Key Insights

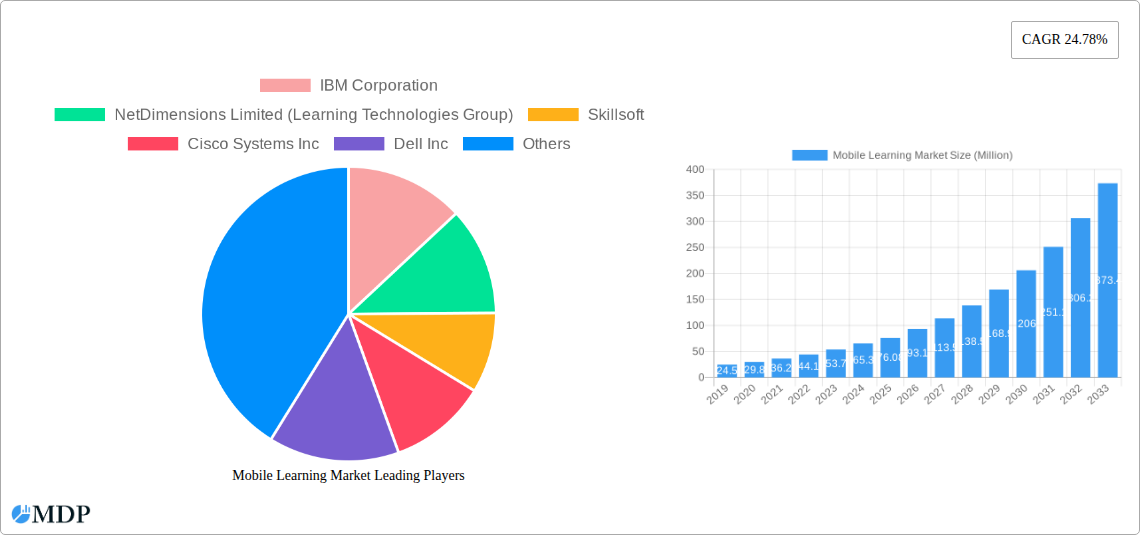

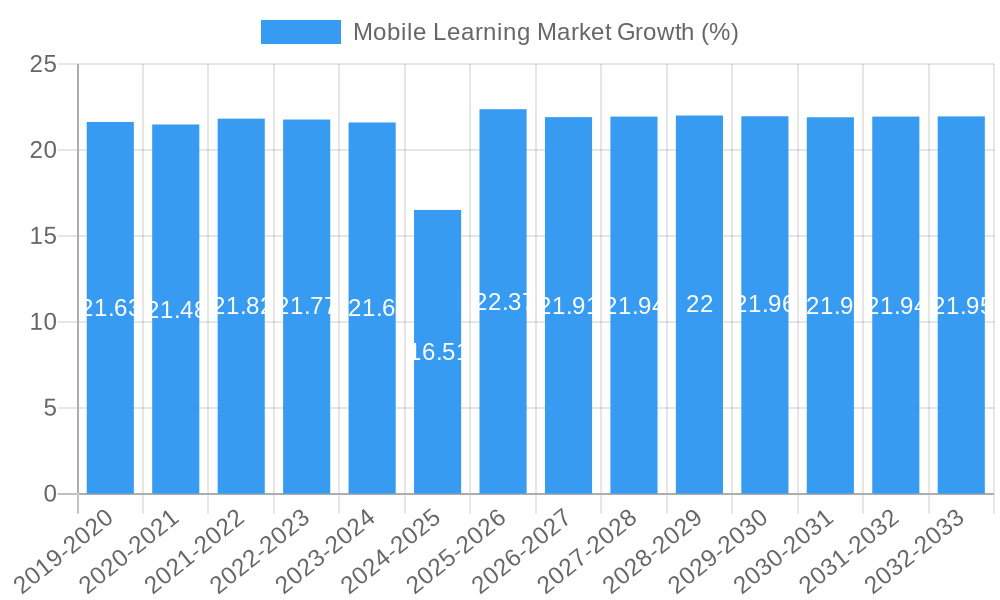

The Mobile Learning Market is poised for substantial growth, projected to reach an impressive market size of USD 76.08 billion by 2025. This rapid expansion is fueled by a compelling Compound Annual Growth Rate (CAGR) of 24.78%, indicating a dynamic and rapidly evolving landscape. The market's trajectory is significantly driven by the increasing penetration of mobile devices across all demographics and the escalating demand for flexible, accessible, and personalized learning solutions. The proliferation of smartphones and tablets, coupled with advancements in mobile technology and network infrastructure, has created fertile ground for mobile learning to flourish. Furthermore, the growing adoption of e-learning platforms and the need for continuous upskilling and reskilling in the corporate sector are powerful catalysts for this market's upward momentum. Interactive assessment tools, mobile-first courseware, and engaging video-based content are emerging as key drivers, offering learners a more immersive and effective educational experience. The shift towards digital transformation across industries is also compelling organizations to invest in mobile learning solutions to enhance employee training and development, making it a critical component of modern learning strategies.

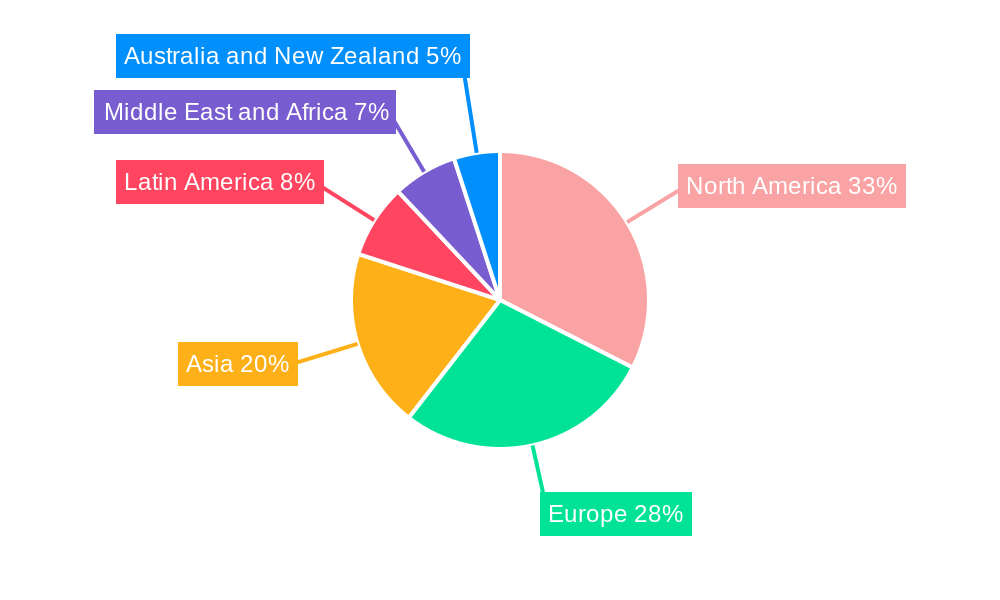

The mobile learning market's diverse application spans across academic, corporate, and independent learning environments. Within academic settings, it facilitates blended learning approaches, offering students supplementary resources and interactive exercises. In the corporate realm, it revolutionizes employee training, onboarding, and skill development, enabling just-in-time learning and on-the-job support. Simulation-based learning and online on-the-job training modules are gaining prominence, providing practical, hands-on experiences in a virtual environment. The market segments include a wide array of software solutions, from e-books and interactive assessments to sophisticated mobile and video-based courseware, alongside various applications tailored for different learning contexts. Key players like IBM Corporation, Skillsoft, and Cisco Systems Inc. are at the forefront, innovating and expanding their offerings to cater to the evolving needs of learners and organizations. The market's robust growth is further supported by a strong global presence, with North America and Europe currently leading adoption, while Asia, Latin America, and the Middle East and Africa are rapidly emerging as significant growth regions.

This comprehensive report delves deep into the burgeoning mobile learning market, a transformative force reshaping e-learning, corporate training, and academic education. With the global mobile learning market projected to reach XX Million by 2033, this analysis provides unparalleled insights into market dynamics, industry trends, leading segments, and strategic opportunities. We cover the period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033. Uncover critical data on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities.

Mobile Learning Market Market Dynamics & Concentration

The mobile learning market exhibits a moderate to high concentration, driven by significant investments in edtech solutions and the increasing adoption of BYOD (Bring Your Own Device) policies across academic and corporate environments. Key innovation drivers include advancements in AI-powered learning, gamification, and the demand for personalized learning experiences. Regulatory frameworks, while evolving, generally support the growth of digital education, focusing on data privacy and accessibility. Product substitutes, such as traditional classroom learning and desktop-based e-learning, are gradually being overshadowed by the flexibility and accessibility offered by mobile learning solutions. End-user trends highlight a strong preference for on-demand learning, microlearning, and just-in-time training, particularly within the corporate learning segment. M&A activities are prevalent as larger players aim to consolidate market share and acquire innovative technologies. For instance, over the historical period 2019-2024, there have been an estimated XX M&A deals, indicating a dynamic and competitive landscape.

- Market Share: Leading companies like IBM Corporation and Skillsoft hold significant market share, with an estimated combined share of XX% in 2025.

- M&A Deal Counts: The number of M&A deals has steadily increased, averaging XX per year during the historical period.

- Innovation Drivers: Personalized learning paths, AI-driven feedback, immersive VR/AR integration.

- End-User Preferences: Mobile-first content, bite-sized modules, immediate skill development.

Mobile Learning Market Industry Trends & Analysis

The mobile learning market is experiencing robust growth, fueled by several interconnected trends. The escalating demand for upskilling and reskilling in a rapidly evolving job market is a primary growth driver. Furthermore, the widespread penetration of smartphones and tablets, coupled with improving mobile internet infrastructure globally, has made mobile learning more accessible than ever. Technological disruptions, such as the integration of Artificial Intelligence (AI) for personalized content delivery and adaptive learning, and the rise of Virtual Reality (VR) and Augmented Reality (AR) for immersive experiences, are revolutionizing how educational content is consumed. Consumer preferences are shifting towards flexible, self-paced learning models that fit seamlessly into busy schedules. This is evidenced by the increasing popularity of online courses, webinars, and mobile-friendly learning platforms. The competitive dynamics are characterized by a blend of established educational technology providers and agile startups, all vying for market dominance through innovative product offerings and strategic partnerships. The market penetration of mobile learning solutions is expected to reach XX% by 2033. The Compound Annual Growth Rate (CAGR) for the mobile learning market is estimated at XX% for the forecast period 2025–2033.

Leading Markets & Segments in Mobile Learning Market

The Corporate Learning segment is poised to dominate the mobile learning market, driven by the continuous need for employee development, compliance training, and performance enhancement in businesses worldwide. The Academic Learning end-user segment also represents a substantial market share, with educational institutions increasingly adopting mobile solutions to supplement traditional classroom instruction and provide remote learning options.

Software Segments Dominance:

- Mobile and Video-Based Courseware: This segment leads due to its engaging and accessible nature, catering to diverse learning styles and content delivery preferences. The proliferation of video content consumption on mobile devices directly translates to its dominance in the learning space.

- Interactive Assessment: Critical for gauging learner progress and knowledge retention, interactive assessments are integral to effective mobile learning strategies.

- E-Books: While still relevant, their dominance is being challenged by more dynamic and interactive content formats.

- Other Softwares: This encompasses a broad range of tools like learning management systems (LMS), content authoring tools, and analytics platforms that support mobile learning delivery.

Application Segments Dominance:

- Corporate Learning: As mentioned, this is the primary driver, encompassing onboarding, skill development, leadership training, and sales enablement. Economic policies encouraging workforce development and competitive pressures for talent acquisition are key drivers.

- In-Class Learning: Mobile devices are increasingly used to enhance classroom experiences through interactive polls, supplementary resources, and collaborative activities.

- Online-on-the-Job Training: This application allows for immediate learning and skill application directly within the work context, boosting productivity and efficiency.

- Simulation-Based Learning: Particularly in fields like healthcare and manufacturing, simulations offer safe and effective training environments accessible via mobile devices.

- Independent Learning: Individuals pursuing personal development or hobby-related learning heavily rely on mobile platforms for their flexibility.

End User Segments Dominance:

- Corporate Learning: This segment is expected to maintain its leading position due to the significant investment businesses make in their workforce's continuous development and the measurable ROI associated with effective training programs. The demand for flexible and accessible training solutions to accommodate diverse workforces and remote employees is a perpetual driver.

- Academic Learning: Educational institutions are embracing mobile learning to foster student engagement, provide blended learning experiences, and cater to the digital natives' learning preferences. Infrastructure development in educational technology and government initiatives supporting digital education are key drivers.

Mobile Learning Market Product Developments

Product developments in the mobile learning market are characterized by a relentless pursuit of enhanced user experience and pedagogical effectiveness. Innovations focus on delivering highly engaging and personalized learning journeys. This includes the integration of AI for adaptive content pathways, real-time feedback mechanisms, and personalized recommendations. Furthermore, the adoption of immersive technologies like VR and AR is creating unprecedented opportunities for hands-on, experiential learning that can be accessed remotely. Competitive advantages are being gained by platforms that offer seamless integration with existing enterprise systems, robust analytics for performance tracking, and intuitive user interfaces that minimize friction for learners. The emphasis is on creating flexible, accessible, and impactful learning solutions that cater to the evolving needs of both individuals and organizations.

Key Drivers of Mobile Learning Market Growth

The growth of the mobile learning market is propelled by several synergistic factors. Technological advancements, particularly the ubiquity of smartphones and affordable mobile data plans, have laid the foundation for widespread adoption. The increasing recognition of the importance of lifelong learning and continuous professional development, driven by rapid technological change and evolving industry demands, is a significant economic driver. Furthermore, supportive government initiatives and policies promoting digital literacy and online education contribute to market expansion. The growing demand for flexible and personalized learning experiences that can be accessed anytime, anywhere, is a primary consumer-driven factor. The shift towards a remote and hybrid work model further accentuates the need for accessible and efficient online training solutions.

Challenges in the Mobile Learning Market Market

Despite its promising trajectory, the mobile learning market faces several challenges. Digital Divide and Access: Unequal access to reliable internet connectivity and suitable mobile devices in certain regions and socio-economic groups can limit market penetration. Content Development Costs: Creating high-quality, engaging mobile learning content requires significant investment in instructional design and multimedia production. Learner Engagement and Retention: Maintaining learner motivation and focus on mobile devices, prone to distractions, remains a persistent challenge. Technical Issues and Device Compatibility: Ensuring seamless user experience across a wide array of mobile devices, operating systems, and network conditions can be complex. Data Security and Privacy Concerns: Protecting sensitive learner data and intellectual property in a mobile environment requires robust security measures.

Emerging Opportunities in Mobile Learning Market

Emerging opportunities in the mobile learning market are vast and multifaceted. The continued integration of AI and machine learning is paving the way for highly personalized and adaptive learning experiences, predicting learner needs and tailoring content accordingly. The burgeoning metaverse and extended reality (XR) technologies present groundbreaking opportunities for immersive, experiential learning that transcends geographical boundaries. Strategic partnerships between educational institutions, technology providers, and industry leaders are fostering innovation and expanding the reach of mobile learning solutions. Furthermore, the growing demand for niche skill development and micro-credentialing offers fertile ground for specialized mobile learning platforms. Emerging markets in developing economies, with their rapidly expanding mobile penetration, represent significant untapped potential for market expansion.

Leading Players in the Mobile Learning Market Sector

- IBM Corporation

- NetDimensions Limited (Learning Technologies Group)

- Skillsoft

- Cisco Systems Inc

- Dell Inc

- AT&T Inc

- Upside Learning Solutions Pvt Ltd

- Citrix Systems Inc

- Promethean World Ltd

- SAP SE

Key Milestones in Mobile Learning Market Industry

- August 2023: EchoExam, a new SaaS summative assessment platform, was launched by Echo360, enhancing its existing video platform for learning engagement outcomes. This offers improved system compatibility and multi-modal exam delivery options.

- March 2023: INSEAD announced a mobile application subscription service, the INSEAD Learning Hub, providing lifetime learning opportunities and access to global community content.

- November 2022: Bodyswaps and Meta Immersive Learning partnered to provide VR technology and software to 100 higher and further education institutions in the UK, North America, France, and Belgium.

- September 2022: Skilldora partnered with D-ID to offer courses entirely taught by AI instructors, signaling a significant advancement in AI-driven educational content.

Strategic Outlook for Mobile Learning Market Market

- August 2023: EchoExam, a new SaaS summative assessment platform, was launched by Echo360, enhancing its existing video platform for learning engagement outcomes. This offers improved system compatibility and multi-modal exam delivery options.

- March 2023: INSEAD announced a mobile application subscription service, the INSEAD Learning Hub, providing lifetime learning opportunities and access to global community content.

- November 2022: Bodyswaps and Meta Immersive Learning partnered to provide VR technology and software to 100 higher and further education institutions in the UK, North America, France, and Belgium.

- September 2022: Skilldora partnered with D-ID to offer courses entirely taught by AI instructors, signaling a significant advancement in AI-driven educational content.

Strategic Outlook for Mobile Learning Market Market

The strategic outlook for the mobile learning market is exceptionally positive, driven by ongoing technological advancements and an unwavering demand for flexible, accessible, and effective learning solutions. The increasing integration of AI, VR, and AR will unlock new dimensions of personalized and immersive learning experiences, driving deeper engagement and knowledge retention. Strategic partnerships between technology providers, content creators, and educational institutions will continue to be crucial for innovation and market expansion. The growing emphasis on lifelong learning and continuous upskilling across all industries will further fuel the demand for mobile-first learning platforms. Organizations that prioritize mobile learning integration will gain a competitive edge in talent development and employee retention, positioning the market for sustained and substantial growth.

Mobile Learning Market Segmentation

-

1. Software

- 1.1. E-Books

- 1.2. Interactive Assessment

- 1.3. Mobile and Video-Based Courseware

- 1.4. Other Softwares

-

2. Application

- 2.1. In-Class Learning

- 2.2. Corporate Learning

- 2.3. Simulation-Based Learning

- 2.4. Online-on-the Job Training

- 2.5. Independent Learning

-

3. End User

- 3.1. Academic Learning

- 3.2. Corporate Learning

Mobile Learning Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Mobile Learning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapid Adoption for Digital Learning Solutions in Corporate Sector to boost overall work Efficinecy and Productivity to drive the market; Growing Concept of BYOD; Increasing Penetration of Mobile Device such as Smartphone

- 3.2.2 Tablet and Laptops

- 3.3. Market Restrains

- 3.3.1. Increasing Initial Investment in Technology Infrastructure

- 3.4. Market Trends

- 3.4.1. Corporate Segment Would Experience Significant Growth and Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Software

- 5.1.1. E-Books

- 5.1.2. Interactive Assessment

- 5.1.3. Mobile and Video-Based Courseware

- 5.1.4. Other Softwares

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. In-Class Learning

- 5.2.2. Corporate Learning

- 5.2.3. Simulation-Based Learning

- 5.2.4. Online-on-the Job Training

- 5.2.5. Independent Learning

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Academic Learning

- 5.3.2. Corporate Learning

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Software

- 6. North America Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Software

- 6.1.1. E-Books

- 6.1.2. Interactive Assessment

- 6.1.3. Mobile and Video-Based Courseware

- 6.1.4. Other Softwares

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. In-Class Learning

- 6.2.2. Corporate Learning

- 6.2.3. Simulation-Based Learning

- 6.2.4. Online-on-the Job Training

- 6.2.5. Independent Learning

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Academic Learning

- 6.3.2. Corporate Learning

- 6.1. Market Analysis, Insights and Forecast - by Software

- 7. Europe Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Software

- 7.1.1. E-Books

- 7.1.2. Interactive Assessment

- 7.1.3. Mobile and Video-Based Courseware

- 7.1.4. Other Softwares

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. In-Class Learning

- 7.2.2. Corporate Learning

- 7.2.3. Simulation-Based Learning

- 7.2.4. Online-on-the Job Training

- 7.2.5. Independent Learning

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Academic Learning

- 7.3.2. Corporate Learning

- 7.1. Market Analysis, Insights and Forecast - by Software

- 8. Asia Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Software

- 8.1.1. E-Books

- 8.1.2. Interactive Assessment

- 8.1.3. Mobile and Video-Based Courseware

- 8.1.4. Other Softwares

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. In-Class Learning

- 8.2.2. Corporate Learning

- 8.2.3. Simulation-Based Learning

- 8.2.4. Online-on-the Job Training

- 8.2.5. Independent Learning

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Academic Learning

- 8.3.2. Corporate Learning

- 8.1. Market Analysis, Insights and Forecast - by Software

- 9. Latin America Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Software

- 9.1.1. E-Books

- 9.1.2. Interactive Assessment

- 9.1.3. Mobile and Video-Based Courseware

- 9.1.4. Other Softwares

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. In-Class Learning

- 9.2.2. Corporate Learning

- 9.2.3. Simulation-Based Learning

- 9.2.4. Online-on-the Job Training

- 9.2.5. Independent Learning

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Academic Learning

- 9.3.2. Corporate Learning

- 9.1. Market Analysis, Insights and Forecast - by Software

- 10. Middle East and Africa Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Software

- 10.1.1. E-Books

- 10.1.2. Interactive Assessment

- 10.1.3. Mobile and Video-Based Courseware

- 10.1.4. Other Softwares

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. In-Class Learning

- 10.2.2. Corporate Learning

- 10.2.3. Simulation-Based Learning

- 10.2.4. Online-on-the Job Training

- 10.2.5. Independent Learning

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Academic Learning

- 10.3.2. Corporate Learning

- 10.1. Market Analysis, Insights and Forecast - by Software

- 11. North America Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 13. Asia Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia and New Zealand

- 14. Latin America Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Argentina

- 15. Middle East and Africa Mobile Learning Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 IBM Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NetDimensions Limited (Learning Technologies Group)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Skillsoft

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cisco Systems Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Dell Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AT&T Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Upside Learning Solutions Pvt Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Citrix Systems Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Promethean World Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 IBM Corporation

List of Figures

- Figure 1: Global Mobile Learning Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Mobile Learning Market Revenue (Million), by Software 2024 & 2032

- Figure 13: North America Mobile Learning Market Revenue Share (%), by Software 2024 & 2032

- Figure 14: North America Mobile Learning Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Mobile Learning Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Mobile Learning Market Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Mobile Learning Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Mobile Learning Market Revenue (Million), by Software 2024 & 2032

- Figure 21: Europe Mobile Learning Market Revenue Share (%), by Software 2024 & 2032

- Figure 22: Europe Mobile Learning Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Mobile Learning Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Mobile Learning Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Mobile Learning Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Mobile Learning Market Revenue (Million), by Software 2024 & 2032

- Figure 29: Asia Mobile Learning Market Revenue Share (%), by Software 2024 & 2032

- Figure 30: Asia Mobile Learning Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Mobile Learning Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Mobile Learning Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Asia Mobile Learning Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Mobile Learning Market Revenue (Million), by Software 2024 & 2032

- Figure 37: Latin America Mobile Learning Market Revenue Share (%), by Software 2024 & 2032

- Figure 38: Latin America Mobile Learning Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Latin America Mobile Learning Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Latin America Mobile Learning Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Latin America Mobile Learning Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Latin America Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Mobile Learning Market Revenue (Million), by Software 2024 & 2032

- Figure 45: Middle East and Africa Mobile Learning Market Revenue Share (%), by Software 2024 & 2032

- Figure 46: Middle East and Africa Mobile Learning Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Mobile Learning Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Mobile Learning Market Revenue (Million), by End User 2024 & 2032

- Figure 49: Middle East and Africa Mobile Learning Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East and Africa Mobile Learning Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Mobile Learning Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mobile Learning Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 3: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Mobile Learning Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia and New Zealand Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 28: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 34: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 42: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 44: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia and New Zealand Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 50: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Brazil Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Mexico Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Argentina Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Mobile Learning Market Revenue Million Forecast, by Software 2019 & 2032

- Table 57: Global Mobile Learning Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Mobile Learning Market Revenue Million Forecast, by End User 2019 & 2032

- Table 59: Global Mobile Learning Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: United Arab Emirates Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Saudi Arabia Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Africa Mobile Learning Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Learning Market?

The projected CAGR is approximately 24.78%.

2. Which companies are prominent players in the Mobile Learning Market?

Key companies in the market include IBM Corporation, NetDimensions Limited (Learning Technologies Group), Skillsoft, Cisco Systems Inc, Dell Inc, AT&T Inc, Upside Learning Solutions Pvt Ltd, Citrix Systems Inc, Promethean World Ltd, SAP SE.

3. What are the main segments of the Mobile Learning Market?

The market segments include Software, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption for Digital Learning Solutions in Corporate Sector to boost overall work Efficinecy and Productivity to drive the market; Growing Concept of BYOD; Increasing Penetration of Mobile Device such as Smartphone. Tablet and Laptops.

6. What are the notable trends driving market growth?

Corporate Segment Would Experience Significant Growth and Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Initial Investment in Technology Infrastructure.

8. Can you provide examples of recent developments in the market?

August 2023: EchoExam, a new SaaS summative assessment platform for education and business, was launched by Echo360, a comprehensive SaaS video platform for learning engagement outcomes in any learning environment. The company expands on and enhances its ExamView testing software with EchoExam, offering administrators and teachers more system compatibility, control, and multi-modal exam delivery options to ensure fair testing conditions for all students.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Learning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Learning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Learning Market?

To stay informed about further developments, trends, and reports in the Mobile Learning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence