Key Insights

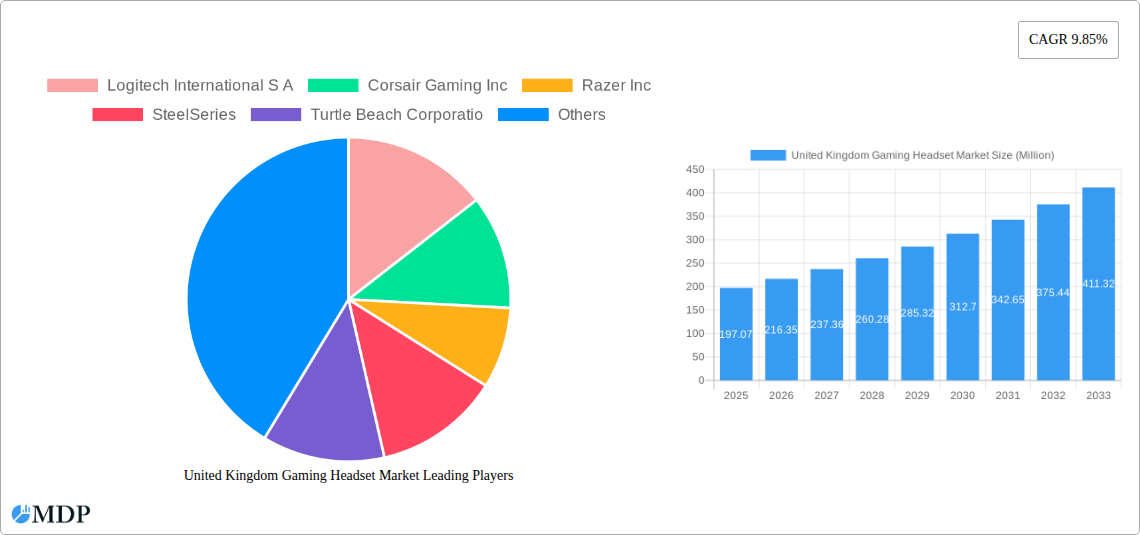

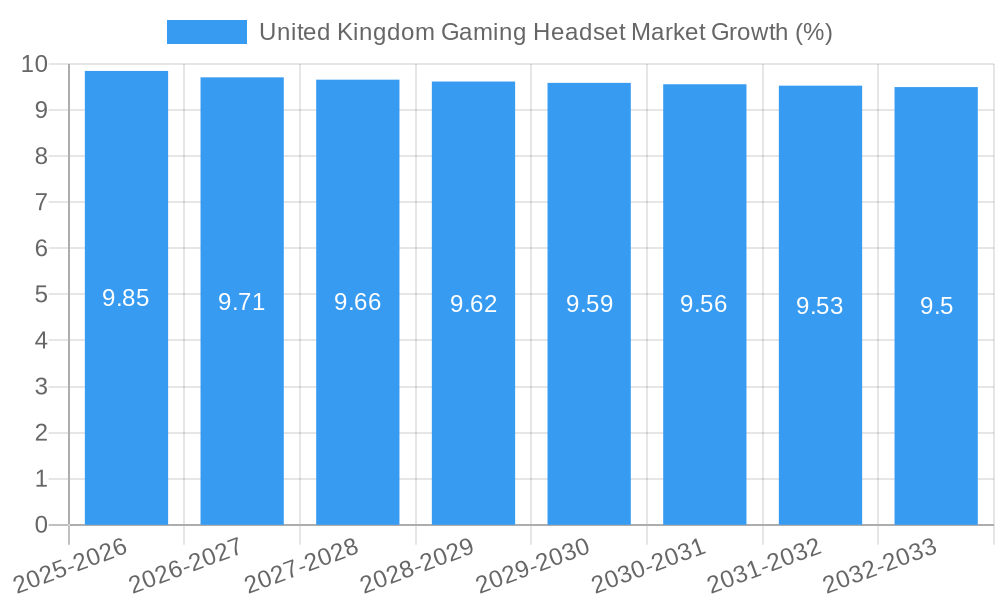

The United Kingdom gaming headset market is poised for significant expansion, projected to reach an estimated value of USD 197.07 million by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 9.85% anticipated over the forecast period of 2025-2033. Several key drivers are propelling this upward trajectory, including the increasing adoption of advanced gaming technologies, the burgeoning popularity of esports, and a continuous demand for immersive audio experiences among gamers. The market is experiencing a surge in the adoption of wireless headsets, driven by the desire for greater freedom and convenience, while PC headsets currently dominate sales due to the widespread PC gaming community. Furthermore, the integration of features like advanced noise cancellation, spatial audio, and customizable RGB lighting is enhancing the appeal of gaming headsets, making them essential peripherals for serious gamers. The shift towards online sales channels is also a prominent trend, offering wider accessibility and competitive pricing for consumers.

Despite the strong growth outlook, certain restraints could temper the market's pace. The initial high cost of premium gaming headsets may deter budget-conscious consumers, and the rapid pace of technological innovation necessitates frequent upgrades, adding to the overall expenditure for gamers. However, the market's inherent dynamism, coupled with the relentless pursuit of enhanced gaming experiences, suggests that these restraints are unlikely to derail the overall positive growth trend. The United Kingdom’s vibrant gaming culture and its position as a significant market for gaming hardware underscore the bright future for gaming headset manufacturers and suppliers in the region. As more individuals embrace gaming as a primary form of entertainment and social interaction, the demand for high-quality audio peripherals like gaming headsets is set to remain strong and consistent.

This in-depth report provides an exhaustive analysis of the United Kingdom gaming headset market, covering historical trends, current dynamics, and future projections. Delve into market segmentation, key player strategies, and emerging opportunities to gain a competitive edge in this rapidly evolving industry. Our comprehensive study spans from 2019 to 2033, with a base year of 2025 and an extensive forecast period from 2025 to 2033, building upon the historical data from 2019 to 2024.

United Kingdom Gaming Headset Market Market Dynamics & Concentration

The United Kingdom gaming headset market is characterized by a moderately concentrated landscape, with a few key players holding significant market share, estimated to be around 65% of the total market value. Innovation serves as a primary driver, with companies continually investing in research and development to enhance audio quality, comfort, and connectivity features. Regulatory frameworks, while generally supportive of consumer electronics, primarily focus on safety standards and compliance, with no significant overt restrictions impacting market entry. Product substitutes, such as standard audio headphones or soundbars, exist but offer a less immersive gaming experience, thus maintaining the strong demand for dedicated gaming headsets. End-user trends reveal a growing preference for wireless connectivity and multi-platform compatibility, driven by the increasing popularity of cross-platform gaming and a desire for greater freedom of movement. Mergers and acquisitions (M&A) activities have been present, with an estimated XX deal counts over the historical period, signifying consolidation and strategic expansion by leading firms. These activities aim to broaden product portfolios and tap into new consumer segments.

United Kingdom Gaming Headset Market Industry Trends & Analysis

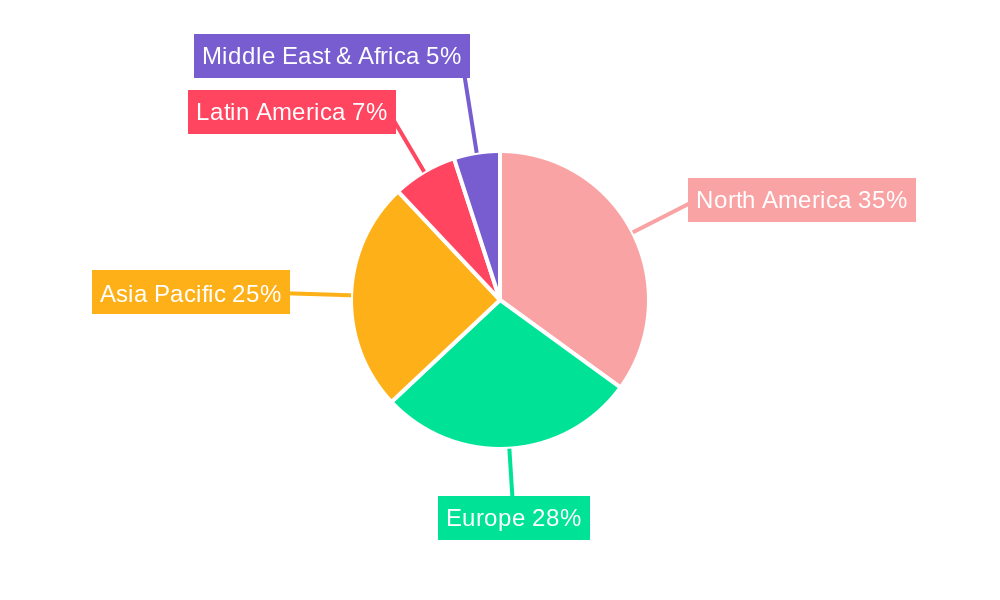

The United Kingdom gaming headset market is experiencing robust growth, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. This expansion is fueled by several interconnected factors. The burgeoning esports scene in the UK, with increased investment in professional leagues and tournaments, directly translates to higher demand for high-performance gaming peripherals, including headsets. Furthermore, the mainstreaming of gaming as a popular entertainment medium, encompassing casual gamers and a growing demographic of older players, broadens the consumer base significantly. Technological advancements are continuously shaping the industry. Innovations in audio drivers, noise-cancellation technology, and virtual surround sound are enhancing the immersive experience, a critical factor for gamers seeking a competitive edge and deeper engagement with game worlds. The increasing adoption of wireless technologies, offering convenience and freedom, is a major trend, with a growing preference for low-latency wireless solutions. The market penetration of gaming headsets is estimated to be around 70% in the UK, with significant room for growth in emerging demographics and regions. Consumer preferences are increasingly leaning towards headsets that offer both exceptional audio fidelity for critical in-game sound cues and clear microphone quality for effective team communication. Personalization through software customization, including EQ settings and RGB lighting, is also becoming a significant differentiator. The competitive dynamics are intense, with established players like Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, and Turtle Beach Corporation vying for market dominance through product innovation, strategic pricing, and effective marketing campaigns. The rise of independent brands and the increasing influence of gaming influencers further contribute to the dynamic competitive landscape, pushing companies to constantly evolve and adapt to changing consumer demands and technological landscapes.

Leading Markets & Segments in United Kingdom Gaming Headset Market

Within the United Kingdom gaming headset market, PC Headsets represent the largest and most dominant segment in terms of market share, accounting for an estimated 55% of the total market value. This dominance is driven by the PC's enduring popularity as a gaming platform, especially among esports enthusiasts and professional gamers who often prioritize superior audio fidelity and customization options available through PC-based software. The substantial installed base of gaming PCs and the continuous development of graphically intensive PC games requiring high-quality audio immersion contribute significantly to this segment's leadership.

Wireless connectivity is emerging as the fastest-growing segment, projected to capture an increased market share of approximately 60% by 2030. The convenience, freedom of movement, and increasing affordability of high-performance wireless technology are major catalysts for this shift. Gamers are increasingly willing to invest in wireless solutions to eliminate cable clutter and enjoy a more seamless gaming experience, particularly for console gaming where movement around a living space is common.

In terms of sales channels, the Online segment is a dominant force, commanding an estimated 70% of total sales. The convenience of online purchasing, wider product availability, competitive pricing, and the ease of comparing features and reading reviews make online platforms the preferred choice for a majority of consumers. Major e-commerce retailers and direct-to-consumer sales from manufacturers contribute significantly to this segment's strength. The Retail segment, while smaller, remains important for consumers who prefer to experience products firsthand before purchasing, offering opportunities for impulse buys and brand engagement through in-store displays and demonstrations.

Console Headsets also represent a significant and growing market, particularly with the continued popularity of gaming consoles like PlayStation and Xbox. The introduction of new console generations with enhanced audio capabilities further stimulates demand for dedicated console headsets. The increasing trend of cross-platform play also benefits this segment, as gamers seek headsets that can seamlessly transition between different gaming ecosystems.

United Kingdom Gaming Headset Market Product Developments

The United Kingdom gaming headset market is experiencing a wave of innovation focused on delivering unparalleled audio immersion, comfort, and connectivity. Companies are pushing the boundaries with advanced driver technologies, spatial audio solutions like Dolby Atmos and DTS Headphone:X, and enhanced microphone clarity with AI-powered noise suppression. The trend towards lightweight, ergonomic designs with breathable materials is paramount for extended gaming sessions. Furthermore, the integration of advanced wireless technologies, ensuring near-imperceptible latency, is becoming standard. This relentless pursuit of technological superiority, coupled with user-centric design, allows manufacturers to create products with distinct competitive advantages, catering to both the discerning esports professional and the casual gamer seeking a more engaging experience.

Key Drivers of United Kingdom Gaming Headset Market Growth

Several key drivers are propelling the growth of the United Kingdom gaming headset market. The escalating popularity of esports, both as a spectator sport and a professional career path, directly fuels demand for high-performance audio equipment. The continuous advancements in gaming technology, including more sophisticated audio engines in video games, necessitate better quality headsets to fully appreciate the immersive soundscapes. Furthermore, the expanding casual gaming segment, driven by a younger demographic and increased disposable income, contributes to broader market penetration. Government initiatives supporting the digital economy and the growth of the UK as a technology hub also foster a positive environment for consumer electronics.

Challenges in the United Kingdom Gaming Headset Market Market

Despite its robust growth, the United Kingdom gaming headset market faces several challenges. Intense competition among established brands and emerging players can lead to price wars, impacting profit margins. Supply chain disruptions, particularly for electronic components, can lead to production delays and increased costs, affecting product availability and pricing. The rapid pace of technological innovation also necessitates continuous investment in R&D, creating a challenge for smaller companies to keep up. Additionally, evolving consumer preferences require agile product development and marketing strategies to remain relevant in a dynamic market.

Emerging Opportunities in United Kingdom Gaming Headset Market

Emerging opportunities in the United Kingdom gaming headset market are abundant. The growing demand for multi-platform compatibility presents a significant avenue for growth, with manufacturers developing headsets that seamlessly work across PCs, consoles, and mobile devices. The increasing adoption of virtual reality (VR) and augmented reality (AR) gaming technologies opens up a new frontier for specialized VR/AR headsets with integrated spatial audio and advanced haptic feedback. Strategic partnerships with game developers to bundle headsets with new game releases or offer exclusive in-game audio content can also drive sales. The untapped potential within the educational sector, utilizing gaming headsets for remote learning and interactive educational content, represents another promising growth area.

Leading Players in the United Kingdom Gaming Headset Market Sector

- Logitech International S A

- Corsair Gaming Inc

- Razer Inc

- SteelSeries

- Turtle Beach Corporation

Key Milestones in United Kingdom Gaming Headset Market Industry

- June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

- May 2024: SteelSeries unveiled its latest headset line, the Arctis Nova 5 series, accompanied by the debut of the Nova 5 Companion App. This app boasts an impressive repertoire of over 100 gaming audio presets. While the series is tailored for PC gaming, it also offers specialized versions for PlayStation (Arctis Nova 5P) and Xbox (Arctis Nova 5X), ensuring compatibility across a broad spectrum of devices.

Strategic Outlook for United Kingdom Gaming Headset Market Market

The strategic outlook for the United Kingdom gaming headset market is overwhelmingly positive, driven by sustained innovation and expanding consumer adoption. Future growth will likely be accelerated by the continued development of wireless audio technologies, offering near-lossless sound quality and extended battery life. The integration of AI-powered features for enhanced audio processing and personalized sound profiles will also be a key differentiator. Companies that focus on ergonomic designs, multi-platform compatibility, and sustainable manufacturing practices are poised to capture a larger market share. Strategic collaborations with esports organizations, game developers, and emerging technology providers will be crucial for staying ahead of the curve and capitalizing on new market trends, ensuring continued expansion and profitability in the coming years.

United Kingdom Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

United Kingdom Gaming Headset Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Wireless Headsets is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corsair Gaming Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Razer Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SteelSeries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Turtle Beach Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Logitech International S A

List of Figures

- Figure 1: United Kingdom Gaming Headset Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Gaming Headset Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: United Kingdom Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Kingdom Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: United Kingdom Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Gaming Headset Market?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the United Kingdom Gaming Headset Market?

Key companies in the market include Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the United Kingdom Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Wireless Headsets is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Gaming Headset Market?

To stay informed about further developments, trends, and reports in the United Kingdom Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence