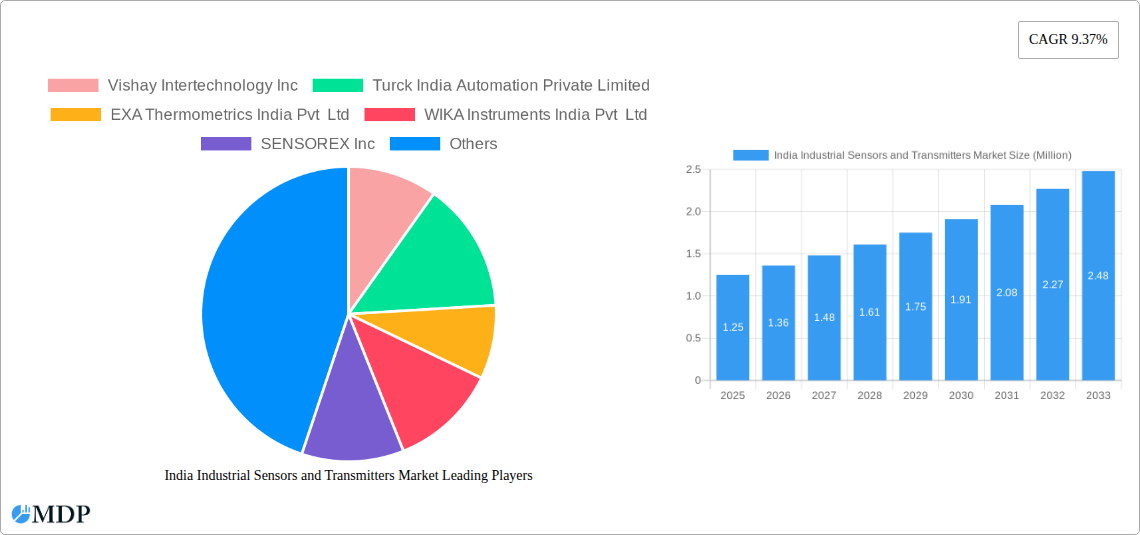

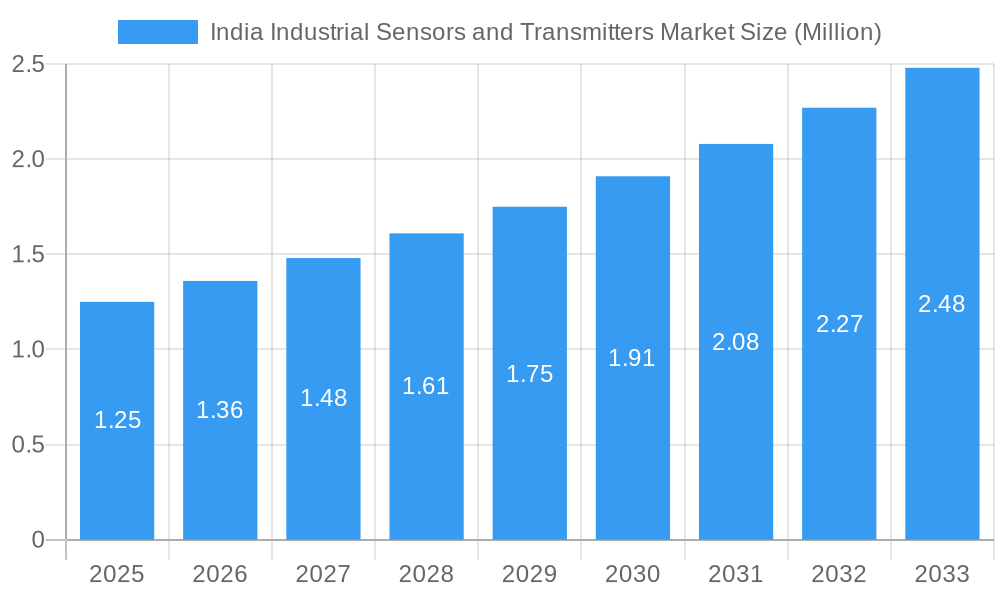

The India Industrial Sensors and Transmitters Market is poised for significant expansion, projected to reach a substantial size with a robust Compound Annual Growth Rate (CAGR) of 9.37% over the forecast period of 2025-2033. This upward trajectory is fueled by a confluence of factors, including the accelerating pace of industrial automation across diverse sectors and the increasing demand for precise process control and monitoring. Key market drivers include the government's push for 'Make in India' initiatives, encouraging domestic manufacturing and, consequently, the adoption of advanced industrial instrumentation. Furthermore, the burgeoning petrochemical, chemical and fertilizer, and oil and gas industries are significant contributors, demanding high-performance sensors and transmitters for efficiency, safety, and regulatory compliance. The power sector's ongoing modernization and expansion also represent a substantial opportunity, with a growing need for reliable monitoring solutions.

India Industrial Sensors and Transmitters Market Market Size (In Million)

The market's dynamism is further underscored by the segmentations observed. Within sensor types, pressure, temperature, and flow sensors are anticipated to witness sustained demand due to their critical role in a multitude of industrial processes. Transmitters and other specialized sensors are also expected to gain traction as industries seek integrated and intelligent solutions. On the end-user front, while the petrochemical, chemicals and fertilizers, and oil and gas sectors remain dominant, the food and beverage and life sciences industries are emerging as significant growth areas, driven by stringent quality control requirements and the increasing adoption of automation. While the market benefits from these growth drivers, potential restraints such as fluctuating raw material prices and the need for skilled labor for installation and maintenance could pose challenges. However, the overall outlook remains strongly positive, indicating a thriving market for industrial sensors and transmitters in India.

India Industrial Sensors and Transmitters Market Company Market Share

Unlock crucial insights into the burgeoning Indian Industrial Sensors and Transmitters market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, emerging trends, leading segments, and key players. This report is essential for stakeholders seeking to understand market concentration, innovation drivers, regulatory landscapes, and future growth trajectories in this vital sector.

India Industrial Sensors and Transmitters Market Market Dynamics & Concentration

The India Industrial Sensors and Transmitters market exhibits a moderate level of concentration, characterized by the presence of both established global players and a growing number of domestic manufacturers. Innovation is primarily driven by the increasing adoption of Industry 4.0 technologies, the demand for smart manufacturing, and the need for enhanced efficiency and safety across various industrial sectors. Regulatory frameworks, particularly those related to industrial safety, environmental compliance, and data security, play a significant role in shaping market entry and product development. The availability of cost-effective product substitutes and the continuous technological advancements in sensor capabilities also influence market dynamics. End-user trends highlight a growing preference for integrated solutions and IoT-enabled devices, leading to a demand for sensors that offer real-time data analytics and remote monitoring capabilities. Mergers and acquisitions (M&A) activities, while not extensive, are strategic, focusing on consolidating market share, acquiring advanced technologies, or expanding product portfolios. For instance, the market has witnessed several smaller acquisitions of specialized technology firms by larger entities to enhance their offerings in areas like IoT connectivity and AI-powered analytics.

- Market Share Landscape: Dominated by a mix of multinational corporations and leading Indian companies, with top players holding an estimated combined market share of 45-55%.

- Innovation Drivers: Industry 4.0 adoption, IIoT integration, demand for precision monitoring, automation, and predictive maintenance solutions.

- Regulatory Impact: Growing emphasis on safety standards, environmental regulations, and cybersecurity mandates.

- Product Substitutes: While direct substitutes are limited for specialized sensors, advancements in software-based analytics and simulation can sometimes reduce the immediate need for certain hardware deployments.

- End-User Demands: Shift towards intelligent, connected, and energy-efficient sensor solutions.

- M&A Activity: Strategic acquisitions focused on technology integration and market reach, with an estimated XX M&A deal counts over the historical period.

India Industrial Sensors and Transmitters Market Industry Trends & Analysis

The India Industrial Sensors and Transmitters market is poised for substantial growth, driven by a confluence of technological advancements, evolving end-user needs, and supportive government initiatives. The increasing digitalization of industries, propelled by the "Make in India" initiative and the growing adoption of Industry 4.0 principles, is a primary catalyst. This translates into a heightened demand for sophisticated sensors and transmitters capable of delivering precise measurements, real-time data, and seamless integration into automated systems. The market is witnessing a significant surge in demand for intelligent sensors that not only measure parameters but also process and communicate data effectively, supporting applications like predictive maintenance, asset tracking, and process optimization. The expansion of sectors such as petrochemicals, power generation, and water treatment further fuels this growth, as these industries rely heavily on accurate and reliable sensing technologies for operational efficiency and safety.

Technological disruptions are a constant feature, with advancements in IoT, AI, and machine learning enabling the development of smarter, more connected sensor solutions. Wireless sensor technologies are gaining traction, reducing installation costs and offering greater flexibility in deployment. Miniaturization and increased ruggedness are also key trends, allowing sensors to operate in harsh industrial environments. Consumer preferences are shifting towards solutions that offer a lower total cost of ownership, enhanced reliability, and ease of integration. This is pushing manufacturers to develop user-friendly interfaces and cloud-enabled platforms for data management and analysis. The competitive landscape is intense, with a healthy mix of global giants and agile domestic players competing on price, innovation, and service. The estimated Compound Annual Growth Rate (CAGR) for the India Industrial Sensors and Transmitters market is projected to be approximately 8-10% during the forecast period, reflecting robust market penetration and sustained demand. The market penetration of advanced industrial sensors is estimated to increase from around 40% in the historical period to over 65% by the end of the forecast period, indicating a significant shift towards technologically advanced solutions.

Leading Markets & Segments in India Industrial Sensors and Transmitters Market

The India Industrial Sensors and Transmitters market is characterized by strong performance across several key segments, with specific end-user industries and sensor types emerging as dominant forces.

Dominant End-User Industries:

- Power: This sector represents a significant market share due to the continuous need for monitoring critical parameters such as temperature, pressure, and flow in power generation and distribution systems to ensure stability and efficiency.

- Key Drivers: Government focus on renewable energy, grid modernization projects, and the expansion of power infrastructure.

- Growth Accelerators: Demand for advanced sensors in smart grids and for the monitoring of distributed energy resources.

- Petrochemicals and Chemicals and Fertilizers: These industries are characterized by complex processes requiring highly accurate and reliable sensing for safety, quality control, and environmental compliance. The demand for pressure, temperature, and flow sensors is particularly high.

- Key Drivers: Expansion of refining capacity, increasing demand for specialty chemicals, and stringent safety regulations.

- Growth Accelerators: Integration of automation and IIoT for process optimization and hazard detection.

- Oil and Gas: Despite fluctuations in global oil prices, the exploration, production, and refining segments continue to drive demand for robust and specialized sensors for harsh environment applications, including pressure, temperature, and level monitoring.

- Key Drivers: Government policies promoting domestic exploration, infrastructure development, and the need for enhanced safety protocols.

- Growth Accelerators: Adoption of advanced sensing technologies for subsea operations and pipeline integrity monitoring.

- Water and Wastewater: Increasing urbanization and a greater focus on water resource management and effluent treatment are driving significant growth in this segment. Level, flow, and quality sensors are crucial for effective monitoring and control.

- Key Drivers: Government initiatives like the Jal Jeevan Mission, Swachh Bharat Abhiyan, and the need for efficient water distribution and wastewater treatment.

- Growth Accelerators: Demand for smart water management systems and real-time quality monitoring.

Dominant Sensor Types:

- Temperature Sensors: Essential across almost all industrial applications for process control, safety, and quality assurance.

- Key Drivers: Ubiquitous demand in manufacturing, power, and chemical processing; advancements in non-contact temperature measurement.

- Pressure Sensors: Critical for monitoring and controlling fluid and gas pressures in a wide range of industrial operations.

- Key Drivers: High demand in petrochemicals, oil & gas, and manufacturing; increasing use in automotive and aerospace.

- Flow Sensors: Vital for measuring the rate of fluid or gas movement in processes, crucial for efficiency and resource management.

- Key Drivers: Essential in chemical processing, water treatment, and food & beverage industries; growing adoption of ultrasonic and Coriolis flow meters.

- Level Sensors: Used to determine the amount of material in tanks and vessels, critical for inventory management and process control.

- Key Drivers: Wide application in storage and process industries; demand for non-contact and robust level sensing technologies.

India Industrial Sensors and Transmitters Market Product Developments

Product innovation in the India Industrial Sensors and Transmitters market is characterized by a focus on enhanced intelligence, connectivity, and miniaturization. Manufacturers are increasingly developing sensors with integrated processing capabilities, enabling edge computing and reducing reliance on centralized data systems. The integration of IIoT protocols like IO-Link is a significant trend, facilitating seamless communication between sensors, controllers, and higher-level IT systems. This allows for more efficient configuration, diagnostics, and data collection. Furthermore, there is a growing emphasis on developing sensors for specific harsh or challenging environments, offering increased durability and resistance to extreme temperatures, pressures, and corrosive materials. Applications are expanding beyond traditional process monitoring to areas like condition monitoring, predictive maintenance, and environmental sensing, providing real-time insights that enhance operational efficiency and safety. Competitive advantages are being derived from offering compact, energy-efficient, and cost-effective solutions that can be easily retrofitted into existing infrastructure.

Key Drivers of India Industrial Sensors and Transmitters Market Growth

The growth of the India Industrial Sensors and Transmitters market is propelled by several key factors. The rapid industrialization and the government's strong emphasis on manufacturing and infrastructure development are creating a sustained demand for industrial automation. The widespread adoption of Industry 4.0 and the Internet of Things (IoT) is a major driver, necessitating intelligent sensors for data acquisition and analysis. Technological advancements, such as the development of more accurate, smaller, and robust sensors, coupled with the decreasing cost of electronic components, are making these solutions more accessible. Increasing regulatory requirements for safety, environmental compliance, and quality control across industries also compel the adoption of advanced sensing technologies. Furthermore, the growing awareness among businesses regarding the benefits of predictive maintenance and operational efficiency is fostering investment in sophisticated sensor systems.

Challenges in the India Industrial Sensors and Transmitters Market Market

Despite the promising growth outlook, the India Industrial Sensors and Transmitters market faces several challenges. A significant hurdle is the high initial cost of implementing advanced sensor systems, which can be prohibitive for small and medium-sized enterprises (SMEs). The lack of skilled personnel for the installation, maintenance, and data interpretation of these complex technologies also presents a challenge. Ensuring interoperability between sensors from different manufacturers and existing legacy systems can be technically complex. Fluctuations in raw material prices, particularly for rare earth metals used in some sensor components, can impact production costs and pricing stability. Additionally, the evolving landscape of cybersecurity threats requires constant vigilance and investment in secure sensor network infrastructure, adding to the overall cost of ownership.

Emerging Opportunities in India Industrial Sensors and Transmitters Market

The India Industrial Sensors and Transmitters market is rife with emerging opportunities, primarily driven by technological innovation and the expansion of industrial ecosystems. The rapid growth of sectors like electric vehicles, renewable energy storage, and advanced manufacturing presents significant new avenues for sensor application. The increasing demand for smart cities and sustainable infrastructure will also boost the adoption of sensors for environmental monitoring, traffic management, and utility services. The development of AI-powered sensor analytics and edge computing solutions offers a distinct opportunity for companies to provide value-added services beyond hardware. Furthermore, strategic partnerships between sensor manufacturers, system integrators, and end-users are crucial for developing customized solutions that address specific industry challenges. The focus on increasing domestic manufacturing capabilities under initiatives like "Atmanirbhar Bharat" also presents an opportunity for local players to innovate and expand their market reach.

Leading Players in the India Industrial Sensors and Transmitters Market Sector

- Vishay Intertechnology Inc

- Turck India Automation Private Limited

- EXA Thermometrics India Pvt Ltd

- WIKA Instruments India Pvt Ltd

- SENSOREX Inc

- Arcotherm Pvt Ltd

- SRI Electronics

Key Milestones in India Industrial Sensors and Transmitters Market Industry

- May 2022: Turck India's launch of its first combination air humidity/temperature sensor. This sensor, featuring an easy-to-integrate IO-Link interface, offers cost-effective condition monitoring for field and IIoT applications. Its dual functionality makes it ideal for machine and plant condition monitoring, as well as climatic condition monitoring in production halls and warehouses across diverse industries like automotive, semiconductor, food, and agriculture.

- October 2021: Vishay Intertechnology's optoelectronics group announced a new AEC-Q100 certified ambient light sensor. Designed for automotive and consumer applications requiring high sensitivity to detect light through dark cover materials, the Vishay Semiconductors VEML6031X00 integrates high-sensitivity photodiodes, low-noise amplifiers, 16-bit ADCs, and IR channels within a compact, opaque surface mount package, contributing to advancements in display technology and sensing capabilities.

Strategic Outlook for India Industrial Sensors and Transmitters Market Market

The strategic outlook for the India Industrial Sensors and Transmitters market is exceptionally positive, driven by ongoing technological advancements and supportive industrial policies. The continued push towards Industry 4.0, smart manufacturing, and the Industrial Internet of Things (IIoT) will remain the primary growth accelerators. Companies that focus on developing intelligent, connected, and data-driven sensor solutions will be well-positioned for success. The increasing demand for customized solutions tailored to specific end-user needs, particularly in burgeoning sectors like renewable energy and electric mobility, presents significant opportunities. Strategic collaborations and partnerships will be crucial for enhancing product portfolios, expanding market reach, and fostering innovation. Emphasis on cybersecurity and data analytics will also become paramount, as end-users seek to leverage sensor data for improved operational efficiency, predictive maintenance, and enhanced safety protocols. The market's trajectory indicates a sustained upward trend, with a strong potential for further expansion and value creation.

India Industrial Sensors and Transmitters Market Segmentation

-

1. Type of Sensor

- 1.1. Flow

- 1.2. Temperature

- 1.3. Pressure

- 1.4. Level

- 1.5. Transmitters and Other Sensors

-

2. End-User

- 2.1. Power

- 2.2. Petrochemicals, Chemicals and Fertilizers

- 2.3. Food and Beverage

- 2.4. Water and Wastewater

- 2.5. Life Sciences

- 2.6. Oil and Gas

- 2.7. Other End-Users

India Industrial Sensors and Transmitters Market Segmentation By Geography

- 1. India

India Industrial Sensors and Transmitters Market Regional Market Share

Geographic Coverage of India Industrial Sensors and Transmitters Market

India Industrial Sensors and Transmitters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention

- 3.3. Market Restrains

- 3.3.1. Cost and Operational Concerns

- 3.4. Market Trends

- 3.4.1. Flow Sensors are Expected to be Higher in Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 5.1.1. Flow

- 5.1.2. Temperature

- 5.1.3. Pressure

- 5.1.4. Level

- 5.1.5. Transmitters and Other Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Power

- 5.2.2. Petrochemicals, Chemicals and Fertilizers

- 5.2.3. Food and Beverage

- 5.2.4. Water and Wastewater

- 5.2.5. Life Sciences

- 5.2.6. Oil and Gas

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vishay Intertechnology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turck India Automation Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EXA Thermometrics India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WIKA Instruments India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SENSOREX Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arcotherm Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SRI Electronics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: India Industrial Sensors and Transmitters Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Industrial Sensors and Transmitters Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2020 & 2033

- Table 2: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2020 & 2033

- Table 3: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2020 & 2033

- Table 8: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2020 & 2033

- Table 9: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Sensors and Transmitters Market?

The projected CAGR is approximately 9.37%.

2. Which companies are prominent players in the India Industrial Sensors and Transmitters Market?

Key companies in the market include Vishay Intertechnology Inc, Turck India Automation Private Limited, EXA Thermometrics India Pvt Ltd, WIKA Instruments India Pvt Ltd, SENSOREX Inc, Arcotherm Pvt Ltd, SRI Electronics.

3. What are the main segments of the India Industrial Sensors and Transmitters Market?

The market segments include Type of Sensor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention.

6. What are the notable trends driving market growth?

Flow Sensors are Expected to be Higher in Demand.

7. Are there any restraints impacting market growth?

Cost and Operational Concerns.

8. Can you provide examples of recent developments in the market?

May 2022 - Turck India's first combination air humidity/temperature sensor, which is very easy to incorporate thanks to the IO-Link interface, provides cost-effective condition monitoring in the field and IIoT applications. The CMTH's combination of the two measured variables, air humidity, and temperature, in a single device, makes it ideal for use in machine and plant condition monitoring systems or for monitoring climatic conditions in production halls and warehouses in a wide range of industries, from the automobile industry to the semiconductor and food industries, all the way through to agriculture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Sensors and Transmitters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Sensors and Transmitters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Sensors and Transmitters Market?

To stay informed about further developments, trends, and reports in the India Industrial Sensors and Transmitters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence